Market Overview

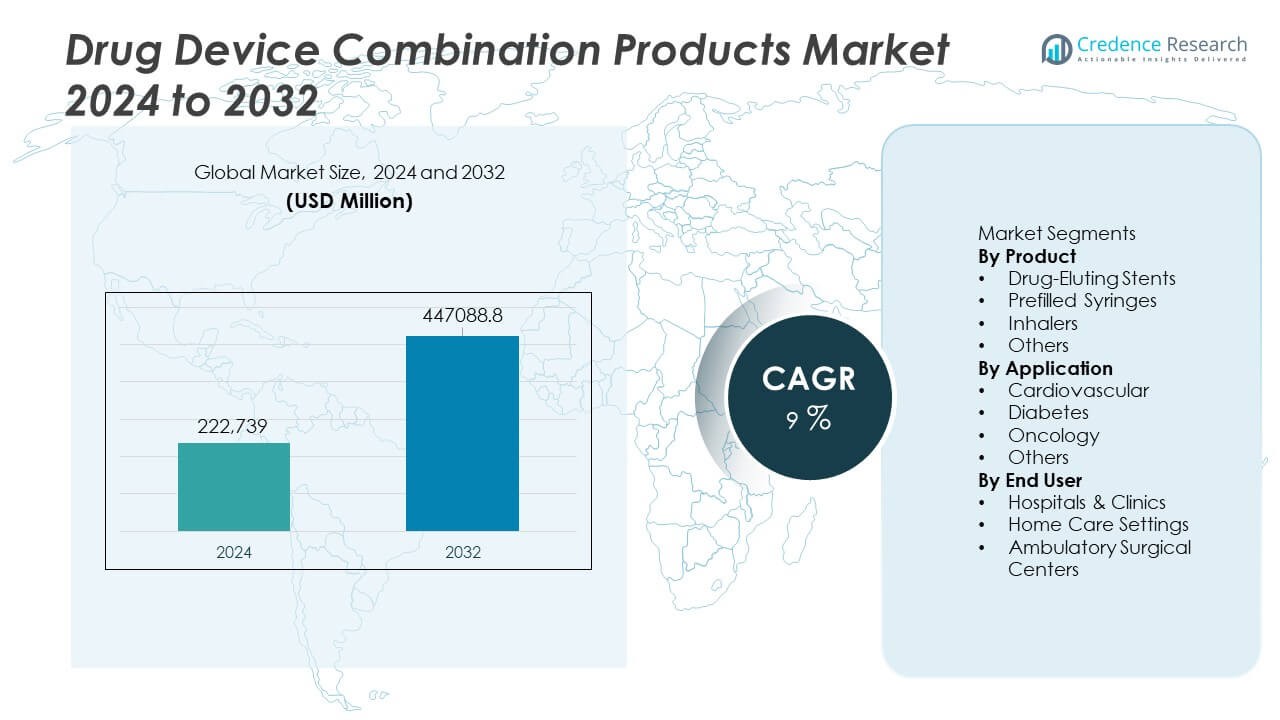

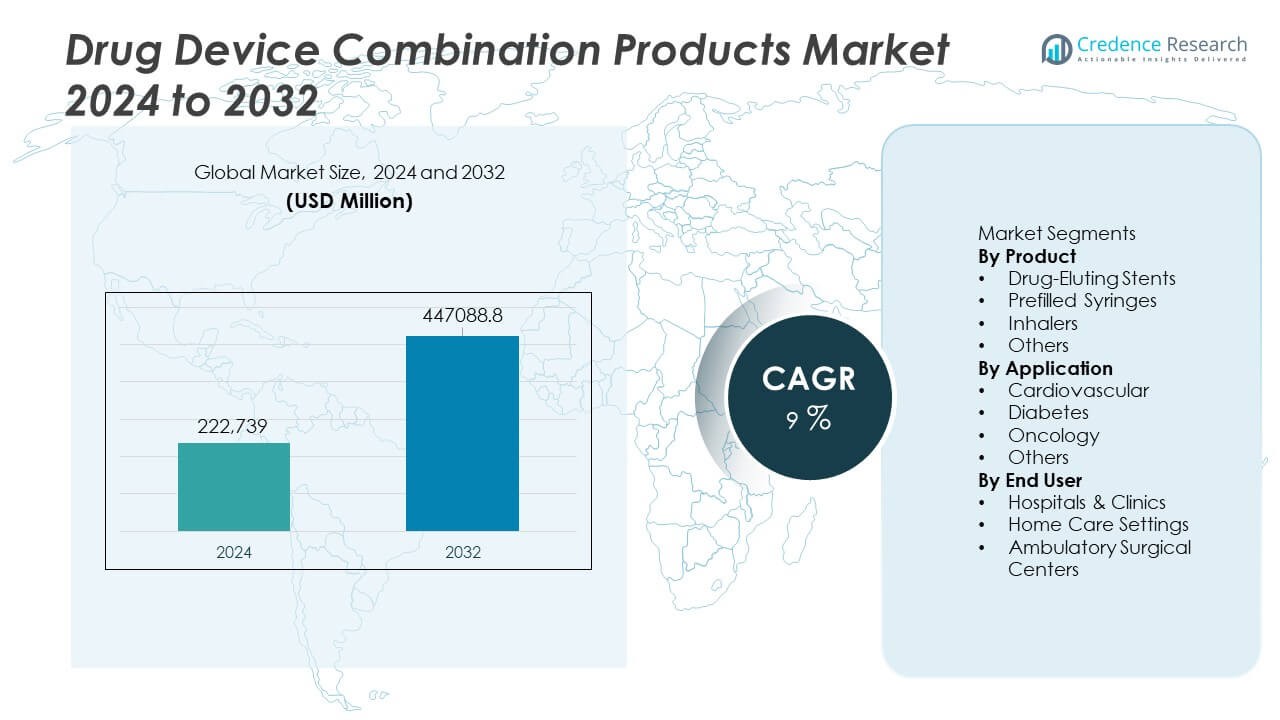

The Drug Device Combination Products Market was valued at USD 222,739 million in 2024 and is projected to reach USD 447,088.8 million by 2032, growing at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Device Combination Products Market Size 2024 |

USD 222,739 Million |

| Drug Device Combination Products Market, CAGR |

9% |

| Drug Device Combination Products Market Size 2032 |

USD 447,088.8 Million |

The Drug Device Combination Products market is driven by leading companies such as Novartis AG, Teleflex Incorporated, Medtronic, Stryker, Becton, Dickinson and Company, Sensely Inc., W. L. Gore & Associates, Inc., Terumo Medical Corporation, Viatris Inc., Boston Scientific Corporation, and Abbott, each advancing integrated drug-delivery systems that enhance precision, safety, and patient adherence. These companies focus on innovation in drug-eluting technologies, prefilled platforms, smart inhalation devices, and wearable injectors. North America leads the market with 41% share, supported by strong adoption of minimally invasive therapies and biologics. Europe follows with 28% share, driven by stringent safety standards and growing chronic disease prevalence, while Asia Pacific accounts for 23% share, fueled by expanding healthcare access and rising demand for self-administration devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drug Device Combination Products market reached USD 222,739 million in 2024 and will grow at a CAGR of 9% through 2032.

- Demand increases as chronic diseases rise and providers adopt drug-eluting stents, prefilled syringes, and smart inhalers to improve treatment precision and patient adherence.

- Digital integration, biologics expansion, and connected delivery systems shape major trends, with drug-eluting stents leading the product segment at 37% share.

- Competition intensifies as key players invest in controlled-release technologies, biologics-compatible devices, and partnerships that accelerate innovation and regulatory approval.

- North America leads with 41% share, followed by Europe at 28% and Asia Pacific at 23%, driven by strong healthcare infrastructure, rising biologics usage, and growing adoption of self-administration therapies.

Market Segmentation Analysis:

By Product

Drug-eluting stents lead the product segment with 37% share, driven by rising demand for minimally invasive cardiovascular interventions and improved long-term clinical outcomes. Their ability to reduce restenosis rates and support faster patient recovery strengthens adoption across hospitals and cardiac centers. Prefilled syringes gain traction due to rising biologics usage and the need for safe, accurate dosing. Inhalers expand steadily as chronic respiratory conditions increase worldwide. Other combination products grow in niche therapeutic areas. The dominance of drug-eluting stents continues as healthcare providers prioritize devices that offer precision drug delivery and reduced complication risk.

- For instance, Abbott’s XIENCE stent platform shows consistently low rates of late stent thrombosis across trials, supported by extensive global use and numerous clinical studies.

By Application

Cardiovascular applications dominate this segment with 41% share, supported by the rising global burden of coronary artery disease and the strong clinical efficacy of drug-eluting stents. These devices improve patient outcomes through targeted drug release and reduced need for repeat procedures. Diabetes applications grow as insulin pens and prefilled delivery systems become more widely adopted. Oncology benefits from combination technologies that enhance localized drug delivery and reduce systemic side effects. Other therapeutic areas contribute steady demand as combination products support better disease management. Cardiovascular leadership reflects strong clinical adoption and high procedural volumes worldwide.

- For instance, Stryker’s Neuroform Atlas stent supports aneurysm therapy with a well-established clinical history and provides precise coil support in complex vessels. The device has a hybrid-cell design that enhances coil scaffolding and conformability, allowing it to navigate small and highly tortuous anatomy.

By End User

Hospitals and clinics hold the leading 56% share, driven by high procedure volumes, advanced infrastructure, and strong adoption of combination products for cardiac, oncology, and chronic disease treatment. These facilities rely on integrated drug-device systems to improve treatment accuracy, streamline workflows, and enhance patient safety during complex interventions. Home care settings grow due to rising demand for prefilled syringes and self-administered therapies that support chronic disease management. Ambulatory surgical centers expand usage as minimally invasive procedures increase. The dominance of hospitals and clinics persists owing to their central role in acute care and specialized medical procedures.

Key Growth Drivers

Key Growth Drivers

Growing Preference for Minimally Invasive Therapies

Demand for minimally invasive procedures continues to rise, driving strong adoption of drug device combination products that offer targeted drug delivery with reduced recovery time. Devices such as drug-eluting stents, infusion pumps, and advanced inhalers improve treatment precision and enhance patient safety. Hospitals increasingly prefer these systems due to their ability to lower complication risks and reduce hospital stays. The shift toward less invasive interventions accelerates adoption across cardiovascular, oncology, and chronic disease treatments. As patient expectations evolve toward faster and safer care, minimally invasive solutions strengthen market growth.

- For instance, Medtronic’s SynchroMed II infusion pump delivers micro-doses as low as 0.006 milliliters per day, improving precision in chronic pain management.

Rising Prevalence of Chronic Diseases

The global rise in chronic conditions such as cardiovascular diseases, diabetes, asthma, and cancer boosts demand for combination products that support long-term therapy and controlled drug delivery. Prefilled syringes, insulin delivery devices, and inhalers offer better dosing accuracy and improve treatment adherence. Healthcare providers rely on these technologies to simplify complex regimens and enhance patient outcomes. Continuous growth in aging populations further increases the need for efficient, easy-to-use devices. The expanding chronic disease burden positions combination products as essential tools for modern clinical management.

- For instance, specific products within BD’s prefilled syringe platform support widespread use for various therapies and feature low needle penetration force, which improves ease of use for chronic-care patients.

Advancements in Drug Delivery Technologies

Rapid innovation in drug delivery enhances the performance and reliability of combination products. Technologies such as controlled-release coatings, auto-injectors, and smart inhalers support precise drug administration tailored to patient needs. Manufacturers invest in materials science, microengineering, and digital integration to improve usability and therapeutic impact. These advancements help reduce side effects, improve pharmacokinetics, and support personalized treatment approaches. As research pipelines expand and biologics gain prominence, drug delivery innovation creates strong momentum for next-generation combination devices.

Key Trends & Opportunities

Integration of Connected and Smart Drug Delivery Systems

Digital health integration creates major opportunities as companies develop smart inhalers, connected auto-injectors, and remote-monitoring infusion systems. These devices provide real-time dosage tracking, adherence monitoring, and data sharing with clinicians. Connectivity strengthens personalized care and helps detect early signs of treatment deviation. Growing demand for home-based therapies supports expanded use of digital-enabled combination products. As healthcare ecosystems prioritize remote care and data-driven decision-making, smart devices emerge as a transformative trend in the market.

- For instance, Propeller Health’s digital inhaler sensor objectively records extensive data points per patient each year, which has been shown to result in significantly reduced rescue inhaler use in documented trials.

Expansion of Biologics and Personalized Medicine

The rising use of biologics in oncology, autoimmune disorders, and chronic diseases increases demand for specialized drug delivery devices that ensure stability, accuracy, and patient-friendly administration. Prefilled syringes, wearable injectors, and on-body delivery systems gain traction due to their ability to support complex formulations. Personalized medicine promotes individualized dosing and device customization. As pharmaceutical pipelines shift toward biologics, manufacturers gain significant opportunities to develop advanced combination systems tailored to specific therapies.

- For instance, Ypsomed’s YpsoMate autoinjector delivers a biologic dose in a brief timeframe using simple, ergonomic push-on-skin activation, with a relatively low required force designed for patient ease.

Key Challenges

Strict Regulatory Requirements and Approval Complexity

Combination products face rigorous regulatory scrutiny because they must meet both drug and device standards. This dual-pathway approval increases development timelines, testing requirements, and documentation workloads. Manufacturers must demonstrate safety, efficacy, and seamless integration between the drug and delivery mechanism. Regulatory variations across regions create additional hurdles for global product launches. These challenges increase development costs and delay commercialization, particularly for complex or innovative technologies.

High Manufacturing and Integration Costs

Producing combination products requires specialized materials, precision engineering, and sophisticated assembly processes that increase overall manufacturing costs. Ensuring compatibility between drug formulations and device components adds complexity to product design. Smaller companies struggle with high capital investment, quality validation, and scaling production. Cost pressures may limit adoption in price-sensitive markets. Maintaining strict quality standards while keeping products affordable remains a significant challenge for manufacturers worldwide.

Regional Analysis

North America

North America leads the Drug Device Combination Products market with 41% share, supported by strong adoption of minimally invasive therapies, biologics, and advanced drug delivery systems. The region has a developed healthcare infrastructure and high procedural volumes, which drives demand for drug-eluting stents, prefilled syringes, and connected inhalation devices. Chronic diseases such as cardiovascular disorders and diabetes remain key drivers of product usage. Favorable reimbursement systems and strong R&D investment encourage innovation and faster commercialization. Collaboration between pharmaceutical and medical device companies strengthens the region’s leadership in combination therapy development.

Europe

Europe holds 28% share, driven by steady adoption of targeted therapies, sustained-release drug technologies, and advanced device-based drug delivery. The region’s strict regulatory standards enhance product reliability and expand clinical acceptance of combination systems like drug-eluting stents and on-body injectors. An aging population and increasing chronic disease burden further accelerate demand across major markets. Investment in biologics and personalized medicine supports segment growth, while rising preference for home-based care strengthens demand for user-friendly devices. Partnerships between industry and healthcare systems continue to expand product availability.

Asia Pacific

Asia Pacific accounts for 23% share, driven by rapid healthcare modernization, rising chronic illness rates, and expanding access to advanced treatment technologies. Demand for prefilled syringes, inhalers, and wearable injectors increases as biologics usage grows across China, Japan, and India. The region benefits from a large patient base, rising income levels, and expanding hospital networks. Governments invest in improving drug delivery standards and promoting innovative therapies. Strong pharmaceutical manufacturing capacity strengthens product availability, positioning Asia Pacific as one of the fastest-growing markets in the combination products segment.

