Market Overview:

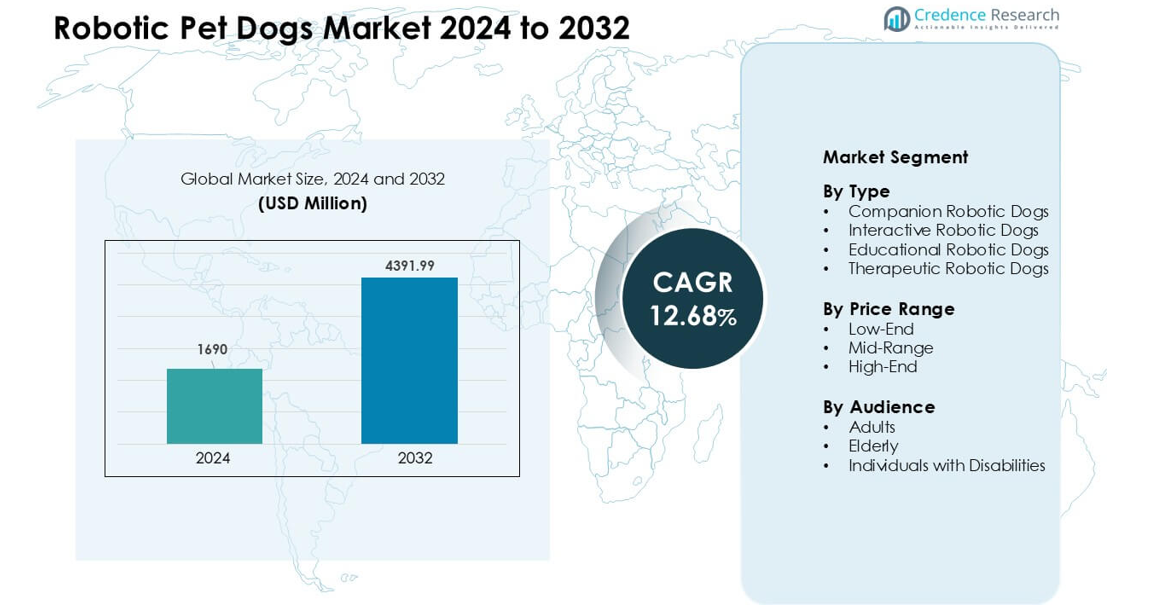

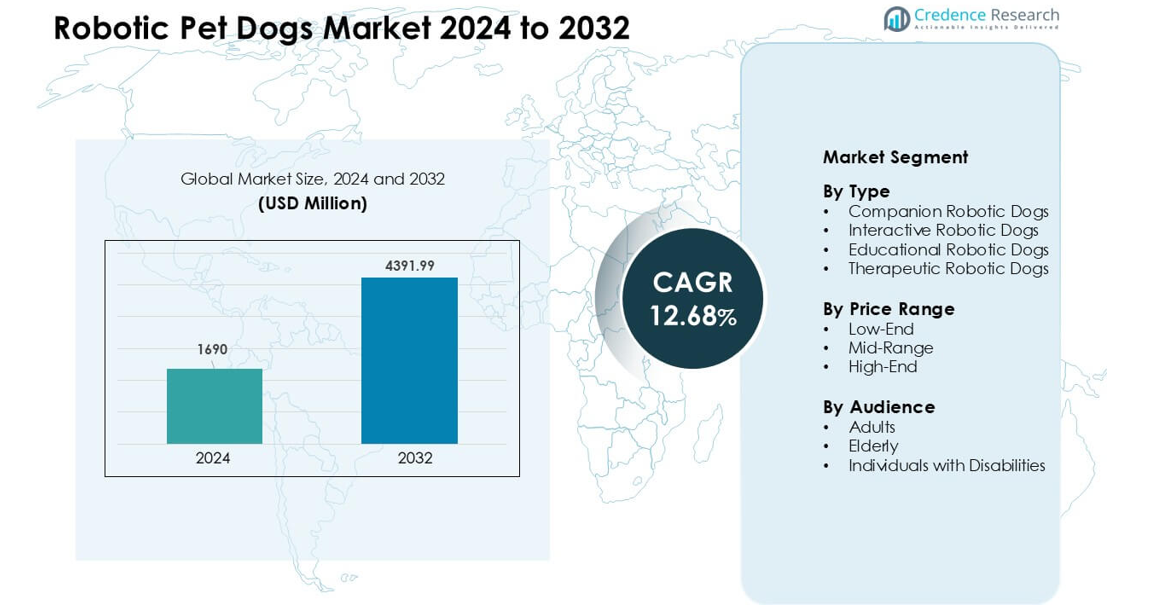

Robotic Pet Dogs Market was valued at USD 1690 million in 2024 and is anticipated to reach USD 4391.99 million by 2032, growing at a CAGR of 12.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Robotic Pet Dogs Market Size 2024

|

USD 1690 million |

| Robotic Pet Dogs Market, CAGR |

12.68% |

| Robotic Pet Dogs Market Size 2032 |

USD 4391.99 million |

The robotic pet dogs market includes major players such as Boston Dynamics Inc., Ghost Robotics Corp., Contixo Inc., Ageless Innovation, LEGO System AS, HangZhou YuShu Technology Co. Ltd., ANYbotics, Dimple nyc., BIRANCO Ltd., and Consequential Robotics Ltd. These companies compete through AI-driven interaction, advanced mobility, and expanded therapeutic and educational applications. North America emerged as the leading region in 2024 with about 37% share, supported by strong consumer spending, rapid adoption of emotional-support technologies, and widespread use of robotic companions in elderly-care programs and assisted-living facilities.

Market Insights:

- The robotic pet dogs market reached USD 1690 million in 2024 and is projected to grow at a CAGR of 12.68 % through the forecast period.

- Demand rises as users seek emotional support and low-maintenance companionship, with companion robotic dogs leading the type segment at about 42% share.

- Key trends include AI-enhanced lifelike behavior, smart-home connectivity, and growing adoption in therapy, education, and elderly-care programs.

- Competition strengthens as players such as Boston Dynamics Inc., Ghost Robotics Corp., Contixo Inc., and Ageless Innovation focus on advanced mobility, adaptive learning, and broader distribution strategies.

