Market Overview

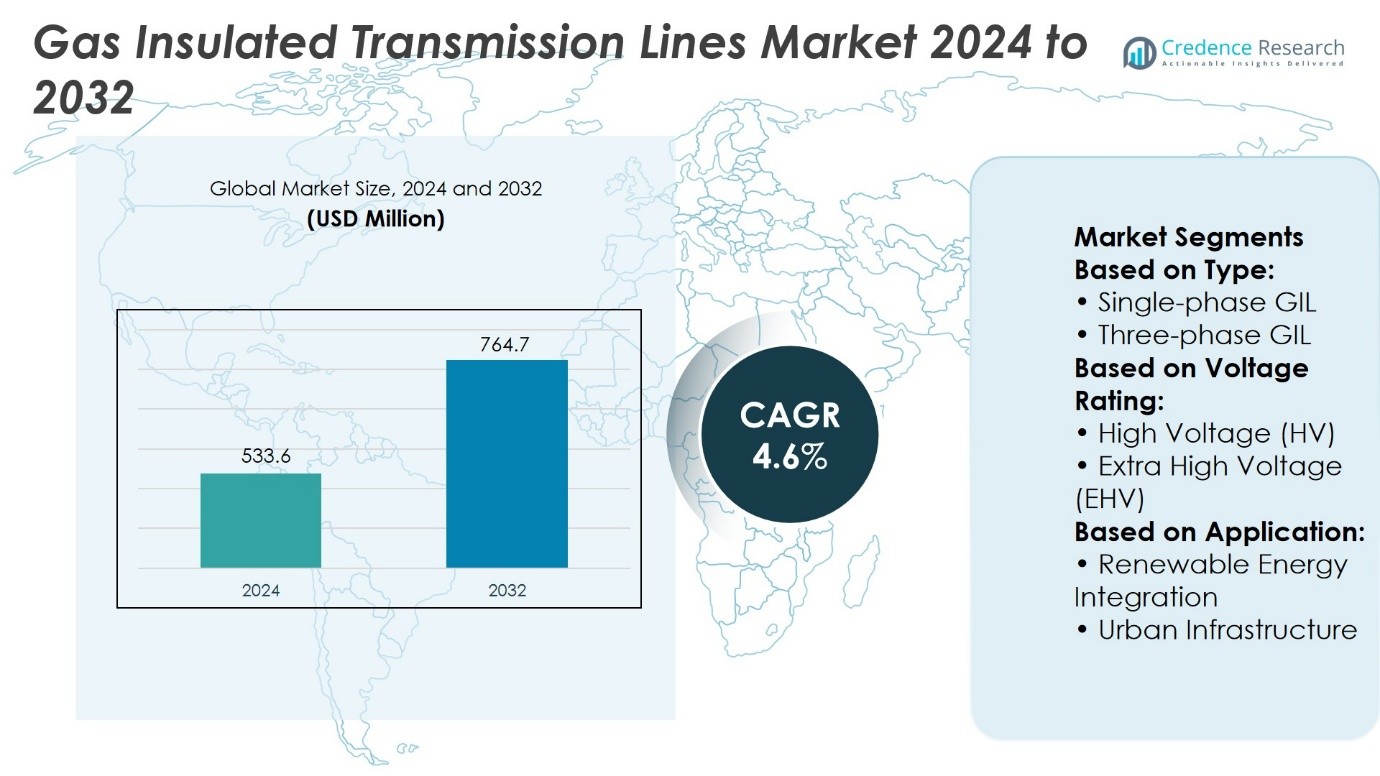

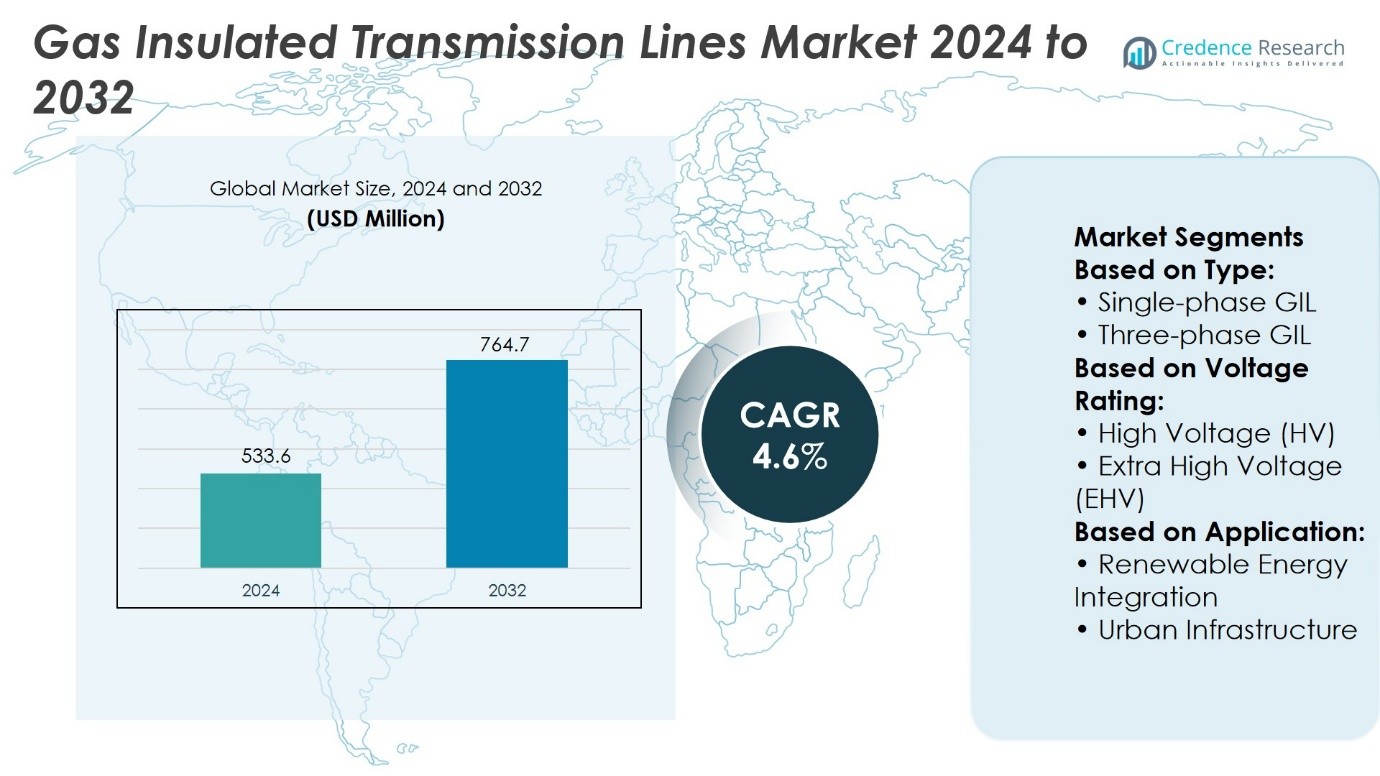

Gas Insulated Transmission Lines Market size was valued at USD 533.6 million in 2024 and is anticipated to reach USD 764.7 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Insulated Transmission Lines Market Size 2024 |

USD 533.6 Million |

| Gas Insulated Transmission Lines Market, CAGR |

4.6% |

| Gas Insulated Transmission Lines Market Size 2032 |

USD 764.7 Million |

The Gas Insulated Transmission Lines Market grows on strong drivers such as rising electricity demand, expansion of high-voltage infrastructure, and increasing need for reliable systems in urban and environmentally sensitive regions. It benefits from safety, compact design, and reduced right-of-way requirements compared with conventional alternatives. Key trends include wider adoption of underground and submarine corridors, transition toward eco-efficient insulation gases, and integration of digital monitoring platforms for predictive maintenance. It also advances with renewable energy integration and cross-border interconnections, positioning insulated transmission systems as critical components of modern grid expansion and energy transition strategies worldwide.

The Gas Insulated Transmission Lines Market shows strong geographical presence with Europe holding leadership through advanced renewable integration, North America focusing on grid modernization, and Asia-Pacific expanding with large-scale high-voltage projects. Latin America and the Middle East & Africa record gradual adoption supported by urban development and renewable corridors. Key players shaping the market include Siemens AG, General Electric, Schneider Electric, Eaton Corporation, Hyundai Heavy Industries, Larsen & Toubro, Nexans, Prysmian Group, Crompton Greaves Consumer Electricals, and China XD Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Gas Insulated Transmission Lines Market size was valued at USD 533.6 million in 2024 and is projected to reach USD 764.7 million by 2032, at a CAGR of 4.6%.

- Rising electricity demand, expansion of high-voltage infrastructure, and adoption in urban and sensitive regions drive steady market growth.

- Wider use of underground and submarine corridors, eco-efficient insulation gases, and digital monitoring platforms highlight key market trends.

