Market Overview

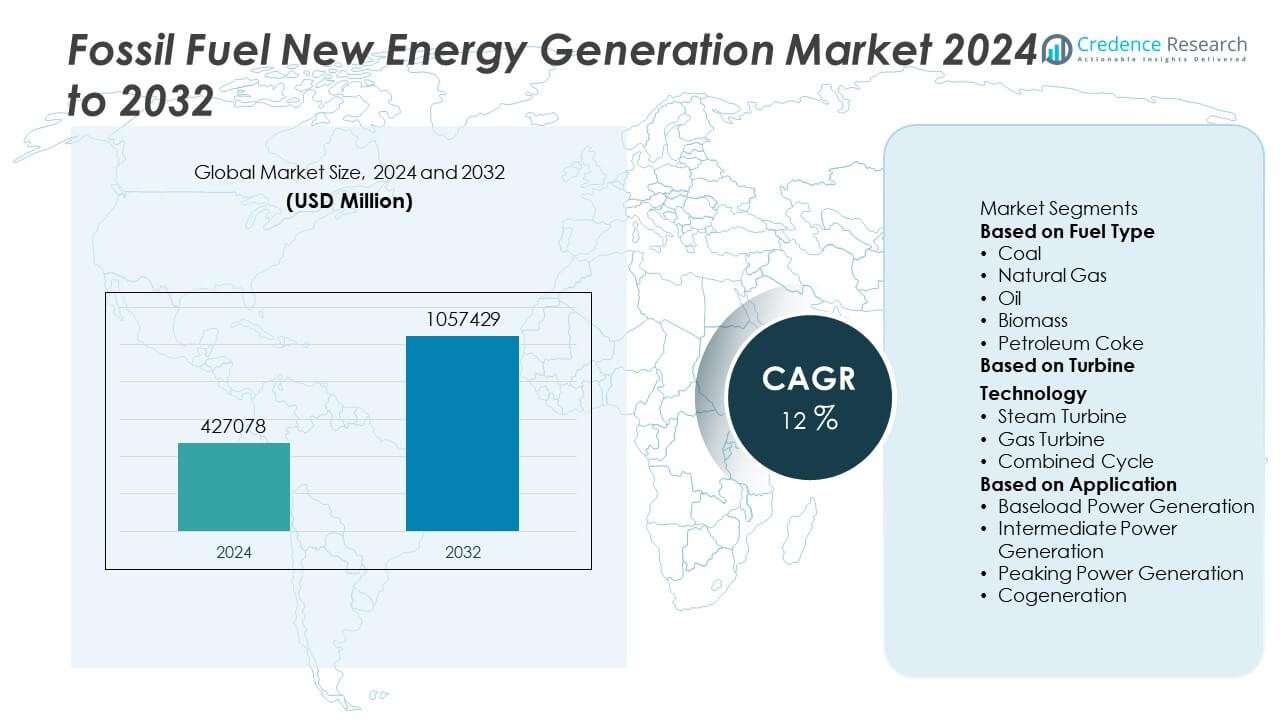

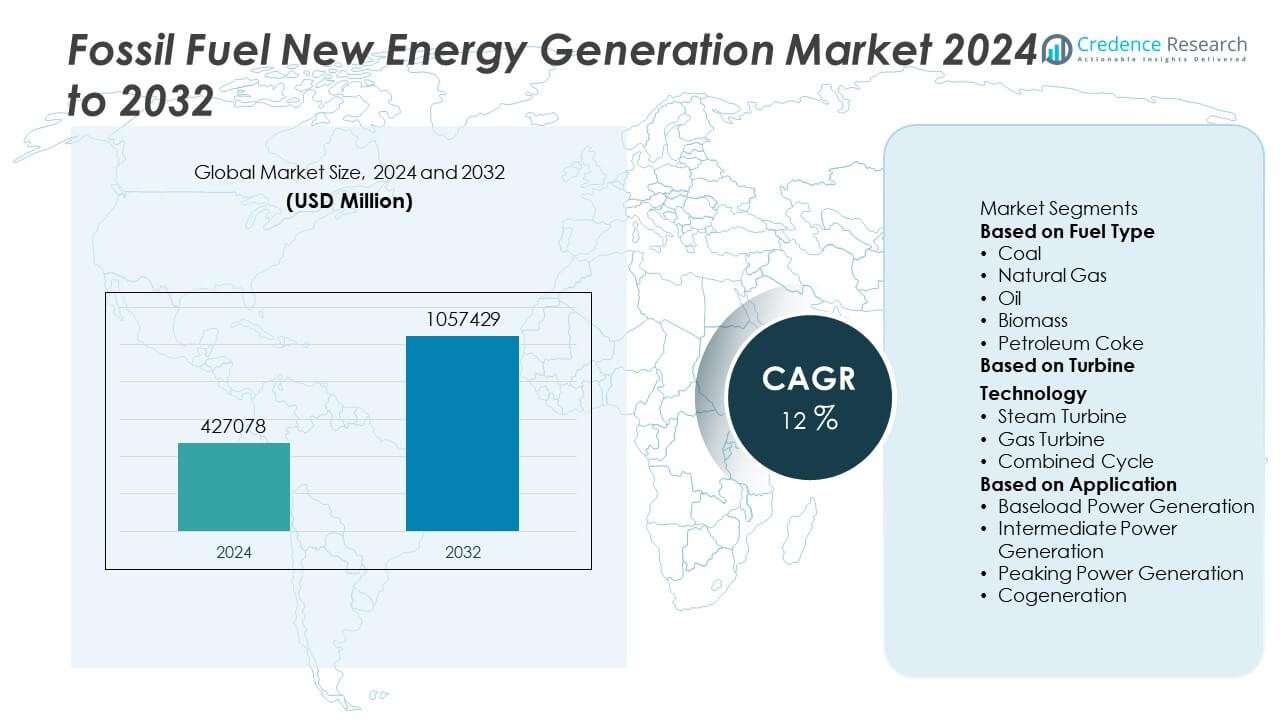

The global Fossil Fuel New Energy Generation Market was valued at USD 427,078 million in 2024 and is anticipated to reach USD 1,057,429 million by 2032, expanding at a strong CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fossil Fuel New Energy Generation Market Size 2024 |

USD 427,078 Million |

| Fossil Fuel New Energy Generation Market, CAGR |

12% |

| Fossil Fuel New Energy Generation Market Size 2032 |

USD 1,057,429 Million |

Fossil Fuel New Energy Generation Market grows with rising global electricity demand and the need for grid stability. Governments invest in modernizing thermal plants and deploying high-efficiency, low-emission technologies. Carbon capture, utilization, and storage projects gain traction to reduce emissions and extend fossil asset life.

North America leads the Fossil Fuel New Energy Generation Market with strong investments in modernizing gas-fired plants and integrating carbon capture projects to meet emission goals. Europe follows with significant upgrades to ultra-supercritical coal units and gas infrastructure while phasing out older, inefficient plants. Asia-Pacific shows the fastest growth, driven by rapid industrialization in China, India, and Southeast Asia, where demand for base-load power continues to rise. Latin America and Middle East & Africa see steady development with a focus on LNG imports and combined-cycle gas projects to strengthen energy security. Key players such as Iberdrola, S.A., Engie, China Datang Corporation, and Eskom Holdings SOC Ltd emphasize high-efficiency generation, digital monitoring, and hybrid solutions integrating renewables. These companies invest in flexible generation assets, CCUS technologies, and regional partnerships to address energy transition requirements while ensuring reliable electricity supply for residential, commercial, and industrial sectors worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Fossil Fuel New Energy Generation Market was valued at USD 427,078 million in 2024 and is projected to reach USD 1,057,429 million by 2032, growing at a CAGR of 12% during the forecast period.

- Rising electricity demand, industrial expansion, and grid reliability needs drive adoption of modern fossil-fuel-based power plants supported by government infrastructure investments.

- Key trends include rapid deployment of carbon capture projects, shift toward combined-cycle and hybrid generation systems, and increasing integration of digital monitoring and predictive maintenance solutions.

- The market is highly competitive with players such as Iberdrola, S.A., Engie, China Datang Corporation, Eskom Holdings SOC Ltd, and ArcelorMittal focusing on low-emission technologies, flexible generation, and regional capacity expansion.

- Stricter emission regulations, carbon taxes, and fuel price volatility act as restraints, pressuring operators to invest in costly efficiency upgrades and CCUS technologies to remain compliant.

- North America leads with heavy investment in gas-fired capacity and CCUS projects, Europe focuses on phasing out coal while expanding gas infrastructure, and Asia-Pacific records the fastest growth driven by industrialization and energy security efforts.

- Emerging opportunities lie in Latin America and Middle East & Africa, where LNG infrastructure development, modular power plants, and hybrid projects support rising electricity demand and enable smoother renewable integration across developing power grids.

Market Drivers

Rising Global Electricity Demand and Grid Reliability Requirements

Fossil Fuel New Energy Generation Market grows with rising electricity demand driven by urbanization, industrial expansion, and population growth. Many countries rely on fossil-based generation to ensure grid stability and meet base-load power needs. It remains a critical backup to intermittent renewable sources like solar and wind. Investments in modern power plants support continuous, reliable electricity supply. Industrial sectors depend on consistent power to avoid production losses. Rising data center operations and electrification of transport further accelerate demand for stable generation sources.

- For instance, Eskom Holdings SOC Ltd did not operate 39,000 MW of coal-fired capacity in 2025; rather, it announced plans in July 2025 to reduce its coal capacity from approximately 39,000 MW to 18,000 MW by 2040. The utility did, however, plan to reduce outages by returning 3,470 MW of capacity to service in February 2025 and announced a similar plan to return 3,330 MW by late July 2025 to stabilize grid performance.

Technological Advancements in Cleaner Fossil Fuel Technologies

Fossil Fuel New Energy Generation Market benefits from innovations in carbon capture, utilization, and storage (CCUS) and high-efficiency power plants. Ultra-supercritical and combined-cycle technologies improve fuel efficiency while reducing emissions. It allows operators to meet strict environmental regulations without compromising power output. Digital monitoring systems optimize plant performance and reduce downtime. Automation helps lower operational costs and improve predictive maintenance. Cleaner combustion methods strengthen public acceptance of fossil-based power generation projects.

- For instance, Engie, as part of a consortium, fully commissioned its 650 MW Red Sea Wind Energy wind farm in Ras Ghareb, Egypt, in June 2025, providing enough renewable energy to power over one million homes and reducing CO₂ emissions by approximately 1.3 million tonnes annually.

Government Support and Infrastructure Modernization Initiatives

Fossil Fuel New Energy Generation Market is supported by government policies focused on energy security and infrastructure upgrades. Public and private funding programs encourage replacement of aging coal, gas, and oil plants with high-efficiency units. It creates opportunities for modern generation facilities to integrate with renewable energy projects. Grid modernization efforts require flexible generation assets to balance variable renewable inputs. Supportive policies drive investments in gas-based plants as a cleaner alternative to coal. Energy transition roadmaps continue to include natural gas as a bridge fuel for decarbonization.

Growing Integration of Hybrid and Flexible Generation Solutions

Fossil Fuel New Energy Generation Market experiences rising demand for hybrid generation systems combining fossil fuels with renewables. These systems provide dispatchable power while optimizing fuel use and lowering emissions. It helps stabilize grids with high renewable penetration. Flexible gas turbines and modular generation units are favored for peak load management. Hybrid projects attract investment from utilities seeking to diversify their generation portfolios. This trend improves resilience of power systems and supports the shift toward low-carbon energy mixes.

Market Trends

Adoption of Carbon Capture and Emission Reduction Technologies

Fossil Fuel New Energy Generation Market shows a clear trend toward integrating carbon capture, utilization, and storage solutions. Power producers invest in post-combustion and oxy-fuel technologies to cut CO₂ emissions. It supports compliance with global climate goals and ESG requirements. Large-scale pilot projects and commercial CCUS plants are expanding in North America, Europe, and Asia. Utilities focus on reducing the carbon intensity of coal and gas power generation. This trend strengthens the role of fossil fuel generation in the energy transition.

- For instance, in June 2023, China Energy Investment Corporation completed a carbon capture, utilization, and storage (CCUS) facility at its Taizhou Power Plant in Jiangsu province, with the capacity to capture 500,000 tons of CO₂ annually.

Shift Toward High-Efficiency and Low-Emission Power Plants

Fossil Fuel New Energy Generation Market benefits from the deployment of ultra-supercritical, combined-cycle, and cogeneration systems. These plants offer higher thermal efficiency and lower fuel consumption per unit of electricity. It helps operators reduce operational costs while maintaining competitive power prices. Investment in digital twins and AI-based optimization tools improves plant performance. Countries with rising energy demand adopt efficient gas turbines to replace older coal units. This trend drives continuous upgrades of generation infrastructure worldwide.

- For instance, the Pingshan II Power Station in Anhui Province began commercial operation of its 1,350 MW ultra-supercritical secondary reheating coal unit in April 2022, achieving a coal consumption rate of 251 grams per kWh.

Integration with Renewable Energy and Hybrid Solutions

Fossil Fuel New Energy Generation Market is witnessing growth in hybrid projects combining fossil-based generation with solar, wind, or battery storage. Hybrid systems balance grid fluctuations and provide backup during renewable intermittency. It enables utilities to meet decarbonization targets without risking power shortages. Flexible gas-fired plants play a key role in supporting variable energy sources. Hybridization helps extend the life of existing fossil assets by improving operational flexibility. This approach ensures energy security while lowering emissions.

Growing Digitalization and Predictive Maintenance Adoption

Fossil Fuel New Energy Generation Market embraces digital transformation to improve efficiency and reliability. Plant operators deploy IoT sensors, predictive analytics, and real-time monitoring to reduce unplanned outages. It allows better forecasting of equipment failures and maintenance planning. Remote operations and AI-driven controls optimize fuel mix and load dispatch. Cybersecurity investment grows to protect digital infrastructure from threats. This trend improves operational performance and lowers lifecycle costs for generation assets.

Market Challenges Analysis

Rising Environmental Regulations and Decarbonization Pressure

Fossil Fuel New Energy Generation Market faces a major challenge from strict emission norms and global climate targets. Governments implement carbon taxes and phase-out timelines for coal, which reduce long-term investments in new projects. It forces operators to adopt expensive emission-control technologies, increasing capital and operational costs. Public opposition to fossil-fuel-based projects creates delays in permitting and financing. Transition toward renewable energy sources reduces reliance on fossil generation in many markets. Meeting compliance requirements without compromising profitability remains a key challenge for power producers.

Volatile Fuel Prices and High Operational Costs

Fossil Fuel New Energy Generation Market is affected by fluctuating coal, oil, and natural gas prices, which impact power generation costs. Price volatility disrupts planning for utilities and raises risks for investors. It puts pressure on power producers to optimize efficiency and hedge against supply chain disruptions. Maintenance of large-scale plants adds significant operational expenses, particularly for aging infrastructure. Rising labor and material costs further increase the total cost of electricity generation. Ensuring cost competitiveness against cheaper renewable energy sources remains a critical obstacle.

Market Opportunities

Growing Investment in Carbon Capture and Low-Emission Technologies

Fossil Fuel New Energy Generation Market offers strong opportunities through rapid expansion of carbon capture, utilization, and storage projects. Governments and energy companies allocate funding to scale CCUS infrastructure for coal and gas plants. It allows fossil generation to remain relevant while meeting emission reduction commitments. Advancements in capture efficiency and cost reduction improve project feasibility. Integration of CCUS with enhanced oil recovery and industrial applications creates additional revenue streams. Power producers adopting these technologies can extend the life of existing assets and maintain profitability.

Expansion of Hybrid and Flexible Generation Projects Globally

Fossil Fuel New Energy Generation Market can grow by supporting hybrid power plants that combine fossil fuels with renewables. Demand for flexible gas turbines and modular generation units is rising to balance intermittent solar and wind output. It strengthens grid reliability while enabling higher renewable penetration. Emerging economies invest in dual-fuel and quick-start generation systems to meet peak demand growth. Utilities benefit from hybrid solutions that optimize fuel use and lower emissions per MWh. This opportunity positions fossil generation as a key enabler of energy transition strategies worldwide.

Market Segmentation Analysis:

By Fuel Type

Fossil Fuel New Energy Generation Market is segmented by fuel type into coal, natural gas, and oil. Natural gas dominates due to its lower carbon emissions and ability to provide flexible generation for balancing renewables. Many countries favor gas-fired combined-cycle plants to replace aging coal infrastructure and meet emission targets. Coal retains a share in regions with abundant reserves and limited gas infrastructure, though adoption of ultra-supercritical technology reduces its environmental impact. Oil-based generation is primarily used for peaking power and in remote locations where other fuels are unavailable. It continues to transition toward cleaner fuels as part of global decarbonization strategies.

- For instance, Pampa Energía operates over 4,000 MW of gas-fired capacity in Argentina, including the Genelba CCGT plant with an installed capacity of 1,253 MW, which is strategically located to help stabilize the Buenos Aires grid.

By Turbine Technology

Fossil Fuel New Energy Generation Market by turbine technology includes combined-cycle gas turbines (CCGT), steam turbines, and open-cycle gas turbines (OCGT). Combined-cycle technology leads the segment because of its high thermal efficiency and lower fuel consumption per MWh. Steam turbines remain relevant in coal-fired plants and cogeneration systems where heat recovery is critical. OCGT units are preferred for fast ramp-up applications in peak load and emergency backup scenarios. It allows grid operators to stabilize supply during demand spikes or renewable intermittency. Investments focus on upgrading turbines with digital controls and improved heat rates to boost performance.

- For instance, a steam turbine at the Unit Q of the Boxberg power plant in Germany produced gross output such that its net plant efficiency was 42.7% during its acceptance tests, which were finished in October 2000. These results were achieved under advanced steam conditions, with the main steam entering at 266 bar (approximately 3857 psi) and 545°C (1013°F). The reheated steam was at 58 bar and 581°C (1078°F).

By Application

Fossil Fuel New Energy Generation Market is segmented by application into base-load, peak-load, and backup power. Base-load generation holds the largest share due to its role in providing continuous and stable electricity supply. Gas and coal plants remain vital for meeting industrial demand and supporting round-the-clock grid operations. Peak-load applications grow as countries integrate more variable renewable energy, requiring quick-start plants to balance supply gaps. Backup power applications gain importance in regions prone to grid instability and natural disasters. It drives adoption of modular and mobile generation units to ensure resilience and reliability in critical infrastructure.

Segments:

Based on Fuel Type

- Coal

- Natural Gas

- Oil

- Biomass

- Petroleum Coke

Based on Turbine Technology

- Steam Turbine

- Gas Turbine

- Combined Cycle

Based on Application

- Baseload Power Generation

- Intermediate Power Generation

- Peaking Power Generation

- Cogeneration

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 31% of the Fossil Fuel New Energy Generation Market, supported by a well-developed power infrastructure and rising investments in modernizing aging thermal plants. The United States drives demand with natural gas dominating new capacity additions due to abundant shale gas reserves and competitive pricing. Canada invests in combined-cycle gas plants to complement renewable energy integration and maintain grid reliability. It benefits from ongoing projects focused on carbon capture, utilization, and storage (CCUS) to reduce emissions from existing coal and gas plants. The region also witnesses growth in flexible gas turbine installations to support renewable integration. Regulatory frameworks encourage modernization while maintaining energy security and affordability for industrial and residential users.

Europe

Europe represents 26% of the Fossil Fuel New Energy Generation Market and is undergoing a significant transition toward lower-carbon generation. Many countries phase out conventional coal plants while investing in gas-based power and CCUS projects. Germany, UK, and Nordic countries lead with large-scale gas capacity additions and efficiency upgrades. It benefits from strong policy support for carbon reduction targets under the EU Green Deal, encouraging operators to adopt ultra-supercritical technologies. Flexible generation solutions are in high demand to balance growing renewable penetration. Investment in hydrogen-ready turbines is increasing as part of long-term decarbonization strategies.

