Market Overview

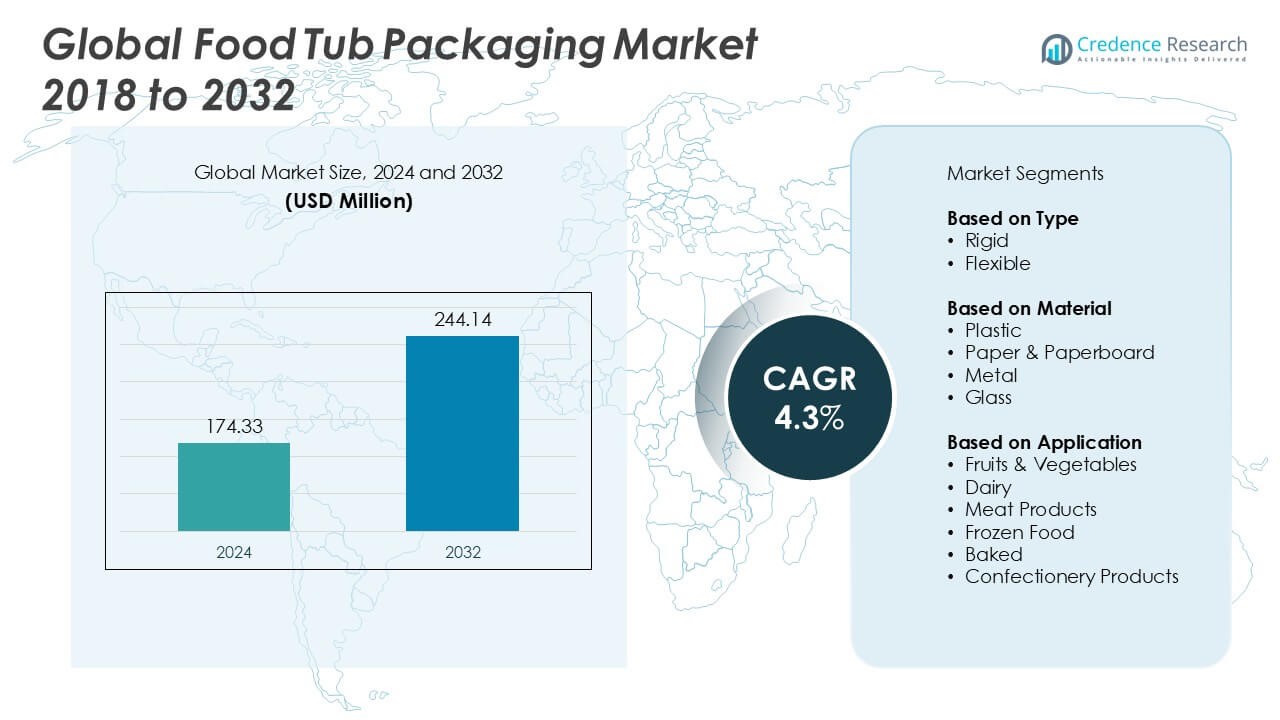

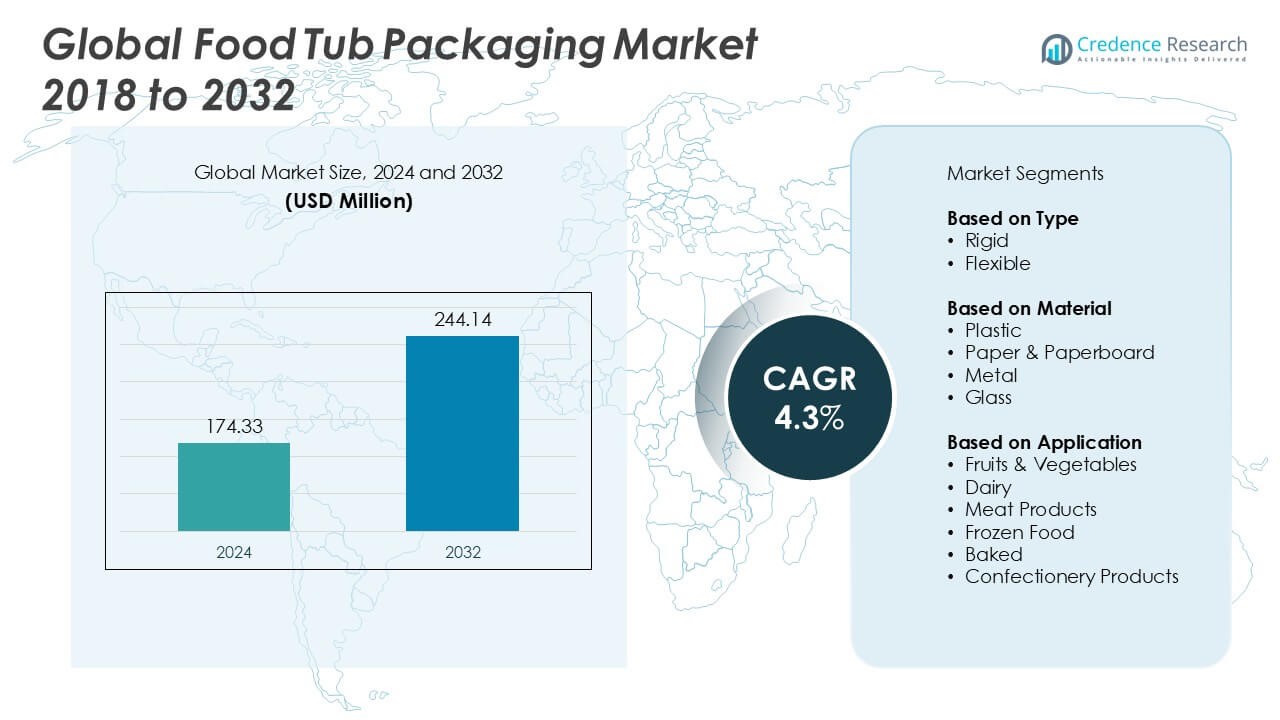

The Food Tub Packaging market size was valued at USD 174.33 million in 2024 and is anticipated to reach USD 244.14 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Tub Packaging Market Size 2024 |

USD 174.33 Million |

| Food Tub Packaging Market, CAGR |

4.3% |

| Food Tub Packaging Market Size 2032 |

USD 244.14 Million |

The Food Tub Packaging market is highly competitive, with key players such as Amcor plc, Silgan Holdings, Inc., Ardagh Group, Berry Plastics Corp., Plastipak Holdings, Inc., Sonoco Products Company, Graham Packaging Company, Inc., Weener Plastics, Ball Corp., and Tetra Pak leading the industry. These companies focus on product innovation, sustainable packaging solutions, and strategic collaborations to strengthen their market presence. Asia-Pacific emerged as the dominant regional market in 2024, accounting for 30% of the global market share, driven by rapid urbanization, growing demand for packaged food, and expanding retail infrastructure. North America and Europe followed, with 28% and 25% shares respectively, supported by strong processed food industries and increasing sustainability initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Tub Packaging market was valued at USD 174.33 million in 2024 and is projected to reach USD 244.14 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Rising demand for convenient, resealable, and portion-controlled food packaging is a key growth driver, particularly in dairy and ready-to-eat segments.

- Trends such as the adoption of sustainable materials, biodegradable tubs, and innovations in barrier technology are transforming product offerings and enhancing shelf life.

- The market is moderately fragmented, with major players like Amcor plc, Silgan Holdings, and Berry Plastics focusing on recyclable packaging, design innovations, and strategic mergers to expand their market presence.

- Asia-Pacific dominates the market with a 30% share, followed by North America (28%) and Europe (25%); among segments, rigid packaging and plastic material types hold the highest shares due to their cost-efficiency and product protection capabilities.

Market Segmentation Analysis:

By Type

The Food Tub Packaging market is segmented into rigid and flexible types, with rigid packaging dominating the market, accounting for the largest share in 2024. Rigid tubs offer superior structural integrity, making them ideal for products requiring protection from crushing and deformation during transportation and storage. Their high adoption in dairy and frozen food sectors is driven by the need for durable, tamper-proof, and stackable solutions. Furthermore, the increasing demand for sustainable and recyclable rigid packaging materials supports continued growth in this sub-segment, especially in developed markets prioritizing packaging efficiency and waste reduction.

- For instance, Berry Global produces over 3.5 billion rigid food containers annually and has developed its proprietary “TamperAlert” technology that provides visual indicators of tampering in dairy tubs.

By Material:

Among materials used in food tub packaging—plastic, paper & paperboard, metal, and glass—plastic remains the dominant sub-segment, capturing the largest market share in 2024. Its popularity stems from its lightweight nature, low cost, and excellent barrier properties that preserve food freshness and extend shelf life. Plastic tubs are widely used in dairy and ready-to-eat food packaging due to their design flexibility and ease of sealing. However, growing environmental concerns and regulations promoting biodegradable alternatives are encouraging innovation in bio-based plastics, which is likely to influence the future growth trajectory of this segment.

- For instance, Amcor has commercialized over 1,200 food-grade plastic packaging products, including tubs made from 100% post-consumer recycled PET under its “EcoGuard” line.

By Application:

In terms of application, the dairy segment holds the largest share in the Food Tub Packaging market, driven by the high consumption of products like yogurt, cheese spreads, and cream. The demand for portion-controlled and resealable tubs aligns with changing consumer preferences for convenience and hygiene. Additionally, the rise in chilled and refrigerated dairy product sales through retail chains fuels the need for robust and attractive packaging. Other segments, such as frozen foods and baked goods, are also growing steadily, supported by increasing urbanization and shifting lifestyles favoring ready-to-eat and easy-to-store food products.

Key Growth Drivers

Rising Demand for Convenience and On-the-Go Food Products

The increasing preference for convenient and ready-to-eat food options is a significant driver for the Food Tub Packaging market. As urbanization rises and consumers adopt fast-paced lifestyles, the demand for easy-to-use, resealable, and portable food packaging formats has surged. Food tubs, particularly in dairy, frozen meals, and snacks, cater well to this need. These packaging solutions offer improved usability, extended shelf life, and portion control—qualities valued by both consumers and retailers. This trend is particularly prominent in urban and working populations, driving consistent market growth.

- For instance, Tetra Pak has designed over 500 tub models with resealable features for chilled and ambient-ready dairy applications, including its “PortionPack” format tailored for on-the-go consumers.

Expansion of the Processed Food Industry

The global growth of the processed food industry is propelling demand for food tub packaging. With increasing consumption of processed and packaged foods, especially in emerging economies, manufacturers are turning to tubs as efficient solutions that offer hygiene, product safety, and aesthetic appeal. The rise in organized retail and food delivery platforms further amplifies the need for robust, tamper-evident packaging formats. Tubs are particularly preferred for sauces, dips, desserts, and dairy products due to their leak-proof and stackable design, helping companies meet growing volume and distribution demands efficiently.

- For instance, Sonoco Products Company supplies over 200 million plastic food tubs per year to major processed food brands across North America, leveraging its “SmartSeal” packaging for shelf-stable applications.

Sustainability and Shift Toward Recyclable Packaging

Environmental awareness among consumers and stringent regulations are pushing companies to adopt sustainable packaging solutions, boosting demand for recyclable and biodegradable food tubs. Packaging manufacturers are increasingly offering eco-friendly alternatives, such as tubs made from paperboard or compostable bioplastics, to reduce environmental impact. This sustainability drive is becoming a competitive differentiator in the market. Brands that align with consumer expectations for responsible packaging stand to gain customer loyalty and regulatory compliance, thus contributing to market expansion while also addressing global environmental concerns.

Key Trends & Opportunities

Technological Innovations in Packaging Materials

Advancements in packaging technologies are enabling the development of food tubs with enhanced barrier properties, lightweight structures, and smart features like QR codes and freshness indicators. These innovations improve product safety, prolong shelf life, and enhance user experience. For instance, antimicrobial coatings and improved sealing mechanisms are gaining traction in perishable food packaging. Manufacturers are also investing in digital printing technologies to offer better customization and branding. These innovations create new opportunities for differentiation and premiumization, particularly in competitive markets such as dairy and ready meals.

- For instance, Ardagh Group has introduced “FreshLite” barrier tubs featuring integrated oxygen scavengers and digital labels, with over 100 million units in circulation across Europe.

Growth in Sustainable and Compostable Packaging Solutions

A notable trend in the Food Tub Packaging market is the increasing shift toward compostable and bio-based materials. Consumers and regulators alike are demanding solutions that minimize environmental impact without compromising functionality. As a result, brands are exploring paperboard-based tubs, PLA composites, and other biodegradable materials. This presents a major opportunity for packaging companies to innovate and lead in sustainability. Governments offering incentives for green packaging further support this transition, creating long-term growth potential for companies that can effectively balance sustainability, cost, and performance.

- For instance, Weener Plastics has launched over 20 compostable tub variants in collaboration with leading European food brands, utilizing PLA and PHA blends certified for industrial compostability under EN 13432.

Key Challenges

Fluctuating Raw Material Prices

One of the primary challenges facing the Food Tub Packaging market is the volatility in raw material prices, particularly for plastics and metals. These fluctuations can significantly impact production costs, thereby affecting pricing strategies and profitability for packaging manufacturers. External factors such as geopolitical tensions, trade restrictions, and supply chain disruptions often exacerbate this issue. Companies reliant on petroleum-based polymers face added risks due to global oil price shifts, pushing many to explore alternative materials that may be more expensive or technologically immature.

Regulatory Pressure on Plastic Usage

Stringent regulations aimed at reducing plastic waste pose a substantial challenge to market players, especially those heavily dependent on conventional plastic-based tubs. Governments across regions are implementing bans, taxes, and extended producer responsibility (EPR) mandates to curb single-use plastics. Compliance with these evolving laws requires significant investment in research, reformulation, and retooling of production lines. Small and medium enterprises may particularly struggle to adapt, while consumers might resist sudden price hikes or changes in product appearance and functionality, creating a delicate balancing act for manufacturers.

Limitations in Recycling Infrastructure

Despite a growing push toward recyclable and eco-friendly packaging, many regions lack adequate infrastructure to support efficient recycling and composting. Inadequate collection systems, inconsistent recycling protocols, and low consumer awareness often result in recyclable tubs ending up in landfills. This gap undermines the effectiveness of sustainability efforts by brands and packaging producers. Companies must often invest in consumer education or collaborate with governments and recycling partners to bridge these gaps, increasing operational complexity and cost without guaranteed returns.

Regional Analysis

North America

North America held a significant share of the Food Tub Packaging market in 2024, accounting for approximately 28% of the global revenue. The region’s dominance is supported by a mature processed food industry, high demand for convenience foods, and widespread adoption of rigid and recyclable packaging formats. The U.S. and Canada are key contributors, with strong consumer preference for single-serve and resealable tubs in dairy, snacks, and ready-to-eat meals. Moreover, growing environmental awareness and regulatory support for sustainable packaging are encouraging manufacturers to invest in eco-friendly materials and innovative formats to meet evolving consumer expectations.

Europe

Europe represented around 25% of the global Food Tub Packaging market in 2024, driven by stringent environmental regulations and growing consumer demand for sustainable packaging. Countries such as Germany, France, and the UK are leading adopters of recyclable and compostable tubs, particularly in the dairy and frozen food sectors. The European Union’s circular economy initiatives are pushing manufacturers toward paper-based and bioplastic alternatives, boosting innovation. Additionally, a strong retail infrastructure and rising preference for private label and portion-controlled products are further contributing to the market’s growth, making Europe a key region for sustainable packaging development.

Asia-Pacific

The Asia-Pacific region accounted for approximately 30% of the global Food Tub Packaging market in 2024, making it the largest regional market. Rapid urbanization, rising disposable incomes, and the expansion of modern retail formats are driving demand across emerging economies like China, India, and Indonesia. Growth in the processed food sector and increasing awareness of hygiene and convenience are fueling the adoption of plastic and flexible tubs. While cost remains a major driver, there is growing interest in sustainable packaging, especially in urban centers. The region’s vast population base and changing dietary habits provide strong growth potential.

Latin America

Latin America contributed around 10% to the global Food Tub Packaging market in 2024. The region is witnessing moderate growth, led by increasing demand for packaged dairy, confectionery, and frozen food products. Brazil and Mexico are the major markets, benefiting from rising urbanization, improved cold chain logistics, and expanding food processing industries. While plastic remains the preferred material due to its affordability, there is a gradual shift toward paper-based and recyclable alternatives in response to regulatory pressures. Limited recycling infrastructure and cost sensitivity remain challenges, but improving economic conditions are expected to support steady market expansion.

Middle East & Africa (MEA)

The Middle East & Africa region held a smaller share of around 7% in the global Food Tub Packaging market in 2024. Growth in this region is driven by increasing consumer demand for hygienic, durable, and affordable food packaging, especially in dairy and meat products. Countries like the UAE, Saudi Arabia, and South Africa are witnessing increased investment in food processing and retail infrastructure. However, adoption of sustainable materials remains limited due to higher costs and lack of recycling infrastructure. Despite these challenges, rising health awareness and modernization in retail formats are expected to drive gradual growth.

Market Segmentations:

By Type:

By Material:

- Plastic

- Paper & Paperboard

- Metal

- Glass

By Application:

- Fruits & Vegetables

- Dairy

- Meat Products

- Frozen Food

- Baked

- Confectionery Products

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the Food Tub Packaging market is characterized by the presence of several established players focusing on innovation, sustainability, and strategic expansion. Key companies such as Amcor plc, Silgan Holdings, Inc., Ardagh Group, and Berry Plastics Corp. are investing in advanced materials and eco-friendly solutions to meet evolving regulatory requirements and consumer preferences. Players are increasingly shifting toward recyclable, compostable, and lightweight materials to gain a competitive edge. Strategic partnerships, mergers, and acquisitions are also common as companies aim to expand their product portfolios and geographic reach. For instance, collaborations with food manufacturers and retailers help packaging companies develop customized solutions aligned with specific product requirements. Additionally, continuous investment in research and development allows leading firms to improve product durability, barrier properties, and design appeal. Emerging players are also entering the market with niche sustainable offerings, intensifying competition. Overall, innovation and sustainability remain key differentiators in this evolving market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor plc

- Berry Plastics Corp.

- Plastipak Holdings, Inc.

- Sonoco Products Company

- Graham Packaging Company, Inc.

- Silgan Holdings, Inc.

- Ardagh Group

- Weener Plastics

- Ball Corp.

- Tetra Pak

Recent Developments

- In 2024, Berry Global also revealed in a press release on the same month that it would invest heavily in boosting its rPET production for food packaging, as demand grew for eco-friendly alternatives.

- In 2024, Apeel captured $100 million capital funding to accelerate growth and commercialize its technology, which is geared towards fruits staying fresher longer.

- In 2024, Huhtamaki declared its plans to acquire Elopak ASA, a major provider of cartons made from recycled paperboard used in aseptic liquid packing, thus solidifying its position as the leader in the sustainable beverage packaging category.

- In October 2024, Tupperware Brands Corporation reached a preliminary agreement with a consortium of secured lenders, notably including Stonehill Capital Management Partners and Alden Global Capital. The plan is to restructure the company into The New Tupperware Company, adopting a start-up mentality. This approach will leverage an agile methodology, facilitating iterative development through dynamic phases to enhance operational flexibility and responsiveness.

- In June 2024, Sonoco Products Company formally disclosed its acquisition of Eviosys, a leading global provider of innovative and sustainable metal packaging solutions catering to the food, consumer goods, and promotional sectors, from KPS Capital Partners for an approximate value of USD 3.9 billion. This strategic move accelerates Sonoco’s initiative to concentrate on and expand its core business segments while pursuing high-yield investment opportunities, both organically and through mergers and acquisitions.

- In February 2024 Amcor announced that they were working with Unilever to develop recyclable paper packaging for Lipton tea bags in a bid to reduce plastic waste and encourage circular economy.

Market Concentration & Characteristics

The Food Tub Packaging Market displays moderate concentration, with a mix of established global players and regional manufacturers competing for market share. Large companies such as Amcor plc, Silgan Holdings, and Berry Plastics Corp. maintain a strong presence through broad product portfolios, innovation capabilities, and established distribution networks. It reflects a demand-driven structure, shaped by evolving consumer preferences for convenience, hygiene, and sustainability. The market supports high-volume production, particularly in dairy and ready-to-eat food categories, where rigid plastic tubs dominate. Companies focus on recyclable and lightweight materials to meet environmental regulations and brand sustainability goals. It is also characterized by rapid shifts in packaging materials, influenced by cost, performance, and regional waste management capabilities. Growth opportunities vary across regions, with Asia-Pacific showing higher expansion due to urbanization and rising processed food consumption. Strategic partnerships between food producers and packaging firms help drive customization and product differentiation. Small and mid-sized players compete through innovation in design and materials, though scale advantages favor larger firms.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Food Tub Packaging market is expected to grow steadily due to rising demand for convenient and ready-to-eat food products.

- Increasing adoption of sustainable and recyclable materials will shape future packaging innovations.

- Rigid tubs will continue to dominate, especially in dairy and frozen food applications.

- Asia-Pacific will remain the fastest-growing region, driven by urbanization and expanding retail infrastructure.

- Technological advancements in barrier properties and sealing features will enhance product shelf life and safety.

- Customized and branded packaging solutions will gain traction among food manufacturers.

- Regulatory pressure will accelerate the shift toward biodegradable and compostable packaging options.

- Consumer demand for eco-friendly and lightweight packaging will influence material choices.

- Strategic collaborations between packaging firms and food producers will drive innovation and efficiency.

- Digital printing and smart packaging technologies will enhance traceability and consumer engagement.