Market Overview

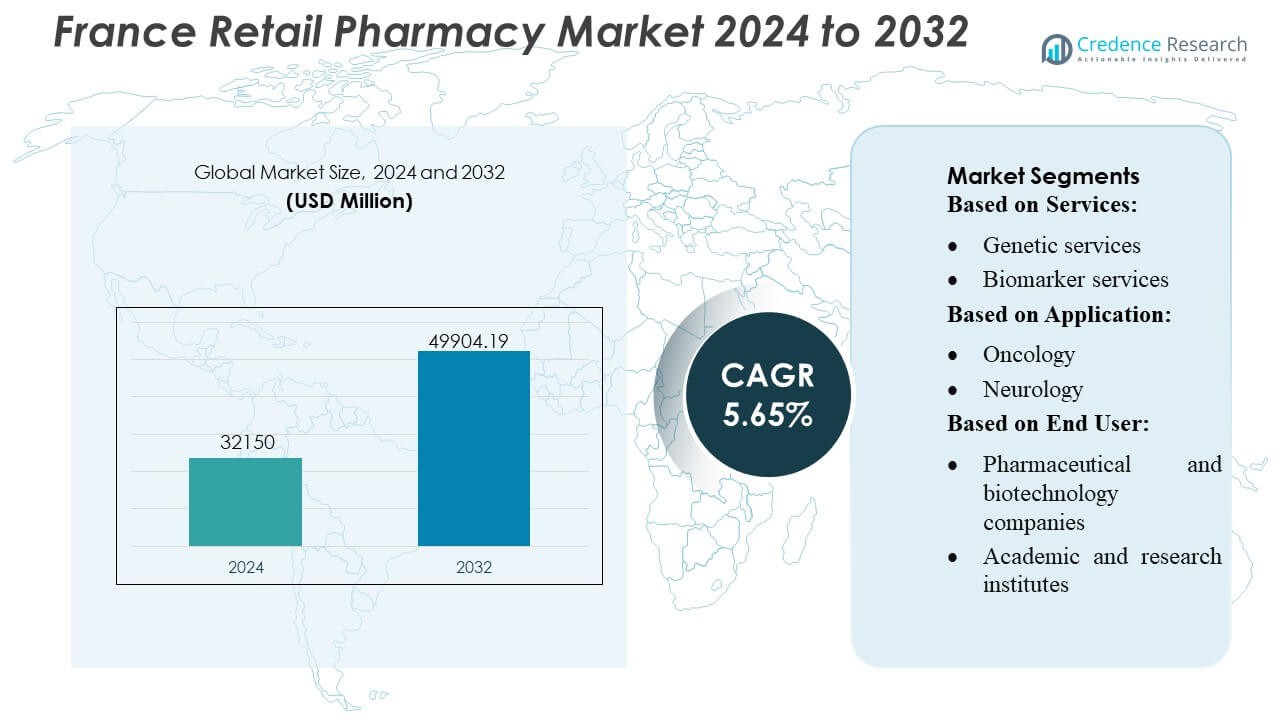

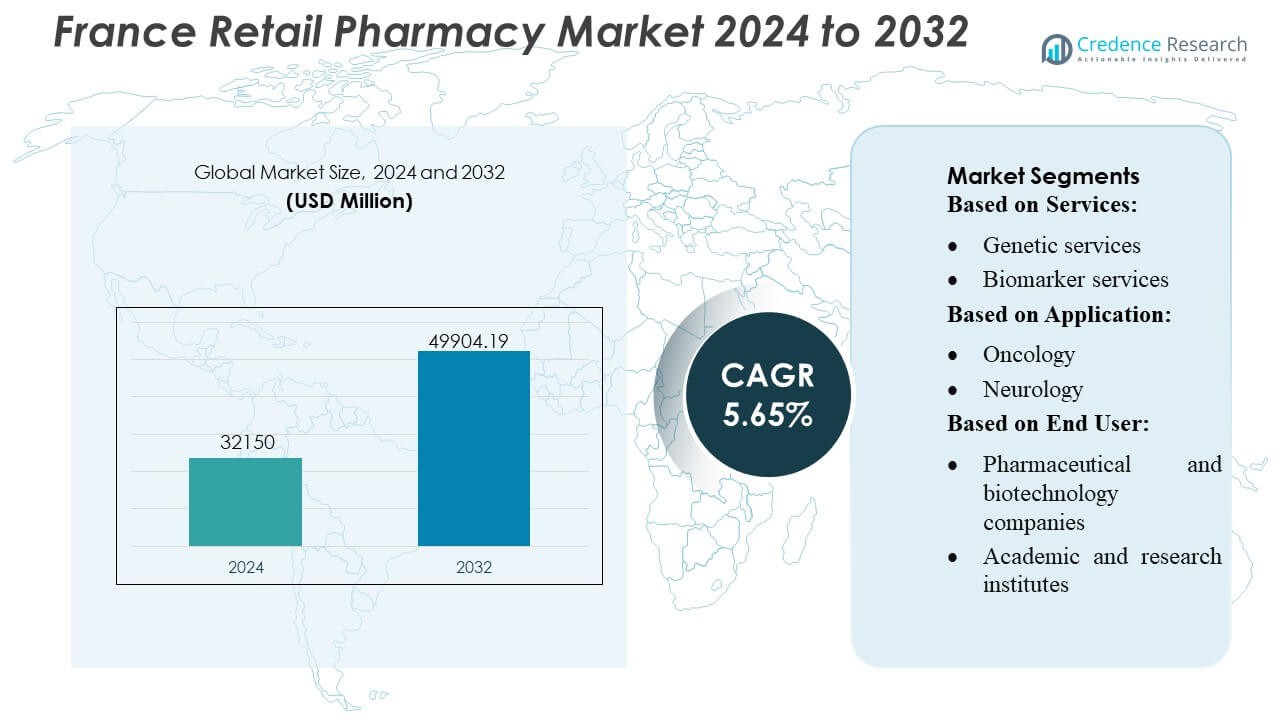

France Retail Pharmacy Market size was valued USD 32150 million in 2024 and is anticipated to reach USD 49904.19 million by 2032, at a CAGR of 5.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Retail Pharmacy Market Size 2024 |

USD 32150 Million |

| France Retail Pharmacy Market, CAGR |

5.65% |

| France Retail Pharmacy Market Size 2032 |

USD 49904.19 Million |

The France Retail Pharmacy Market features strong competition driven by established national pharmacy chains, expanding digital-first networks, and integrated healthcare service providers that continue to modernize dispensing and clinical support capabilities. Leading companies focus on digital prescription processing, chronic disease management, rapid diagnostic services, and personalized care models to strengthen patient engagement and broaden revenue streams. Europe stands as the leading region in the overall market, holding an exact 38% share, supported by robust healthcare infrastructure, advanced regulatory frameworks, and rapid adoption of pharmacist-led clinical services. This regional dominance continues to shape innovation, service expansion, and competitive strategies across France’s retail pharmacy landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Retail Pharmacy Market was valued at USD 32,150 million in 2024 and is projected to reach USD 49,904.19 million by 2032, advancing at a CAGR of 5.65%, driven by rising healthcare demand and expanding pharmacy-led clinical services.

- Strong market drivers include digital prescription adoption, chronic disease management programs, and rapid diagnostic services that enhance accessibility and patient adherence across major pharmacy networks.

- Key market trends reflect growing use of e-pharmacy platforms, automation technologies, and personalized care models, with pharmacies integrating biomarker testing and preventive health programs.

- Competitive intensity increases as retail chains modernize dispensing workflows and expand clinical offerings, while operational restraints include regulatory limitations on pharmacist authority and staffing shortages affecting service scalability.

- Europe leads the market with a 38% regional share, while pharmacy services dominate the segment landscape, particularly clinical and diagnostic offerings, which continue to grow as France accelerates community-based healthcare delivery.

Market Segmentation Analysis:

Market Segmentation Analysis:

- By Services

Genetic services hold the dominant share of approximately 32% in the France Retail Pharmacy Market, driven by the rapid adoption of pharmacogenomic testing and the expansion of personalized medicine programs across national healthcare networks. Pharmacies increasingly integrate genetic screening panels for drug–gene interactions, enabling optimized therapy selection and reducing adverse drug reactions. Biomarker and microbiology services gain traction as retail pharmacies incorporate advanced diagnostic kiosks and digital test-ordering systems, while anatomic pathology support and specimen management remain smaller but steadily growing segments due to rising demand for decentralized clinical workflows.

- For instance, (Med24) that processes over 25,000 order lines per day using automation, demonstrating the type of capabilities that large-scale retail pharmacy networks can leverage to support large-scale diagnostic and specimen-handling operations.

- By Application

Oncology represents the largest application segment, accounting for nearly 38% of market share, supported by France’s strong cancer-screening infrastructure and rising prescriptions for targeted therapies requiring genomic validation. Retail pharmacies play a central role in dispensing oral oncolytics, managing supportive care, and coordinating biomarker test access. Neurology and cardiology applications expand steadily as pharmacies introduce risk-profiling tools and chronic disease management services. Infectious diseases continue to show resilient demand due to widespread use of rapid diagnostic tests, while other applications benefit from the shift toward preventive care and patient-centric clinical pathways.

- For instance, Kroger Health now operates over 2,200 pharmacies across 35 U.S. states and supports more than 17 million patients annually — a scale that demonstrates its capacity to deliver high-volume prescription fulfillment and health services via a robust, distributed network.

- By End-user

Pharmaceutical and biotechnology companies dominate the end-user landscape with an estimated 42% share, driven by strong collaboration with retail pharmacies for companion diagnostics deployment, clinical sampling programs, and post-marketing surveillance initiatives. These partnerships enable broader patient reach and faster real-world evidence generation. Academic and research institutes increasingly utilize pharmacy networks for population-level studies and decentralized sample collection. Other end-users, including diagnostic service providers and digital health companies, expand their presence as pharmacies evolve into hybrid clinical access points offering advanced testing, therapy adherence support, and data-enabled patient services.

Key Growth Drivers

1. Expansion of Clinical and Diagnostic Services

The France retail pharmacy market grows rapidly as pharmacies expand into clinical and diagnostic services, particularly chronic disease monitoring, rapid testing, and personalized care programs. Government-backed initiatives enabling pharmacists to deliver vaccinations, medication reviews, and point-of-care diagnostics strengthen demand. Rising patient preference for accessible, community-based healthcare accelerates uptake of pharmacy-led services. Pharmacies increasingly integrate digital tools, allowing seamless test ordering, biomarker assessments, therapy adjustments, and remote follow-up consultations, supporting broader adoption of clinical services within the retail ecosystem.

- For instance, Humana became the first major U.S. insurer to integrate its health-plan data into the widely used patient portal MyChart — enabling more than 3 million members to access coverage information, benefit details, and plan resources directly through the same app they use for provider appointments.

2. Rising Demand for Personalized and Genomic Medicine

Personalized medicine significantly boosts market growth as retail pharmacies integrate pharmacogenomics, biomarker testing, and therapy-optimization platforms. Increased use of targeted oncology, neurology, and cardiology therapies requires medication adjustments based on genetic profiles, creating strong demand for decentralized genomic services. French pharmacies leverage digital health tools for genetic data interpretation, drug–gene interaction alerts, and individualized treatment recommendations. The rising incidence of chronic conditions and the national focus on personalized health pathways strengthen retail pharmacy involvement in advanced therapeutic decision support.

- For instance, Apollo Pharmacy, Asia’s largest omnichannel pharmacy network, operates more than 7,000 pharmacy outlets across India and supports a vast, technologically advanced supply chain network designed for high-volume operations.

3. Growth of Chronic Disease Burden and Aging Population

France’s rising chronic disease prevalence and rapidly aging population propel demand for pharmacy-based health management solutions. Pharmacies increasingly provide medication adherence support, long-term therapy monitoring, and preventive health programs for cardiovascular, metabolic, and neurological conditions. Their proximity and extended operating hours make them essential touchpoints for elderly patients seeking regular health checks and medication adjustments. Government programs promoting preventive care and shifting routine follow-up services from hospitals to community pharmacies further expand the market and reinforce the pharmacy’s role in long-term disease management.

Key Trends & Opportunities

1. Digital Health Integration and e-Pharmacy Expansion

Digitalization creates major opportunities as pharmacies adopt e-prescriptions, teleconsultation services, AI-driven medication management tools, and integrated patient records. The expansion of e-pharmacies and home-delivery models strengthens convenience-led purchasing, particularly for chronic therapies and wellness products. Pharmacies increasingly deploy digital kiosks, remote diagnostic platforms, and automated dispensing systems to improve efficiency and accuracy. These developments enable greater patient retention, personalized product recommendations, and seamless coordination with healthcare providers, positioning retail pharmacies at the center of France’s digital healthcare transformation.

- For instance, Matsumotokiyoshi Co., Ltd. has strengthened its digital ecosystem through its mobile membership app, which surpassed 18 million registered users, demonstrating how large-scale digital and logistics infrastructure can accelerate e-pharmacy growth and personalized service delivery.

2. Strengthening Role in Preventive and Primary Care

Retail pharmacies gain strategic importance as France accelerates decentralization of primary healthcare. Pharmacies increasingly deliver preventive care services such as vaccinations, cardiovascular risk assessments, lifestyle counseling, and metabolic screenings. Policymakers encourage pharmacists to assume broader clinical responsibilities to relieve pressure on general practitioners. This shift allows pharmacies to expand revenue streams while improving community-level health outcomes. The growing emphasis on early disease detection and public health campaigns creates additional opportunities for pharmacies to scale patient engagement and preventive service offerings.

- For instance, Walmart Inc. reported that its approximately 4,600 U.S. pharmacies administered over 6 million immunizations in a single year, demonstrating how large retail networks can strengthen preventive and frontline care delivery through scalable clinical infrastructure.

3. Expanding Partnerships with Pharma, Biotech, and Diagnostic Companies

Collaborations between pharmacies and pharmaceutical, biotechnology, and diagnostic companies create new revenue pathways. Pharmacies become critical channels for distributing companion diagnostics, supporting real-world evidence studies, and enabling decentralized clinical sampling. Biotech firms increasingly rely on pharmacies to raise patient awareness about specialty drugs and targeted therapies. Partnerships also support innovative therapy-support programs, adherence monitoring, and precision-medicine workflows. These alliances strengthen the pharmacy’s position within therapeutic ecosystems and accelerate access to advanced treatments across France.

Key Challenges

1. Regulatory Constraints and Scope-of-Practice Limitations

Despite expanding responsibilities, pharmacies in France continue to face regulatory constraints that limit their ability to deliver higher-complexity services. Strict rules surrounding diagnostic testing, prescribing rights, and reimbursement frameworks slow adoption of advanced clinical offerings. Pharmacists require additional certifications for certain services, delaying operational scaling. Variation in regional implementation of healthcare policies creates uncertainties for service expansion. These regulatory boundaries hinder full integration of pharmacies into care pathways and restrict revenue growth from emerging clinical service categories.

2. Workforce Shortages and Operational Capacity Pressures

Pharmacies face increasing pressure due to workforce shortages, rising patient volumes, and expanding clinical responsibilities. Limited availability of trained pharmacists and technicians complicates delivery of time-intensive services such as chronic care management, genomic counseling, and diagnostic support. Increased administrative workload from digital platforms and care coordination adds operational strain. Smaller pharmacies struggle to invest in automation or specialized equipment, widening performance gaps within the sector. Workforce and capacity constraints may slow service diversification and limit the market’s ability to meet evolving healthcare demands.

Regional Analysis

North America

North America holds approximately 34% of the France Retail Pharmacy Market’s global share, supported by strong healthcare spending, rapid adoption of digital pharmacy solutions, and high demand for advanced medication management services. The region benefits from mature retail chains, extensive e-pharmacy penetration, and favorable reimbursement structures that enhance access to chronic disease therapies. Expanding roles for pharmacists in clinical services—such as immunizations, diagnostic testing, and chronic care consultations—reinforce market strength. Technological integration, including AI-driven prescription systems and automated dispensing, continues to reshape pharmacy operations and patient engagement across the region.

Europe

Europe dominates the global landscape with around 38% market share, driven by well-established pharmacy regulations, strong public healthcare infrastructure, and increasing adoption of pharmacist-led clinical services. France plays a central role within the region due to its expanding scope-of-practice policies, rapid digital health integration, and rising demand for preventive care. European pharmacies benefit from structured reimbursement models, high chronic disease prevalence, and widespread use of e-prescriptions. Collaboration between pharmacies, diagnostic service providers, and biotech companies strengthens access to personalized medicine, while continued emphasis on population-wide screening programs sustains regional momentum.

Asia-Pacific

Asia-Pacific accounts for roughly 22% of market share, supported by growing healthcare modernization, rising retail pharmacy consolidation, and increasing demand for chronic disease management. Pharmacies in emerging economies such as India, China, and Southeast Asia expand rapidly due to urbanization and improving access to healthcare services. Digital health adoption accelerates through e-pharmacies, teleconsultations, and mobile prescription platforms. The region’s expanding middle-class population drives demand for wellness products, self-care therapies, and over-the-counter medications. Regulatory reforms enabling pharmacists to deliver broader clinical services further strengthen APAC’s long-term market potential.

Latin America

Latin America holds nearly 4% of market share, reflecting gradual expansion of pharmacy networks and rising consumer dependence on retail channels for primary healthcare needs. Countries such as Brazil, Mexico, and Colombia experience increased demand for chronic disease medications, preventive health products, and affordable generics. Pharmacist-delivered immunizations and point-of-care testing gain traction as governments expand access to community health services. Despite market opportunities, variability in regulatory frameworks and economic fluctuations slows large-scale modernization. Growing partnerships with pharmaceutical manufacturers and digital platforms improves pharmacy accessibility and operational efficiency across urban centers.

Middle East & Africa

The Middle East & Africa region contributes approximately 2% of market share, characterized by developing pharmacy infrastructures and rising investment in community healthcare services. Gulf countries, including UAE and Saudi Arabia, lead adoption of modern retail pharmacy formats, offering chronic care support, wellness products, and limited diagnostic services. Increasing healthcare digitalization and expanding insurance coverage strengthen demand. In Africa, market growth remains gradual due to supply-chain gaps and limited pharmacist availability, but ongoing reforms and private-sector investments enhance retail pharmacy penetration and broaden access to essential therapies.

Market Segmentations:

By Services:

- Genetic services

- Biomarker services

By Application:

By End User:

- Pharmaceutical and biotechnology companies

- Academic and research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the France Retail Pharmacy Market players such as MedPlusMart.com, Well Pharmacy, The Kroger Co., Humana, Apollo Pharmacy, Matsumotokiyoshi Co., Ltd., Walmart Inc., Rite Aid Corp., MCKESSON CORPORATION, and Boots Walgreens. the France Retail Pharmacy Market is defined by strong domestic pharmacy networks, expanding digital health platforms, and rising integration of clinical services within retail settings. Pharmacies increasingly adopt advanced dispensing systems, e-prescription workflows, and AI-enabled medication management tools to enhance service efficiency and improve patient outcomes. Competition intensifies as pharmacies broaden their scope to include diagnostic testing, vaccination services, chronic disease monitoring, and personalized therapy support. The market also benefits from partnerships with pharmaceutical manufacturers, diagnostic service providers, and health insurers that enable wider access to targeted therapies and companion diagnostics. As consumer expectations shift toward convenience, transparency, and preventive care, retail pharmacies differentiate themselves through expanded care models, digital engagement, and wellness-focused product portfolios. Regulatory reforms that grant pharmacists greater clinical authority further shape competitive positioning and accelerate innovation across the French retail pharmacy ecosystem.

Key Player Analysis

- com

- Well Pharmacy

- The Kroger Co.

- Humana

- Apollo Pharmacy

- Matsumotokiyoshi Co., Ltd.

- Walmart Inc.

- Rite Aid Corp.

- MCKESSON CORPORATION

- Boots Walgreens

Recent Developments

- In January 2025, Walmart Inc. announced availability of same-day pharmacy delivery service in 49 states of the U.S. Through this strategic advancement, the company has integrated pharmacy, grocery and general merchandise services.

- In September 2024, CVS Health launched hormonal contraceptive prescribing services at its Massachusetts pharmacies to improve access to birth control. This expansion of their services was part of a broader strategy to adapt healthcare to changing dynamics and make reproductive health more accessible for patients.

- In June 2024, Labcorp introduced Labcorp Global Trial Connect, a Suite of digital and data solutions designed to improve clinical trial efficiency, reduce data delays and simplify investigator site workflows.

- In March 2024, OHAUS Corporation unveiled its latest innovations, the FRONTIER 5720R and FRONTIER 5830R Multi-Pro Refrigerated Centrifuges. These state-of-the-art centrifuges are designed to meet the diverse needs of modern laboratories, offering exceptional versatility, speed, and reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Services, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market increasingly shifts toward clinical service delivery as pharmacies expand diagnostic testing, vaccinations, and chronic care support.

- Digital health integration accelerates with wider adoption of e-prescriptions, teleconsultations, and AI-enabled medication management.

- Personalized medicine gains traction as pharmacies incorporate pharmacogenomics, biomarker testing, and targeted therapy support.

- Retail pharmacies strengthen their role in preventive care through screening programs and lifestyle management services.

- Automation and smart dispensing technologies improve operational efficiency and reduce medication errors.

- Pharmacy chains invest in digital platforms to enhance patient engagement, home delivery, and adherence monitoring.

- Collaborations with pharmaceutical and biotech companies deepen to support companion diagnostics and real-world evidence initiatives.

- Regulatory reforms continue expanding pharmacists’ clinical authority and reimbursement opportunities.

- Aging populations increase demand for long-term therapy management and community-based healthcare access.

- Competition intensifies as pharmacies diversify product offerings and integrate wellness, nutritional, and self-care solutions.

Market Segmentation Analysis:

Market Segmentation Analysis: