Market Overview

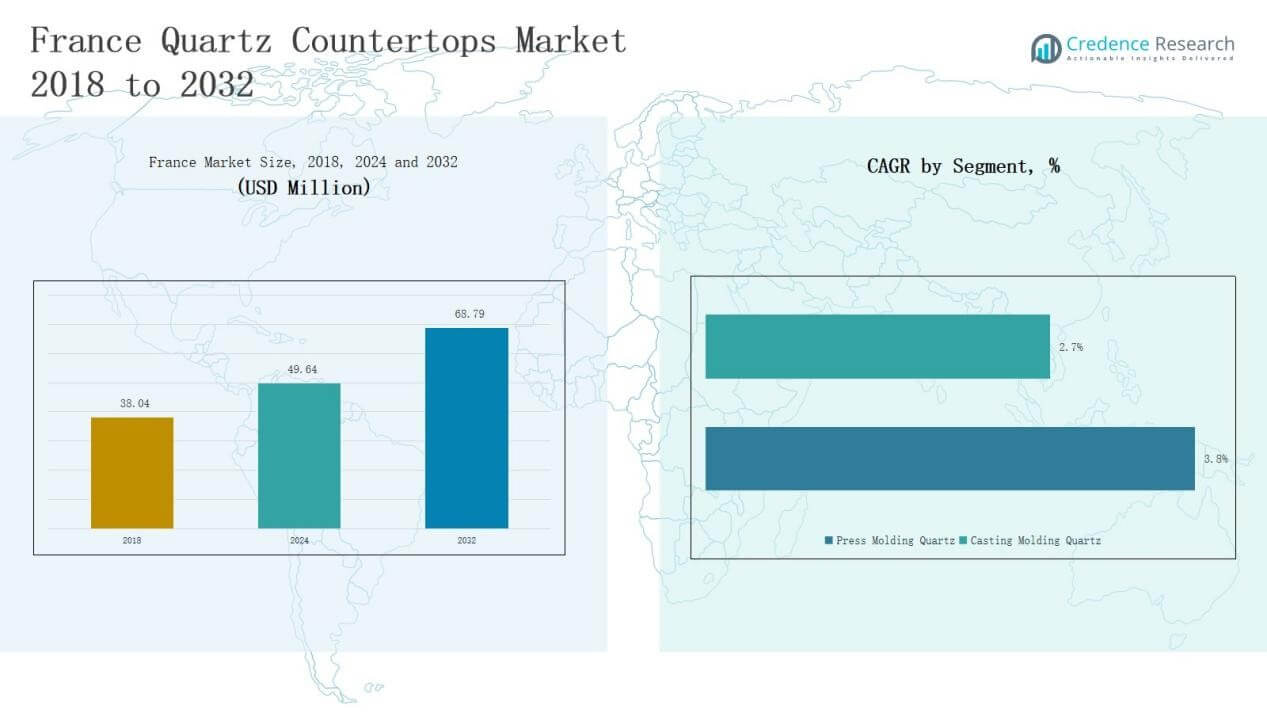

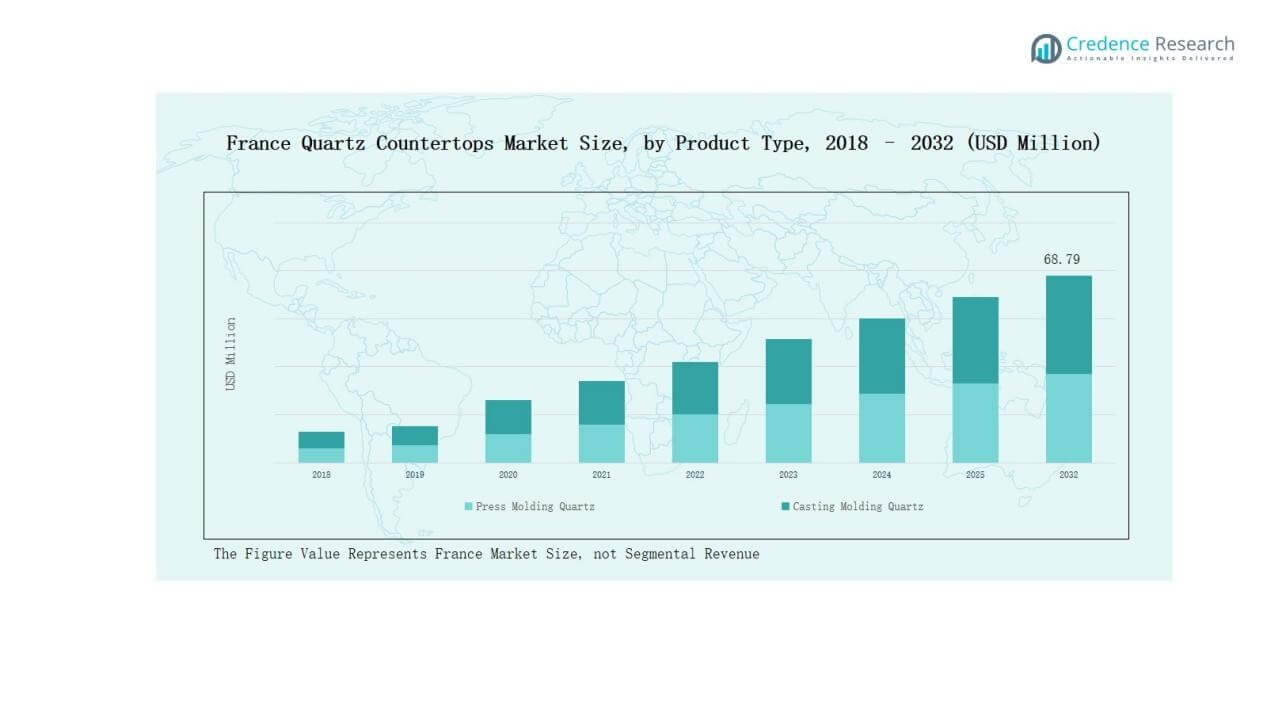

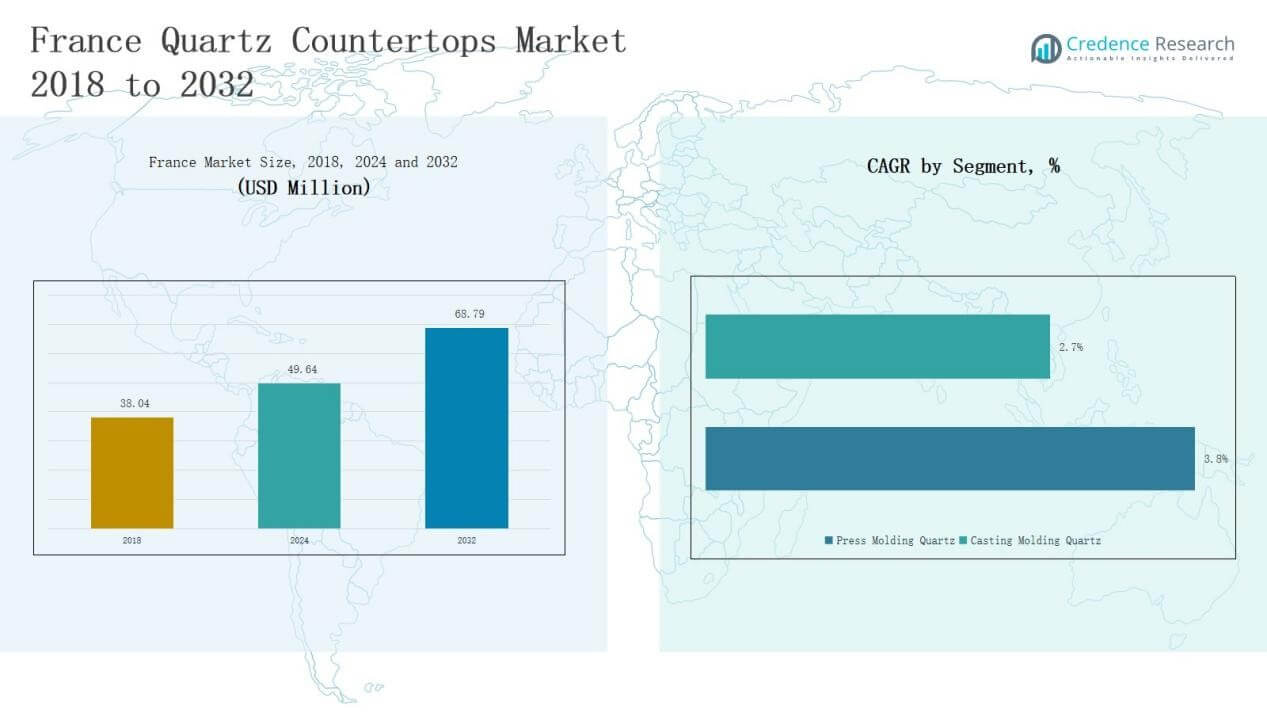

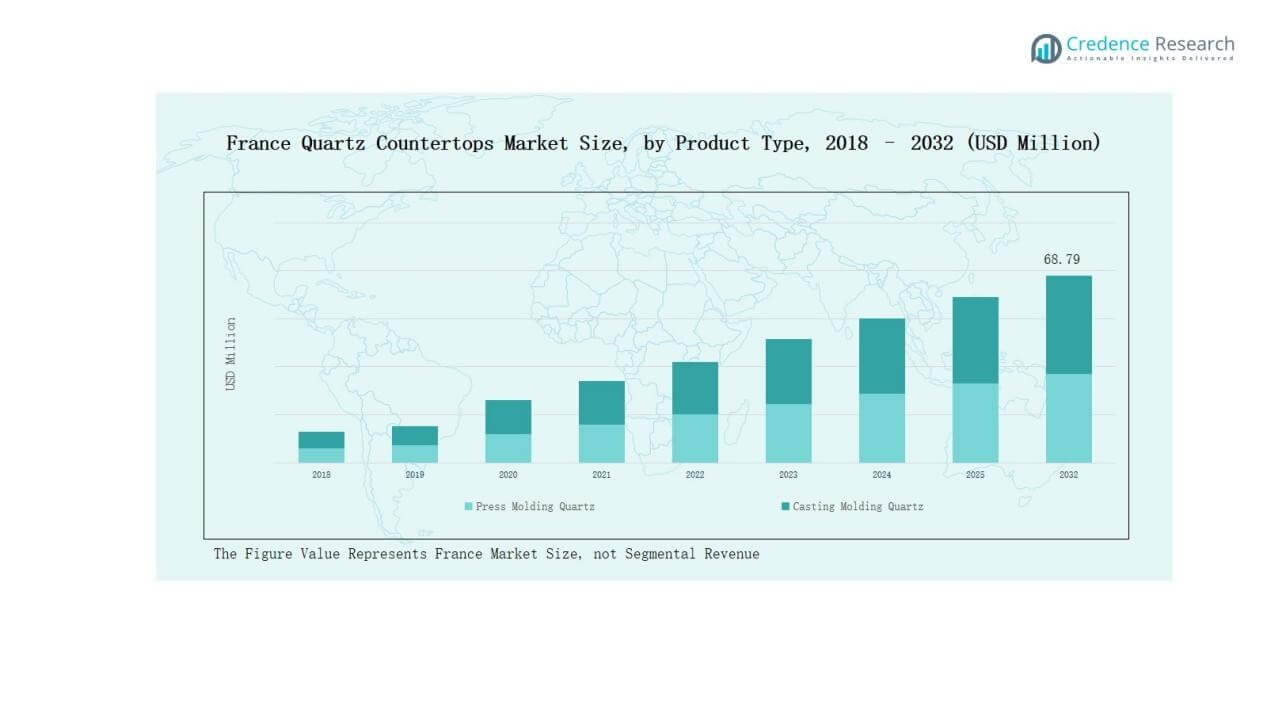

France Quartz Countertops Market size was valued at USD 38.04 million in 2018, reached USD 49.64 million in 2024, and is anticipated to reach USD 68.79 million by 2032, growing at a CAGR of 3.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Countertops Market Size 2024 |

USD 49.64 Million |

| France Quartz Countertops Market, CAGR |

3.87% |

| France Quartz Countertops Market Size 2032 |

USD 68.79 Million |

The France Quartz Countertops Market features strong competition from global and regional players, with Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana holding significant presence. These companies compete through diverse product portfolios, advanced design technologies, and sustainable solutions targeting both residential and commercial applications. Their strategies emphasize customization, premium finishes, and eco-friendly offerings to capture a broader consumer base. Southern France emerged as the leading region in 2024 with 34% share, driven by luxury housing projects, robust tourism infrastructure, and rising commercial real estate investments, positioning it as the key growth hub.

Market Insights

Market Insights

- The France Quartz Countertops Market grew from USD 38.04 million in 2018 to USD 49.64 million in 2024 and is projected to reach USD 68.79 million by 2032, expanding at a CAGR of 3.87%.

- Press molding quartz led with 61% share in 2024 due to cost efficiency and consistency, while casting molding quartz held 39% share, favored for premium and luxury applications.

- The residential segment dominated with 68% share in 2024, supported by rising kitchen and bathroom renovations, while commercial accounted for 22% and others contributed 10%.

- Southern France led regionally with 34% share in 2024, driven by luxury housing, tourism, and commercial real estate, followed by Northern France at 28%, Western France at 20%, and Central and Eastern France at 18%.

- Key players such as Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana compete through advanced designs, sustainable products, and customization strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the France Quartz Countertops Market in 2024 with about 61% share, supported by cost efficiency, consistent finishes, and suitability for large-scale applications. Casting molding quartz captured the remaining 39% share, appealing to premium buyers due to its versatility in replicating marble and granite aesthetics. Press molding is expected to retain leadership through strong demand in residential remodeling and mid-range projects, while casting molding gains traction in luxury and design-focused applications.

For instance, Caesarstone’s process involves combining up to 90% crushed quartz with high-quality polymer resins and pigments.

By Application

The residential segment led with nearly 68% share in 2024, driven by kitchen and bathroom renovations across urban housing markets. Consumers prefer quartz for its durability, stain resistance, and stylish customization. The commercial segment followed with 22% share, supported by hotels, offices, and retail projects emphasizing durability in high-traffic zones. The “Others” segment, holding about 10% share, includes healthcare and institutional projects, where quartz’s hygiene benefits and sustainability features are increasingly valued.

For instance, Silestone by Cosentino launched its HybriQ+ technology, produced with 99% reused water and 100% renewable energy, appealing to hospitals and institutional constructions focused on eco-friendly materials.

Key Growth Drivers

Rising Residential Renovations

Residential remodeling projects remain the strongest driver in the France Quartz Countertops Market. Homeowners are prioritizing modern kitchens and bathrooms, where quartz offers durability, stain resistance, and long-term value. Urban housing demand and increased spending on home improvement further accelerate adoption. Renovation projects in metropolitan areas such as Paris and Lyon highlight quartz’s role as a preferred material. With stylish finishes and low-maintenance features, quartz countertops continue to dominate residential installations, positioning the segment for sustainable revenue growth.

For instance, Cosentino expanded its Silestone Loft Series in France, offering industrial-inspired quartz surfaces that appeal to urban renovation projects.

Expanding Hospitality and Retail Infrastructure

France’s thriving hospitality and retail sectors are fueling quartz demand, particularly in luxury hotels, restaurants, and modern office spaces. Quartz countertops are valued for their durability and ability to withstand high-traffic usage while maintaining aesthetic appeal. Tourism-driven investments, combined with upgrades to commercial interiors, are pushing developers toward modern surface solutions. This trend is reinforced by rising consumer expectations for premium finishes in commercial spaces, making quartz an increasingly attractive choice for architects and interior designers.

Superior Material Performance

Quartz’s superior physical and chemical properties give it a competitive advantage over natural stone alternatives. Its non-porous surface offers resistance to stains, scratches, and bacterial growth, making it suitable for both residential and commercial applications. Unlike granite or marble, quartz requires minimal maintenance, which appeals to modern consumers. Sustainability benefits, including longer lifecycle and recyclability, also support its adoption. These advantages ensure quartz continues to capture market share across France, even amid price competition from alternative surface materials.

For instance, Caesarstone expanded its Porcelain and Mineral Surfaces line in Europe to complement its quartz portfolio, highlighting durability and ease of care for both hospitality and residential sectors.

Key Trends & Opportunities

Key Trends & Opportunities

Growing Demand for Customization

Customization is becoming a defining trend in the France Quartz Countertops Market. Consumers and designers seek unique colors, textures, and finishes to align with evolving style preferences. Digital design technologies and advanced manufacturing allow producers to offer marble-look, matte, or glossy finishes with precision. Customized edge profiles and tailored dimensions further enhance demand across both residential and commercial segments. This trend supports premium product offerings, enabling manufacturers to strengthen brand differentiation and capture design-focused customer bases.

For instance, Cosentino introduced its Silestone Ethereal Collection, offering quartz slabs with marble-inspired veining to meet rising demand for premium customization.

Integration with Sustainable Construction

Sustainability presents a strong opportunity as France increases investment in eco-friendly building materials. Quartz countertops align with green building goals due to their durability, recyclability, and reduced maintenance requirements. Builders and developers prefer materials with lower lifecycle costs and environmental impact. Government-backed sustainability policies and certifications encourage wider adoption. Manufacturers offering eco-certified quartz products gain competitive advantage by catering to environmentally conscious buyers, positioning quartz as a preferred choice for sustainable interior solutions in France’s growing construction sector.

Key Challenges

Price Sensitivity in Mid-Range Market

Price sensitivity poses a challenge in France’s mid-range housing and commercial projects. While quartz offers superior performance, its cost remains higher than alternatives such as laminates or ceramic surfaces. Budget-conscious buyers often opt for these substitutes, limiting quartz penetration in value-driven segments. Developers also weigh material costs when undertaking large-scale projects. To overcome this, manufacturers must balance premium positioning with affordable product lines, ensuring quartz remains competitive without compromising on quality or performance features.

Competition from Alternative Materials

Quartz faces rising competition from natural stones and engineered surfaces offering similar aesthetics at competitive prices. Granite, marble, and solid-surface materials remain popular in high-end and mid-range markets. Emerging substitutes such as sintered stone and porcelain slabs further intensify rivalry by offering comparable durability and style. This competitive landscape pressures quartz manufacturers to continuously innovate in design and performance. Without differentiation, quartz risks losing share to alternatives that attract customers with lower prices or newer design options.

Supply Chain and Raw Material Costs

Fluctuations in raw material availability and supply chain disruptions create challenges for quartz countertop producers. Rising costs of resins, pigments, and quartz aggregates directly impact pricing and margins. France’s reliance on imports for certain inputs makes the market vulnerable to global trade shifts and logistics bottlenecks. Inflationary pressures also increase operational expenses for manufacturers. To mitigate risks, companies must strengthen local sourcing strategies, optimize supply networks, and invest in cost-efficient technologies to sustain profitability and competitiveness.

Regional Analysis

Northern France

Northern France accounted for 28% share of the France Quartz Countertops Market in 2024. Strong urban development and ongoing residential renovation projects drive steady demand. Households prefer quartz for kitchens and bathrooms due to its durability and low maintenance. Commercial adoption is also rising, with hotels and office spaces in cities such as Lille and Rouen installing quartz surfaces. Growing construction activity and consumer preference for modern interiors strengthen the region’s position. It continues to benefit from strong retail distribution networks.

Southern France

Southern France led the market with 34% share in 2024. The region benefits from advanced infrastructure, luxury housing projects, and tourism-driven demand. High adoption of premium quartz surfaces in hotels, resorts, and high-end residences fuels growth. Rising investment in commercial real estate across cities such as Marseille and Nice supports quartz installations. Consumers also favor eco-friendly materials, which boosts sales of sustainable quartz products. The region remains a key growth hub due to its mix of residential and commercial projects.

Western France

Western France held 20% share in 2024. Expanding residential construction and strong renovation activity in urban areas such as Nantes and Rennes support quartz demand. The region’s preference for cost-efficient press molding quartz is evident in middle-income housing projects. Commercial adoption is growing steadily, particularly in retail and hospitality sectors. Local distributors play an important role in ensuring market penetration across suburban areas. It continues to be a competitive region with strong demand for mid-range product categories.

Central and Eastern France

Central and Eastern France represented 18% share in 2024. Demand is primarily driven by residential projects across cities such as Lyon, Clermont-Ferrand, and Strasbourg. Builders prefer quartz for its long lifecycle and consistent performance, which appeals to modern households. The healthcare and institutional sectors in Eastern France also contribute to demand due to quartz’s hygiene benefits. While commercial usage is smaller, it is gradually increasing in urban centers. It remains an emerging region with long-term potential for steady growth.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

- Northern

- Southern

- Western

- Central and Eastern

Competitive Landscape

The France Quartz Countertops Market is characterized by the presence of global leaders and strong regional manufacturers competing through product innovation, design diversity, and pricing strategies. Companies such as Cosentino S.A., Caesarstone, Compac, Technistone, Breton S.p.A., Santa Margherita, Quarella, Lapitec, Quartzforms, and Stone Italiana hold significant market presence with extensive portfolios covering both press molding and casting molding quartz. Their strategies focus on offering advanced finishes, marble-look surfaces, and customized solutions to capture design-conscious consumers. Intense competition drives continuous investment in R&D, sustainable production methods, and digital design technologies. Partnerships with distributors, retailers, and builders strengthen supply networks and widen market access across residential and commercial segments. While global brands dominate premium categories, regional players leverage cost efficiency and local distribution channels to compete in mid-range projects. It remains a competitive market where differentiation through sustainability, product customization, and brand reputation is essential for long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2025, Cosentino Group partnered with Marriott to supply engineered quartz surfaces for hotel renovations across North America.

- In June 2025, Caesarstone launched the ICON™ 2025 collection. These surfaces are crystalline silica-free and contain approximately 80% recycled materials, providing improved depth and durability.

- In May 2025, Technistone unveiled the La Natura 2025 collection, featuring five new nature-inspired designs. The collection emphasizes sustainable production using recycled materials and reduced water consumption.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz countertops will rise with growing residential renovation projects across urban regions.

- Commercial adoption will expand as hotels, restaurants, and offices invest in premium interiors.

- Sustainable quartz surfaces will gain traction supported by eco-friendly construction practices.

- Customization in colors, textures, and edge profiles will remain a major growth driver.

- Technological advancements in digital design will support innovative surface finishes.

- Local distributors and retail channels will play a stronger role in market penetration.

- Luxury housing developments will boost demand for casting molding quartz products.

- Price-competitive press molding quartz will continue to dominate mid-range residential projects.

- Rising tourism infrastructure will create opportunities for premium quartz installations in resorts.

- Global players and regional manufacturers will compete on design innovation and brand reputation.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: