Market Overview

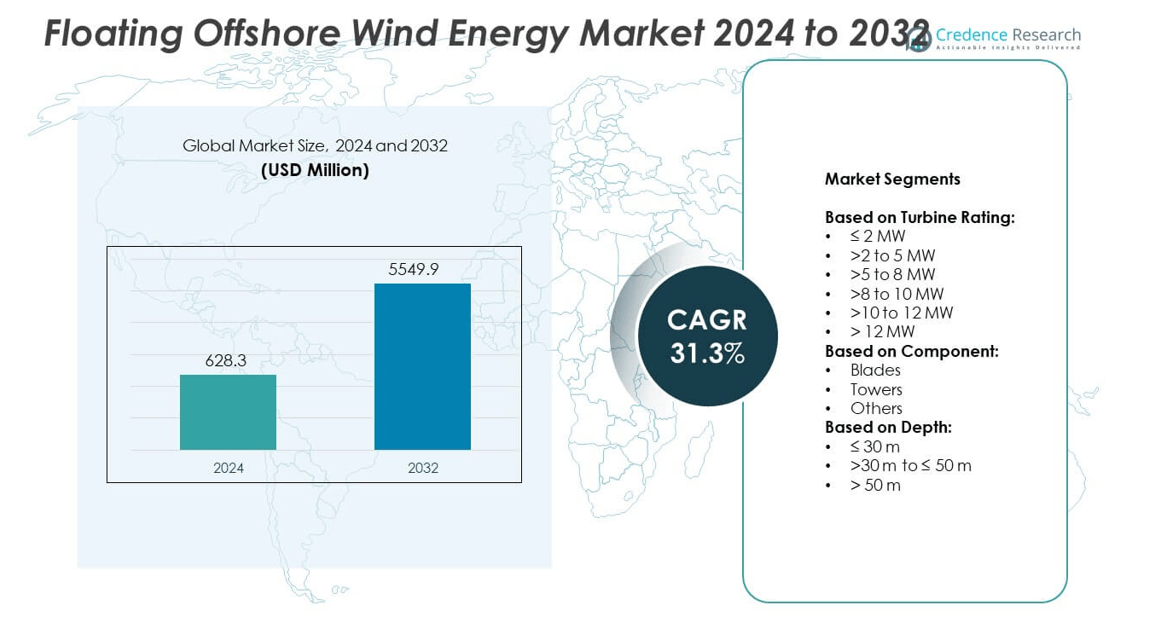

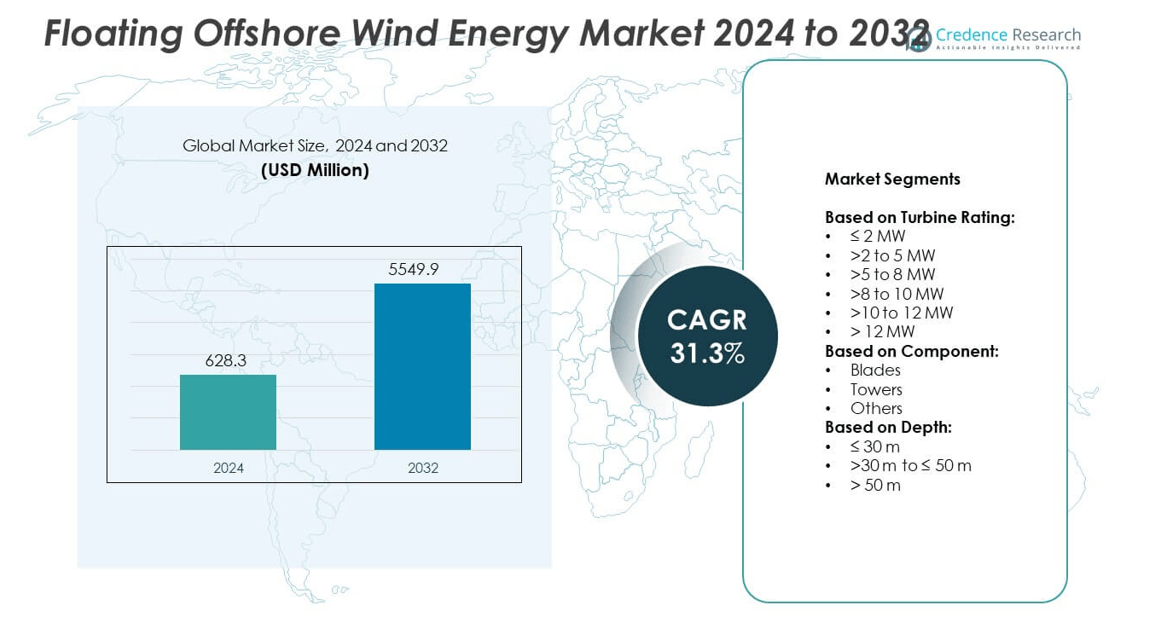

The Floating Offshore Wind Energy Market size was valued at USD 628.3 million in 2024 and is anticipated to reach USD 5,549.9 million by 2032, growing at a CAGR of 31.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floating Offshore Wind Energy Market Size 2024 |

