Market Overview

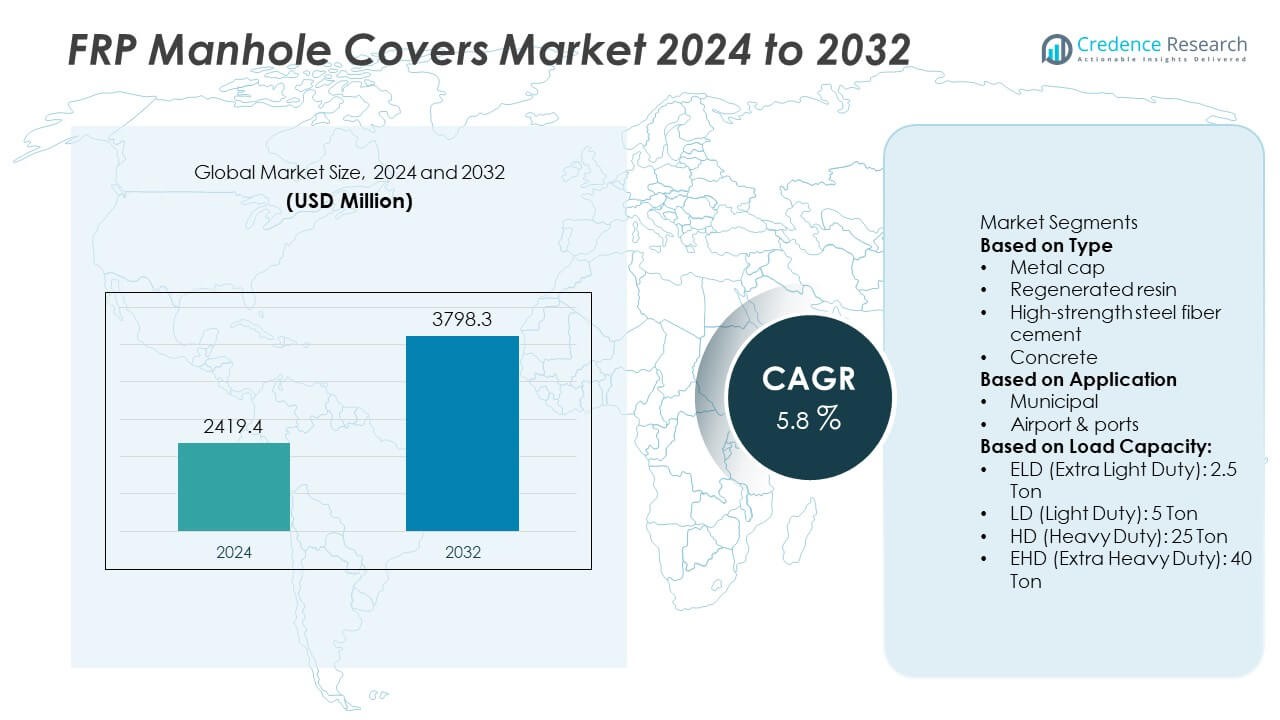

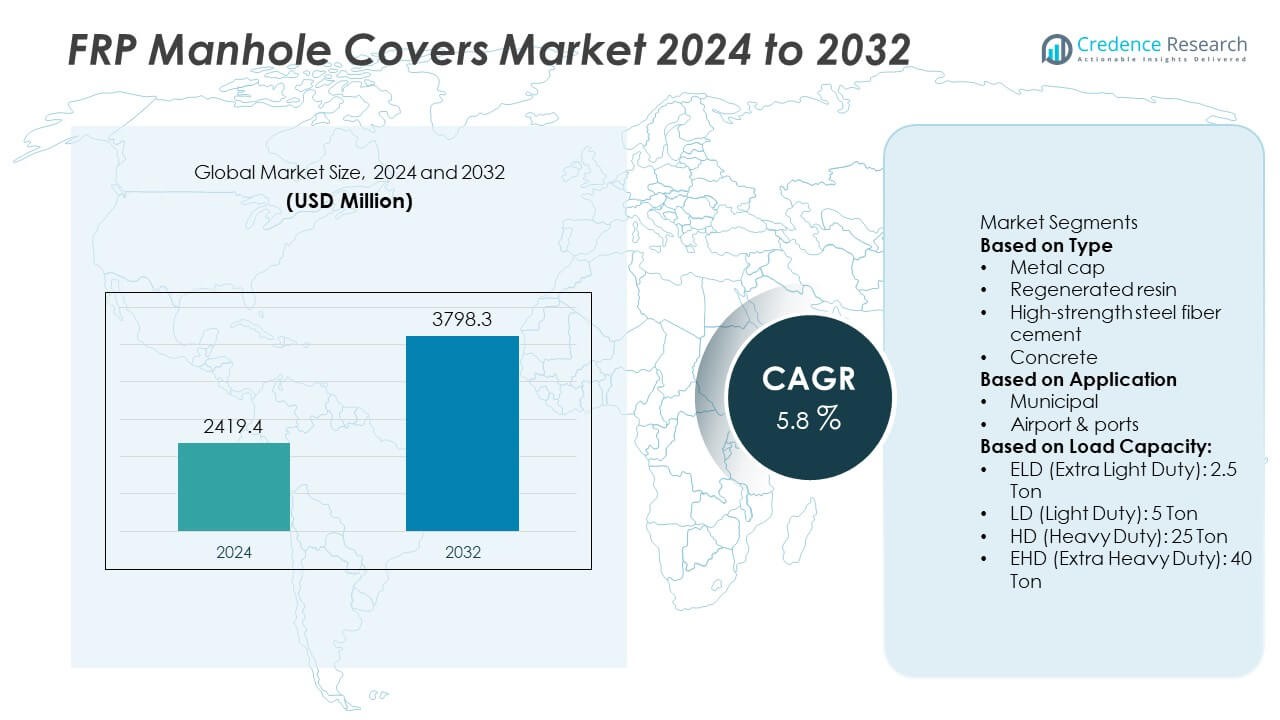

The FRP Manhole Covers Market was valued at USD 2,419.4 million in 2024 and is projected to reach USD 3,798.3 million by 2032, registering a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

|

|

USD 2,419.4 Million |

| FRP Manhole Covers Market ,CAGR |

5.8% |

| FRP Manhole Covers Market Size 2032 |

USD 3,798.3 Million |

The FRP Manhole Covers Market grows on rising demand for lightweight, durable, and theft-resistant alternatives to cast iron and concrete covers. Municipalities and utility operators adopt FRP solutions for their corrosion resistance, non-conductive properties, and reduced maintenance needs, which extend service life in urban and industrial environments.

The FRP Manhole Covers Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with adoption influenced by infrastructure development, regulatory frameworks, and urban modernization needs. North America emphasizes safety and theft resistance, driving replacement of traditional cast iron covers in smart city projects. Europe focuses on sustainable and recyclable materials, supported by strict environmental regulations and advanced municipal planning. Asia-Pacific emerges as the most dynamic region with rapid urbanization, government-led infrastructure programs, and widespread acceptance of cost-effective alternatives in cities and industrial zones. Latin America and the Middle East & Africa demonstrate gradual adoption, particularly in areas facing urban drainage challenges and large-scale construction activity. Key players shaping this market include Fibrelite, Saint Gobain, Crescent Foundry, and Polieco Group, all of which invest in innovative composites, expanded product ranges, and region-specific solutions to address diverse infrastructure requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The FRP Manhole Covers Market was valued at USD 2,419.4 million in 2024 and is projected to reach USD 3,798.3 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- Rising demand for lightweight, corrosion-resistant, and theft-proof infrastructure materials drives adoption, with municipalities and industrial sectors favoring FRP over traditional cast iron.

- Growing emphasis on smart city projects and sustainable urban infrastructure trends supports the integration of RFID-enabled and customizable FRP manhole covers.

- Competitive dynamics remain strong, with leading players such as Fibrelite, Saint Gobain, Crescent Foundry, and Polieco Group focusing on innovation, material advancements, and global distribution networks.

- High initial costs and limited awareness in emerging markets act as restraints, slowing replacement of conventional covers in cost-sensitive regions.

- North America and Europe adopt FRP covers rapidly due to regulatory compliance and modernization projects, while Asia-Pacific shows the fastest growth through urbanization and infrastructure expansion.

- Latin America and the Middle East & Africa gradually increase adoption, particularly in drainage systems, industrial hubs, and smart city initiatives supported by public-private investments.

