| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Culture Market Size 2024 |

USD 44,713.81 Million |

| Food Culture Market, CAGR |

5.79% |

| Food Culture Market Size 2032 |

USD 72,465.72 Million |

Market Overview

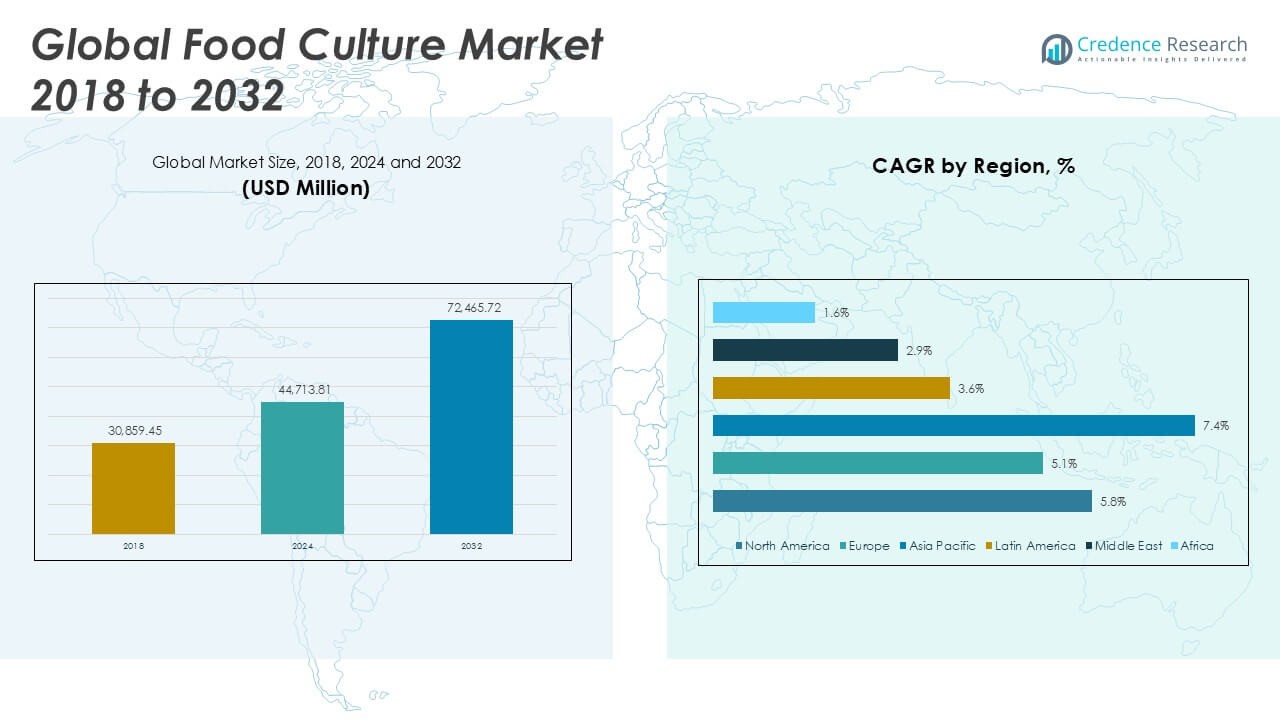

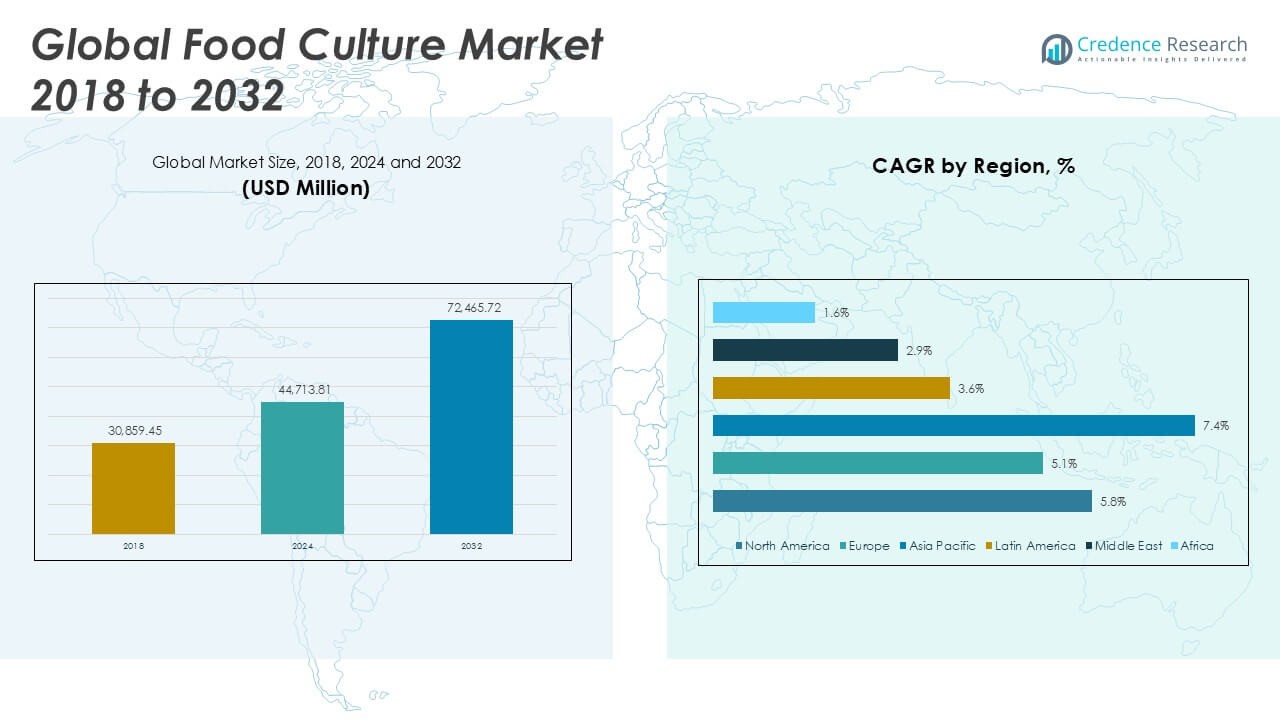

The Food Culture Market was valued at USD 30,859.45 million in 2018, reached USD 44,713.81 million in 2024, and is anticipated to reach USD 72,465.72 million by 2032, reflecting a CAGR of 5.79% during the forecast period.

The Food Culture Market is driven by increasing consumer interest in diverse culinary experiences, rising disposable incomes, and growing globalization, which encourage the exploration of international cuisines and unique food traditions. Health and wellness trends also influence market growth, as consumers seek natural, organic, and functional foods inspired by global food cultures. Urbanization and the expansion of foodservice channels, including restaurants, food festivals, and social media platforms, further accelerate market demand by enhancing accessibility and awareness. The rise of food tourism and cultural exchange initiatives contributes to the popularity of ethnic and fusion cuisines, fostering innovation in product offerings. Market trends indicate a shift towards authentic, artisanal, and locally sourced ingredients, as well as sustainable production practices. Companies are investing in digital marketing and personalized culinary experiences to engage consumers and strengthen brand loyalty, reflecting the market’s dynamic evolution and adaptability to changing consumer preferences.

The Food Culture Market demonstrates significant regional diversity, with North America, Europe, and Asia Pacific serving as the primary growth engines. North America benefits from a mature food industry and advanced consumer preferences for innovative and health-focused products. Europe emphasizes traditional foods, clean-label products, and sustainability, supported by a strong regulatory environment. Asia Pacific experiences rapid expansion driven by urbanization, rising incomes, and increasing interest in global cuisines, particularly in China, Japan, and India. Latin America, the Middle East, and Africa show steady growth with rising demand for value-added dairy and bakery products. Leading companies shaping the Food Culture Market include Chr. Hansen A/S, renowned for its broad microbial culture portfolio; Danisco A/S (now part of IFF), recognized for its innovation in functional food ingredients; Döhler Group, offering a diverse range of food culture solutions; and Angel Yeast Co. Ltd., a key player in yeast-based ingredients and fermentation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Culture Market is projected to grow from USD 44,713.81 million in 2024 to USD 72,465.72 million by 2032, reflecting a CAGR of 5.79%.

- Rising demand for natural, organic, and functional foods drives market growth as consumers seek health-focused and authentic culinary experiences.

- Increasing globalization, food tourism, and cultural exchange accelerate the adoption of diverse and international cuisines across both retail and foodservice channels.

- Key players such as Chr. Hansen A/S, Danisco A/S (now part of IFF), Döhler Group, and Angel Yeast Co. Ltd. actively innovate by expanding product portfolios and investing in research and development.

- The market faces restraints including complex supply chain management, sourcing difficulties for authentic ingredients, and stringent food safety regulations.

- Digitalization and technological integration influence the industry, with brands leveraging e-commerce, social media, and digital marketing to engage consumers and create personalized experiences.

- North America, Europe, and Asia Pacific dominate regional development, with rapid expansion in urbanized Asia Pacific markets, while Latin America, the Middle East, and Africa show steady but moderate growth.

Market Drivers

Rising Consumer Interest in Global Cuisines and Culinary Diversity

The growing curiosity for international flavors and unique culinary experiences serves as a primary driver for the Food Culture Market. Consumers are increasingly seeking new taste profiles influenced by diverse ethnic backgrounds, which leads to greater demand for products and services reflecting global food traditions. The influence of social media and food-focused content exposes a wider audience to trending dishes and regional specialties, encouraging experimentation at home and in restaurants. Globalization facilitates access to international ingredients and fosters cross-cultural culinary exchange, broadening consumer palates. Food festivals and themed events also contribute to this cultural shift, supporting the popularity of fusion cuisines. The Food Culture Market benefits from this openness, as both traditional and innovative offerings capture consumer interest and drive category growth.

- For instance, Döhler Group reported launching 350 new flavor solutions for international cuisine applications and supplied more than 700 clients with customized food culture blends in 2022.

Health and Wellness Priorities Shaping Food Preferences

Growing awareness of health and wellness impacts purchasing decisions, steering consumers toward products that emphasize nutritional value and natural ingredients. Many consumers now prioritize clean-label foods, organic options, and minimally processed products, aligning with broader health trends. Companies respond by incorporating functional ingredients and focusing on transparency in sourcing and labeling. Food culture brands that highlight authenticity and health benefits gain a competitive edge, appealing to both niche and mainstream audiences. It becomes essential for brands to adapt to evolving dietary trends, such as plant-based eating and allergen-free choices, to maintain relevance. This health-centric mindset is expected to continue influencing product development and market expansion.

- For instance, Chr. Hansen A/S recorded over 900 million daily servings of products using its probiotic cultures consumed globally as of 2022.

Urbanization and Changing Lifestyles Expanding Market Reach

Rapid urbanization and busier lifestyles have transformed how consumers interact with food, fueling demand for convenient yet culturally rich options. The proliferation of quick-service restaurants, delivery platforms, and ready-to-eat meals allows greater access to global cuisines without compromising on authenticity. Urban consumers often have more exposure to diverse food cultures, thanks to multicultural neighborhoods and travel opportunities. The Food Culture Market leverages these trends by offering a range of solutions catering to both on-the-go and experiential dining. Brands are innovating packaging and service models to suit fast-paced urban environments. This shift enables broader market penetration and sustained growth.

Sustainability and Ethical Sourcing Influencing Brand Perception

Increasing emphasis on sustainability and ethical practices plays a pivotal role in shaping consumer preferences within the Food Culture Market. Many consumers consider the environmental impact and social responsibility of brands before making purchasing decisions. Companies are responding by sourcing local and seasonal ingredients, reducing food waste, and promoting fair trade practices. Sustainable packaging and supply chain transparency further enhance brand reputation and consumer trust. It is essential for market participants to align business strategies with these values to attract environmentally conscious customers. This focus on responsible consumption continues to shape the evolution of the Food Culture Market.

Market Trends

Growing Demand for Authentic and Artisanal Food Experiences

Consumers increasingly value authenticity in their culinary choices, seeking traditional recipes, regional specialties, and handcrafted products. The Food Culture Market reflects this trend by highlighting small-batch production and provenance, appealing to consumers who associate quality with artisanal methods. Artisanal food experiences often emphasize unique flavors, heritage ingredients, and a direct connection to food origins. This demand influences both retail and foodservice sectors, encouraging businesses to curate menus and offerings that celebrate tradition and craft. Social media amplifies the appeal of authentic food stories and artisan brands. The market benefits from a willingness to pay a premium for products that deliver a sense of originality and genuine cultural identity.

- For instance, Angel Yeast Co. Ltd. exported 34,000 tons of yeast products in 2022, serving 155 countries and supporting thousands of small-scale artisanal bakeries.

Integration of Technology and Digital Engagement

Technology plays a transformative role in shaping the Food Culture Market, with digital platforms facilitating greater access to culinary content and inspiration. Food delivery apps, recipe sharing, and virtual cooking classes expand consumer exposure to global cuisines and preparation techniques. Brands use digital channels to engage audiences through storytelling, influencer partnerships, and interactive campaigns. The integration of online grocery shopping and meal kits offers convenient solutions for home cooks exploring new cuisines. It also allows food culture brands to personalize marketing efforts and tailor offerings based on consumer preferences. This digital evolution supports continuous innovation and closer consumer-brand relationships.

- For instance, IFF (Danisco) digitalized its culture development and tracking system for over 1,200 global customers, resulting in 2,400 custom starter culture projects delivered in 2022.

Emphasis on Health, Wellness, and Functional Foods

Consumers display a heightened interest in health-conscious eating, seeking out functional ingredients and wellness-focused products within the Food Culture Market. It responds by introducing items rich in probiotics, superfoods, and natural additives linked to specific health benefits. Trends like plant-based, gluten-free, and low-sugar foods are now mainstream, driven by evolving dietary needs and nutritional awareness. Brands invest in research and development to meet this demand, focusing on transparent labeling and evidence-backed health claims. Food culture influences, such as traditional diets with proven health benefits, gain traction in product innovation. The focus on wellness drives new category growth and redefines traditional offerings.

Sustainability and Ethical Consumption Gaining Prominence

Sustainable sourcing and ethical production practices are at the forefront of consumer priorities, shaping the evolution of the Food Culture Market. It faces pressure to reduce environmental impact through local sourcing, seasonal menus, and responsible packaging solutions. Consumers show strong preference for brands committed to fair trade, animal welfare, and reducing food waste. Businesses adopt circular economy models and emphasize transparency across supply chains to meet these expectations. The trend towards conscious consumption not only supports brand loyalty but also prompts industry-wide changes in procurement and distribution strategies. Sustainability remains a defining characteristic of market leadership and long-term value creation.

Market Challenges Analysis

Complex Supply Chain Management and Sourcing Difficulties

Managing a diverse and global supply chain presents significant challenges for the Food Culture Market. Sourcing authentic ingredients from different regions requires coordination with multiple suppliers, leading to logistical complexities and potential delays. Variability in quality, limited seasonal availability, and fluctuating costs often disrupt consistency in product offerings. The need for reliable cold-chain logistics further increases operational expenses. Import regulations and trade barriers can restrict access to specialty items, impacting the ability to deliver authentic experiences. Businesses must invest in resilient supply networks and maintain strict quality control to uphold brand reputation and customer satisfaction.

Navigating Evolving Consumer Preferences and Regulatory Standards

The Food Culture Market faces ongoing pressure to adapt to rapidly changing consumer trends and strict regulatory frameworks. Shifts toward health-conscious, allergen-free, or ethically sourced products demand constant product innovation and reformulation. It must comply with diverse food safety, labeling, and sustainability regulations across different markets, which can complicate operations and increase compliance costs. Consumer skepticism about claims of authenticity or sustainability may lead to greater scrutiny and reputational risks. Brands must balance innovation with transparency to maintain trust while ensuring adherence to evolving industry standards and local regulations.

Market Opportunities

Expansion into Emerging Markets and Untapped Regions

The Food Culture Market holds significant growth potential by expanding into emerging markets and regions with rising disposable incomes and evolving culinary interests. Urbanization and the influence of global media expose new consumer segments to international cuisines and gourmet products. Companies can leverage strategic partnerships and localized product development to cater to regional tastes while introducing global food culture trends. Direct-to-consumer platforms and e-commerce channels offer cost-effective market entry and broader reach. The ability to adapt to local preferences and regulatory environments supports sustainable growth. Brands that establish early presence in these markets gain a competitive advantage and foster long-term loyalty.

Innovation in Health-Focused and Sustainable Offerings

Growing demand for health-conscious and sustainably produced foods creates opportunities for innovation within the Food Culture Market. Brands can differentiate by launching products that emphasize functional benefits, clean labels, and plant-based or allergen-free formulations. It benefits from investment in transparent sourcing, ethical production practices, and eco-friendly packaging solutions that appeal to environmentally aware consumers. Collaborations with nutritionists, chefs, and influencers enhance product credibility and market visibility. Digital marketing and data-driven personalization allow companies to target specific health and lifestyle segments effectively. By aligning with evolving consumer values, businesses unlock new revenue streams and strengthen their market position.

Market Segmentation Analysis:

By Microorganism Type:

Bacteria represent the dominant segment, driven by their extensive application in dairy fermentation, probiotics, and preservation processes. The versatility and functional benefits of bacteria make them essential for producing yogurt, cheese, and other cultured foods. Yeast follows as a vital segment, particularly in the production of baked goods, alcoholic beverages, and functional foods, owing to its fermentation capabilities and contribution to flavor development. Mold occupies a niche role but remains indispensable in specialty cheese production and certain fermented products, providing unique textures and sensory characteristics that enhance product differentiation.

- For instance, Chr. Hansen A/S supplied cultures for 24 billion liters of fermented milk products worldwide in 2022, supporting large-scale dairy producers and specialty cheese manufacturers.

By Product Type:

Within the product type segment, starter cultures account for the largest share, underscoring their critical role in initiating controlled fermentation in both dairy and bakery applications. These cultures ensure product consistency, safety, and desired sensory profiles. Protective cultures have gained traction, driven by demand for natural solutions that inhibit spoilage and extend shelf life without artificial additives. Probiotic cultures continue to rise in popularity as health-conscious consumers seek functional foods with digestive and immune health benefits. The integration of probiotic cultures into dairy, beverages, and snacks supports both product innovation and premiumization within the Food Culture Market.

- For instance, Sacco S.R.L. manufactured over 500 unique starter and protective cultures in 2022, with more than 100 being probiotic strains used in functional foods across 65 countries.

By Function:

Function-based segmentation highlights the importance of texturizers, flavorants, preservatives, and colorants in food manufacturing. Texturizers enhance the sensory appeal and mouthfeel of various products, particularly in dairy and plant-based alternatives. Flavorants are critical in delivering distinctive taste profiles and authentic cultural experiences, supporting product differentiation in a crowded marketplace. Preservatives play a vital role in ensuring food safety and extending product shelf life, particularly in clean-label and minimally processed foods. Colorants, derived from microbial sources, provide appealing visual characteristics while meeting consumer expectations for natural ingredients. The “others” category captures emerging functions such as health-promoting bioactives, which broaden the application landscape of food cultures and drive further market innovation.

Segments:

Based on Microorganism Type:

Based on Product Type:

- Starter Cultures

- Protective Cultures

- Probiotic Cultures

Based on Function:

- Texturizer

- Flavorant

- Preservative

- Colorant

- Others

Based on End Use:

- Dairy Products

- Baked Products

- Breakfast Cereals

- Beverages

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Food Culture Market

North America Food Culture Market grew from USD 13,036.58 million in 2018 to USD 18,686.57 million in 2024 and is projected to reach USD 30,371.47 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.8%. North America is holding a 42% market share. The United States and Canada lead this region, driven by a strong focus on innovative dairy, probiotic, and plant-based products. The region benefits from established food manufacturing infrastructure and a robust health and wellness trend. Consumer preference for natural and functional foods supports demand for specialized food cultures. Key players leverage digital platforms and premiumization to expand market reach.

Europe Food Culture Market

Europe Food Culture Market grew from USD 9,607.78 million in 2018 to USD 13,463.90 million in 2024 and is projected to reach USD 20,660.90 million by 2032, reflecting a CAGR of 5.1%. Europe is holding a 29% market share. Germany, France, and the United Kingdom remain central to market growth, supported by traditional food culture and increasing demand for clean-label products. The region prioritizes sustainability and regulatory compliance, fostering innovation in microbial cultures and natural ingredients. Artisanal and organic food trends further strengthen segment expansion. Companies in this market focus on transparency and traceability to attract health-conscious consumers.

Asia Pacific Food Culture Market

Asia Pacific Food Culture Market grew from USD 6,059.10 million in 2018 to USD 9,500.79 million in 2024 and is projected to reach USD 17,400.47 million by 2032, reflecting a CAGR of 7.4%. Asia Pacific is holding a 24% market share. China, Japan, and India are key countries contributing to rapid market expansion, driven by growing urbanization, disposable incomes, and changing dietary patterns. The rise of functional foods, fermented products, and premium dairy items accelerates demand for advanced food culture solutions. The region’s young consumer base actively adopts new culinary trends and international flavors.

Latin America Food Culture Market

Latin America Food Culture Market grew from USD 1,121.43 million in 2018 to USD 1,598.64 million in 2024 and is projected to reach USD 2,202.44 million by 2032, reflecting a CAGR of 3.6%. Latin America is holding a 3% market share. Brazil, Mexico, and Argentina lead this region with a focus on traditional fermented dairy and bakery products. Demand for food cultures is rising as consumers seek enhanced taste, texture, and shelf life. Industry participants are investing in product localization and regional partnerships to increase adoption.

Middle East Food Culture Market

Middle East Food Culture Market grew from USD 692.79 million in 2018 to USD 896.22 million in 2024 and is projected to reach USD 1,162.60 million by 2032, reflecting a CAGR of 2.9%. The Middle East is holding a 2% market share. Saudi Arabia and the United Arab Emirates serve as primary growth centers, supported by growing urban populations and rising awareness of health and wellness. The market focuses on dairy and beverage applications, integrating traditional and global food cultures. The region shows increasing adoption of advanced preservation and functional culture technologies.

Africa Food Culture Market

Africa Food Culture Market grew from USD 341.77 million in 2018 to USD 567.69 million in 2024 and is projected to reach USD 667.85 million by 2032, reflecting a CAGR of 1.6%. Africa is holding a 1% market share. South Africa, Nigeria, and Egypt are key markets, with growth driven by urbanization and expanding middle-class populations. The demand for value-added dairy, bakery, and cereal products supports gradual market development. Investments in infrastructure, distribution networks, and local capacity-building remain crucial for sustained progress in this region.

Key Player Analysis

- Hansen A/S

- Danisco A/S (now part of IFF)

- Döhler Group

- Angel Yeast Co. Ltd.

- E&O Laboratories Ltd.

- Lactina Ltd.

- HiMedia Laboratories

- Sacco S.R.L.

- Dalton Biotechnologies

Competitive Analysis

The Food Culture Market features a highly competitive landscape, with leading players such as Chr. Hansen A/S, Danisco A/S (now part of IFF), Döhler Group, Angel Yeast Co. Ltd., E&O Laboratories Ltd., Lactina Ltd., HiMedia Laboratories, Sacco S.R.L., and Dalton Biotechnologies shaping the industry. These companies distinguish themselves through extensive research and development, robust product portfolios, and global distribution networks. Emphasis on microbial innovation, functional ingredients, and sustainability drives product differentiation and enhances brand reputation. The competitive landscape encourages ongoing investment in quality assurance and compliance with evolving regulatory standards, ensuring product safety and consumer trust. Companies increasingly engage in strategic collaborations, partnerships, and acquisitions to expand their geographic presence and respond to shifting consumer preferences for authenticity, health, and clean-label solutions. Digitalization plays a pivotal role, with businesses leveraging e-commerce, digital marketing, and personalized solutions to capture new market segments. The intensity of competition motivates market participants to continuously adapt, innovate, and deliver value-added offerings in line with emerging trends.

Recent Developments

- In February 2025, Kerry Group released its 2025 Global Taste Charts, highlighting emerging flavors such as Sichuan, Yuzu, and Korean BBQ. This resource aids food industry professionals in aligning products with current consumer trends.

- In December 2024, DSM-Firmenich unveiled “Milky Maple” as its flavor of the year for 2025, combining the creaminess of milk with the sweetness of maple. This initiative reflects the company’s focus on innovative flavor development.

- In October 2024, Döhler Group has invested in Nukoko to scale the production of the world’s first cocoa-free ‘bean-to-bar’ chocolate, addressing challenges in the global cocoa supply chain.

- In March 2024, Superbrewed Food was the first to obtain a no-questions letter from the FDA for bacteria biomass protein which made it possible for the product to be used in many USA consumer goods. In addition, the European Union, the United Kingdom and Canada were all working on expanding their operations.

Market Concentration & Characteristics

The Food Culture Market exhibits a moderate to high degree of market concentration, with a select group of established global and regional players driving the majority of innovation and supply. It is characterized by significant barriers to entry, including the need for specialized technological expertise, advanced research capabilities, and compliance with rigorous food safety regulations. Companies differentiate through proprietary microbial strains, diverse product portfolios, and investments in sustainable and functional solutions. The market values authenticity, transparency, and clean-label claims, reflecting shifting consumer preferences toward natural and health-oriented foods. Strong focus on research and development enables rapid adaptation to emerging trends such as plant-based diets, probiotics, and artisanal products. Distribution networks are well-developed in mature regions but remain fragmented in developing markets, presenting growth opportunities for new entrants with niche expertise. The Food Culture Market operates within a framework of strict quality assurance, continuous innovation, and customer-driven product development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Microorganism Type, Product Type, Function, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Food Culture Market will continue to expand driven by consumer demand for authentic and traditional ingredients.

- Demand for functional and health-promoting cultures will grow alongside wellness trends.

- Continued innovation in plant-based fermentation will create diversified application opportunities.

- Growing e-commerce penetration will enhance consumer access to specialty cultures.

- Producers will invest in scalable and sustainable manufacturing practices.

- Collaboration between food culture firms and research institutions will accelerate new strain development.

- Increased adoption of clean-label and transparent sourcing practices will build consumer trust.

- Integration of digital traceability tools will improve supply chain visibility and quality assurance.

- Rising interest in fermented products and probiotics will spur category expansion in emerging markets.

- Regulatory frameworks will evolve to support novel food culture applications and global market harmonization.