Market Overview

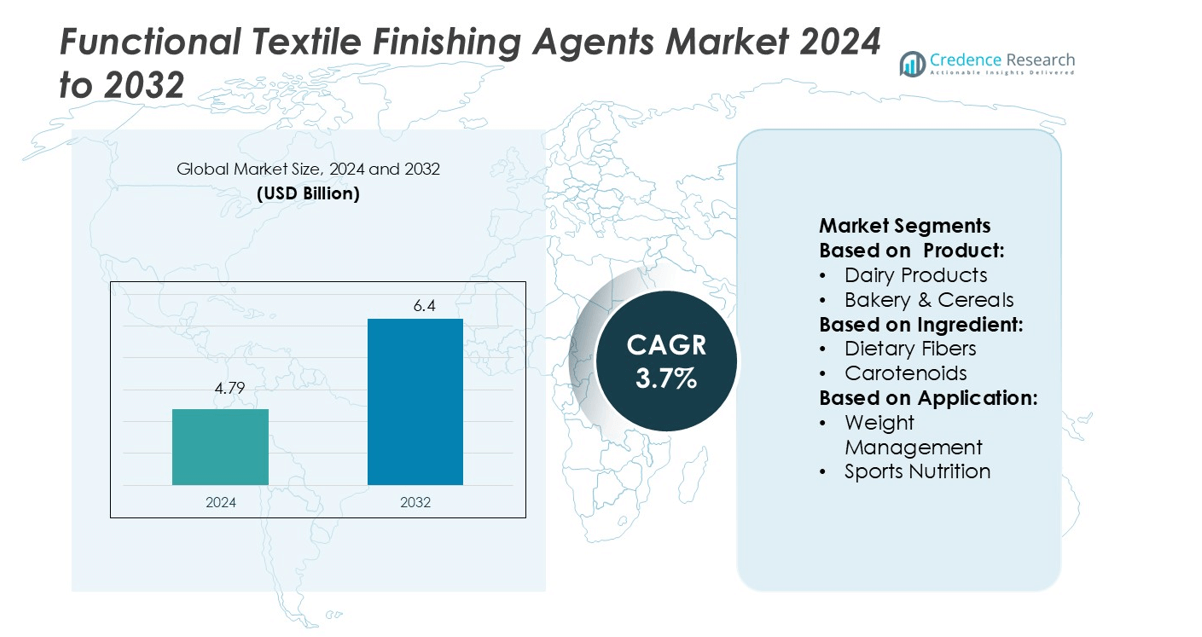

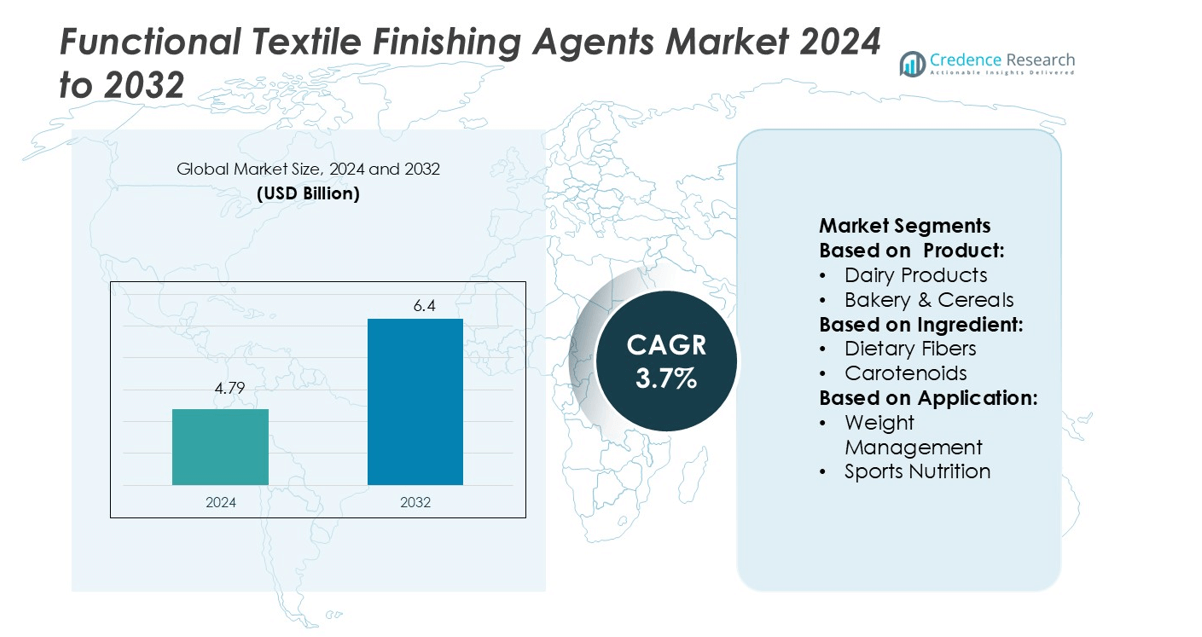

Functional Textile Finishing Agents Market size was valued USD 4.79 billion in 2024 and is anticipated to reach USD 6.4 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Textile Finishing Agents Market Size 2024 |

