Market Overview

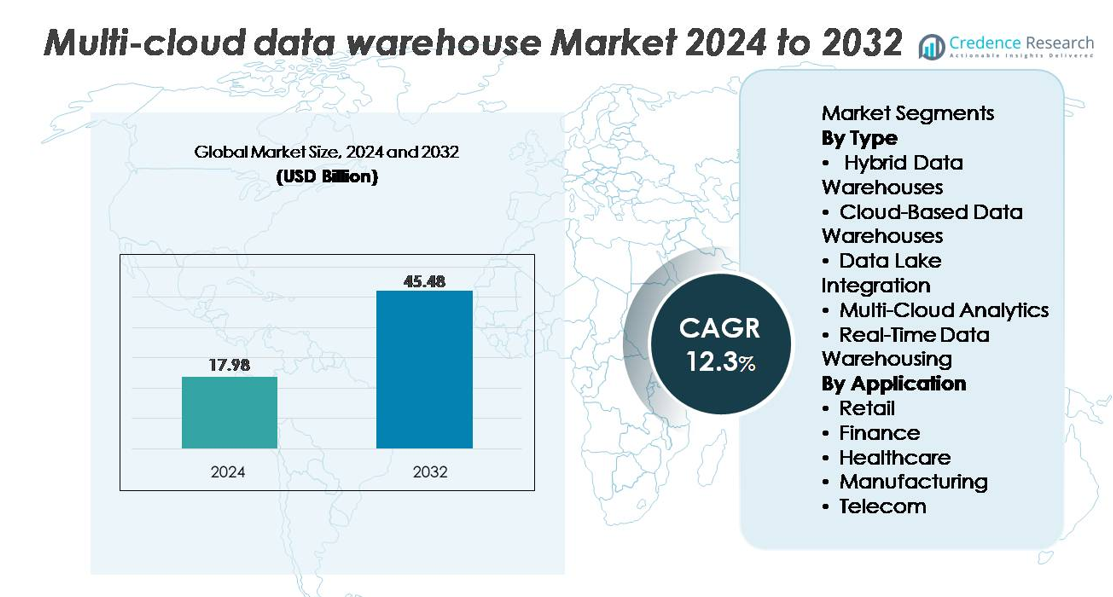

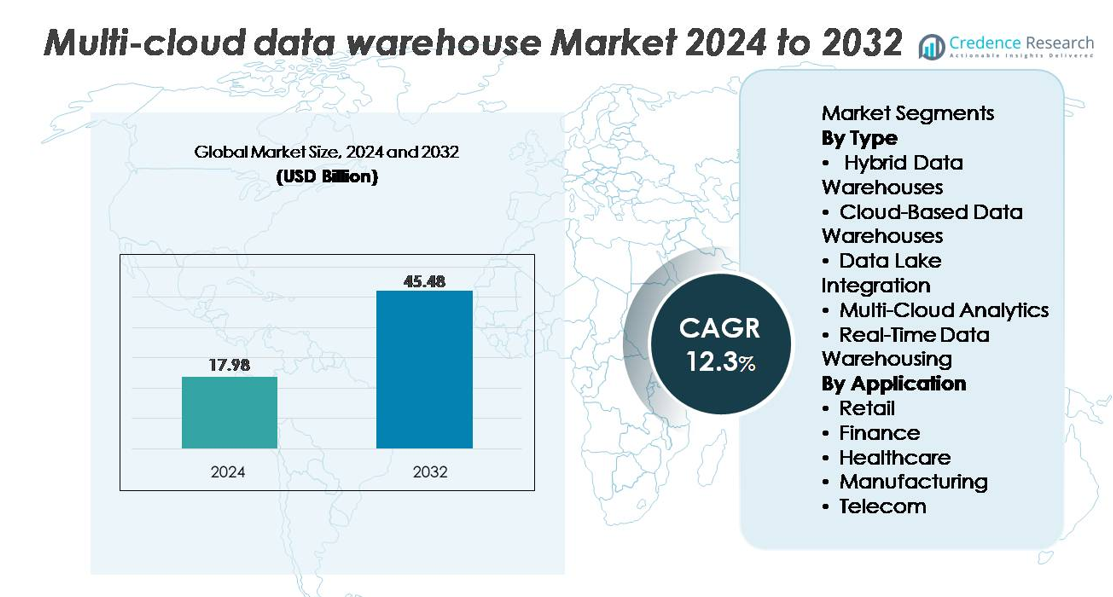

The global multi-cloud data warehouse market was valued at USD 17.98 billion in 2024 and is projected to reach USD 45.48 billion by 2032, expanding at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multi-Cloud Data Warehouse Market Size 2024 |