Latin America

Latin America holds 5% share, supported by expanding access to combination therapies for cardiovascular disease, diabetes, and cancer. Brazil and Mexico generate most of the regional demand through improved healthcare infrastructure and higher adoption of minimally invasive procedures. Prefilled syringes and inhalers gain traction due to increasing focus on chronic disease management. Challenges related to reimbursement and economic variability slow adoption in some countries, yet private healthcare investment continues to rise. Growing awareness of advanced treatment options supports steady long-term market expansion.

Middle East & Africa

Middle East & Africa account for 3% share, driven by growing healthcare investments and increasing adoption of advanced therapies, particularly in Gulf countries such as Saudi Arabia and the UAE. Hospitals adopt drug-device combinations to enhance procedural outcomes in cardiovascular and oncology cases. Rising chronic disease incidence improves demand for inhalers and injectable delivery systems. However, uneven healthcare access and cost constraints limit adoption across parts of Africa. Gradual improvements in infrastructure and expanding pharmaceutical distribution channels support stable future growth in the region.

Market Segmentations:

By Product

- Drug-Eluting Stents

- Prefilled Syringes

- Inhalers

- Others

By Application

- Cardiovascular

- Diabetes

- Oncology

- Others

By End User

- Hospitals & Clinics

- Home Care Settings

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drug Device Combination Products market is shaped by key players such as Novartis AG, Teleflex Incorporated, Medtronic, Stryker, Becton, Dickinson and Company, Sensely Inc., W. L. Gore & Associates, Inc., Terumo Medical Corporation, Viatris Inc., Boston Scientific Corporation, and Abbott. These companies focus on advancing integrated drug-delivery technologies, including drug-eluting stents, prefilled systems, smart inhalers, and wearable injectors that enhance treatment precision and patient adherence. Product innovation remains central as firms invest in controlled-release coatings, biologics-compatible devices, and connected delivery systems. Strategic partnerships between pharmaceutical and medical device companies strengthen development pipelines and accelerate market entry. Regulatory compliance, safety validation, and digital integration further define competitive positioning. Companies that deliver strong clinical outcomes, ease of use, and cost-effective solutions gain significant advantage, especially as demand rises for minimally invasive and self-administered therapies.

Key Player Analysis

- Novartis AG

- Teleflex Incorporated

- Medtronic

- Stryker

- Becton, Dickinson and Company

- Sensely, Inc.

- L. Gore & Associates, Inc.

- Terumo Medical Corporation

- Viatris Inc.

- Boston Scientific Corporation

- Abbott

Recent Developments

- In July 2024, Stryker Corporation expanded its healthcare-technology offerings through the acquisitions of Artelon and MOLLI Surgical, reinforcing its presence in soft tissue fixation and breast cancer surgery localization.

- In May 2024, Abbott Laboratories launched the XIENCE Sierra Everolimus-Eluting Coronary Stent System in India.

- In October 2023, Medtronic announced U.S. Food and Drug Administration (FDA) approval of its next-generation SynchroMed III intrathecal drug delivery system for patients with chronic pain, cancer pain, and severe spasticity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for combination products will grow as minimally invasive treatments become standard.

- Smart and connected drug-delivery devices will gain wider clinical adoption.

- Biologics expansion will drive strong growth in prefilled and wearable injectors.

- Drug-eluting technologies will advance to improve precision and long-term outcomes.

- Home-based self-administration devices will see rapid adoption across chronic diseases.

- Personalized medicine will increase demand for tailored drug-device platforms.

- Regulatory focus on safety and integration will shape product development timelines.

- Partnerships between pharma and medtech firms will accelerate innovation.

- Emerging markets will adopt combination products as healthcare access expands.

- Digital monitoring and data-driven therapy adjustments will become key value drivers.

Key Growth Drivers

Key Growth Drivers