Market Overview

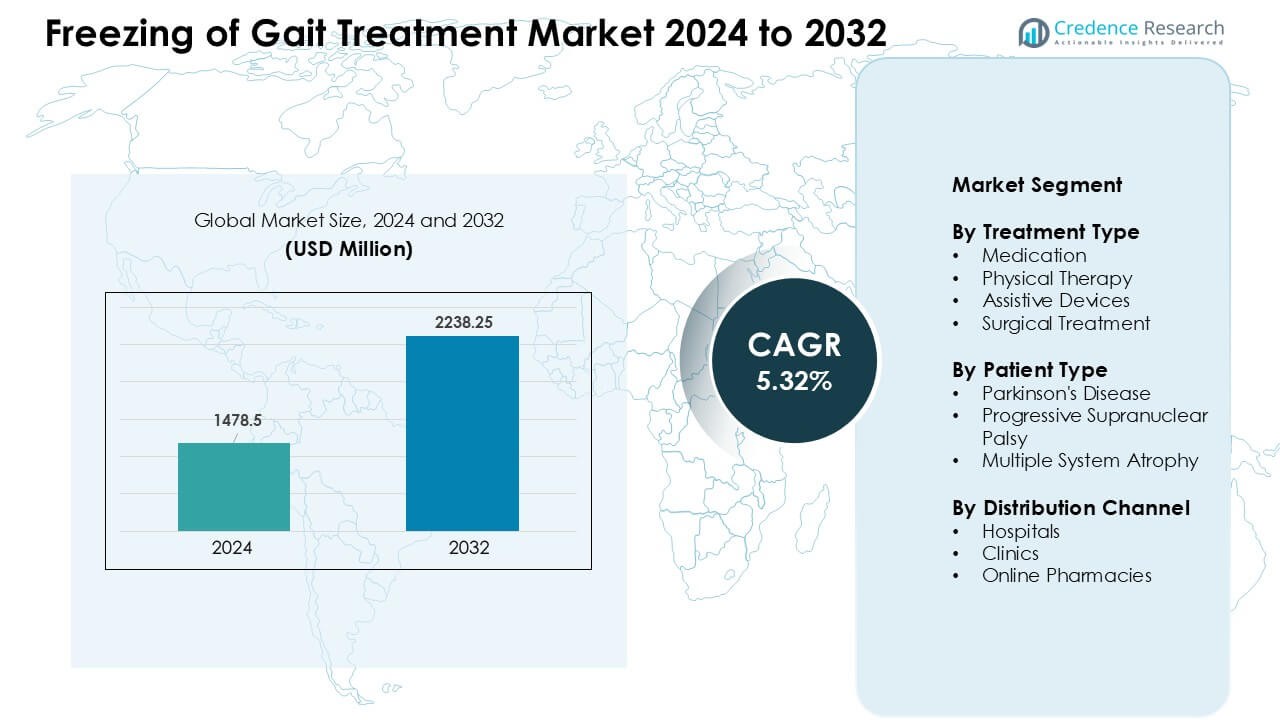

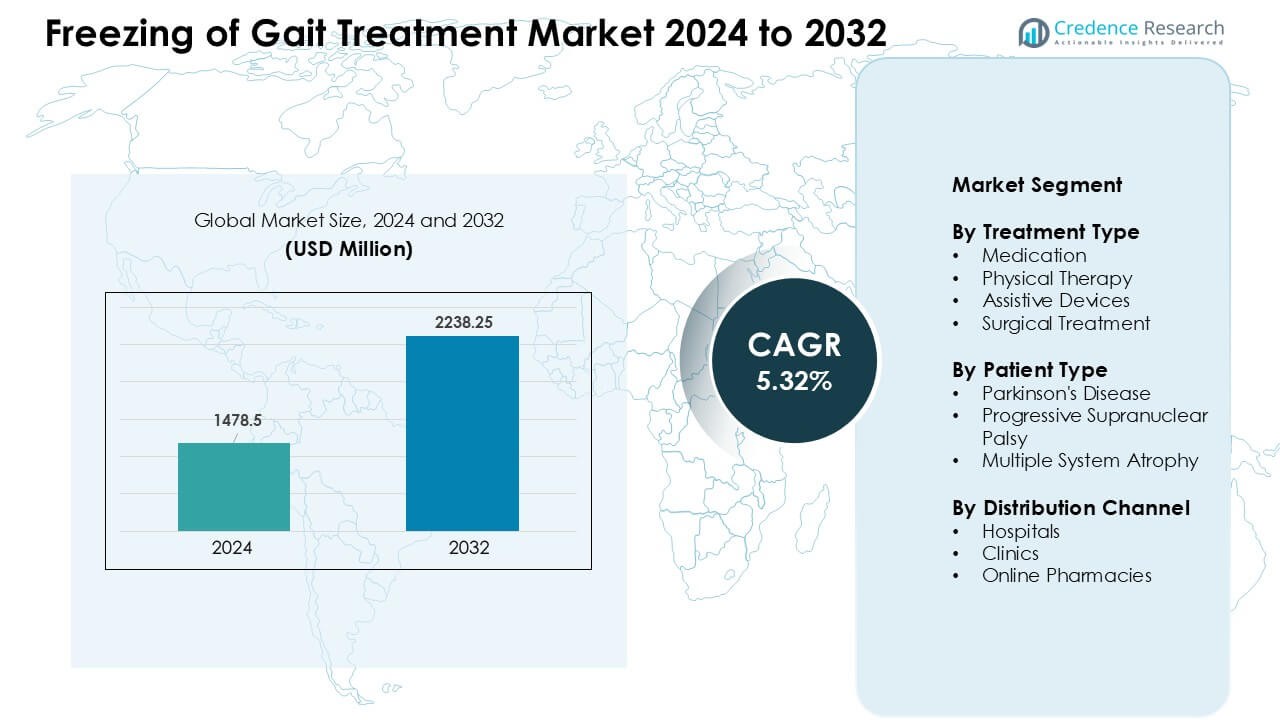

Freezing of Gait Treatment Market was valued at USD 1478.5 million in 2024 and is anticipated to reach USD 2238.25 million by 2032, growing at a CAGR of 5.32 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freezing of Gait Treatment Market Size 2024 |

USD 1478.5 Million |

| Freezing of Gait Treatment Market, CAGR |

5.32 % |

| Freezing of Gait Treatment Market Size 2032 |

USD 2238.25 Million |

North America led the Freezing of Gait Treatment Market in 2024 with about 38% share, supported by strong neurological care networks and early adoption of advanced therapies. Key players such as GlaxoSmithKline plc, Abbott Laboratories, Sanofi S.A., Pfizer Inc., Bayer AG, Novartis AG, Medtronic, Boston Scientific Corporation, Teva Pharmaceutical Industries Ltd., and Merck & Co., Inc. shaped the competitive space through innovation in medication, neuromodulation, and assistive technologies. These companies focused on improving gait-related symptom control, expanding rehabilitation solutions, and strengthening distribution channels. Their continued investment in research and digital mobility tools further reinforced regional and global market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Freezing of Gait Treatment Market was valued at USD 5 million in 2024 and is projected to reach USD 2238.25 million by 2032, growing at a CAGR of 5.32%.

- Market growth is driven by rising Parkinson’s disease cases, wider adoption of physiotherapy-based gait training, and increased use of neuromodulation and wearable cueing devices.

- Key trends include expanding digital gait-monitoring tools, home-based rehabilitation programs, and growing innovation in non-dopaminergic drug development that supports better control of freeze episodes.

- Competitive activity remains strong as major companies focus on medication advances, deep brain stimulation systems, and assistive technologies; the dominant segment in 2024 was Medication with about 46% share.

- North America led the market with nearly 38% share due to advanced neurological care, followed by Europe at around 32%, while Asia-Pacific grew fastest with about 22% share, supported by rising aging populations and wider access to rehabilitation services.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Treatment Type

Medication held the dominant share in 2024 with about 46% of the Freezing of Gait Treatment Market. Strong use came from dopaminergic drugs that help reduce gait blocks in Parkinson’s patients. Physical therapy grew due to rising adoption of gait-cueing exercises and balance training. Assistive devices such as laser-guided canes supported home-based management for older adults. Surgical treatment stayed limited, used mainly for deep brain stimulation in advanced cases. Demand for medication stayed high because doctors prefer fast symptom control and simple dosing plans.

- For instance, studies have shown that administration of levodopa (or levodopa plus entacapone) can significantly decrease both the frequency and duration of “off-related” freezing-of-gait (FOG) episodes in responsive patients, making dopaminergic medication a first-line, relatively immediate option for this specific type of FOG.

