Market overview

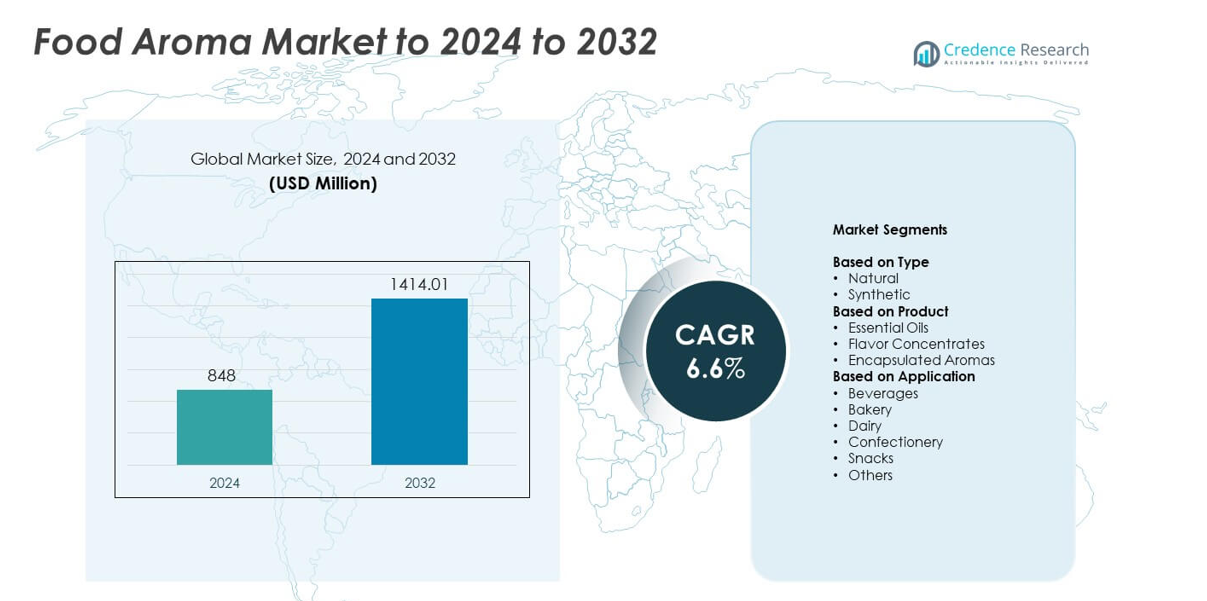

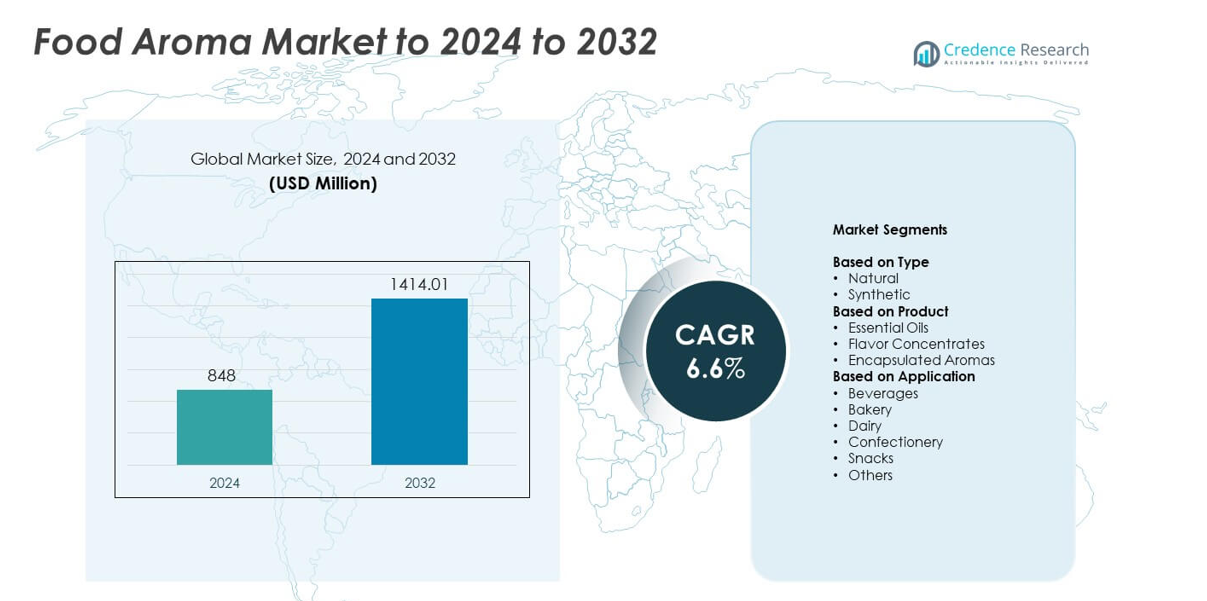

The food aroma market size was valued at USD 848 million in 2024 and is anticipated to reach USD 1,414.01 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Aroma Market Size 2024 |

USD 848 million |

| Food Aroma Market, CAGR |

6.6% |

| Food Aroma Market Size 2032 |

USD 1,414.01 million |

The food aroma market is dominated by key players such as Givaudan, Kerry Group, BASF SE, Archer Daniels Midland (ADM), Lonza Group, International Flavors & Fragrances (IFF), Cargill Inc., Nestlé Health Science, DSM Nutritional Products, Glanbia Nutritionals, and Ingredion Incorporated. These companies focus on developing sustainable, natural, and clean-label aroma solutions to meet rising consumer demand for authentic flavors. Investments in biotechnology, encapsulation, and fermentation-based aroma production enhance product performance and stability. Regionally, North America led the market with a 34.6% share in 2024, supported by strong processed food consumption and technological advancements in natural aroma development

.Market Insights

- The food aroma market was valued at USD 848 million in 2024 and is projected to reach USD 1,414.01 million by 2032, growing at a CAGR of 6.6%.

- Rising demand for natural and clean-label ingredients drives market expansion, with natural aromas accounting for 61.8% of total share in 2024.

- The market is witnessing a shift toward bio-based extraction, encapsulation technologies, and AI-driven flavor formulation to enhance aroma stability and authenticity.

- Competition remains strong among major players focusing on sustainable sourcing, product innovation, and partnerships to expand global reach.

- North America led the market with a 34.6% share in 2024, followed by Europe at 29.4% and Asia Pacific at 23.8%, supported by rising processed food and beverage consumption across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The natural segment dominated the food aroma market with a 61.8% share in 2024. Demand for natural ingredients is rising as consumers prefer clean-label and chemical-free products. Essential oils and plant-derived compounds are increasingly used in beverages, bakery, and dairy applications. Growing health awareness and regulatory support for natural additives further strengthen this segment. Manufacturers are expanding sourcing of botanical extracts and investing in sustainable aroma extraction methods to meet evolving consumer expectations for authenticity and safety.

- For instance, In 2024, Robertet reported that over 250 of its products were connected to supply chains that were verified or certified according to a CSR (Corporate Social Responsibility) standard.

By Product

The essential oils segment held the largest share of 44.5% in 2024, driven by their versatility and strong aromatic properties. These oils are widely applied across bakery, confectionery, and beverage products to enhance sensory appeal. Their natural origin and compatibility with organic formulations make them a preferred choice for food manufacturers. The segment benefits from technological improvements in steam distillation and cold-press extraction that preserve volatile compounds. Rising demand for citrus, mint, and spice-based oils in flavor creation continues to fuel market growth.

- For instance, Givaudan’s citrus program accesses over 1,000 varieties through the UCR Citrus Variety Collection, supporting robust essential-oil flavor development.

By Application

The beverages segment accounted for a 33.2% share in 2024, emerging as the leading application area for food aromas. Increasing consumption of flavored soft drinks, energy beverages, and ready-to-drink teas drives demand for natural and synthetic aroma compounds. Beverage producers rely on customized flavor formulations to enhance taste differentiation and brand appeal. Growth in functional and low-sugar drinks further supports aroma innovation. Expanding product portfolios from global brands and heightened consumer preference for sensory-rich beverages continue to propel this segment forward.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

Consumers increasingly prefer natural aromas derived from fruits, herbs, and spices due to health awareness and clean-label trends. Food manufacturers are replacing artificial flavoring agents with plant-based alternatives to meet regulatory and consumer expectations. This shift drives investment in natural extraction technologies and bio-based formulations. Expanding use of essential oils and botanical extracts across bakery, dairy, and beverage products continues to strengthen market expansion for natural aroma solutions globally.

- For instance, According to market data cited by Sensient, 4 out of 5 colored products launched or reformulated in 2023 and 2024 used natural colors. This industry trend demonstrates the ongoing consumer-driven demand for clean-label products.

Expansion of Processed and Packaged Food Industry

Growing consumption of ready-to-eat meals, snacks, and beverages boosts the use of food aromas for flavor enhancement and freshness retention. Urbanization, changing lifestyles, and time constraints have accelerated packaged food adoption. Manufacturers are integrating advanced aroma compounds to improve sensory appeal and shelf life. The expanding global convenience food industry, supported by modern retail channels, directly contributes to rising demand for innovative aroma formulations.

- For instance, Kerry maintains a global Research and Development team of over 1,200 scientists, food scientists, and other experts. This team, which operates across more than 70 Technology and Innovation centers, enables the company to provide rapid support and innovative solutions, particularly for its large packaged-food customers.

Technological Innovations in Flavor Encapsulation

Encapsulation technologies improve aroma stability, controlled release, and shelf-life performance, enabling greater use across food categories. Advancements in microencapsulation and nanoencapsulation help protect volatile aroma compounds during processing and storage. Companies are leveraging biotechnology and emulsification systems to enhance aroma delivery efficiency. These developments enhance product quality and open new opportunities for high-value aroma solutions in functional foods and beverages.

Key Trends & Opportunities

Sustainability and Bio-Based Aroma Production

Manufacturers are focusing on sustainable sourcing and bio-based aroma synthesis using fermentation and enzymatic pathways. The transition toward renewable raw materials helps reduce dependence on petrochemical-based ingredients. Consumer preference for eco-friendly, traceable, and cruelty-free flavors encourages companies to adopt circular production models. Growing interest in green chemistry and carbon-neutral aroma manufacturing creates new opportunities for market differentiation and premium product offerings.

- For instance, Isobionics (a brand of BASF Aroma Ingredients) launched the natural flavor ingredient, Natural alpha-Farnesene 95, which is produced through fermentation using renewable resources and has a purity of more than 95%.

Rising Adoption of AI and Analytics in Flavor Development

Artificial intelligence and data-driven modeling tools are transforming flavor and aroma formulation. These technologies analyze consumer preferences and predict flavor combinations for product innovation. Companies use AI algorithms to accelerate aroma compound discovery and optimize sensory performance. Integration of predictive analytics in R&D processes enhances formulation accuracy and reduces development time, supporting faster go-to-market strategies across food categories.

- For instance, Coca-Cola launched the AI-co-created Y3000 Zero Sugar in September 2023, which was made available for a limited time in select markets, including the United States, Canada, Europe, Australia, China, and Africa. This launch, part of the Coca-Cola Creations platform, demonstrated the company’s data-driven approach to flavor creation by using both human insights and artificial intelligence.

Key Challenges

Regulatory Complexity and Approval Barriers

The food aroma industry faces strict regulatory scrutiny across different regions, affecting product approvals and formulation processes. Compliance with safety standards from EFSA, FDA, and other authorities increases development timelines. Labeling transparency and allergen disclosure rules further challenge manufacturers. Frequent updates to food additive lists and documentation requirements raise operational costs, limiting smaller players’ competitiveness in global markets.

Volatility in Raw Material Supply and Pricing

Fluctuating availability and cost of natural raw materials, such as essential oils and botanical extracts, disrupt production consistency. Weather conditions, crop yield variations, and supply chain constraints impact sourcing stability. These fluctuations lead to price volatility, forcing companies to balance cost efficiency with quality assurance. Dependence on limited geographical sources also increases the risk of supply shortages and production delays.

Regional Analysis

North America

North America dominated the food aroma market with a 34.6% share in 2024, driven by high demand for flavored bakery, dairy, and beverage products. The U.S. leads the region, supported by a strong processed food industry and increasing use of natural aroma extracts. Manufacturers are investing in clean-label and organic flavor systems to meet consumer preferences. The presence of leading players and continuous innovation in encapsulated aroma technologies further support regional growth. Expanding applications in functional beverages and health-oriented snacks continue to strengthen market expansion across the U.S. and Canada.

Europe

Europe accounted for a 29.4% share in 2024, supported by a well-established food and beverage manufacturing base and stringent regulatory standards. Consumers in countries such as Germany, France, and the U.K. favor natural and plant-based aromas over synthetic alternatives. The regional market benefits from innovations in bio-based extraction and fermentation-derived flavor compounds. Manufacturers are focusing on sustainable sourcing and traceability to align with EU food safety norms. Rising adoption of premium bakery, confectionery, and dairy products enhances demand for high-quality aroma formulations across European markets.

Asia Pacific

Asia Pacific held a 23.8% share in 2024, fueled by rapid growth in processed food consumption and expanding beverage manufacturing. China, India, and Japan are major contributors, driven by rising disposable income and changing dietary habits. Increasing adoption of natural flavor systems in bakery and dairy products supports regional momentum. The proliferation of convenience food brands and expanding distribution networks enhance product availability. Local producers are investing in essential oil extraction and aroma encapsulation technologies to strengthen competitiveness in domestic and export markets.

Latin America

Latin America captured a 7.1% share in 2024, primarily driven by growing demand for flavored snacks, beverages, and bakery products. Brazil and Mexico lead regional adoption due to expanding food processing sectors and shifting consumer preferences toward exotic and fruit-based flavors. The market benefits from local raw material availability for natural aroma extraction. Increasing foreign investments and partnerships with global flavor companies are strengthening technological capabilities. Gradual expansion of modern retail and e-commerce channels is improving accessibility to aroma-based processed foods across the region.

Middle East and Africa

The Middle East and Africa accounted for a 5.1% share in 2024, supported by increasing processed food consumption and urban lifestyle changes. Demand is rising for flavored dairy, confectionery, and beverage products across the Gulf Cooperation Council countries and South Africa. Manufacturers are focusing on halal-certified and region-specific aroma formulations to cater to diverse consumer preferences. Growing investments in food manufacturing and distribution infrastructure are creating new growth avenues. Expansion of quick-service restaurants and rising youth population are further stimulating demand for aroma-based food innovations.

Market Segmentations:

By Type

By Product

- Essential Oils

- Flavor Concentrates

- Encapsulated Aromas

By Application

- Beverages

- Bakery

- Dairy

- Confectionery

- Snacks

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The food aroma market is highly competitive, with major players including Givaudan, Kerry Group, BASF SE, Archer Daniels Midland (ADM), Lonza Group, International Flavors & Fragrances (IFF), Cargill Inc., Nestlé Health Science, DSM Nutritional Products, Glanbia Nutritionals, and Ingredion Incorporated. The competition centers on product innovation, sustainability, and expanding natural aroma portfolios. Companies are investing in biotechnology, fermentation processes, and microencapsulation to enhance aroma stability and purity. Strategic mergers and acquisitions help broaden regional presence and product offerings. Firms focus on sustainable sourcing, regulatory compliance, and clean-label formulations to align with shifting consumer preferences. Rising demand for plant-based and functional food products continues to drive research in natural aroma extraction and advanced flavor engineering. Continuous R&D and technology-driven product differentiation remain central to maintaining market leadership and global competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Givaudan

- Kerry Group

- BASF SE

- Archer Daniels Midland (ADM)

- Lonza Group

- International Flavors & Fragrances (IFF)

- Cargill Inc.

- Nestlé Health Science

- DSM Nutritional Products

- Glanbia Nutritionals

- Ingredion Incorporated

Recent Developments

- In 2025, Givaudan launched Zensera™, a natural, patent-pending lemon balm extract designed to support cognitive performance during stressful events.

- In 2023, IFF announced the addition of two new flavor labs to its Europe Innovation Hub in Brabrand, Denmark.

- In 2023, ADM announced an agreement to acquire Revela Foods, a Wisconsin-based manufacturer of dairy flavor ingredients. The deal was officially closed in January 2024.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing use of natural and sustainable aroma ingredients.

- Advancements in fermentation and bio-based extraction will improve production efficiency.

- Rising demand for functional and fortified foods will boost aroma innovation.

- AI-driven formulation tools will accelerate new flavor and aroma development.

- Expanding processed food and beverage industries will support global market penetration.

- Consumer shift toward clean-label and allergen-free products will favor natural aroma growth.

- Growth in plant-based food products will create new application opportunities.

- Companies will invest more in encapsulation technologies for aroma stability.

- Emerging economies in Asia Pacific and Latin America will drive future consumption.

- Strategic collaborations among manufacturers will strengthen global supply and innovation capacity.