Market Overview

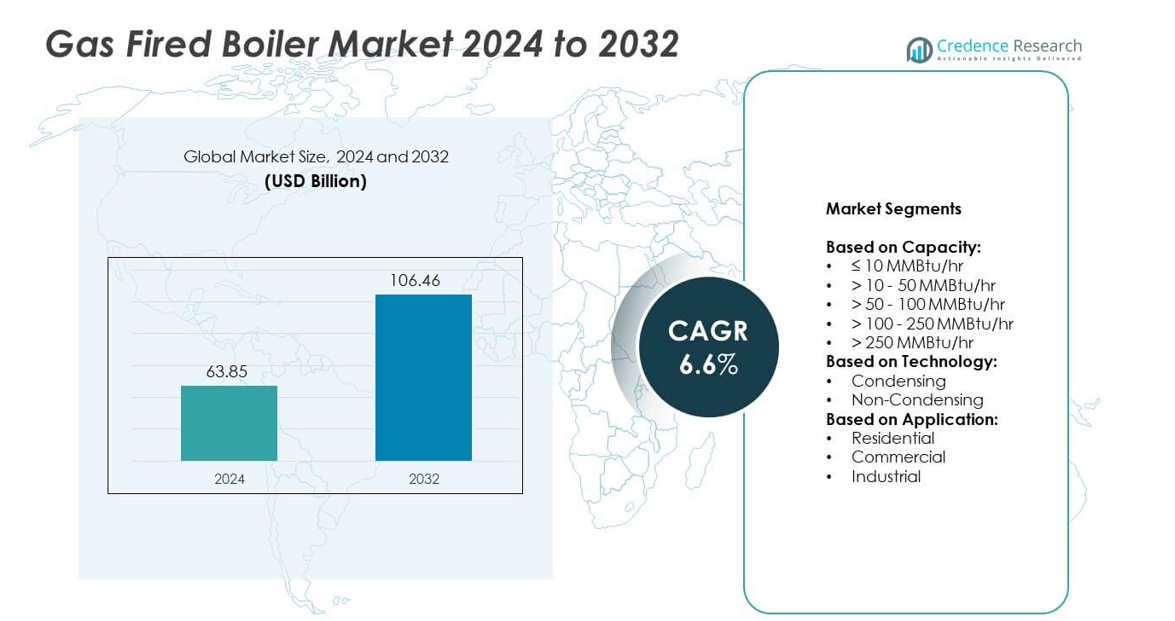

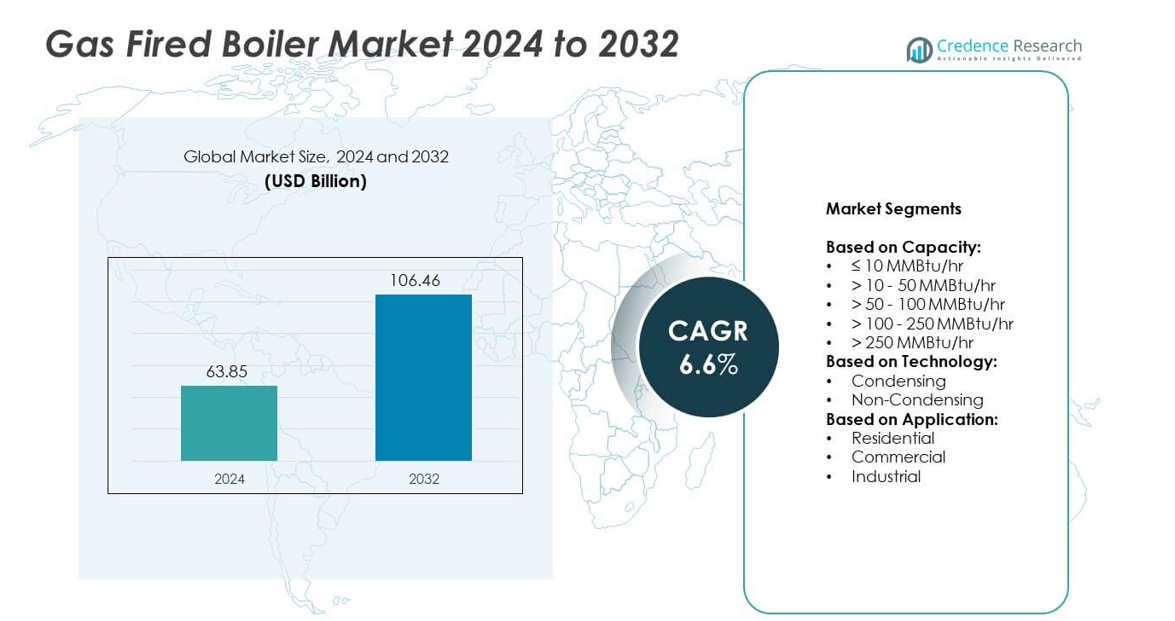

The Gas Fired Boiler Market size was valued at USD 63.85 billion in 2024 and is expected to reach USD 106.46 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Boiler Market Size 2024 |

USD 63.85 billion |

| Gas Fired Boiler Market, CAGR |

6.6% |

| Gas Fired Boiler Market Size 2032 |

USD 106.46 billion |

The Gas Fired Boiler market grows through rising global energy demand, stricter emission regulations, and adoption of high-efficiency systems. Industries rely on gas-fired units for reliable process heating, while commercial and residential sectors benefit from modern condensing technologies. Government incentives and regulatory frameworks drive replacement of outdated equipment with cleaner solutions. Integration of smart monitoring and hybrid systems enhances performance and sustainability. Expanding infrastructure in emerging economies further strengthens demand, ensuring long-term growth for gas-fired boiler installations worldwide.

North America and Europe remain strong markets for gas-fired boilers due to advanced infrastructure and strict efficiency regulations, while Asia-Pacific leads growth with rapid industrialization and expanding natural gas networks. Latin America and the Middle East & Africa show steady opportunities through industrial and commercial projects. Key players driving the market include Viessmann, BDR Thermea Group, Bosch Industriekessel, and Carrier, who focus on advanced technologies, emission compliance, and tailored solutions to strengthen their presence across diverse regional markets.

Market Insights

- The Gas Fired Boiler market was valued at USD 63.85 billion in 2024 and is expected to reach USD 106.46 billion by 2032, growing at a CAGR of 6.6%.

- Rising global energy demand and strict emission regulations drive strong adoption of gas-fired boilers across industrial, commercial, and residential sectors.

- Increasing preference for condensing technologies, smart monitoring systems, and hybrid solutions shapes long-term market trends.

- The market is highly competitive with players such as Viessmann, Bosch Industriekessel, BDR Thermea Group, Carrier, and A.O. Smith focusing on innovation and regional expansion.

- Fluctuating natural gas prices and growing competition from renewable alternatives present key restraints for long-term growth in developed economies.

- Asia-Pacific leads expansion due to rapid industrialization, infrastructure growth, and strong adoption in manufacturing and residential sectors, while North America and Europe remain mature but steady markets.

- Latin America and the Middle East & Africa show emerging opportunities supported by energy diversification policies, rising urbanization, and investments in natural gas infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Energy Demand and Dependence on Natural Gas

The Gas Fired Boiler market is supported by increasing global demand for energy across industrial, commercial, and residential sectors. Natural gas continues to dominate fuel choices because of its cleaner combustion compared to coal and oil. Many countries rely on gas infrastructure, making boilers essential for heating and process applications. Governments promote natural gas projects to reduce carbon footprints and improve energy security. It drives steady installation of new gas-fired units in growing economies. Rising urbanization and industrial growth sustain this demand.

