Market Overviews

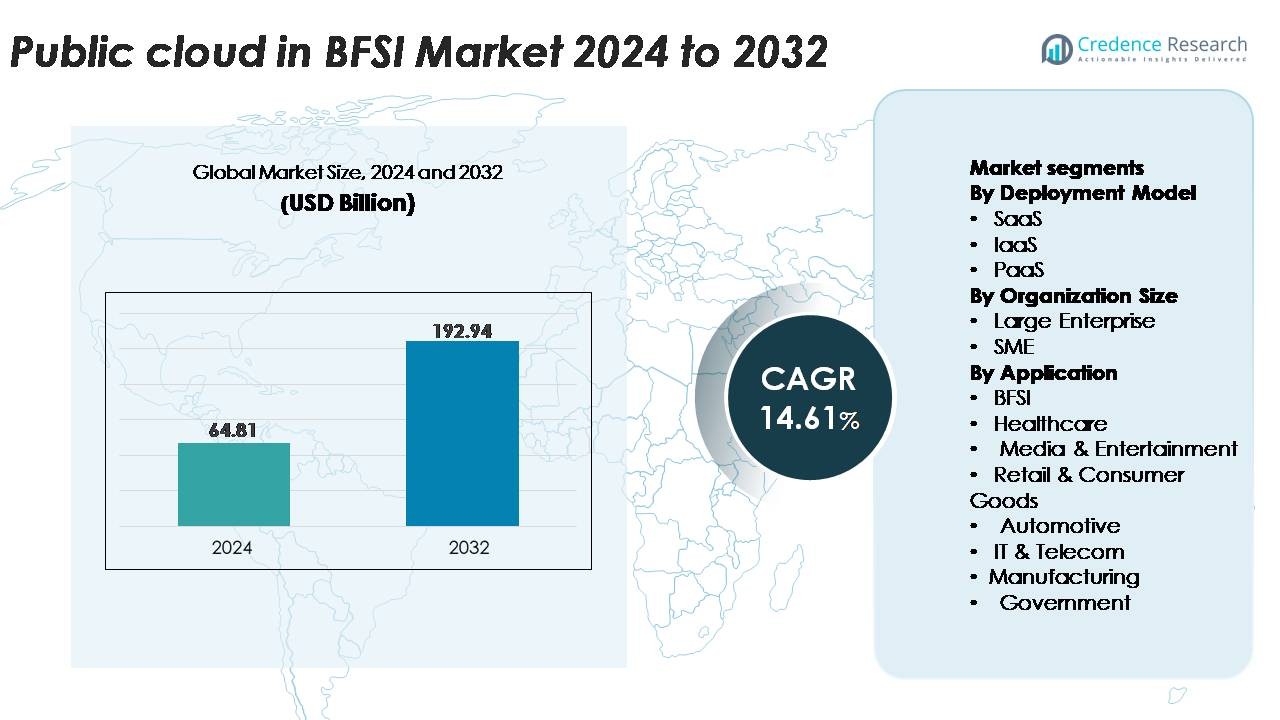

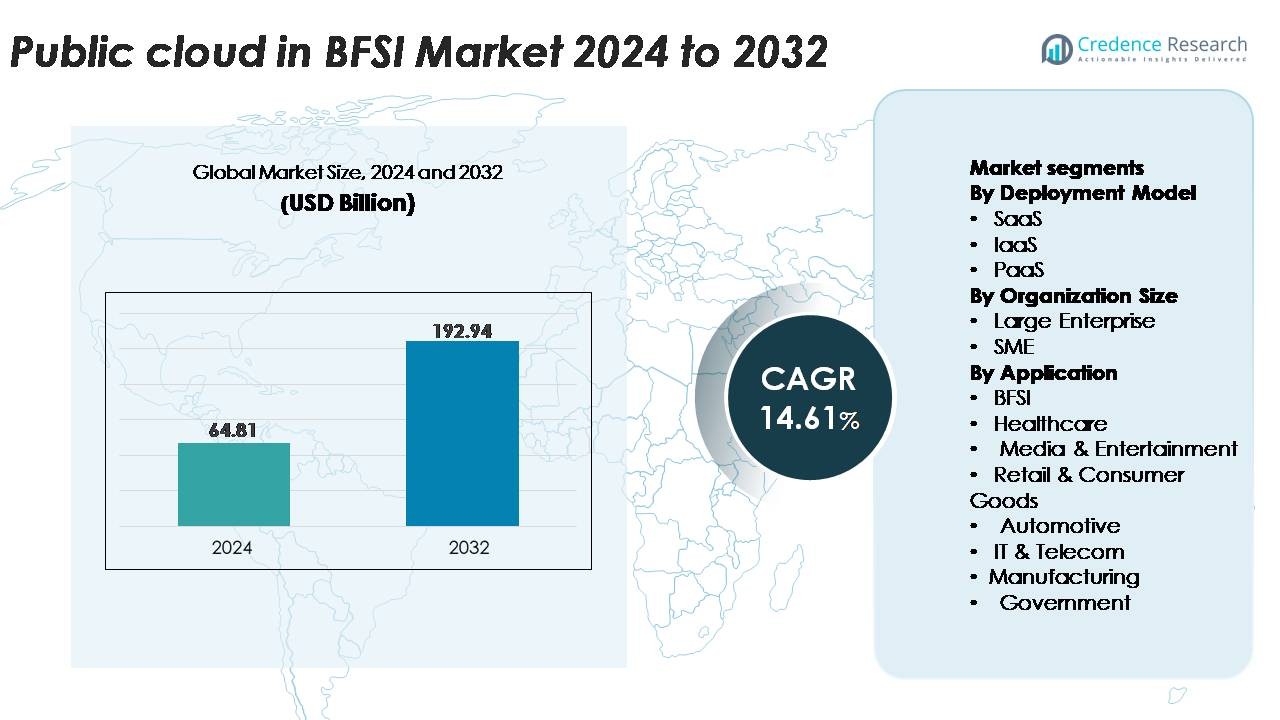

The public cloud in BFSI market was valued at USD 64.81 billion in 2024 and is anticipated to reach USD 192.94 billion by 2032, expanding at a CAGR of 14.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Public Cloud In BFSI Market Size 2024 |

USD 64.81 Billion |

| Public Cloud In BFSI Market, CAGR |

14.61% |

| Public Cloud In BFSI Market Size 2032 |

USD 192.94 Billion |

The public cloud in BFSI market is shaped by major technology providers that offer secure, compliant, and scalable cloud architectures tailored to banking and insurance workloads. Key players such as IBM Corporation, Tencent Cloud, Oracle Corporation, Salesforce, Google LLC, SAP SE, Nutanix, Amazon Web Services, Alibaba Group, and Microsoft Corporation continue to expand industry-specific cloud services, advanced analytics, and AI-driven automation for financial institutions. These companies strengthen competitiveness through data-residency solutions, multi-cloud management, and fintech ecosystem integration. North America leads the market with approximately 34% share, supported by aggressive cloud modernization and strong regulatory alignment, followed by Asia-Pacific and Europe, which show rapid adoption across digital banking and payments modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The public cloud in BFSI market was valued at USD 64.81 billion in 2024 and is projected to reach USD 192.94 billion by 2032, registering a 14.61% CAGR, driven by accelerated digital transformation across global banking and insurance sectors.

- Strong market momentum arises from rising demand for scalable infrastructure, AI-driven analytics, core banking modernization, and enhanced security frameworks, with SaaS holding the largest segment share due to rapid deployment and compliance-ready features.

- Key trends include rapid expansion of multi-cloud adoption, growth of cloud-native payment systems, and increasing collaboration between cloud providers, fintech platforms, and regtech vendors to support real-time processing and regulatory automation.

- Competitive intensity remains high as AWS, Microsoft, Google, IBM, Oracle, and Alibaba strengthen cross-industry cloud offerings, sovereign-cloud capabilities, and integrated cybersecurity services while addressing restraints such as data-residency rules and migration complexity.

- Regionally, North America leads with ~34% share, followed by Asia-Pacific at ~30% and Europe at ~28%, reflecting strong cloud modernization, digital payments expansion, and open-banking acceleration across these markets.

Market Segmentation Analysis:

By Deployment Model

In the deployment model segment, SaaS dominates the public cloud in BFSI market, capturing the largest share due to its rapid implementation, modular scalability, and strong alignment with digital banking modernization initiatives. Financial institutions increasingly adopt SaaS-based core banking modules, CRM platforms, fraud-detection engines, and regulatory reporting tools to reduce IT overhead and speed up innovation cycles. IaaS gains traction for core infrastructure consolidation, while PaaS adoption rises as banks build cloud-native applications. However, SaaS leads growth as BFSI enterprises prioritize continuous upgrades, subscription affordability, and compliance-ready managed services.

- For instance, Salesforce Financial Services Cloud leverages Einstein AI, which makes tens of billions of AI-powered predictions per day. This technology enables features like real-time credit scoring and customer-engagement automation at scale.

By Organization Size

Among organization sizes, large enterprises account for the dominant market share, driven by accelerated cloud migration roadmaps, multi-region failover requirements, and the integration of advanced analytics and cybersecurity frameworks. Established banks and insurance providers leverage cloud platforms to modernize legacy systems, streamline omnichannel operations, and meet stringent regulatory standards. SMEs are expanding adoption steadily, using public cloud services to minimize upfront investment and leverage preconfigured security and automation capabilities. While SME uptake grows across digital lending and fintech operations, large enterprises remain the primary adopters due to the scale of workloads and transformation budgets.

- For instance, AWS supports multi-region financial deployments using its Global Infrastructure of over 105 Availability Zones, enabling banks to achieve recovery time objectives measured in seconds for critical workloads.

By Application

Within the application segment, BFSI remains the leading sub-segment, accounting for the largest share as banks, insurers, and fintech firms increasingly adopt cloud-based solutions for real-time payments processing, digital onboarding, risk modeling, and regulatory compliance automation. Healthcare, retail, media, and government sectors also contribute to growth as they adopt cloud platforms for data integration and consumer-facing digital services. However, BFSI continues to dominate due to the sector’s high dependency on secure cloud environments, advanced analytics, and AI-driven fraud management systems that support resilient and scalable financial service delivery.

Key Growth Drivers:

Rapid Digital Transformation and Core System Modernization

Banks and financial institutions increasingly prioritize modernization of legacy IT environments to support real-time operations, customer-centric service models, and digital-first engagement. Public cloud platforms enable BFSI organizations to migrate core banking, payment processing, and CRM systems to scalable architectures that reduce operational complexity and accelerate deployment cycles. Institutions leverage cloud-native microservices, containerization, and continuous integration pipelines to deliver faster product updates and improve service reliability. This modernization push is reinforced by rising consumer adoption of mobile banking, instant payments, and digital lending. The ability of public cloud systems to handle high-volume transactions, integrate advanced analytics, and support seamless API connections with fintech ecosystems makes them central to ongoing digital acceleration. As financial institutions pursue long-term operational agility, cloud-based modernization remains a major driver of market expansion.

- For instance, Google Kubernetes Engine (GKE) supports cluster scaling up to 65,000 nodes for Standard clusters (in version 1.31 and later) and 5,000 nodes for Autopilot clusters.

Rising Demand for Data Security, Compliance Automation, and Fraud Prevention

Data protection and regulatory adherence are critical priorities across the BFSI ecosystem, pushing institutions toward public cloud platforms that offer built-in security automation, encryption, digital identity tools, and compliance-ready architectures. Cloud providers deliver frameworks aligned with global standards such as PCI DSS, ISO 27001, GDPR, and region-specific financial regulations, reducing the compliance burden for institutions. Banks increasingly deploy cloud-based fraud detection engines, behavioral analytics, and AI-driven risk scoring models to counter rising cyberattacks and financial crime. Public cloud infrastructures also support enhanced auditability through automated log monitoring, configuration baselines, and controlled data governance. As threats grow more sophisticated, public cloud adoption is driven by the need for adaptive security, proactive threat intelligence, and continuous compliance, enabling BFSI organizations to manage risk more effectively while maintaining operational resilience.

- For instance, AWS GuardDuty analyzes tens of billions of events across multiple AWS data sources (including AWS CloudTrail logs, Amazon VPC Flow Logs, and DNS query logs) to detect anomalies and malicious activity in near real-time.

Expansion of Digital Payments, Open Banking, and API-led Ecosystems

The rapid evolution of digital payments, open banking frameworks, and embedded finance models drives financial institutions to adopt public cloud to support high-speed transaction processing and seamless third-party integrations. Cloud-native APIs enable banks to connect with fintech platforms, payment gateways, and digital identity services while maintaining strong security controls. Public cloud environments offer performance optimization for instant payment schemes, cross-border remittances, and real-time settlement systems that require elastic compute power. The growth of digital wallets, BNPL services, neo-banks, and decentralized financial products further intensifies the need for scalable cloud infrastructure. As regulators encourage data portability and interoperability through open banking initiatives, cloud platforms become essential for institutions aiming to innovate quickly and deliver personalized financial services. This ecosystem-driven transformation significantly boosts market adoption.

Key Trends and Opportunities:

Acceleration of AI, ML, and Advanced Analytics Adoption

Public cloud platforms generate new opportunities for BFSI institutions to scale AI, machine learning, and predictive analytics across customer engagement, risk modeling, underwriting, and portfolio management. Banks deploy cloud-based analytics engines to deliver personalized insights, automate credit scoring, and enhance operational forecasting. AI-driven automation also supports intelligent document processing, chatbot-based servicing, and anomaly detection in financial transactions. As cloud providers offer pre-trained models, GPU acceleration, and integrated data-lake architectures, adoption becomes more cost-effective and faster to deploy. The rising emphasis on hyper-personalization, autonomous finance, and algorithmic decision-making creates long-term opportunities for cloud-enabled AI ecosystems within BFSI.

- For instance, Google’s Vertex AI can train large-scale models using pods of up to 16,384 TPU v5e chips, enabling high-speed execution of fraud-detection and risk-scoring workloads.

Growth of Hybrid, Multi-Cloud, and Sovereign Cloud Architectures

Financial institutions increasingly adopt hybrid and multi-cloud strategies to balance regulatory compliance, data residency requirements, and operational flexibility. This trend creates significant opportunities for public cloud providers offering secure interconnectivity, unified workload management, and institution-specific data localization frameworks. Sovereign cloud initiatives emerge as a strategic priority, enabling BFSI organizations to store sensitive workloads within national boundaries while maintaining access to global cloud innovations. Multi-cloud adoption also mitigates vendor lock-in and enhances resilience through redundancy. As financial regulators promote operational continuity and risk diversification, hybrid and multi-cloud models gain traction, expanding the market’s growth potential.

- For instance, Microsoft’s Cloud for Sovereignty supports deployments across more than 60 Azure regions and enables policy enforcement through over 10,000 built-in compliance controls, ensuring regulated data remains within approved jurisdictions.

Expansion of Cloud-Based Banking-as-a-Service (BaaS) and Fintech Collaboration

The rise of BaaS platforms, digital onboarding solutions, and embedded financial services creates new opportunities for public cloud adoption in BFSI. Cloud providers increasingly partner with fintech companies, core banking vendors, and digital payment solution providers to build modular, API-enabled ecosystems. These collaborations support rapid launch of digital-only banks, micro-lending services, wealth-tech platforms, and insurance-tech products. Public cloud infrastructure enables low-latency integrations and scalable deployment of customer-facing applications. As more institutions shift to platform-based business models, cloud-enabled BaaS becomes a major opportunity area, fostering innovation and new revenue streams across the financial value chain.

Key Challenges:

Regulatory Complexity, Data Residency Constraints, and Audit Requirements

While public cloud adoption accelerates, financial institutions face significant challenges in meeting strict regulatory mandates related to data storage, cross-border data transfer, operational continuity, and audit transparency. Many regions require sensitive financial data to remain within domestic boundaries, limiting how institutions can deploy public cloud workloads. Frequent updates to supervisory guidelines demand continuous risk assessments, vendor audits, and compliance reporting, increasing operational burden. Institutions must also maintain visibility into shared responsibility models, encryption policies, and third-party access controls. These regulatory complexities slow down migration timelines and require robust governance frameworks to ensure adherence without compromising innovation.

Legacy System Integration, Skill Gaps, and Migration Complexity

Integrating legacy core banking systems with modern cloud architectures remains a major challenge for BFSI institutions. Many banks operate decades-old mainframes with tightly coupled applications, making cloud migration technically complex and resource-intensive. The shortage of cloud-native skills such as DevOps, container orchestration, and microservices design further delays transformation initiatives. Migration also involves high operational risk, including potential downtime, data synchronization issues, and architectural redesign. Institutions must balance modernization efforts with day-to-day operations, making phased transitions essential. These integration and skill challenges continue to slow adoption despite strong long-term benefits of public cloud deployment.

Regional Analysis:

North America

North America holds the largest share at approximately 34%, driven by strong adoption of cloud-native banking platforms, digital payment modernization, and stringent cybersecurity frameworks. Large banks and insurance providers accelerate migration of core workloads to public cloud to enhance resiliency, strengthen compliance automation, and support real-time analytics. The U.S. leads deployment, supported by mature financial infrastructure and strong cloud–fintech collaboration. Canada follows with increased investment in digital banking transformation and open-banking readiness. The region’s advanced regulatory alignment and high innovation spending continue to position it as the primary contributor to market growth.

Europe

Europe accounts for around 28% of the global market, fueled by rapid adoption of cloud services across retail banking, payments, and insurance as institutions respond to PSD2, GDPR, and open-banking mandates. Countries such as the UK, Germany, and the Nordics lead cloud migration initiatives, emphasizing data sovereignty, sovereign cloud partnerships, and cross-border digital payment standardization. Financial institutions increasingly deploy cloud-enabled analytics, fraud detection, and digital onboarding solutions. Growing collaboration between global cloud providers and European regulators further accelerates compliance-ready cloud adoption. This structured regulatory ecosystem strengthens Europe’s position as a high-value regional contributor.

Asia-Pacific

Asia-Pacific represents approximately 30% of the market, emerging as the fastest-growing region due to large-scale digital banking expansion, rising fintech activity, and sustained cloud investments in China, India, Japan, and Southeast Asia. Banks adopt public cloud to support real-time payments, digital lending, and high-volume mobile banking environments. Government-led digital economy initiatives and national cloud policies accelerate BFSI migration. The region also experiences strong adoption of AI-driven fraud detection and cloud-based compliance platforms. With a rapidly expanding customer base and high demand for mobile-first services, Asia-Pacific continues to generate strong demand for scalable cloud infrastructure.

Latin America

Latin America contributes around 5% of global market share, supported by growing cloud adoption among banks modernizing legacy systems and expanding digital banking services. Brazil and Mexico lead deployments as financial institutions invest in cloud-based payment rails, digital onboarding, and cybersecurity modernization. Fintech expansion, particularly in digital wallets and micro-lending, further boosts public cloud demand. While regulatory clarity varies across countries, rising cloud partnerships and national digital transformation programs help accelerate adoption. Despite infrastructure challenges, the region presents emerging opportunities driven by increasing mobile banking penetration and rising consumer demand for digital financial access.

Middle East & Africa

The Middle East & Africa (MEA) region holds approximately 3% of the market, with cloud adoption accelerating in Gulf Cooperation Council economies, including the UAE and Saudi Arabia. Banks invest in cloud platforms to enhance compliance, support digital payments, and deploy AI-driven customer engagement solutions. National cloud and data-residency policies such as Saudi Arabia’s digitalization initiatives and the UAE’s cloud-first strategies encourage BFSI migration. In Africa, growing mobile banking ecosystems and fintech innovation stimulate demand for scalable public cloud infrastructure. While adoption remains gradual, MEA shows rising momentum driven by digital transformation agendas and expanding financial inclusion.

Market Segmentations:

By Deployment Model

By Organization Size

By Application

- BFSI

- Healthcare

- Media & Entertainment

- Retail & Consumer Goods

- Automotive

- IT & Telecom

- Manufacturing

- Government

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the public cloud in BFSI market is defined by the presence of major global cloud providers and specialized fintech–cloud partnerships that collectively shape digital transformation strategies across the financial sector. Leading players including AWS, Microsoft Azure, Google Cloud, IBM Cloud, and Oracle Cloud compete by offering compliance-ready architectures, advanced security frameworks, and AI-driven analytics tailored to banking and insurance workloads. These vendors invest heavily in multi-zone data centers, sovereign cloud capabilities, and regulatory certifications to meet evolving financial governance requirements. Strategic collaborations with core banking vendors, payment processors, regtech providers, and digital identity platforms further strengthen market positioning. Providers differentiate through industry-specific offerings such as cloud-native core banking engines, fraud detection suites, API management platforms, and high-performance compute for real-time transaction processing. As BFSI institutions accelerate modernization, competition intensifies around automation, resilience, and integrated AI services, driving continuous innovation across the ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM Corporation

- Tencent Cloud

- Oracle Corporation

- Salesforce, Inc.

- Google LLC

- SAP SE

- Nutanix

- Amazon Web Services, Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

Recent Developments:

- In May 2025, Nutanix released a public preview of its Cloud Clusters (NC2) on Google Cloud, enabling hybrid and multicloud workload mobility including migration and disaster-recovery capabilities suited for finance environments.

- In May 2025, Oracle launched new cloud services targeted at retail banking institutions, enabling modernization of lending and collections functions through its public-cloud infrastructure and applications.

- In November 2025, IBM signed a long-term agreement with German financial-services provider Atruvia GmbH to modernize its IT platform using IBM’s cloud, automation and data-services portfolio across banking operations and hybrid-cloud workloads.

Report Coverage:

The research report offers an in-depth analysis based on Deployment model, Organization size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Public cloud adoption in BFSI will accelerate as banks modernize core systems and expand cloud-native digital banking capabilities.

- Institutions will increase use of AI, ML, and automation on cloud platforms to enhance fraud detection, underwriting, and customer analytics.

- Multi-cloud and hybrid cloud strategies will strengthen as organizations balance resilience, vendor diversification, and regulatory compliance.

- Cloud-enabled real-time payment infrastructure will expand to support growing demand for instant transactions and cross-border connectivity.

- Open banking and API-driven ecosystems will deepen cloud dependency as banks collaborate more with fintech and regtech partners.

- Sovereign cloud frameworks will gain momentum as countries enforce data residency, privacy, and governance requirements.

- Cloud-based cybersecurity tools will evolve to address sophisticated financial threats through continuous monitoring and adaptive protection.

- Digital onboarding, KYC automation, and cloud-hosted identity solutions will become mainstream across financial institutions.

- Cloud adoption among insurers will grow through advanced risk modeling, claims automation, and telematics integration.

- The shift toward autonomous finance and personalized digital services will push BFSI providers toward deeper cloud integration across all operations.