USD 17.98 billion |

| Multi-Cloud Data Warehouse Market, CAGR |

12.3% |

| Multi-Cloud Data Warehouse Market Size 2032 |

USD 45.48 billion |

The multi-cloud data warehouse market is shaped by major technology providers including Amazon Web Services, Microsoft Azure, Google Cloud, Snowflake, Oracle, IBM, Teradata, Cloudera, SAP, and Domo, each advancing capabilities in federated querying, elastic compute scaling, and cross-cloud interoperability. Snowflake and Google Cloud lead in cloud-native analytics innovation, while AWS and Azure dominate enterprise adoption through broad ecosystem integration. Oracle, IBM, and SAP strengthen hybrid and regulated-industry deployments, and Teradata maintains leadership in high-performance analytical workloads. North America remains the leading region with approximately 38% market share, driven by mature cloud adoption, strong regulatory alignment, and concentrated hyperscaler presence.

Market Insights

- The multi-cloud data warehouse market reached USD 17.98 billion in 2024 and is projected to hit USD 45.48 billion by 2032, registering a CAGR of 12.3%, supported by expanding enterprise analytics and cloud modernization initiatives.

- Strong market drivers include rising demand for unified data platforms, real-time analytics acceleration, and flexible workload distribution across cloud environments, with cloud-based data warehouses holding the dominant segment share due to high scalability and managed service adoption.

- Key trends include rapid growth of lakehouse architectures, AI-driven automation across pipelines, real-time streaming integration, and increasing enterprise focus on cost governance and multi-cloud optimization through FinOps practices.

- Competitive dynamics intensify as AWS, Azure, Google Cloud, and Snowflake lead innovation, while Oracle, IBM, SAP, Teradata, Cloudera, and Domo expand hybrid, regulated, and high-performance offerings; however, interoperability complexity and cross-cloud governance challenges act as restraints.

- Regionally, North America holds ~38%, Europe ~27%, Asia-Pacific ~24%, Latin America ~6%, and Middle East & Africa ~5%, reflecting varying cloud maturity levels and regulatory environments influencing adoption patterns globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Cloud-Based Data Warehouses represent the dominant segment, supported by rapid enterprise migration to fully managed platforms that offer elastic scaling, integrated security, and automated workload orchestration. Their strong adoption is driven by reduced infrastructure overhead, multi-region redundancy, and seamless interoperability with major cloud ecosystems. Hybrid Data Warehouses continue to gain traction among organizations balancing on-premises governance with cloud agility, while Data Lake Integration strengthens unified storage and analytics strategies. Multi-Cloud Analytics and Real-Time Data Warehousing expand usage in decentralized architectures, especially for latency-sensitive and distributed intelligence workloads across global operations.

- For instance, Snowflake offers multi-cluster warehouses that can dynamically scale out to numerous compute clusters for high concurrency, enabling rapid elasticity for heavy analytical workloads, while Amazon Redshift RA3 nodes support up to 128 TB of managed storage per node, ensuring efficient querying within the AWS cloud ecosystem.

By Application

The Finance segment leads the market, driven by the need for real-time risk modeling, regulatory reporting, fraud detection, and high-resilience multi-zone data architectures. Financial institutions increasingly adopt multi-cloud warehousing to meet stringent compliance requirements while ensuring uninterrupted analytics throughput. Retail follows closely, using cloud-based warehousing for omnichannel analytics, demand forecasting, and personalization engines. Healthcare accelerates adoption to support interoperable patient records and clinical data pipelines, while Manufacturing leverages distributed analytics for supply chain visibility. The Telecom segment strengthens multi-cloud adoption for network performance analytics, subscriber insights, and large-scale event processing.

- For instance, JPMorgan Chase uses a hybrid-cloud strategy combining private and public cloud platforms to support large-scale analytics and AI-driven fraud detection. The bank publicly disclosed plans to host 75% of its data in the cloud by 2024, reflecting its shift toward multi-cloud resilience and advanced data processing.

Key Growth Drivers:

Rising Enterprise Demand for Unified, Scalable, and Distributed Analytics

Enterprises increasingly embrace multi-cloud data warehouses to support unified analytics across distributed environments, driven by the need to process high-velocity data from diverse applications, cloud-native platforms, and edge systems. Organizations seek architectures that eliminate silos, improve query performance, and support advanced analytics such as predictive modeling and real-time intelligence. Multi-cloud models enable flexible workload distribution, continuous availability, and dynamic scaling without vendor lock-in. Their adoption is further accelerated by digital transformation initiatives in retail, BFSI, and telecom, which require seamless data mobility, high compute elasticity, and integrated governance frameworks to support mission-critical analytics across global operations.

- For instance, Google BigQuery can scan multiple petabytes of data in a single SQL query using its Dremel-based MPP engine distributed across thousands of nodes, enabling enterprises to run high-volume analytics with minimal latency.

Growing Focus on Regulatory Compliance, Security, and Data Sovereignty

Regulatory frameworks governing data protection, localization, retention, and auditability push enterprises toward multi-cloud strategies that offer stronger compliance controls and regional redundancy. Multi-cloud data warehouses enable organizations to store and process sensitive datasets across compliant geographic zones while applying centralized security, encryption, and identity management. As regulations evolve across sectors like finance, healthcare, and government services, multi-cloud platforms allow companies to align datasets with jurisdictional requirements without operational disruption. Enhanced capabilities for fine-grained access control, continuous monitoring, and policy automation ensure adherence to frameworks such as GDPR, HIPAA, and industry-specific audit standards.

- For instance, Microsoft Azure’s Confidential Computing environment uses Intel SGX–enabled VMs that enforce hardware-level isolation and support encrypted execution with EPC-backed secure enclaves, which meet compliance needs for regulated workloads across more than 60 Azure regions.

Integration of AI, ML, and Intelligent Automation Across Data Pipelines

The infusion of AI and machine learning into data warehousing workflows significantly accelerates adoption of multi-cloud architectures. Organizations increasingly automate ingestion, transformation, cataloging, anomaly detection, and performance tuning using intelligent systems that operate across cloud environments. Multi-cloud data warehouses enable AI-driven query optimization, automated scaling, and cost management, enhancing both performance and governance. The ability to integrate ML workloads natively with analytics engines strengthens use cases in fraud detection, real-time personalization, predictive maintenance, and operational forecasting. This convergence drives the shift toward self-optimizing, autonomous data platforms that improve decision-making speed and reliability.

Key Trends and Opportunities:

Expansion of Real-Time and Near-Real-Time Analytics Across Industries

Demand for real-time insights creates significant opportunities as organizations shift from batch processing to continuous data streams. Multi-cloud data warehouses now integrate change data capture, in-memory acceleration, and event-based architectures that support instant reporting, anomaly detection, and operational dashboards. Industries such as finance, telecom, and retail increasingly rely on sub-second insights for fraud detection, network optimization, inventory visibility, and personalization. This trend fuels investment in streaming analytics platforms, distributed compute systems, and serverless real-time pipelines that operate seamlessly across multiple cloud regions.

- For instance, Apache Kafka is broadly deployed in multi-cloud architectures, and LinkedIn reports that its Kafka infrastructure processes over 7 trillion messages per day across global services. Amazon Kinesis provides managed real-time streaming with automatic scaling and high-throughput ingestion for analytics workloads. Together, these platforms enable low-latency data processing across distributed cloud environments.

Rapid Growth of Data Lakehouse and Multi-Engine Query Architectures

The convergence of data lakes and warehouses into unified lakehouse frameworks presents a major opportunity for vendors. Multi-cloud environments increasingly support flexible compute engines, hybrid metadata layers, and unified storage systems that allow users to execute SQL, ML, and BI workloads on a single platform. As organizations seek to reduce duplication, improve governance, and accelerate data democratization, lakehouse adoption strengthens. Multi-engine query layers enable low-cost archival queries, high-speed analytics, and AI-driven processing within the same multi-cloud fabric, creating opportunities for interoperability-focused solutions and federated query technologies.