- North America held the largest regional share at 37% in 2024, driven by high spending power and strong uptake across households and care facilities, while Asia-Pacific showed the fastest growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Companion robotic dogs held the dominant share in 2024 with about 42% of the type segment. Strong demand came from households seeking emotional support tools, especially for users who wanted low-maintenance companionship. Growth also rose as advanced AI features improved behavior recognition and lifelike responses. Interactive and educational models gained steady attention due to rising use in learning spaces. Therapeutic robotic dogs expanded in care homes and rehabilitation centers, driven by studies showing reduced stress and improved engagement among patients.

- For instance, Unitree Robotics a leading quadruped‑robot producer had units used in private residences for pet‑like companionship; Unitree’s consumer‑grade robots feature AI‑driven navigation and object‑avoidance sensors that mimic pet mobility and provide interactive companionship.

By Price Range

The mid-range category led the price range segment in 2024 with nearly 46% share. Consumers preferred this tier because it balanced affordability with enhanced features such as responsive sensors, mobility upgrades, and basic AI learning. Low-end models gained traction in budget-focused households and early learners, though limited functionality slowed broader adoption. High-end devices saw rising interest from tech-savvy users due to premium materials and advanced emotional-interaction systems. Growing disposable income and wider online availability supported mid-range dominance.

- For instance, high-end consumer robots like those from major robotics firms integrate AI navigation, rich sensor arrays, and sometimes programmable behaviors similar to premium quadruped robots from Unitree Robotics that offer high-speed mobility and obstacle detection, making them appealing to early adopters and tech enthusiasts.

By Audience

Adults represented the leading audience segment in 2024 with around 44% share. Many adults adopted robotic dogs for stress relief, daily companionship, and simplified pet-like interaction. The elderly group also grew due to increased use in assisted-living facilities, where robotic pets helped reduce loneliness and support cognitive engagement. Individuals with disabilities showed steady adoption as devices assisted with emotional support and structured routines. Rising awareness of mental-wellness benefits and user-friendly designs strengthened adoption across all audience groups.

Key Growth Drivers:

Growing Demand for Emotional Support and Companionship

Emotional wellness needs drive strong adoption of robotic pet dogs across homes, workplaces, and care facilities. Many users seek low-maintenance companionship that replicates the comfort of real pets without feeding, grooming, or allergy concerns. Rising stress levels, increased social isolation, and long working hours push adults to adopt robotic pets as consistent emotional support tools. The elderly population also benefits from structured engagement and reduced loneliness, which strengthens market demand. Advancements in behavioral AI help these robotic dogs mimic social cues, reinforcing user attachment. Wider acceptance of companion technology and strong consumer willingness to try digital pet alternatives continues to accelerate market growth.

- For instance, in a long-term care program in the U.S., more than 700 animatronic pets (cats and dogs) were distributed to socially isolated seniors — recipients reported incrased engagement and companionship, especially during COVID‑19 lockdowns.

Rising Use in Elderly Care, Therapy, and Rehabilitation

Healthcare and assisted-living centers increasingly integrate robotic pet dogs into therapy programs due to their positive emotional impact. These devices support dementia care, reduce agitation, and encourage social behavior among elderly residents. Therapists use robotic dogs to stimulate cognitive responses and promote routine-based interaction, which helps patients maintain engagement. Individuals recovering from trauma or physical limitations also gain comfort through predictable companionship. Market growth strengthens as care facilities adopt technology-driven therapy models to reduce staff burden. Growing clinical research that highlights the psychological benefits of robotic pets further boosts adoption, positioning these devices as valuable therapeutic tools rather than simple consumer gadgets.

- For instance, a 12‑week randomized clinical trial involving 61 dementia patients (average age 83.4 years) using the PARO robotic pet observed decreases in patients’ pulse rate, reductions in psychoactive and pain‑medication usage, and improved stress-related biomarkers results held consistently across the study duration.

Advances in Artificial Intelligence and Sensor Technology

Rapid improvements in AI, voice recognition, haptics, and motion sensors enhance the realism and appeal of robotic pet dogs. Developers now integrate adaptive learning, emotional recognition, and high-precision movement to improve user interaction. These improvements support personalized responses and lifelike behavior patterns, making robotic pets more attractive for both household and therapeutic use. Enhanced mobility, improved battery life, and compact embedded systems allow smoother performance at lower cost. Progress in manufacturing also reduces component prices, helping mid-range models gain wider traction. As AI ecosystems expand, robotic dogs increasingly serve as smart-home companions, creating new digital lifestyle opportunities and strengthening long-term market prospects.

Key Trends & Opportunities:

Expansion of Socially Assistive Robotics and Emotion-Responsive Features

A major trend shaping the robotic pet dogs market is the shift toward socially assistive robotics with advanced emotional-response systems. Manufacturers now integrate facial-expression recognition, real-time sentiment analysis, and adaptive behavior engines that allow robotic dogs to react differently based on user mood or voice tone. These features enable deeper emotional engagement and enhance perceived companionship value. Companies are also exploring biomimetic materials that imitate skin and fur textures to increase realism. Startups focus on lightweight, modular components that support frequent software updates and customizable personalities. As consumers become more comfortable with human-robot interaction, there is rising demand for robots that can act as emotional partners rather than simple entertainment devices. This creates strong opportunities for developers investing in cloud-AI, behavioral modeling, and long-term learning features that make robotic dogs feel more lifelike and personalized.

- For instance, a recent co‑design workshop (with animal‑welfare educators and children) for a zoomorphic robot pet highlighted that a natural, furry texture especially tactile fur on tail and ears significantly increases children s acceptance and emotional engagement, effectively bridging the gap between mechanical robot and pet feel.

Rising Demand in Education and Learning Environments

Educational institutions and parents adopt robotic pet dogs as hands-on learning tools for STEM, early communication skills, and emotional development. These devices help children understand cause-and-effect behavior, basic coding concepts, and structured interactive play. Schools use robotic pets to support inclusive learning for children with social or attention difficulties. Manufacturers see an opportunity to design curriculum-integrated models with modular features, programmable behavior, and gamified learning tasks. Increasing demand for tech-assisted learning and growing comfort among educators create strong expansion potential. Partnerships between developers and education providers can unlock new long-term revenue channels.

- For instance, in a recent pilot study using a multi-modal robot system for inclusive learning (for children with dyslexia or other learning differences), interaction with robots through gestures, touch, and simple dance/song tasks improved student engagement and motivation compared to non-robot-assisted learning.

Expansion in Healthcare and Assisted-Living Programs

Healthcare programs continue to explore robotic pet dogs to support emotional balance, memory engagement, and behavioral stabilization among patients. Hospitals use these devices to ease anxiety before treatment, while rehabilitation centers adopt them to encourage routine-based interactions. Growing global investment in elderly-care infrastructure enhances market opportunity, as robotic dogs offer scalable companionship without staffing strain. Developers can also create specialized therapeutic modules tailored to dementia, anxiety, or developmental disorders. Rising clinical validation and stronger institutional acceptance position healthcare as a key opportunity for sustained market growth.

Key Challenge :

High Costs and Limited Affordability in Mass Markets

Advanced robotic pet dogs require expensive components such as AI processors, high-precision motors, and multisensory systems. These costs restrict adoption among budget-conscious consumers, particularly in emerging economies. High-end models often exceed the spending limits of households seeking simple companionship solutions. Limited price elasticity slows mass adoption, even when demand exists. Manufacturers face pressure to reduce costs without compromising realism or interactivity, which remains difficult due to material and development expenses. As a result, market penetration depends heavily on mid-range innovation and improvements in low-cost assembly.

Ethical Concerns and Emotional Dependency Risks

The growing reliance on robotic pet dogs raises ethical debates around emotional substitution and long-term psychological effects. Some experts worry that users, especially children and the elderly, may develop strong attachments that distort social interaction or reduce human-to-human engagement. Care facilities also face concerns about replacing real caregiving with robotic companionship. The lack of clear guidelines on therapeutic use and data privacy adds further hesitation. These concerns slow adoption in sensitive environments and require manufacturers to balance emotional realism with responsible design.

Regional Analysis:

North America

North America led the robotic pet dogs market in 2024 with about 37% share. Strong adoption came from households seeking emotional support tools and elderly-care facilities integrating robotic therapy programs. The U.S. dominated regional demand due to high consumer spending, advanced AI development, and established healthcare infrastructure. Growing awareness of stress-relief technologies and rising acceptance of digital companionship strengthened market traction. Canada showed steady expansion as assisted-living centers and rehabilitation clinics adopted robotic pets for cognitive and emotional engagement. Wider availability across online platforms and active product innovation supported continued growth in the region.

Europe

Europe held nearly 30% share in 2024, supported by strong demand across Germany, the U.K., France, and the Nordic countries. The region benefited from government-backed elderly-care initiatives that encouraged the use of digital therapy tools. High interest in robotic companionship for mental-wellness applications also boosted adoption. Healthcare providers used robotic dogs to support dementia care and reduce patient isolation, especially in long-term care facilities. Strong consumer focus on advanced home automation and AI-enabled devices improved regional uptake. Growing investment in ethical AI and human-robot interaction research further contributed to market expansion.

Asia-Pacific

Asia-Pacific accounted for about 25% share in 2024 and represented the fastest-growing region. Japan and South Korea led adoption due to cultural acceptance of companion robots and strong robotics manufacturing capabilities. China showed rapid expansion as rising disposable income and smart-home penetration increased interest in affordable robotic pets. Healthcare facilities in Japan and Singapore used robotic dogs for elderly engagement, supporting regional growth. Manufacturers benefited from large-scale production advantages, enabling broader distribution. Expanding urban populations and strong demand for tech-assisted learning among children contributed to steady market momentum across key Asia-Pacific economies.

Latin America

Latin America captured around 5% share in 2024, with gradual adoption driven by rising awareness of robotic companionship. Brazil and Mexico led demand as middle-income households explored affordable digital pet alternatives. Growth also came from early use in educational programs aimed at improving STEM learning engagement. Limited purchasing power and higher import costs slowed widespread adoption, but online retail channels helped expand access. Healthcare centers in select urban areas experimented with robotic pets to support emotional therapy. As local distributors expand product availability, gradual market penetration is expected across major economies.

Middle East & Africa

The Middle East & Africa region held nearly 3% share in 2024, reflecting early-stage adoption. The UAE and Saudi Arabia showed the strongest uptake due to high disposable income and interest in smart-home technology. Hospitals and wellness centers in the Gulf region used robotic pets for patient comfort and stress reduction. Africa’s adoption remained limited by affordability barriers and lower technology access. However, awareness programs and growing digital infrastructure are slowly improving market visibility. As premium consumer segments expand and robotics imports increase, demand is expected to rise in selected urban markets over the forecast period.

Market Segmentations:

By Type

- Companion Robotic Dogs

- Interactive Robotic Dogs

- Educational Robotic Dogs

- Therapeutic Robotic Dogs

By Price Range

- Low-End

- Mid-Range

- High-End

By Audience

- Adults

- Elderly

- Individuals with Disabilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotic pet dogs market features companies such as Boston Dynamics Inc., Ghost Robotics Corp., Contixo Inc., Ageless Innovation, LEGO System AS, HangZhou YuShu Technology Co. Ltd., ANYbotics, Dimple nyc., BIRANCO Ltd., and Consequential Robotics Ltd. These players compete through advancements in AI-driven behavior, improved mobility, and sensory technology that enhances lifelike interaction. Many companies focus on expanding product portfolios that address companionship, education, and therapeutic use. Mid-range brands emphasize affordability and intuitive controls to reach wider consumer groups, while premium manufacturers invest in advanced emotional-recognition systems. Partnerships with healthcare facilities, eldercare centers, and educational institutions strengthen market presence and support adoption across structured programs. Companies also leverage online retail channels and global distribution networks to expand accessibility. Continuous innovation in smart-home integration, adaptive learning algorithms, and durable design materials remains central to gaining competitive advantage in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In January 2025, Ghost Robotics announced it would leave its Pennovation Works facility after months of protests and scrutiny over military sales, marking an operational/site change while continuing to push Vision 60 deployments for defense and public-safety customers.

- In September 2024, Boston Dynamics announced a partnership with Assa Abloy to let Spot interact with digital door/access systems (HID Signo readers), enabling more autonomous indoor navigation for security and facilities use.

- In August 2024, During Robotics Week outreach in Hatfield, the University of Hertfordshire used Consequential Robotics MiRo-E zoomorphic companion robot in primary-school workshops, later analysed in a 2025 social-robotics study on how children attribute emotions and intentions to robotic animal companions

Report Coverage:

The research report offers an in-depth analysis based on Type, Price Range, Audience and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand as emotional-support technology becomes a normal part of daily life.

- AI upgrades will make robotic dogs more realistic, adaptive, and socially responsive.

- Elderly-care facilities will increase adoption to support cognitive and emotional well-being.

- Educational use will grow as schools integrate robotic pets into STEM and social-skill programs.

- Prices will become more competitive as component costs fall and production scales.

- Smart-home integration will strengthen, allowing robotic dogs to function as connected assistants.

- Therapeutic applications will rise as healthcare providers validate benefits in mental-wellness programs.

- Personalization features will expand, enabling custom behavior, voices, and routines.

- Online retail growth will boost market reach across emerging economies.

- Manufacturers will explore sustainable materials and energy-efficient designs to meet consumer expectations.