| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Soy-Based Chemicals Market Size 2024 |

USD 1,070.47 Million |

| France Soy-Based Chemicals Market, CAGR |

7.33% |

| France Soy-Based Chemicals Market Size 2032 |

USD 1,884.50 Million |

Market Overview

The France Soy-Based Chemicals Market is projected to grow from USD 1,070.47 million in 2024 to an estimated USD 1,884.50 million by 2032, with a compound annual growth rate (CAGR) of 7.33% from 2025 to 2032. This growth trajectory reflects the increasing adoption of sustainable and bio-based alternatives across various industries.

Key drivers of this market include stringent environmental regulations, rising consumer demand for eco-friendly products, and advancements in soy processing technologies. These factors contribute to the growing preference for soy-based chemicals as replacements for conventional petroleum-based products.

Geographically, Europe, particularly France, is witnessing significant growth in the soy-based chemicals sector. The market is characterized by the presence of major players such as Dow, Archer Daniels Midland Company, and Cargill Inc., who are actively involved in the development and distribution of soy-based products. These companies are focusing on innovation and sustainability to meet the evolving demands of the French market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Soy-Based Chemicals Market is projected to grow from USD 1,070.47 million in 2024 to USD 1,884.50 million by 2032, driven by the shift towards sustainable and bio-based alternatives.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Stringent environmental regulations in France and Europe are encouraging the adoption of soy-based chemicals as eco-friendly alternatives to petroleum-based products.

- Increasing consumer awareness and demand for natural, sustainable products is fueling the growth of soy-based chemicals across various sectors, including cosmetics and packaging.

- The high cost of production, due to specialized processing technologies and smaller scale compared to petrochemical alternatives, remains a challenge for widespread adoption.

- The reliance on soybeans as the main raw material can lead to supply chain disruptions due to factors like weather conditions and competition from other industries.

- Western France plays a key role in the market, benefiting from its strong agricultural sector and soy production, contributing significantly to raw material supply.

- Northern France sees high demand for soy-based chemicals in industrial applications, while Southern France’s automotive and construction sectors are adopting soy-derived materials for sustainability.

Market Drivers

Consumer Demand for Sustainable Products

There is a growing consumer preference in France for products that are environmentally friendly and sustainably sourced. This shift in consumer behavior has led companies to reformulate products using bio-based ingredients, including soy-derived chemicals. Industries such as cosmetics and personal care are increasingly incorporating soy-based components to cater to the demand for clean-label and cruelty-free products. This trend not only aligns with ethical consumerism but also contributes to the reduction of carbon footprints associated with traditional chemical manufacturing processes.

Investment and Innovation in the Bioeconomy

Investment in the bioeconomy sector has surged, with both public and private sectors recognizing the potential of bio-based chemicals in driving economic growth and environmental sustainability. French biotech companies specializing in soy-based products are attracting funding to scale up production and innovate new applications. Collaborations between industry leaders and research institutions are fostering the development of advanced soy-based chemicals, positioning France as a hub for green chemistry innovation in Europe.

Environmental Regulations and Policy Support

The French government’s commitment to sustainability has significantly influenced the growth of the soy-based chemicals market. Initiatives such as the National Strategy to Combat Imported Deforestation aim to reduce reliance on soy imports from regions linked to deforestation, thereby promoting domestic production of plant-based proteins. This policy shift not only supports sustainable agriculture but also encourages the development of bio-based chemicals derived from locally sourced soybeans. For instance, companies like TotalEnergies are investing in bio-based alternatives to petroleum derivatives to comply with European Union sustainability mandates. Additionally, the European Union’s stringent regulations on greenhouse gas emissions and the use of hazardous chemicals have propelled industries to seek eco-friendly alternatives. As of 2023, companies in the automotive and packaging sectors are significantly increasing their use of bio-based chemicals in response to these regulations, helping drive the demand for soy-based chemicals in France.