USD 4.79 billion |

| Functional Textile Finishing Agents Market, CAGR |

3.7% |

| Functional Textile Finishing Agents Market Size 2032 |

USD 6.4 billion |

The functional textile finishing agents market is driven by top players such as Huntsman Corporation, Sarex, OMNOVA Solutions (Synthomer), NICCA Chemical Co., Ltd., Archroma, KAPP-CHEMIE, Sumitomo Chemical, Wacker Chemie AG, Covestro, and Zydex Industries. These companies focus on sustainable finishing technologies, advanced chemical formulations, and performance-enhancing coatings to meet evolving industry demands. They invest heavily in R&D, eco-friendly solutions, and strategic collaborations to strengthen their global presence. North America leads the market with a 34.5% share, supported by strong manufacturing capabilities, high consumer demand for performance textiles, and early adoption of green technologies. This leadership is reinforced by innovation in antimicrobial, water-repellent, and smart finishing solutions that cater to healthcare, sportswear, and industrial applications.

Market Insights

- Functional Textile Finishing Agents Market size was valued at USD 4.79 billion in 2024 and is projected to reach USD 6.4 billion by 2032, growing at a CAGR of 3.7%.

- Increasing demand for eco-friendly and high-performance finishing solutions is driving market growth, supported by advancements in sustainable technologies and chemical formulations.

- Rising adoption of smart, antimicrobial, and water-repellent finishes in healthcare, sportswear, and industrial applications is shaping key market trends.

- The market is highly competitive, with leading players focusing on innovation, R&D investments, and strategic partnerships to expand global reach and strengthen their product portfolios.

- North America holds a 34.5% regional share, leading the market due to strong manufacturing capabilities and early technology adoption, while the dairy products segment dominates product share, supported by increasing consumer demand for durable and functional textile applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Dairy products hold the dominant share in the functional textile finishing agents market. These products offer high nutritional value and support health-focused consumption trends. Manufacturers add proteins, probiotics, and vitamins to enhance functionality and shelf life. Rising demand for functional yogurts, fortified milk, and protein-enriched beverages boosts this segment. Strong consumer preference for natural and clean-label options further drives innovation. The bakery and cereals segment follows, supported by fortified bread and energy bars designed for health-conscious consumers.

- For instance, Huntsman’s textile division introduced AVITERA® SE dyes that reduce production water and energy usage by up to 50% and increase mill throughput by up to 25% or more compared to conventional dyeing processes.

By Ingredient

Vitamins lead the ingredient segment due to their wide application in functional food and beverage formulations. Fortified products with vitamins A, D, E, and B-complex cater to immunity, bone health, and energy needs. Easy integration of vitamins in dairy, bakery, and sports nutrition products supports this dominance. Growing awareness of micronutrient deficiencies encourages product innovation and regulatory support for vitamin fortification. Dietary fibers also show strong growth, driven by increasing demand for gut health solutions.

- For instance, OMNOVA’s surf(x) Echo 3D Emboss-In-Register (EIR) laminate “Bodega Old Light Plank” was produced in a 16 mil rigid thermofoil format, using EIR embossing to match natural wood grain precisely.

By Application

Weight management is the dominant application segment in the functional textile finishing agents market. Rising obesity rates and lifestyle-related health issues drive the adoption of fortified products supporting calorie control and satiety. Dairy-based protein shakes, fiber-rich snacks, and functional beverages lead this category. Increasing awareness of preventive health and personalized nutrition further strengthens demand. Sports nutrition and digestive health are also expanding, supported by active lifestyle trends and growing interest in wellness-focused diets.

Key Growth Drivers

Rising Demand for Performance and Protective Textiles

Growing demand for functional apparel with enhanced protection and comfort is driving market expansion. Consumers prefer textiles that offer moisture management, UV resistance, antimicrobial properties, and odor control. Increasing use in sportswear, outdoor clothing, and healthcare uniforms boosts production volumes. Industrial sectors are adopting these textiles for safety and durability. Manufacturers are investing in advanced chemical treatments to improve performance without compromising fabric quality, supporting widespread adoption across multiple end-use industries.

