Market Overview:

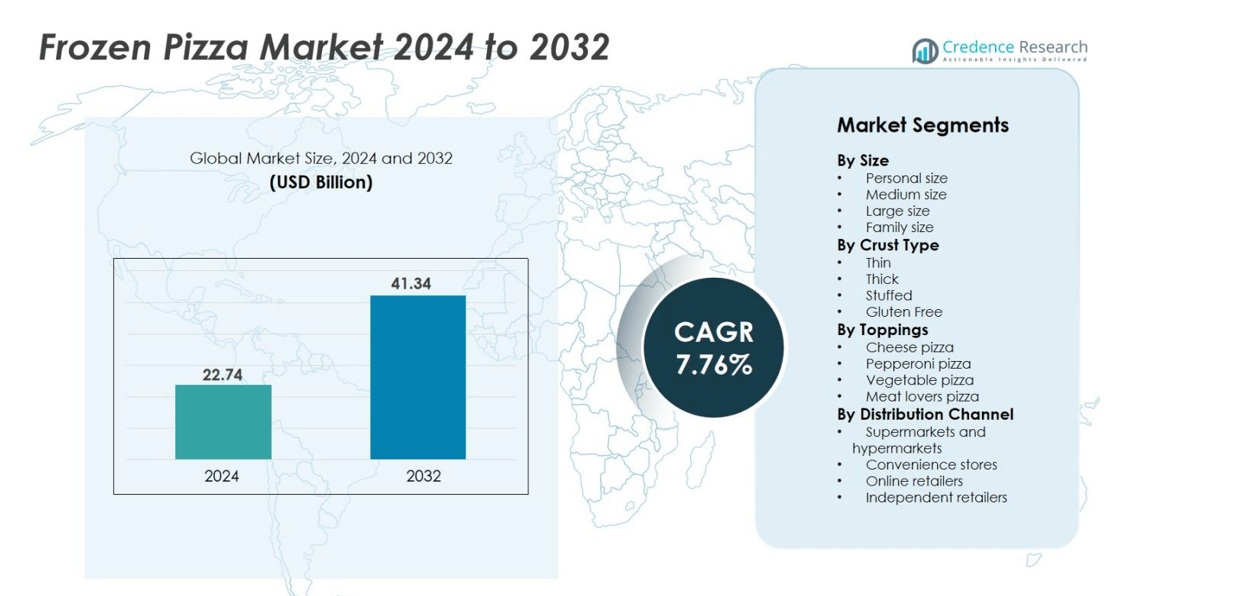

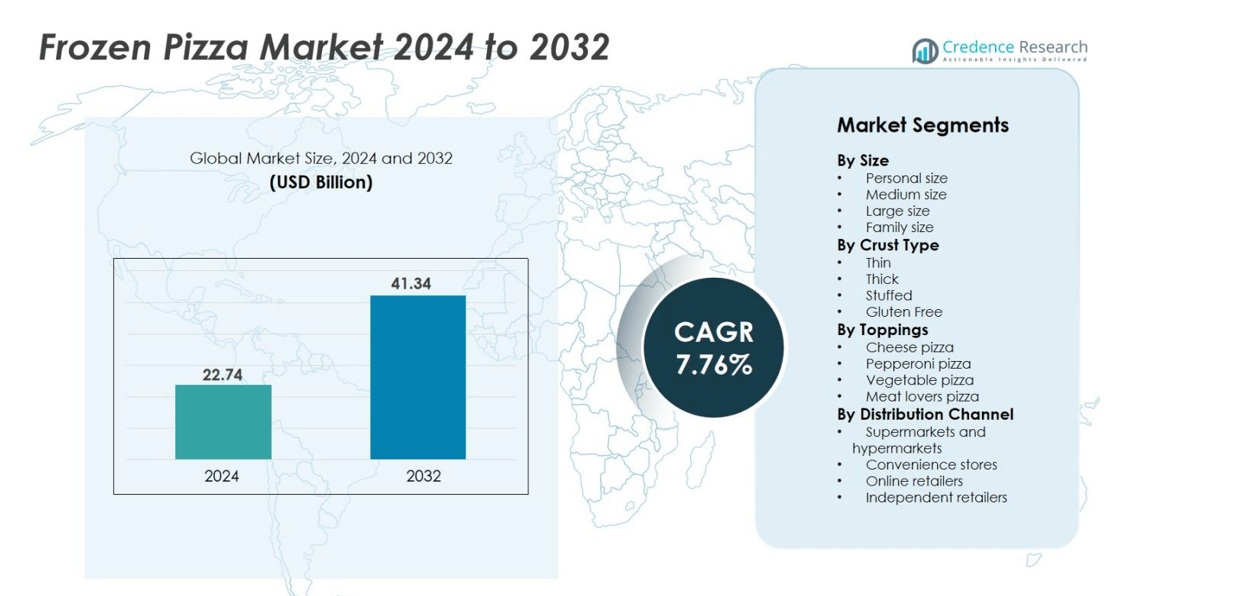

Frozen Pizza market size was valued at USD 22.74 billion in 2024 and is anticipated to reach USD 41.34 billion by 2032, at a CAGR of 7.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Pizza Market Size 2024 |

USD 22.74 billion |

| Frozen Pizza Market, CAGR |

7.6% |

| Frozen Pizza Market Size 2032 |

USD 41.34 billion |

The Frozen Pizza market is marked by intense rivalry among global and regional producers. Leading companies including Nestlé S.A., Dr. Oetker, McCain Foods Limited, Freiberger Lebensmittel GmbH, Bellisio Foods, Daiya Foods, California Pizza Kitchen, and Jubilant FoodWorks are broadening their portfolios with premium crust varieties, clean-label formulations, and plant-based topping options. Many brands strengthen retail presence through supermarket partnerships and online delivery platforms. North America leads the market with a 38% share, driven by high frozen food consumption and strong cold-chain logistics, while Europe holds 32%, supported by premium product adoption and private-label growth. Continuous innovation and regional flavor customization remain key competitive strategies.

Market Insights

- The Frozen Pizza market was valued at USD 22.74 billion in 2024 and will reach USD 41.34 billion by 2032, growing at a CAGR of 7.76%.

- Convenience and ready-to-eat meal demand drive growth, supported by busy lifestyles, strong retail penetration, and expanding online grocery channels.

- Thin-crust pizzas hold the largest crust share at 41%, while cheese toppings lead with 34%, and personal-size formats dominate size preferences.

- Competition remains high, with leading players such as Nestlé, Dr. Oetker, McCain Foods, Freiberger, and Bellisio Foods launching clean-label, plant-based, and gourmet products to strengthen differentiation.

- North America leads with 38% market share, followed by Europe at 32%, while Asia Pacific captures 18% and remains the fastest-growing region due to rising urbanization and adoption of Western-style frozen foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Size

Personal-size frozen pizzas lead this category with a 38% market share due to rising single-person households and demand for convenient, portion-controlled meals. Quick preparation time and lower price points make this format attractive for students and working professionals. Medium and large sizes continue to appeal to families seeking shared meals, while family-size formats gain traction through value packs offered by major retailers. However, the personal segment remains dominant as busy consumers prefer grab-and-go meals and healthier calorie control, supporting steady adoption across supermarkets and online grocery channels.

- For instance, Nestlé launched a new line of personal frozen pizzas in the U.S. specifically designed for calorie control and busy consumers, priced at around $5 and tailored for people managing weight with GLP-1 drugs, highlighting the focus on health-conscious portion sizes.

By Crust Type

Thin-crust frozen pizzas dominate the crust segment with a 41% market share, driven by consumer interest in lighter textures, lower calories, and faster baking times. Brands position thin-crust variants as a healthier and crispier alternative to traditional thick bases, boosting repeat purchases. Stuffed crust appeals to indulgence-driven buyers, while gluten-free options grow rapidly among health-conscious consumers and people with wheat intolerance. Despite this growth, thin crust remains the leading choice across North America and Europe, supported by premium product launches and artisanal-style recipes.

- For instance, Domino’s recently launched its first-ever Parmesan Stuffed Crust Pizza, made with mozzarella stuffed buttery-flavored dough topped with garlic seasoning and Parmesan, targeting indulgence-driven buyers with a premium product.

By Toppings

Cheese pizza holds the largest share at 34%, making it the dominant topping segment thanks to its universal taste and lower price compared to meat-based options. Pepperoni and meat-lover variants attract buyers who prefer high-protein meals, especially in Western markets. Vegetable-based toppings are gaining popularity among vegan and flexitarian consumers, supported by plant-based cheese and clean-label ingredients. However, cheese pizzas maintain leadership because they target all age groups, offer freezer-friendly packaging formats, and serve as a base for customization at home.

Key Growth Drivers

Rise of Convenient and Ready-to-Eat Meals

Growing demand for quick meals continues to propel frozen pizza sales across global markets. Busy working lifestyles, dual-income households, and limited time for cooking increase reliance on ready-to-eat products with long shelf life. Frozen pizzas require minimal preparation, making them popular among students, office workers, and families with hectic schedules. Retail chains offer a wide range of flavors and crust types, which support variety and repeat purchases. Expansion of microwave-friendly and oven-ready packaging also enhances product convenience. As rapid urbanization accelerates, especially in Asia and Latin America, more consumers adopt frozen meal habits, positioning frozen pizza as a preferred comfort food.

- For instance, Rustica Foods launched a line of frozen pizzas in November 2024, including varieties like Double Pepperoni and 4 Cheese & Garlic, catering to diverse taste preferences with ready-to-bake convenience.

Innovation in Premium and Health-Focused Variants

Product innovation drives strong growth as brands introduce gluten-free, whole wheat, vegan cheese, and plant-based toppings to meet changing dietary habits. Consumers seeking healthier alternatives prefer lower-calorie thin crusts, reduced sodium options, and high-fiber formulations. Manufacturers also use organic ingredients, artisan sauces, and clean-label claims to capture premium buyers. The rise of plant-based diets supports rapid growth of meatless toppings and dairy-free cheese, especially among flexitarian and lactose-intolerant consumers. Brands invest in natural preservatives instead of synthetic additives, improving nutritional appeal without compromising taste or texture.

- For instance, Oggi has expanded its offerings by partnering with Beyond Meat to launch entirely plant-based pizzas featuring vegan mozzarella and plant-based sausage and beef crumbles, tapping into the rising demand for vegan and flexitarian diets in North America.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online grocery platforms and quick-commerce delivery models create new growth opportunities for frozen pizzas. Consumers prefer doorstep delivery of frozen meals, especially after the widespread shift to digital shopping. Supermarkets partner with delivery apps to offer real-time inventory and discount offers, making frozen pizzas easily accessible. Direct-to-consumer subscription boxes and brand-owned web stores offer customizable toppings, specialty dietary products, and bulk pricing. Improved cold-chain logistics, temperature-controlled packaging, and reliable last-mile delivery reduce spoilage risks. As digital adoption accelerates in emerging markets, online distribution helps brands reach consumers beyond traditional retail stores, supporting strong market penetration and stable sales volumes.

Key Trends & Opportunities

Growing Popularity of Premium and Gourmet Flavors

Consumers increasingly seek restaurant-style frozen pizzas offering wood-fired crusts, authentic sauces, and unique toppings like goat cheese, truffle oil, or smoked meats. Gourmet frozen pizzas replicate artisanal quality at a lower cost compared to dine-in restaurants or delivery chains. Brands experiment with international flavors such as Mediterranean, Mexican, or Asian-inspired toppings to attract adventurous buyers. The rise of premium supermarket chains and specialty food stores also supports higher-priced gourmet options. As consumers shift towards indulgent comfort foods with high quality, this premiumization trend strengthens revenue potential, especially in urban markets.

- For instance, Kagome India produces authentic pizza sauce made from vine-ripened tomatoes and select herbs without preservatives, providing a fresh, natural flavor that elevates frozen pizza quality.

Increasing Adoption of Plant-Based and Clean-Label Products

Health-conscious consumers and vegan buyers accelerate adoption of plant-based frozen pizzas. These products use dairy-free cheese, vegetable proteins, and wheat-free crusts to meet special diets. Clean-label ingredient lists, free from trans fats, artificial flavors, or preservatives, attract parents and wellness-focused buyers. Brands highlight nutritional claims such as high fiber, reduced calories, and organic ingredients to build trust. Strong growth in lactose-intolerant and gluten-sensitive populations further drives demand. As food regulations tighten and consumer awareness rises, clean-label innovation becomes a key competitive strategy for new entrants and established manufacturers.

- For instance, Daiya Foods has introduced its melty plant-based mozzarella that enhances the sensory appeal of dairy-free pizzas, supporting its growth in the health-focused segment.

Key Challenges

High Competition from Fresh and Fast-Food Alternatives

Frozen pizzas face strong competition from food delivery services, fresh bakery pizzas, and quick-service restaurants. Consumers often prefer hot, freshly made pizza with customizable toppings, making delivered meals a strong substitute. In markets where delivery apps offer low-cost deals and fast service, frozen pizza struggles to compete on taste and freshness perception. Restaurants advertise fresh dough, premium cheese, and healthier ingredient claims, attracting customers who view frozen meals as less nutritious. To counter this challenge, frozen brands focus on artisanal-style crusts, premium toppings, and healthier formulations, but price-sensitive buyers may still shift toward discounted restaurant offers.

Cold-Chain and Storage Limitations in Emerging Markets

Frozen pizza relies on reliable cold-chain logistics from production to retail shelves. In emerging regions, inadequate freezer storage, power instability, and high logistics costs create distribution barriers. Small stores may avoid frozen products due to limited freezer capacity, restricting rural penetration. Transportation challenges increase spoilage risk and raise product prices, reducing affordability. As a result, market growth remains slower in regions without strong infrastructure. Companies must invest in logistics partnerships, centralized distribution hubs, and insulated packaging to improve availability. Without these improvements, penetration in developing countries will remain restricted despite high demand potential.

Regional Analysis

North America

North America holds the largest market share at 38%, supported by high consumption of ready-to-eat meals, strong retail presence, and widespread adoption of frozen foods in household diets. The U.S. drives most sales through supermarket chains, club stores, and online grocery platforms offering large product assortments. Consumers prefer premium thin-crust, gluten-free, and gourmet toppings, pushing brands to innovate healthier and artisanal-style variants. Canada follows a similar demand pattern, with rising interest in organic and plant-based toppings. Strong cold-chain logistics and aggressive promotional offers ensure consistent product availability, reinforcing the region’s leadership position.

Europe

Europe captures 32% market share, driven by strong demand in Germany, the U.K., Italy, and France. Consumers show high preference for authentic flavors, sourdough crusts, and clean-label formulations. Premium frozen pizzas compete directly with restaurant-style offerings, attracting buyers seeking high-quality meals at affordable prices. Growth in vegan options and lactose-free cheese supports increasing adoption among health-conscious and gluten-sensitive consumers. Supermarkets and discount retail chains expand private-label offerings, boosting sales volume across Western and Central Europe. Efficient refrigeration infrastructure and mature retail distribution networks sustain stable growth across the region.

Asia Pacific

Asia Pacific accounts for 18% market share, but remains the fastest-growing region due to rapid urbanization and rising acceptance of Western fast foods. Young consumers and working professionals show strong interest in convenient frozen meals, especially in Japan, South Korea, China, and Australia. International brands introduce localized flavors such as seafood, spicy sauces, and vegetarian toppings to appeal to regional tastes. Expanding cold-chain logistics, e-commerce penetration, and modern retail stores enhance product accessibility. Increasing disposable income and aggressive marketing campaigns further strengthen market growth, making Asia Pacific a key long-term opportunity.

Latin America

Latin America holds 7% market share, led by Brazil, Mexico, and Argentina. Demand grows as supermarket chains and hypermarkets expand frozen food sections with economy and premium product options. Consumers prefer large and family-sized formats designed for group dining, boosting volume sales. Economic private-label offerings attract price-sensitive households. Limited cold-chain infrastructure in rural locations restricts full market penetration, but urban regions see steady adoption. Promotions, bundled offers, and brand partnerships with retail chains strengthen visibility, supporting gradual expansion of frozen pizza consumption in the region.

Middle East & Africa

The Middle East & Africa region represents 5% market share, supported by growing modern retail distribution in the UAE, Saudi Arabia, and South Africa. Increasing expatriate population and demand for Western-style fast foods contribute to frozen pizza adoption. Manufacturers introduce halal-certified, vegetarian, and cheese-focused variants to meet regional dietary preferences. However, high product pricing and limited freezer capacity in small stores restrict wider access. Expansion of supermarket chains, online grocery platforms, and cold-storage facilities gradually improves availability, positioning the region for future growth despite its smaller base.

Market Segmentations:

By Size

- Personal size

- Medium size

- Large size

- Family size

By Crust Type

- Thin

- Thick

- Stuffed

- Gluten Free

By Toppings

- Cheese pizza

- Pepperoni pizza

- Vegetable pizza

- Meat lovers pizza

By Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Online retailers

- Independent retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Frozen Pizza market remains highly competitive, with global and regional players focusing on product quality, flavor innovation, and wider retail penetration. Leading companies such as Nestlé S.A., Dr. Oetker, McCain Foods, California Pizza Kitchen, and Freiberger Lebensmittel GmbH expand portfolios with thin-crust, gluten-free, and gourmet-style offerings to attract health-conscious and premium buyers. Private-label brands from large retail chains further intensify competition by offering cost-effective alternatives. Manufacturers invest in clean-label ingredients, organic toppings, and environmentally friendly packaging to strengthen brand appeal. E-commerce distribution, quick-commerce platforms, and direct-to-consumer models support broader market reach. Strategic marketing, partnerships with supermarkets, and promotional pricing drive higher volumes in developed regions, while localization of flavors supports expansion in emerging markets. Overall, innovation, distribution strength, and pricing strategy remain central competitive factors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Freiberger Lebensmittel GmbH Co

- One Planet Pizza

- Bellisio Foods, Inc.

- Jubilant FoodWorks

- McCain Foods Limited

- The Simply Good Foods Company

- Dr. Oetker

- Nestlé S.A.

- California Pizza Kitchen

- Daiya Foods

Recent Developments

- In November 2025, Urban Farmer completed the acquisition of CAULIPOWER, forming an integrated frozen foods platform emphasizing healthier frozen pizzas and dough products.

- In September 2025, MBC Companies acquired Alpha Foods to strengthen its frozen pizza manufacturing capabilities and expand its product portfolio.

- In May 2025, Palermo Villa Inc. partnered with Ragu to launch a new frozen pizza line featuring sauces inspired by the Ragu brand.

- In 2023, Schwan’s Company opened a state-of-the-art frozen pizza facility in Kansas, USA, boosting production capacity for its Red Baron and Freschetta brands to meet rising demand.

Report Coverage

The research report offers an in-depth analysis based on Size, Crust, Toppings, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for convenient ready-to-eat meals will continue to rise among busy consumers.

- Premium and gourmet frozen pizzas will gain stronger traction in retail stores.

- Plant-based toppings and dairy-free cheese options will expand product portfolios.

- Gluten-free and clean-label formulations will attract health-conscious buyers.

- Online grocery platforms and quick-commerce delivery will boost market penetration.

- Brands will invest in sustainable packaging and cleaner ingredient lists.

- Restaurant-style crusts and artisanal flavors will improve product quality perception.

- Private-label frozen pizzas will grow in supermarkets due to cost advantage.

- Emerging markets will adopt frozen pizzas faster as cold-chain logistics improve.

- Flavor localization will help international brands reach regional consumer preferences.