USD 628.3 million |

| Floating Offshore Wind Energy Market, CAGR |

31.3% |

| Floating Offshore Wind Energy Market Size 2032 |

USD 5,549.9 million |

The Floating Offshore Wind Energy market grows through strong government support, ambitious renewable energy targets, and rising demand for clean power. Technological advancements in large turbines, floating platforms, and digital monitoring improve efficiency and reduce costs. Growing policy incentives and financing frameworks accelerate commercial deployment across deeper waters. Expanding global project pipelines and strategic partnerships enhance scalability and investor confidence. It reflects a clear shift toward sustainable energy solutions while diversifying regional energy portfolios and strengthening long-term market growth.

Europe leads the Floating Offshore Wind Energy market with established infrastructure and strong regulatory support, while North America scales projects through state-led initiatives and federal incentives. Asia-Pacific shows rapid growth, driven by Japan, South Korea, and China investing in deep-water projects. Latin America and the Middle East & Africa remain at early stages but present long-term potential. Key players such as Equinor ASA, Ørsted A/S, Siemens Gamesa Renewable Energy, and Vestas actively shape the market through innovation and global project expansion.

Market Insights

- The Floating Offshore Wind Energy market was valued at USD 628.3 million in 2024 and is projected to reach USD 5,549.9 million by 2032, growing at a CAGR of 31.3%.

- The market is driven by global decarbonization goals, rising demand for renewable power, and strong government incentives supporting offshore wind adoption.

- Technological trends include the adoption of turbines above 12 MW, modular floating platforms, and the use of digital tools for predictive maintenance and performance optimization.

- Competitive dynamics are shaped by leading players focusing on innovation, strategic partnerships, and large-scale project execution in deep-water regions.

- The market faces restraints from high capital costs, limited supply chain readiness, and challenges related to installation, maintenance, and financing risks.

- Regionally, Europe leads with strong policy frameworks and mature infrastructure, North America expands through state and federal support, and Asia-Pacific accelerates growth with investments in Japan, South Korea, and China.

- Latin America and the Middle East & Africa remain in early stages but present emerging opportunities as governments diversify energy portfolios and attract global partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Renewable Energy and Decarbonization Targets

The Floating Offshore Wind Energy market gains strong momentum from global decarbonization commitments. Governments implement aggressive renewable energy targets to reduce reliance on fossil fuels. Offshore wind farms provide scalable clean power with minimal land use conflicts. Floating technology enables deployment in deeper waters, expanding access to stronger wind resources. Countries such as the United States, the United Kingdom, and Japan push projects to meet climate goals. It supports energy transition by diversifying power generation and reducing carbon emissions.

- For instance, Equinor’s Hywind Scotland project delivers 30 MW from five 6 MW turbines and displaces an estimated 63,000 tonnes of carbon emissions annually.

Technological Advancements and Cost Competitiveness

The Floating Offshore Wind Energy market benefits from continuous innovation in turbine size, floating structures, and anchoring systems. Larger turbines with capacities beyond 12 MW deliver higher efficiency and power output. Standardization of components and industrial-scale production reduce capital and operational costs. Improved digital monitoring and predictive maintenance enhance reliability and minimize downtime. Floating foundations such as spar-buoy, semi-submersible, and tension leg platforms open opportunities in challenging seabed conditions. It enables competitive pricing against conventional offshore wind, driving investor interest.

- For instance, GE Vernova’s Haliade-X wind turbines are available in several capacities, including a version rated at 14.7 MW, which is certified to produce up to 76 GWh of gross annual energy per unit.

Strong Policy Support and Government Incentives

The Floating Offshore Wind Energy market expands with supportive policies, subsidies, and long-term procurement frameworks. Governments provide tax credits, feed-in tariffs, and auction schemes to encourage private investments. Regulatory bodies streamline permitting processes, which reduces project delays and financing risks. Public funding supports research and pilot projects that validate new designs and materials. Collaboration between governments and industry players ensures faster commercialization. It creates favorable conditions for large-scale deployment across multiple regions.