By Patient Type

Parkinson’s disease patients accounted for the largest share in 2024 with nearly 71%. Most freezing-of-gait cases link directly to Parkinson’s progression, driving strong treatment use across drugs, therapy, and assistive tools. Progressive supranuclear palsy showed steady need due to early gait instability, while multiple system atrophy cases grew as awareness improved among neurologists. The Parkinson’s group stayed dominant because patient volume remained far higher than other disorders and treatment guidelines focused primarily on Parkinson’s-related gait blocks.

- For instance, in typical Parkinson’s disease (PD) populations, FOG is reported to affect “over half” of individuals during the disease course, underscoring why PD-based FOG patients dominate the treatment market.

By Distribution Channel

Hospitals led the market in 2024 with around 54% share, supported by higher patient inflow for diagnosis, medication adjustment, and advanced care. Clinics followed with strong use of physical therapy and follow-up services. Online pharmacies expanded as chronic patients preferred home delivery of long-term prescriptions. Hospitals stayed dominant because they provide neurologist-led evaluation, imaging access, and multidisciplinary care needed for freezing-of-gait management.

Key Growth Drivers

Growing Burden of Parkinson’s Disease

Rising Parkinson’s disease cases drive strong demand for freezing-of-gait treatments, as gait blocks remain one of the most disabling symptoms in advanced stages. The global Parkinson’s population has more than doubled over the past 25 years, which increases the number of patients needing medication adjustments, physical therapy, and assistive devices. Higher life expectancy also expands the pool of older adults who face mobility issues linked to neurodegeneration. Healthcare systems now screen gait disorders more often, allowing earlier identification of freezing episodes. This wider diagnosis results in larger treatment volumes across hospitals and clinics. Governments and nonprofit groups promote early awareness programs, which help patients seek care sooner and boost adoption of therapy-based interventions. Pharmaceutical companies also invest in new dopamine-based and non-dopamine medications, strengthening the treatment pipeline. These combined factors make Parkinson’s disease growth a major driver supporting steady expansion of the freezing-of-gait treatment market.

- For instance, according to a recent global burden study, in 2021 there were approximately 11.77 million people worldwide living with Parkinson’s disease a marked increase compared with earlier decades.

Advances in Neuromodulation and Digital Therapy

Rapid development of neuromodulation systems and digital therapeutics strengthens treatment outcomes for freezing-of-gait patients. Deep brain stimulation and non-invasive stimulation devices now target gait-related brain circuits with better precision, improving mobility in advanced cases. Companies are also introducing wearable sensors that track gait freezing in real time and send cues through vibrations or audio signals. These tools help patients react quickly and reduce fall risk during daily movement. Smartphone-based gait-cueing apps grow in use because neurologists use them to monitor symptoms remotely. Artificial intelligence supports personalized gait data analysis, helping predict freeze episodes before they occur. Physical therapists now integrate virtual reality balance training into rehabilitation to improve motor control. These innovations widen clinical adoption and raise treatment effectiveness, making technology-driven solutions a core growth driver in the freezing-of-gait treatment market.

- For instance, a recent clinical study demonstrated the feasibility and safety of a novel adaptive neuromodulation approach variable-parameter Deep Brain Stimulation (DBS) to improve gait and reduce freezing episodes in PD patients, opening the door for personalized stimulation protocols tailored to gait impairment.

Growing Access to Multidisciplinary Care

The expansion of multidisciplinary care programs builds stronger demand for freezing-of-gait treatment, as coordinated care offers better patient outcomes. Hospitals now combine neurology, physiotherapy, rehabilitation, and geriatrics into structured gait management clinics. This integration leads to faster diagnosis and more targeted therapy plans. Health systems also expand community-based rehab centers where patients receive regular gait training, cueing therapy, and fall-prevention support. Insurance coverage improvements help patients access physical therapy and advanced assistive devices with fewer financial barriers. Many countries invest in elderly mobility programs, which raise treatment awareness and encourage routine follow-up. Neurologists increasingly emphasize early rehabilitation along with medication adjustments, which drives higher adoption of non-drug therapies. This model of integrated care strengthens long-term mobility outcomes and supports sustained market growth.

Key Trends & Opportunities

Rising Adoption of Wearable Assistive Technologies

Wearable devices emerge as a key trend, offering real-time cueing support that helps patients overcome gait freezing. Laser-guided shoes, vibrating cue bands, and auditory metronome devices help users maintain rhythm during walking tasks. These tools also track step patterns and freeze duration, giving doctors clear insights into progression. Increased investment in sensor-based gait monitoring platforms enables home-based management and reduces reliance on hospital visits. Manufacturers focus on lightweight, comfortable designs to enhance daily usability. Growing demand for personalized mobility solutions strengthens this trend and encourages innovation across device categories.

- For instance, a recent real-time wearable system for freezing-of-gait (FoG) achieved 95.1% detection accuracy and triggered cueing signals with only 261 milliseconds detection delay, cutting the average duration of freezing episodes by about 45%.

Expansion of Remote and Home-Based Rehabilitation

Home-based freezing-of-gait therapy is rising as telehealth becomes more common in neurology and rehabilitation. Virtual physiotherapy programs allow patients to practice cueing exercises under remote supervision. Digital platforms now deliver structured gait-training routines supported by video guidance and live feedback. Remote monitoring tools help doctors spot severe freeze episodes and adjust treatment early. This trend is strong among elderly patients who prefer home convenience and face mobility barriers. Adoption of this model increases therapy adherence, lowers care costs, and creates long-term opportunities for digital rehab providers.

- For instance, a telerehabilitation (remote physical therapy) program involving gait training, balance exercises and guided motor tasks for patients with Parkinson’s demonstrated high adherence and improved mobility outcomes in a 4-week study of patients from remote communities.

Growing Pipeline of Next-Generation Medications

Drug development for gait freezing shows renewed momentum, with trials exploring non-dopaminergic pathways to address limited response to standard drugs. New formulations aim for longer action, fewer side effects, and better control of off-period gait issues. Research also evaluates combination therapies that pair medication with cueing technology for improved motor stability. As clinical data grows, more companies enter the space, strengthening competitive activity. These advances broaden treatment options and support future expansion of the market.

Key Challenges

Limited Effectiveness in Advanced Disease Stages

A major challenge comes from limited response to treatment in late-stage Parkinson’s, where dopaminergic medications often fail to reduce gait blocks. Neuromodulation helps some patients but remains costly and invasive. Physical therapy results also weaken as motor control deteriorates. These constraints leave a sizable group struggling with persistent freeze episodes, falls, and reduced quality of life. The lack of strong late-stage solutions restricts overall treatment success and slows market adoption, creating an unmet need for new therapeutic approaches.

High Cost of Advanced Devices and Neuromodulation

Advanced gait-freezing treatment tools, including wearable cueing devices and neuromodulation systems, remain expensive for many patients. Deep brain stimulation involves surgical risk, high installation costs, and long-term maintenance needs. Insurance coverage is uneven across regions, limiting access to technology-based solutions. Even digital therapy platforms and premium assistive devices pose affordability issues in low-income settings. These cost barriers reduce adoption rates and widen treatment gaps, posing a significant challenge to market expansion.

Regional Analysis

North America

North America held the largest share of the Freezing of Gait Treatment Market in 2024 with about 38%. Strong presence of neurologists, advanced hospital systems, and early adoption of deep brain stimulation supported market growth. The United States contributed most of the regional demand due to high Parkinson’s disease prevalence and wide access to digital gait-monitoring tools. Canada expanded its share through improved elderly care programs and rehabilitation coverage. Rising use of physical therapy, home-based cueing devices, and clinical trials for next-generation drugs further strengthened the region’s leadership.

Europe

Europe accounted for nearly 32% of the market in 2024, driven by strong healthcare infrastructure and widespread access to physiotherapy-based gait management. Germany, the United Kingdom, and France remained major contributors due to early diagnosis programs and higher spending on mobility rehabilitation. The region also benefited from broad adoption of wearable gait-cueing devices and advanced neuromodulation systems. Growing support for elderly neurodegenerative care and government-funded mobility programs helped expand overall treatment volume. Rising research collaborations strengthened Europe’s position as a key market for freezing-of-gait innovations.

Asia-Pacific

Asia-Pacific held about 22% share in 2024 and showed the fastest growth due to rising Parkinson’s prevalence and larger aging populations in China, Japan, South Korea, and India. Improved hospital access, expanding neurology departments, and wider adoption of digital physiotherapy platforms drove treatment uptake. Japan’s mature healthcare system advanced early screening for gait disorders, while China increased investment in neurological rehabilitation centers. Growing use of cost-effective assistive devices, along with higher awareness of gait-related falls, supported wider adoption. This region is expected to gain further traction as access to multidisciplinary care improves.

