Market Overview

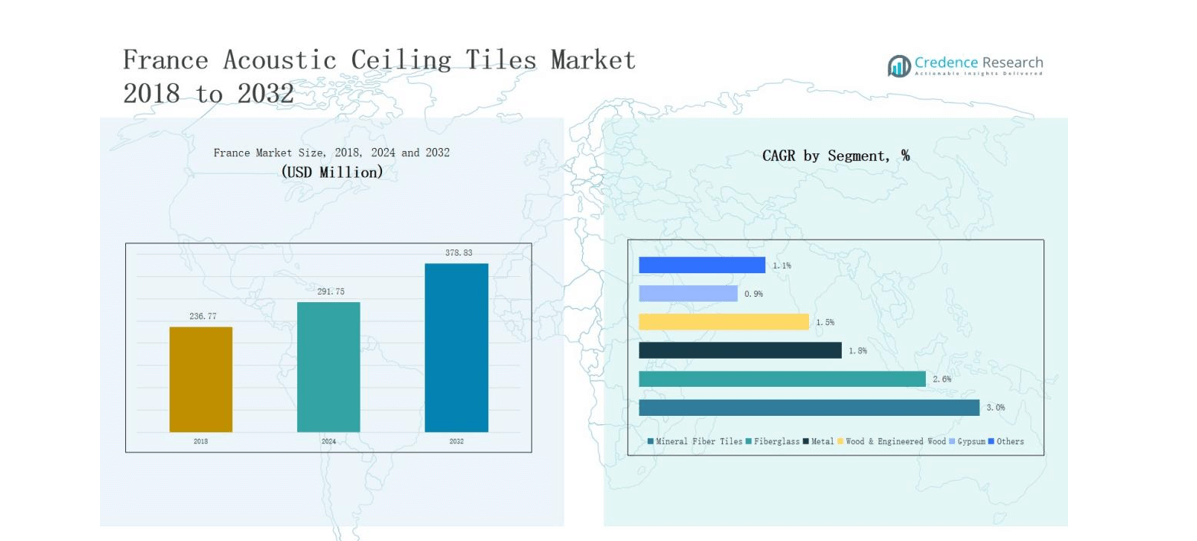

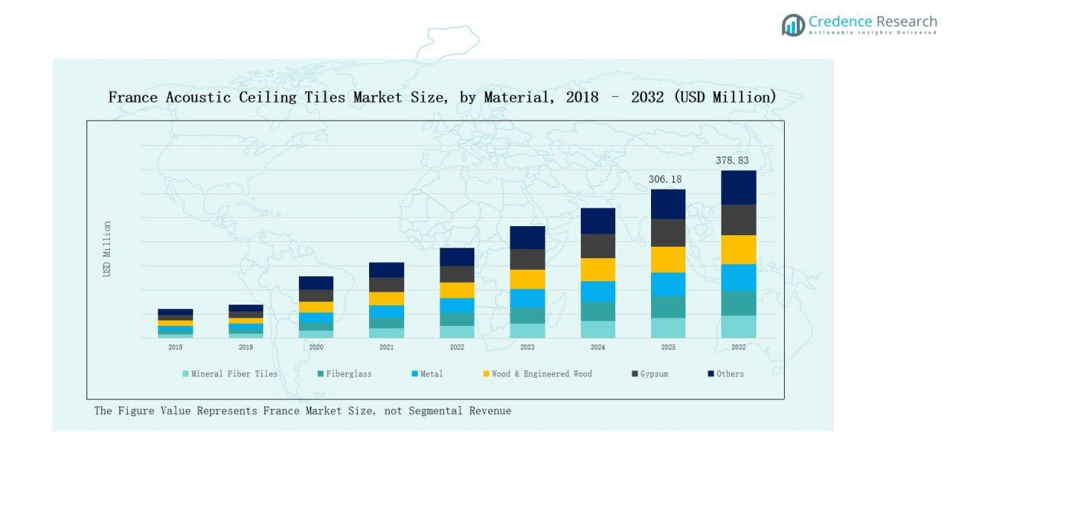

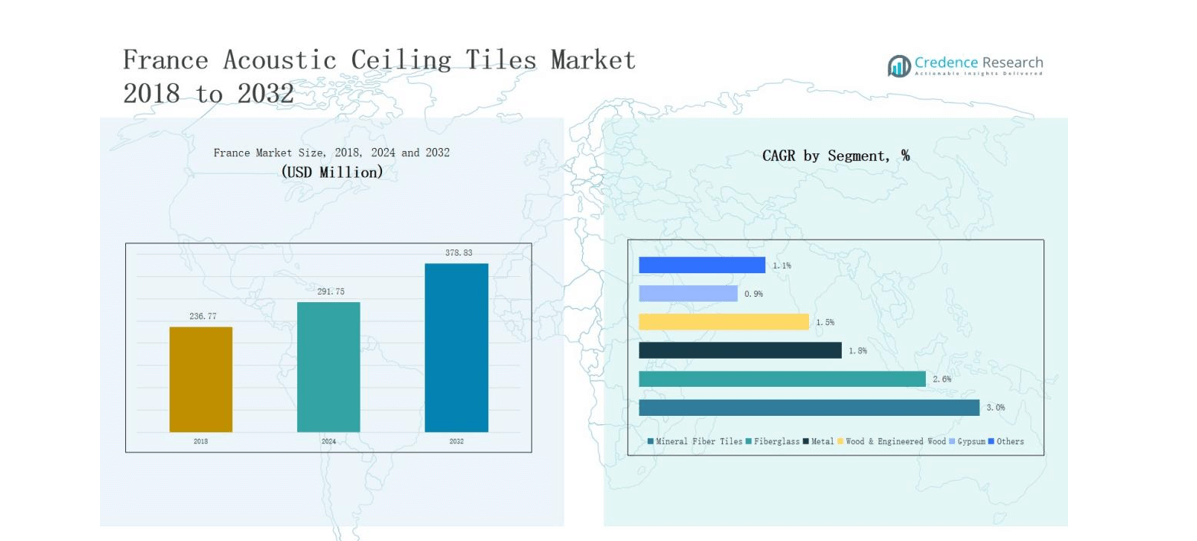

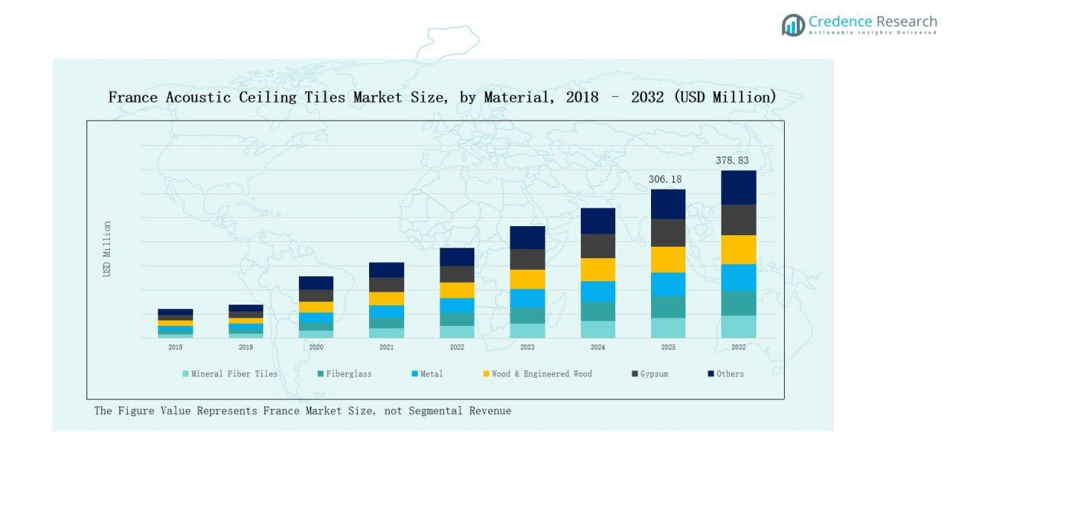

France Acoustic Ceiling Tiles Market size was valued at USD 236.77 million in 2018, reached USD 291.75 million in 2024, and is anticipated to reach USD 378.83 million by 2032, growing at a CAGR of 3.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Acoustic Ceiling Tiles Market Size 2024 |

USD 291.75 million |

| France Acoustic Ceiling Tiles Market, CAGR |

3.09% |

| France Acoustic Ceiling Tiles Market Size 2032 |

USD 378.83 million |

The France Acoustic Ceiling Tiles Market is shaped by global leaders and regional specialists focusing on performance, sustainability, and design innovation. Key players include Saint-Gobain, Armstrong World Industries France, Knauf Insulation, Rockfon France, OWA GmbH, Hunter Douglas France, Ceilume France, SAS International France, Texaa, and Ecophon, each strengthening their presence through advanced product portfolios and strong distribution networks. These companies emphasize mineral fiber and fiberglass solutions for commercial and institutional use, while premium wood and metal tiles target luxury projects. Among regions, South France led the market with 31% share in 2024, supported by industrial hubs, commercial real estate growth, and rising demand for high-end acoustic solutions.

Market Insights

- France Acoustic Ceiling Tiles Market reached USD 291.75 million in 2024 and is projected to hit USD 378.83 million by 2032, growing at 3.09%.

- Mineral fiber tiles led with 42% share in 2024, supported by strong insulation, fire resistance, and compliance with energy efficiency standards.

- Suspended ceiling tiles dominated with 67% share, driven by versatility, ease of maintenance, and integration with lighting and HVAC systems in commercial spaces.

- Building contractors held 39% share in 2024, favoring cost-efficient mineral fiber and suspended systems for large-scale residential and commercial projects.

- South France emerged as the leading region with 31% share, driven by industrial hubs, commercial real estate growth, and premium demand in housing and hospitality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

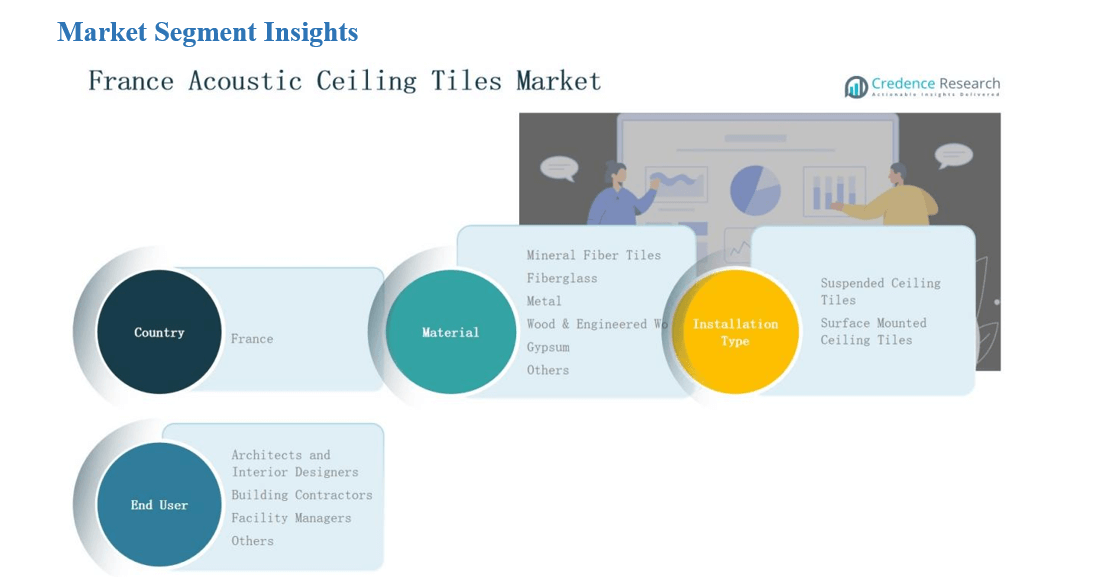

Market Segment Insights

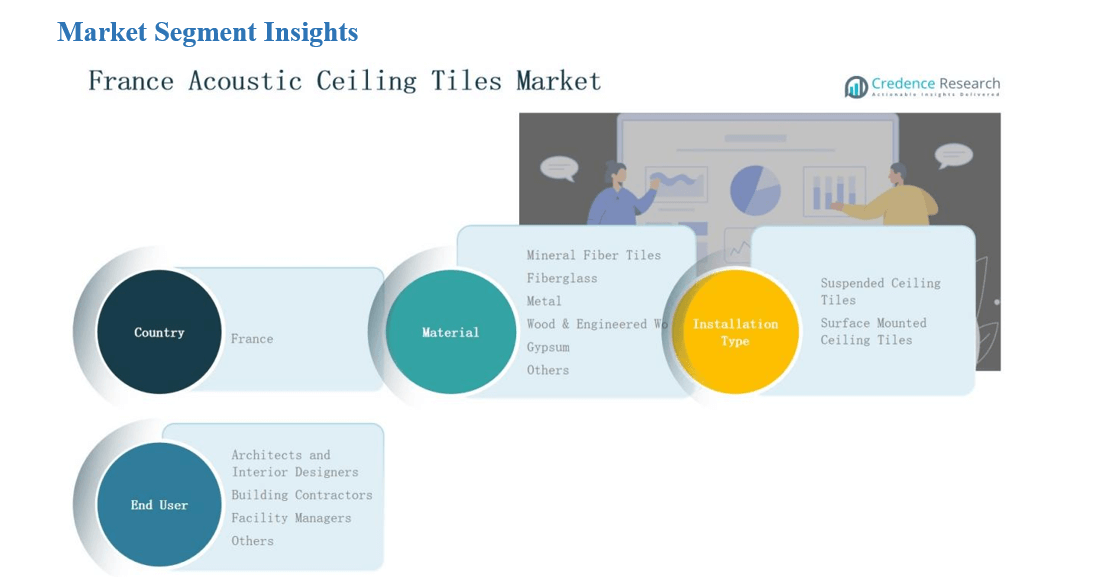

By Material

Mineral fiber tiles dominated the France acoustic ceiling tiles market, accounting for 42% share in 2024. Their widespread use in commercial and institutional buildings is supported by strong acoustic insulation, fire resistance, and cost-effectiveness. Government emphasis on energy efficiency standards further drives adoption. Fiberglass tiles follow with notable growth, driven by lightweight and moisture-resistant properties. Metal, wood, gypsum, and other alternatives serve niche demand, often selected for premium aesthetics or specialized performance in modern building projects.

- For instance, Saint-Gobain introduced its Ecophon Hygiene Meditec range of fiberglass ceiling tiles designed specifically for healthcare facilities, combining noise reduction with antimicrobial surfaces.

By Installation Type

Suspended ceiling tiles held the dominant position with 67% market share in 2024, reflecting their versatility, easy maintenance, and integration with HVAC and lighting systems. Their popularity is strong across office spaces, educational institutions, and healthcare facilities in France. Surface-mounted tiles accounted for the remaining market share, favored in small-scale projects or where suspended grids are impractical. Growing demand for renovation and retrofitting is expected to drive surface-mounted tiles, although suspended systems will continue to lead long-term adoption.

- For instance, Armstrong World Industries introduced its Ultima+ range of suspended ceiling tiles featuring enhanced acoustic control and light reflection, making them widely adopted in European office projects.

By End User

Building contractors represented the leading end-user group with a 39% share in 2024, driven by large-scale residential and commercial construction projects across France. Contractors favor mineral fiber and suspended systems for their cost efficiency and compliance with acoustic performance standards. Architects and interior designers closely follow, emphasizing design aesthetics, customization, and premium finishes. Facility managers and other stakeholders account for the remaining share, focusing on renovations, maintenance, and replacements to ensure compliance with safety and energy efficiency regulations.

Market Overview

Rising Demand for Energy-Efficient Buildings

France’s strict energy efficiency standards are fueling demand for acoustic ceiling tiles. Mineral fiber and fiberglass tiles are widely chosen due to their insulation properties and ability to lower heating and cooling costs. The shift toward green construction practices under EU directives strengthens adoption. Builders and contractors increasingly specify ceiling systems that align with environmental certifications such as BREEAM and HQE. This regulatory push, combined with growing corporate sustainability goals, reinforces market expansion for energy-efficient acoustic ceiling solutions.

- For instance, Knauf Ceiling Solutions delivered its Heradesign acoustic range for several HQE-certified school renovation projects in France, emphasizing sustainability and thermal performance.

Expanding Commercial Construction Projects

Ongoing investments in commercial real estate, including office spaces, educational facilities, and healthcare centers, are a major driver. Suspended acoustic ceiling tiles dominate installations due to flexibility, design appeal, and integration with lighting and HVAC systems. Major cities such as Paris and Lyon are witnessing robust infrastructure upgrades, where acoustic performance and aesthetics are critical. Contractors and architects prefer advanced ceiling systems to meet modern acoustic standards. This trend creates steady growth opportunities for manufacturers serving France’s expanding construction sector.

Growing Focus on Workplace Well-Being

The rising focus on employee productivity and well-being is driving adoption of acoustic ceiling tiles in office buildings. Open-plan layouts create challenges related to noise control, making mineral fiber and fiberglass tiles attractive solutions. Employers and facility managers are investing in acoustic-friendly interiors to enhance concentration and comfort. Government-backed initiatives on occupational health further encourage demand. With hybrid work models and corporate wellness strategies becoming mainstream, acoustic ceiling tiles are increasingly viewed as essential elements of modern workplace environments.

- For instance, Knauf Ceiling Solutions has supplied mineral fiber ceiling systems across several European office renovation projects to improve acoustic quality and meet occupational health standards.

Key Trends & Opportunities

Increasing Use of Sustainable Materials

Eco-friendly product innovation is a growing trend, with companies in France introducing ceiling tiles made from recycled and low-emission materials. This aligns with Europe’s sustainability goals and consumer demand for green products. Mineral fiber and bio-based composites are gaining traction in both residential and commercial projects. Manufacturers are leveraging circular economy practices, such as recycling waste tiles into new products. This trend provides opportunities for differentiation and premium positioning, as green-certified projects increasingly specify sustainable ceiling solutions.

- For instance, Saint-Gobain Ecophon® launched SoundCircularity™, a circular economy service that recycles end-of-life ceiling tiles made from glass wool with up to 65% post-recycled content, significantly reducing raw material consumption.

Rising Adoption of Aesthetic and Multifunctional Designs

A growing opportunity lies in demand for ceiling systems that combine acoustic performance with modern design. Architects and interior designers are requesting customizable patterns, colors, and finishes to match contemporary interiors. Multifunctional tiles with integrated lighting, ventilation, and antimicrobial coatings are also entering the French market. These innovations appeal to high-end residential projects and premium office spaces where aesthetics and performance converge. This trend enables manufacturers to expand portfolios and capture value-added segments in a competitive environment.

- For instance, Rockfon expanded its collection in France with the Rockfon Mono Acoustic solution, which provides seamless smooth surfaces integrated with high acoustic ratings, catering to premium office designs.

Key Challenges

High Initial Installation Costs

The upfront cost of acoustic ceiling tiles, particularly suspended systems, remains a challenge in France. Many small-scale contractors and residential projects hesitate to adopt advanced ceiling systems due to budget constraints. While long-term energy savings and acoustic benefits are significant, the higher initial expense compared to conventional ceilings discourages adoption. Price-sensitive customers in smaller towns and residential markets often opt for cheaper alternatives, limiting penetration. This cost barrier continues to slow wider market expansion beyond large-scale urban projects.

Competition from Alternative Materials

Acoustic ceiling tiles face growing competition from alternative materials such as acoustic wall panels, modular partitions, and soundproof coatings. These alternatives often provide similar performance at lower cost or with easier installation. Some designers prefer wall-mounted solutions for flexibility in renovation projects. As a result, ceiling tiles must compete not only on price but also on added value features like design versatility and durability. This competition from substitutes represents an ongoing challenge for manufacturers targeting diverse customer segments.

Fluctuations in Raw Material Prices

Volatility in the prices of raw materials, including mineral fiber, fiberglass, and metals, creates challenges for manufacturers. Global supply chain disruptions and energy price fluctuations directly affect production costs. Passing these increases on to customers is difficult in France’s competitive market, where price sensitivity remains high. Manufacturers are pressured to balance profitability with affordability, often impacting margins. This volatility also affects long-term project planning for contractors, making it harder to predict costs and hindering large-scale adoption of acoustic ceiling systems.

Regional Analysis

North France

North France accounted for 22% share in 2024 in the France Acoustic Ceiling Tiles Market. The region benefits from strong demand in commercial offices, educational institutions, and healthcare facilities. Urban development projects in Lille and nearby areas drive installation of suspended ceiling systems. Mineral fiber tiles dominate adoption due to their acoustic performance and compliance with building regulations. Contractors and facility managers prefer energy-efficient and cost-effective solutions for large-scale projects. Growing renovation activity in older buildings also supports steady demand.

South France

South France held the leading position with 31% market share in 2024. The region’s industrial hubs and expanding commercial real estate drive higher adoption of acoustic ceiling solutions. It also shows strong demand for premium products, including wood and metal tiles, in luxury housing and hospitality projects. Architects and interior designers in cities such as Marseille and Nice emphasize design flexibility alongside performance. Facility managers are focusing on products that enhance energy efficiency in large properties. Strong construction activity ensures continued dominance.

East France

East France captured 24% market share in 2024, supported by industrial activity and institutional projects. The market here emphasizes durability and cost-effective ceiling systems. Mineral fiber and fiberglass tiles are widely preferred by building contractors for manufacturing plants, logistics centers, and public sector projects. Growing focus on sustainable construction practices creates opportunity for recycled and eco-friendly ceiling products. Regional investments in infrastructure upgrades continue to support installations. East France demonstrates balanced growth across commercial, industrial, and residential end users.

West France

West France represented 23% share in 2024, driven by mixed demand from residential and commercial sectors. Cities such as Nantes and Rennes are experiencing steady construction activity, where suspended ceiling systems are the top choice. Facility managers focus on renovation projects in existing public and private buildings. Contractors prefer mineral fiber solutions for cost and compliance benefits. Architects highlight aesthetic designs, fueling moderate demand for wood and metal tiles. The region shows consistent adoption supported by balanced urban and suburban growth.

Market Sementations:

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Wood

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- North France

- South France

- East France

- West France

Competitive Landscape

The France Acoustic Ceiling Tiles Market is characterized by the presence of global leaders and regional specialists competing through innovation, design, and sustainability. Companies such as Saint-Gobain, Armstrong World Industries France, Knauf Insulation, and Rockfon France hold strong positions, supported by extensive product portfolios and distribution networks. OWA GmbH, Hunter Douglas France, and SAS International France emphasize advanced acoustic technologies and customizable designs to cater to evolving project needs. Niche players like Texaa, Ceilume France, and Ecophon strengthen the landscape with specialized solutions in lightweight, aesthetic, and eco-friendly categories. Competitive strategies focus on mineral fiber and fiberglass tiles due to high adoption in commercial and institutional applications, while premium materials such as wood and metal target luxury projects. Firms increasingly invest in sustainable materials, recycling initiatives, and energy-efficient designs to align with national regulations and customer expectations. Intense competition encourages continuous innovation, shaping a market defined by both performance and design versatility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saint-Gobain

- Armstrong World Industries France

- Knauf Insulation

- Rockfon France

- OWA GmbH

- Hunter Douglas France

- Ceilume France

- SAS International France

- Texaa

- Ecophon

Recent Developments

- In May 2025, Impact Acoustic joined the NCS+ partnership, strengthening design and acoustic integration for projects in France and wider Europe.

- In 2025, Knauf Ceiling Solutions launched TOPIQ Alpha, a new mineral laminated ceiling tile range produced at its Illange (France) plant.

- In February 2025, BAUX launched Acoustic X-FELT, a circular acoustic tile collection using PET material.

- In January 2024, Armstrong World Industries (AWI) formed a strategic alliance with McKinstry, a top construction and energy services company, to accelerate sustainable construction solutions focusing on energy efficiency and intelligent ceiling technologies.

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mineral fiber tiles will continue to dominate due to cost and acoustic performance.

- Fiberglass tiles will gain momentum driven by lightweight, moisture-resistant, and sustainable features.

- Premium demand for wood and metal tiles will rise in luxury housing and hospitality projects.

- Suspended ceiling systems will remain the preferred choice for commercial and institutional buildings.

- Surface-mounted ceiling tiles will expand in small-scale residential and renovation projects.

- Architects and interior designers will drive growth through emphasis on aesthetics and customization.

- Building contractors will maintain strong influence with preference for efficient and regulation-compliant solutions.

- Facility managers will focus on replacements and retrofitting projects in older building infrastructure.

- Sustainability regulations will push manufacturers to invest in eco-friendly and recyclable tile solutions.

- Regional growth will remain strongest in South France supported by industrial and real estate development.