Expanding Global Project Pipeline and Private Investments

The Floating Offshore Wind Energy market witnesses rapid expansion of project pipelines worldwide. Developers invest heavily in pilot and pre-commercial projects to establish operational track records. Strategic alliances among energy companies, technology providers, and investors accelerate project execution. Financial institutions recognize the long-term stability of offshore wind revenues, unlocking funding opportunities. International oil and gas companies diversify into offshore renewables, leveraging their offshore expertise. It strengthens global supply chains and boosts confidence in market scalability.

Market Trends

Adoption of Larger Turbine Capacities for Higher Efficiency

The Floating Offshore Wind Energy market is witnessing a clear trend toward larger turbine installations. Developers are shifting from 8–10 MW units to next-generation turbines exceeding 12 MW capacity. These turbines deliver greater power output and reduce the cost per megawatt installed. Larger units also optimize space utilization, reducing the number of foundations needed per project. This trend strengthens project economics by improving scalability and lowering maintenance requirements. It positions floating offshore wind as a competitive option in global energy markets.

- For instance, Japan’s METI-backed Goto Floating Offshore Wind Farm is a 16.8 MW capacity project with FIT incentives, though its commercial operation start was delayed from an initial schedule in 2024 to January 2026

Growing Focus on Standardization and Modular Designs

The Floating Offshore Wind Energy market is moving toward standardized and modular floating platforms. Standardized designs reduce costs, speed up construction timelines, and simplify supply chain logistics. Modular platforms allow easier assembly and deployment across different water depths. Industry players adopt semi-submersible and spar-buoy configurations that demonstrate proven scalability. This trend ensures repeatable designs that attract investors by lowering project risks. It helps developers deploy projects more quickly and cost-effectively in new regions.

- For instance, Shell and ScottishPower formed a joint venture in 2022 to develop two floating wind projects, MarramWind (3 GW) and CampionWind (2 GW), for a total of 5 GW capacity in the UK’s ScotWind leasing round. However, in late 2024, Shell announced its intent to exit this venture.

Integration of Digital Technologies for Performance Optimization

The Floating Offshore Wind Energy market is embracing digital innovations such as IoT sensors, predictive analytics, and AI-driven monitoring. Digital systems track turbine performance, structural integrity, and environmental conditions in real time. Predictive maintenance reduces downtime and improves overall project efficiency. Data-driven insights also support resource forecasting and asset optimization. This trend enhances safety by detecting faults early and extending equipment lifespan. It improves operational reliability while reducing costs across large-scale floating wind farms.

Expansion into New Geographies with Deeper Waters

The Floating Offshore Wind Energy market is expanding into regions with deeper waters and stronger wind resources. Europe continues to lead, but Asia-Pacific and North America are rapidly scaling projects. Countries such as Japan, South Korea, and the United States drive early adoption outside Europe. Floating technology enables project deployment where fixed-bottom foundations are not feasible. This trend accelerates global diversification and enhances energy security. It broadens the market’s geographical base and supports long-term growth potential.

Market Challenges Analysis

High Capital Costs and Financing Barriers

The Floating Offshore Wind Energy market faces significant challenges from high upfront investment requirements. Floating platforms, advanced turbines, and specialized installation vessels demand substantial capital compared to fixed-bottom alternatives. Limited track records for large-scale projects make investors cautious, increasing financing risks. Insurance premiums and long payback periods further restrict financial accessibility. Developers struggle to secure competitive funding, especially in emerging markets with limited policy support. It creates financial uncertainty that slows down the pace of commercialization.

Complex Supply Chain and Technical Constraints

The Floating Offshore Wind Energy market encounters hurdles in establishing reliable global supply chains. Specialized components such as floating foundations, mooring systems, and subsea cables are not widely available. Manufacturing bottlenecks, port infrastructure limitations, and lack of skilled labor intensify deployment delays. Harsh offshore conditions also pose risks to durability, installation, and maintenance operations. Developers face high operational costs due to the need for advanced monitoring and repair systems. It limits scalability until supply chains and infrastructure adapt to industry demands.

Market Opportunities

Expansion Potential in Untapped Deep-Water Regions

The Floating Offshore Wind Energy market offers strong opportunities in regions with deep-water coastlines. Countries with limited shallow waters, such as Japan, South Korea, and parts of the U.S., can leverage floating technology to meet renewable energy goals. Offshore areas with high wind intensity provide abundant, consistent energy resources that fixed-bottom foundations cannot access. Advancing designs for semi-submersible and spar-type platforms enable scalability across diverse marine environments. Governments seeking energy independence encourage projects in such geographies through supportive frameworks. It opens large-scale deployment opportunities for developers and technology providers.

