Market Overview

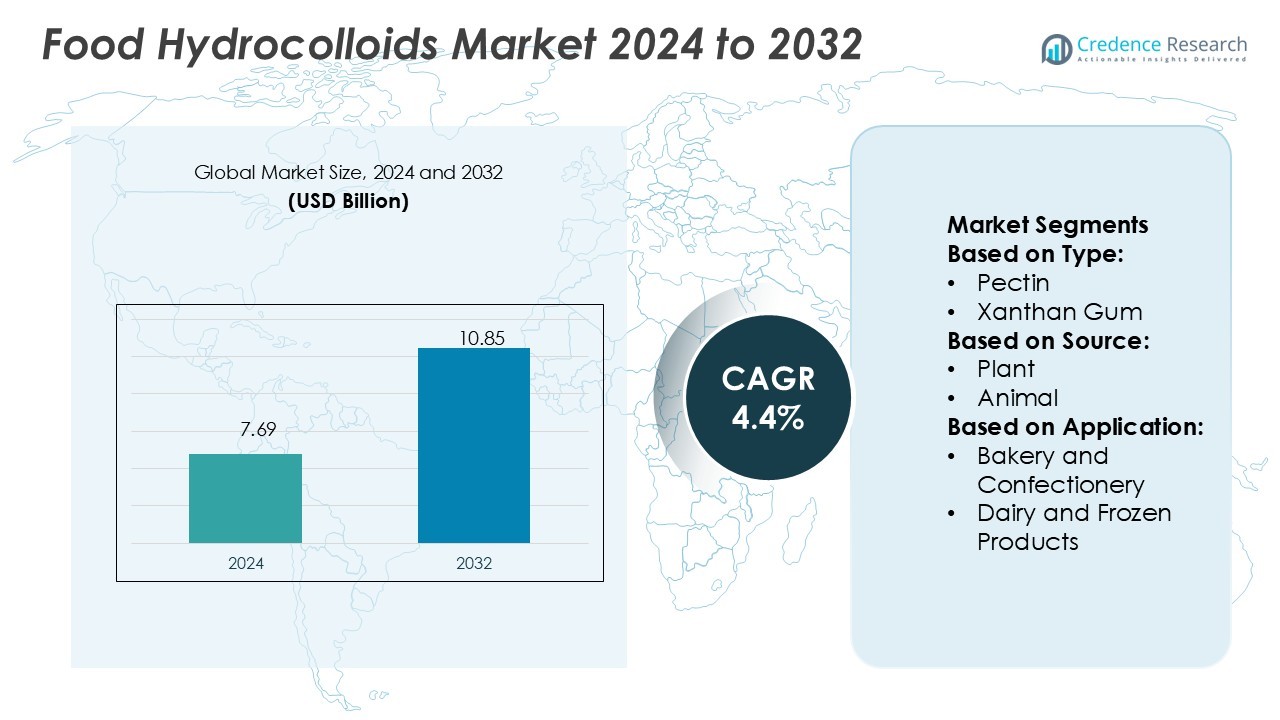

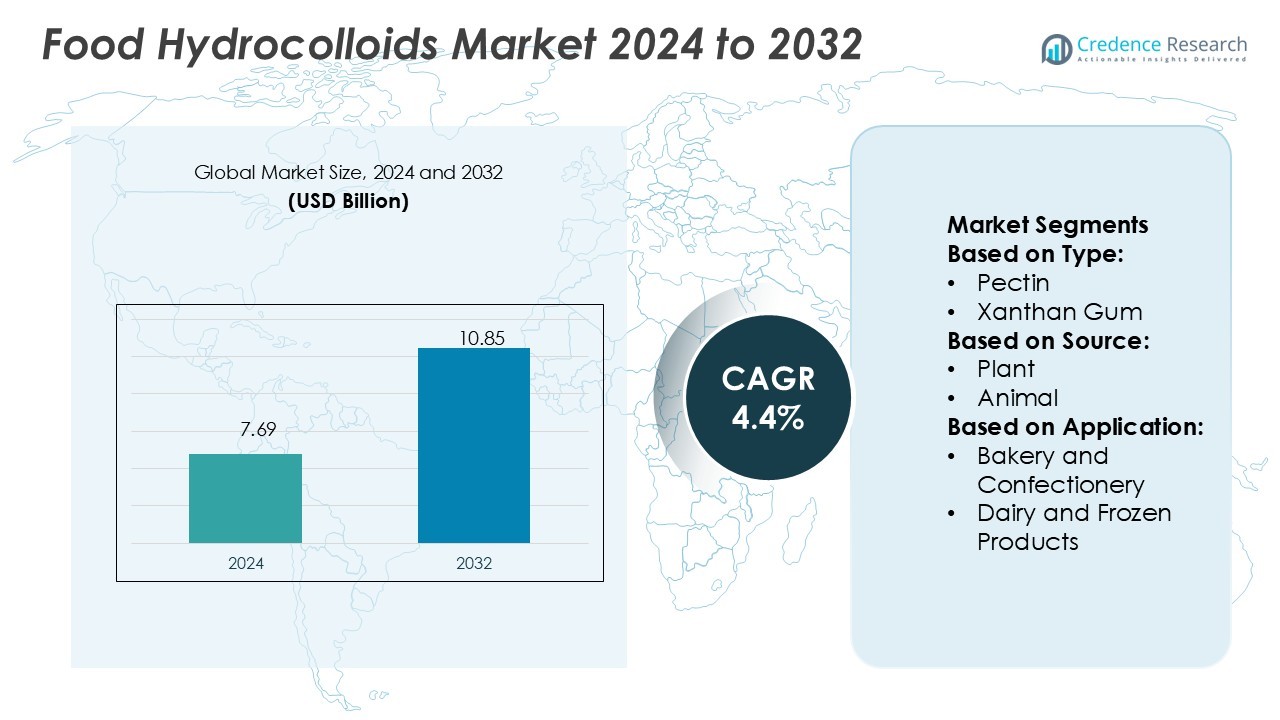

Food Hydrocolloids Market size was valued USD 7.69 billion in 2024 and is anticipated to reach USD 10.85 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Hydrocolloids Market Size 2024 |

USD 7.69 Billion |

| Food Hydrocolloids Market, CAGR |

4.4% |

| Food Hydrocolloids Market Size 2032 |

USD 10.85 Billion |

The food hydrocolloids market is driven by prominent players including Cargill, Incorporated, CP Kelco, DuPont de Nemours, Inc., Ingredion Incorporated, Kerry Group plc, Ashland Global Holdings Inc., FMC Corporation, Koninklijke DSM N.V., Lonza Group AG, and Gum Technology Corporation. These companies focus on innovation, sustainable sourcing, and clean-label product development to strengthen their competitive positions. Strategic investments in R&D, partnerships, and customized solutions for bakery, dairy, beverages, and functional foods support market expansion. Regionally, Asia-Pacific leads the market with a 34% share, driven by rapid industrialization, rising packaged food demand, and abundant raw material availability, solidifying its dominance in the global landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Hydrocolloids Market was valued at USD 7.69 billion in 2024 and will reach USD 10.85 billion by 2032, growing at a CAGR of 4.4%.

- Growing demand for clean-label, plant-based, and functional foods is a key driver supporting wider adoption of hydrocolloids across bakery, dairy, beverage, and meat applications.

- Leading players such as Cargill, CP Kelco, DuPont, Ingredion, and Kerry Group emphasize innovation, sustainable sourcing, and customized product solutions to maintain competitiveness.

- Market restraints include raw material supply volatility, particularly for guar and seaweed, and stringent regulatory standards that increase production costs and compliance challenges.

- Asia-Pacific leads with a 34% share due to strong food processing growth and raw material availability, while gelatin dominates the type segment with 28% share, supported by high demand in confectionery, dairy, and meat products.

Market Segmentation Analysis:

By Type

Gelatin gum holds the dominant position in the food hydrocolloids market with a 28% share. Its leadership stems from broad use in confectionery, dairy, and meat products, where it delivers texture, stability, and gelling functions. Demand is driven by its unique functional versatility and clean-label recognition, which support growth in premium food categories. Growing applications in low-fat formulations and functional foods also enhance its adoption, making gelatin gum the preferred hydrocolloid compared to pectin, xanthan gum, guar gum, carrageenan, and other types.

- For instance, Lonza’s Capsugel® operations have a production capacity of approximately 260 billion capsules annually. The company integrates advanced polymers, including gelatin and non-gelatin materials, to improve stability and bioavailability in applications for both the pharmaceutical and nutraceutical industries.

By Source

Plant-based hydrocolloids dominate the market with a 34% share, benefiting from rising consumer preference for natural and vegan ingredients. They provide thickening, stabilizing, and emulsifying functions across beverages, bakery, and frozen desserts. Drivers include the global shift toward sustainable sourcing and clean-label formulations that align with health-conscious and ethical consumption trends. Seaweed, microbial, and synthetic sources continue to expand, but plant-derived ingredients remain the preferred choice due to scalability, diverse application range, and alignment with plant-based dietary patterns.

- For instance, Cargill’s partnership in the Qore joint venture processes corn into QIRA, a bio-based replacement for petrochemical 1,4-butanediol. The new facility in Eddyville, Iowa, has the capacity to produce 66,000 metric tons of QIRA annually from corn feedstock.

By Application

Bakery and confectionery lead the applications segment with a 29% share in the food hydrocolloids market. These products use hydrocolloids to improve dough stability, extend shelf life, and enhance mouthfeel in baked goods and sweets. The growth of processed and convenience foods further drives demand, supported by rising consumption of packaged confectionery. Dairy and frozen products, beverages, and meat and seafood applications show strong expansion, but bakery and confectionery maintain dominance due to high-volume usage and critical functionality in product quality and innovation.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The growing preference for processed and convenience foods drives the food hydrocolloids market. Hydrocolloids improve texture, stability, and shelf life in ready-to-eat meals, snacks, and packaged beverages. As urbanization increases and lifestyles become busier, consumers seek products with longer storage capacity and consistent quality. Hydrocolloids provide essential functionality in these formulations, making them indispensable for large-scale food manufacturing. The trend supports steady demand across developed and emerging markets, particularly in bakery, confectionery, dairy, and frozen product categories.

- For instance, FMC’s Gelstar IC 3548 stabilizer (a blend of MCC and cellulose gel) was demonstrated in a frozen dessert prototype incorporating over 60% fruit concentrate, showcasing its ability to provide structural integrity and a controlled meltdown profile.

Shift Toward Clean-Label and Natural Ingredients

Rising consumer awareness about food ingredients fuels the adoption of natural hydrocolloids. Clean-label trends emphasize plant, seaweed, and microbial-derived alternatives over synthetic additives. Consumers increasingly seek transparency, preferring products free from artificial stabilizers and chemicals. Manufacturers respond by reformulating product lines to highlight natural origins, improving trust and market competitiveness. This shift is particularly strong in dairy, beverages, and health-focused food segments. The clean-label movement ensures sustained growth for plant-based hydrocolloids such as pectin, guar gum, and xanthan gum.

- For instance, Kerry operates over 25 distinct process-technology platforms (such as fermentation, encapsulation, extrusion) and employs more than 1,100 scientists to develop texturant systems that reduce reliance on artificial stabilizers.

Expanding Applications in Functional and Health Foods

The increasing popularity of functional and health foods boosts hydrocolloid adoption. Hydrocolloids enhance nutritional formulations by stabilizing proteins, reducing fat, and providing desirable textures. Their role in low-calorie and sugar-free products aligns with rising health-conscious consumption. Growing demand for fortified snacks, protein drinks, and plant-based alternatives further broadens their application scope. Hydrocolloids also support innovation in dietary fiber-rich products, addressing digestive health trends. This functional versatility makes them central to product differentiation, driving market expansion across both mainstream and specialty food industries.

Key Trends & Opportunities

Growth in Plant-Based and Vegan Alternatives

The shift toward plant-based and vegan diets creates opportunities for hydrocolloid suppliers. Derived from sources such as guar beans, pectin-rich fruits, and seaweed, these ingredients replace animal-derived gelatin in multiple applications. They meet the rising demand for cruelty-free, sustainable, and allergen-friendly food solutions. Global brands increasingly highlight plant-based hydrocolloids in labeling to capture health-conscious and ethical consumers. This trend is further reinforced by government initiatives and investments in sustainable food innovation, opening significant growth avenues for natural hydrocolloid producers.

- For instance, DuPont won three 2025 R&D 100 Awards for innovations including the FilmTec™ Fortilife™ XC160 membrane, capable of ultra-high-pressure recovery in water reuse with flux rates over 40 L/m²·h under 60 bar across harsh feed streams.

Innovation in Sustainable Sourcing and Processing

Sustainability is becoming a key market driver, offering opportunities for eco-friendly hydrocolloid production. Companies invest in sustainable sourcing of raw materials, such as seaweed farming and renewable microbial processes, to reduce environmental impact. Advancements in energy-efficient extraction and refining technologies further enhance competitiveness. Eco-certifications and transparent supply chains also add market value, meeting regulatory and consumer expectations. This trend positions sustainable hydrocolloid solutions as premium offerings, appealing to brands aiming to reduce their carbon footprint while maintaining product performance and quality.

- For instance, CP Kelco’s NUTRAVA® Citrus Fiber is designed to extend or reduce tomato solids in sauces. According to CP Kelco’s lab studies, the fiber can support the extension of up to 25% of tomato solids while maintaining mouthfeel, texture, and appearance.

Key Challenges

Volatility in Raw Material Supply

The market faces challenges due to fluctuations in raw material availability, especially for seaweed and guar gum. Climate variability, harvesting restrictions, and supply chain disruptions can impact sourcing consistency. This volatility affects production costs and limits the ability of manufacturers to maintain stable pricing. Companies must diversify sourcing and invest in sustainable farming practices to mitigate these risks. Without supply chain resilience, long-term market growth may face constraints, particularly in high-demand segments such as dairy and bakery applications.

Regulatory Compliance and Quality Standards

Strict food safety and labeling regulations pose challenges for hydrocolloid manufacturers. Different regions enforce varying standards on additives, clean-label claims, and permissible levels of use. Adapting to these requirements demands continuous investment in testing, certification, and compliance management. Smaller producers often face higher barriers due to cost burdens, while larger players allocate significant resources to ensure global compliance. Failure to meet regulations can lead to product recalls, reputational damage, and restricted market entry, limiting overall growth potential in the competitive landscape.

Regional Analysis

North America

North America holds a 32% share of the food hydrocolloids market, supported by high demand from the bakery, confectionery, and dairy sectors. The region benefits from a mature processed food industry and strong adoption of clean-label ingredients. Rising consumer preference for natural, plant-based, and vegan alternatives further drives market growth. The U.S. dominates due to advanced R&D capabilities and significant investments by leading food companies. Additionally, the growing popularity of functional foods and fortified beverages enhances hydrocolloid usage, particularly in stabilizers and gelling agents. Regulatory support for natural additives sustains strong growth momentum.

Europe

Europe accounts for 27% of the food hydrocolloids market, driven by stringent regulatory standards and strong consumer awareness of clean-label products. The region shows high demand for pectin, carrageenan, and plant-derived hydrocolloids due to established bakery and dairy industries. Germany, France, and the UK are key contributors, supported by innovation in vegan and functional foods. Regulatory emphasis on natural and sustainable sourcing promotes plant-based and seaweed-derived hydrocolloids. Growing adoption in beverages, sauces, and frozen products strengthens regional market share. Food manufacturers in Europe actively invest in sustainable processing methods to align with environmental and health-focused consumer demands.

Asia-Pacific

Asia-Pacific leads the global market with a 34% share, fueled by rapid industrialization, population growth, and expanding food processing sectors. China, India, and Japan drive demand for hydrocolloids across bakery, beverages, and frozen dairy products. Rising urbanization and increasing disposable incomes support higher consumption of packaged and convenience foods. The region benefits from abundant raw material availability, particularly seaweed and guar, which strengthens local production. Growing health-conscious consumer segments also favor plant-based hydrocolloids, expanding application in functional foods. Continuous investments in food innovation and strong growth in emerging economies enhance Asia-Pacific’s leadership position in the global market.

Latin America

Latin America holds a 5% share of the food hydrocolloids market, supported by rising demand for processed and packaged foods. Brazil and Mexico dominate, driven by strong bakery, confectionery, and dairy industries. Growing middle-class populations and urbanization stimulate demand for convenient food products that rely on hydrocolloids for stability and texture. Regional producers increasingly focus on natural sources such as guar and carrageenan, aligning with global clean-label trends. However, limited technological infrastructure and supply chain constraints pose challenges. Expanding investment in local food processing industries offers growth opportunities, particularly in beverages and functional food categories.

Middle East & Africa

The Middle East & Africa region contributes 2% share to the global food hydrocolloids market, showing steady but limited growth. Rising demand for packaged food and beverages, particularly in urban centers, fuels hydrocolloid adoption. Countries such as South Africa, the UAE, and Saudi Arabia are key markets, supported by expanding food retail sectors. Increasing focus on dairy, frozen desserts, and confectionery products enhances demand for hydrocolloids as stabilizers and gelling agents. Supply chain limitations and reliance on imports remain challenges, but growing investments in food manufacturing and diversification into plant-based sources create future growth opportunities.

Market Segmentations:

By Type:

By Source:

By Application:

- Bakery and Confectionery

- Dairy and Frozen Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food hydrocolloids market features leading players such as Lonza Group AG, Gum Technology Corporation, Cargill, Incorporated, Ashland Global Holdings Inc., FMC Corporation, Kerry Group plc, DuPont de Nemours, Inc., Ingredion Incorporated, CP Kelco, and Koninklijke DSM N.V. The food hydrocolloids market is shaped by strong innovation, sustainability efforts, and expanding application scope across the global food industry. Companies focus on developing clean-label, plant-based, and functional solutions to align with shifting consumer preferences. Investments in advanced processing technologies, such as eco-friendly extraction and fermentation methods, enhance product quality and reduce environmental impact. Strategic collaborations with food manufacturers support customized formulations tailored to bakery, dairy, beverage, and functional food applications. In addition, global expansion into emerging markets, particularly in Asia-Pacific and Latin America, strengthens competitiveness. Continuous R&D and adherence to strict food safety regulations remain critical factors influencing market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lonza Group AG

- Gum Technology Corporation

- Cargill, Incorporated

- Ashland Global Holdings Inc.

- FMC Corporation

- Kerry Group plc

- DuPont de Nemours, Inc.

- Ingredion Incorporated

- CP Kelco

- Koninklijke DSM N.V.

Recent Developments

- In May 2025, Sarda Bio Polymers introduced clean-label, plant-based hydrocolloid solutions for meat and alternative protein applications. Their offerings include guar gum, cassia tora gum, konjac, xanthan, carrageenan, tamarind xyloglucan, and CMC, designed to enhance texture with minimal processing while emphasizing sustainability and performance.

- In October 2024, Jungbunzlauer has initiated construction of a facility in Canada to produce xanthan gum, a fermentation-derived ingredient used in food, cosmetic, and pharmaceutical products. The facility will utilize locally sourced corn as the primary raw material.

- In January 2024, IFF launched Grindsted Pectin FB 420 for baking applications. Grindsted Pectin FB 420 is ideal for baking applications. It has unique sensory qualities for bake-stable fruit fillings and is label-friendly and process-efficient.

- In March 2023, Hydrosol developed stabilizing and texturing systems to reduce sugar and fat in dairy and deli foods. The developed systems use selected hydrocolloids and vegetable fiber to substitute for the beneficial technological properties of sugar and fat.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for plant-based and vegan alternatives.

- Clean-label and natural ingredient preferences will strengthen hydrocolloid adoption.

- Functional foods and beverages will drive higher utilization of stabilizers and gelling agents.

- Sustainable sourcing and eco-friendly production methods will gain stronger importance.

- Asia-Pacific will remain the largest growth hub due to industrial expansion and rising consumption.

- Advanced processing technologies will enhance efficiency and product performance.

- Food manufacturers will increasingly adopt hydrocolloids in low-fat and sugar-free products.

- Strategic collaborations will support innovation and customized product development.

- Regulatory compliance will shape innovation in natural and safe food formulations.

- Rising investments in R&D will ensure continuous expansion of application areas.