Latin America

Latin America captured nearly 5% of the market in 2024, with growth supported by rising awareness of Parkinson’s-related gait issues and expanding access to neurology services. Brazil and Mexico contributed most of the demand due to larger patient pools and increasing use of physical therapy programs. Limited availability of advanced neuromodulation systems kept adoption moderate, but uptake of affordable assistive devices continued to rise. Regional governments also promoted fall-prevention programs for elderly populations, increasing treatment engagement. Gradual improvements in hospital infrastructure are expected to support steady market expansion.

Middle East & Africa

The Middle East & Africa region held around 3% share in 2024, driven by growing investment in specialty hospitals and enhanced neurological care services in Gulf countries. The UAE and Saudi Arabia led adoption due to stronger rehabilitation facilities and rising use of gait-cueing devices. Access remained limited in several African nations, where treatment focused mainly on medication and basic physiotherapy. Awareness campaigns for Parkinson’s symptoms and early gait-freezing signs began expanding treatment uptake. Improved diagnostic capacity and steady healthcare modernization are expected to support gradual market growth in the coming years.

Market Segmentations:

By Treatment Type

- Medication

- Physical Therapy

- Assistive Devices

- Surgical Treatment

By Patient Type

- Parkinson’s Disease

- Progressive Supranuclear Palsy

- Multiple System Atrophy

By Distribution Channel

- Hospitals

- Clinics

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Freezing of Gait Treatment Market features strong competition among leading companies such as GlaxoSmithKline plc, Abbott Laboratories, Sanofi S.A., Pfizer Inc., Bayer AG, Novartis AG, Medtronic, Boston Scientific Corporation, Teva Pharmaceutical Industries Ltd., and Merck & Co., Inc. These companies strengthen their positions through drug innovation, expanded neuromodulation solutions, and broader access to physiotherapy-based care. Medication portfolios remain central as firms refine dopaminergic and non-dopaminergic therapies for improved symptom control. Neuromodulation leaders invest in advanced deep brain stimulation platforms designed to reduce gait blocks in complex cases. Several companies also support digital health partnerships to improve gait monitoring and home-based rehabilitation. Strong distribution networks allow broad access to chronic therapies, while continuous clinical research helps sustain competitive advantage. The market remains dynamic as firms diversify treatment pathways, enhance device-drug integration, and target unmet needs in late-stage Parkinson’s disease and related disorders.

Key Player Analysis

- GlaxoSmithKline plc

- Abbott Laboratories

- Sanofi S.A.

- Pfizer Inc.

- Bayer AG

- Novartis AG

- Medtronic

- Boston Scientific Corporation

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

Recent Developments

- In February 2025, Medtronic received U.S. FDA approval for its BrainSense Adaptive DBS (aDBS) system and BrainSense Electrode Identifier (EI), marking a major regulatory milestone in neurotherapeutics.

- In December 2024, Bayer AG in its publicly released pipeline update, Bayer lists an rAAV gene‑therapy candidate (AB‑1005) for Parkinson’s disease

- In November 2024, GSK signed a research & licensing deal with a biotech startup, Vesalius Therapeutics, to search for new drugs for neurodegenerative disorders including Parkinson’s disease. Under the deal, GSK gains rights to preclinical small‑molecule compounds for Parkinson’s and can advance others.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Patient Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for freezing-of-gait treatments will rise as Parkinson’s cases grow worldwide.

- Digital gait-monitoring tools will gain wider clinical adoption for early detection.

- Neuromodulation systems will become more precise and accessible for advanced patients.

- Wearable cueing devices will expand in use due to better comfort and accuracy.

- Home-based rehabilitation platforms will support long-term therapy adherence.

- New non-dopaminergic drugs will enter the pipeline to address treatment gaps.

- Multidisciplinary gait clinics will increase availability in major healthcare systems.

- AI-based prediction models will help reduce fall incidents linked to gait freezing.

- Assistive device makers will innovate toward lighter and more personalized designs.

- Emerging markets will adopt advanced therapies faster as neurology care improves.

Market Segmentation Analysis:

Market Segmentation Analysis: