Market Overview

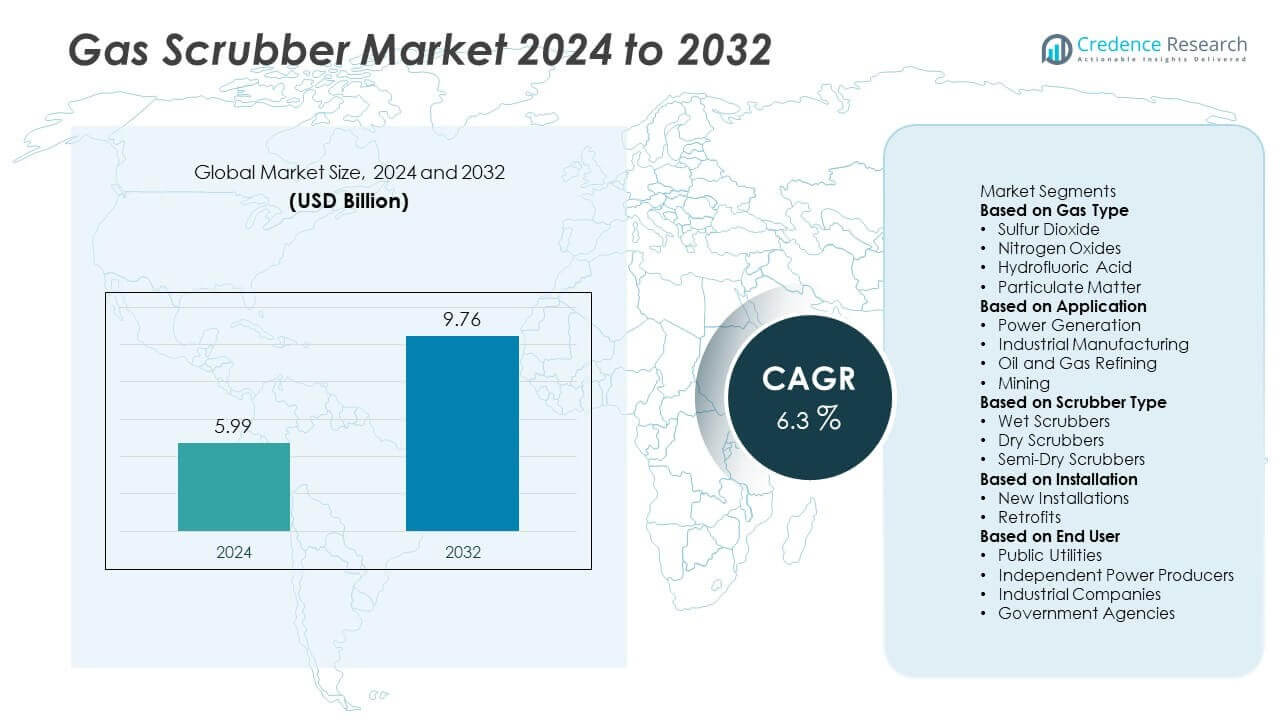

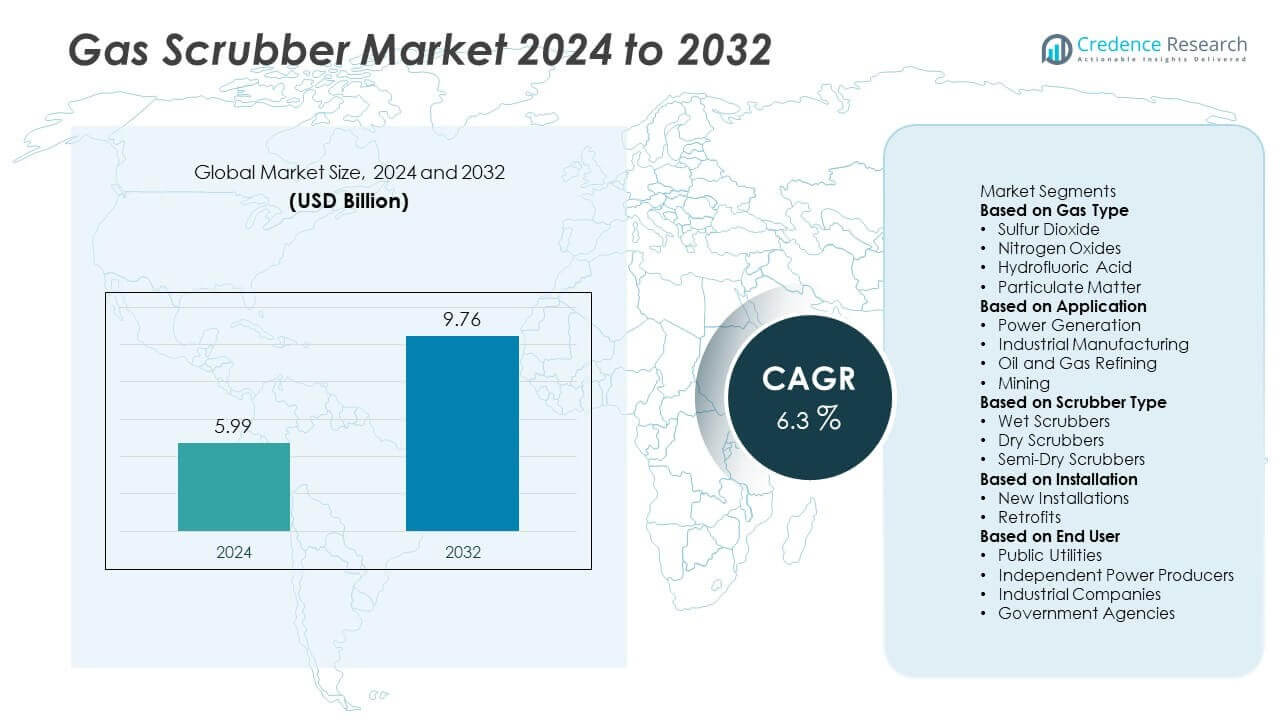

The global Gas Scrubber Market was valued at USD 5.99 billion in 2024 and is projected to reach USD 9.76 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Scrubber Market Size 2024 |

USD 5.99 Billion |

| Gas Scrubber Market, CAGR |

6.3% |

| Gas Scrubber Market Size 2032 |

USD 9.76 Billion |

Gas Scrubber Market grows with rising enforcement of air quality regulations and demand for cleaner industrial operations. Industries such as power generation, oil & gas, and chemicals adopt scrubbers to control SOx, NOx, and particulate emissions. It supports compliance with global sustainability goals and reduces environmental impact.

Gas Scrubber Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, supported by stringent emission norms and rapid industrialization. North America leads adoption with extensive use of wet and dry scrubbers in power generation and refining sectors to meet EPA standards. Europe emphasizes decarbonization, driving demand for advanced flue gas desulfurization systems and marine scrubbers under IMO 2020 regulations. Asia-Pacific grows rapidly with China and India installing scrubbers in power plants, steel, and cement facilities to curb pollution. Latin America and Middle East & Africa witness steady uptake driven by oil & gas expansion and stricter compliance requirements. Key players include Mitsubishi Heavy Industries, Thermax, Alfa Laval, Babcock Wilcox, and Ducon, focusing on innovative, energy-efficient designs, hybrid systems, and automation to enhance performance. Strategic collaborations, retrofitting projects, and capacity expansions strengthen their competitive position globally.

Market Insights

- Gas Scrubber Market was valued at USD 5.99 billion in 2024 and is projected to reach USD 9.76 billion by 2032, growing at a CAGR of 6.3%.

- Rising demand for emission control solutions across power generation, chemical, and marine sectors drives strong market growth.

- Market trends highlight the shift toward hybrid, dry, and energy-efficient scrubbers that reduce water and reagent consumption.

- Competitive landscape includes Mitsubishi Heavy Industries, Thermax, Alfa Laval, Babcock Wilcox, and Ducon focusing on innovation, automation, and sustainable solutions.

- High installation and maintenance costs remain a restraint, limiting adoption among small and medium industries in cost-sensitive regions.

- North America and Europe lead adoption with strict air quality regulations, while Asia-Pacific shows the fastest growth with large-scale power plant and industrial installations.

- Expanding adoption of marine scrubbers under IMO 2020 regulations and industrial retrofitting projects create significant opportunities for manufacturers worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Stringent Environmental Regulations Driving Adoption

Gas Scrubber Market grows with rising enforcement of strict air quality standards worldwide. Governments implement emission norms targeting SOx, NOx, and particulate matter to reduce industrial pollution. Power plants, refineries, and chemical producers adopt scrubbers to meet compliance requirements. It helps industries avoid penalties while improving environmental performance. Regulatory frameworks such as the U.S. Clean Air Act and EU Industrial Emissions Directive strengthen demand for advanced systems. Growing public pressure for clean air supports long-term market growth.

- For instance, Mitsubishi Heavy Industries (MHI) licensed its carbon capture technology for Europe’s first fully operational post-combustion carbon capture plant, which removes approximately 25,000 tonnes of CO₂ annually from a natural gas treatment plant near Ravenna, Italy.

Industrial Expansion and Rising Energy Demand

Gas Scrubber Market benefits from rapid industrialization in emerging economies. Growing production in sectors such as oil & gas, petrochemicals, and metallurgy drives installation of emission control equipment. It ensures safer workplace environments and reduces harmful gas exposure for workers. Expanding power generation capacity creates strong demand for flue gas desulfurization systems. Increased infrastructure investments in Asia-Pacific and the Middle East boost deployment of wet and dry scrubbers. Rising urbanization and energy consumption further accelerate adoption.

- For instance, Ducon Technologies has supplied wet Flue Gas Desulfurization (FGD) systems covering over 20,000 megawatts of combined power plant capacity. The company, which is an EPC (Engineering, Procurement, and Construction) firm, has a long history of installing its proprietary pollution control and material handling systems.

Technological Advancements in Scrubber Design

Gas Scrubber Market sees growth from innovations that improve efficiency and reduce operating costs. Manufacturers develop high-performance packed bed and venturi scrubbers with lower water and energy consumption. It enhances pollutant removal while minimizing maintenance requirements. Automation and real-time monitoring systems improve process control and reliability. Integration with digital platforms allows predictive maintenance and performance optimization. These advancements make scrubbers more cost-effective and attractive for a wider range of industries.

Growing Focus on Workplace Safety and Sustainability

Gas Scrubber Market expands with rising emphasis on employee health and corporate sustainability goals. Companies install scrubbers to protect workers from hazardous gases and comply with occupational safety standards. It supports ESG initiatives by reducing carbon and pollutant emissions. Industries adopt eco-friendly systems that use less water and chemicals to align with sustainability targets. Growing awareness of environmental impact encourages upgrades from older equipment to modern solutions. Investment in green technologies strengthens market growth trajectory.

Market Trends

Market Trends

Rising Adoption of Wet and Dry Scrubbing Systems

Gas Scrubber Market shows growing preference for both wet and dry scrubbers based on application needs. Wet scrubbers remain popular for power plants and chemical industries due to high SOx and particulate removal efficiency. Dry scrubbers gain traction in regions with water scarcity and stricter wastewater regulations. It allows industries to choose solutions that balance cost, performance, and environmental impact. Hybrid systems combining wet and dry technologies are also emerging. This trend supports flexibility and wider adoption across diverse sectors.

- For instance, Ducon’s Venturi scrubber is designed to achieve over 99.9% collection efficiency for sub-micron particulate matter and can be built to handle pressure drops up to 80 inches W.G. or more. This high efficiency is achieved by using a high-velocity gas stream to atomize the scrubbing liquid and capture fine particulate matter.

Integration of Automation and Digital Monitoring

Gas Scrubber Market is embracing automation and digital control systems for better performance management. Automated systems enable precise control of gas flow rates, reagent usage, and pressure drops. It improves efficiency and reduces operational costs for end users. Real-time monitoring with IoT integration allows predictive maintenance and early fault detection. Remote access capabilities support quick decision-making and minimize downtime. This trend aligns with Industry 4.0 initiatives, making scrubber operations smarter and more efficient.

- For instance, Endress+Hauser’s wash-water monitoring system for marine exhaust gas cleaning track both inlet and outlet scrubber water quality with sensors certified under MEPC.259(68) and MEPC.340(77), enabling compliance verification aboard ships.

Focus on Energy-Efficient and Low-Maintenance Designs

Gas Scrubber Market experiences demand for systems that minimize energy consumption and maintenance costs. Manufacturers develop scrubbers with optimized fan and pump designs to reduce power usage. It lowers overall operating expenses and supports sustainability targets. Materials with high corrosion resistance extend equipment life and cut replacement costs. Compact and modular designs allow easy installation in space-constrained facilities. This shift encourages adoption among cost-sensitive industries seeking long-term savings.

Growing Use in Emerging and Niche Applications

Gas Scrubber Market is expanding into new industries beyond traditional power and chemical sectors. Food processing, semiconductor manufacturing, and waste-to-energy plants are increasingly installing scrubbers. It helps control odor emissions and toxic byproducts unique to these industries. Demand rises for customized solutions that handle complex gas streams with high efficiency. Industrial expansion in Asia-Pacific and Latin America drives growth in these niche applications. This trend diversifies market opportunities and supports steady growth across regions.

Market Challenges Analysis

High Capital Investment and Operating Costs

Gas Scrubber Market faces challenges due to significant upfront capital requirements for installation. High-quality wet and dry scrubbers involve complex designs and expensive materials, raising procurement costs. It becomes difficult for small and mid-sized industries to justify investment despite regulatory pressure. Ongoing expenses for energy, water, and reagents further add to the financial burden. Maintenance and periodic replacement of components also increase total ownership cost. These factors slow adoption, particularly in cost-sensitive regions with limited industrial budgets.

Complex Maintenance and Waste Management Issues

Gas Scrubber Market encounters challenges related to maintenance and safe handling of byproducts. Wet scrubbers generate wastewater containing pollutants that require treatment before discharge. It raises compliance costs and creates environmental management concerns. Dry scrubbers produce solid residues that need proper disposal, adding logistical complexity. Skilled labor is essential for routine monitoring and maintenance, but availability can be limited in developing regions. Equipment downtime during servicing impacts productivity and plant efficiency. These challenges hinder smooth operation and discourage rapid system upgrades.

Market Opportunities

Expansion of Industrial and Power Generation Sectors

Gas Scrubber Market holds strong opportunities with growth in industrialization and power generation capacity worldwide. Rising demand for electricity drives construction of thermal power plants that require flue gas desulfurization systems. It supports large-scale deployment of scrubbers to control SOx and particulate emissions. Petrochemical, metal processing, and fertilizer industries are expanding, further boosting need for emission control equipment. Governments invest in upgrading old plants to meet updated emission norms. This expansion creates consistent demand for efficient scrubber solutions across multiple sectors.

Advancement of Green Technologies and Innovation

Gas Scrubber Market benefits from development of energy-efficient and eco-friendly systems. Manufacturers introduce scrubbers with lower water consumption, optimized reagent use, and automated controls. It reduces operational costs while helping industries achieve sustainability goals. Opportunities emerge from hybrid and modular scrubber designs that offer flexibility and scalability. Growing focus on carbon capture and air quality management creates scope for integration with advanced pollution control technologies. Adoption of digital monitoring and predictive maintenance systems further enhances market potential.

Market Segmentation Analysis:

By Gas Type

Gas Scrubber Market is segmented by gas type into sulfur oxides (SOx), nitrogen oxides (NOx), carbon dioxide, volatile organic compounds (VOCs), and others. SOx scrubbers dominate due to strict global regulations for desulfurization in power plants, marine vessels, and industrial boilers. It helps meet emission limits set by MARPOL and regional air quality standards. NOx control systems gain demand in chemical, fertilizer, and refinery operations where high-temperature combustion releases harmful gases. VOC scrubbers are widely used in petrochemical and coating industries to manage hazardous emissions. Growing focus on carbon reduction creates opportunities for CO₂ scrubbing systems in cement, steel, and waste-to-energy plants. This segment benefits from rising environmental awareness and regulatory enforcement worldwide.

- For instance, Mitsubishi Heavy Industries supplied a CO₂ capture system at Petra Nova capable of processing 4,776 metric tonnes of CO₂ per day from flue gas streams, making it one of the largest post-combustion capture facilities globally.

By Application

Gas Scrubber Market by application includes power generation, chemical processing, petrochemicals, food and beverage, pharmaceuticals, and others. Power generation leads adoption with high deployment of flue gas desulfurization units in coal-fired plants. It ensures compliance with emission standards and supports cleaner energy production. Chemical and petrochemical industries rely on scrubbers to neutralize hazardous process gases and protect workers and the environment. Food and beverage plants use scrubbers for odor control and removal of acidic fumes. Pharmaceutical manufacturing adopts compact scrubbers to manage solvent vapors and maintain air purity. Growing industrialization in Asia-Pacific drives strong demand across all application categories.

- For instance, Babcock & Wilcox (B&W) installed a wet Flue Gas Desulfurization (FGD) system for multiple large power units, including systems for units as large as 1,300 MW. B&W’s wet FGD technology is designed to achieve high SO₂ removal efficiencies (often over 99%) and high system availability (greater than 99.5%) for reliable base-load operation.

By Scrubber Type

Gas Scrubber Market is classified into wet scrubbers, dry scrubbers, and hybrid systems. Wet scrubbers hold the largest share due to their high efficiency in removing SOx and particulate matter. It is preferred in applications with high moisture content and corrosive gases. Dry scrubbers are gaining traction where water availability is limited or wastewater disposal regulations are strict. They offer lower maintenance and no liquid effluent handling requirements. Hybrid scrubbers combine benefits of both systems, delivering flexibility and efficiency for complex gas streams. Manufacturers focus on designing modular and energy-efficient systems to meet varied industry needs.

Segments:

Based on Gas Type

- Sulfur Dioxide

- Nitrogen Oxides

- Hydrofluoric Acid

- Particulate Matter

Based on Application

- Power Generation

- Industrial Manufacturing

- Oil and Gas Refining

- Mining

Based on Scrubber Type

- Wet Scrubbers

- Dry Scrubbers

- Semi-Dry Scrubbers

Based on Installation

- New Installations

- Retrofits

Based on End User

- Public Utilities

- Independent Power Producers

- Industrial Companies

- Government Agencies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% market share in the Gas Scrubber Market, driven by stringent environmental regulations and strong industrial presence. The United States leads adoption with wide deployment of flue gas desulfurization units in coal-fired power plants to meet EPA standards. It benefits from rising demand in chemical, oil & gas, and metal processing industries where emission control is a top priority. Canada contributes with investments in clean air initiatives and upgrades to existing industrial plants. Adoption of hybrid and dry scrubbers grows due to the region’s focus on reducing water consumption and waste generation. Strong presence of technology providers and government incentives for cleaner production methods support continued growth in this market.

Europe

Europe holds 28% market share supported by its aggressive decarbonization goals and strict air quality directives. Germany, the U.K., and France are key contributors with major investments in upgrading power generation and industrial facilities. It benefits from EU policies that promote the reduction of SOx, NOx, and VOC emissions across multiple sectors. Adoption of wet scrubbers remains high due to their efficiency, but demand for dry scrubbers is rising in areas with limited water resources. Eastern European countries modernize manufacturing plants to meet EU environmental compliance standards, fueling demand. Growing use of scrubbers in marine vessels under IMO 2020 regulations further strengthens the regional market outlook.

Asia-Pacific

Asia-Pacific captures 30% market share and is the fastest-growing regional market due to rapid industrialization and urbanization. China dominates with large-scale installation of scrubbers in power plants, cement factories, and steel manufacturing facilities to combat severe air pollution. India follows with increasing focus on emission control through government-led initiatives and environmental regulations for coal-based plants. It benefits from strong growth in petrochemicals, fertilizers, and food processing sectors driving need for cost-effective gas cleaning systems. Southeast Asian nations invest in industrial infrastructure and adopt scrubbers for odor and fume control. Growing emphasis on sustainability and energy-efficient equipment creates long-term opportunities in this region.