Technological Advancements in Biotechnology

Advancements in biotechnology have played a crucial role in enhancing the efficiency and cost-effectiveness of producing soy-based chemicals. Innovations in fermentation processes and enzyme technologies have enabled the extraction of high-value compounds from soybeans, making them viable substitutes for petroleum-based chemicals. For instance, Cargill has developed advanced biorefinery processes that extract high-quality soy-based ingredients for industrial applications. These technological improvements have expanded the application scope of soy-based chemicals across various industries, including cosmetics, pharmaceuticals, and packaging, thereby accelerating market growth. BASF, for instance, has integrated enzyme technology into its production processes to create soy-derived additives for the food industry, enhancing the efficiency of the manufacturing process and increasing the availability of sustainable alternatives. These innovations allow for the mass production of soy-based chemicals, opening up new markets for sustainable chemical alternatives.

Market Trends

Growing Adoption of Soy-Based Plastics and Polymers

One of the key trends in the France soy-based chemicals market is the increasing adoption of soy-based plastics and polymers as alternatives to traditional petroleum-based plastics. These bioplastics, derived from soybeans, are being used in the manufacturing of packaging materials, automotive parts, and consumer goods. For instance, Ford Motor Company reported that it uses up to 2.3 kilograms of soy-based polyurethane foam in each of its vehicles for seat cushions and headrests, reducing petroleum usage and CO₂ emissions. As consumer awareness about environmental impact grows, there is a noticeable shift towards sustainable packaging solutions that reduce reliance on single-use plastics. In packaging, NatureWorks LLC has expanded production of bioplastics made with soy-derived content, manufacturing over 136,000 metric tons annually to meet demand. Soy-based plastics offer benefits such as biodegradability, lower carbon emissions, and the reduction of plastic waste, making them an attractive option for manufacturers seeking to align with the global push for sustainability.

Integration of Soy-Based Chemicals in Cosmetics and Personal Care Products

Soy-based chemicals are increasingly being used in the formulation of cosmetics and personal care products in France. This shift is driven by rising consumer demand for natural, vegan, and cruelty-free alternatives. For instance, The Estée Lauder Companies use soy-derived lecithin and proteins in over 120 of their skincare and cosmetic products, citing their benefits in skin hydration and texture improvement. Soy-derived ingredients, such as soy protein, soy lecithin, and soy-based emulsifiers, are being incorporated into skincare products, shampoos, conditioners, and cosmetics due to their moisturizing, anti-aging, and skin-conditioning properties. Additionally, L’Oréal has implemented bio-based sourcing strategies, incorporating soy components into formulations used across multiple brands in its portfolio. These ingredients align with the growing trend toward clean beauty, where consumers seek products that are free from harmful chemicals and sourced from renewable resources.

Expansion of Soy-Based Chemicals in the Automotive Sector

Another significant trend is the growing use of soy-based chemicals in the automotive industry, particularly in the production of eco-friendly car parts. Soy-based foams, such as those used in automotive seating, offer better sustainability compared to traditional petroleum-based foams. Manufacturers are increasingly replacing petroleum-based plastics with soy-based alternatives in components such as seat cushions, interior panels, and insulation materials. This trend not only helps automakers meet environmental regulations but also appeals to environmentally-conscious consumers who prefer vehicles made with renewable materials.

Increased Focus on Innovation in Soy-Based Biofuels and Industrial Chemicals

In France, there is a growing focus on the development of soy-based biofuels and industrial chemicals as part of the broader transition to a bioeconomy. Biofuels derived from soybeans are being explored as a sustainable alternative to fossil fuels, with applications in transportation, energy generation, and industrial processes. Research and innovation in bio-based industrial chemicals are also on the rise, aiming to reduce dependence on fossil feedstocks for chemicals traditionally derived from petrochemical processes. This trend reflects a shift towards circular economy principles, where waste is minimized, and renewable resources such as soybeans are used to produce sustainable chemicals for various industries.

Market Challenges

High Production Costs and Limited Economies of Scale

One of the primary challenges facing the France soy-based chemicals market is the high production costs associated with the manufacturing of soy-based chemicals. Despite their environmental benefits, the production of soy-based chemicals often requires advanced processing techniques and specialized equipment, which can increase costs. For instance, BASF has reported investing over €10 million in research and development to improve its biorefining processes for producing soy-based chemicals, which has increased initial production costs. Moreover, the relatively smaller scale of the soy-based chemicals industry in comparison to conventional petrochemical industries limits the ability to achieve economies of scale, resulting in higher per-unit costs. Cargill has acknowledged that the soy-based chemical production process is more capital-intensive than traditional chemical manufacturing, which poses a significant barrier for market entry in certain industries. This makes it difficult for manufacturers to compete on price with established petroleum-based chemicals, especially in price-sensitive industries like packaging and textiles. For instance, the cost of producing soy-based plastics is considerably higher than that of conventional plastic made from petroleum derivatives. As demand for soy-based chemicals grows, overcoming this challenge will require investments in scaling up production capacity, improving process efficiency, and developing cost-effective technologies to make these products more competitive in the market.

Supply Chain Vulnerabilities and Raw Material Availability

Another significant challenge is the reliance on soybeans as the primary raw material for producing soy-based chemicals, which makes the market susceptible to fluctuations in supply. Factors such as weather conditions, crop yields, and price volatility in the global agricultural market can impact the availability and cost of soybeans. In addition, the global competition for soybeans from industries like food production and animal feed exacerbates the issue, making it challenging to secure a stable supply of raw materials at consistent prices. To mitigate these risks, manufacturers in France must explore alternative sourcing strategies, such as local soybean cultivation, while also investing in research to diversify feedstock options and enhance the sustainability of their supply chains.

Market Opportunities

Growing Demand for Sustainable Packaging Solutions

The increasing consumer demand for sustainable packaging presents a significant opportunity for the France soy-based chemicals market. As businesses across various industries face mounting pressure to reduce their environmental impact, the adoption of bio-based and biodegradable packaging materials is on the rise. Soy-based plastics offer an eco-friendly alternative to traditional petroleum-based packaging, providing manufacturers with a competitive edge in the growing market for sustainable packaging solutions. The French government’s strong focus on reducing plastic waste, coupled with the European Union’s commitment to sustainability, further reinforces the market opportunity. This trend is particularly relevant in industries such as food and beverages, cosmetics, and pharmaceuticals, where packaging plays a key role in meeting consumer preferences for environmentally responsible products.

Expansion of Bio-Based Chemicals in the Automotive Industry

Another promising market opportunity lies in the expanding use of soy-based chemicals within the automotive industry. The growing trend toward sustainability and eco-friendly materials in vehicle manufacturing presents a unique chance for soy-based products to replace conventional petroleum-derived chemicals in automotive components. Soy-based foams, plastics, and adhesives are increasingly being incorporated into vehicle interiors and exterior parts, including seat cushions, insulation, and dashboard components. As automakers continue to focus on reducing their carbon footprint and complying with stricter environmental regulations, the demand for soy-based materials is expected to rise. This opportunity is further amplified by the French government’s push for greener transportation solutions, making the market for soy-based chemicals in the automotive sector an attractive avenue for growth.