- Strong competition exists among global players focusing on R&D, sustainable solutions, and large-scale project execution.

- High capital costs, complex installation requirements, and regulatory restrictions on insulation gases remain significant restraints.

- Europe leads with renewable integration, North America emphasizes grid modernization, and Asia-Pacific expands with high-voltage projects, while Latin America and the Middle East & Africa show gradual adoption.

- Siemens AG, General Electric, Schneider Electric, Eaton Corporation, Hyundai Heavy Industries, Larsen & Toubro, Nexans, Prysmian Group, Crompton Greaves Consumer Electricals, and China XD Group dominate the competitive landscape.

Market Drivers

Rising Electricity Demand and Expansion of High-Voltage Infrastructure

The Gas Insulated Transmission Lines Market gains strong momentum from the rising demand for electricity and the expansion of high-voltage transmission infrastructure. Global power consumption continues to climb with urbanization and industrialization driving network upgrades. It supports stable electricity supply across long distances where conventional lines face technical limitations. Grid operators adopt this technology to ensure reliable performance in congested urban areas. It improves operational flexibility in projects requiring underground or underwater installation. Governments prioritize secure transmission systems to address growing energy security concerns.

- For instance, Siemens Energy executed a gas‑insulated transmission line project for China’s Xiluodu hydropower plant—including 12.5 km of GIL and seven three‑phase systems rated at 550 kV, with a project order valued at approximately 30 million euros.

Increasing Emphasis on Safety, Reliability, and Compact Design

The Gas Insulated Transmission Lines Market benefits from an industry-wide focus on safety and reliability. It minimizes the risk of short circuits and external environmental damage due to its enclosed, insulated structure. Operators value compact design that reduces right-of-way requirements compared with overhead systems. It allows construction in urban corridors where space is scarce and public opposition is high. Advanced insulation materials further strengthen reliability under varying load conditions. Utilities and developers view it as a critical solution for projects requiring long-term stability.

- For instance, Siemens Energy supplied gas‑insulated switchgear systems—including compact clean‑air Blue technology bays rated up to 550 kV—to Finland’s Fingrid, under a contract valued at 45 million euros for ten bays delivering enhanced safety and a reduction in maintenance requirements through its enclosed design.

Strong Role of Renewable Energy Integration into Transmission Networks

The Gas Insulated Transmission Lines Market expands with renewable energy integration across national grids. Wind and solar projects located in remote areas require efficient high-capacity transmission. It ensures minimal power losses during long-distance transfer of renewable electricity. Utilities favor the technology for linking offshore wind farms with coastal load centers. It addresses the variability of renewable generation by enabling consistent grid support. Policy support for decarbonization continues to drive investment in efficient transmission systems.

Technological Innovations and Long-Term Cost Efficiency

The Gas Insulated Transmission Lines Market advances through continuous technological innovation and cost optimization. Modern systems feature improved insulation gases that deliver stronger performance while reducing environmental impact. It achieves lower maintenance costs compared with traditional alternatives over extended lifecycles. Manufacturers focus on modular designs that simplify installation and reduce project timelines. It delivers reliable performance in harsh terrains including mountains and densely populated regions. Long-term cost efficiency encourages governments and utilities to expand deployment across strategic corridors.

Market Trends

Growing Preference for Underground and Submarine Transmission Corridors

The Gas Insulated Transmission Lines Market shows a clear trend toward underground and submarine projects. Dense urban development creates constraints for overhead lines, prompting utilities to choose compact and enclosed designs. It supports transmission through tunnels, congested city centers, and environmentally sensitive regions. Submarine corridors benefit from reduced exposure to harsh weather conditions and improved reliability. Governments invest in cross-border submarine links to secure energy trade. It strengthens the role of advanced insulated systems in long-distance and high-capacity projects.

- For instance, Siemens Energy contributed to the COBRAcable submarine HVDC transmission project between the Netherlands and Denmark with Siemens supplying the HVDC converter substations under a contract valued at approximately 580 million euros enabling deployment of a highly compact, enclosed design suited to underwater routing.

Rising Use of Environmentally Friendly Insulation Gases

The Gas Insulated Transmission Lines Market reflects a transition toward sustainable insulation materials. Growing restrictions on sulfur hexafluoride (SF6) drive innovation in alternative gases with lower global warming potential. It incorporates advanced mixtures such as fluoronitriles and fluoroketones that deliver comparable dielectric strength. Manufacturers highlight eco-efficient solutions to align with global climate targets. It enhances acceptance among regulators and utilities seeking environmentally compliant systems. Industry collaboration accelerates research and development of scalable green alternatives.