Latin America

Latin America represents 6% market share with Brazil and Mexico leading adoption across oil & gas, mining, and chemical sectors. The region sees rising deployment of gas scrubbers in refineries and metal smelters to reduce emissions and improve compliance with environmental standards. It benefits from expansion of power generation capacity and stricter government norms on industrial air pollution. Investment in modernizing existing plants supports demand for both wet and dry scrubber systems. Partnerships with international technology suppliers enhance availability of advanced solutions. Continued industrial growth and regulatory alignment with global standards fuel steady adoption.

Middle East & Africa

Middle East & Africa hold 4% market share driven by oil & gas processing, petrochemical production, and power generation projects. Saudi Arabia and UAE invest in emission control systems to support sustainability goals and industrial diversification initiatives. It gains traction from the installation of scrubbers in refineries and gas processing plants to manage sulfur emissions. South Africa and Egypt adopt scrubbers in mining and fertilizer industries to meet national air quality standards. Limited water availability in some areas increases preference for dry and hybrid scrubbers. Growing development of industrial parks and stricter regulations are expected to expand demand over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ducon

- Moller Maersk

- Thermax

- Mitsubishi Heavy Industries

- Amec Foster Wheeler

- Sagamihara Machinery Works

- Alfa Laval

- Air Pollution Control Technologies

- Veoliawater Technologies

- Babcock Wilcox

Competitive Analysis

Competitive landscape of the Gas Scrubber Market features leading players such as Mitsubishi Heavy Industries, Thermax, Alfa Laval, Babcock Wilcox, Ducon, Amec Foster Wheeler, Sagamihara Machinery Works, Veoliawater Technologies, Air Pollution Control Technologies, and P. Moller Maersk competing through technology innovation, strategic partnerships, and global reach. These companies focus on developing advanced wet, dry, and hybrid scrubber systems that meet stringent environmental regulations and reduce operating costs for end users. They invest in R&D to enhance efficiency, improve energy recovery, and integrate automation for real-time monitoring and compliance reporting. Strategic collaborations with power plants, oil refineries, and marine operators support large-scale deployment and retrofitting projects. Players also expand service offerings including installation, maintenance, and performance optimization to strengthen customer relationships. Mergers, acquisitions, and capacity expansions help widen their market footprint and enhance supply capabilities. Continuous innovation and compliance with global standards enable these companies to stay competitive and capture growing demand.

Recent Developments

- In 2025, Ducon published details of its Venturi Scrubber (high-efficiency for sub-micron particles). Notable features: wetted-wall liquid inlet to avoid build-up, no spray nozzles, ability to handle high solids in recycled scrubbing liquid.

- In September 2024, Mitsubishi Heavy Industries (MHI) — Announced Europe’s first post-combustion carbon capture plant (Ravenna CCS Project, Phase 1) begins operation using MHI technology.

- In June 2024, Mitsubishi Heavy Industries (MHI) — Received an order to rebuild a waste-to-something flue gas system for use in methanation, a joint project with a city, to process its flue gas.

- In 2024, Veolia Water Technologies — At WEFTEC 2024, described a process using chemical alkaline scrubber followed by alkaline solution for H₂S removal from biogas.

Report Coverage

The research report offers an in-depth analysis based on Gas Type, Application, Scrubber Type, Installation, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gas scrubbers will rise with stricter global air quality and emission norms.

- Adoption of hybrid and dry scrubbers will increase to reduce water and reagent usage.

- Marine scrubber installations will grow under IMO 2020 regulations for sulfur emission control.

- Integration of automation and IoT-based monitoring will become standard for compliance tracking.

- Retrofitting of existing power plants and industrial facilities will create consistent demand.

- Emerging markets will invest heavily in scrubbers to address rapid industrialization and pollution control.

- Manufacturers will focus on energy-efficient designs to lower operational costs for end users.

- Customized scrubber solutions will gain traction for sector-specific applications like petrochemicals and steel.

- Strategic partnerships between equipment makers and EPC contractors will support large-scale projects.

- Continuous R&D will deliver compact, low-maintenance, and high-performance systems for diverse industries.

Market Trends

Market Trends