Market Drivers

Rising Preference for Lightweight and Durable Infrastructure Materials

The FRP Manhole Covers Market grows steadily due to the increasing adoption of lightweight alternatives to traditional cast iron and concrete covers. Fiber-reinforced plastic offers superior strength-to-weight ratio, making it easier to transport, install, and maintain. Municipal corporations and utility companies adopt FRP covers to reduce the risks of workplace injuries during handling. It provides exceptional resistance to corrosion, water absorption, and environmental degradation, which enhances lifespan in harsh urban and industrial environments. The shift toward low-maintenance infrastructure supports strong replacement demand across cities. Growing awareness about lifecycle cost savings reinforces its acceptance in public infrastructure projects.

- For instance, Fibrelite manufactures composite manhole covers that are up to 65% lighter than equivalent metal covers and has deployed more than 300,000 units globally across infrastructure projects, reducing handling-related injuries by verified industry reports.

Growing Emphasis on Theft Resistance and Public Safety

The rising incidents of metal theft in urban infrastructure accelerate the demand for FRP covers. Unlike cast iron, FRP has no scrap value, eliminating incentives for theft and improving public safety by preventing open manholes. Governments and municipalities invest in FRP installations to avoid road accidents and liability costs linked to missing covers. It ensures compliance with safety standards while reducing the need for frequent replacements. The anti-skid and non-conductive properties further enhance safety for pedestrians and vehicles. Increasing adoption across highways, residential complexes, and smart city projects reflects this critical driver.

- For instance, Crescent Foundry supplied over 50,000 FRP composite covers to Indian municipal bodies between 2022 and 2024, directly reducing theft-related replacements that previously cost cities more than 12,000 units annually in lost cast iron covers.

Expanding Urbanization and Infrastructure Modernization

Rapid growth in urban populations fuels the demand for modern sewage, drainage, and utility infrastructure. The FRP Manhole Covers Market benefits from city-level investments aimed at upgrading outdated cast iron networks with safer, durable solutions. Infrastructure modernization projects in Asia-Pacific and the Middle East highlight the rising deployment of composite covers. It supports large-scale adoption in roads, airports, metro systems, and industrial zones where long-lasting materials are prioritized. Governments allocate significant budgets for smart city initiatives, further stimulating demand. The ability to customize FRP covers for different load-bearing classes strengthens its role in large infrastructure upgrades.

Regulatory Push Toward Sustainable and Low-Maintenance Solutions

Environmental regulations encourage the shift from traditional metal covers to composite alternatives with lower lifecycle costs. The FRP Manhole Covers Market aligns with these policies by offering corrosion-resistant materials that reduce replacement frequency. It supports sustainable urban development by lowering carbon footprints through reduced production and maintenance requirements. Municipal authorities recognize FRP’s recyclability potential, improving compliance with green building codes. Stringent safety guidelines in Europe and North America accelerate market penetration. Industry players respond by expanding production capacities and innovating resin formulations to meet diverse regulatory standards.

Market Trends

Increasing Integration of Smart and Customizable Designs

The FRP Manhole Covers Market witnesses growing adoption of smart-enabled and customized solutions that meet diverse infrastructure needs. Manufacturers embed RFID tags, sensors, and GPS trackers to support asset monitoring and prevent unauthorized access. It improves operational efficiency for municipalities and utility operators by enabling real-time location and condition tracking. Custom designs with logos, color coding, and varying load capacities create branding opportunities for city projects and housing developers. Demand for aesthetic appeal alongside functional performance strengthens this trend. Tailor-made covers with precise engineering standards gain popularity in both developed and emerging regions.

- For instance, Fibrelite offers FRP trench and manhole covers rated up to 90‑ton (202,000 lb) load capacity while remaining lightweight enough for single‑person manual removal, achieved thanks to their ergonomic lifting handle design.

Rising Focus on Corrosion Resistance and Longevity

End users increasingly prioritize materials that offer high resistance to chemical exposure and weather conditions. The FRP Manhole Covers Market benefits from this shift as composite materials outperform traditional cast iron in drainage systems, coastal installations, and industrial areas. It reduces maintenance cycles, extending the service life significantly under demanding conditions. The trend aligns with growing investments in wastewater management and urban sanitation. Strong adoption in coastal cities highlights the preference for anti-rust solutions. Global construction players specify FRP covers to meet durability standards in infrastructure contracts.

- For instance, Polieco Group introduced its KIO composite manhole covers, ranging from classes B125 to D400. These covers are available in various sizes, from 300×300 mm up to Ø 1230 mm, and maintain certification under the EN 124 standard.

Growing Adoption in Smart City and Infrastructure Projects

Rapid development of smart cities drives higher demand for advanced manhole solutions. The FRP Manhole Covers Market positions itself as a reliable choice for modern urban networks due to its safety, durability, and adaptability. It supports applications in roads, metros, and airports where load-bearing efficiency and public safety are critical. Government-backed infrastructure projects in Asia-Pacific and the Middle East integrate composite covers in large-scale rollouts. Rising preference for energy-efficient and sustainable materials strengthens long-term adoption. Integration of FRP into digitalized urban planning frameworks shapes future deployments.

Expanding Innovation in Manufacturing and Materials

Manufacturers innovate with resin formulations, advanced molding processes, and automated production lines to enhance performance and scalability. The FRP Manhole Covers Market evolves with lighter yet stronger covers that meet international load class standards. It enables faster production while reducing energy consumption and material waste. The use of hybrid composites further extends design flexibility for diverse municipal and industrial requirements. Companies invest in R&D to develop products that meet stringent environmental and safety regulations. Continuous innovation in production processes creates competitive advantages for market leaders.

Market Challenges Analysis

High Initial Costs and Limited Awareness Among End Users

The FRP Manhole Covers Market faces a significant barrier due to higher upfront costs compared to traditional cast iron or concrete alternatives. While long-term benefits such as reduced maintenance and extended lifespan justify investment, many municipalities and small contractors remain price-sensitive. It limits adoption in developing regions where budget constraints dominate infrastructure planning. Limited awareness about technical advantages such as non-conductivity, corrosion resistance, and theft prevention further slows replacement of legacy systems. The absence of widespread demonstration projects in cost-sensitive markets adds to the challenge. Manufacturers must invest in education campaigns and pilot projects to improve user confidence.

Standardization Issues and Performance Concerns in Diverse Conditions

Another challenge arises from the lack of globally harmonized standards governing FRP manhole cover production and testing. The FRP Manhole Covers Market struggles with fragmented regulations across countries, which complicates large-scale procurement by international infrastructure developers. It creates inconsistencies in quality assurance and performance benchmarks, raising doubts among end users. Concerns about durability under extreme temperatures, heavy axle loads, and chemical exposure remain in regions with harsh operating environments. Limited field data in certain geographies reduces trust compared to the long-established track record of cast iron. Industry leaders must address these gaps through certification programs, rigorous testing, and collaboration with regulatory bodies.

Market Opportunities

Expanding Role in Smart Cities and Infrastructure Modernization

The FRP Manhole Covers Market presents strong opportunities through large-scale adoption in smart city initiatives and infrastructure renewal projects. Governments prioritize modern materials that ensure safety, durability, and low maintenance for urban networks. It supports deployment in roads, metro systems, airports, and industrial parks where long-lasting solutions are essential. The integration of IoT-enabled sensors and RFID tracking in covers creates new opportunities for digital infrastructure monitoring. Urban planners increasingly specify FRP to align with sustainability and safety standards. Rising public and private investment in city modernization drives growth potential across multiple regions.

Growing Adoption in Emerging Economies and Specialized Applications

Rapid urbanization in Asia-Pacific, Latin America, and the Middle East generates demand for advanced sewage, drainage, and utility systems. The FRP Manhole Covers Market finds new opportunities in these geographies due to expanding construction activity and the push for modern alternatives to traditional materials. It benefits from broader awareness of theft-prevention, corrosion resistance, and safety features. Specialized applications in chemical plants, coastal installations, and energy projects highlight further potential where extreme conditions require high-performance materials. Partnerships between local governments and global manufacturers open channels for accelerated adoption. Expanding distribution networks and customization capabilities strengthen prospects in underserved markets.

Market Segmentation Analysis:

By Type

The FRP Manhole Covers Market divides by type into square, rectangular, and circular designs, each serving distinct infrastructure requirements. Square and rectangular covers dominate urban sewerage and drainage systems due to their compatibility with linear network layouts. Circular covers remain widely used in municipal applications, offering high structural integrity under traffic loads. It benefits from flexibility in production, allowing manufacturers to deliver customized shapes and dimensions to suit project specifications. Demand continues to grow for covers that balance safety, aesthetics, and ease of handling. The variety of types supports broad adoption across both public and private infrastructure projects.

- For instance, Polieco Group’s KIO line includes composite covers certified to EN 124‑1/‑5 in classes B125, C250, and D400; the KIO C250 round covers are offered with a clear opening diameter of 805 mm (outer frame Ø 1100 mm) and withstand load tests up to 250 kN without failure.

By Application

Applications span municipal, industrial, and residential sectors where FRP manhole covers provide safety, durability, and reduced maintenance costs. The FRP Manhole Covers Market finds significant demand in municipalities, which prioritize theft-proof and corrosion-resistant solutions for sewerage and stormwater systems. Industrial zones adopt FRP covers to withstand chemical exposure and heavy-duty operations. Residential complexes prefer lightweight covers for ease of installation and aesthetic appeal, often integrating customized designs. It supports diverse requirements by offering products tailored for different environments. Strong demand in wastewater management and transportation networks highlights the growing utility of FRP solutions.

- For instance, Terra Firma’s ThruBeam composite access covers used in petroleum forecourts and tunnels are gas- and water-tight, NATA-tested to AS 3996 Class E (400 kN), and feature single-cover weights of 28–29 kg while meeting AASHTO and EN 124 D400.

By Load Capacity

Segmentation by load capacity includes extra light duty (2.5 ton), light duty (5 ton), heavy duty (25 ton), and extra heavy duty (40 ton). The FRP Manhole Covers Market addresses specific needs ranging from pedestrian pathways and residential areas to highways and industrial facilities. Extra light and light duty covers dominate in gardens, footpaths, and residential projects, where minimal load is expected. Heavy duty covers are critical in urban roads, commercial hubs, and industrial areas exposed to vehicle traffic. Extra heavy duty variants meet the stringent demands of airports, seaports, and logistics centers. It ensures safety and reliability across multiple infrastructure classes by offering tailored load-bearing solutions.

Segments:

Based on Type

- Metal cap

- Regenerated resin

- High-strength steel fiber cement

- Concrete

Based on Application

- Municipal

- Airport & ports

Based on Load Capacity:

- ELD (Extra Light Duty): 2.5 Ton

- LD (Light Duty): 5 Ton

- HD (Heavy Duty): 25 Ton

- EHD (Extra Heavy Duty): 40 Ton

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 28% market share in the FRP Manhole Covers Market, driven by strong demand from urban infrastructure modernization and strict safety regulations. The region invests heavily in replacing traditional cast iron covers with FRP alternatives due to theft concerns and the need for lightweight, durable solutions. Municipalities across the United States adopt FRP covers in smart city projects, sewerage networks, and transportation hubs. It gains further traction from regulatory pressure emphasizing sustainable materials and reduced lifecycle costs. Canada demonstrates growing adoption in urban drainage systems, supported by federal infrastructure funding. The presence of leading manufacturers and technology innovators strengthens supply capabilities across the region.

Europe

Europe accounts for a 24% market share, supported by stringent environmental regulations and advanced infrastructure programs. Countries such as Germany, the United Kingdom, and France lead the transition toward corrosion-resistant and recyclable FRP materials. The FRP Manhole Covers Market benefits from widespread use in wastewater management facilities, highways, and urban renewal projects. It aligns well with EU directives promoting sustainability and carbon footprint reduction. Eastern European countries show rising adoption due to expanding urbanization and modernization of old sewage systems. The established presence of European composite manufacturers accelerates product innovation and compliance with diverse performance standards.

Asia-Pacific

Asia-Pacific commands the largest share at 32%, reflecting rapid urbanization and extensive infrastructure development across China, India, and Southeast Asia. The FRP Manhole Covers Market thrives in this region due to government-backed investments in smart cities, metro systems, and drainage modernization. China leads in large-scale deployments supported by municipal projects, while India shows strong growth under urban renewal missions and safety mandates. It experiences high demand in coastal cities, where corrosion resistance provides a clear advantage over cast iron. Local manufacturing initiatives reduce costs and improve accessibility across diverse markets. Rising awareness of theft-prevention and safety benefits strengthens adoption across both residential and industrial sectors.

Latin America

Latin America represents a 9% market share, with growth led by Brazil, Mexico, and Argentina. The FRP Manhole Covers Market expands gradually in this region, where governments and private contractors seek cost-effective and durable infrastructure solutions. Urban flooding challenges and outdated sewage systems increase demand for lightweight, corrosion-resistant alternatives. It supports city-level initiatives focused on reducing theft-related losses and improving pedestrian safety. Brazil leads adoption due to its urban density and investments in smart city frameworks. Regional expansion opportunities exist as awareness about long-term cost savings improves.

Middle East & Africa

The Middle East & Africa accounts for a 7% market share, supported by infrastructure projects in the Gulf countries and gradual adoption in African cities. The FRP Manhole Covers Market grows in this region due to demand for heavy-duty covers in airports, ports, and industrial complexes. It benefits from resistance to extreme temperatures and chemical exposure, critical in oil and gas-rich economies. Gulf nations adopt FRP covers in modern city developments and large-scale industrial parks. African countries demonstrate slower penetration but show potential in urban centers where safety and durability drive procurement decisions. Strategic partnerships with global suppliers expand product availability in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the FRP Manhole Covers Market is shaped by leading players such as Fibrelite, Saint Gobain, Crescent Foundry, Polieco Group, Ducast Factory, Terra Firma Industries, Hygrade Products Limited, Eagle Manufacturing Group, Forecourt Solutions, and Prime Composites Australia Ply Ltd, who focus on product innovation, regional expansion, and long-term infrastructure partnerships. Fibrelite emphasizes advanced composites with high load-bearing capacities and customization, while Saint Gobain leverages its global expertise in materials science to strengthen adoption in smart city and industrial projects. Crescent Foundry integrates FRP into its diverse portfolio to offer flexibility across markets, whereas Polieco Group develops sustainable solutions with advanced resin technologies aligned with European regulations. Regional leaders such as Ducast Factory and Terra Firma Industries deliver cost-effective, locally designed products for Middle Eastern and Asia-Pacific markets. Hygrade Products Limited and Eagle Manufacturing Group provide robust heavy-duty options tailored for urban utilities, while Forecourt Solutions and Prime Composites Australia Ply Ltd focus on niche applications through specialized engineering. Collectively, these companies invest in R&D, automation, and distribution networks to enhance performance standards and drive global adoption of FRP manhole covers.

Recent Developments

- In July 2025, Fibrelite announced a new generation of radio frequency (RF) friendly manhole covers. These covers are designed to support data transfer between antennas underground and aboveground, particularly for applications like remote underground monitoring in utilities, mining, and telecoms.

- In November 2024, Terra Firma Industries released a document titled “A Year of Progress and Growth for You – A Terra Firma Year in Review.” This document likely highlighted the company’s achievements and advancements throughout the preceding year.

- In July 2024, Terra Firma Industries, the company highlighted its innovative FRP composite solutions for infrastructure, including pit lids and access covers engineered to replace heavy traditional materials with stronger, lighter alternatives

Market Concentration & Characteristics

The FRP Manhole Covers Market reflects moderate concentration, with a mix of global leaders and regional manufacturers shaping competition through technology, innovation, and localized strategies. Large players focus on advanced composites, sustainability, and smart-enabled features to strengthen adoption in municipal, industrial, and residential applications. Regional firms compete by offering cost-efficient designs tailored to local infrastructure standards and regulations. It demonstrates characteristics of a technology-driven market where durability, theft resistance, and lifecycle cost reduction define product differentiation. The industry continues to evolve with regulatory support for sustainable materials and growing demand from smart city projects. Partnerships, acquisitions, and capacity expansions remain key strategies for players aiming to extend geographic reach and serve diverse end-use sectors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Load Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and durable covers will expand across urban and industrial projects.

- Adoption in smart city infrastructure will accelerate through integration of RFID and IoT features.

- Governments will promote FRP solutions to reduce theft, improve safety, and cut maintenance costs.

- Manufacturers will invest in advanced composites and resin technologies to enhance performance.

- Growth will strengthen in Asia-Pacific due to rapid urbanization and infrastructure modernization.

- Europe will lead in sustainability-focused adoption driven by strict environmental regulations.

- North America will expand replacement demand supported by modernization of sewerage and drainage systems.

- Latin America and Middle East & Africa will show gradual adoption with targeted city-level investments.

- Competition will intensify as global players expand distribution networks and regional firms focus on cost-efficient solutions.

- Innovation in hybrid composites and modular designs will create new opportunities across heavy-duty applications.