Market Overview

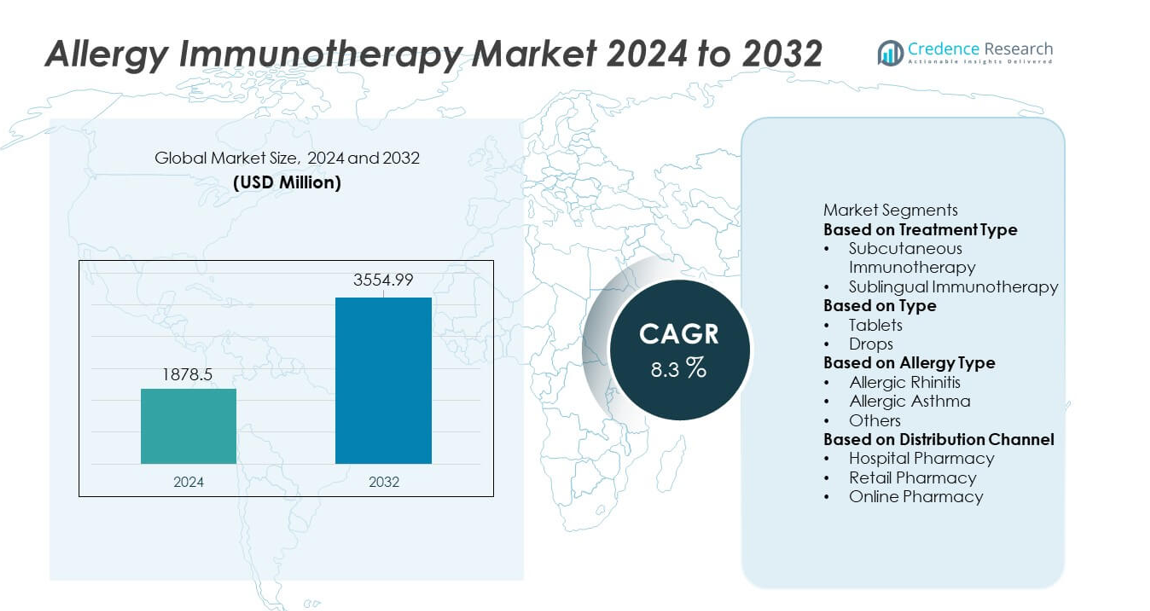

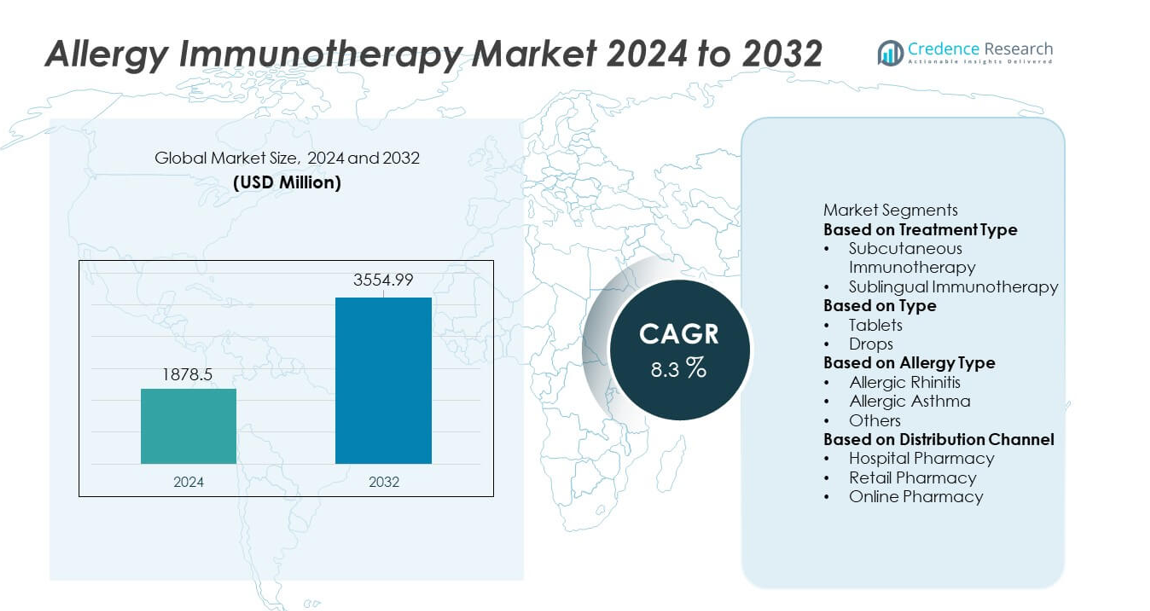

The Allergy Immunotherapy market was valued at USD 1,878.5 million in 2024 and is expected to reach USD 3,554.99 million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Allergy Immunotherapy Market Size 2024 |

USD 1,878.5 million |

| Allergy Immunotherapy Market, CAGR |

8.3% |

| Allergy Immunotherapy MarketSize 2032 |

USD 3,554.99 million |

The Allergy Immunotherapy market is shaped by major players such as ALK-Abelló A/S, HAL Allergy B.V., Allergy Therapeutics, HollisterStier Allergy, LETIPharma, Circassia, ASIT Biotech, DESENTUM OY, DVB Technologies SA, and DMK Pharmaceuticals, each expanding portfolios across subcutaneous and sublingual treatments. These companies focus on high-purity extracts, tablet-based formulations, and advanced recombinant approaches that improve safety and long-term tolerance. North America leads the market with a 38% share, supported by strong diagnosis rates and mature clinical adoption. Europe follows with a 32% share, driven by robust reimbursement frameworks and widespread acceptance of allergen-specific tablets. Their combined dominance reflects strong regulatory support, continuous innovation, and rising demand for disease-modifying therapies.

Market Insights

- The Allergy Immunotherapy market reached USD 1,878.5 million in 2024 and is projected to hit USD 3,554.99 million by 2032 at a CAGR of 8.3%, reflecting steady global demand for long-term allergy management.

- Growing cases of allergic rhinitis and asthma drive adoption of disease-modifying therapies, with subcutaneous immunotherapy holding a 62% share due to strong clinical effectiveness and widespread use in specialized centers.

- Market trends highlight rising uptake of sublingual tablets supported by high compliance rates, while digital adherence tools and standardized extract development accelerate innovation across delivery formats.

- Leading players such as ALK-Abelló A/S, HAL Allergy B.V., Allergy Therapeutics, and HollisterStier Allergy expand high-purity allergen portfolios, while competition intensifies around recombinant and peptide-based advancements that reduce treatment duration.

- North America leads with a 38% regional share, followed by Europe at 32%, while Asia Pacific grows rapidly with rising allergy prevalence and higher adoption of immunotherapy services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Treatment Type

Subcutaneous immunotherapy leads this segment with a market share of 62% due to its strong clinical effectiveness and long-term desensitization outcomes. Healthcare providers prefer this treatment for moderate to severe respiratory allergies because it delivers sustained symptom control. Wider adoption also comes from standardized allergen extracts and clear dosing schedules that support predictable results. Sublingual immunotherapy grows steadily as patients seek home-based treatment options with better convenience and lower risk of systemic reactions. Rising awareness of allergy prevention and expanding treatment guidelines strengthen the demand for both modalities across global healthcare settings.

- For instance, ALK-Abelló advanced SLIT adoption through its ACARIZAX dust-mite tablet, which in a large-scale 834-patient clinical trial (MT-04), demonstrated a 34% relative risk reduction in the first moderate or severe asthma exacerbation during a mandated inhaled corticosteroid (ICS) dose reduction/withdrawal period compared to a placebo group.

By Type

Tablets dominate this segment with a market share of 68% driven by high patient compliance and approval of multiple allergen-specific formulations. These products support consistent dosing, simplified administration, and strong safety profiles, making them suitable for long-term therapy. Pharmaceutical companies invest in new tablet formulations targeting pollens, dust mites, and pet allergens to broaden treatment options. Drops remain relevant due to flexible dosing and suitability for pediatric patients. However, their adoption expands at a slower pace because standardized formulations vary by region. Growing demand for non-invasive immunotherapy continues to boost both formats.

- For instance, Leti Pharma produces sublingual immunotherapy (SLIT) formulations that have been evaluated in numerous pediatric studies, consistently demonstrating a favorable safety profile characterized by mild, local reactions (e.g., oral itching) and very rare systemic reactions.

By Allergy Type

Allergic rhinitis holds the leading position with a market share of 57% as rising exposure to airborne allergens increases the need for long-term desensitization therapies. The sub-segment gains traction due to strong clinical evidence supporting immunotherapy effectiveness in reducing seasonal and perennial symptoms. Allergic asthma follows as clinicians integrate immunotherapy to improve respiratory control and reduce steroid dependency. Other allergies, such as insect venom and food-related hypersensitivities, show emerging interest through advanced biologic research. Growing global allergy prevalence and improved diagnostic rates continue to support demand across all sub-segments.

Key Growth Drivers

Expanding Burden of Allergic Diseases

Rising global cases of respiratory and environmental allergies strengthen the need for long-term desensitization therapies. Urban pollution, climate-related pollen shifts, and increased allergen exposure drive higher diagnostic rates across all age groups. Healthcare providers adopt immunotherapy to reduce symptom severity, minimize medication dependence, and improve quality of life. Growing awareness programs and improved access to allergy testing support wider treatment adoption. Pharmaceutical companies expand their product portfolios with standardized extracts, boosting treatment availability. This expanding disease burden positions immunotherapy as a core intervention in chronic allergy management.

- For instance, Thermo Fisher Scientific provides precise IgE diagnostics with its ImmunoCAP tests, which enable identification of sensitizations to over 500 individual allergens and allergen mixes.

Advancements in Allergen-Specific Immunotherapy

Continuous improvements in allergen standardization, formulation precision, and dosing schedules enhance treatment outcomes. Companies develop high-purity extracts and optimized delivery systems that improve safety and reduce adverse reactions. Sublingual and subcutaneous therapies gain traction through strong clinical evidence demonstrating durable tolerance induction. Regulatory approvals for new tablet formulations targeting dust mites, pollens, and pet allergens broaden patient access. These advancements support long-term efficacy and help clinicians tailor therapy for complex allergy profiles. Innovation across delivery technologies and extract production accelerates market expansion.

- For instance, Jubilant HollisterStier (JHS) has undertaken significant expansion projects, including a $92 million investment in 2021 to add a high-speed sterile injectable fill line and two large lyophilizers, and the recent commissioning of another line, all of which contribute to an overall plan to double the Spokane facility’s total sterile injectable manufacturing capacity.

Growing Preference for Long-Term Disease Modification

Patients and clinicians increasingly choose immunotherapy for its ability to alter immune response rather than only manage symptoms. The therapy’s long-term benefits, including reduced relapse rates and sustained tolerance, drive adoption across chronic allergy cases. Growing concerns around antihistamine overuse and corticosteroid side effects encourage a shift toward disease-modifying treatments. Immunotherapy’s potential to prevent progression from allergic rhinitis to asthma further strengthens its value. Expanding clinical guidelines and insurance coverage improve treatment accessibility. As demand for lasting relief increases, immunotherapy becomes a preferred strategy in allergy care.

Key Trends & Opportunities

Rising Adoption of Sublingual Immunotherapy (SLIT)

Sublingual tablets gain strong acceptance due to ease of use, favorable safety profiles, and suitability for home-based treatment. Manufacturers secure multiple approvals for allergen-specific tablets that support consistent dosing and predictable outcomes. This non-invasive format benefits children and patients seeking alternatives to injections. Growing digital adherence tools, such as mobile reminders and remote monitoring, improve compliance rates. Expansion of SLIT formulations for new allergens creates opportunities for product diversification. As demand for self-managed therapies increases, SLIT remains a major growth catalyst.

- For instance, Torii Pharmaceutical advanced SLIT adoption in Japan by distributing over 3.2 million cedar pollen tablets in one season, supported by clinical data from over 1,000 patients showing strong adherence.

Integration of Digital Allergy Management Platforms

Digital tools enhance patient engagement, monitoring, and treatment personalization in allergy care. Mobile apps track symptoms, remind patients about dosing, and support communication with clinicians. AI-based platforms analyze exposure patterns and optimize therapy scheduling for better clinical results. Remote consultations expand access in underserved regions and increase therapy continuity. Pharmaceutical companies explore digital companion tools to improve adherence and collect real-world evidence. The growing convergence of digital health and immunotherapy creates new opportunities for connected, data-driven treatment models.

- For instance, Doccla’s remote patient monitoring supports patients across the NHS, helping patients avoid hospital admissions.

Key Challenges

High Treatment Duration and Compliance Issues

Immunotherapy requires long treatment cycles, often lasting three to five years, which affects patient adherence. Many individuals discontinue therapy due to time commitment, slow symptom improvement, or missed follow-up visits. Inconsistent compliance reduces treatment success and limits long-term tolerance development. Healthcare systems face challenges in tracking dosing schedules and maintaining engagement. Although digital tools improve oversight, adherence remains a major barrier in real-world settings. This extended treatment burden continues to restrain full market potential

Variability in Allergen Standardization and Regulatory Differences

Allergen extracts vary across regions due to distinct production standards and regulatory requirements. Differences in potency, purity, and labeling create challenges for clinicians selecting consistent products. Regulatory pathways for sublingual and subcutaneous formulations also differ among markets, slowing global product launches. This variability limits cross-border harmonization and complicates clinical research comparability. Manufacturers face added costs in meeting region-specific guidelines. These inconsistencies remain key hurdles for global expansion and uniform clinical adoption.

Regional Analysis

North America

North America holds a market share of 38% due to strong diagnosis rates, advanced healthcare systems, and high acceptance of long-term desensitization therapies. The region benefits from widespread use of subcutaneous and sublingual immunotherapy supported by clear clinical guidelines. Growth is driven by rising cases of allergic rhinitis and asthma linked to pollen exposure and pollution. Pharmaceutical companies expand standardized allergen products and invest in real-world evidence programs. Insurance coverage for immunotherapy further encourages adoption. Strong research activity and continuous regulatory approvals keep North America a leading region in the global market.

Europe

Europe accounts for a market share of 32% driven by well-established allergy treatment guidelines and strong reimbursement frameworks. Countries such as Germany, France, and the U.K. lead adoption due to high physician preference for immunotherapy and broad availability of allergen-specific tablets. Rising environmental allergies and cross-border harmonization efforts support steady demand. Regulatory bodies encourage standardized extract production, improving treatment quality and safety. Research institutions advance next-generation formulations, strengthening industry innovation. Strong patient awareness programs and mature healthcare infrastructure keep Europe a key contributor to global market expansion.

Asia Pacific

Asia Pacific holds a market share of 22% driven by rising urbanization, pollution exposure, and increasing prevalence of respiratory allergies. Countries like China, Japan, and South Korea expand allergy testing and immunotherapy services as diagnosis rates improve. Growing middle-class populations and higher spending on long-term care fuel demand for both subcutaneous and sublingual treatments. Pharmaceutical partnerships and local manufacturing initiatives enhance product accessibility. Digital health adoption supports remote monitoring and treatment adherence. Expanding healthcare infrastructure and rising clinical research activity position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America captures a market share of 5% as awareness of allergy management improves across major countries such as Brazil and Mexico. Growth is supported by increasing adoption of subcutaneous immunotherapy in specialized clinics and rising demand for cost-effective treatment options. Expanding urban populations face higher allergen exposure, driving diagnosis and treatment initiation. Limited insurance coverage and variable product availability restrain broader adoption, yet ongoing healthcare modernization improves accessibility. Regional medical societies promote training programs that strengthen clinician familiarity with immunotherapy. Gradual infrastructure expansion supports future market growth.

Middle East & Africa

The Middle East & Africa region holds a market share of 3% driven by rising cases of respiratory allergies linked to dust exposure, desert climates, and increasing pollution. Gulf countries invest in advanced allergy clinics and expand access to sublingual and subcutaneous therapies. North African nations experience growing demand as diagnostic services improve. Limited specialist availability and lower awareness slow adoption in some areas, but government-led healthcare upgrades support gradual progress. International pharmaceutical companies expand regional distribution networks, helping improve treatment accessibility. Steady improvements in healthcare systems drive emerging opportunities across the region.

Market Segmentations:

By Treatment Type

- Subcutaneous Immunotherapy

- Sublingual Immunotherapy

By Type

By Allergy Type

- Allergic Rhinitis

- Allergic Asthma

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as ALK-Abelló A/S, HAL Allergy B.V., Allergy Therapeutics, HollisterStier Allergy, LETIPharma, ASIT Biotech, DESENTUM OY, Circassia, DVB Technologies SA, and DMK Pharmaceuticals. These companies focus on expanding allergen-specific immunotherapy portfolios, strengthening R&D pipelines, and improving the standardization of extracts to enhance safety and long-term clinical outcomes. Leading manufacturers prioritize subcutaneous and sublingual formulations supported by strong clinical evidence and regulatory approvals. Many players invest in tablet-based therapies targeting pollens, dust mites, and pet allergens, while others pursue novel recombinant and peptide-based approaches to reduce treatment duration and minimize adverse reactions. Strategic collaborations, manufacturing capacity upgrades, and digital adherence tools support broader market penetration. Companies also expand real-world data programs to validate treatment effectiveness and differentiate product value. As global demand rises, competition intensifies around innovation, safety profiles, and patient-centric delivery systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HAL Allergy B.V.

- Circassia

- DESENTUM OY

- LETIPharma

- Allergy Therapeutics

- DVB Technologies SA

- HollisterStier Allergy

- ASIT Biotech

- ALK-Abelló A/S

- DMK Pharmaceuticals

Recent Developments

- In June 2025, ALK-Abelló A/S presented data on two new paediatric AIT tablets and a nasal adrenaline spray at EAACI 2025.

- In November 2024, ALK-Abelló A/S published results of a pivotal Phase 3 trial in children — a key step to expand indications for its allergy immunotherapy products.

- In January 2023, HollisterStier Allergy introduced a new product “Ultrafiltered Dog” to help treat patients sensitive to dog allergens

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Type, Allergy Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for long-term desensitization therapies will rise as allergic diseases continue to grow worldwide.

- Subcutaneous and sublingual treatments will expand as clinical guidelines strengthen global adoption.

- Tablet-based immunotherapy will gain traction due to high compliance and strong safety profiles.

- Recombinant and peptide-based formulations will advance to shorten treatment duration and improve precision.

- Digital tools will support adherence through remote monitoring, automated reminders, and symptom tracking.

- Real-world evidence programs will strengthen clinical confidence and expand regulatory approvals.

- Emerging markets will adopt immunotherapy faster as diagnostic services and specialist access improve.

- Research will expand into multi-allergen therapies to support complex allergy profiles.

- Partnerships between pharmaceutical companies and research institutes will accelerate product development.

- Environmental changes and rising pollution levels will increase patient demand for disease-modifying treatments.