Market Overview

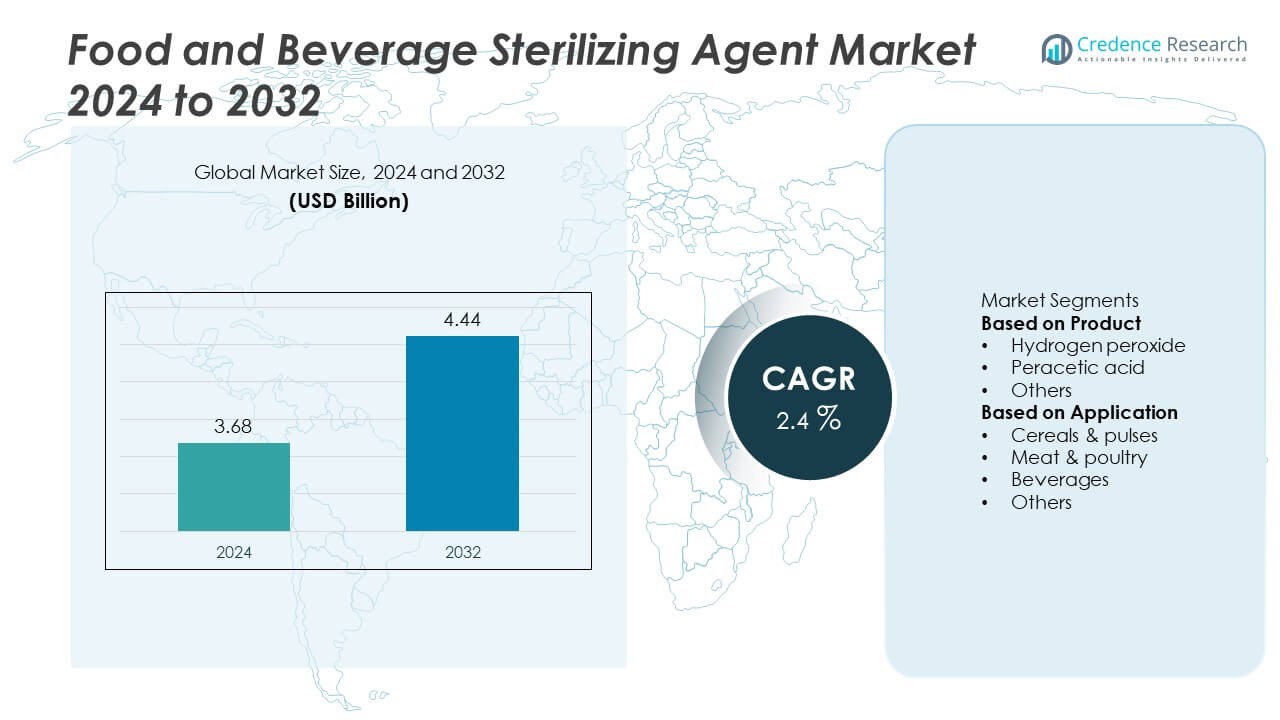

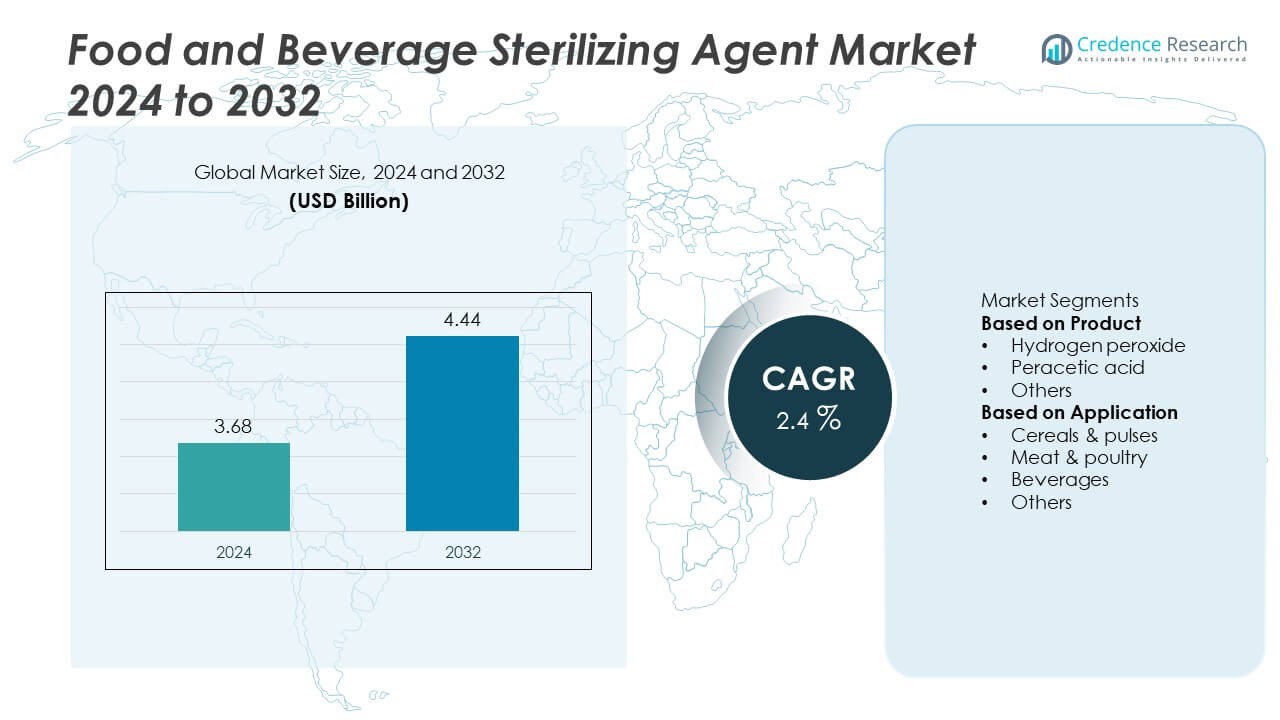

The Food and Beverage Sterilizing Agent Market was valued at USD 3.68 billion in 2024 and is projected to reach USD 4.45 billion by 2032, expanding at a CAGR of 2.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food and Beverage Sterilizing Agent Market Size 2024 |

USD 3.68 Billion |

| Food and Beverage Sterilizing Agent Market, CAGR |

2.4% |

| Food and Beverage Sterilizing Agent Market Size 2032 |

USD 4.45 Billion |

The top players in the food and beverage sterilizing agent market include Taekwang Industry Co., Ltd., Solvay, Hansol Chemical, Arkema, Mitsubishi Gas, Evonik Industries, Steris, OCI Company Ltd., Peroxy Chem, and BASF SE. These companies strengthen their positions through advanced sterilizing solutions, eco-friendly product development, and compliance with strict global food safety standards. Regionally, North America led with a 34% share in 2024, supported by robust food processing infrastructure and FDA regulations, while Asia-Pacific accounted for 29% share, driven by rapid urbanization and rising packaged food demand. Europe held a 28% share, led by stringent EU directives and strong adoption of sustainable agents, while Latin America and the Middle East & Africa represented 5% and 4% shares, respectively, reflecting emerging but growing adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food and Beverage Sterilizing Agent market was valued at USD 3.68 billion in 2024 and is projected to reach USD 4.44 billion by 2032, expanding at a CAGR of 2.4% during the forecast period.

- Growth is driven by stringent food safety regulations and rising demand for packaged foods, with hydrogen peroxide leading the product segment at 54% share in 2024 due to its versatility and regulatory approval.

- Key trends include increasing adoption of eco-friendly and residue-free sterilizing agents, along with the integration of advanced sterilization technologies that improve efficiency and reduce operational costs.

- The competitive landscape features players such as Taekwang Industry Co., Ltd., Solvay, Hansol Chemical, Arkema, Mitsubishi Gas, Evonik Industries, Steris, OCI Company Ltd., Peroxy Chem, and BASF SE, focusing on sustainability, product innovation, and market expansion.

- Regionally, North America held 34% share, followed by Asia-Pacific at 29% and Europe at 28%, while Latin America and Middle East & Africa accounted for 5% and 4% shares, respectively, reflecting steady but emerging adoption.

Market Segmentation Analysis:

By Product

Hydrogen peroxide dominated the food and beverage sterilizing agent market in 2024, holding a 54% share due to its high effectiveness, broad-spectrum antimicrobial properties, and regulatory approval for use in food contact surfaces. It is widely applied in packaging sterilization, beverage processing, and dairy industries owing to its efficiency and relatively low cost. Peracetic acid followed with rising adoption, especially in meat and poultry applications, as it delivers strong oxidizing properties and leaves no harmful residues. Other agents contribute smaller shares, serving niche requirements. Hydrogen peroxide remains the leading product, supported by versatility and compliance with global safety standards.

- For instance, Solvay produces more than 1 million tons of hydrogen peroxide annually across its global plants, with its INTEROX® AG series applied in aseptic packaging lines sterilizing up to 48,000 cartons per hour in dairy beverage facilities.

By Application

The meat and poultry segment led the market in 2024, accounting for a 39% share. Sterilizing agents such as peracetic acid and hydrogen peroxide are critical in maintaining hygiene, reducing microbial contamination, and extending shelf life of meat and poultry products. Rising consumer demand for safe, fresh, and minimally processed meat drives growth in this segment. Strict food safety regulations further enhance adoption of sterilizing agents in processing facilities. Cereals and pulses also contribute significantly, but the meat and poultry sector dominates due to higher contamination risks and stringent hygiene standards.

- For instance, Mitsubishi Gas Chemical supplies high-purity hydrogen peroxide, with a significant portion of its production going toward the electronics and food and beverage industries. A food additive-grade hydrogen peroxide is used in sterilizing beverage containers, and the company also produces peracetic acid, which is used for sterilizing poultry, pork, and seafood.

Key Growth Drivers

Stringent Food Safety Regulations

Strict food safety regulations remain a primary driver for the food and beverage sterilizing agent market. Global authorities require sterilization processes to prevent contamination and extend product shelf life. Compliance with standards from FDA, EFSA, and WHO increases the use of hydrogen peroxide and peracetic acid across industries. Rising consumer focus on hygienic, safe, and long-lasting food products further accelerates adoption. This regulatory push ensures sustained demand, especially in processed and packaged food sectors where safety standards are non-negotiable.

- For instance, Steris operates over 60 sterilization facilities worldwide, processing a vast number of medical and pharmaceutical products annually in compliance with FDA and international standards.

Rising Demand for Packaged and Processed Foods

Growing demand for packaged and processed foods significantly drives the sterilizing agent market. Urbanization, busy lifestyles, and consumer preference for ready-to-eat products have boosted global consumption of processed foods and beverages. Sterilizing agents play a critical role in preventing microbial spoilage, enhancing shelf life, and maintaining product quality. Manufacturers increasingly rely on effective sterilization to meet large-scale production needs. The rapid expansion of the packaged food industry worldwide underpins consistent growth in sterilizing agent usage.

- For instance, Hansol Chemical produces hydrogen peroxide in South Korea, primarily for the semiconductor and display industries, with some supply also going to the paper and textile sectors. It is known for its high-purity hydrogen peroxide used as an etching and cleaning agent in electronics manufacturing.

Expansion of Beverage Industry

The beverage industry’s rapid growth is another major contributor to market expansion. High global demand for soft drinks, juices, and dairy-based beverages necessitates effective sterilization of both equipment and packaging. Hydrogen peroxide and peracetic acid are widely adopted due to their strong antimicrobial properties and residue-free breakdown. Investments in beverage processing technologies further enhance demand. With packaged beverage consumption rising steadily, this industry provides a long-term growth avenue for sterilizing agent manufacturers.