- For instance, Databricks’ Photon engine has been benchmarked by the company to deliver up to 2× faster SQL query performance compared to Apache Spark SQL on TPC-DS–style workloads, driven by its vectorized execution and modern CPU optimizations.

Increasing Adoption of FinOps, Cost Governance, and Multi-Cloud Optimization Tools

As enterprises scale analytics workloads across multiple cloud platforms, cost optimization and intelligent resource utilization become top priorities. FinOps-driven architectures that provide real-time cost visibility, automated scaling, and cross-cloud workload balancing gain momentum. Multi-cloud observability and optimization tools help organizations identify inefficient queries, redundant storage, and underutilized compute clusters. Vendors offering policy automation, predictive cost modeling, and AI-based optimization unlock significant market opportunity as organizations pursue cost governance without compromising performance or data availability.

Key Challenges:

High Complexity in Cross-Cloud Integration, Interoperability, and Governance

Integrating multiple cloud environments introduces architectural complexity, driven by differences in compute engines, networking layers, data formats, security policies, and cost models. Maintaining interoperability across storage layers, BI tools, ETL pipelines, and ML frameworks requires advanced orchestration and governance mechanisms. Organizations often struggle with inconsistent metadata, fragmented lineage tracking, and multi-layered permission structures. Ensuring seamless data mobility without compromising latency, reliability, or compliance adds technical burden. This complexity increases development cycles and raises operational costs, creating barriers for enterprises lacking specialized multi-cloud engineering expertise.

Rising Concerns Around Data Security, Privacy, and Cross-Region Risks

Multi-cloud data warehousing environments elevate risk profiles due to broader attack surfaces, distributed access points, and multi-zone data movement. Ensuring consistent encryption, identity management, access control, and threat detection across cloud platforms remains challenging. Misconfigurations, cross-cloud data drift, and shadow IT increase vulnerability to breaches. Companies must also navigate varied jurisdictional requirements related to data residency, audits, and privacy mandates. As the volume of sensitive financial, healthcare, and customer data grows, organizations face heightened pressure to reinforce security frameworks while maintaining high-speed analytics performance.

Regional Analysis

North America

North America holds the largest share of the multi-cloud data warehouse market at approximately 38%, driven by strong adoption of advanced analytics, AI-driven data platforms, and hybrid cloud architectures. Enterprises in the U.S. and Canada lead investments in real-time analytics, multi-cloud governance, and regulatory compliance frameworks supporting sectors such as BFSI, telecom, and retail. The region benefits from the presence of major cloud hyperscalers and analytics vendors offering integrated multi-cloud ecosystems. High maturity in cloud-native adoption, strong cybersecurity frameworks, and accelerated digital transformation initiatives continue to strengthen the region’s leadership position.

Europe

Europe accounts for around 27% of the market, supported by strong data protection regulations, cross-border compliance requirements, and rapid growth in multi-cloud deployments across financial services, manufacturing, and public sector organizations. Countries such as Germany, the U.K., France, and the Nordics lead adoption due to increasing investments in cloud interoperability, data sovereignty, and AI-enabled analytics pipelines. Strict adherence to GDPR drives demand for multi-region data storage and resilient architectures. Enterprises increasingly shift toward cloud-agnostic warehousing models that mitigate vendor lock-in, enhance operational flexibility, and support distributed analytics across complex regulatory environments.

Asia-Pacific

Asia-Pacific captures approximately 24% of the global market, emerging as the fastest-expanding region due to accelerated digitalization across banking, telecom, e-commerce, and healthcare. Countries such as China, India, Japan, and South Korea invest heavily in scalable, cloud-native analytics environments to handle rapid data growth. The rise of digital payment ecosystems, 5G infrastructure expansion, and large-scale customer intelligence platforms strengthens adoption of multi-cloud warehousing. Enterprises increasingly pursue distributed data strategies to improve latency, compliance, and disaster recovery, positioning the region as a significant driver of cloud modernization and real-time analytics adoption.

