Market Overview

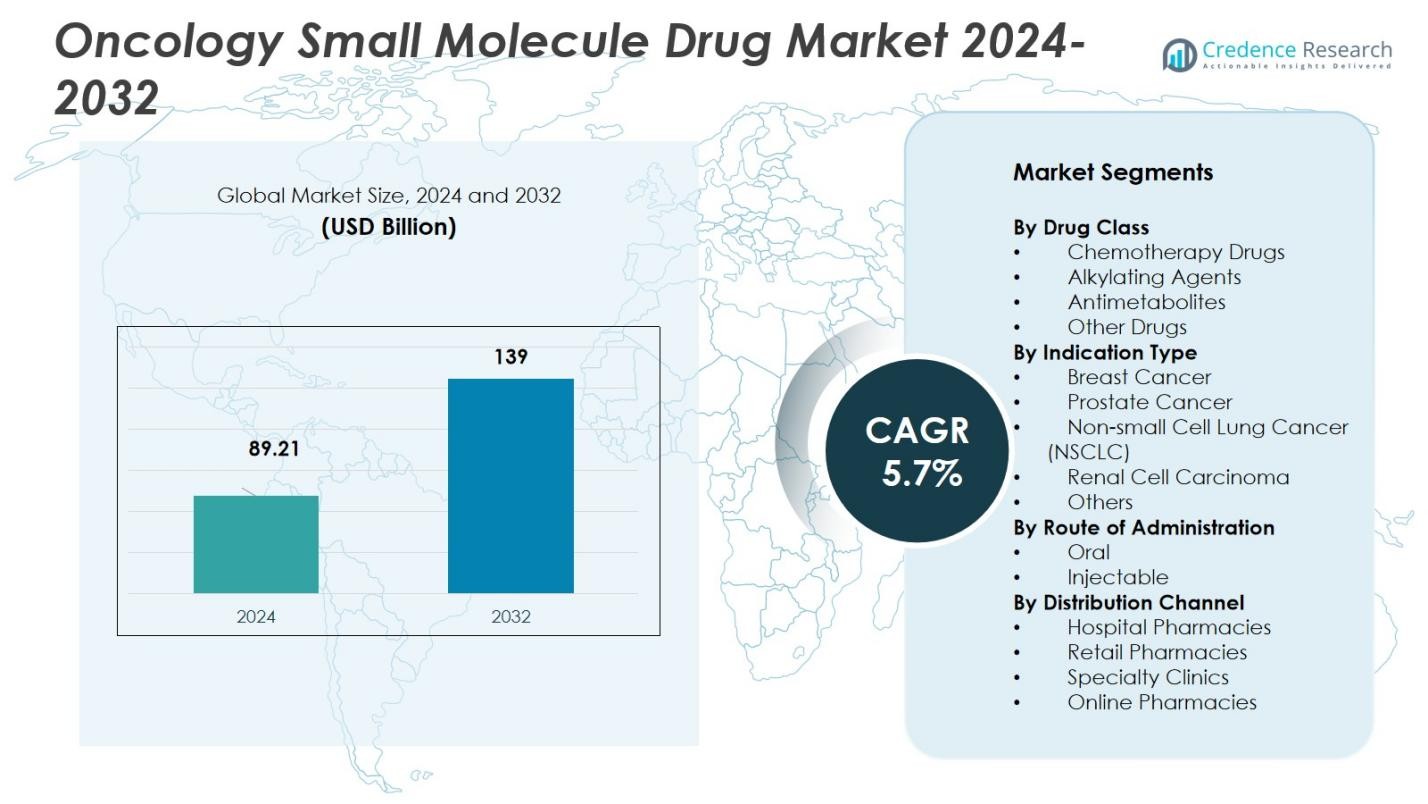

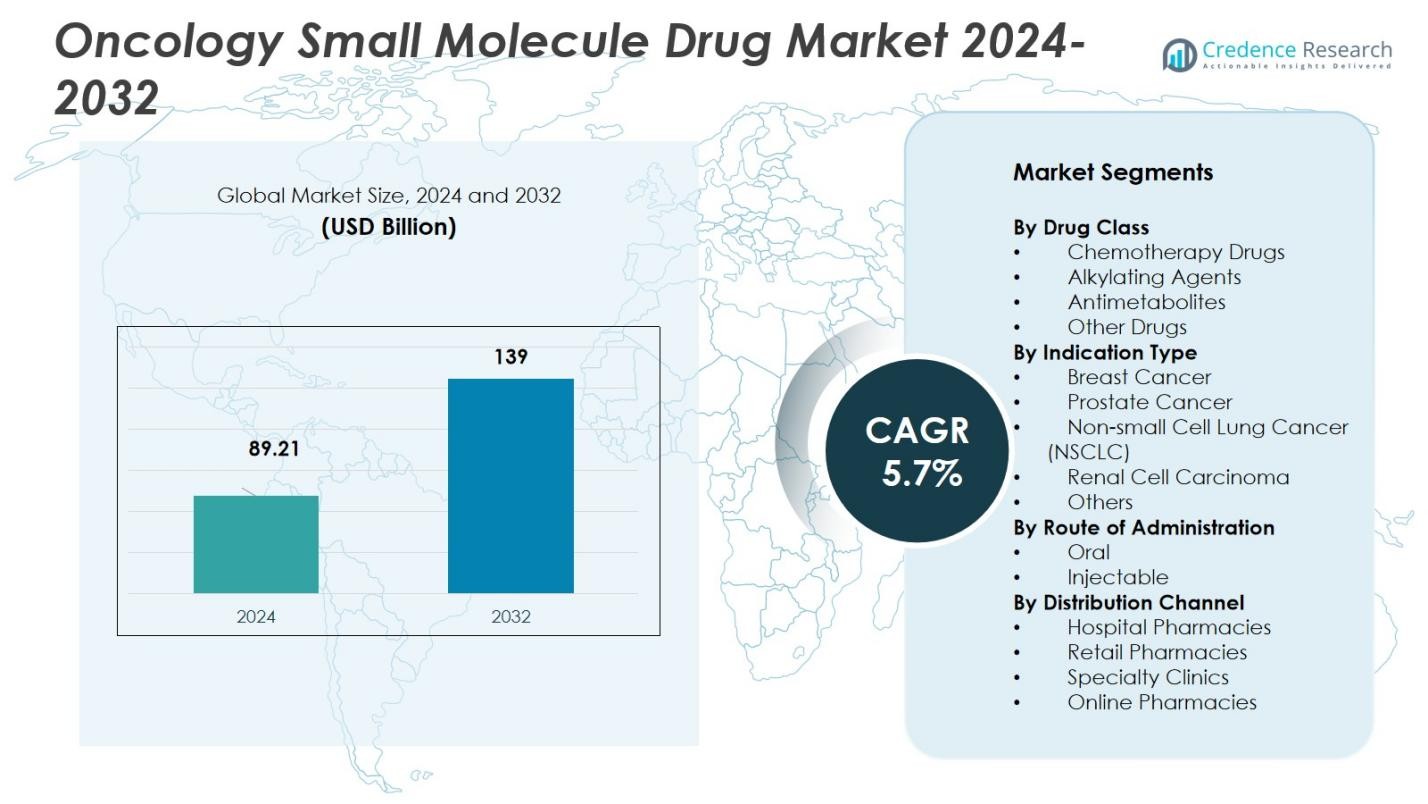

The Oncology Small Molecule Drug Market size was valued at USD 89.21 Billion in 2024 and is anticipated to reach USD 139 Billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oncology Small Molecule Drug Market Size 2024 |

USD 89.21 Billion |

| Oncology Small Molecule Drug Market, CAGR |

5.7% |

| Oncology Small Molecule Drug Market Size 2032 |

USD 139 Billion |

The Oncology Small Molecule Drug Market is led by major players including Pfizer Inc., F. Hoffmann‑La Roche Ltd., AbbVie Inc., AstraZeneca plc and Novartis AG, whose extensive portfolios and robust R&D pipelines drive competitive advantage. These companies consistently launch novel small‑molecule oncology therapies, expand indications, and invest in targeted and precision medicine, sustaining market momentum. The leading region for this market is North America, which holds a market share of 46%; the region’s well‑established healthcare infrastructure, advanced diagnostics and high rate of drug approvals support highest uptake of small‑molecule oncology therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Oncology Small Molecule Drug Market was valued at USD 89.21 Billion in 2024 and is anticipated to reach USD 139 Billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- Key growth drivers include increasing cancer incidence globally, advancements in precision medicine, and substantial investments in oncology drug development, driving demand for targeted and oral therapies.