- For instance, NICCA’s NICCANON RB-560 finishing agent achieves a high antiviral effect on polyester, cotton, and nylon, and maintains antiviral performance after repeated washing cycles (per ISO 18184 tests).

Technological Advancements in Finishing Processes

Advancements in nanotechnology, plasma treatment, and microencapsulation are enhancing product functionality. These technologies improve durability, softness, and protection against environmental factors. They allow better bonding of active ingredients with fabrics, resulting in longer-lasting finishes. Energy-efficient and water-saving finishing processes are gaining traction as sustainability becomes a priority. Textile manufacturers are using these innovations to differentiate products and meet regulatory standards, creating strong growth momentum in the market.

- For instance, Archroma’s NTR Printing System uses renewable feedstock in pigment, binder, and fixing agents; the pigment black component PrintoFix BLACK NTR-TF achieves 79 % renewable carbon content.

Rising Focus on Sustainable and Eco-Friendly Finishes

Global regulatory pressure and consumer awareness are accelerating the shift to sustainable finishing solutions. Companies are replacing hazardous chemicals with bio-based and non-toxic alternatives. Water-repellent, flame-retardant, and antimicrobial finishes now use greener formulations with lower environmental impact. This shift supports compliance with environmental standards and improves brand reputation. Growing investment in biodegradable and recyclable textile solutions further strengthens market growth, particularly in regions with strict sustainability regulations.

Key Trends & Opportunities

Expansion of Smart and Responsive Textiles

Smart textiles with embedded sensors and responsive coatings are creating new opportunities. These materials adapt to environmental or physiological changes, offering advanced functionality. Growth in wearable technology and connected devices accelerates demand for such fabrics. Applications in healthcare, defense, and sports sectors drive product innovation. Manufacturers integrating functional agents with smart technologies can offer high-value solutions, enhancing competitiveness in global markets.

- For instance, Sumitomo’s COMFORMER® resin is a phase-change material integrated into fiber form (not microcapsulated) that can absorb and release heat in the 20-50 °C range and still be processed via melt spinning.

Rising Popularity of Antimicrobial and Hygiene-Focused Finishes

The post-pandemic environment has increased demand for antimicrobial textile finishes. Hospitals, hospitality, and sports industries are adopting fabrics with advanced protection against pathogens. Silver-based and plant-derived antimicrobial agents are gaining popularity due to their effectiveness and eco-friendliness. This trend is strengthening investment in R&D and product differentiation. Long-lasting hygiene protection has become a key selling point, opening strong growth opportunities for suppliers.

- For instance, Wacker’s silicone wetting agents can reduce the surface tension of aqueous systems to approximately 20 mN/m, which helps achieve better penetration of functional antimicrobial agents into fibers.

Increased Adoption of Waterless and Energy-Efficient Processes

Waterless finishing technologies are gaining traction to meet environmental goals. These processes lower water and energy use, reducing production costs and emissions. Brands using such technologies benefit from improved compliance with global environmental standards. Government incentives and consumer demand for sustainable textiles further drive adoption. This creates opportunities for suppliers offering advanced, eco-efficient finishing solutions.

Key Challenges

High Cost of Advanced Finishing Technologies

The integration of innovative technologies like nanocoatings and plasma treatments requires high investment. Small and medium textile producers often face cost barriers to adopting these solutions. Equipment upgrades, skilled labor, and R&D expenses further increase production costs. This slows the rate of technology penetration in cost-sensitive markets. Price-sensitive consumers also limit premium product adoption, challenging broader market expansion.

Stringent Environmental and Safety Regulations

Strict regulatory frameworks restrict the use of hazardous chemicals in textile finishing. Compliance with REACH, EPA, and other global standards requires continuous investment in R&D and testing. Manufacturers face challenges in replacing effective but harmful chemicals with sustainable alternatives without losing performance. Non-compliance risks market access limitations and penalties. These regulatory pressures increase operational complexity and slow product development cycles.

Regional Analysis

North America

North America leads the functional textile finishing agents market with a 34.5% share. Strong demand for performance textiles in sportswear, healthcare, and industrial applications drives growth. The region benefits from advanced textile manufacturing capabilities and early adoption of sustainable finishing technologies. Regulatory support for eco-friendly chemicals encourages innovation. Leading brands focus on antimicrobial, water-repellent, and moisture management finishes to meet consumer preferences. High consumer spending and the presence of major global manufacturers further strengthen the region’s market position.

Europe

Europe accounts for 28.7% of the global market share, supported by strong environmental regulations and sustainable production practices. The region emphasizes bio-based and non-toxic finishing agents to meet strict REACH standards. Rising demand for functional apparel in sports and fashion sectors drives innovation in advanced finishes. Government support for green textile technologies accelerates adoption among manufacturers. The presence of premium brands and growing interest in high-performance clothing enhance regional market growth. Leading textile hubs in Germany, Italy, and France play a key role.

Asia Pacific

Asia Pacific holds a 26.2% market share and is the fastest-growing region. Rapid industrialization and strong textile production capabilities in China, India, and Japan drive market expansion. Rising disposable income and growing sportswear demand fuel adoption of advanced finishes. Manufacturers are investing in energy-efficient, sustainable technologies to meet export standards. The region benefits from low production costs and expanding domestic markets. Increased investments from international players and government initiatives supporting sustainable textile manufacturing enhance regional competitiveness.

Latin America

Latin America represents 6.1% of the functional textile finishing agents market. The region is witnessing rising demand for functional apparel, especially in sports and workwear segments. Brazil and Mexico lead textile production and export activities. Local manufacturers are adopting sustainable finishing technologies to align with global standards. Investment in modern textile infrastructure supports market expansion. Though growth is moderate compared to other regions, increasing urbanization and improving consumer purchasing power are driving steady market development.

Middle East & Africa

The Middle East & Africa account for 4.5% of the global market share. Market growth is supported by rising investment in textile production hubs, particularly in the UAE, South Africa, and Egypt. Expanding construction, hospitality, and healthcare sectors are driving demand for performance textiles. Manufacturers are gradually adopting antimicrobial and water-resistant finishes to meet industry needs. While infrastructure limitations remain a challenge, strategic partnerships with global players and government-backed industrial development programs are improving regional market prospects.

Market Segmentations:

By Product:

- Dairy Products

- Bakery & Cereals

By Ingredient:

- Dietary Fibers

- Carotenoids

By Application:

- Weight Management

- Sports Nutrition

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The functional textile finishing agents market is shaped by key players including Huntsman Corporation, Sarex, OMNOVA Solutions (Synthomer), NICCA Chemical Co., Ltd., Archroma, KAPP-CHEMIE, Sumitomo Chemical, Wacker Chemie AG, Covestro, and Zydex Industries. The functional textile finishing agents market is highly competitive, driven by innovation, sustainability, and performance enhancement. Companies are focusing on advanced chemical technologies that improve fabric durability, moisture control, antimicrobial protection, and UV resistance. The shift toward eco-friendly and water-efficient finishing solutions is reshaping production strategies. Manufacturers are adopting sustainable raw materials and cleaner application methods to meet strict environmental regulations. Investments in nanotechnology, smart coatings, and waterless processing methods are increasing. Strategic partnerships, capacity expansions, and product differentiation remain key factors in strengthening market presence. Continuous R&D and global distribution capabilities further enhance competitiveness in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman Corporation

- Sarex

- OMNOVA Solutions (Synthomer)

- NICCA Chemical Co., Ltd.

- Archroma

- KAPP-CHEMIE

- Sumitomo Chemical

- Wacker Chemie AG

- Covestro

- Zydex Industries

Recent Developments

- In May 2025, HF Foods Groups Inc., unveiled that they are expanding their digital presence by launching a new online platform specifically designed for restaurant staff, along with a group of targeted consumers.

- In February 2025, Unifi, Inc. launched Integr8™, a spandex-free stretch yarn made with REPREVE® recycled polyester. It offered softness, moisture management, and advanced functionality, positioning it as one of the most versatile and sustainable yarns in the textile industry.

- In September 2023, Yoplait, a dairy product manufacturing company, expanded its product offering by launching high protein yogurt products under its SKYR Energy brand. The new product contains real fruit pieces, vitamin B6 and vitamin D, and is available in two different flavors – Strawberry & Blackcurrant and Mango & Passion fruit.

- In May 2023, Javo Beverage, one of the emerging beverage companies, introduced its new all-natural functional energy lemonades and flavored teas for food service operators. The company aimed to meet consumer demand for functional beverage products through this launch

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and sustainable finishing agents will increase across major textile sectors.

- Waterless and energy-efficient finishing technologies will gain wider industry adoption.

- Smart and responsive textile finishes will drive innovation in performance apparel.

- Antimicrobial and hygiene-focused finishes will see strong growth in healthcare and hospitality.

- Regulatory compliance and green certifications will influence product development strategies.

- Nanotechnology and bio-based chemical formulations will enhance fabric functionality.

- Strategic collaborations and joint ventures will expand global manufacturing capabilities.

- High-performance coatings will play a key role in technical textiles and industrial applications.

- Digital finishing and automated processes will improve production efficiency.

- Rising demand from emerging economies will create new growth opportunities for manufacturers.