Market Overview

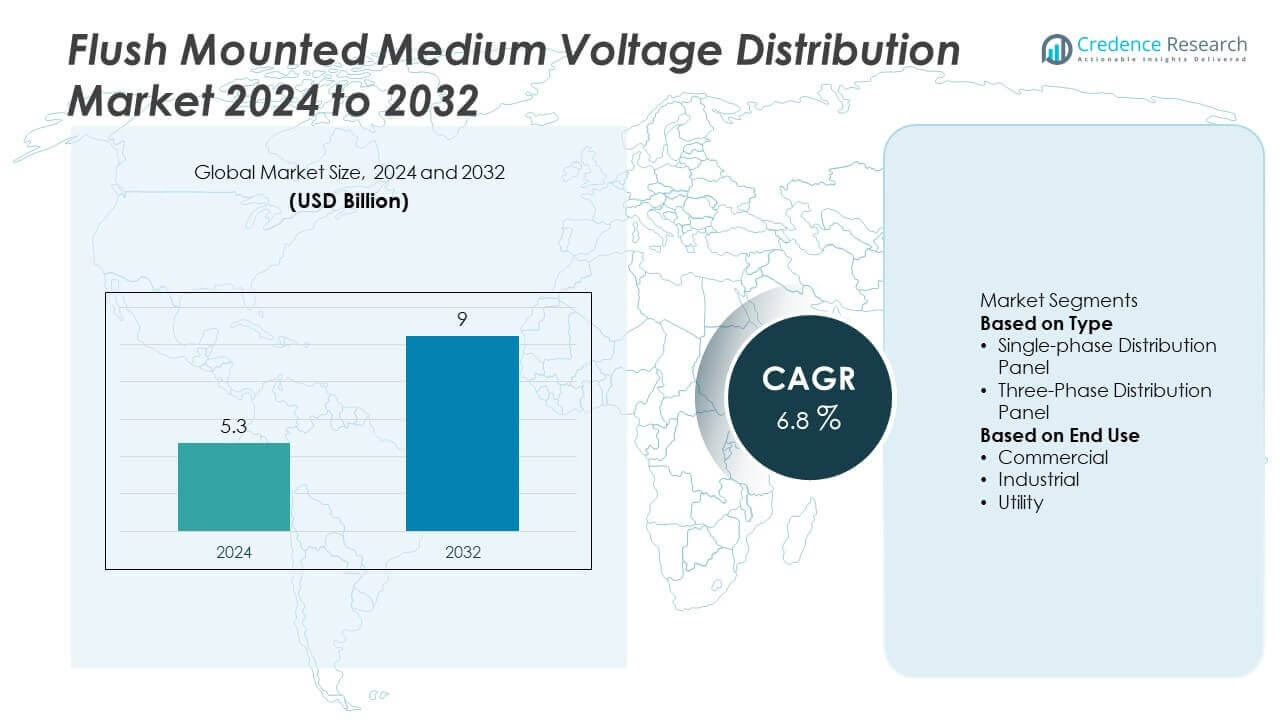

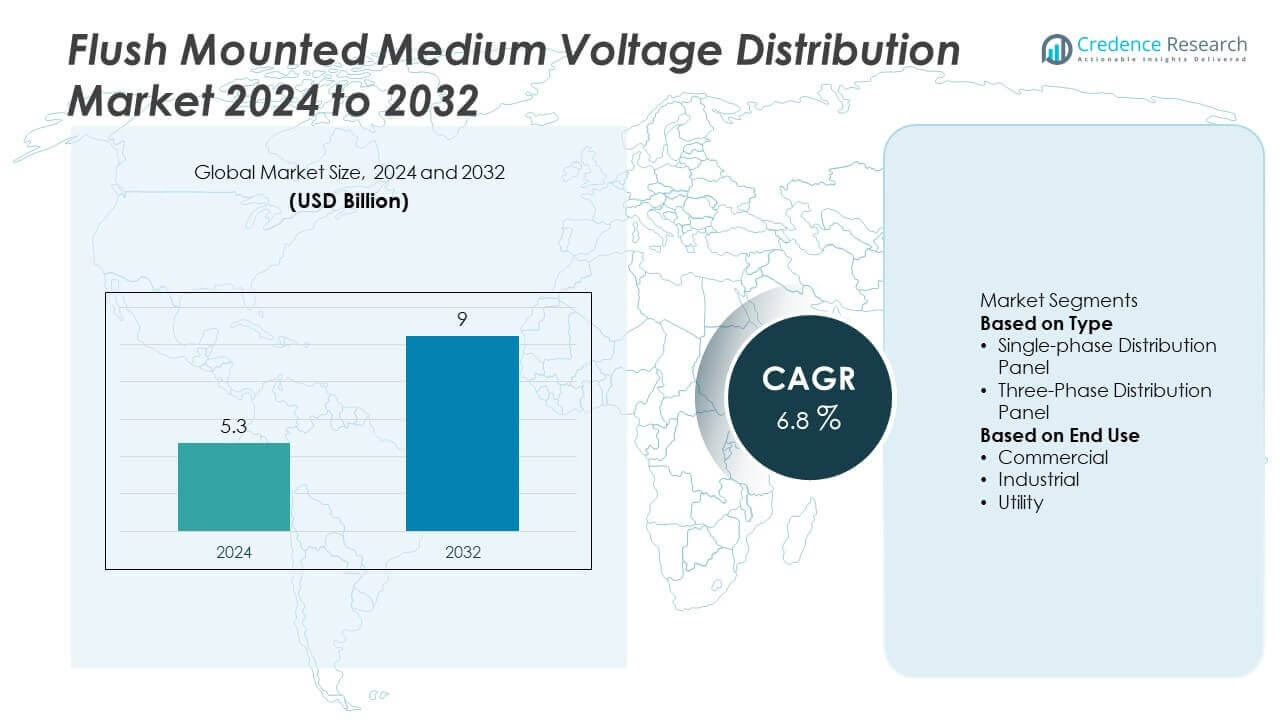

Flush Mounted Medium Voltage Distribution Market size was valued at USD 5.3 billion in 2024 and is projected to reach USD 9 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flush Mounted Medium Voltage Distribution Market Size 2024 |

USD 5.3 Billion |

| Flush Mounted Medium Voltage Distribution Market, CAGR |

6.8% |

| Flush Mounted Medium Voltage Distribution Market Size 2032 |

USD 9 Billion |

The Flush Mounted Medium Voltage Distribution Market grows through rising demand for grid reliability, urban infrastructure projects, and energy-efficient solutions. Industrial and commercial sectors adopt compact systems to ensure stable power in space-constrained environments.

The Flush Mounted Medium Voltage Distribution Market shows broad geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America advances with strong investments in grid modernization and digital monitoring infrastructure, while Europe emphasizes sustainability and strict regulatory compliance. Asia-Pacific demonstrates rapid growth driven by industrialization, smart city development, and large-scale renewable integration. Latin America and the Middle East & Africa expand steadily through urban infrastructure projects and utility upgrades. Key players actively shaping this market include ABB, Eaton, and General Electric, which deliver advanced distribution solutions with compact designs and digital capabilities. Companies such as Legrand also strengthen their presence through innovative flush mounted panels that support energy efficiency and space optimization. These players focus on innovation, reliability, and regional expansion to align with global energy transition goals and the rising demand for efficient medium voltage distribution systems worldwide.

Market Insights

- The Flush Mounted Medium Voltage Distribution Market was valued at USD 5.3 billion in 2024 and is projected to reach USD 9 billion by 2032, growing at a CAGR of 6.8%.

- Growth is driven by demand for reliable grid infrastructure, rising urban development, and adoption of compact, energy-efficient systems across industrial and commercial sectors.

- Key trends include integration with smart grid technologies, adoption of IoT-enabled monitoring, preference for space-saving designs, and rising focus on sustainable, low-loss power equipment.

- Competitive analysis highlights major players such as ABB, Eaton, General Electric, and Legrand, who focus on advanced switchgear, digital monitoring, and regional expansion to strengthen their positions.

- Restraints include high installation costs, complex retrofitting in older facilities, and limited skilled workforce availability in emerging markets, which slow adoption despite strong long-term benefits.

- Regional analysis shows North America leading through advanced grid upgrades, Europe focusing on sustainability and compliance, Asia-Pacific expanding rapidly with industrialization and smart city projects, while Latin America and the Middle East & Africa experience steady growth through infrastructure and utility modernization.

- The market demonstrates resilience by aligning with renewable energy integration, digital infrastructure, and sustainability goals, making flush mounted medium voltage distribution systems vital for the future of global power distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Grid Reliability and Stable Power Supply

The Flush Mounted Medium Voltage Distribution Market gains momentum from growing demand for reliable electricity. Power distribution networks in urban and industrial zones require stable systems to reduce downtime. Flush mounted configurations provide compact designs that minimize footprint in space-constrained facilities. Utilities adopt these solutions to ensure efficient energy flow in residential, commercial, and industrial sectors. It supports higher resilience against voltage fluctuations and equipment failures. The rising focus on dependable grid infrastructure positions flush mounted systems as a priority investment for utilities.

- For instance, ABB launched its Protecta Power Panel Board in November 2023, featuring integrated digital monitoring, with operational current ratings up to 800 A. The panel board is a low-voltage solution designed for commercial, industrial, and institutional applications, and supports ratings of up to 50 kA for one second, depending on the specific configuration.

Accelerating Urbanization and Infrastructure Expansion Projects

Rapid urbanization across developing economies creates demand for modernized power distribution frameworks. The Flush Mounted Medium Voltage Distribution Market benefits from infrastructure projects such as airports, metros, and commercial complexes that require reliable medium voltage systems. Governments invest heavily in building smart cities, driving the adoption of compact, safe, and easily integrated distribution panels. Real estate developers prefer flush mounted solutions to maximize space efficiency in high-rise buildings. It also enables streamlined installation, reducing overall project timelines. The scale of ongoing construction activities secures consistent demand for these systems worldwide.

- For instance, Siemens’ SIVACON S8 switchboards offer rated currents up to 7,000 A and short-circuit strength up to 150 kA, making them well-suited for space-efficient installations in fast-growing urban infrastructure.

Adoption of Energy Efficiency and Sustainability Standards

Global emphasis on energy-efficient technologies encourages wider integration of flush mounted systems. The Flush Mounted Medium Voltage Distribution Market responds to policies that require lower energy losses and improved safety. Manufacturers design switchgear and panels with advanced insulation and reduced fault risks. It ensures compliance with environmental regulations while lowering operational costs for utilities and industries. The drive toward carbon reduction makes these solutions attractive for long-term deployment. Government incentives and regulatory pressure continue to guide investments in efficient distribution infrastructure.

Technological Advancements in Switchgear and Smart Monitoring

Continuous innovation in switchgear and monitoring tools enhances the value of flush mounted systems. The Flush Mounted Medium Voltage Distribution Market adopts features such as digital relays, IoT-enabled diagnostics, and real-time fault detection. It improves predictive maintenance and reduces the risk of sudden outages. Advanced monitoring capabilities support remote management, making operations cost-effective and safe. Integration with smart grids also creates compatibility with renewable energy sources. The expanding role of digitalization ensures these systems remain relevant in modern power distribution strategies.

Market Trends

Integration of Smart Grid Technologies with Medium Voltage Distribution Systems

The Flush Mounted Medium Voltage Distribution Market is witnessing rapid integration with smart grid technologies. Utilities deploy intelligent switchgear, IoT sensors, and automated relays to enhance monitoring and control. It allows operators to detect faults in real time and reduce outage risks. Smart-enabled panels improve grid flexibility, especially in regions with high renewable penetration. Remote access capabilities enable predictive maintenance, lowering operational expenses. This trend highlights the shift toward digital infrastructure in medium voltage networks.

- For instance, ABB introduced its SafePlus AirPlus switchgear, tested at 24 kV with a rated current of 630 A and a short-time withstand current of 20 kA for 3 seconds, integrating digital sensors and remote monitoring for predictive grid management.

Growing Preference for Compact and Space-Saving Electrical Solutions

Urban expansion drives the preference for compact distribution systems that fit in constrained environments. The Flush Mounted Medium Voltage Distribution Market addresses this demand with flush mounted designs that optimize floor space. High-rise buildings, airports, and industrial plants increasingly adopt these solutions for efficiency. It enables clean layouts while maintaining safety and reliability standards. Developers recognize the value of reducing bulky installations in dense construction projects. This trend supports the strong penetration of compact systems in both mature and emerging economies.

- For instance, Schneider Electric’s SureSeT medium-voltage switchgear, integrates EvoPacT digital breakers with continuous thermal sensors. These allow remote monitoring of temperature, vibration, and current—keeping technicians outside arc-flash zones and enabling control of breaker racking or operation remotely via secure wireless links.

Shift Toward Sustainable and Low-Loss Power Distribution Equipment

Sustainability commitments accelerate the transition to energy-efficient distribution equipment. The Flush Mounted Medium Voltage Distribution Market benefits from advancements that reduce power losses and improve insulation. Manufacturers adopt eco-friendly materials to comply with environmental standards. It ensures better energy savings for end users while supporting long-term regulatory goals. Global decarbonization policies strengthen the demand for efficient medium voltage infrastructure. This trend reinforces the role of sustainability as a critical market driver.

Rising Adoption of Renewable Energy Integration into Distribution Networks

Expanding renewable capacity increases the complexity of medium voltage distribution. The Flush Mounted Medium Voltage Distribution Market supports solar and wind integration with advanced switchgear and automation. Utilities require flush mounted solutions that handle variable loads and grid balancing. It ensures seamless operation between renewable input and traditional power supply. Countries with aggressive clean energy targets prioritize such systems in new projects. This trend underscores the importance of adaptable distribution networks in the energy transition.

Market Challenges Analysis

High Installation Costs and Complex Integration with Existing Infrastructure

The Flush Mounted Medium Voltage Distribution Market faces obstacles linked to high upfront installation costs. Retrofitting older facilities with modern flush mounted systems requires redesigning layouts and reconfiguring electrical networks. It creates financial strain for utilities and industrial players with limited budgets. Technical integration challenges also arise when aligning new systems with legacy distribution frameworks. Many organizations delay adoption due to cost-benefit concerns despite long-term efficiency advantages. This challenge slows wider penetration in cost-sensitive markets, especially in developing economies.

Limited Skilled Workforce and Maintenance Barriers in Emerging Regions

Another challenge for the Flush Mounted Medium Voltage Distribution Market is the shortage of skilled professionals. Operating and maintaining advanced switchgear requires technical expertise often lacking in emerging regions. It restricts proper deployment and increases reliance on external specialists. Lack of training programs further limits the ability to manage modernized systems effectively. Downtime risks rise when preventive maintenance is delayed or incorrectly executed. These workforce gaps undermine efficiency and hinder large-scale adoption in fast-growing markets.

Market Opportunities

Expansion of Smart Infrastructure and Digital Energy Networks

The Flush Mounted Medium Voltage Distribution Market presents strong opportunities through the growth of smart infrastructure. Governments and private developers continue to invest in digital grids, automated substations, and connected facilities. It enables flush mounted systems with integrated sensors and IoT features to gain wider acceptance. Adoption in smart cities, airports, and advanced manufacturing hubs expands the scope of demand. Compact design and real-time monitoring capabilities position these systems as a preferred choice. The accelerating digital transformation of power distribution strengthens long-term market potential.

Rising Investments in Renewable Energy and Sustainable Power Projects

The global energy transition creates new opportunities for the Flush Mounted Medium Voltage Distribution Market. Renewable projects such as solar and wind farms require reliable medium voltage solutions to balance fluctuating loads. It supports efficient integration of clean energy with traditional grids while minimizing technical losses. International funding in green infrastructure further boosts demand for modernized distribution systems. Eco-friendly designs and compliance with emission reduction targets enhance their attractiveness for large-scale deployments. The push for sustainable power networks secures significant opportunities for manufacturers and utilities alike.

Market Segmentation Analysis:

By Type

The Flush Mounted Medium Voltage Distribution Market is segmented into single-phase distribution panels and three-phase distribution panels. Single-phase panels are primarily deployed in smaller facilities, commercial buildings, and light industrial applications where power demand is moderate. It offers a cost-effective solution for operations that require compact and reliable energy distribution without complex load management. Three-phase distribution panels dominate in heavy industries, large commercial projects, and utility applications due to their ability to handle higher loads efficiently. These systems support stable operations in manufacturing plants, data centers, and critical infrastructure projects. Demand for three-phase systems continues to rise as industries expand production capacity and prioritize uninterrupted operations. Together, both types provide tailored solutions that ensure reliable power distribution across diverse settings.

- For instance, Eaton offers a wide range of medium-voltage (MV) switchgear, which is primarily designed for three-phase systems used in industrial and large commercial applications.

By End Use

The Flush Mounted Medium Voltage Distribution Market demonstrates adoption across industrial, commercial, and utility end users. Industrial end users account for a major share, driven by automation projects, smart factories, and energy-intensive operations that require uninterrupted and safe power distribution. It supports integration with advanced equipment and ensures compliance with operational safety standards. Commercial end users, including healthcare, hospitality, airports, and retail complexes, rely on flush mounted systems for efficient energy distribution in space-constrained environments. These solutions are favored for their compact design and ease of integration into modern buildings. Utilities also emerge as a significant end-use category, focusing on grid modernization and renewable energy integration where reliability and adaptability are critical. Each end-use category underscores the versatility of flush mounted panels in meeting evolving global requirements for safe, compact, and efficient distribution systems.

- For instance, the Siemens 8DJH medium-voltage switchgear is widely adopted in industrial and public energy systems for secondary power distribution, including commercial and utility sectors. Some models, such as the 8DJH Compact, support rated voltages up to 24 kV with rated continuous currents up to 630 A. At 24 kV, it can feature a rated short-time withstand current of 20 kA for 3 seconds.

Segments:

Based on Type

- Single-phase Distribution Panel

- Three-Phase Distribution Panel

Based on End Use

- Commercial

- Industrial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Flush Mounted Medium Voltage Distribution Market, accounting for 32% of the global share in 2024. The region’s dominance is supported by strong investment in modernizing grid infrastructure and integrating digital monitoring systems. It benefits from advanced adoption of smart grid technologies across the United States and Canada, driven by federal funding and state-level initiatives. Industrial facilities, data centers, and high-rise commercial projects in metropolitan areas continue to demand flush mounted solutions for compact and reliable distribution. The U.S. leads the regional market, with ongoing investments in renewable integration and urban expansion projects. Canada supports growth through large-scale utility modernization programs and energy-efficient infrastructure upgrades. This combination of advanced technology adoption and regulatory push ensures the region maintains a steady position in global market growth.

Europe

Europe represents the second-largest market, holding 28% of the global share in 2024. The region is characterized by strong focus on sustainability, energy efficiency, and strict compliance with EU environmental directives. It benefits from extensive deployment of flush mounted systems across industrial zones in Germany, France, and the United Kingdom. The growth in commercial projects such as healthcare facilities, airports, and transport infrastructure fuels demand. It also gains momentum from Europe’s renewable integration efforts, where reliable medium voltage distribution is critical for wind and solar projects. Germany remains a key contributor due to its advanced industrial sector and continuous focus on reducing energy losses in distribution networks. Southern and Eastern European countries are increasingly investing in modernized electrical systems, adding to regional expansion. Europe’s leadership in green technology adoption further strengthens long-term prospects.

Asia-Pacific

Asia-Pacific accounts for 25% of the Flush Mounted Medium Voltage Distribution Market in 2024, marking it as one of the fastest-growing regions. Rapid industrialization, urbanization, and large-scale infrastructure investments across China, India, and Southeast Asia drive the surge in adoption. It supports the demand for compact systems in high-density urban construction projects, including smart cities and large commercial complexes. China leads the region with heavy investments in grid modernization and renewable energy projects. India follows with ambitious urban development initiatives, including metro expansions and high-rise building construction, which create opportunities for flush mounted distribution panels. Southeast Asian nations, including Indonesia and Vietnam, show rising demand through industrial zones and manufacturing hubs. The region’s emphasis on digital infrastructure and cost-efficient power systems ensures it remains a vital growth market in the forecast period.

Latin America

Latin America holds 8% of the global share in 2024, supported by increasing infrastructure modernization and urban expansion. Countries such as Brazil and Mexico lead adoption, driven by commercial real estate development and industrial activity. It gains traction in metro projects, airports, and utility modernization programs where space-saving solutions are critical. The reliance on flush mounted systems grows as governments prioritize safety and reliability in power distribution. Smaller economies in the region are gradually investing in renewable energy infrastructure, adding to medium-term opportunities. Challenges such as limited investment budgets and slower regulatory frameworks restrict rapid growth, but the region continues to evolve steadily.

Middle East & Africa

The Middle East & Africa account for 7% of the global share in 2024, making it the smallest but steadily expanding region. Growth is fueled by investments in mega infrastructure projects across the Gulf Cooperation Council (GCC) countries. It is adopted in large commercial complexes, airports, and industrial facilities in Saudi Arabia, the UAE, and Qatar. Africa shows emerging potential, particularly in South Africa, where utilities and industrial hubs seek compact and efficient distribution systems. Flush mounted solutions gain traction in renewable integration, particularly in solar projects, due to regional energy diversification efforts. While infrastructure gaps and workforce challenges remain, rising investments in smart city projects and power reliability initiatives strengthen long-term prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEWISS

- ESL POWER SYSTEMS, INC.

- Legrand

- Meba Electric Co., Ltd

- Eaton

- General Electric

- Hager Group

- ABB

- EAMFCO

- Gem Switchgear

Competitive Analysis

The competitive landscape of the Flush Mounted Medium Voltage Distribution Market is shaped by leading players such as ABB, Eaton, General Electric, Legrand, Hager Group, GEWISS, ESL Power Systems, Inc., Gem Switchgear, Meba Electric Co., Ltd, and EAMFCO. These companies focus on delivering compact, efficient, and digitally enabled distribution systems that address the growing demand for reliable medium voltage solutions across industrial, commercial, and utility sectors. They invest in research and development to enhance switchgear performance, improve insulation, and integrate IoT-enabled monitoring features for predictive maintenance and real-time diagnostics. Strategic partnerships, acquisitions, and product innovations strengthen their global presence while meeting diverse customer requirements in developed and emerging economies. Many of these players align with sustainability goals by designing eco-friendly and low-loss distribution equipment that complies with stringent international standards. With rising demand for smart grids, renewable integration, and urban infrastructure expansion, the competitive environment emphasizes technology advancement, regional expansion, and cost-effective solutions that secure long-term growth opportunities.

Recent Developments

- In August 2024, Eaton released educational content through its Experience Centers focusing on medium-voltage motor control and electrical arcing—supporting knowledge around flush-mounted MV systems.

- In May 2024, Eaton outlined in its New Product Development roadmap enhancements in voltage analytics and cellular voltage monitoring—relevant for future flush-mounted MV distribution platforms.

- In November 2023, ABB introduced the Protecta Power Panel Board, enhancing its distribution solutions with a robust, flush-to-wall design optimized for safety and easier installation.

- In 2023, ABB reaffirmed the features of the Protecta Power panel board, emphasizing smart electrical distribution in infrastructure buildings.

Report Coverage

The research report offers an in-depth analysis based on Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for compact and reliable distribution systems.

- Smart grid integration will drive adoption of IoT-enabled and digitally monitored panels.

- Industrial automation will increase reliance on advanced medium voltage distribution solutions.

- Commercial infrastructure growth will create steady demand for space-saving systems.

- Renewable energy integration will strengthen the need for adaptable and efficient panels.

- Sustainability goals will push manufacturers to design eco-friendly and low-loss equipment.

- Technological innovation in switchgear will enhance safety and operational efficiency.

- Utilities will adopt flush mounted systems to modernize grids and improve reliability.

- Emerging economies will offer opportunities through large-scale infrastructure projects.

- Competitive pressure will encourage global players to expand regional presence and product portfolios.