Market Overview

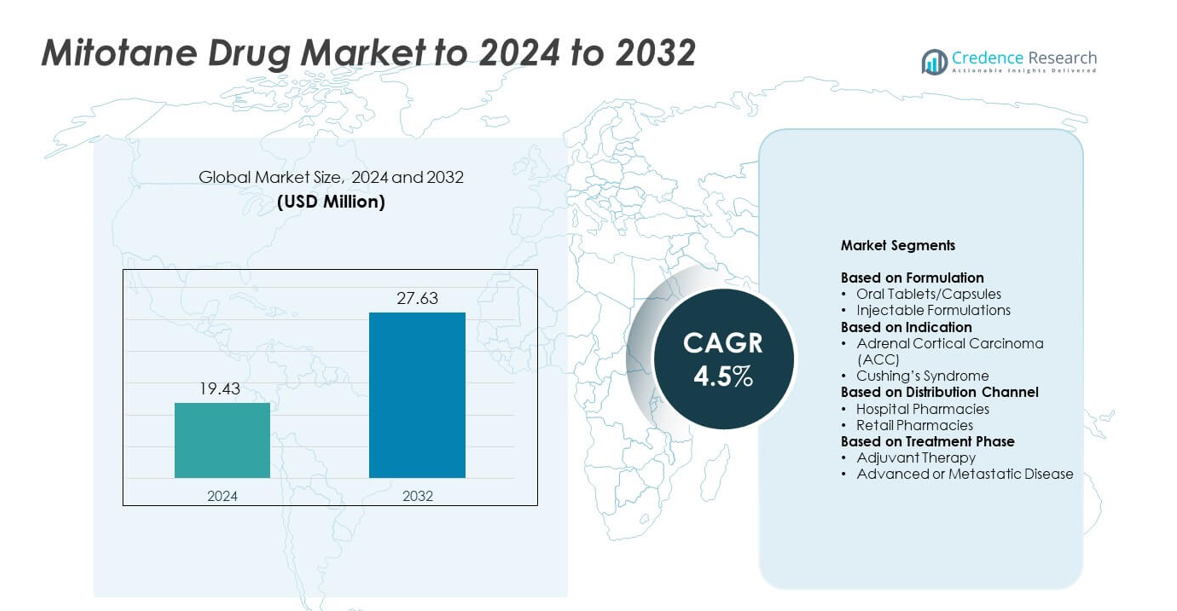

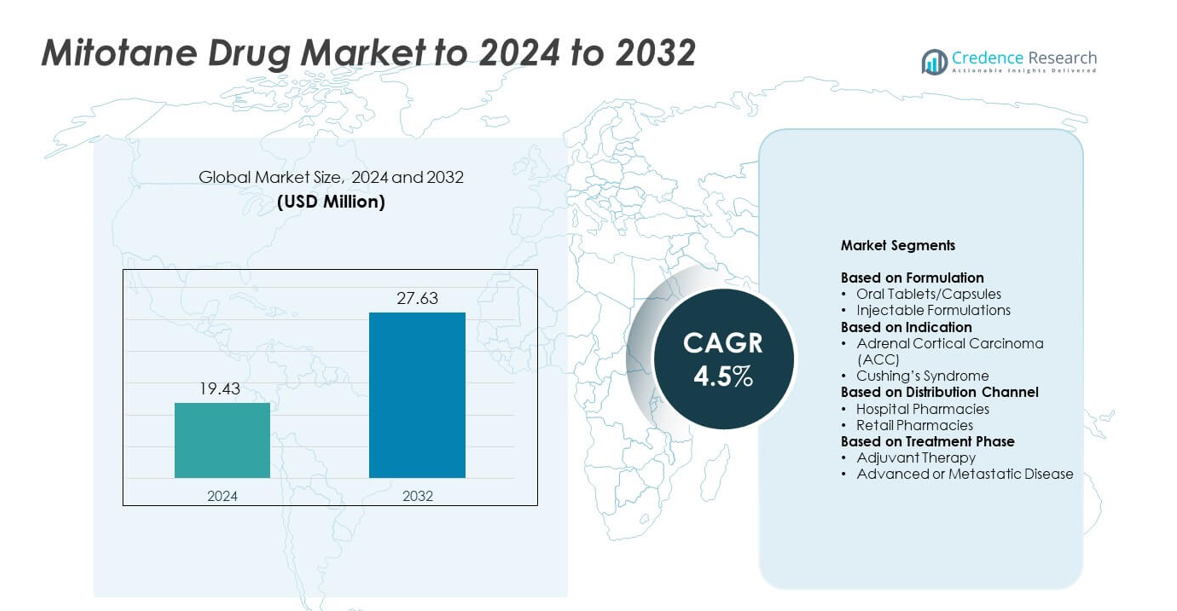

Mitotane Drug Market size was valued at USD 19.43 million in 2024 and is anticipated to reach USD 27.63 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mitotane Drug Market Size 2024 |

USD 19.43 million |

| Mitotane Drug Market, CAGR |

4.5% |

| Mitotane Drug Market Size 2032 |

USD 27.63 million |

The Mitotane Drug Market is shaped by major players such as Prime Therapeutics, Hikma Pharmaceuticals, Novartis Pharmaceuticals Corporation, TherDose Pharma Pvt. Ltd, Aspen Pharmacare, HRA Pharma Rare Diseases, Tizig Pharma Pvt. Ltd, Bristol-Myers Squibb Company, and ESTEVE. These companies support market growth through strong distribution networks, reliable product supply, and focused oncology partnerships. North America led the market in 2024 with about 39% share due to advanced cancer care infrastructure and widespread access to therapeutic drug monitoring. Europe followed with nearly 31% share, supported by harmonized guidelines and strong specialty hospital networks. Asia Pacific accounted for about 22% share, driven by expanding oncology capabilities and improving diagnostic coverage.

Market Insights

- The Mitotane Drug Market reached USD 19.43 million in 2024 and is projected to hit USD 27.63 million by 2032, growing at a CAGR of 4.5%.

- Growth is driven by rising adrenal cortical carcinoma cases, wider oncology access, and stronger adoption of standardized monitoring protocols that support safer long-term therapy.

- Key trends include improved dose-monitoring tools, rising treatment uptake in emerging markets, and growing clinical integration of mitotane within structured oncology pathways.

- The market remains moderately competitive, with companies expanding distribution strength while focusing on formulation consistency and enhanced clinical support across specialist centers.

- North America held about 39% share in 2024, followed by Europe at nearly 31% and Asia Pacific at about 22%, while oral tablets and capsules dominated the formulation segment with roughly 82% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Formulation

Oral tablets and capsules dominated the Mitotane Drug Market in 2024 with about 82% share. Patients and clinicians preferred these solid forms because they offer steady absorption, easier dose titration, and better adherence during long-term therapy. Hospitals also favored oral formats due to simpler storage and wider availability in oncology units. Injectable formulations held a smaller share because they are used only in select clinical settings and require higher administration oversight. Rising ACC treatment demand and supportive clinical guidelines continued to reinforce the strong uptake of oral mitotane.

- For instance, HRA Pharma Rare Diseases supplies Lysodren as 500 mg mitotane tablets in bottles of 100 tablets, providing a standardized solid oral format widely used for long-term adrenal cortical carcinoma therapy.

By Indication

Adrenal cortical carcinoma led the indication segment in 2024 with nearly 91% share of the Mitotane Drug Market. ACC remained the primary approved use because mitotane is a standard adrenolytic therapy in advanced or unresectable tumors. Growing diagnosis rates, wider access to oncology care, and the drug’s established role in adjuvant treatment supported high adoption. Cushing’s syndrome accounted for a minor share, as mitotane is prescribed in limited and specific refractory cases due to safety considerations and the availability of alternative therapies.

- For instance, Mayo Clinic reports that mitotane is used to treat adrenal gland cancer that cannot be removed by surgery, and its pediatric ACC series followed 41 children with adrenocortical carcinoma treated at the clinic between 1950 and 2017.

By Distribution Channel

Hospital pharmacies dominated the distribution channel in 2024 with nearly 68% share. Strong reliance on hospital settings for ACC management and continuous dose monitoring drove higher dispensing from these channels. Oncologists often initiate and adjust mitotane therapy within tertiary hospitals, which ensured greater volume flow through institutional pharmacies. Retail pharmacies captured the remaining share but had lower uptake because mitotane requires specialized oversight, frequent serum level monitoring, and structured follow-up that aligns more closely with hospital-based care pathways.

Key Growth Drivers

Rising burden of adrenal cortical carcinoma

Growing ACC incidence supported steady demand for mitotane therapy, as this drug remains the primary adrenolytic option for advanced or recurrent cases. Many patients require long treatment cycles, which increased annual consumption across hospital networks. Wider access to oncology care and broader recognition of ACC symptoms helped improve diagnosis rates, which expanded the treatment pool. Strong clinical preference for mitotane in adjuvant settings also reinforced usage, making ACC growth one of the strongest market drivers.

- For instance, the University of Texas MD Anderson Cancer Center documented 139 patients with adrenocortical carcinoma registered at the institution from 1980 onward in a large single-centre series, underscoring the cumulative clinical load of this rare malignancy.

Expanded clinical adoption in specialized oncology centers

Specialized cancer hospitals increased mitotane uptake due to structured protocols and better monitoring infrastructure. Advanced oncology units tracked serum mitotane levels more effectively, which improved dosing accuracy and clinical outcomes. Growing clinician awareness, improved patient management tools, and stronger collaboration between endocrinologists and oncologists enhanced treatment efficiency. This expansion in organized care networks supported higher prescription volume and strengthened adoption across both established and emerging healthcare systems.

- For instance, Institut Gustave-Roussy in France conducted a prospective study of 24 ACC patients, including 13 with metastatic disease and 11 receiving adjuvant therapy, treated with mitotane doses up to 6–12 g per day and monitored every two months for plasma levels.

Supportive treatment guidelines and improved monitoring practices

Updated clinical guidelines continued to endorse mitotane for ACC management, which increased confidence among prescribing clinicians. Better access to therapeutic drug monitoring simplified long-term dose adjustment and reduced treatment risks. Growing investment in diagnostic tools helped physicians identify suitable candidates more effectively. These efforts strengthened standardized care pathways and improved patient response outcomes, making guideline-driven adoption a major driver for sustained market expansion.

Key Trends & Opportunities

Advances in precision monitoring and dose optimization

Improved monitoring technologies created opportunities to raise treatment success by helping clinicians maintain therapeutic mitotane levels more consistently. Digital tools and lab automation supported faster reporting, which enabled better dose adjustments and reduced toxicity. These upgrades encouraged higher physician acceptance, as treatment became safer and more predictable. Adoption of advanced management platforms across oncology centers opened new pathways for quality improvement and expanded therapy suitability for a broader patient group.

- For instance, Italian diagnostics firm BSN Srl’s FloChrom Mitotane/DDE in Plasma kit specifies a therapeutic target range of 14–20 micrograms per millilitre and notes that significant adverse effects are generally observed when plasma levels exceed 20 micrograms per millilitre, supporting tighter drug-level control.

Growth potential in emerging healthcare markets

Expanding oncology infrastructure in developing regions created meaningful opportunities for market growth. More hospitals gained access to specialist care, which increased the number of diagnosed ACC cases receiving timely treatment. Governments and private providers invested in cancer centers, raising demand for essential therapies such as mitotane. As patient referral networks improved and awareness increased, emerging economies became key focus areas for long-term expansion and broader treatment access.

- For instance, Max Healthcare Institute in India, which currently operates over 5,000 beds across 22 facilities, has announced an investment plan of ₹6,000 crore to add approximately 3,700 new beds by 2028.

Development of supportive therapies and combination regimens

Research into multimodal treatment approaches expanded the opportunity landscape by helping clinicians explore safer and more effective combinations. Supportive therapies aimed at managing adverse effects improved patient tolerance, which supported longer treatment continuity. These developments encouraged clinical teams to integrate mitotane into broader care plans, enhancing therapeutic value and expanding its relevance across advanced oncology units.

Key Challenges

Narrow therapeutic window and toxicity concerns

Mitotane requires precise dosing because its therapeutic levels vary widely between patients. This narrow window increased the risk of adverse effects, which made treatment difficult without reliable monitoring tools. Many healthcare settings lack adequate serum testing capacity, limiting safe dose optimization. These challenges slowed wider adoption in smaller hospitals and created hesitancy in regions with limited oncology infrastructure. Safety concerns continued to affect patient adherence and shaped a major barrier for broader market uptake.

Limited awareness and specialist availability

ACC remains rare, and many clinicians have limited experience managing mitotane therapy. Lack of specialized oncologists and endocrinologists in emerging regions hindered timely diagnosis and appropriate treatment planning. Patients often reached tertiary centers only after significant delays, reducing treatment success rates. Limited educational programs and lower awareness of proper monitoring practices further restricted adoption. This shortage of trained specialists remained a key challenge that affected both access and long-term market growth.

Regional Analysis

North America

North America led the Mitotane Drug Market in 2024 with about 39% share, driven by strong oncology infrastructure and high adoption in tertiary cancer centers. Early diagnosis rates, wider availability of serum monitoring, and established treatment guidelines supported consistent use across the United States and Canada. Hospitals maintained structured ACC management pathways, which increased long-term patient adherence. Growing access to specialty endocrinology units further strengthened prescribing patterns. Improved coverage for rare cancer treatments and rising enrollment in clinical programs also helped maintain regional leadership.

Europe

Europe held nearly 31% share in 2024, supported by broad access to specialist oncology centers and harmonized treatment guidelines across several countries. Strong diagnostic networks and established ACC management protocols encouraged steady mitotane usage. Germany, France, Italy, and the United Kingdom showed strong demand due to structured monitoring frameworks and advanced hospital capabilities. Rising awareness among clinicians and efforts to standardize follow-up care improved treatment outcomes. Expansion of rare cancer programs and increased investment in oncology services continued to strengthen regional uptake.

