Market Overview:

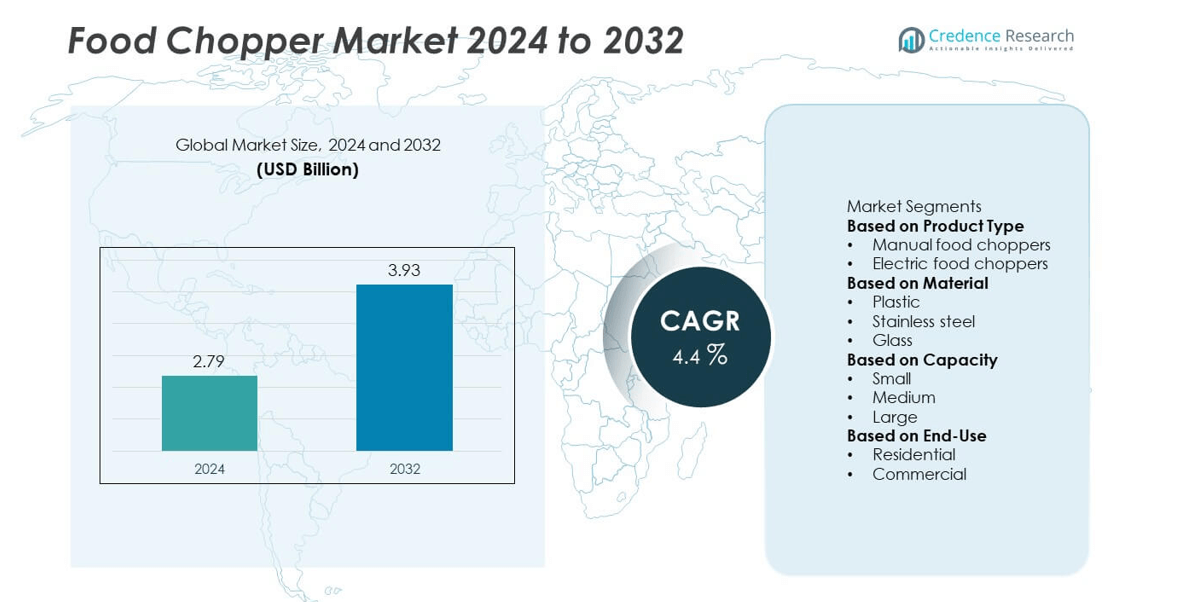

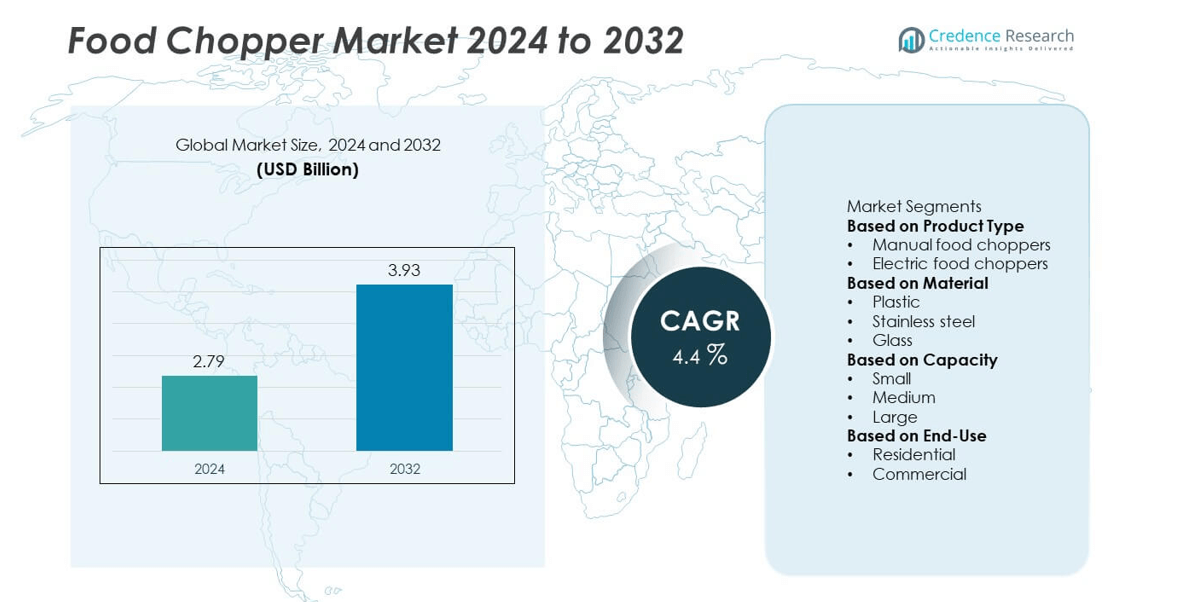

The global food chopper market was valued at USD 2.79 billion in 2024 and is projected to reach USD 3.93 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Chopper Market Size 2024 |

