Market Overview:

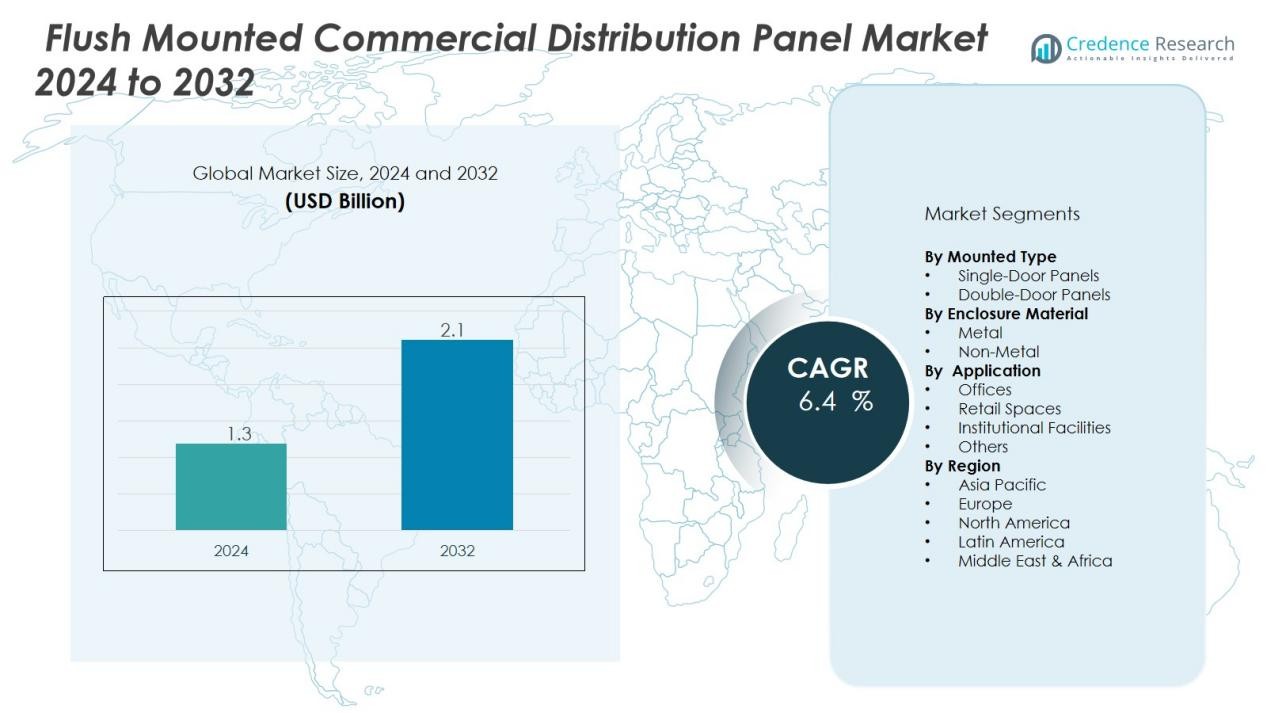

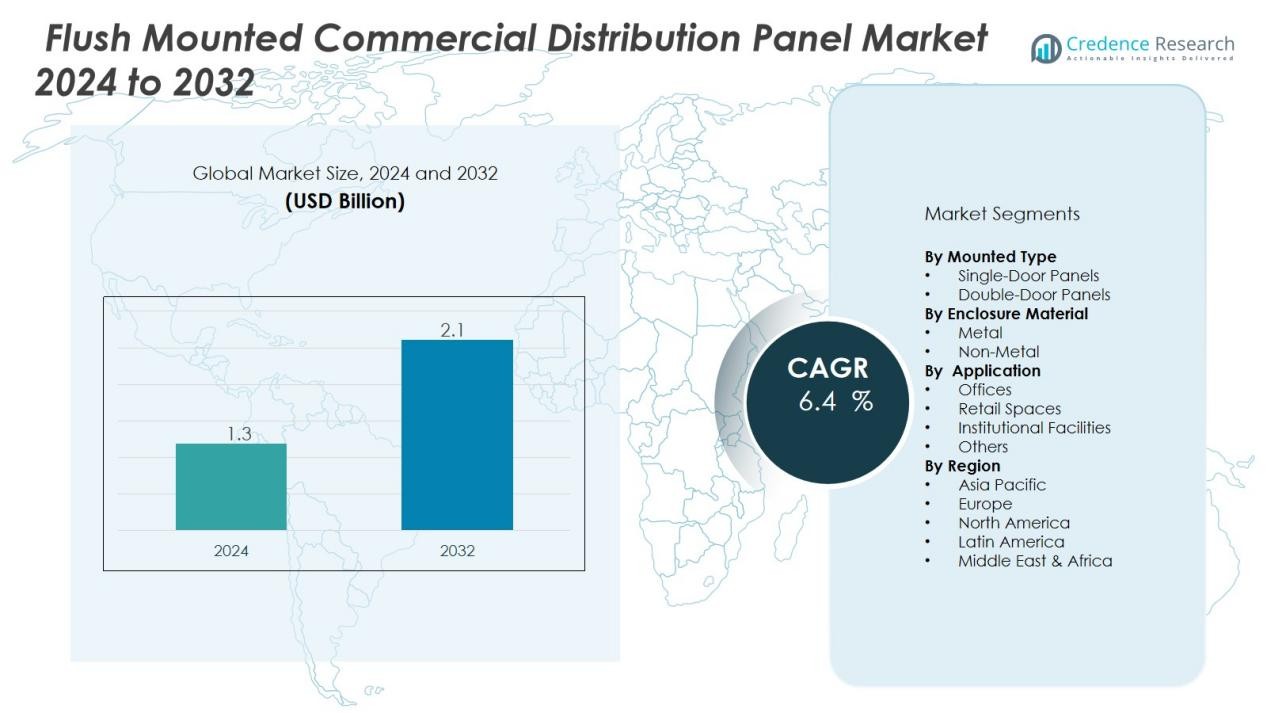

The flush mounted commercial distribution panel market size was valued at USD 1.3 billion in 2024 and is anticipated to reach USD 2.1 billion by 2032, at a CAGR of 6.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flush Mounted Commercial Distribution Panel Market Size 2024 |

USD 1.3 Billion |

| Flush Mounted Commercial Distribution Panel Market, CAGR |

6.4 % |

| Flush Mounted Commercial Distribution Panel Market Size 2032 |

USD 2.1 Billion |

Key market drivers include the rising focus on safety, energy efficiency, and reliable power distribution across commercial spaces. Growing urbanization, coupled with the shift toward smart building technologies, is further fueling adoption. Increasing regulatory emphasis on fire safety standards and compliance with electrical codes also supports market penetration. The integration of intelligent monitoring systems and circuit protection devices into flush mounted panels enhances functionality, making them a preferred choice in commercial construction projects.

Regionally, North America leads the market due to widespread modernization of commercial infrastructure and strong adherence to safety regulations. Europe follows closely, driven by stringent electrical standards and adoption of smart grid-compatible panels. Asia-Pacific is the fastest-growing region, with rapid urban development in China and India boosting demand. Meanwhile, Latin America and the Middle East & Africa present emerging opportunities through expanding commercial real estate and ongoing urban infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The flush mounted commercial distribution panel market was valued at USD 1.3 billion in 2024 and is projected to reach USD 2.1 billion by 2032.

- Rising demand for space-efficient and aesthetic power distribution solutions drives adoption across offices, malls, and institutions.

- Growing emphasis on safety regulations and compliance with fire safety standards strengthens market penetration globally.

- Integration of smart technologies, including IoT-enabled monitoring and energy management, enhances functionality and reliability.

- High installation costs and complex retrofitting requirements continue to challenge adoption in cost-sensitive markets.

- North America leads with 34% share in 2024, followed by Europe with 28% supported by strict regulations.

- Asia-Pacific holds 27% share and emerges as the fastest-growing region, fueled by rapid urban development in China and India.

Market Drivers:

Rising Demand for Space-Efficient and Aesthetic Power Distribution Solutions:

The flush mounted commercial distribution panel market is driven by the growing preference for compact and visually integrated electrical solutions. Modern commercial spaces such as offices, malls, and institutions demand designs that optimize space while maintaining safety and performance. Flush mounted panels address this need by blending seamlessly into walls and enhancing the aesthetics of interiors. It supports architects and contractors seeking efficient installations without compromising design quality.

- For instance, Schneider Electric’s Superboard Series offers a 15-way, 100A flush-mounted distribution board with dimensions of 376 mm width and 258 mm height.

Increasing Focus on Electrical Safety and Regulatory Compliance:

Safety regulations and building codes are pushing demand for advanced distribution panels that meet strict standards. The flush mounted commercial distribution panel market benefits from regulations that require reliable power distribution and fire safety measures in commercial buildings. It ensures compliance through features like circuit breakers, fault detection, and enhanced insulation. Rising awareness among facility managers and building owners further supports adoption across developed and developing economies.

- For Instance, ABB’s technical documentation and standard electrical engineering principles, the SACE Emax 2 is an air circuit breaker, not a flush-mounted distribution panel, and the 85 kA rating refers to its rated short-time withstand current (Icw) for one second, while its ultimate breaking capacity (Icu) is up to 100 kA.

Integration of Smart Technologies and Intelligent Monitoring Features:

The market is also shaped by the rising adoption of smart technologies in commercial infrastructure. Flush mounted panels equipped with monitoring systems, energy management tools, and remote diagnostics are gaining traction. It enables facility managers to optimize power usage, improve efficiency, and reduce downtime. Growing demand for IoT-enabled solutions across smart buildings strengthens the role of these panels in modern construction projects.

Urbanization and Growth in Commercial Infrastructure Investments:

Rapid urbanization and large-scale investments in commercial infrastructure are expanding opportunities for this market. The flush mounted commercial distribution panel market is witnessing strong growth in regions with rising construction of office complexes, retail centers, and institutional facilities. It benefits from government-backed infrastructure projects and private sector investments that emphasize reliable and efficient energy distribution. The trend is particularly evident in emerging economies with expanding urban centers.

Market Trends:

Growing Adoption of Smart and Energy-Efficient Electrical Distribution Solutions:

The flush mounted commercial distribution panel market is experiencing strong demand for smart and energy-efficient products. Building owners and facility managers increasingly prefer panels that integrate monitoring, automation, and energy management features. It supports the global push for sustainability by enabling better load management and reduced energy wastage. Smart panels also enhance operational efficiency by allowing predictive maintenance and fault detection. Demand is rising in modern commercial buildings where digital infrastructure and connected systems are becoming standard. The trend is reinforced by supportive government policies promoting energy-efficient building practices.

- For Instances, SPAN’s panels are widely deployed across all 50 U.S. states with a network of hundreds of electrical installers.

Rising Integration with Modular and Aesthetic Building Designs:

Architects and contractors are driving demand for panels that align with modern design and functional requirements. The flush mounted commercial distribution panel market benefits from the preference for sleek, space-saving installations that complement interiors. It offers flexibility in commercial projects by providing customizable configurations and concealed fittings. Growing interest in modular construction and retrofitting projects also supports demand for flush mounted designs. The trend is visible in premium office spaces, retail centers, and institutional facilities where visual appeal and functionality hold equal importance. Rising urban development projects worldwide continue to expand this adoption trajectory.

- For instance, ABB’s flush-mounted commercial distribution panels in the U.S. include customizable modular solutions with up to 24 modules per rail and robust steel construction, supporting neat integration in office and commercial settings

Market Challenges Analysis:

High Installation Costs and Complex Retrofitting Requirements:

The flush mounted commercial distribution panel market faces challenges linked to higher installation costs compared to surface-mounted alternatives. It often requires precise wall modifications, skilled labor, and additional time, which increase project expenses. Retrofitting in older buildings becomes even more complex, as structural limitations restrict panel integration. This discourages adoption in cost-sensitive markets where budget constraints dominate decision-making. Contractors and developers sometimes prefer simpler solutions that reduce upfront investment. The cost barrier continues to limit broader penetration, especially in small-scale commercial projects.

Limited Awareness and Resistance in Developing Markets:

Another major challenge lies in the lack of awareness among end-users and contractors in emerging regions. The flush mounted commercial distribution panel market struggles in areas where conventional panels remain the default choice. It faces resistance due to unfamiliarity with the long-term benefits of space efficiency, safety, and aesthetics. In many cases, decision-makers prioritize immediate affordability over advanced design features. Training gaps among electricians and installers also reduce adoption. Without stronger awareness campaigns and regulatory support, the shift toward flush mounted panels remains gradual in developing economies.

Market Opportunities:

Expansion of Smart Building Projects and Green Infrastructure Initiatives:

The flush mounted commercial distribution panel market presents significant opportunities through the rising adoption of smart buildings and sustainable infrastructure. It can leverage demand for panels with energy management features, real-time monitoring, and IoT integration. Governments and private developers are investing in green buildings that prioritize efficient energy use and advanced safety standards. This shift creates a strong growth pathway for flush mounted solutions that combine aesthetics with functionality. Commercial complexes, retail spaces, and institutional facilities increasingly require panels that align with digital and sustainability goals. The transition toward intelligent infrastructure directly expands the market potential.

Growing Demand in Emerging Economies and Retrofit Applications:

Urbanization and rapid commercial development in Asia-Pacific, Latin America, and the Middle East provide new opportunities. The flush mounted commercial distribution panel market benefits from rising construction of offices, malls, and institutional buildings in these regions. It also gains traction in retrofitting projects, where space optimization and compliance upgrades are critical. Developers seek compact, durable, and safe distribution solutions that improve both function and interior design. Increasing investments in modernization of older buildings support wider acceptance of flush mounted panels. The growing emphasis on high-quality commercial infrastructure strengthens long-term adoption trends across developing markets.

Market Segmentation Analysis:

By Mounted Type:

The flush mounted commercial distribution panel market by mounted type is divided into single-door and double-door panels. Single-door panels are widely used in small and medium commercial spaces due to ease of installation and cost efficiency. Double-door panels dominate in large facilities that require advanced load management and enhanced safety features. It offers greater accessibility for maintenance and supports higher circuit capacity, making it suitable for malls, corporate offices, and institutions. Demand for both types continues to grow with expanding urban infrastructure projects.

- For instance, Honeywell’s SPN Single Door Distribution Board is designed for single-phase and neutral supply systems and typically features 4-way breaker configurations, which facilitate quick installation and efficient circuit distribution in smaller commercial setups.

By Enclosure Material:

The market by enclosure material includes metal and non-metal panels. Metal enclosures lead the segment due to their durability, fire resistance, and ability to withstand demanding commercial environments. Non-metal enclosures are gaining traction in specific applications where corrosion resistance and lightweight design are critical. It supports industries seeking long-lasting and reliable power distribution systems. Growing safety regulations and design flexibility further drive adoption of advanced enclosure materials.

- For instance, Ceco Building Systems manufactures fire-resistant insulated metal panels with mineral wool cores that achieve 1-, 2-, and 3-hour fire resistance ratings, maintaining durability and thermal performance over decades with minimal upkeep.

By Application:

The flush mounted commercial distribution panel market by application is segmented into offices, retail spaces, institutional facilities, and others. Offices account for significant demand, supported by the need for compact and safe electrical systems. Retail and malls also represent strong growth, as developers prioritize design aesthetics alongside functionality. Institutional facilities such as hospitals and educational centers adopt panels to ensure reliable power distribution. It gains traction across diverse applications, supported by urbanization and rising investments in commercial construction.

Segmentations:

By Mounted Type:

- Single-Door Panels

- Double-Door Panels

By Enclosure Material:

By Application:

- Offices

- Retail Spaces

- Institutional Facilities

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe:

North America holds 34% share of the flush mounted commercial distribution panel market in 2024, supported by widespread modernization of commercial infrastructure. Europe follows with 28% share, driven by strict electrical standards and adoption of energy-efficient solutions. It benefits from strong government regulations emphasizing safety and sustainability. Demand in both regions is reinforced by investments in smart building technologies and advanced distribution systems. Commercial complexes, retail centers, and institutional facilities prioritize panels that align with energy codes and interior design requirements. The presence of leading manufacturers and mature construction industries further strengthens market growth.

Asia-Pacific:

Asia-Pacific accounts for 27% share of the flush mounted commercial distribution panel market in 2024, making it the fastest-growing regional segment. Rising urbanization in China and India, coupled with large-scale investments in commercial infrastructure, drives demand. It benefits from government-led projects focusing on smart cities and modern building standards. Adoption of flush mounted panels is expanding across office complexes, malls, and institutional facilities. Developers increasingly select space-saving and safe solutions to meet urban design needs. Growing awareness and improved construction practices support long-term growth in this region.

Latin America and Middle East & Africa:

Latin America represents 6% share of the flush mounted commercial distribution panel market in 2024, while the Middle East & Africa hold 5%. It is supported by urban infrastructure expansion and growing investments in commercial real estate. Governments are prioritizing modernization projects to improve energy distribution and safety compliance. Demand is strongest in urban centers where new construction activities are rising. Flush mounted solutions are gaining traction among developers seeking reliable and aesthetically integrated power systems. Expanding construction pipelines and supportive policy frameworks are expected to unlock new growth opportunities in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Chint Group Corporation

- Mitsubishi Electric Corporation

- Hyundai Electric Energy Systems Co., Ltd.

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- Legrand S.A.

- Rockwell Automation, Inc.

- Eaton Corporation

- Schneider Electric

- Siemens AG

- GE (General Electric)

Competitive Analysis:

The flush mounted commercial distribution panel market is characterized by intense competition among global and regional players. Key participants include Chint Group Corporation, Mitsubishi Electric Corporation, Hyundai Electric Energy Systems Co., Ltd., Yaskawa Electric Corporation, Delta Electronics, Inc., Legrand S.A., Rockwell Automation, Inc., and Eaton Corporation. It is shaped by strategies focused on product innovation, compliance with safety standards, and integration of smart technologies. Leading companies emphasize expanding portfolios that address the growing demand for energy-efficient and space-saving solutions in commercial infrastructure. Partnerships with contractors and developers support wider adoption in urban construction projects. Regional players compete by offering cost-effective solutions tailored to specific market needs, while global firms leverage strong distribution networks and advanced R&D capabilities. It continues to evolve with growing investments in digitalization, sustainability, and customer-centric solutions, creating opportunities for both established players and emerging entrants.

Recent Developments:

- In June 2025, Mitsubishi Electric Corporation developed a world-first compact 7GHz band gallium nitride (GaN) power amplifier module for 5G-Advanced base stations with high power efficiency.

- In February 2025, Mitsubishi Electric Corporation signed an agreement to establish a joint venture and acquire a stake in HD Renewable Energy Co., Ltd. for solar power and battery storage system projects.

- In April 2025, HD Hyundai Electric launched “PowerUp HDE,” a startup program designed to discover and support next-generation power technology startups focusing on power systems and eco-friendly energy solutions.

Report Coverage:

The research report offers an in-depth analysis based on Mounted Type, Enclosure Material, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The flush mounted commercial distribution panel market will expand with rising adoption of smart building technologies.

- Growing demand for energy-efficient panels will create opportunities in commercial infrastructure projects.

- Integration of IoT and remote monitoring features will strengthen product functionality and market appeal.

- Urbanization in emerging economies will drive installations in office complexes, malls, and institutional facilities.

- Investments in retrofitting older buildings will support demand for space-saving distribution solutions.

- Stringent safety regulations will accelerate the shift toward advanced flush mounted electrical panels.

- Collaboration between manufacturers and construction firms will promote customized and modular product offerings.

- Sustainable construction initiatives will increase adoption of eco-friendly and durable panel materials.

- Technological upgrades in fire safety and circuit protection will enhance customer confidence.

- Expansion of distribution networks and online sales channels will improve accessibility across regions.