Asia Pacific

Asia Pacific accounted for about 22% share in 2024, driven by expanding cancer care infrastructure across China, India, Japan, and South Korea. Growth remained strong as more hospitals adopted advanced diagnostic tools and improved access to endocrine oncology specialists. Rising healthcare spending and improved patient referral networks helped increase ACC detection rates. Adoption improved in urban centers with better laboratory support for serum monitoring. Government investments in oncology and broader availability of imported mitotane formulations also supported rising demand across emerging healthcare systems.

Latin America

Latin America held around 5% share in 2024, with demand concentrated in Brazil, Mexico, and Argentina. Limited specialist availability and uneven diagnostic coverage slowed broader adoption, though major urban hospitals maintained stable usage. Growing awareness of ACC management and improvement in oncology capacities supported gradual expansion. Access challenges and limited monitoring tools remained barriers, but improving reimbursement frameworks helped strengthen uptake. Emerging collaborations with international oncology programs also supported improved treatment availability in leading regional centers.

Middle East and Africa

Middle East and Africa captured nearly 3% share in 2024, reflecting limited access to specialized cancer care and low availability of advanced monitoring tools. Adoption remained highest in Gulf countries with strong tertiary hospitals, while many parts of Africa faced diagnostic and treatment constraints. Growing investment in oncology units and rising awareness of ACC contributed to slow but steady demand. International partnerships improved physician training and enhanced treatment pathways in select centers. Despite infrastructure gaps, gradual expansion of specialized care continued to support long-term growth potential.

Market Segmentations:

By Formulation

- Oral Tablets/Capsules

- Injectable Formulations

By Indication

- Adrenal Cortical Carcinoma (ACC)

- Cushing’s Syndrome

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

By Treatment Phase

- Adjuvant Therapy

- Advanced or Metastatic Disease

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Mitotane Drug Market features key players such as Prime Therapeutics, Hikma Pharmaceuticals, Novartis Pharmaceuticals Corporation, TherDose Pharma Pvt. Ltd, Aspen Pharmacare, HRA Pharma Rare Diseases, Tizig Pharma Pvt. Ltd, Bristol-Myers Squibb Company, and ESTEVE. Companies strengthened their market position through reliable supply chains, wider distribution reach, and expanded access across oncology centers. Manufacturers focused on improving formulation quality, enhancing monitoring support, and ensuring consistent therapeutic performance for long-term ACC treatment. Many firms invested in clinician education programs to support safer dose management and improve patient adherence. Expansion into emerging healthcare markets and partnerships with hospital networks helped broaden treatment availability. Firms also worked on meeting strict regulatory standards and improving manufacturing precision to support stable global distribution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Prime Therapeutics

- Hikma Pharmaceuticals

- Novartis Pharmaceuticals Corporation

- TherDose Pharma Pvt. Ltd

- Aspen Pharmacare

- HRA Pharma Rare Diseases

- Tizig Pharma Pvt. Ltd

- Bristol-Myers Squibb Company

- ESTEVE

Recent Developments

- In 2025, the Spanish pharmaceutical company ESTEVE acquired Regis Technologies, a U.S.-based Contract Development and Manufacturing Organization (CDMO) headquartered in Chicago

- In 2025, Prime Therapeutics’ updated Isturisa (osilodrostat) clinical criteria document lists mitotane as an EMA-approved adrenal steroidogenesis inhibitor option, alongside other agents for Cushing’s syndrome.

- In 2024, FarmaMondo and HRA Pharma Rare Diseases announced an exclusive partnership to distribute Lysodren (mitotane) in Brazil, expanding access for adrenal cortical carcinoma patients in Latin America.

Report Coverage

The research report offers an in-depth analysis based on Formulation, Indication, Distribution Channel, Treatment Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as ACC diagnosis rates improve across advanced healthcare systems.

- Adoption will rise with stronger oncology infrastructure and wider access to serum level monitoring.

- Clinical guidelines will continue to support mitotane as a core therapy for advanced ACC.

- Emerging regions will contribute more as cancer centers strengthen and referral pathways improve.

- Research will explore safer dosing strategies to improve patient tolerance and long-term adherence.

- Combination therapy development will enhance treatment effectiveness and support broader clinical use.

- Digital monitoring tools will improve dose optimization and reduce treatment-related risks.

- Hospitals will maintain strong demand due to expanded specialist networks and structured care models.

- Manufacturers will invest in improving formulation efficiency and global supply chain reliability.

- Increased awareness programs will help reduce treatment delays and improve patient outcomes globally.