Market Overview

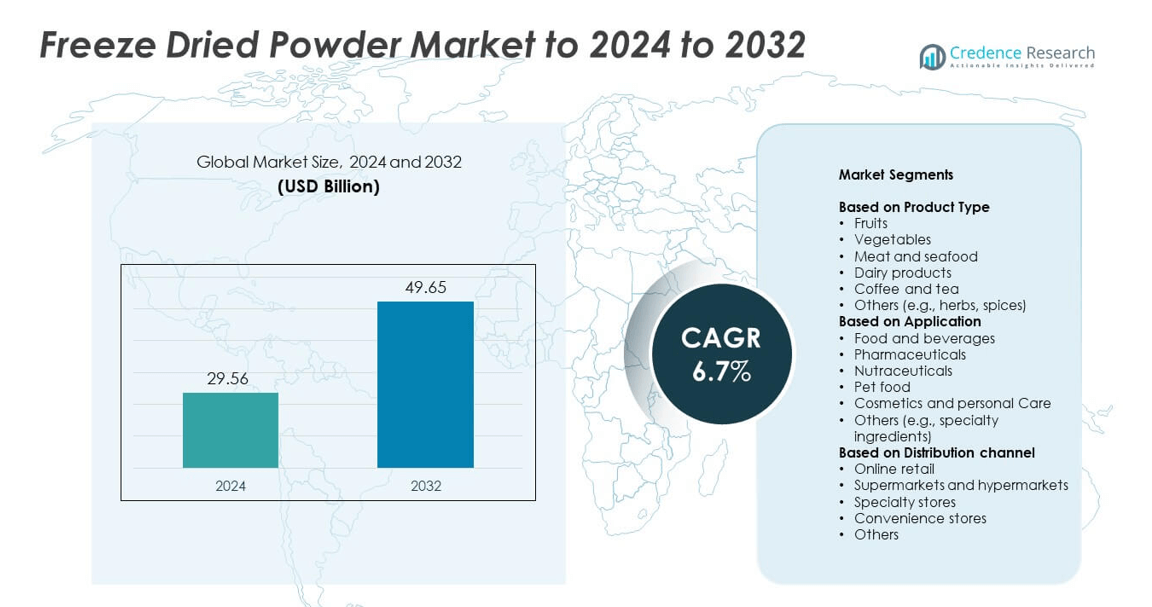

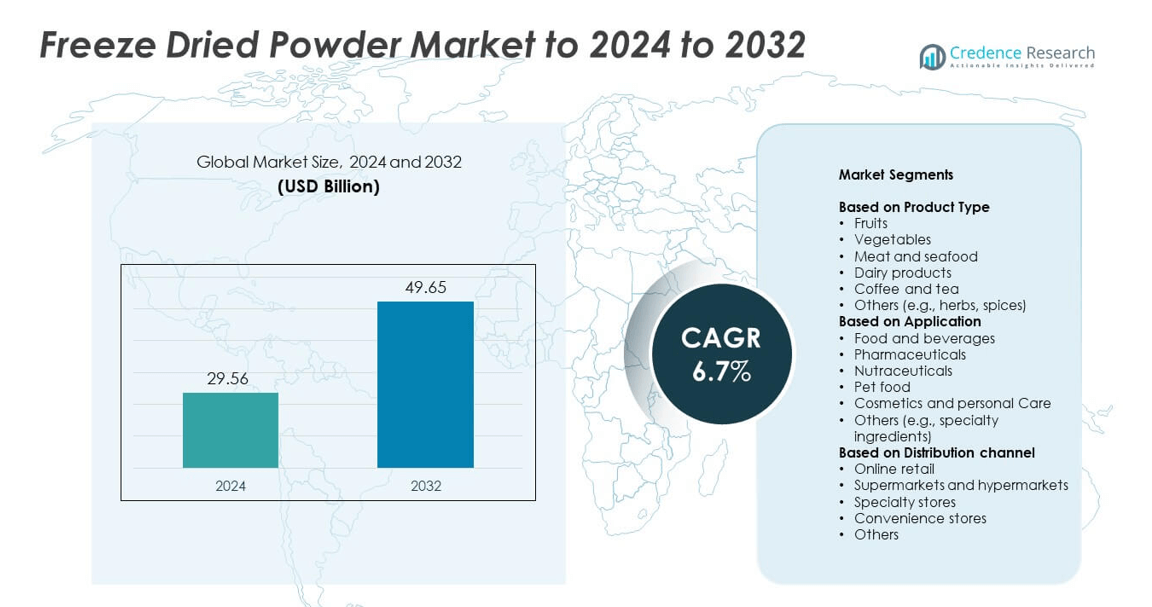

Freeze Dried Powder Market size was valued at USD 29.56 billion in 2024 and is anticipated to reach USD 49.65 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freeze Dried Powder Market Size 2024 |

