Market Overview

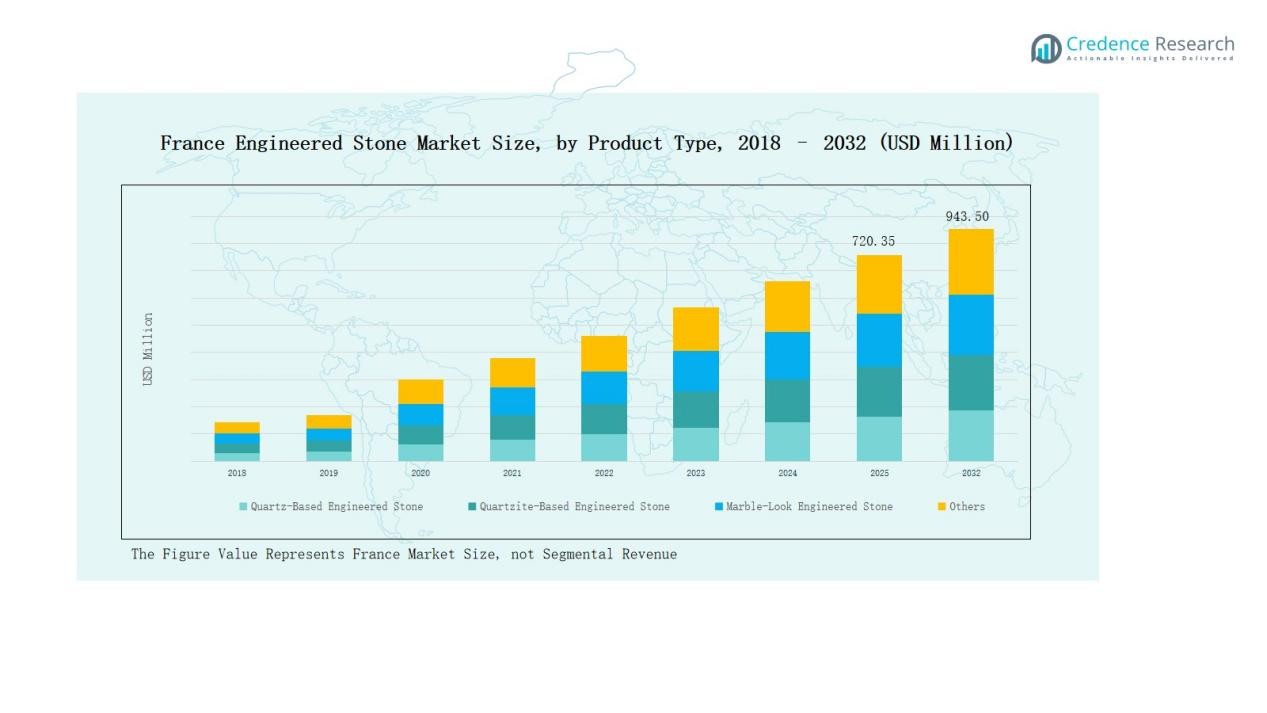

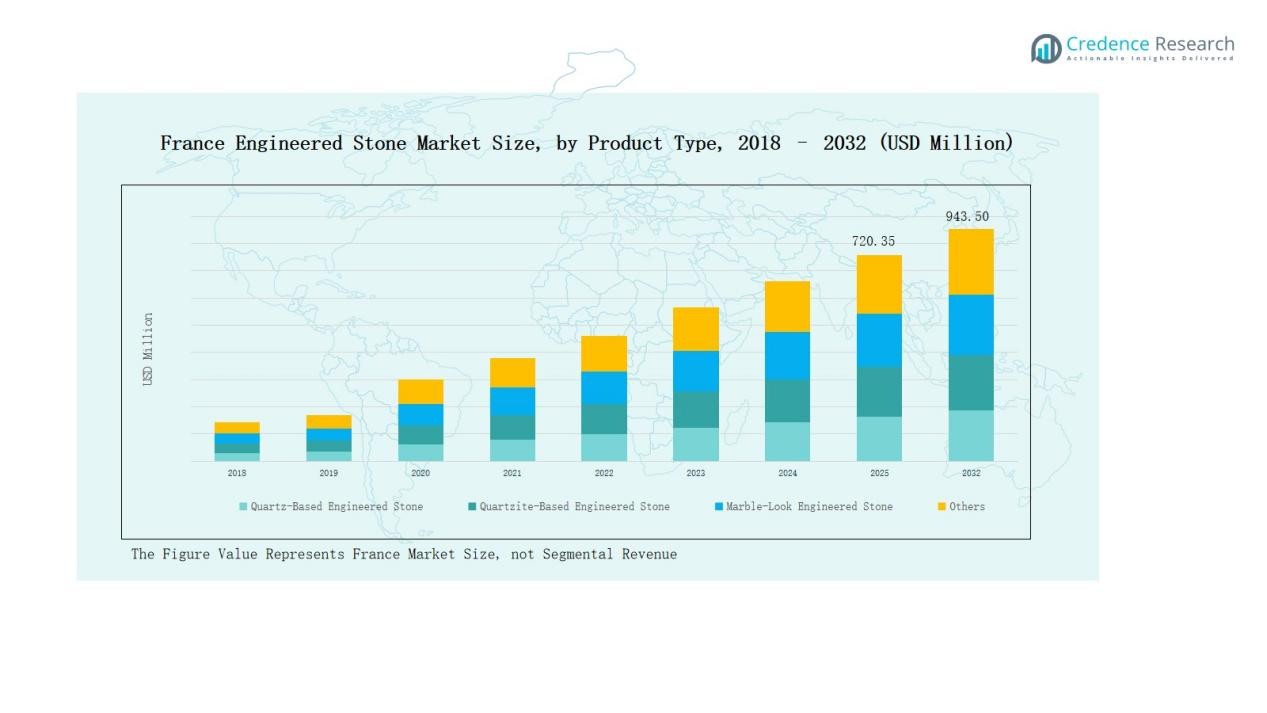

France Engineered Stone Market size was valued at USD 522.36 million in 2018, reached USD 677.70 million in 2024, and is anticipated to reach USD 943.50 million by 2032, growing at a CAGR of 3.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Engineered Stone Market Size 2024 |

USD 677.70 Million |

| France Engineered Stone Market, CAGR |

3.93% |

| France Engineered Stone Market Size 2032 |

USD 943.50 Million |

The France Engineered Stone Market is shaped by leading players including Cosentino, Silestone France, Caesarstone France, Lapitec France, Breton France, Compac France, Quarella France, Technistone France, Franchi Umberto Marmi France, and Santa Margherita France. These companies compete through product innovation, sustainability-focused portfolios, and strong distribution partnerships with contractors and designers. Quartz-based products remain central to their offerings, supported by growing demand for marble-look finishes in luxury projects. Regionally, Île-de-France leads the market with a 38% share in 2024, driven by premium residential developments, modern office projects, and renovation activities across Paris and surrounding urban centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Engineered Stone Market grew from USD 522.36 million in 2018 to USD 677.70 million in 2024 and is projected to reach USD 943.50 million by 2032, at a CAGR of 93%.

- Quartz-based engineered stone led the market with a 61% share in 2024, driven by durability, cost-effectiveness, and popularity in modern kitchens and bathrooms.

- The residential sector accounted for a 64% share in 2024, supported by high demand for stylish countertops, flooring, and extensive remodeling activities across urban households.

- By end-use, construction and infrastructure dominated with a 57% share in 2024, fueled by housing activity, commercial projects, and government-backed renovation initiatives.

- Regionally, Île-de-France led with 38% share in 2024, followed by Southern France (27%), Western France (19%), and Northern France (16%), each supported by distinct housing and commercial drivers.

Market Segment Insights

By Product Type

Quartz-based engineered stone dominated the France market in 2024, capturing a 61% share. Its strength, cost-effectiveness, and wide variety of colors make it the preferred choice for modern interiors. Rising adoption in luxury kitchens and bathrooms further supports its growth. Quartzite-based products followed with niche applications in premium projects, while marble-look stones gained traction for aesthetic appeal. Other variants, though smaller in share, serve specialized needs in decorative applications and customized interior solutions.

- For instance, Cosentino expanded the Silestone collection with HybriQ+ technology, offering sustainable quartz surfaces tailored for high-end residential projects.

By Application

The residential sector accounted for a 64% share of the France engineered stone market in 2024. High demand for stylish, durable countertops and flooring in urban households drives this dominance. Renovation and remodeling activities, particularly in high-income housing, also boost adoption. The commercial segment, though smaller, shows steady growth, supported by demand in hotels, restaurants, and office interiors that prioritize aesthetics, durability, and ease of maintenance to withstand high traffic environments.

- For instance, Caesarstone launched its Metropolitan Collection in France, designed with a raw, industrial aesthetic that caters to contemporary home design trends.

By End-Use Industry

Construction and infrastructure led the market with a 57% share in 2024, supported by France’s strong housing and commercial building activities. Government-backed renovation programs and green building certifications also fuel adoption of engineered stone. Interior design and decoration followed, gaining traction in high-end residential and boutique commercial projects, where customization and design flexibility are essential. The “Others” category, including art installations and specialty projects, remains limited but offers opportunities for niche applications and design-focused innovations.

Key Growth Drivers

Rising Demand for Luxury Interiors

The growing preference for premium kitchen countertops, bathroom vanities, and flooring solutions is a key growth driver. French consumers increasingly prioritize design, durability, and low maintenance, making engineered stone the material of choice. Rising disposable income and lifestyle upgrades in urban regions further fuel demand. This trend is particularly visible in Paris and Southern France, where luxury housing projects and high-end renovations dominate, creating consistent opportunities for engineered stone adoption in both residential and commercial applications.

- For instance, Lapitec, an Italian engineered stone brand, witnessed growing demand in France by offering large-format sintered stone slabs that combine aesthetic appeal with enhanced durability, often specified for high-end renovations in urban areas.

Government Focus on Sustainable Construction

France’s strong focus on sustainability and energy efficiency drives engineered stone adoption. Green building certifications such as HQE and BREEAM encourage the use of eco-friendly, recyclable, and durable materials. Engineered stone, particularly quartz-based surfaces, meets these requirements by offering longevity and minimal maintenance. Incentives for sustainable renovation projects and public sector investments in modern infrastructure further strengthen market demand. This alignment with environmental policies ensures consistent opportunities for manufacturers that emphasize sustainable production and supply chain practices.

- For instance, Caesarstone introduced its Mineral Surfaces collection in Europe, highlighting reduced crystalline silica content and sustainable production.

Expanding Renovation and Remodeling Activities

Renovation activity in France continues to expand, driven by aging housing stock and urban infrastructure upgrades. Consumers prefer engineered stone due to its cost-effectiveness, durability, and modern design flexibility compared to natural stone. Government-backed home improvement programs also encourage adoption, particularly in residential settings. High demand for kitchen and bathroom remodeling projects, combined with rising property investments, ensures steady growth. Commercial renovation in hospitality and office spaces further supports the market, making remodeling a central pillar of long-term demand.

Key Trends & Opportunities

Shift Toward Silica-Free and Recycled Products

French consumers and regulators increasingly emphasize health and environmental safety, encouraging silica-free and recycled engineered stone adoption. Leading players now introduce crystalline silica-free solutions and incorporate up to 80% recycled materials in production. This trend aligns with stricter workplace safety regulations and environmental goals, positioning sustainable product portfolios as a strong competitive advantage. Companies investing in these eco-innovations gain opportunities to capture both regulatory-driven demand and growing consumer preference for sustainable, safe, and high-performance interior materials.

- For instance, Compac developed its Obsidiana range using 100% recycled glass, positioning it as a sustainable high-performance option for interior applications.

Growth in Commercial and Hospitality Applications

While residential demand dominates, commercial adoption offers rising opportunities. Hotels, restaurants, and modern office spaces increasingly use engineered stone for flooring, reception areas, and decorative surfaces. Its strength, easy maintenance, and aesthetic versatility make it ideal for high-traffic environments. The tourism sector, particularly luxury hospitality, drives demand for marble-look and premium quartz finishes. As France continues to invest in tourism infrastructure and modern workspaces, commercial applications provide significant growth potential beyond the traditional residential customer base.

- For instance, MSI Surfaces supplies quartz and marble surfaces to Hilton, Marriott, and Wyndham hotels across the U.S., using engineered stone for vanities and lobby walls.

Key Challenges

Rising Regulatory Scrutiny on Silica Dust

The health risks of silica dust exposure have prompted stricter regulations in France. Compliance with workplace safety standards raises production and installation costs for manufacturers and contractors. Companies face challenges in redesigning processes, adopting safer materials, and ensuring regulatory compliance. Smaller firms, in particular, struggle with the capital investment required for dust-control technologies. This regulatory scrutiny poses risks but also pressures the industry toward safer, silica-free alternatives, creating both compliance challenges and long-term transformation opportunities.

Intense Market Competition

The France engineered stone market faces intense competition from both international giants and domestic suppliers. Major global brands dominate premium segments with advanced product portfolios, while local firms compete on price and customized solutions. This dynamic creates margin pressures and forces continuous innovation. Companies must balance sustainability, quality, and design variety to maintain competitiveness. Aggressive marketing strategies, distributor partnerships, and differentiation through eco-friendly innovations are essential, yet challenging, for players seeking to strengthen their foothold in this competitive market.

High Installation and Maintenance Costs in Premium Segment

Although engineered stone offers durability and long-term savings, its high initial installation cost limits adoption among budget-conscious consumers. Premium finishes, particularly marble-look and large-format slabs, require skilled labor and advanced installation techniques, driving expenses. This pricing challenge restricts adoption to high-income households and luxury projects. In commercial markets, budget constraints in mid-tier hotels and offices also curb demand. Balancing affordability with quality remains a key challenge, pushing companies to innovate with cost-effective solutions and targeted product lines.

Regional Analysis

Île-de-France

Île-de-France held the leading position in the France Engineered Stone Market with 38% share in 2024. The region benefits from strong demand in luxury residential projects across Paris and surrounding urban areas. Rising investments in premium apartments and modern office spaces strengthen adoption of quartz-based and marble-look surfaces. Renovation activity in historical properties also supports demand for durable, low-maintenance solutions. Commercial applications in hotels, retail, and corporate offices contribute further to growth. The combination of high-income households and active infrastructure projects secures its dominance.

Southern France

Southern France accounted for 27% share of the market in 2024. The region shows strong adoption of engineered stone in villas, luxury resorts, and coastal housing projects. Tourism-related construction, particularly in Provence and the French Riviera, drives commercial usage in hotels and restaurants. Demand for marble-look engineered stone remains strong due to aesthetic preferences in high-end residential developments. Growing investment in real estate also expands opportunities. It continues to benefit from a mix of luxury housing demand and commercial hospitality projects.

Western France

Western France captured 19% share of the market in 2024. Renovation programs in mid-sized cities and towns drive steady growth, especially in residential applications. Kitchen countertops and flooring solutions dominate demand, supported by affordability and design flexibility. Commercial adoption is moderate, mainly in retail outlets and small hospitality projects. Infrastructure upgrades and government-backed urban renewal initiatives also influence market activity. It remains an important contributor by balancing residential and light commercial demand across the region.

Northern France

Northern France represented 16% share of the France Engineered Stone Market in 2024. The region relies heavily on construction and infrastructure projects, particularly in Lille and surrounding areas. Demand is supported by residential renovations in suburban housing and moderate growth in commercial interiors. Engineered stone adoption benefits from durability and compliance with sustainability requirements in public projects. While luxury housing demand is lower compared to Paris or the south, steady investments in housing and regional infrastructure sustain market growth.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Country

- Île-de-France

- Southern France

- Western France

- Nortehrn France

Competitive Landscape

The France Engineered Stone Market is highly competitive, with international brands and domestic players actively expanding their presence. Leading companies such as Cosentino, Caesarstone, Silestone France, Lapitec, Breton, Compac, Quarella, Technistone, Franchi Umberto Marmi, and Santa Margherita dominate through strong product portfolios and brand recognition. These firms focus on quartz-based and marble-look engineered stone, supported by innovations in silica-free and recycled materials to meet sustainability requirements. Intense competition centers on pricing, distribution, and partnerships with architects, contractors, and distributors. International brands leverage premium positioning, while domestic companies emphasize cost-effective and tailored offerings for localized demand. Rising regulatory focus on worker safety and eco-friendly production compels companies to adapt their processes, driving innovation in product development. Strategic marketing campaigns and participation in trade fairs strengthen visibility, while collaboration with real estate developers and design firms enhances market penetration. The competitive environment remains dynamic, with sustainability and design leadership shaping long-term growth.

Key Players

- Cosentino

- Silestone France

- Caesarstone France

- Lapitec France

- Breton France

- Compac France

- Quarella France

- Technistone France

- Franchi Umberto Marmi France

- Santa Margherita France

Recent Developments

- In February 2025, Caesarstone introduced its Caesarstone ICON™, a crystalline silica-free advanced fusion surface. The launch highlights the company’s move toward safer and more sustainable engineered stone products, with potential adoption in France.

- In September 2023, Polycor finalized the acquisition of Rocamat, a French quarry and stone processing company. This deal strengthened Polycor’s presence in France and expanded its influence across the engineered and natural stone sector.

- In February 2025, MAPEI launched a Manufactured Stone Veneer Systems (MSVS) product line with new mortars and accessories.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will continue to dominate due to durability and design variety.

- Adoption of marble-look surfaces will rise in luxury housing and high-end commercial projects.

- Sustainable and silica-free product innovations will gain stronger acceptance across regions.

- Residential renovation and remodeling will remain a key driver of market expansion.

- Commercial demand will grow in hospitality, retail, and modern office spaces.

- Île-de-France will maintain its leading share, supported by premium real estate projects.

- Southern France will expand further with strong demand from tourism-driven construction.

- Partnerships with architects and interior designers will shape distribution strategies.

- Digital marketing and online retail channels will play a greater role in product sales.

- Regulatory focus on health and environmental standards will encourage industry-wide innovation.