Key Trends & Opportunities

Shift Toward Eco-Friendly Sterilizing Agents

The market is witnessing a growing shift toward sustainable and residue-free sterilizing solutions. Agents like hydrogen peroxide and peracetic acid are gaining popularity because they decompose into harmless byproducts such as water and oxygen. Consumer preference for safe, clean-label foods aligns with this trend, encouraging manufacturers to adopt eco-friendly sterilization methods. Companies focusing on green solutions and innovations in environmentally safe chemicals are well-positioned to capitalize on this opportunity.

- For instance, Arkema produces more than 80,000 tons annually of hydrogen peroxide in Europe, marketed under its Oxydes® brand, which decomposes entirely into water and oxygen during sterilization.

Adoption of Advanced Sterilization Technologies

Advanced sterilization systems are transforming market opportunities by improving efficiency and reducing chemical consumption. Automated systems, precise dosing equipment, and integrated monitoring technologies are increasingly used in processing plants. These technologies enhance food safety, reduce costs over time, and align with global modernization efforts in food and beverage industries. Emerging markets investing in modern infrastructure present significant opportunities for companies offering advanced sterilization solutions.

- For instance, Tetra Pak delivered 178 billion packages worldwide in fiscal year 2024, with some of its latest E3 filling machines using electron-beam sterilization instead of hydrogen peroxide for enhanced sustainability, while ensuring product safety and extended shelf life.

Key Challenges

High Operational and Maintenance Costs

One of the main restraints is the high cost of sterilizing agents and associated systems. Regular application, monitoring, and equipment maintenance add recurring expenses for manufacturers. This challenge is especially evident in small and mid-scale plants operating in cost-sensitive markets. While large enterprises adopt sterilization systems easily, smaller players may struggle to balance costs with compliance. This remains a limiting factor for broader adoption.

Health and Environmental Concerns

Some sterilizing agents pose risks when misused, creating concerns for both human health and the environment. Overexposure can affect worker safety, while improper disposal may impact ecosystems. These issues have attracted stricter regulations and greater consumer scrutiny. Manufacturers must therefore focus on safety, controlled application, and innovation in cleaner agents to maintain compliance. Addressing these challenges is essential for ensuring trust and sustainable growth in the market.

Regional Analysis

North America

North America held a 34% share of the food and beverage sterilizing agent market in 2024, driven by strict FDA regulations and advanced food processing infrastructure. The United States leads the region, with high adoption of hydrogen peroxide and peracetic acid in beverage packaging and meat processing facilities. Rising demand for packaged foods, coupled with consumer focus on safety and extended shelf life, strengthens growth. Canada also contributes significantly with expanding dairy and beverage sectors. Regulatory compliance and investments in modern sterilization technologies sustain North America’s leadership in the global market.

Europe

Europe accounted for a 28% share of the food and beverage sterilizing agent market in 2024, supported by stringent EU food safety directives and sustainability goals. Countries like Germany, France, and the UK dominate usage, particularly in meat, poultry, and beverage industries. Growing demand for eco-friendly sterilizing agents such as peracetic acid aligns with the region’s green initiatives. Expansion of processed food consumption and premium packaged beverages further supports adoption. With strong regulatory frameworks and advanced food industries, Europe remains a mature yet innovation-focused market for sterilizing agents.

Asia-Pacific

Asia-Pacific captured a 29% share of the food and beverage sterilizing agent market in 2024, making it one of the fastest-growing regions. Rapid urbanization, population growth, and rising disposable incomes in China, India, and Japan are fueling demand for processed foods and beverages. Governments are strengthening food safety standards, encouraging wider adoption of sterilizing agents in cereals, meat, and beverage industries. Increasing consumption of packaged dairy products and ready-to-drink beverages also boosts growth. With large-scale food production facilities and growing consumer awareness, Asia-Pacific is expected to remain a key driver of future market expansion.

Latin America

Latin America held a 5% share of the food and beverage sterilizing agent market in 2024, with Brazil and Mexico leading adoption. Growth is supported by rising demand for packaged foods and beverages, particularly in urban centers. The meat and poultry industry is a significant user of sterilizing agents, as stricter hygiene requirements gain importance. However, limited regulatory enforcement in some countries and cost constraints restrict broader adoption. Despite these challenges, expanding middle-class populations and growing investments in modern food processing facilities are expected to drive steady growth in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the food and beverage sterilizing agent market in 2024, driven by expanding food processing industries in Saudi Arabia, the UAE, and South Africa. Rising demand for packaged beverages, dairy products, and cereals supports growth in sterilizing agent adoption. Governments are increasingly focusing on food safety regulations to reduce contamination risks and improve public health standards. However, reliance on imports and high costs remain restraints. With growing urbanization and investments in food processing, the region offers long-term opportunities for market expansion.

Market Segmentations:

By Product

- Hydrogen peroxide

- Peracetic acid

- Others

By Application

- Cereals & pulses

- Meat & poultry

- Beverages

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food and beverage sterilizing agent market is shaped by leading players such as Taekwang Industry Co., Ltd., Solvay, Hansol Chemical, Arkema, Mitsubishi Gas, Evonik Industries, Steris, OCI Company Ltd., Peroxy Chem, and BASF SE. These companies focus on delivering advanced sterilizing solutions such as hydrogen peroxide and peracetic acid that comply with strict food safety regulations. Strategic investments in R&D enable them to enhance efficiency, safety, and eco-friendly properties of their product portfolios. Many players are expanding into high-growth markets in Asia-Pacific and the Middle East, where packaged food demand is rising rapidly. Sustainability initiatives, including the development of residue-free and biodegradable sterilizing agents, are central to their growth strategies. Strong distribution networks, global partnerships, and regulatory compliance ensure competitive advantage. Intense rivalry drives continuous innovation, positioning these companies to capture opportunities across processed food, beverages, dairy, and meat industries worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Taekwang Industry Co., Ltd.

- Solvay

- Hansol Chemical

- Arkema

- Mitsubishi Gas

- Evonik Industries

- Steris

- OCI Company Ltd.

- Peroxy Chem

- BASF SE

Recent Developments

- In September 2025, Solvay completed an expansion at its Zhenjiang, China facility to double production capacity of ultra-pure hydrogen peroxide, supporting high-purity uses in electronics and related industries.

- In June 2025, Solvay and BASF announced a collaboration to reduce Scope 3 emissions in their hydrogen peroxide supply chain. They shifted sourcing of aluminum chloride for Solvay’s Linne Herten plant to BASF in Germany, achieving over 50% reduction in raw material carbon footprint.

- In April 2025, Steris officials remarked they are delaying capacity expansion in EO sterilants until regulatory clarity emerges around EO rules in the U.S.

- In November 2024, Steris disclosed it faced ~275 lawsuits alleging that its EtO emissions led to cancer among nearby populations, reflecting increased regulatory and social risk in sterilization operations.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will remain steady due to stricter global food safety regulations and compliance needs.

- Hydrogen peroxide will continue to dominate as the most widely used sterilizing agent.

- Peracetic acid will see rising adoption in meat and poultry industries for its strong antimicrobial action.

- Eco-friendly and residue-free sterilizing agents will gain importance with sustainability initiatives.

- The beverage sector will drive growth through higher demand for sterilized packaging and equipment.

- Asia-Pacific will emerge as the fastest-growing region due to urbanization and packaged food demand.

- North America and Europe will sustain leadership through advanced infrastructure and regulatory enforcement.

- Companies will expand R&D efforts to develop safer and more cost-efficient sterilizing solutions.

- Automation and advanced sterilization technologies will improve efficiency and reduce chemical usage.

- Growing consumer demand for convenience and processed foods will ensure long-term market growth.