USD 29.56 billion |

| Freeze Dried Powder Market, CAGR |

6.7% |

| Freeze Dried Powder Market Size 2032 |

USD 49.65 billion |

The freeze-dried powder market is led by major companies including Nestlé Health Science, Thrive Foods, European Freeze Dry, Doehler Group SE, Paradise Fruits, Farmvilla Food, SouthAm, Verum Ingredients Inc., and Moonstore. These players focus on technological innovation, product diversification, and strategic partnerships to strengthen their global presence. Continuous advancements in freeze-drying technology and sustainability initiatives enhance product quality and energy efficiency. North America dominated the market with a 35% share in 2024, driven by strong demand for functional foods, nutraceuticals, and clean-label products. Europe and Asia Pacific followed, supported by growing health-conscious consumer bases and expanding processing capacities.

Market Insights

- The freeze-dried powder market was valued at USD 29.56 billion in 2024 and is expected to reach USD 49.65 billion by 2032, growing at a CAGR of 6.7%.

- Growing demand for nutrient-rich, long-shelf-life foods and increasing applications in nutraceuticals and pharmaceuticals are major market drivers.

- Key trends include technological advancements in freeze-drying, the rise of plant-based formulations, and expanding online retail distribution.

- The market is competitive, with companies focusing on innovation, sustainability, and partnerships to enhance production efficiency and product diversity.

- North America leads with a 35% share, followed by Europe at 27% and Asia Pacific at 28%, while the fruits segment dominates the product category with 32% share due to its high use in food and beverage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Fruits dominate the freeze-dried powder market, holding around 32% share in 2024. The segment leads due to rising demand for natural and nutrient-rich ingredients in smoothies, snacks, and bakery applications. Freeze-dried fruits such as berries, mango, and banana retain color, flavor, and nutritional value, making them popular in clean-label and vegan food products. Growth in ready-to-eat and functional food categories further supports segment expansion. Increasing innovation in packaging and storage stability drives broader adoption across global food manufacturing and retail sectors.

- For instance, Pol’s (Turkey) lifted fruit- and vegetable–freeze-drying output from 200 to 300 tons per year after installing a GEA RAY® 125 system in Ermenek.

By Application

The food and beverages segment accounted for the largest market share of nearly 40% in 2024. Its dominance is driven by the growing demand for shelf-stable ingredients in instant meals, beverages, and bakery items. Freeze-dried powders enhance flavor and texture without requiring refrigeration. Rising consumer focus on natural additives and long-lasting ingredients boosts their use in soups, sauces, and snacks. Expanding demand for convenience foods and premium beverages further strengthens this segment’s position in both developed and emerging markets.

- For instance, Starbucks’ Augusta plant makes up to 4,000 metric tons/year soluble coffee.

By Distribution Channel

Supermarkets and hypermarkets held the leading share of about 38% in 2024. These outlets offer wide product visibility, trusted brands, and convenient purchasing options. The dominance of this segment stems from growing urbanization and consumer preference for one-stop shopping. Retail chains increasingly stock freeze-dried fruit powders, dairy additives, and coffee blends due to expanding health-oriented demand. However, online retail is growing rapidly as consumers shift toward digital platforms for premium and specialty freeze-dried products, supported by improved logistics and e-commerce reach.

Key Growth Drivers

Rising Demand for Nutrient-Rich and Shelf-Stable Foods

The demand for freeze-dried powders is increasing due to their ability to retain high nutritional content and long shelf life. Consumers are adopting convenient, additive-free products that support healthy lifestyles and on-the-go consumption. Food manufacturers use freeze-dried powders in snacks, beverages, and functional foods to enhance flavor and nutrition. The shift toward clean-label and organic food products further strengthens this driver, particularly in developed regions where consumers prioritize quality, sustainability, and natural ingredients.