Asia-Pacific

Asia-Pacific holds 33% of the Fossil Fuel New Energy Generation Market, making it the largest regional segment. Rapid industrialization and urbanization in China, India, and Southeast Asia drive massive electricity demand. Many countries expand coal and gas capacity to meet base-load requirements and prevent power shortages. It also invests heavily in supercritical and ultra-supercritical plants to improve efficiency and cut emissions. Gas infrastructure development in emerging markets supports transition from coal to cleaner fuels. Governments in the region focus on energy security, making fossil generation critical despite parallel renewable investments.

Latin America

Latin America contributes 6% of the Fossil Fuel New Energy Generation Market, with Brazil and Mexico leading capacity additions. Gas-fired plants are expanding as countries shift from oil-based generation to cleaner and more efficient solutions. It benefits from regional investment in LNG import terminals to ensure reliable fuel supply. Peak-load and backup power projects are growing in remote and off-grid areas. Utilities focus on hybrid solutions combining fossil fuels with solar and wind to enhance grid stability.

Middle East & Africa

Middle East & Africa account for 4% of the Fossil Fuel New Energy Generation Market, driven by growing demand for electricity to support industrial and residential development. Natural gas remains the dominant fuel, supported by large reserves in the Gulf region. It sees rising investment in combined-cycle plants and co-generation projects for desalination and industrial complexes. Africa focuses on expanding reliable power supply through modular and mobile generation units. Governments aim to balance economic growth with emissions management through gradual adoption of low-carbon technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Iberdrola, S.A.

- Pampa Energía S.A.

- Eskom Holdings SOC Ltd

- China Huadian Corporation LTD

- Engie

- ArcelorMittal

- IPJSC EN+ GROUP

- AtkinsRéalis

- EZ, a. s.

- China Datang Corporation

Competitive Analysis

Competitive landscape of the Fossil Fuel New Energy Generation Market is shaped by leading players such as Iberdrola, S.A., Engie, China Datang Corporation, Eskom Holdings SOC Ltd, ArcelorMittal, IPJSC EN+ GROUP, AtkinsRéalis, EZ, a. s., Pampa Energía S.A., and China Huadian Corporation LTD. These companies focus on developing high-efficiency, low-emission power generation assets to meet rising energy demand and stricter environmental regulations. They invest in combined-cycle gas turbines, carbon capture and storage projects, and hybrid solutions integrating fossil generation with renewable energy. Strategic partnerships and joint ventures enable expansion into emerging markets and strengthen regional power supply networks. Digital transformation remains a priority, with operators adopting IoT-enabled monitoring, AI-driven optimization, and predictive maintenance to reduce downtime and improve operational efficiency. Companies also diversify fuel sources, expand LNG infrastructure, and deploy flexible generation units to support grid stability. Continuous investment in innovation and sustainability keeps competition strong and technology-driven.

Recent Developments

- In August 2025, Eskom Holdings SOC Ltd launched its first Renewable Energy Offtake Programme, inviting large power users to procure 291 MW of Solar PV capacity via long-term PPAs.

- In July 2025, Eskom Holdings SOC Ltd unveiled plans to transition its generation mix by raising renewables to 32 GW and reducing coal capacity from 39 GW to 18 GW by 2040.

- In July 2025, Huadian Group began operating the world’s first 500-MW fully hydrogen-cooled generator at its Wangting Power Plant in Jiangsu, China.

- In April 2025, China released guidelines saying newly built coal plants should have 10-20% lower carbon emissions per unit of output compared to the 2024 fleet.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Turbine Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fossil fuel generation will stay strong to ensure grid stability and base-load supply.

- Natural gas capacity will expand as a preferred bridge fuel for low-carbon energy transition.

- Carbon capture, utilization, and storage projects will scale rapidly to cut emissions.

- Hybrid power plants combining fossil fuels with renewables will see wider deployment.

- Investment in ultra-supercritical and combined-cycle plants will improve efficiency and lower fuel use.

- Digital monitoring and predictive maintenance will reduce downtime and enhance plant performance.

- LNG infrastructure development will support growth in gas-based generation in emerging markets.

- Flexible gas turbines and modular plants will gain traction for peak-load and quick-start needs.

- Policy-driven phaseout of coal will accelerate, but cleaner coal technologies will still find niche demand.

- Competition will intensify as global players focus on sustainability, innovation, and regional expansion.