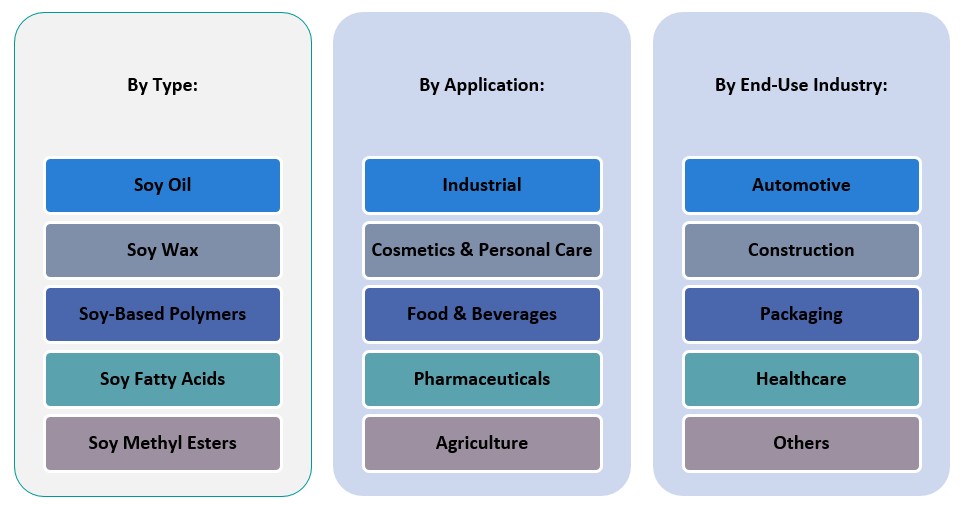

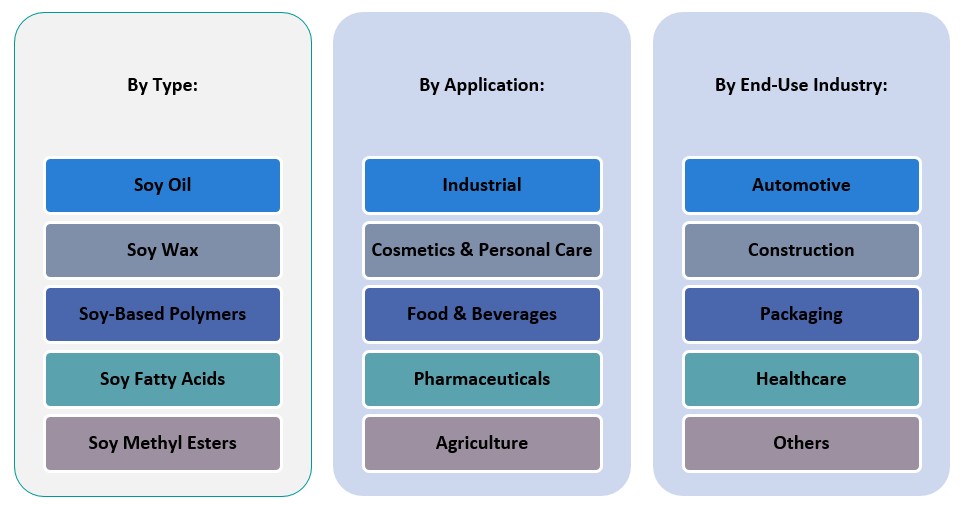

Market Segmentation Analysis

By Type:

The soy-based chemicals market is primarily divided into several types based on the chemical composition derived from soybeans. Soy oil, accounting for a significant share, is used across various industries, particularly in bio-based lubricants and biodiesel production. Soy wax, another major segment, is utilized in applications such as candles, cosmetics, and packaging. Soy-based polymers are gaining popularity due to their eco-friendly properties and are used in packaging, automotive parts, and textiles. Soy fatty acids, derived from soybeans, are essential for the production of various chemical products, including surfactants and detergents. Lastly, soy methyl esters, a key component in the production of biodiesel, are seeing an increase in demand due to the rising focus on renewable energy sources.

By Application:

The market’s applications are widespread, with soy-based chemicals being used in several industries. The industrial segment is a major contributor, where soy-derived chemicals are used in manufacturing processes, including adhesives, paints, and coatings. The cosmetics and personal care segment is witnessing growth due to consumer demand for natural and sustainable ingredients in skincare, haircare, and makeup products. In the food and beverages sector, soy-based chemicals, such as soy lecithin, are widely used as emulsifiers and stabilizers. In pharmaceuticals, soy derivatives are used for drug formulations and excipients. Lastly, the agriculture sector benefits from soy-based chemicals in crop protection products, fertilizers, and soil conditioners.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- Western France

- Northern France

- Southern France

- Eastern France and Paris Region

Regional Analysis

Western France (30%)

Western France, particularly regions like Brittany, plays a key role in the agricultural production of soybeans, which is essential for the soy-based chemicals market. This region has a large agricultural base and is a major contributor to the availability of raw soy materials. The integration of sustainable farming practices and growing demand for bio-based chemicals has boosted the production of soy-based derivatives in these areas. In terms of market share, Western France is estimated to account for approximately 30% of the overall market, owing to its strategic positioning for raw material availability and industry presence.

Northern France (25%)

Northern France, particularly around regions like Hauts-de-France, has seen an uptick in the manufacturing of bio-based chemicals due to its proximity to major industrial hubs and its strong focus on environmental regulations. The adoption of soy-based chemicals in industrial applications, including paints, coatings, and adhesives, is particularly strong in this region. Additionally, with growing demand for bio-based plastics, Northern France is expected to hold a market share of about 25%, driven by the push for sustainable packaging solutions and the presence of key industry players.

Key players

- BASF SE

- Solvay S.A.

- Evonik Industries AG

- Croda International Plc

- Clariant AG

- Oleon NV

- Arkema S.A.

- Akzo Nobel N.V.

- Neste Oyj

- Perstorp Holding AB

Competitive Analysis

The France Soy-Based Chemicals Market is highly competitive, with key players leveraging their technological expertise, broad product portfolios, and strategic business initiatives to maintain market leadership. BASF SE and Solvay S.A. dominate the market with their comprehensive range of bio-based chemicals, supported by strong research and development capabilities. Evonik Industries and Croda International are focusing on sustainable innovations to expand their presence in the market, particularly in cosmetics and personal care applications. Clariant AG and Arkema S.A. emphasize eco-friendly product offerings to cater to the growing demand for green chemicals. Additionally, companies like Oleon NV and Akzo Nobel N.V. are capitalizing on their established supply chains to meet the increasing demand for soy-based chemicals across diverse industries. As the market expands, these players are likely to face growing competition from new entrants and regional innovators, which could further accelerate technological advancements and market diversification.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The France Soy-Based Chemicals Market exhibits moderate market concentration, with a few large multinational players such as BASF SE, Solvay S.A., and Evonik Industries AG dominating the landscape. These companies hold significant market share due to their advanced technological capabilities, extensive product portfolios, and established supply chains. However, the market also features a range of regional players and smaller enterprises focused on niche applications, such as sustainable packaging and cosmetics, which contribute to market diversification. The market is characterized by a strong emphasis on sustainability, innovation in bio-based chemicals, and increasing consumer demand for environmentally friendly products. As the market grows, collaboration between large companies and emerging innovators is expected to drive further development and competitiveness within the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable products will continue to drive the growth of soy-based chemicals, as industries increasingly focus on reducing their environmental impact.

- Soy-based chemicals will see increased adoption in automotive manufacturing, especially for eco-friendly interior materials and insulating components.

- With the growing trend for clean and natural beauty products, soy-based chemicals will play a significant role in formulations within the cosmetics and personal care industry.

- France’s regulatory framework and EU policies aimed at reducing carbon footprints will further boost the adoption of bio-based chemicals in the market.

- Continued advancements in processing technologies will improve the cost-effectiveness and scalability of producing soy-based chemicals, enhancing their market appeal.

- As packaging industries seek biodegradable and renewable alternatives, the demand for soy-based plastics and polymers will rise significantly in the coming years.

- The soy-based biofuel segment will expand, driven by the EU’s renewable energy targets and the increasing focus on sustainable energy solutions.

- Rising consumer awareness about the environmental impact of synthetic chemicals will further elevate the demand for soy-based alternatives in various products.

- Collaborations between large chemical manufacturers and startups will foster innovation and accelerate the development of new soy-based chemical solutions.

- As France continues to embrace bio-based chemicals, regional growth in agricultural production of soybeans will strengthen the domestic supply chain, supporting long-term market stability.