- For instance, LDC-Instanta’s Vietnam site adds 5,600 metric tons/year freeze-dried coffee capacity.

Expanding Applications in Pharmaceuticals and Nutraceuticals

Pharmaceutical and nutraceutical industries are increasingly using freeze-dried powders for vitamins, proteins, and herbal formulations. These powders maintain bioactivity and ensure higher stability during storage and transportation. Companies are investing in advanced freeze-drying technologies to preserve sensitive compounds, improving therapeutic effectiveness. The growth of dietary supplements and preventive healthcare supports consistent demand. Rising awareness of immune-boosting and functional ingredients accelerates adoption among nutraceutical producers globally.

- For instance, Berkshire Sterile’s line reaches 70,000 10R vials per run capacity.

Growth in E-Commerce and Specialty Retail Channels

The rapid expansion of online and specialty retail channels has enhanced market accessibility for premium freeze-dried products. E-commerce platforms allow direct consumer engagement, customized packaging, and wider product reach. Improved digital marketing and cold-chain logistics enable suppliers to offer diverse powder types across regions. This trend supports smaller brands and private-label players in reaching niche consumer bases focused on fitness, wellness, and convenience-based food products.

Key Trends and Opportunities

Advancements in Freeze-Drying Technology

Technological innovation is improving energy efficiency and process speed in freeze-drying systems. New vacuum and microwave-assisted drying technologies preserve flavor, color, and nutrient content while reducing production time. Manufacturers are adopting automation and real-time monitoring for consistent product quality. These innovations lower production costs and open new opportunities for large-scale commercial applications across food, pharmaceuticals, and cosmetics industries.

- For instance, EnWave cites a peer-reviewed study showing >80% time reduction vs. conventional.

Rising Popularity of Plant-Based and Functional Products

Consumers are showing strong interest in plant-based, protein-rich, and functional formulations. Freeze-dried fruit, vegetable, and herb powders serve as natural additives in smoothies, supplements, and energy bars. The trend aligns with sustainability goals and the clean-label movement. Companies are launching vegan-friendly and allergen-free options to capture growing demand from health-conscious and flexitarian consumers across global markets.

- For instance, IMA Life’s LYOMAX shelves cut weight by 20%, reducing energy use.

Growing Use in Cosmetic and Personal Care Formulations

Freeze-dried botanical and collagen powders are gaining traction in skincare and cosmetic applications. These ingredients maintain high purity, stability, and potency, ideal for formulations like serums, masks, and supplements. Brands are emphasizing science-backed beauty and nutraceutical integration. The rising demand for multifunctional products that bridge health and beauty presents new opportunities for cross-industry innovation and product diversification.

Key Challenges

High Production and Equipment Costs

Freeze-drying involves substantial investment in machinery, energy, and maintenance, which raises overall production costs. Small and medium-sized manufacturers face challenges in scaling operations due to limited capital and technical expertise. The high cost of production restricts affordability and limits market penetration in developing regions. Energy-intensive drying processes also increase operational expenses, prompting the need for cost-efficient, sustainable alternatives.

Quality Control and Supply Chain Limitations

Maintaining consistent product quality and ensuring raw material availability remain major challenges. Variations in input quality, moisture levels, and drying parameters can affect texture and nutrient retention. Global supply chain disruptions further impact sourcing of fruits, dairy, and meat materials. Ensuring traceability, contamination control, and regulatory compliance across diverse production sites adds complexity for manufacturers operating in multiple markets.

Regional Analysis

North America

North America held the largest share of 35% in the freeze-dried powder market in 2024. The region’s dominance is driven by strong demand for convenient, nutrient-dense food products and a well-developed packaged food sector. Major producers in the United States are expanding capacity to meet growing applications in nutraceuticals and pharmaceuticals. The popularity of clean-label and high-protein snacks continues to fuel product innovation. Additionally, the expansion of e-commerce platforms and private-label brands has made premium freeze-dried powders more accessible to consumers across both the U.S. and Canada.

Europe

Europe accounted for around 27% share in the global freeze-dried powder market in 2024. Demand is supported by the region’s focus on natural food preservation, stringent quality standards, and sustainable production. Countries like Germany, France, and the Netherlands are key contributors due to their established food processing industries. Rising use of freeze-dried dairy and fruit powders in bakery and health supplements is notable. Increasing interest in vegan and organic formulations also supports market expansion, particularly in Western Europe where plant-based innovation is advancing rapidly.

Asia Pacific

Asia Pacific captured 28% share of the freeze-dried powder market in 2024 and is the fastest-growing regional market. Growth is led by China, Japan, and India, where demand for processed and convenience foods continues to surge. Expanding middle-class income, urbanization, and strong nutraceutical adoption drive consumption. Local manufacturers are investing in advanced freeze-drying facilities to enhance product quality and shelf stability. Rising exports of freeze-dried fruits, coffee, and herbs to Western markets are strengthening regional competitiveness, while domestic consumption of instant food and beverage mixes further accelerates growth.

Latin America

Latin America represented 6% share of the global freeze-dried powder market in 2024. Countries such as Brazil and Mexico are leading due to increased production of tropical fruits and coffee-based powders. Growth is supported by the expanding food processing sector and export-oriented agricultural production. Consumers are showing higher interest in natural and convenient food ingredients. However, limited processing infrastructure and high equipment costs remain barriers. Investment in regional manufacturing and strategic partnerships with international brands are helping improve supply chain efficiency and distribution reach.

Middle East and Africa

The Middle East and Africa accounted for 4% share in 2024, driven by growing adoption of freeze-dried products in urban and high-income markets. Demand is rising for powdered dairy, fruits, and nutritional supplements, particularly in the UAE, Saudi Arabia, and South Africa. Expanding retail networks and rising health awareness among consumers are supporting growth. However, dependency on imports and high operational costs pose challenges. Ongoing investment in food technology parks and cold-chain infrastructure is expected to improve regional production and enhance competitiveness over the forecast period.

Market Segmentations:

By Product Type

- Fruits

- Vegetables

- Meat and seafood

- Dairy products

- Coffee and tea

- Others (e.g., herbs, spices)

By Application

- Food and beverages

- Pharmaceuticals

- Nutraceuticals

- Pet food

- Cosmetics and personal Care

- Others (e.g., specialty ingredients)

By Distribution channel

- Online retail

- Supermarkets and hypermarkets

- Specialty stores

- Convenience stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The freeze-dried powder market features a competitive landscape led by key players such as Nestlé Health Science, Thrive Foods, European Freeze Dry, Doehler Group SE, Paradise Fruits, Farmvilla Food, SouthAm, Verum Ingredients Inc., and Moonstore. Market participants focus on expanding production capacity, improving processing efficiency, and developing innovative formulations to meet growing demand across food, nutraceutical, and pharmaceutical sectors. Companies are investing in advanced freeze-drying technologies to preserve nutritional value and enhance product stability. Strategic collaborations with ingredient suppliers and retailers are strengthening global distribution networks. Sustainability is becoming a major focus, with firms adopting eco-friendly packaging and energy-efficient systems to reduce operational impact. Continuous R&D efforts are aimed at expanding product portfolios, offering plant-based and functional variants to appeal to health-conscious consumers. Regional diversification and expansion into emerging markets are further shaping the competitive environment, creating opportunities for long-term growth and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Moonstore Introduced two new freeze-dried fruit powders—mango and strawberry—to the Indian retail market.

- In 2023, Thrive Foods acquired the Canadian pet food company Canature, gaining a new freeze-drying facility and expanding its freeze-dried pet food and treats business.

- In 2022, Nestlé Health Science acquired the natural food and supplement company Puravida in Brazil, which sells superfood ingredients like açaí in freeze-dried powder form.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising demand for nutrient-rich and long-shelf-life products.

- Technological advancements in freeze-drying will enhance energy efficiency and product quality.

- Increasing applications in nutraceuticals and pharmaceuticals will boost industry diversification.

- Online retail and direct-to-consumer platforms will strengthen product accessibility worldwide.

- Growing consumer preference for clean-label and plant-based ingredients will drive innovation.

- Manufacturers will focus on sustainable packaging and energy-efficient production methods.

- Expansion in emerging economies will create new opportunities for local processing facilities.

- Collaborations between food and cosmetic brands will promote cross-industry product development.

- Automation and digital monitoring will improve process consistency and reduce operational costs.

- Rising demand for functional and fortified foods will continue to shape future product portfolios.