Strategic Partnerships and Diversification of Energy Portfolios

The Floating Offshore Wind Energy market benefits from growing collaboration between utilities, oil and gas companies, and technology innovators. Traditional energy firms diversify portfolios by investing in floating wind projects to align with sustainability targets. Partnerships accelerate knowledge transfer, reduce project risks, and strengthen financial viability. Supply chain integration across ports, shipbuilders, and component manufacturers unlocks cost reduction potential. Early adopters gain competitive advantage by establishing operational expertise in this emerging sector. It creates long-term opportunities for stakeholders to capture global market share.

Market Segmentation Analysis:

By Turbine Rating:

The Floating Offshore Wind Energy market shows strong traction in the >10 to 12 MW and >12 MW segments. Larger turbines dominate due to their ability to generate higher output with fewer installations. Developers favor high-capacity turbines to lower the levelized cost of energy and enhance efficiency. The >8 to 10 MW category continues to see demand, especially in early-stage projects and demonstration sites. Smaller segments such as ≤2 MW and >2 to 5 MW are largely limited to pilot projects and nearshore applications. The >5 to 8 MW segment serves as a transitional option in mid-sized farms. It reflects a steady movement toward high-capacity installations for large-scale projects.

- For instance, Siemens Gamesa’s SG 14-222 DD offshore turbine features a 222-meter rotor and generates 25% more energy than its predecessor

By Component:

Blades represent the leading segment driven by their critical role in power generation efficiency. Continuous advancements in blade design and lightweight composite materials increase energy capture and durability. Towers follow as a vital segment, supporting larger turbines and withstanding harsh marine conditions. Developers focus on improving tower height and structural stability to maximize wind potential. The “others” category includes mooring systems, cables, and ancillary parts that ensure structural integrity. These components are essential for floating platforms to remain stable in deeper waters. It highlights the growing demand for integrated systems to improve performance.

- For instance, Principle Power’s WindFloat Atlantic project in Portugal deployed three 8.4 MW turbines on semi-submersible platforms, achieving over 90% availability.

By Depth:

The >50 m category dominates due to the unique advantage of floating platforms in deeper waters. These installations unlock access to high wind resources not reachable with fixed-bottom turbines. The >30 m to ≤50 m segment records steady demand in regions with moderate depth zones. The ≤30 m category remains limited, as fixed-bottom structures are often more economical in shallow waters. Project developers continue to prioritize deep-water potential for long-term scalability. This shift enhances the role of floating systems in diversifying renewable energy portfolios. It strengthens the market’s global expansion into new geographies with favorable offshore conditions.

Segments:

Based on Turbine Rating:

- ≤ 2 MW

- >2 to 5 MW

- >5 to 8 MW

- >8 to 10 MW

- >10 to 12 MW

- > 12 MW

Based on Component:

Based on Depth:

- ≤ 30 m

- >30 m to ≤ 50 m

- > 50 m

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28% in the Floating Offshore Wind Energy market. The region benefits from strong government commitments to decarbonization and clean energy targets, particularly in the United States. Federal support through tax credits, lease auctions, and offshore wind development programs accelerates adoption. Coastal states such as California and Maine prioritize floating wind technology to access deep-water resources unavailable to fixed-bottom installations. The U.S. Department of Energy invests in pilot projects and research to improve technology readiness and reduce costs. Partnerships between utilities, oil and gas companies, and technology providers strengthen industry collaboration. It positions North America as a leading hub for future large-scale floating offshore wind deployment.

Europe

Europe commands the largest share at 40%, making it the most mature region for floating offshore wind. Countries such as the United Kingdom, France, and Norway spearhead deployment through robust regulatory frameworks and financial incentives. The European Union’s Green Deal and offshore wind strategies accelerate project pipelines across the continent. Established supply chains, advanced infrastructure, and technological expertise contribute to Europe’s leadership. Demonstration projects in Scotland, France, and Norway set benchmarks for global adoption. Developers benefit from regional collaboration and knowledge sharing, further advancing cost reduction. It reinforces Europe’s dominant role as both an innovation hub and a deployment leader in floating offshore wind.