- The market is witnessing significant trends such as the rising adoption of personalized medicine and combination therapies, particularly targeted drugs combined with immunotherapy to enhance efficacy.

- Major players such as Pfizer Inc., F. Hoffmann-La Roche Ltd., AbbVie Inc., and AstraZeneca plc are strengthening their positions through strategic acquisitions, R&D, and collaborations to expand market presence.

- North America leads the market with a 46% share, followed by Asia Pacific with 23%, driven by rising healthcare access and increasing adoption of oncology therapies in these regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Drug Class

The “Targeted Therapy Drugs” sub‑segment dominates the oncology small molecule drug market with a 34.5% share in 2024. This leading position stems from the increasing adoption of precision medicine, where molecular diagnostics guide the use of targeted agents against specific oncogenic pathways. The growing prevalence of actionable genetic mutations across various tumor types and favorable safety profiles compared to traditional cytotoxic agents drive demand. Furthermore, robust R&D pipelines and regulatory approvals of novel kinase and pathway inhibitors continue to expand the targeted‑therapy portfolio, reinforcing its market leadership.

- For instance, Pfizer’s Ibrance (palbociclib) has demonstrated significant effectiveness in HR-positive breast cancer by inhibiting cyclin-dependent kinases, becoming a standard targeted therapy option.

By Indication Type

Within indication‑based segmentation, the “Non‑small Cell Lung Cancer (NSCLC)” sub‑segment commands the largest share at 28.2%. This dominance reflects NSCLC’s high global incidence and historically limited treatment options, prompting intense clinical and commercial focus. Advances in molecular diagnostics, such as EGFR, ALK, and ROS1 mutation testing, enable precise targeted‑therapy prescriptions, boosting uptake. In parallel, growing awareness, screening improvements, and expanding lines of therapy contribute to rising demand for small molecule drugs in NSCLC, consolidating its top position among indications.

- For instance, Pfizer’s ALK inhibitor, Lorbrena (lorlatinib), demonstrated a 48% overall response rate in ALK-positive NSCLC patients, expanding treatment options.

By Route of Administration

The “Oral” route of administration leads with a 62.5% share of the oncology small molecule drug market. Oral formulations offer clear advantages in patient convenience, allowing self‑administration at home and reducing hospital visits — a compelling factor for both patients and payers. Additionally, oral drugs support chronic dosing schedules and maintenance therapy regimens common in modern oncology, which enhances adherence and quality of life. As a result, pharmaceutical developers increasingly prioritize oral small‑molecule formulations over injectables, sustaining the route’s dominant market position.

Key Growth Drivers

Increasing Cancer Incidence and Prevalence

The rising global incidence of cancer remains a major driver for the oncology small molecule drug market. As the population ages and lifestyle factors contribute to higher cancer rates, the demand for effective therapies continues to grow. The incidence of cancers like breast, lung, and prostate is steadily increasing, fueling the need for innovative treatment options. In response, pharmaceutical companies are investing heavily in the development of new small molecules designed to target specific cancer pathways, further expanding the market.

- For instance, pharmaceutical companies like Roche have developed small molecule inhibitors specifically designed to target molecular pathways implicated in these cancers, enhancing treatment efficacy.

Advances in Precision Medicine

Precision medicine is reshaping oncology treatments by enabling tailored therapies based on genetic mutations and biomarkers. This approach enhances the efficacy of small molecule drugs, as they can be designed to target specific genetic alterations in tumors, improving patient outcomes. The growing availability of genomic testing and targeted therapies is boosting market demand, particularly in indications like NSCLC and breast cancer. The shift toward personalized treatment is expected to accelerate, driving further growth in the oncology small molecule drug sector.

- For instance, AstraZeneca focuses on targeted therapies for lung and breast cancers, leveraging artificial intelligence to optimize clinical trials for precision oncology drugs.

Rising Investment in Cancer Research and Development

Ongoing advancements in cancer research are a key factor driving market growth. Increased funding for oncology drug discovery, particularly for small molecule therapeutics, is leading to the development of novel agents with improved efficacy and reduced toxicity. Pharmaceutical giants and biotech companies are collaborating on clinical trials, spurring innovation in both existing and emerging small molecule drugs. The high success rates of recent drug approvals and the expanding pipeline of oncology therapies indicate that R&D investment will continue to propel market expansion.

