Market Overview

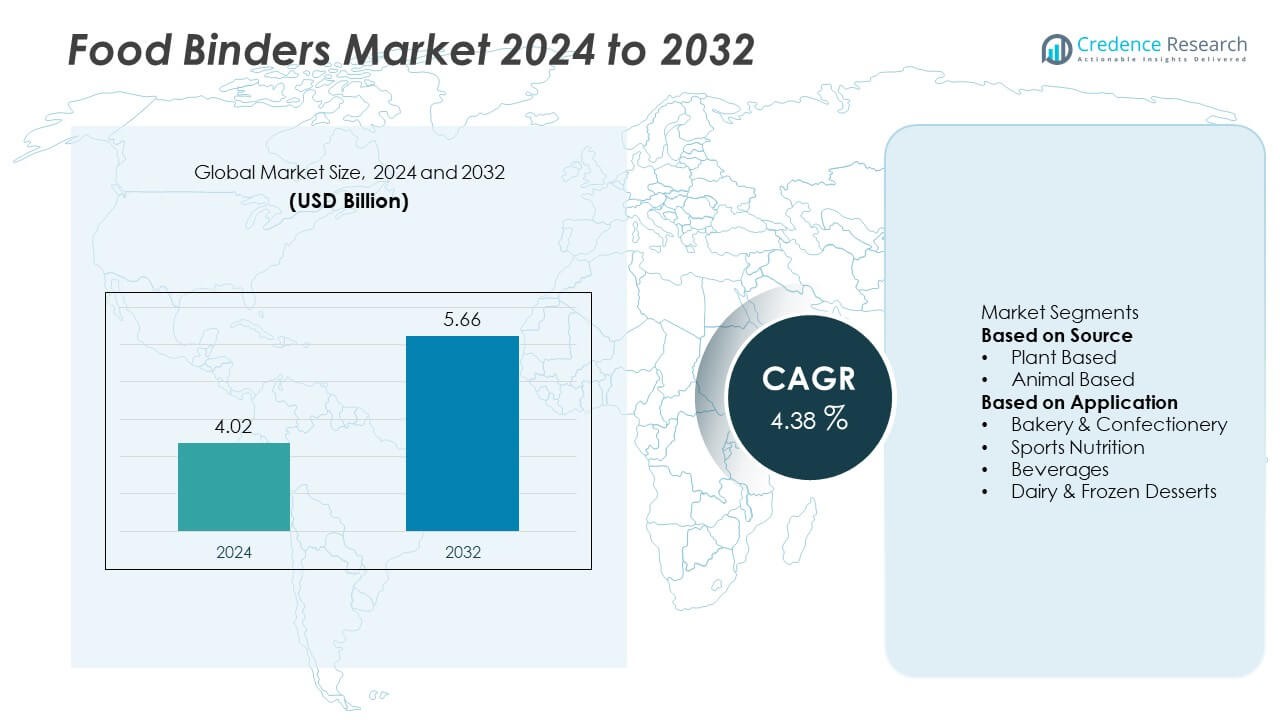

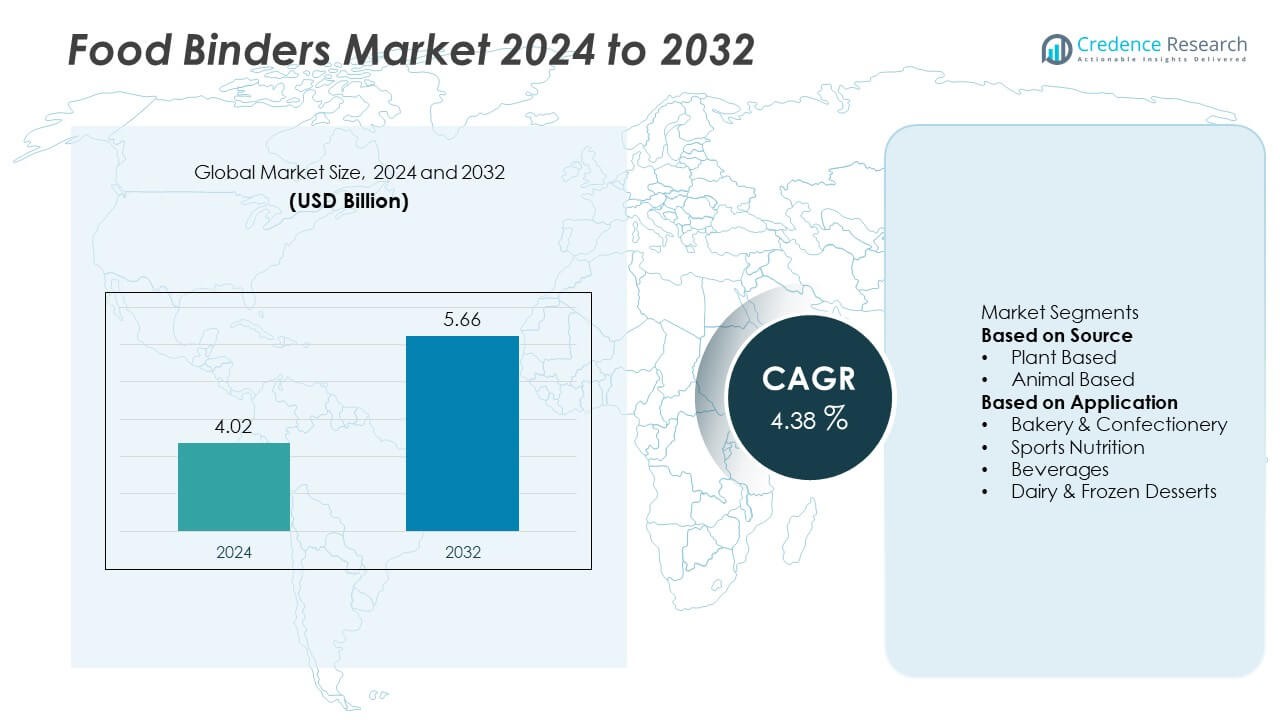

The Food Binders Market was valued at USD 4.03 billion in 2024 and is projected to reach USD 5.67 billion by 2032, growing at a CAGR of 4.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Binders Market Size 2024 |

USD 4.03 Billion |

| Food Binders Market, CAGR |

4.38% |

| Food Binders Market Size 2032 |

USD 5.67 Billion |

The top players in the food binders market include Darling Ingredients, ADM, Visco Starch, Gelita AG, Dupont, FMC Corporation, BASF SE, Tate & Lyle, Alltech, and Cargill Incorporated. These companies maintain strong global positions through diverse product portfolios, advanced R&D, and strategic partnerships that support innovation in clean-label, plant-based, and functional binder solutions. Regionally, North America leads with a 34% share in 2024, driven by robust demand in bakery, confectionery, and sports nutrition applications. Asia-Pacific follows with 28% share, fueled by rapid urbanization and growing processed food consumption, while Europe accounts for 27% share, supported by strict regulatory standards and high adoption of natural ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Binders market was valued at USD 4.02 billion in 2024 and is projected to reach USD 5.66 billion by 2032, growing at a CAGR of 4.38%.

- Growth is driven by rising demand for plant-based binders, which held a 62% share by source in 2024, supported by clean-label preferences and regulatory push for natural ingredients.

- Key trends include the expansion of bakery and confectionery applications, leading with 38% share by application, and increasing adoption of binders in sports nutrition, beverages, and dairy products.

- The competitive landscape is shaped by players such as Darling Ingredients, ADM, Gelita AG, Dupont, BASF SE, Tate & Lyle, Cargill Incorporated, FMC Corporation, Visco Starch, and Alltech, focusing on innovation and sustainable binder solutions.

- Regionally, North America led with 34% share, followed by Asia-Pacific at 28% and Europe at 27%, while Latin America and Middle East & Africa accounted for 6% and 5% respectively.

Market Segmentation Analysis:

By Source

Plant-based binders dominated the food binders market in 2024, accounting for nearly 62% share. Their leadership stems from rising demand for clean-label, vegan, and allergen-free products across bakery, dairy, and beverage applications. Increasing consumer preference for sustainable and health-focused ingredients drives steady adoption of starches, gums, and plant proteins as binding agents. Animal-based binders, including gelatin and casein, continue to hold relevance, particularly in confectionery and dairy sectors. However, plant-based alternatives are expected to expand their dominance, supported by regulatory encouragement for plant-derived food ingredients and ongoing innovation in functional food formulations.

- For instance, Tate & Lyle produces a wide variety of specialty starches, like their tapioca-based CLARIA® Bliss, which functions as a clean-label binder in applications such as dairy desserts and baked goods. The company serves customers in over 120 countries and offers a range of ingredients used for sweetening, mouthfeel, and fortification in food and beverage products.

By Application

The bakery and confectionery segment held the leading position in 2024 with over 38% share of the food binders market. Binders are widely used to improve dough elasticity, texture, and shelf stability in breads, cakes, and candies. Strong consumer demand for ready-to-eat bakery products and premium confectionery sustains this dominance. Growth is further fueled by urban lifestyles, expanding quick-service restaurants, and innovation in gluten-free and vegan bakery items. The ability of binders to deliver consistent quality and texture in large-scale manufacturing makes this segment the key driver of overall market expansion.

- For instance, Cargill supplies pectin and starch binders to bakery and confectionery manufacturers globally, with European pectin plants in Malchin, Germany; Redon, France; and Milazzo, Italy.

Key Growth Drivers

Rising Demand for Plant-Based Ingredients

The food binders market is expanding as plant-based binders gain strong preference among consumers and manufacturers. Rising vegan and vegetarian populations, combined with demand for allergen-free and sustainable products, are pushing companies to replace animal-based binders like gelatin with starches, pectin, and plant proteins. This shift is further encouraged by regulatory support for clean-label formulations and natural ingredient sourcing. With consumers associating plant-based solutions with health and environmental benefits, their adoption continues to accelerate, strengthening the growth prospects of plant-based food binder suppliers globally.

- For instance, ADM processes millions of metric tons of soybeans annually, with a significant portion used to produce a range of ingredients like soy protein. ADM offers soy protein for clean-label, plant-based formulations, supplying protein binders for various food products, including meat alternatives and bakery goods.

Expansion of Processed and Convenience Foods

Increasing consumption of processed and convenience foods remains a major driver of the food binders market. Bakery, confectionery, ready-to-drink beverages, and frozen desserts rely heavily on binders to maintain product consistency, texture, and shelf stability. The surge in urban populations, rising disposable incomes, and fast-paced lifestyles has elevated the demand for packaged and quick-service foods. Food manufacturers are investing in innovative binder solutions to enhance product quality and meet consumer expectations, making the expansion of processed food industries a critical factor driving long-term growth.

- For instance, GELITA, a global supplier of functional animal-based binders derived from collagen, supplies global confectionery and dessert manufacturers, among other customers. Gelatin and collagen products from major manufacturers enhance gelling strength, texture stability, and shelf-life performance in large-scale processed food production.

Growth of Sports Nutrition and Functional Foods

The sports nutrition and functional food sectors have become significant contributors to binder demand. Binders are crucial in protein powders, energy bars, and fortified beverages to improve texture, stability, and nutrient delivery. Growing consumer focus on fitness, weight management, and preventive healthcare drives rising adoption of sports and functional nutrition. The market benefits from expanding health-conscious populations, especially among millennials and athletes, who prefer high-protein and fortified food options. This growth creates sustained demand for advanced binder formulations tailored to nutritional and performance-enhancing products.

Key Trends & Opportunities

Shift Toward Clean-Label and Natural Formulations

The market is witnessing a strong trend toward clean-label, natural, and non-GMO food binders. Consumers increasingly avoid synthetic additives, preferring products with transparent labeling and natural ingredients. This shift creates opportunities for manufacturers to innovate with starches, hydrocolloids, and plant-based proteins that offer functional benefits while meeting clean-label standards. Companies focusing on natural binder innovations are gaining a competitive edge, as food brands reformulate products to align with consumer demand for transparency, sustainability, and healthier ingredient sourcing.

- For instance, Ingredion produces pea protein, such as its VITESSENCE® line, at its North American and European facilities, supplying clean-label binding and texturizing solutions for various formulations, including plant-based dairy, bakery, and snacks.

Innovation in Functional and Specialty Applications

Emerging applications of binders in fortified foods, dairy alternatives, and beverages represent significant opportunities. Manufacturers are exploring specialty binder formulations that improve nutrient stability, enhance shelf life, and optimize sensory profiles. With demand for functional foods and plant-based dairy alternatives growing, innovative binder solutions are in high demand. Opportunities lie in developing multifunctional binders that can address diverse product needs, from texture enhancement to improved nutritional delivery. This trend is pushing companies toward R&D investments, driving innovation-driven growth in the food binders market.

- For instance, Cargill operates a pectin facility in Malchin, Germany, producing UniPECTINE solutions, which are multifunctional binders that enhance texture and nutrient stability in dairy alternatives and fortified beverages.

Key Challenges

Volatility in Raw Material Prices

The food binders market faces challenges from fluctuating raw material prices, particularly for plant-derived gums, starches, and proteins. Factors such as changing agricultural yields, supply chain disruptions, and global trade uncertainties contribute to cost instability. These fluctuations directly impact the pricing strategies of food manufacturers and can hinder profitability. Companies are increasingly investing in supply chain resilience and alternative sourcing strategies to manage this challenge, but volatility remains a key restraint affecting growth consistency in the global food binders market.

Regulatory Compliance and Product Safety Standards

Meeting strict regulatory frameworks for food safety, labeling, and additive usage presents an ongoing challenge for food binder manufacturers. Regions such as the U.S. and EU enforce stringent guidelines under FDA and EFSA regulations, requiring companies to ensure safety, purity, and compliance for binder applications. Non-compliance risks product recalls, reputational damage, and financial penalties. Furthermore, growing consumer scrutiny of ingredient sourcing and labeling adds complexity. Manufacturers must continuously invest in R&D, testing, and certifications to align with evolving regulatory and consumer expectations.

Regional Analysis

North America

North America accounted for 34% share of the food binders market in 2024, driven by strong demand from the bakery, confectionery, and dairy industries. The region benefits from well-established food processing infrastructure and widespread adoption of clean-label and plant-based binders. Rising health-conscious consumer behavior and preference for gluten-free and vegan formulations further support market expansion. The United States leads in consumption, supported by innovation in sports nutrition and functional food categories. Continuous investment by major food companies in reformulated and fortified products sustains the region’s leadership, making North America a central hub for binder-driven food innovation.

Europe

Europe held a 27% share of the food binders market in 2024, supported by stringent regulatory frameworks and strong consumer demand for natural ingredients. The bakery and confectionery sectors remain the largest contributors, with countries like Germany, France, and the UK at the forefront of consumption. The region is experiencing strong adoption of plant-based binders, aligned with EU directives promoting sustainability and reduced reliance on animal-derived additives. Growth is further fueled by innovation in dairy alternatives and functional foods. The push toward cleaner labels and high-quality ingredients positions Europe as a leader in food binder innovation.

Asia-Pacific

Asia-Pacific captured a 28% share of the food binders market in 2024, making it one of the fastest-growing regions. Rising urbanization, growing disposable incomes, and expanding food processing industries fuel binder demand across bakery, confectionery, and frozen dessert applications. Countries such as China, India, and Japan are driving adoption through increased consumption of processed and convenience foods. The region is also witnessing strong growth in plant-based binders, supported by changing dietary preferences and government-backed initiatives in food safety. Expanding middle-class populations and rising investments in packaged foods position Asia-Pacific as a key driver of future market growth.

Latin America

Latin America accounted for a 6% share of the food binders market in 2024, with growth centered in Brazil and Mexico. The region’s market expansion is fueled by rising demand for bakery, confectionery, and dairy products, particularly among younger populations. Increasing influence of Western dietary habits and a growing preference for packaged foods support higher binder utilization. Local food manufacturers are increasingly incorporating plant-based and clean-label binders to align with changing consumer expectations. Although smaller in share, the region shows steady growth potential as health-conscious consumers push for reformulated and functional food options in everyday diets.

Middle East & Africa

The Middle East & Africa region held a 5% share of the food binders market in 2024, driven by growing demand for bakery products, dairy, and frozen desserts. Rising urbanization and expanding retail food chains are creating opportunities for binder adoption in packaged foods. Countries such as South Africa, Saudi Arabia, and the UAE are leading markets within the region. Increased investments in food processing infrastructure and consumer inclination toward fortified and functional products are supporting market expansion. While growth is moderate, rising health awareness and evolving dietary preferences will boost future adoption of food binders.

Market Segmentations:

By Source

By Application

- Bakery & Confectionery

- Sports Nutrition

- Beverages

- Dairy & Frozen Desserts

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food binders market features key players such as Darling Ingredients, ADM, Visco Starch, Gelita AG, Dupont, FMC Corporation, BASF SE, Tate & Lyle, Alltech, and Cargill Incorporated. These companies focus on expanding their portfolios with plant-based, clean-label, and multifunctional binder solutions to meet evolving consumer demand. Strategic investments in R&D, acquisitions, and partnerships are central to their growth, enabling them to deliver innovative formulations that enhance texture, stability, and shelf life in bakery, dairy, confectionery, and sports nutrition applications. Regional expansion and sustainability initiatives remain critical differentiators, as firms align with regulatory frameworks promoting natural and eco-friendly food ingredients. Market leaders leverage advanced processing technologies, supply chain integration, and strong global distribution networks to maintain competitive advantage. Intense rivalry fosters continuous innovation, positioning these companies to capture growth opportunities in emerging markets and strengthen their share in developed economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Darling Ingredients

- ADM

- Visco Starch

- Gelita AG

- Dupont

- FMC Corporation

- BASF SE

- Tate & Lyle

- Alltech

- Cargill Incorporated

Recent Developments

- In September 2025, Mitsubishi Chemical entered a joint development agreement with Freshr Sustainable Technologies to advance food-quality preservation and packaging solutions.

- In September 2025, Tate & Lyle launched a new formulation tool in Asia-Pacific aimed at unlocking “mouthfeel” properties for food systems, supporting better binding and texture in products.

- In July 2025, Tate & Lyle announced appointments in its Executive Committee to strengthen its supply chain and commercial operations, likely supporting scaling of its binder and texture systems.

- In May 2025, Darling Ingredients and Tessenderlo Group signed a term sheet to form Nextida, combining their collagen and gelatin operations with a combined capacity of ~200,000 metric tons across 23 facilities.

Report Coverage

The research report offers an in-depth analysis based on Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth in plant-based binders due to rising vegan adoption.

- Clean-label and natural ingredient demand will drive reformulation across bakery and dairy sectors.

- Sports nutrition and functional food applications will expand binder usage in protein-rich products.

- Innovation in multifunctional binders will support stability, texture, and nutritional delivery.

- Strategic R&D investments will enhance product quality and sustainability in manufacturing.

- Regulatory frameworks will continue pushing companies toward safer and eco-friendly binder solutions.

- Asia-Pacific will emerge as the fastest-growing region with strong processed food demand.

- North America and Europe will maintain dominance with high adoption of premium formulations.

- Mergers and partnerships will strengthen supply chains and global distribution networks.

- Consumer preference for fortified and convenient foods will create long-term growth opportunities.