Asia-Pacific

Asia-Pacific holds a market share of 22%, driven by the increasing demand for renewable energy and energy security. Countries such as Japan, South Korea, and Taiwan lead the regional floating wind pipeline with ambitious targets. Japan invests in floating wind to offset limited land availability and nuclear dependence. South Korea emphasizes industrial collaboration, leveraging domestic shipbuilding and offshore engineering capabilities. China expands pilot projects while gradually moving toward larger commercial deployments. Strong regional support aligns with decarbonization targets and growing electricity needs. It establishes Asia-Pacific as one of the fastest-growing markets for floating offshore wind.

Latin America

Latin America accounts for 5% of the Floating Offshore Wind Energy market, reflecting early-stage development. Brazil leads the region with favorable wind resources and a growing renewable energy agenda. National energy policies encourage diversification beyond hydropower, opening space for offshore wind. International developers explore project feasibility along the Brazilian coastline due to deep-water conditions. The region lacks extensive infrastructure but attracts interest from global energy investors. Chile and Colombia assess opportunities to integrate floating wind into future energy mixes. It creates long-term potential for floating offshore wind expansion across Latin America.

Middle East & Africa

The Middle East & Africa region secures a 5% share, reflecting gradual adoption in offshore renewables. South Africa explores offshore wind to diversify its power sector and reduce coal reliance. The Middle East examines floating wind for integration into broader clean energy initiatives alongside solar and hydrogen. High capital costs and limited offshore wind infrastructure remain barriers to rapid growth. International partnerships play a vital role in supporting feasibility studies and pilot projects. Governments recognize floating wind as a pathway to meet carbon reduction targets. It provides early opportunities for strategic growth in offshore renewable development across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Prysmian Group

- Hexicon

- Vattenfall AB

- Siemens Gamesa Renewable Energy

- Global Energy (Group) Limited

- Nexans

- Equinor ASA

- Simply Blue Group

- Ørsted A/S

- General Electric

- RWE

- Vestas

- Sumitomo Electric Industries, Ltd.

Competitive Analysis

The Floating Offshore Wind Energy market is shaped by leading players such as Equinor ASA, Ørsted A/S, Siemens Gamesa Renewable Energy, Vestas, RWE, Prysmian Group, Nexans, Vattenfall AB, General Electric, Sumitomo Electric Industries Ltd., Simply Blue Group, Hexicon, and Global Energy (Group) Limited. These companies drive advancements in turbine technology, floating foundation design, and grid connectivity, positioning themselves at the forefront of large-scale project development. The market demonstrates intense competition as players leverage partnerships, joint ventures, and pilot projects to strengthen market presence. Technological innovation remains a critical differentiator, with larger turbine capacities and modular floating platforms setting new benchmarks for efficiency and cost reduction. Companies expand global footprints by targeting high-potential regions such as Europe, Asia-Pacific, and North America, where supportive policies create favorable conditions. Strong investment in digital monitoring, predictive maintenance, and integrated supply chains enhances reliability and scalability of projects. Financial strength and access to capital further shape competitiveness, as large-scale projects require significant upfront investments. Players with offshore oil and gas expertise adapt capabilities to floating wind, creating a unique advantage in operations and maintenance. The competitive landscape continues to evolve as firms align with decarbonization targets and capture long-term revenue potential from emerging deep-water markets.

Recent Developments

- In 2025, Equinor progressed its South Korean Firefly/Bandibuli floating wind project, selecting a technology provider for the planned 750 MW site.

- In 2025, Nexans secured a contract for the LanWin2 offshore grid connection in Germany, supporting major offshore and floating wind integration.

- In 2024, GE Vernova announced plans to install a prototype in Norway after securing Nkr332m ($31m) from the Norwegian government-backed agency Enova.

Report Coverage

The research report offers an in-depth analysis based on Turbine Rating, Component, Depth and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Floating Offshore Wind Energy market will expand through large-scale commercial projects in deeper waters.

- Technological improvements in turbines and floating platforms will reduce costs and improve efficiency.

- Governments will continue supporting adoption with favorable policies, subsidies, and auction schemes.

- Energy companies will diversify portfolios by investing in floating wind to meet climate targets.

- Supply chain development will strengthen, improving availability of specialized components and infrastructure.

- Digital tools such as predictive analytics and IoT will enhance performance and reduce downtime.

- Collaborations between oil, gas, and renewable firms will accelerate knowledge sharing and deployment.

- Asia-Pacific will emerge as a strong growth region due to rising energy demand and coastal potential.

- Europe will maintain leadership by scaling projects and setting new technological benchmarks.

- The market will attract increasing investor interest due to stable long-term revenue potential.