- For instance, GE Vernova’s Grid Solutions delivered the world’s first 245 kV SF₆‑free gas‑insulated substation to France’s RTE under a contract valued at 25 million euros, marking a significant milestone in phasing out SF₆ with g³ alternatives.

Integration with Smart Grid and Digital Monitoring Solutions

The Gas Insulated Transmission Lines Market aligns with the expansion of smart grid infrastructure. Utilities demand real-time monitoring and predictive maintenance capabilities to optimize performance. It enables digital sensors and communication modules that track temperature, pressure, and insulation integrity. Cloud-based platforms analyze operational data to reduce unplanned outages. It strengthens system resilience and improves decision-making for asset management. Growing digital adoption transforms transmission infrastructure into more intelligent and adaptive networks.

Increasing Deployment in Renewable Energy Transmission Projects

The Gas Insulated Transmission Lines Market advances with large-scale renewable integration. Offshore wind farms and remote solar parks require reliable and compact transmission solutions. It reduces power losses over extended distances and connects renewable hubs to demand centers. Governments prioritize renewable corridors supported by high-capacity insulated lines. It provides a critical link between generation zones and metropolitan regions with high consumption. Rising renewable targets worldwide push adoption of this technology into mainstream grid expansion plans.

Market Challenges Analysis

High Capital Costs and Complex Installation Requirements

The Gas Insulated Transmission Lines Market faces significant challenges linked to high upfront capital costs and complex installation procedures. It requires advanced engineering expertise, specialized equipment, and customized project planning, which increase expenditure. Utilities in developing regions often delay adoption due to constrained budgets and lack of financing mechanisms. It demands strict adherence to safety standards, land use permits, and coordination with multiple stakeholders, which prolong project timelines. Maintenance infrastructure for these systems remains less widespread compared with conventional alternatives. It limits wider penetration where cost-sensitive utilities prioritize short-term affordability over long-term efficiency.

Regulatory Barriers and Environmental Concerns over Insulating Gases

The Gas Insulated Transmission Lines Market also encounters regulatory barriers and environmental scrutiny. It often depends on insulating gases such as sulfur hexafluoride (SF6), which face strict restrictions due to high global warming potential. Regulatory bodies enforce tighter controls on production, transport, and disposal, creating compliance burdens for manufacturers and utilities. It increases the need for costly transition toward eco-efficient alternatives that meet performance and sustainability standards. Regional differences in regulation create uncertainties that slow international project execution. It requires continuous innovation and industry collaboration to mitigate the environmental impact while ensuring system reliability.

Market Opportunities

Expansion of Renewable Energy Corridors and Cross-Border Interconnections

The Gas Insulated Transmission Lines Market presents strong opportunities through expansion of renewable energy corridors and cross-border power interconnections. Offshore wind projects, desert-based solar plants, and remote hydro facilities require compact high-capacity transmission systems. It supports integration of renewable hubs into national and regional grids with minimal power losses. Governments emphasize interconnection projects to stabilize supply and strengthen energy security across multiple countries. It positions insulated systems as a critical enabler of clean energy transition. Growing investment in large-scale renewable projects creates consistent demand for advanced transmission infrastructure.

Advancements in Eco-Efficient Technologies and Digital Solutions

The Gas Insulated Transmission Lines Market also benefits from opportunities linked to eco-efficient technologies and digital integration. Manufacturers invest in alternatives to sulfur hexafluoride (SF6) that meet stringent environmental standards. It accelerates market acceptance in regions with ambitious climate goals and regulatory support for low-emission systems. Digital platforms embedded in transmission lines create new opportunities for predictive maintenance and asset optimization. It improves operational visibility and reduces long-term lifecycle costs for utilities. Growing emphasis on sustainability and smart grid modernization strengthens adoption across developed and emerging economies alike.

Market Segmentation Analysis:

By Type

The Gas Insulated Transmission Lines Market is segmented into single-phase GIL and three-phase GIL, each serving distinct operational needs. Single-phase GIL provides flexibility for specialized projects that require modular installation and easy maintenance. It is often preferred in cases of retrofit projects or constrained urban spaces where compact design is critical. Three-phase GIL dominates large-scale transmission projects due to its ability to handle higher power loads within limited corridors. It supports deployment in tunnels, underground passages, and long-distance interconnection routes. Growing investment in integrated grid solutions continues to expand the role of both configurations, with three-phase GIL gaining broader application in high-capacity networks.

By Voltage Rating

The Gas Insulated Transmission Lines Market also segments by voltage rating into high voltage (HV) and extra high voltage (EHV) categories. HV systems serve regional transmission and distribution requirements where reliability and compactness are key priorities. It finds application in metropolitan areas where underground installation reduces land-use conflicts. EHV systems address long-distance, high-capacity transmission that supports national and cross-border projects. It enables efficient transfer of renewable electricity from remote generation zones to demand-heavy urban centers. The increasing complexity of global power grids positions EHV solutions as a cornerstone for secure and sustainable electricity transmission.

- For instance, Siemens supplied 12.5 km of 550 kV gas-insulated transmission line for China’s Xiluodu hydropower plant, under a contract valued at 30 million euros.

By Application

The Gas Insulated Transmission Lines Market further divides by application into renewable energy integration and urban infrastructure. Renewable energy integration represents a major driver, with offshore wind, solar parks, and hydroelectric facilities requiring advanced insulated systems to minimize losses and ensure stability. It strengthens interconnections between renewable hubs and regional demand centers, supporting decarbonization targets. Urban infrastructure also records growing adoption where compact and safe transmission systems enable development in cities with limited space and strict regulations. It provides a reliable alternative to overhead lines, reducing environmental and social impact. Both application segments create long-term opportunities for deployment, reflecting the critical role of insulated transmission lines in modern power networks.

- For instance, Siemens Energy’s deployment of a 12.5 km, 550 kV GIL system at the Xiluodu hydropower plant executed under a contract valued at 30 million euros.

Segments:

Based on Type:

- Single-phase GIL

- Three-phase GIL

Based on Voltage Rating:

- High Voltage (HV)

- Extra High Voltage (EHV)

Based on Application:

- Renewable Energy Integration

- Urban Infrastructure

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 28% in the Gas Insulated Transmission Lines Market, supported by advanced grid modernization initiatives and rising investments in underground and renewable-focused transmission networks. The United States leads regional adoption due to its robust regulatory frameworks and emphasis on reliable infrastructure in urban and environmentally sensitive areas. It benefits from ongoing replacement of aging overhead infrastructure with compact underground systems to ensure resilience against natural disasters and severe weather conditions. Canada contributes to growth with cross-border interconnections that strengthen energy trade and improve supply security. It also emphasizes deployment of eco-efficient technologies that align with decarbonization targets and stricter environmental regulations. Growing renewable energy capacity across wind and solar projects continues to create demand for high-capacity insulated transmission corridors, ensuring steady adoption across the region.

Europe

Europe accounts for a market share of 32% in the Gas Insulated Transmission Lines Market, driven by strong regulatory mandates, rapid renewable energy integration, and technological leadership. Germany, the United Kingdom, and France spearhead underground and submarine projects that link offshore wind farms to mainland grids. It supports energy transition goals outlined under the European Green Deal and regional decarbonization policies. The market benefits from significant research and development in eco-efficient insulation gases that address strict restrictions on sulfur hexafluoride (SF6). Scandinavian countries also prioritize long-distance submarine projects to support cross-border interconnections with neighboring states. It gains further traction in densely populated metropolitan regions where compact design reduces land-use conflicts. Rising investments in energy security and grid reliability reinforce Europe’s leadership in deploying advanced gas insulated transmission systems.

Asia-Pacific

Asia-Pacific captures a market share of 27% in the Gas Insulated Transmission Lines Market, supported by rapid industrialization, population growth, and strong demand for reliable electricity infrastructure. China leads with extensive investments in high-voltage and extra high-voltage projects that connect renewable-rich regions with urban consumption centers. It expands capacity through large-scale adoption of underground and tunnel-based systems in megacities where space is limited. India strengthens deployment through renewable integration projects, particularly in solar and wind corridors requiring long-distance transmission. Japan and South Korea contribute with advanced grid technologies and investments in earthquake-resilient infrastructure. It remains a priority market due to strong government-backed programs that emphasize energy security, renewable adoption, and sustainable infrastructure expansion.

Latin America

Latin America holds a market share of 7% in the Gas Insulated Transmission Lines Market, with gradual adoption supported by energy diversification and renewable expansion. Brazil leads regional growth through hydroelectric and wind-based transmission projects that require reliable high-capacity systems. It expands infrastructure with compact solutions suitable for urban areas where overhead lines face opposition. Mexico and Chile also record growth in projects integrating solar and geothermal energy into national grids. It demonstrates potential for submarine interconnections to strengthen energy trade across regional partners. Limited financial resources and regulatory complexities slow wider adoption, yet long-term opportunities remain strong as renewable capacity continues to rise.

Middle East & Africa

The Middle East & Africa region accounts for a market share of 6% in the Gas Insulated Transmission Lines Market, driven by energy diversification strategies and infrastructure modernization. Gulf countries invest in underground insulated systems to support expanding urban development and rising electricity demand. It contributes to renewable integration projects, particularly in solar power corridors across Saudi Arabia and the United Arab Emirates. Africa records initial adoption in South Africa and Morocco, supported by international financing for grid stability and renewable expansion. It also gains momentum from cross-border projects that strengthen regional power pool initiatives. Limited technical expertise and capital investment remain challenges, but long-term energy demand growth and renewable development secure ongoing opportunities for insulated transmission line deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Gas Insulated Transmission Lines Market features include Crompton Greaves Consumer Electricals, Eaton Corporation, Hyundai Heavy Industries, Siemens AG, Prysmian Group, Schneider Electric, Larsen Toubro, Nexans, General Electric, and China XD Group. The Gas Insulated Transmission Lines Market demonstrates a competitive landscape shaped by technological innovation, regulatory compliance, and large-scale infrastructure demands. Companies focus on delivering high-voltage and extra high-voltage solutions that ensure compact design, operational safety, and long-term reliability. Intense competition centers on the ability to supply eco-efficient systems that address restrictions on insulating gases with lower environmental impact. Firms differentiate through advanced R&D, integration of digital monitoring platforms, and expertise in executing complex underground and submarine transmission projects. Competitive strategies also emphasize partnerships with utilities, governments, and engineering firms to secure multi-billion-dollar contracts in renewable integration and cross-border interconnection projects. Continuous investment in sustainable technologies and global project execution capacity positions leading players to strengthen their share in a market driven by rising electricity demand and energy transition goals.

Recent Developments

- In May 2025, Hitachi Energy delivered the world’s first 550 kV gas-insulated switchgear (GIS) free of sulfur hexafluoride (SF6) to the Central China Branch of the State Grid Corporation of China (SGCC).

- In November 2024, Sterile Power finished the Goa-Tamnar Transmission Project executed through a special-purpose vehicle, Goa-Tamnar Transmission Project Limited (GTTPL).

- In June 2023, Siemens unveiled its investment plan, which includes primarily for additional production capacity as well as innovation laboratories, education centers, and other own locations, with the goals of accelerating future growth, fostering innovation, and enhancing resilience.

- In 2023, Larsen & Toubro granted Grid Solutions a contract to deliver 380 kV T155 gas-insulated substations (GIS) for the world’s biggest utility-scale hydrogen plant, which will produce what is commonly referred to as “green hydrogen” using only renewable energy sources.

Market Concentration & Characteristics

The Gas Insulated Transmission Lines Market reflects a moderately concentrated structure where a limited number of global companies dominate supply due to high capital requirements, advanced engineering needs, and strict regulatory standards. It demonstrates strong entry barriers, with technology-intensive manufacturing, specialized installation skills, and long project cycles restricting new participants. Market concentration is reinforced by firms that hold significant expertise in high-voltage systems, underground transmission, and eco-efficient insulation solutions. It shows clear differentiation through innovation in sustainable gases, digital monitoring platforms, and modular designs that reduce installation complexity. Regional governments and utilities prefer established vendors with proven reliability, further consolidating market power among a few players. It highlights a competitive environment where partnerships, large-scale project execution, and R&D investments define long-term positioning.

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Gas Insulated Transmission Lines Market will expand with rising demand for compact transmission systems in urban and congested regions.

- It will benefit from stricter regulations that accelerate adoption of eco-efficient insulation gases with low environmental impact.

- Utilities will deploy more underground and submarine corridors to ensure reliable electricity supply across critical routes.

- It will gain momentum from large renewable energy projects that require efficient long-distance transmission.

- Digital integration will increase with predictive maintenance tools and real-time monitoring platforms.

- It will attract investments in cross-border interconnection projects that strengthen regional energy security.

- Manufacturers will focus on modular designs that reduce installation complexity and shorten project timelines.

- It will record higher adoption in regions with aging infrastructure that requires modernization.

- Collaboration between governments and technology providers will expand to drive innovation and standardization.

- It will position itself as a vital enabler of energy transition strategies worldwide.