Market Overview

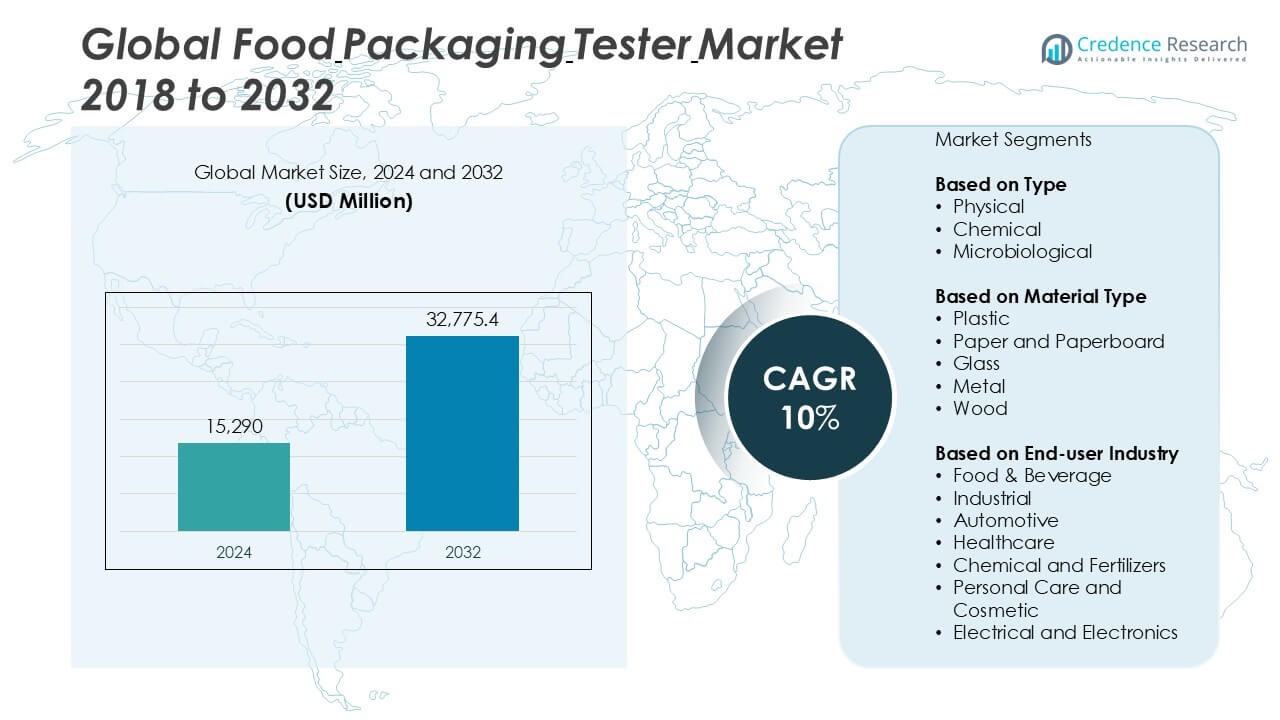

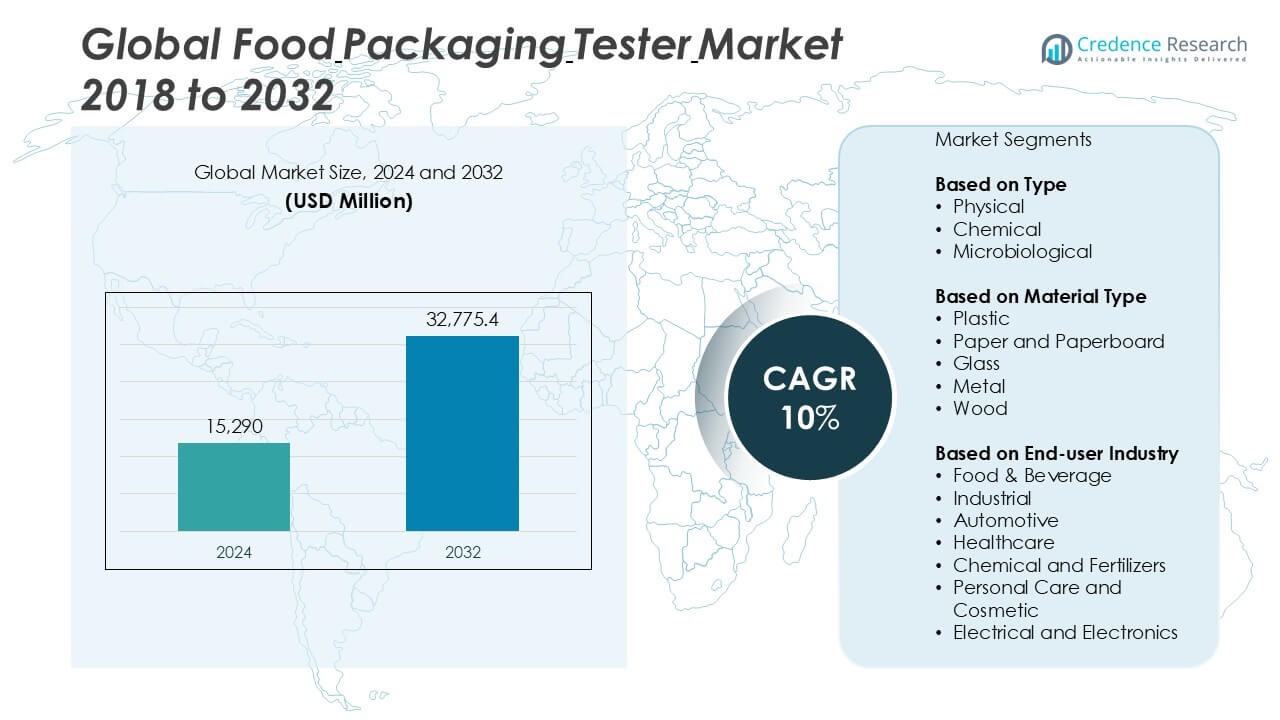

The Food Packaging Tester market size was valued at USD 15,290 million in 2024 and is anticipated to reach USD 32,775.4 million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Packaging Tester Market Size 2024 |

USD 15,290 Million |

| Food Packaging Tester Market, CAGR |

10% |

| Food Packaging Tester Market Size 2032 |

USD 32,775.4 Million |

The Food Packaging Tester market is led by prominent players such as Intertek Group PLC, Bureau Veritas SA, Microbac Laboratories Inc., Qualitest International Inc., and DDL Inc. (Integreon Global), who offer comprehensive testing solutions and maintain strong global networks. Companies like PackTest Machines Inc., National Technical Systems Inc., and IFP Institute for Product Quality GmbH further strengthen the competitive landscape through specialized equipment and regional expertise. North America holds the largest regional share, accounting for 32% of the global market in 2024, driven by stringent regulatory standards, advanced testing infrastructure, and high demand for packaged foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Packaging Tester market was valued at USD 15,290 million in 2024 and is projected to reach USD 32,775.4 million by 2032, growing at a CAGR of 10% during the forecast period.

- Increasing demand for packaged and processed foods, along with strict food safety regulations, is driving the adoption of testing equipment across industries.

- Trends such as the use of sustainable packaging materials and the integration of AI-enabled testing systems are reshaping the market, offering opportunities for innovation.

- Key players like Intertek Group PLC, Bureau Veritas SA, and Microbac Laboratories Inc. dominate the competitive landscape, while high equipment costs and lack of standardization remain key restraints.

- North America led the market with a 32% share in 2024, followed by Europe at 27% and Asia Pacific at 24%; among segments, physical testing and plastic material segments held the largest shares due to their widespread application and regulatory relevance.

Market Segmentation Analysis:

By Type

The Food Packaging Tester market, segmented by type into physical, chemical, and microbiological testing, is led by the physical testing sub-segment, which accounted for the largest market share in 2024. This dominance is driven by the high demand for mechanical and barrier property evaluations to ensure packaging durability and integrity during transportation and storage. Industries increasingly rely on physical testers to detect leaks, tensile strength, and compression resistance, making them critical in maintaining food safety standards and compliance with international quality certifications.

- For instance, Intertek Group PLC offers over 150 mechanical and physical packaging tests globally through its Packaging Performance Testing (PPT) labs, helping clients assess compression strength, burst resistance, and seal integrity under simulated transport conditions.

By Material Type:

Among material types, the plastic segment held the largest share in 2024, owing to its widespread use in food packaging due to lightweight, cost-effectiveness, and flexibility. The increased adoption of flexible packaging formats such as pouches, wraps, and containers, especially in ready-to-eat and processed food segments, fuels demand for plastic material testing. As concerns over sustainability and recyclability rise, plastic testing has gained importance to ensure compliance with evolving regulatory standards and to assess the impact of biodegradable and recycled plastics on food safety.

- For instance, Bureau Veritas SA conducted material migration and compliance testing on over 25,000 plastic food contact samples in 2023 alone, supporting brands transitioning to recycled PET and PLA packaging.

By End-user Industry:

The food & beverage industry emerged as the dominant end-user in 2024, capturing the largest share of the Food Packaging Tester market. The segment’s growth is propelled by rising consumer demand for packaged and processed food, which necessitates stringent testing to prevent contamination, spoilage, and leakage. Regulatory pressure to ensure product safety and shelf-life integrity further amplifies the need for comprehensive packaging tests. Additionally, manufacturers increasingly invest in advanced testing technologies to comply with international food safety norms, contributing significantly to the growth of this segment.

Key Growth Drivers

Rising Demand for Packaged and Processed Foods

The global increase in consumer preference for packaged and processed food products significantly drives the Food Packaging Tester market. Urbanization, busy lifestyles, and growing awareness of hygiene and food safety have led to higher consumption of ready-to-eat and convenience food items. This shift places pressure on food manufacturers to ensure packaging meets quality and safety standards, thereby boosting the need for advanced packaging testers. These instruments are essential for verifying seal integrity, barrier properties, and contamination resistance to maintain product shelf life and comply with regulations.

- For instance, DDL Inc., a subsidiary of Integreon Global, reported a 30% year-over-year increase in demand for their ASTM F88 seal strength testing services from frozen food manufacturers in 2023.

Stringent Food Safety Regulations and Compliance Standards

Governmental and international regulatory bodies have introduced stringent food safety and packaging regulations, compelling manufacturers to invest in reliable testing systems. These include guidelines related to material migration, microbial contamination, and mechanical durability of packaging materials. Compliance with standards such as FDA, EU food contact regulations, and ISO certifications requires thorough testing of packaging solutions. As regulatory scrutiny intensifies, the adoption of food packaging testers across industries increases, ensuring that materials used do not compromise food quality or consumer health, thus supporting market expansion.

- For instance, Microbac Laboratories Inc. processed more than 14,000 ISO 17025-compliant packaging safety assessments for food manufacturers in the U.S. and EU zones during 2023, helping clients meet global certification requirements.

Technological Advancements in Testing Equipment

Continuous innovation in food packaging testing technologies is another crucial driver for market growth. Manufacturers are developing highly automated, user-friendly, and multi-functional testing systems that enhance accuracy and operational efficiency. These include non-destructive testing methods, smart sensors, and AI-enabled diagnostic tools that provide real-time insights into packaging performance. The integration of digital technologies allows faster detection of defects and helps companies in predictive maintenance, thereby reducing production downtime. These advancements not only improve testing outcomes but also expand application areas across various packaging materials and formats.

Key Trends & Opportunities

Sustainability and Eco-friendly Packaging Materials

The shift toward sustainable and recyclable packaging solutions has emerged as a vital trend in the Food Packaging Tester market. As brands adopt biodegradable and plant-based materials to meet consumer and environmental expectations, the need for specialized testing systems increases. These materials often exhibit different mechanical and chemical properties, requiring tailored testing protocols to ensure food safety and regulatory compliance. This trend opens opportunities for manufacturers to develop testers specifically designed for evaluating green packaging, promoting innovation and competitive differentiation in the market.

- For instance, IFP Institute for Product Quality GmbH carried out over 8,700 migration and stability tests in 2023 focused exclusively on compostable and bio-based packaging used in organic food products.

Growth in Emerging Markets and Food Export Sectors

Emerging economies in Asia Pacific, Latin America, and the Middle East present untapped growth opportunities for food packaging testers due to rapid urbanization and a booming middle-class population. As domestic food manufacturers expand operations and increase exports, maintaining international packaging standards becomes essential. This scenario drives the demand for advanced packaging testing equipment, especially among small- and medium-sized enterprises aiming to comply with global trade regulations. The rise in food export activities also necessitates strict packaging quality checks, creating a favorable environment for market expansion.

- For instance, Qualitest International Inc. supplied over 1,200 advanced burst testers and oxygen permeability analyzers to food exporters in India and Brazil between 2022 and 2023, enhancing compliance with U.S. and European packaging standards.

Key Challenges

High Cost of Advanced Testing Equipment

One of the primary challenges in the Food Packaging Tester market is the high cost associated with acquiring and maintaining advanced testing systems. Small- and medium-scale manufacturers, especially in developing regions, often face budget constraints that limit their ability to invest in modern testing technologies. These capital-intensive systems may also require skilled personnel for operation and calibration, further adding to operational costs. Consequently, cost concerns can hinder widespread adoption, particularly in price-sensitive markets where manual testing methods may still be prevalent.

Lack of Standardization Across Regions

Another significant challenge is the lack of uniform standards for food packaging testing across different countries and regions. Varying regulatory requirements make it difficult for manufacturers to adopt a single, unified testing process, thereby increasing complexity and compliance costs. Companies engaged in cross-border trade often need to adapt their packaging and testing protocols to meet specific national standards, which can slow product development cycles and disrupt supply chains. This fragmentation impedes operational efficiency and poses barriers to global market integration.

Limited Awareness and Technical Expertise

Despite growing awareness of food safety, many small-scale manufacturers still lack sufficient knowledge and expertise in packaging testing technologies. Limited technical training and inadequate understanding of regulatory requirements often result in improper or insufficient testing. This knowledge gap affects product quality, brand reputation, and compliance with international norms. Addressing this challenge requires increased efforts in training programs, knowledge dissemination, and collaborations with testing equipment providers to improve the overall adoption and effectiveness of food packaging testers.

Regional Analysis

North America

North America held a significant share of the Food Packaging Tester market in 2024, accounting for approximately 32% of the global revenue. The region’s dominance is attributed to the presence of a well-established food processing industry and strict regulatory frameworks enforced by agencies like the FDA and USDA. Growing consumer awareness regarding food safety and increasing demand for packaged food further fuel market growth. The United States remains the key contributor, supported by substantial investments in technological innovation and automation in packaging testing. Additionally, the rise in sustainable packaging trends encourages the adoption of advanced testing solutions across industries.

Europe

Europe captured around 27% of the global Food Packaging Tester market in 2024, driven by robust regulatory standards and an emphasis on food safety and environmental compliance. Countries like Germany, France, and the UK are major contributors due to their strong food manufacturing base and adherence to EU food packaging directives. The region’s focus on sustainable materials and circular economy practices has led to increased testing of biodegradable and recyclable packaging solutions. Innovation in testing technologies and rising demand for organic and ready-to-eat foods also contribute to the market’s expansion in this region.

Asia Pacific

Asia Pacific emerged as a rapidly growing region, accounting for approximately 24% of the global Food Packaging Tester market in 2024. The expansion is fueled by rising urbanization, increasing disposable income, and growing consumption of packaged and processed foods, particularly in China, India, and Southeast Asian countries. Government initiatives to improve food safety standards and the development of export-oriented food industries further stimulate demand. Additionally, local manufacturers are increasingly investing in quality assurance infrastructure to meet global regulatory requirements, boosting the adoption of food packaging testers throughout the region.

Latin America

Latin America contributed nearly 9% to the global Food Packaging Tester market in 2024, with Brazil and Mexico leading regional demand. The market benefits from expanding food and beverage sectors, increased food exports, and efforts to align with international packaging safety standards. Although regulatory enforcement is still evolving in parts of the region, the trend toward automation and quality assurance is growing. Government programs aimed at enhancing food safety awareness and infrastructure have further supported the use of packaging testers, especially among medium-sized food processing firms.

Middle East and Africa (MEA)

The Middle East and Africa region held a modest share of around 8% in the global Food Packaging Tester market in 2024. Growth is primarily driven by rising demand for packaged foods due to increasing urban populations and shifting dietary preferences. Countries like the UAE, Saudi Arabia, and South Africa are investing in food manufacturing and quality control to meet both local consumption and export standards. However, limited infrastructure and technical expertise remain challenges. Nevertheless, ongoing investments in food safety modernization and growing interest in international trade support steady adoption of packaging testing technologies.

Market Segmentations:

By Type

- Physical

- Chemical

- Microbiological

By Material Type

- Plastic

- Paper and Paperboard

- Glass

- Metal

- Wood

By End-user Industry

- Food & Beverage

- Industrial

- Automotive

- Healthcare

- Chemical and Fertilizers

- Personal Care and Cosmetic

- Electrical and Electronics

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Food Packaging Tester market features a competitive and moderately fragmented landscape, with several global and regional players vying for market share through innovation, strategic partnerships, and service expansion. Key companies such as Intertek Group PLC, Bureau Veritas SA, and Microbac Laboratories Inc. dominate through comprehensive testing capabilities, global presence, and adherence to international food safety standards. These players focus on offering end-to-end testing solutions covering physical, chemical, and microbiological parameters. Meanwhile, companies like PackTest Machines Inc. and Qualitest International Inc. emphasize technological advancements by developing automated and multifunctional testing equipment. Regional players, including IFP Institute for Product Quality GmbH and Turner Packaging Limited, cater to specific local regulations and industry needs, providing cost-effective solutions. The market is also witnessing increased merger and acquisition activity, aimed at expanding service portfolios and geographic reach. Overall, innovation, regulatory compliance, and customer-specific customization remain key factors shaping competitive strategies in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PackTest Machines Inc.

- Microbac Laboratories Inc.

- Qualitest International Inc.

- National Technical Systems Inc.

- IFP Institute for Product Quality GmbH

- Intertek Group PLC

- Bureau Veritas SA

- Turner Packaging Limited

- Marchesini Group S.p.A.

- DDL Inc. (Integreon Global)

Recent Developments

- In April 2025, LakeShore Biopharma Co., Ltd. launched a new novel packaging solution for the rabies vaccine, addressing critical safety challenges in vaccine safety and vaccine administration.

- In January 2025, Lamb Weston announced the launch of a recyclable paper fry bag for its products in the US.

- In October 2024, RE-ZIP CEO and founder, Bo Bach Boddum expressed, “We have rolled out the project in several countries, but the collaboration with Amazon is the biggest single test we’ve ever conducted. That’s why we’re very excited to see how Amazon’s customers will receive our patented cardboard boxes.”

- In October 2024, RE-ZIP announced the launch of a new trial with Amazon to test whether it is possible to reduce packaging consumption by using a specially designed cardboard box that can be easily folded and returned.

Market Concentration & Characteristics

The Food Packaging Tester Market exhibits moderate to high market concentration, with a mix of global players and regional specialists competing across various segments. It is characterized by a strong focus on regulatory compliance, technological precision, and customization. Global leaders such as Intertek Group PLC, Bureau Veritas SA, and Microbac Laboratories Inc. maintain dominance through extensive service portfolios and established client networks. The market favors companies that can offer integrated solutions for physical, chemical, and microbiological testing, particularly those that align with food safety mandates. It shows a steady shift toward automation, digital diagnostics, and sustainability-focused packaging analysis. Demand for high-performance testers is rising across food, beverage, and healthcare sectors, supported by increased scrutiny over packaging integrity. The market structure supports innovation and technical advancement, but smaller firms face barriers due to high equipment costs and limited expertise. Regional markets differ in terms of regulatory standards and infrastructure, influencing the adoption rate of advanced testing equipment. It continues to grow with a strong emphasis on efficiency, compliance, and operational reliability.

Report Coverage

The research report offers an in-depth analysis based on Type, Material Type, End-user Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Food Packaging Tester market is expected to witness steady growth driven by rising global demand for packaged and processed foods.

- Increasing adoption of sustainable and biodegradable packaging will create demand for specialized testing equipment.

- Technological advancements such as AI-enabled diagnostics and non-destructive testing methods will enhance testing accuracy and efficiency.

- Regulatory bodies are likely to implement stricter packaging standards, prompting broader adoption of testing systems.

- Emerging economies in Asia Pacific and Latin America will present significant growth opportunities due to expanding food manufacturing sectors.

- Automation and integration of smart sensors will become standard features in next-generation testing machines.

- Demand will rise for multi-functional testing equipment capable of handling various packaging materials.

- Collaboration between equipment manufacturers and food producers will increase to develop customized testing solutions.

- High equipment costs may limit adoption among small manufacturers, driving demand for affordable and compact solutions.

- Continued emphasis on food safety and supply chain transparency will sustain long-term market growth.