Market overview

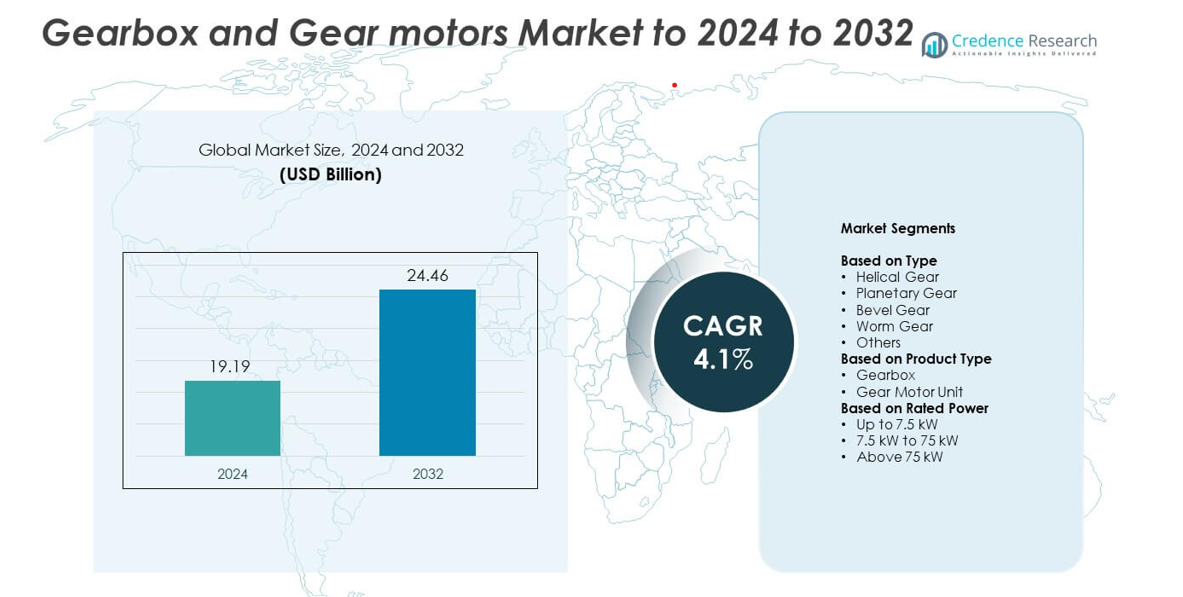

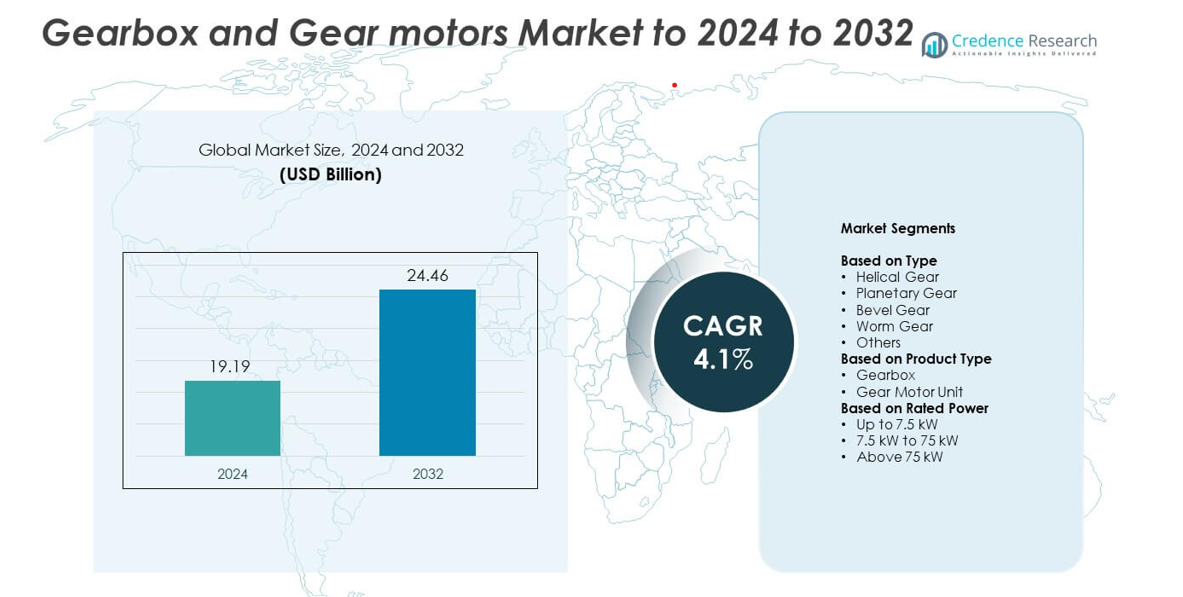

The gearbox and gear motors market size was valued at USD 19.19 billion in 2024 and is anticipated to reach USD 26.46 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gearbox and Gear Motors Market Size 2024 |

USD 19.19 billion |

| Gearbox and Gear Motors Market, CAGR |

4.1% |

| Gearbox and Gear Motors Market Size 2032 |

USD 26.46 billion |

The gearbox and gear motors market is led by major players including Siemens AG, SEW-EURODRIVE GmbH & Co. KG, Bonfiglioli S.p.A., NORD Drivesystems Group, Regal Rexnord Corporation, Nidec Corporation, and Sumitomo Heavy Industries Ltd. These companies maintain strong global positions through continuous innovation, energy-efficient designs, and smart drive technologies that support automation and precision control. They focus on expanding manufacturing capacities, integrating IoT-enabled systems, and offering customized modular solutions for key industries such as automotive, energy, and construction. Regionally, North America leads the market with a 34% share in 2024, followed closely by Europe with 29% and Asia-Pacific with 31%, driven by industrial expansion and renewable energy development.

Market Insights

- The gearbox and gear motors market was valued at USD 19.19 billion in 2024 and is expected to reach USD 26.46 billion by 2032, growing at a CAGR of 4.1%.

- Rising industrial automation, construction equipment demand, and renewable energy expansion are key drivers enhancing product adoption across multiple sectors.

- Technological advancements such as IoT-enabled systems and energy-efficient motor integration are emerging trends improving operational efficiency and reducing maintenance costs.

- The market remains moderately consolidated, with leading players focusing on innovation, capacity expansion, and strategic partnerships to maintain competitiveness.