- For instance, B&W’s thermal segment company announced a significant $246 million gas conversion project for a power plant in North America in 2024, involving the conversion of over 1,000 MW of capacity.

Stringent Emission Regulations and Environmental Compliance Goals

Governments across regions enforce strict emission regulations to cut greenhouse gases and pollutants. The Gas Fired Boiler market benefits from this trend because gas-fired systems produce lower emissions compared to coal-based units. It aligns with environmental compliance frameworks such as the EU Green Deal and U.S. clean energy targets. Industries favor gas-fired boilers to achieve sustainability certifications. Manufacturers respond by enhancing combustion efficiency and adopting low-NOx burner technologies. Regulatory pressure accelerates the transition toward natural gas solutions.

- For instance, Viessmann Vitocrossal 300 boilers (including models in the 100 to 1000 kW range) achieve low NOx emissions, often at or below 55 mg/kWh. These performance levels comply with EU Ecodesign requirements, which mandated a maximum NOx emission limit of 56 mg/kWh for gas boilers with a rated output of 400 kW or less, effective September 26, 2018.

Expansion of Industrial and Commercial Infrastructure Worldwide

Global expansion of manufacturing plants, hospitals, hotels, and commercial complexes fuels boiler adoption. The Gas Fired Boiler market gains traction from demand for reliable steam and hot water systems. Industries such as food processing, chemical production, and textiles require continuous heat supply. It ensures consistent performance and efficiency in large-scale operations. Commercial construction projects adopt modern boilers to meet energy efficiency codes. Rising investments in infrastructure development in Asia and the Middle East strengthen market potential.

Advancements in Boiler Technology and Smart Integration

Technological innovation supports efficiency, durability, and integration with smart systems. The Gas Fired Boiler market advances through condensing technologies that maximize heat recovery and reduce fuel use. Manufacturers integrate IoT-based monitoring for predictive maintenance and energy optimization. It enhances operational reliability and reduces downtime for industrial users. Compact designs also enable space-saving in urban applications. Hybrid solutions that combine renewable inputs with gas-fired systems highlight the transition to sustainable heating. Technology-driven upgrades reshape the competitive landscape.

Market Trends

Growing Preference for High-Efficiency Condensing Boilers

The Gas Fired Boiler market is witnessing strong growth in condensing boiler adoption. These systems capture waste heat from exhaust gases, achieving higher efficiency compared to conventional models. It reduces fuel consumption and lowers operating costs for industries and households. Governments support this trend with incentives for energy-efficient equipment. Manufacturers promote advanced condensing technologies to meet stricter environmental standards. Demand continues to rise in Europe and North America where efficiency regulations are most rigorous.

- For instance, Miura modular systems can achieve fuel savings of around 20% compared to conventional boiler systems. Additionally, specific models like the EX-Series Dual Fuel boiler, can achieve up to 85% efficiency.

Integration of Smart Monitoring and Control Technologies

Smart technologies are transforming traditional boiler operations into connected and automated systems. The Gas Fired Boiler market benefits from IoT-enabled sensors and cloud-based platforms that allow real-time performance tracking. It enables predictive maintenance, reducing unexpected downtime for industrial users. Advanced control systems also improve combustion accuracy and energy optimization. Smart integration supports operators in reducing costs while meeting sustainability goals. Remote monitoring features are gaining strong acceptance across large-scale commercial and industrial facilities.

- For instance, Bosch Industriekessel, through solutions like its MEC Remote access and Predictive Maintenance 4.0, offers IoT remote diagnostics for its industrial boilers to provide real-time monitoring and advanced analytics

Shift Toward Hybrid and Renewable-Compatible Solutions

Energy transition goals drive interest in hybrid systems that combine natural gas with renewable sources. The Gas Fired Boiler market evolves with designs that complement solar thermal or biomass heating. It allows end users to maintain reliability while lowering carbon intensity. Hybrid setups appeal to industrial buyers seeking flexibility and compliance with net-zero commitments. Manufacturers invest in product lines that align with sustainable heating frameworks. Demand for hybrid solutions is steadily increasing in regions with aggressive decarbonization policies.

Rising Demand Across Emerging Economies with Rapid Urbanization

Developing countries experience rapid population growth, industrialization, and urban development. The Gas Fired Boiler market expands in Asia-Pacific, Latin America, and parts of Africa. It meets rising demand for industrial process heating, district heating, and commercial applications. Growing infrastructure in healthcare, hospitality, and manufacturing supports this trend. Local governments encourage natural gas use to replace less efficient fuel sources. Increasing investment in energy infrastructure strengthens long-term demand for gas-fired boilers in emerging markets.

Market Challenges Analysis

Volatility in Natural Gas Prices and Supply Disruptions

The Gas Fired Boiler market faces uncertainty due to fluctuating natural gas prices. Volatility arises from geopolitical tensions, supply chain disruptions, and seasonal demand shifts. It creates cost instability for industries that depend heavily on boilers for production. Rising import costs also challenge countries with limited domestic gas resources. Industrial buyers hesitate to invest in new systems when fuel price risks remain high. Dependence on global supply networks further exposes markets to unexpected disruptions.

Competition from Renewable Energy and Electrification Initiatives

Governments worldwide push for renewable adoption and electrification of heating systems. The Gas Fired Boiler market competes with technologies such as heat pumps, biomass boilers, and solar heating. It risks slower growth in regions with strong subsidies for clean alternatives. Stricter emission targets encourage industries to explore zero-carbon solutions. Manufacturers must innovate to maintain competitiveness against greener technologies. Regulatory and consumer pressure create long-term challenges for gas-based systems in decarbonizing economies.

Market Opportunities

Adoption of Energy-Efficient and Low-Emission Technologies

The Gas Fired Boiler market holds strong opportunities through advanced energy-efficient solutions. Condensing boilers with low-NOx burners attract buyers seeking lower operating costs and compliance with emission rules. It positions manufacturers to meet both regulatory and consumer demands for cleaner systems. Governments support this shift through incentives for efficiency upgrades in industrial and commercial facilities. Integration with digital monitoring tools further enhances appeal by improving performance. The trend creates long-term growth prospects for companies investing in sustainable designs.

Expansion in Emerging Markets and Infrastructure Development

Rapid industrialization and urbanization in Asia-Pacific, Latin America, and the Middle East create major opportunities. The Gas Fired Boiler market benefits from rising demand in manufacturing plants, commercial complexes, and district heating projects. It ensures steady adoption where governments expand natural gas networks to replace coal-based systems. Healthcare, hospitality, and residential construction sectors further drive installations. Rising investment in infrastructure modernizes energy supply chains and increases boiler penetration. Global manufacturers gain competitive advantages by targeting these high-growth regions.

Market Segmentation Analysis:

By Capacity:

The Gas Fired Boiler market shows diverse adoption patterns across industries and facilities. Units rated ≤ 10 MMBtu/hr dominate the residential and small commercial segment, where compact and efficient designs remain essential. The > 10 – 50 MMBtu/hr range is widely used in mid-sized buildings, hospitals, and retail spaces due to balanced performance and fuel efficiency. Systems between > 50 – 100 MMBtu/hr support large commercial structures and light industrial plants that require consistent steam or hot water supply. Boilers in the > 100 – 250 MMBtu/hr class serve energy-intensive sectors like food processing and chemical manufacturing. Units above > 250 MMBtu/hr find strong demand in heavy industries and large-scale power generation applications, where reliability and high output remain critical.

- For instance, In 2024, the U.S. commercial boiler market was estimated to be valued between approximately $1.35 billion and $2.5 billion, according to various market analysis reports. The market is experiencing growth driven by the increasing adoption of smart, IoT-enabled controls, alongside the demand for energy-efficient buildings and evolving regulatory requirements

By Technology:

Condensing boilers account for a growing share due to their superior efficiency and ability to recover heat from exhaust gases. Their adoption is strongest in regions with strict emission standards and incentives for energy-efficient systems. The non-condensing segment maintains relevance in cost-sensitive markets and applications where upfront investment influences buyer decisions. It remains attractive for users prioritizing simple installation and low maintenance requirements. Manufacturers continue to improve both categories to address evolving energy and environmental regulations.

- For instance, Groupe Atlantic, which produces a range of boilers and renewable heating systems, develops hybrid heating solutions for both domestic and commercial applications in France, the company has heavily invested in manufacturing facilities for heat pumps in France, including a €150 million investment announced in November 2023 for a new plant in Saône-et-Loire to start production in 2025

By Application:

Residential demand remains significant, driven by urbanization, rising household heating needs, and growing awareness of efficiency benefits. The commercial segment gains traction from sectors like hospitality, education, and healthcare that require reliable hot water and heating systems. The industrial segment dominates overall demand, as it depends on large-capacity boilers for process heating, power generation, and manufacturing operations. It secures a strong position due to rising industrial activity in both developed and emerging economies. Each application segment contributes to shaping long-term market expansion

Segments:

Based on Capacity:

- ≤ 10 MMBtu/hr

- > 10 – 50 MMBtu/hr

- > 50 – 100 MMBtu/hr

- > 100 – 250 MMBtu/hr

- > 250 MMBtu/hr

Based on Technology:

- Condensing

- Non-Condensing

Based on Application:

- Residential

- Commercial

- Industrial

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the Gas Fired Boiler market, supported by strong industrial and commercial demand. The region benefits from abundant natural gas reserves and a well-established pipeline network, ensuring stable supply. Industries such as food processing, chemicals, and manufacturing contribute significantly to adoption, requiring high-capacity units for continuous operations. It also sees steady installations in hospitals, schools, and hospitality facilities to meet heating and hot water requirements. Residential demand remains moderate, driven by efficiency upgrades and replacement of aging systems. Government incentives for energy-efficient technologies further accelerate the adoption of condensing boilers. The presence of key manufacturers ensures steady availability of advanced solutions across the U.S. and Canada.

Europe

Europe represents 25% of the Gas Fired Boiler market, with strong emphasis on environmental compliance and emission reduction. Countries such as Germany, the UK, and France lead adoption due to strict efficiency regulations and decarbonization targets. It benefits from widespread acceptance of condensing boilers that align with the EU Green Deal and national energy efficiency programs. Residential and commercial demand is high, especially for space heating in colder climates. Industrial use remains vital, with chemical, pharmaceutical, and food industries driving installations. Transition away from coal-based systems further boosts reliance on gas-fired units. Local manufacturers continue to innovate with low-NOx and hybrid systems to meet regional sustainability goals.

Asia-Pacific

Asia-Pacific holds 32% of the Gas Fired Boiler market, making it the largest regional contributor. Rapid urbanization, population growth, and industrial expansion drive demand for residential, commercial, and industrial boilers. China, India, and Japan dominate installations, supported by strong construction activity and government-backed energy infrastructure projects. It sees rising use in large industrial plants, district heating projects, and expanding manufacturing facilities. Residential applications grow steadily with increasing urban housing projects. The region also benefits from rising investments in natural gas distribution networks, replacing coal-based heating systems. Global and local manufacturers target Asia-Pacific for future growth due to its scale and long-term demand potential.

Latin America

Latin America accounts for 8% of the Gas Fired Boiler market, supported by expanding infrastructure and energy diversification efforts. Brazil and Mexico lead demand, with growing adoption in industrial plants and commercial buildings. It benefits from rising investments in manufacturing, healthcare, and hospitality projects requiring reliable heating solutions. Residential demand remains smaller but is gradually increasing in urban centers. Governments encourage cleaner energy adoption to reduce reliance on oil-based systems, supporting gas-fired solutions. Infrastructure development in natural gas pipelines creates further growth opportunities across the region. Global suppliers view Latin America as a developing but promising market for expansion.

Middle East and Africa

The Middle East and Africa contribute 7% of the Gas Fired Boiler market, driven by industrial activity and infrastructure projects. Countries in the Gulf Cooperation Council adopt boilers for large commercial complexes, hospitals, and energy-intensive industries. It also benefits from natural gas availability, which lowers fuel costs for end users. Africa sees gradual growth, led by South Africa and Nigeria, where industrial projects demand reliable heating solutions. Residential use is limited but expanding with urban development. Government-led energy diversification policies encourage industries to adopt efficient gas-fired systems. The region shows potential for future growth as gas infrastructure expands further.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Forbes Marshall

- Viessmann

- Miura America

- Burnham Commercial Boilers

- Rentech Boilers

- Groupe Atlantic

- Carrier

- O. Smith

- Bosch Industriekessel

- Hurst Boiler & Welding Co

- BDR Thermea Group

- The Fulton Companies

- WM Technologies

- Bradford White Corporation

- Lochinvar

- Ariston Holding

- Vaillant Group

- Ferroli

- Babcock & Wilcox Enterprises

- Daikin

Competitive Analysis

The Gas Fired Boiler market is shaped by leading players including Forbes Marshall, Viessmann, Miura America, Burnham Commercial Boilers, Rentech Boilers, Groupe Atlantic, Carrier, A.O. Smith, Bosch Industriekessel, Hurst Boiler & Welding Co, BDR Thermea Group, The Fulton Companies, WM Technologies, Bradford White Corporation, Lochinvar, Ariston Holding, Vaillant Group, Ferroli, Babcock & Wilcox Enterprises, and Daikin. These companies hold strong positions through product innovation, global presence, and strategic partnerships. Competition focuses on high-efficiency condensing technologies and compliance with emission standards. Firms invest in R&D to deliver advanced boilers that reduce fuel consumption and enhance operational reliability. Many players emphasize IoT-enabled monitoring solutions, offering predictive maintenance and energy optimization for industrial and commercial clients. Regional diversification also plays a key role, with European firms leveraging sustainability regulations, while North American and Asian manufacturers focus on industrial expansion and infrastructure projects. Market leaders pursue mergers, acquisitions, and collaborations to expand portfolios and strengthen distribution networks. They also prioritize customer-specific solutions, catering to residential, commercial, and heavy industrial applications. By balancing cost-efficiency with advanced technology, these players ensure competitiveness in both mature and emerging markets. The industry remains dynamic, driven by regulations, customer demand for cleaner systems, and ongoing infrastructure development.

Recent Developments

- In 2025, Forbes Marshall showcased advanced emissions monitoring solutions at CEM Middle East.

- In 2024, Viessmann launched Vitocal 250-A PRO: A compact monobloc heat pump for commercial use, recognized with the iF Gold Design Award 2024, offering heating, cooling, and hot water with flow temperatures up to 70 °C.

- In 2024, Miura America launched Miura Connect™ 2.0: A significant upgrade to its boiler room management system, offering real-time monitoring, predictive maintenance, and greater operational control and visibility.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Gas Fired Boiler market will expand with rising industrial and commercial energy needs.

- Condensing boilers will gain share due to higher efficiency and emission compliance.

- IoT-enabled monitoring and smart controls will become standard in new installations.

- Hybrid systems integrating renewable energy will see increasing adoption.

- Replacement of aging boiler fleets will drive steady demand across developed regions.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization.

- Government incentives for energy-efficient systems will encourage technology upgrades.

- Industrial sectors such as chemicals, food, and textiles will sustain high capacity demand.

- Manufacturers will focus on low-NOx technologies to meet stricter regulations.

- Emerging markets in Latin America and Africa will offer new growth opportunities.