Key Trends & Opportunities

Adoption of Targeted Therapies

Targeted therapies are becoming an increasingly prevalent trend in the oncology small molecule drug market. These therapies focus on specific molecular targets associated with cancer cells, allowing for more precise and less toxic treatment options. As genomic research uncovers new molecular targets, the potential for targeted small molecules is expanding. This trend is supported by regulatory approvals and positive clinical trial outcomes, positioning targeted therapies as a promising opportunity for market players to meet the growing demand for personalized cancer treatment.

- For instance, small-molecule drugs effectively penetrate cells to disrupt enzymes in cancer progression, particularly in lung and blood cancers, with oral formulations improving patient adherence.

Expanding Role of Combination Therapies

Combination therapies, which involve using small molecule drugs alongside other treatment modalities such as immunotherapy or chemotherapy, are gaining momentum. This trend is driven by the need to enhance treatment efficacy, overcome drug resistance, and reduce side effects. The combination of targeted small molecule drugs with immunotherapies like PD-1/PD-L1 inhibitors has shown significant potential in treating various cancers, including melanoma and NSCLC. As clinical trials continue to validate these combinations, the market for oncology small molecule drugs will expand, offering new opportunities for both existing and emerging players.

- For instance, the combination of nivolumab (anti-PD-1 monoclonal antibody) and ipilimumab (anti-CTLA-4 monoclonal antibody) has demonstrated significant antitumor effects in various cancers by boosting immune response, as evidenced in multiple clinical trials.

Key Challenges

High Treatment Costs and Access Issues

The high cost of oncology treatments, including small molecule drugs, presents a significant challenge to market growth. The expense of drug development, along with ongoing treatment regimens, makes these therapies inaccessible to a large segment of the global population, especially in low- and middle-income countries. While small molecule drugs are often considered more cost-effective than biologics, the overall cost of cancer care remains a barrier to widespread adoption, limiting the market’s potential in certain regions.

Drug Resistance and Limited Efficacy

A major challenge faced by the oncology small molecule drug market is the development of drug resistance. Many cancers eventually become resistant to the therapies that initially show effectiveness, necessitating the development of second-line treatments. Drug resistance can limit the long-term efficacy of small molecule drugs, leading to treatment failure. Additionally, the heterogeneity of tumors and genetic mutations complicates the development of drugs that can target a wide range of cancer types effectively. Addressing this challenge is critical for sustained market growth.

Regional Analysis

North America

North America commands a leading position in the oncology small molecule drug market, accounting for 46% of global revenue in 2024. The region’s dominance stems from its advanced healthcare infrastructure, high cancer prevalence, and substantial investments in R&D and clinical development by major pharmaceutical companies. Regulatory frameworks supporting rapid drug approvals and widespread adoption of innovative therapies further reinforce this dominance. The strong presence of well‑established market players and high patient access to diagnostics and treatment elevate demand for small molecule oncology therapeutics across the region, which continues to lead in both market share and revenue.

Asia Pacific

The Asia Pacific region holds a growing share of 23% in the global oncology small molecule drug market. Expanding demand is driven by increasing cancer incidence, rising healthcare penetration, and improving infrastructure. Emerging economies such as China and India contribute significantly to growth as governments invest in oncology care and expand access to cancer treatments. The region benefits from growing awareness, improved diagnostics, and rising adoption of targeted therapies and oral small-molecule regimens. Asia Pacific’s growth dynamics make it a key growth engine, with expected expansion in both the patient population and therapeutic access.

Europe

Europe accounts for 22% of the global oncology small molecule drug market in 2024. The region’s market is bolstered by comprehensive healthcare systems, strong regulatory frameworks, and high penetration of advanced cancer therapies. The emphasis on early detection, widespread screening programs, and reimbursement policies supports the uptake of small molecule oncology drugs. A mature pharmaceutical industry and active clinical development further sustain demand. Europe’s consistent adoption of targeted therapies and integration of small molecule drugs into standard-of-care regimens across multiple cancer types reinforce its significant contribution to global market share.

Latin America

Latin America holds a smaller but growing share of 4% in the global oncology small molecule drug market. Expanding healthcare access, increasing government and private healthcare investment, and rising public awareness about cancer are key growth drivers. However, challenges such as pricing sensitivity, varied healthcare infrastructure, and limited access to advanced diagnostics moderate market penetration. As small molecule therapies become more accessible and healthcare systems strengthen, the region presents emerging opportunities for market expansion. Increased healthcare funding and better distribution networks will fuel further growth in the coming years.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 5% of the global oncology small molecule drug market. This region is constrained by uneven healthcare infrastructure, limited access to advanced treatments, and variable regulatory environments. However, increasing awareness of cancer care, rising healthcare expenditure in several Gulf countries, and gradual improvements in oncology services are supporting market growth. As access to diagnostics and therapies improves, the MEA region is poised to see incremental adoption of small molecule oncology drugs, with the potential for growth driven by healthcare improvements and regional collaborations.

South & Central America / Other Emerging Regions

South & Central America, along with other emerging regions, holds a modest 2% share of the global oncology small molecule drug market. The demand in these regions is driven by increasing cancer burden, growing demand for affordable therapies such as oral small molecules, and expanding public and private investment in healthcare infrastructure. While adoption rates are lower compared to developed regions, these areas show long-term growth potential as healthcare access and awareness improve. The increasing focus on cancer care and treatment accessibility in these regions will drive gradual market expansion in the coming years.

Market Segmentations:

By Drug Class

- Chemotherapy Drugs

- Alkylating Agents

- Antimetabolites

- Other Drugs

- Proteasome Inhibitors

- Tyrosine Kinase Inhibitors

- mTOR Inhibitors

- Others

By Indication Type

- Breast Cancer

- Prostate Cancer

- Non-small Cell Lung Cancer (NSCLC)

- Renal Cell Carcinoma

- Others

By Route of Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Specialty Clinics

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The oncology small molecule drug market is highly competitive, with key players such as Pfizer Inc., F. Hoffman-La Roche Ltd., AbbVie Inc., AstraZeneca plc, and Novartis AG leading the market. These companies are continuously expanding their product portfolios through innovative drug development, strategic acquisitions, and partnerships. Pfizer, for instance, has strengthened its oncology division with the launch of targeted therapies for lung and breast cancer, while Roche’s presence in personalized medicine, particularly in targeted therapies for various cancers, continues to grow. Additionally, pharmaceutical giants like AstraZeneca and AbbVie are focusing on developing therapies for high unmet needs in areas such as prostate and ovarian cancer. The market is characterized by high investment in R&D, with firms striving to advance precision medicine and develop oral formulations for ease of use. As competition intensifies, players are also leveraging collaborations with biotech companies and clinical trials to gain market share and drive growth.

Key Player Analysis

- Incyte Corporation

- Millennium Pharmaceuticals

- Pfizer Inc

- F. Hoffman-La Roche Ltd

- Amgen Inc

- Novartis AG

- Eli Lilly and Company

- AbbVie Inc

- AstraZeneca plc

- Sanofi S.A.

Recent Developments

- In November 2025, Johnson & Johnson agreed to acquire Halda Therapeutics for USD 3.05 billion, adding Halda’s pipeline of oral targeted therapies for solid tumors including a lead candidate in prostate cancer to J&J’s oncology portfolio.

- In July 2025, Pfizer Inc. completed a licensing agreement with 3SBio to bolster its investigational cancer‑therapy portfolio.

- In April 2025, Novartis AG announced a planned USD 23 billion investment over five years to expand its U.S.-based manufacturing and R&D footprint, strengthening its ability to supply oncology small molecule drugs for U.S. patients.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Indication Type, Route of Administration, Distribtuion Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The oncology small molecule drug market is expected to continue expanding as the global cancer burden rises.

- Increasing adoption of personalized and targeted therapies will drive the demand for small molecule drugs.

- Growing investment in cancer research and development will result in more innovative and effective small molecule drugs.

- The trend toward oral formulations will further enhance market growth by improving patient convenience and adherence.

- Advancements in precision medicine, including the identification of new biomarkers, will fuel the development of next-generation small molecule therapies.

- Market players will focus on expanding the indications for existing small molecule drugs to increase their clinical utility.

- Collaboration between pharmaceutical companies and biotechnology firms will lead to more comprehensive treatment options.

- Regulatory agencies are expected to continue streamlining the approval process for oncology drugs, facilitating market entry.

- The increasing availability of diagnostic tools for early cancer detection will lead to earlier treatment interventions, boosting drug adoption.

- Emerging markets, particularly in Asia Pacific and Latin America, will present significant growth opportunities as healthcare access improves

Market Segmentation Analysis:

Market Segmentation Analysis: