Market Overview

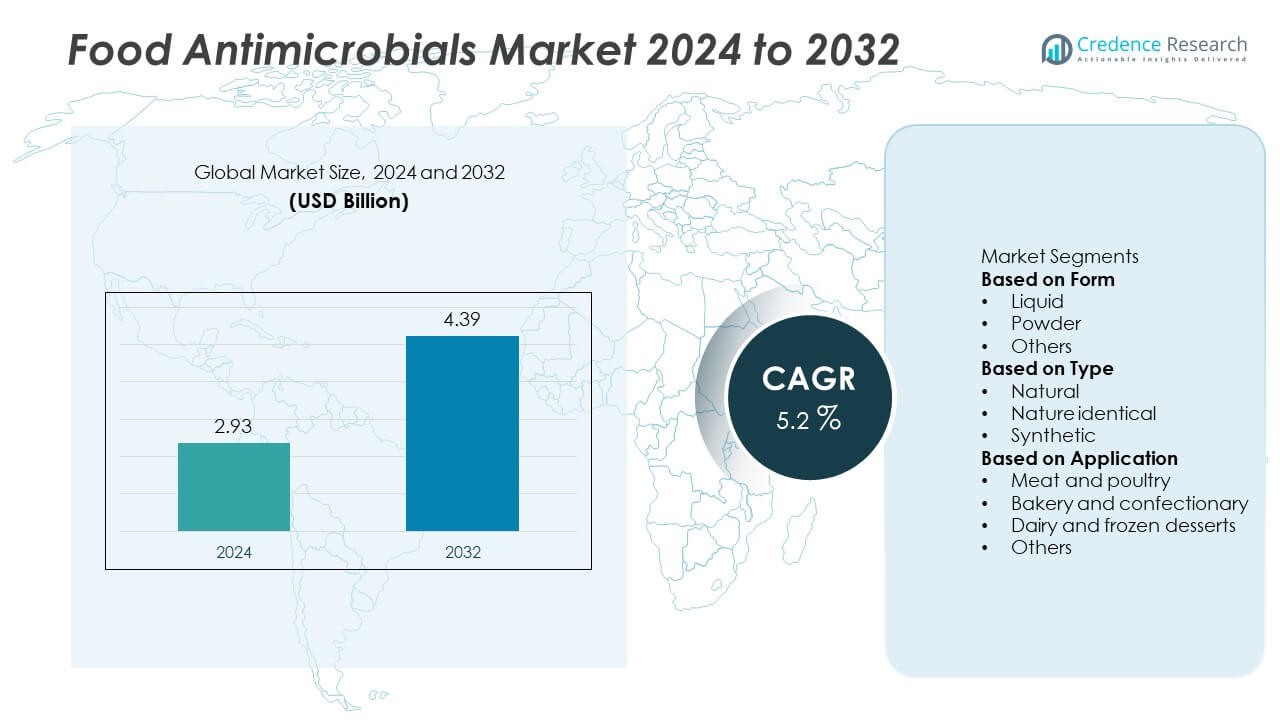

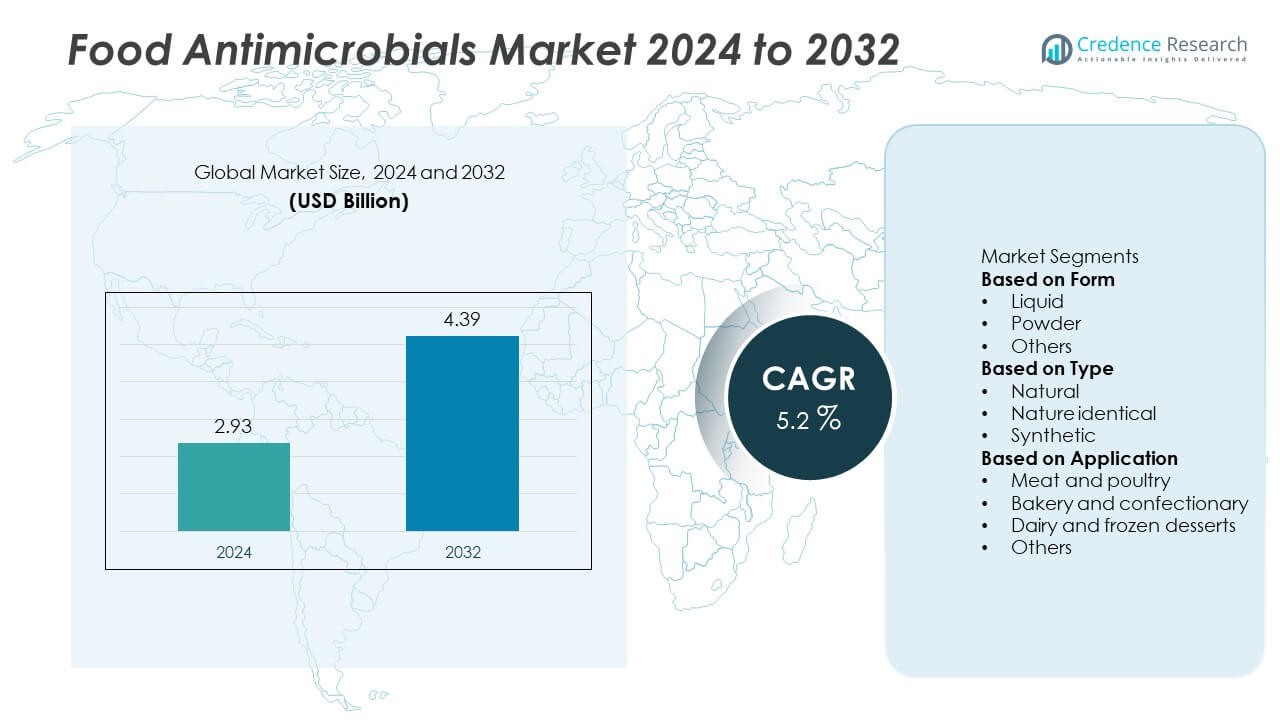

The Food Antimicrobials market was valued at USD 2.93 billion in 2024 and is projected to reach USD 4.39 billion by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Antimicrobials Market Size 2024 |

USD 2.93 Billion |

| Food Antimicrobials Market, CAGR |

5.2% |

| Food Antimicrobials Market Size 2032 |

USD 4.39 Billion |

The food antimicrobials market is led by key players including Galactic, Mitsubishi Chemical, Kerry Group, Jungbunzlauer, Corbion, International Flavors & Fragrances, Eastman, Dsm-firmenich, Celanese, and Kalsec. These companies drive growth by developing innovative natural and synthetic antimicrobial solutions to meet stringent safety regulations and rising demand for clean-label products. Regionally, North America held the largest share at 34% in 2024, supported by advanced food processing infrastructure and strict FDA standards. Europe followed with 29% share, driven by sustainable and natural preservative adoption, while Asia-Pacific accounted for 26% share, fueled by rapid urbanization and expanding packaged food consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food antimicrobials market was valued at USD 2.93 billion in 2024 and is projected to reach USD 4.39 billion by 2032, growing at a CAGR of 5.2%.

- Growth is driven by increasing demand for safe and longer shelf-life food products, with natural antimicrobials gaining strong traction due to rising consumer preference for clean-label and sustainable solutions.

- Market trends highlight a surge in R&D for bio-based preservatives and multifunctional antimicrobials, with natural type leading the segment at 47% share in 2024.

- The competitive landscape features key players such as Galactic, Mitsubishi Chemical, Kerry Group, Jungbunzlauer, and Corbion, focusing on innovation, regulatory compliance, and expansion in high-growth emerging markets.

- Regionally, North America led with 34% share in 2024, followed by Europe at 29% and Asia-Pacific at 26%, while Latin America and Middle East & Africa accounted for 6% and 5%, respectively, reflecting steady adoption in developing regions.

Market Segmentation Analysis:

By Form

In 2024, the powder segment dominated the food antimicrobials market with a 56% share. Powder-based antimicrobials are widely preferred due to their longer shelf life, easy handling, and stability during transportation and storage. They are extensively used in processed meat, dairy, and bakery applications where consistent dosage and extended preservation are essential. Liquid antimicrobials followed, gaining traction in beverage and dairy formulations for faster solubility and easy blending. The versatility and cost-effectiveness of powdered antimicrobials ensure their continued dominance across large-scale food processing industries.

- For instance, Corbion produces lactic acid, a portion of which is converted into powdered antimicrobial solutions like lactates and acetates for meat preservation. The company has expanded its production capacity over the years to meet growing demand.

By Type

The natural type segment led the market in 2024, holding a 49% share, driven by strong consumer demand for clean-label and chemical-free food ingredients. Natural antimicrobials such as essential oils, plant extracts, and microbial-derived compounds are increasingly used to enhance food safety while aligning with sustainability and health-conscious trends. Synthetic antimicrobials maintain relevance in certain high-volume applications due to lower costs, but stricter regulations are limiting their adoption. Nature-identical compounds also show steady growth, serving as a balance between efficacy and consumer-friendly labeling, but natural antimicrobials remain the dominant segment.

- For instance, Kerry’s plant-based preservation portfolio includes fermentates used in over 1,000 commercial food and beverage products globally, offering natural antimicrobial protection without synthetic additives.

By Application

Meat and poultry emerged as the dominant application in 2024, accounting for a 41% share of the market. High susceptibility of meat products to microbial contamination drives strong demand for antimicrobials that extend shelf life and ensure safety. Dairy and frozen desserts also represent a significant share, with antimicrobials preventing spoilage and maintaining product quality during storage and transport. Bakery and confectionery applications are growing steadily, supported by demand for mold inhibitors and extended freshness solutions. The meat and poultry sector remains the largest application area due to stringent safety standards and consumer demand for safe, longer-lasting products.

Key Growth Drivers

Rising Demand for Packaged and Processed Foods

The growing consumption of packaged and processed foods is a major driver of the food antimicrobials market. Busy lifestyles, urbanization, and increasing reliance on convenience foods have raised the need for effective preservation solutions. Antimicrobials play a vital role in extending shelf life, ensuring safety, and preventing spoilage in ready-to-eat meals, dairy products, and meat items. With global demand for longer-lasting, high-quality food continuing to expand, food antimicrobials are becoming indispensable across both developed and emerging markets.

- For instance, Kerry reported that its antimicrobial ingredient line is used in over 1,000 meat and bakery applications worldwide, reducing microbial growth and extending shelf life by up to 40% in processed products.

Shift Toward Natural and Clean-Label Ingredients

Consumer preference for clean-label, chemical-free products has accelerated the adoption of natural antimicrobials. Ingredients derived from plant extracts, essential oils, and microbial sources are gaining popularity as safer, sustainable alternatives to synthetic preservatives. This shift aligns with increasing health awareness and regulatory restrictions on artificial additives. Food manufacturers are responding by reformulating products with natural antimicrobials, boosting innovation and driving significant market growth. The clean-label trend continues to reshape demand, making natural antimicrobials a core growth engine for the industry.

- For instance, Kalsec supplies natural rosemary and green tea extracts to over 70 countries, and its Durashield antimicrobial blends have been validated to extend shelf life of meat products by up to 14 days under commercial storage conditions.

Stringent Food Safety Regulations

Regulatory frameworks set by global authorities such as FDA, EFSA, and WHO mandate strict safety and quality standards for food products. These regulations fuel the adoption of antimicrobials to minimize contamination risks and ensure compliance. Food processors are increasingly required to implement reliable preservation systems to meet both domestic and international safety requirements. Rising recalls and foodborne illness cases have further heightened the focus on microbial control. As governments enforce stricter safety norms, demand for effective antimicrobial solutions continues to expand across global markets.

Key Trends & Opportunities

Advancements in Antimicrobial Technologies

Innovations in antimicrobial delivery, such as encapsulation and nanotechnology, are creating opportunities for improved effectiveness and controlled release. These technologies enhance stability, allow targeted application, and reduce the required dosage, making antimicrobials more efficient and cost-effective. Advanced systems are being applied in beverages, dairy, and meat processing, where microbial control is critical. The integration of these technologies provides food manufacturers with enhanced preservation methods while meeting consumer demand for safer and longer-lasting products.

- For instance, DSM-Firmenich offers protective microbial cultures for dairy production that enhance resistance to bacteriophages (viruses) and are used globally. These cultures help protect against spoilage and ensure a more consistent fermentation process, contributing to a longer shelf life for cheeses.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present strong opportunities for market expansion. Rapid urbanization, rising disposable incomes, and increasing demand for packaged foods are fueling antimicrobial adoption in these regions. Local food producers are investing in preservation technologies to meet growing consumer demand and comply with evolving safety standards. With expanding retail infrastructure and heightened awareness of foodborne risks, these markets are expected to play a central role in future growth for antimicrobial solutions.

- For instance, Corbion operates a production facility in Rayong, Thailand, with an annual lactic acid capacity of 125,000 metric tons, supporting regional demand for natural antimicrobial solutions in processed meat and bakery sectors.

Key Challenges

High Cost of Natural Antimicrobials

While demand for natural antimicrobials is growing, their higher cost compared to synthetic alternatives poses a challenge. Extracting and processing plant-based or microbial-derived antimicrobials involves higher production expenses, limiting affordability for price-sensitive markets. This cost barrier often discourages small and mid-scale food producers from adopting natural options, despite consumer preference. Unless technological advances reduce costs, reliance on synthetic antimicrobials may persist in certain regions.

Regulatory Barriers and Approval Delays

Strict regulatory requirements for new antimicrobial approvals can slow down innovation and market entry. Extensive testing, safety validations, and lengthy approval processes increase time-to-market for new products. Smaller companies with limited resources may struggle to meet compliance demands, restricting competition. Moreover, varying standards across regions complicate global product launches. These regulatory hurdles present significant challenges to market expansion, especially for companies focused on introducing novel or bio-based antimicrobial solutions.

Regional Analysis

North America

North America held a 35% share of the food antimicrobials market in 2024, making it the leading region. Strong demand for packaged and processed foods, combined with strict regulatory standards from the FDA and USDA, drives antimicrobial adoption. Meat and poultry processing industries remain primary consumers, supported by advanced preservation technologies and well-established food safety frameworks. Rising consumer preference for clean-label and natural preservatives further supports the transition toward bio-based antimicrobials. With high awareness of foodborne illnesses and strong retail infrastructure, North America continues to dominate global demand.

Europe

Europe accounted for 28% share of the food antimicrobials market in 2024, driven by strict EU food safety regulations and consumer demand for sustainable, natural ingredients. Countries such as Germany, the UK, and France lead adoption, particularly in meat, dairy, and bakery applications. Clean-label trends are accelerating the use of natural antimicrobials such as plant extracts and microbial-derived solutions. The region’s mature food processing industry, combined with strong regulatory compliance, supports consistent demand. Sustainability goals and growing innovation in eco-friendly preservation solutions further position Europe as a key market for antimicrobial adoption.

Asia-Pacific

Asia-Pacific captured 27% share of the food antimicrobials market in 2024, making it the fastest-growing region. Rising population, urbanization, and higher disposable incomes drive strong demand for packaged and convenience foods. Countries such as China, India, and Japan are at the forefront, with expanding food processing sectors and increasing consumer awareness of food safety. Meat, poultry, and dairy industries are key application areas, supported by stricter government regulations on microbial contamination. With growing retail networks and demand for natural preservatives, Asia-Pacific is expected to significantly expand its market share during the forecast period.

Latin America

Latin America held a 6% share of the food antimicrobials market in 2024, with Brazil and Mexico leading demand. The meat and poultry sector remains a dominant application, supported by rising exports and domestic consumption. Urbanization and growing middle-class populations are fueling demand for processed foods, encouraging greater antimicrobial use. However, economic instability and uneven regulatory frameworks across the region limit broader adoption of advanced solutions. Despite these challenges, expanding packaged food industries and rising awareness of food safety present growth opportunities for antimicrobial adoption in Latin America.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the food antimicrobials market in 2024, reflecting its position as an emerging region. Demand is driven by increasing packaged food consumption in urban centers of Saudi Arabia, the UAE, and South Africa. Rising investments in food processing infrastructure and government initiatives to strengthen food safety regulations are fueling adoption. Meat, poultry, and dairy industries are primary contributors. However, cost constraints and reliance on imports of antimicrobial ingredients hinder rapid growth. Despite these barriers, the region presents long-term potential as food safety awareness expands.

Market Segmentations:

By Form

By Type

- Natural

- Nature identical

- Synthetic

By Application

- Meat and poultry

- Bakery and confectionary

- Dairy and frozen desserts

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the food antimicrobials market is defined by the presence of leading companies such as Galactic, Mitsubishi Chemical, Kerry Group, Jungbunzlauer, Corbion, International Flavors & Fragrances, Eastman, Dsm-firmenich, Celanese, and Kalsec. These players actively compete through innovation in natural and clean-label antimicrobial solutions that align with rising consumer demand for safe and preservative-free foods. Companies are investing in research to expand product applications across meat, dairy, bakery, and ready-to-eat foods, ensuring extended shelf life and compliance with stringent food safety regulations. Strategic initiatives, including acquisitions, partnerships, and global distribution network expansion, strengthen their market positioning. Focus on bio-based antimicrobials and sustainable production methods further intensifies competition, as manufacturers address both regulatory pressure and evolving consumer preferences. With regional demand patterns shifting, key players prioritize tailored solutions, reinforcing their competitive edge while capturing opportunities in emerging and developed markets alike.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, dsm-firmenich launched four new Dairy Safe™ culture rotations with improved phage robustness for cheese preservation.

- In August 2025, Corbion partnered with Brain Biotech AG to co-develop biobased antimicrobial compounds and derivatives.

- In May 2025, Kerry highlighted antimicrobial solutions for baked goods, meat, meals, beverages, and pet food applications.

- In May 2025, Corbion presented natural preservation solutions that shut down Listeria in protein formats at IFFA 2025.

Report Coverage

The research report offers an in-depth analysis based on Form, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label antimicrobials will continue to grow across global markets.

- Innovation in multifunctional antimicrobial solutions will expand applications in packaged and processed foods.

- Meat and poultry will remain the largest application segment, driven by strict safety standards.

- Advances in biotechnology will support development of eco-friendly antimicrobial formulations.

- Asia-Pacific will emerge as the fastest-growing region with rising food safety awareness.

- North America and Europe will sustain leadership through strong regulatory frameworks and innovation.

- Powdered antimicrobials will see higher adoption due to ease of use and longer stability.

- Strategic collaborations between food processors and ingredient manufacturers will accelerate product adoption.

- Regulatory support for bio-based preservatives will drive investments in sustainable solutions.

- Increasing demand for shelf-life extension in dairy and bakery products will ensure steady market growth.