USD 2.79 billion |

| Food Chopper Market, CAGR |

4.4% |

| Food Chopper Market Size 2032 |

USD 3.93 billion |

The food chopper market is led by major players such as KitchenAid, OXO International Ltd., Magimix, Breville Group Limited, Preethi Kitchen Appliances Pvt Ltd, Hamilton Beach Brands, Inc., Cuisinart, Groupe SEB (Moulinex), Braun GmbH, and Koninklijke Philips N.V. These companies dominate through product innovation, durable designs, and extensive retail and online presence. Asia Pacific held the leading 29% market share in 2024, driven by rising disposable incomes, urbanization, and growing adoption of electric choppers. North America followed with 34% share, supported by strong demand for multifunctional kitchen appliances and smart home integration. Europe accounted for 27%, emphasizing eco-friendly materials and energy-efficient designs.

Market Insights

- The food chopper market was valued at USD 2.79 billion in 2024 and is projected to reach USD 3.93 billion by 2032, growing at a CAGR of 4.4%.

- Increasing demand for convenient, time-saving kitchen appliances and rising adoption of electric food choppers are major drivers of market growth.

- The trend toward multifunctional, compact, and energy-efficient choppers with detachable blades and easy-clean designs is shaping consumer preferences.

- Leading players such as KitchenAid, Breville Group Limited, Braun GmbH, and Philips focus on innovation, product design, and expanding online distribution networks to strengthen competitiveness.

- North America led with 34% market share in 2024, followed by Asia Pacific with 29% and Europe with 27%, while the electric food chopper segment held a 63% share, supported by strong household and commercial adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The electric food chopper segment dominated the food chopper market with a 63% share in 2024. Its leadership is driven by convenience, faster operation, and suitability for modern kitchens. Electric choppers are widely used for chopping vegetables, fruits, and nuts with minimal effort, appealing to working households and commercial users. Increasing availability of multi-speed and energy-efficient models enhances functionality. Manufacturers are integrating safety locks, detachable blades, and easy-clean designs, boosting adoption. The rise in smart kitchen appliances and growing demand for compact electric devices continue to fuel segment growth globally.

- For instance, Breville Group Limited introduced the Paradice™ 9-Cup Food Processor, which features a heavy-duty 625-watt induction motor and a 4.7-inch wide feed chute. The dicing kit, included for precision 12mm dicing, is highlighted for increasing meal preparation efficiency.

By Material

The stainless-steel segment accounted for the largest market share of 52% in 2024, supported by its durability, corrosion resistance, and aesthetic appeal. Stainless-steel blades and bodies offer long service life and superior performance compared to plastic alternatives. The material’s hygienic properties make it preferred for both home and commercial kitchens. Growing consumer preference for sustainable, easy-to-clean, and heat-resistant materials further supports demand. Manufacturers are combining stainless steel with transparent glass or high-grade plastic housings to enhance design and usability, reinforcing this segment’s dominance in the global market.

- For instance, KitchenAid launched its Go™ Cordless Food Chopper with dual stainless-steel precision blades and two speed settings. Its 5-cup, BPA-free plastic bowl is dishwasher-safe and features a pour spout and drizzle basin. The cordless design, powered by a rechargeable 12V lithium-ion battery, allows for versatile meal preparation.

By Capacity

The medium-capacity segment held the leading 46% share of the food chopper market in 2024. Its dominance stems from its versatility, making it suitable for both single households and small families. Medium choppers offer an ideal balance between storage convenience and functional efficiency, driving adoption in urban residential settings. The increasing trend of preparing fresh meals at home has elevated demand for mid-sized appliances with multifunctional blades. Manufacturers are focusing on developing ergonomically designed medium-capacity choppers with improved motor performance and enhanced safety features to meet evolving consumer preferences.

Key Growth Drivers

Rising Demand for Convenient Kitchen Appliances

Growing urbanization and busy lifestyles are increasing the need for time-saving kitchen tools, driving food chopper adoption. Consumers prefer compact, easy-to-use appliances that simplify food preparation. The availability of multifunctional electric choppers that can dice, mince, and grind in seconds supports strong market growth. Manufacturers are introducing user-friendly models with energy-efficient motors and improved safety features, further boosting household demand.

- For instance, Hamilton Beach Brands, Inc. launched its Stack & Snap 4-Cup Food Chopper equipped with a 250-watt motor. It also features an Easy Stack & Snap assembly that locks the lid securely and prevents the motor from running when the lid is detached during use.

Expansion of E-commerce and Online Retail Channels

Online retail has become a major sales channel for kitchen appliances, fueling the food chopper market. Consumers benefit from wider product access, transparent pricing, and frequent discounts. Brands leverage online platforms to promote electric and smart choppers through targeted digital marketing. The convenience of doorstep delivery and product comparison accelerates global adoption, particularly among younger urban consumers.

- For instance, Preethi Kitchen Appliances Pvt. Ltd. manufactures a Turbo Chop mini electric chopper. The device features a 450-watt motor, enabling it to chop vegetables in a matter of seconds. Some sellers describe the blades as laser-sharp, food-grade stainless steel.

Growing Popularity of Healthy and Home-Cooked Meals

The rising focus on healthy eating and fresh meal preparation is boosting demand for food choppers. Consumers increasingly prepare salads, sauces, and plant-based meals at home, creating consistent appliance demand. Food choppers enable faster processing of fruits and vegetables, reducing meal preparation time. As health awareness spreads globally, both manual and electric choppers are witnessing higher adoption in households and commercial kitchens.

Key Trends & Opportunities

Integration of Smart and Multifunctional Designs

Manufacturers are developing food choppers with smart features such as variable speed control, detachable blades, and easy-clean technology. Multifunctional designs that combine chopping, blending, and mixing capabilities appeal to small households. The integration of digital controls and rechargeable batteries offers enhanced convenience. This trend supports long-term market opportunities for innovation-driven brands targeting tech-savvy consumers.

- For instance, Koninklijke Philips N.V. introduced the Viva Collection compact food processor with a 750-watt motor. It features two speed settings and a pulse function, which, combined with Philips’ PowerChop technology, offers superior chopping performance.

Sustainability and Energy-Efficient Materials

Sustainability is becoming central to product development in the food chopper market. Companies are introducing BPA-free plastics, stainless-steel components, and energy-saving motors. Environmentally conscious consumers prefer durable, recyclable, and low-power appliances. The trend toward eco-friendly materials and reduced packaging waste creates opportunities for premium product positioning and stronger brand differentiation.

- For instance, Groupe SEB under its Moulinex brand developed the Eco Respect food chopper using 23% recycled plastic for one 500-watt model, and up to 46% recycled plastic for a 1000-watt model. Some of these models, like the 500-watt version, also feature energy-saving technology, consuming up to 66% less energy compared to previous models for a single recipe.

Key Challenges

Intense Market Competition and Price Sensitivity

The presence of numerous local and international players has intensified competition in the food chopper market. Price-sensitive consumers in developing regions often favor low-cost alternatives, reducing brand loyalty. To maintain profitability, manufacturers must balance affordability with quality. Continuous innovation and cost-efficient production remain crucial to sustaining competitive advantage.

Maintenance and Product Durability Issues

Frequent wear and tear, blade dullness, and motor failures limit long-term product reliability, especially in low-cost models. These challenges affect consumer satisfaction and brand perception. Companies need to improve material durability and after-sales service to build trust. Investing in high-quality components and warranties can mitigate product replacement concerns and strengthen market reputation.

Regional Analysis

North America

North America held a 34% share of the food chopper market in 2024, driven by high demand for advanced and multifunctional kitchen appliances. The United States leads regional growth due to busy lifestyles, strong adoption of electric choppers, and rising preference for healthy meal preparation at home. Manufacturers are focusing on compact, easy-to-clean models suited for modern kitchens. Growing awareness of time-saving devices and high household appliance penetration further support market expansion. Increasing innovation in smart kitchen technology and strong e-commerce presence continue to strengthen North America’s leading position in the global market.

Europe

Europe accounted for a 27% share of the food chopper market in 2024, supported by widespread adoption of energy-efficient and eco-friendly appliances. Consumers in Germany, France, and the U.K. prefer high-quality, durable stainless-steel products for everyday use. The region’s emphasis on sustainability and the use of recyclable materials have influenced new product designs. Strong retail networks and online availability of premium kitchen appliances enhance accessibility. Growing demand for compact electric choppers and multifunctional food processors, particularly among urban households, reinforces Europe’s position as a key regional market.

Asia Pacific

Asia Pacific dominated the food chopper market with a 29% share in 2024, fueled by rapid urbanization, rising disposable incomes, and increasing adoption of modern kitchen tools. China, India, and Japan lead regional growth with expanding middle-class populations and rising interest in convenient food preparation appliances. Electric choppers are witnessing strong adoption due to affordability and availability across e-commerce platforms. Manufacturers are introducing locally manufactured, energy-efficient products to meet regional preferences. The growing culture of home cooking and the rise of compact apartment living further drive Asia Pacific’s continued market expansion.

Latin America

Latin America captured a 6% share of the food chopper market in 2024, supported by growing awareness of home cooking convenience and rising sales of small kitchen appliances. Brazil and Mexico are key contributors due to expanding urban populations and increasing retail availability of low-cost electric choppers. Consumers are showing preference for easy-to-use, durable, and multi-functional products. Local manufacturers are strengthening distribution networks to reach tier-two cities. However, economic volatility and limited brand penetration in rural areas slightly restrict faster growth. Continuous marketing and promotional activities are expected to enhance product adoption across the region.

Middle East & Africa

The Middle East & Africa region held a 4% share of the food chopper market in 2024. Growth is driven by increasing urban household formation, rising income levels, and improving retail infrastructure. The United Arab Emirates, Saudi Arabia, and South Africa are the leading markets, supported by growing awareness of kitchen automation. Demand for compact and affordable choppers is increasing among working-class consumers. However, lower market maturity and limited product variety hinder widespread adoption. Expanding e-commerce platforms and regional distribution partnerships are expected to create new growth opportunities in the coming years.

Market Segmentations:

By Product Type

- Manual food choppers

- Electric food choppers

By Material

- Plastic

- Stainless steel

- Glass

By Capacity

By End-Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food chopper market is characterized by the strong presence of leading players such as KitchenAid, OXO International Ltd., Magimix, Breville Group Limited, Preethi Kitchen Appliances Pvt Ltd, Hamilton Beach Brands, Inc., Cuisinart, Groupe SEB (Moulinex), Braun GmbH, and Koninklijke Philips N.V. These companies compete through continuous innovation, wide product portfolios, and expanding global distribution networks. Market leaders focus on integrating advanced blade technology, multifunctional features, and ergonomic designs to enhance performance and consumer convenience. Strategic initiatives such as mergers, product diversification, and partnerships with e-commerce platforms strengthen brand visibility. Regional players emphasize affordability and localized production to capture growing demand in emerging economies. Additionally, the shift toward energy-efficient and eco-friendly materials drives competition, pushing manufacturers to prioritize sustainability while maintaining product efficiency and durability. This competitive environment continues to evolve with rising consumer interest in compact, smart, and time-saving kitchen solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KitchenAid

- OXO International Ltd.

- Magimix

- Breville Group Limited

- Preethi Kitchen Appliances Pvt Ltd

- Hamilton Beach Brands, Inc.

- Cuisinart

- Groupe SEB (Moulinex)

- Braun GmbH

- Koninklijke Philips N.V.

Recent Developments

- In September 2024, Breville teamed up with Crate & Barrel to unveil a new collection of its appliances, featuring a unique Almond Nougat colorway. This strategic partnership sought to bolster Breville’s foothold in the upscale kitchen appliance market.

- In 2024, KitchenAid launched a new cordless 5-cup food chopper, model KFCR531, powered by a 12V MAX removable battery. The unit delivers up to 25 minutes of continuous runtime and includes two accessories for chopping, whisking, and pureeing.

- In April 2023, BLACK+DECKER unveiled new attachments for its cordless kitchen multi-tool, the BLACK+DECKER Kitchen Wand™, boosting its utility for home chefs. The new attachments, a food chopper and a hand mixer, are designed to streamline meal prep. The food chopper boasts features like measurement markings and a liquid port, enabling chopping, dicing, and blendin

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Capacity, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for food choppers will continue to rise due to busy urban lifestyles.

- Electric and multifunctional choppers will dominate as consumers prefer automation.

- Manufacturers will focus on compact and ergonomic designs suited for small kitchens.

- Smart kitchen integration with digital controls will gain popularity among tech-savvy users.

- Sustainable materials and energy-efficient models will drive new product development.

- Online retail and e-commerce platforms will remain major sales channels for global brands.

- Asia Pacific will emerge as the fastest-growing region due to expanding middle-class households.

- North America will maintain leadership with strong brand presence and product innovation.

- Product differentiation through advanced blade technology and durability will enhance competitiveness.

- Continuous innovation in design and user convenience will sustain long-term market growth.