Latin America

Latin America holds around 6% of the market, supported by growing cloud adoption in banking, retail, and telecommunications sectors across Brazil, Mexico, Chile, and Colombia. Organizations in the region adopt multi-cloud data warehouses to enable cost-efficient analytics, meet regional compliance requirements, and reduce dependency on single cloud providers. Rising demand for fraud analytics, omnichannel retail insights, and digital services drives investments in real-time and hybrid warehousing models. While infrastructure disparities remain, expanding hyperscaler availability zones and government digital initiatives continue to unlock opportunities for scalable data modernization.

Middle East & Africa

The Middle East & Africa region represents approximately 5% of the global market, with adoption strengthening across the UAE, Saudi Arabia, South Africa, and emerging digital economies. Governments and enterprises invest in multi-cloud strategies to support smart city programs, financial modernization, and large-scale public-sector digitization. Multi-cloud data warehouses enable improved governance, real-time decision-making, and cross-region data resilience in geographically diverse environments. While cloud maturity varies, the establishment of new regional data centers by major hyperscalers and rising enterprise focus on cybersecurity accelerate the shift toward interoperable, cloud-agnostic analytics platforms.

Market Segmentations:

By Type

- Hybrid Data Warehouses

- Cloud-Based Data Warehouses

- Data Lake Integration

- Multi-Cloud Analytics

- Real-Time Data Warehousing

By Application

- Retail

- Finance

- Healthcare

- Manufacturing

- Telecom

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the multi-cloud data warehouse market is defined by intense innovation among hyperscalers, cloud-native analytics platforms, and enterprise data management providers. Leading players such as AWS, Microsoft Azure, Google Cloud, and Snowflake drive market expansion through advanced multi-region replication, serverless compute scaling, and integrated AI/ML services that enhance query performance and real-time analytics. Traditional enterprise vendors including IBM, Oracle, SAP, Cloudera, and Teradata strengthen their positioning by modernizing legacy architectures, integrating lakehouse capabilities, and offering hybrid deployment models that support strict data governance and regulatory mandates. The competition increasingly centers on interoperability, cost optimization, federated query execution, and automated pipeline management. Vendors are also investing in strategic alliances, marketplace ecosystems, and cross-cloud orchestration tools to deliver seamless workload portability. As enterprises pursue cloud-agnostic architectures, providers differentiate through performance acceleration, security automation, and unified metadata management, creating a dynamic and innovation-driven competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cloudera (US)

- SAP (Germany)

- Domo (US)

- IBM (US)

- Google Cloud (US)

- Teradata (US)

- Snowflake (US)

- Microsoft Azure (US)

- Oracle (US)

- Amazon Web Services (US)

Recent Developments

- In November 2025, SAP unveiled new data fabric innovations under its business data cloud effort: improved integration with cloud-native warehouses by extending support to the leading warehouse engine (via a “SAP Snowflake” solution extension in SAP Business Data Cloud), simplifying multi-cloud data governance, data sharing, and analytics workflows.

- In September 2025, Cloudera announced a significant update: the launch of Iceberg REST Catalog and Cloudera Lakehouse Optimizer, enabling zero-copy data sharing, unified metadata governance, and cost-effective multi-engine data access across clouds and on-prem environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- Multi-cloud data warehouses will increasingly adopt autonomous optimization capabilities powered by AI-driven performance tuning and automated workload orchestration.

- Enterprises will expand real-time and near–real-time analytics deployments to support instant decision-making across distributed operations.

- Lakehouse architectures will gain broader adoption as organizations seek unified storage, governance, and multi-engine query execution.

- FinOps practices will become standard as companies prioritize cost visibility, cross-cloud optimization, and intelligent resource allocation.

- Data sovereignty and compliance requirements will accelerate regionalized multi-cloud deployments with localized processing zones.

- Hybrid and cloud-agnostic architectures will strengthen as enterprises seek to reduce vendor lock-in and increase operational resilience.

- Federated querying across multiple clouds and on-premises systems will become more advanced and widely utilized.

- Security automation will evolve, integrating continuous posture management and unified identity frameworks across cloud environments.

- Industry-specific analytics solutions will expand, particularly in finance, healthcare, telecom, and retail.

- Multi-cloud observability and metadata intelligence platforms will grow as organizations prioritize governance, lineage tracking, and unified data visibility.