- North America leads with a 34% share, followed by Europe at 29% and Asia-Pacific at 31%; by type, helical gears dominate with a 38% share due to their efficiency and durability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Helical gear dominated the gearbox and gear motors market in 2024, accounting for a 38% share. Its efficiency, high torque output, and smooth operation drive its use across manufacturing, mining, and material handling industries. The low noise level and durability make helical gears preferred in high-load and continuous-duty applications. Planetary and bevel gears are also growing, supported by demand in robotics and precision machinery, but helical designs remain dominant due to improved load distribution and reduced vibration in heavy-duty systems.

- For instance, Flender’s Winergy brand announced in 2021 that it had delivered over 200 GW of wind gearbox capacity and has continued to supply the wind industry with its components since passing this milestone.

By Product Type

Gearbox units held the leading 55% share in 2024, driven by their widespread use in heavy industrial and power transmission systems. Their flexibility to integrate with multiple drive technologies and long operational life strengthen their adoption in automation, mining, and energy sectors. Gear motor units are gaining traction in compact machinery, logistics, and robotics due to their energy efficiency and easy installation. However, gearboxes remain the core component across industries because of their scalability and mechanical reliability under high torque conditions.

- For instance, Bonfiglioli’s 300M gearboxes reach 1,286,700 Nm rated output torque.

By Rated Power

The 7.5 kW to 75 kW range accounted for 46% share in 2024, dominating the gearbox and gear motors market. This range is ideal for medium-duty applications such as conveyors, mixers, and compressors in manufacturing and construction industries. Demand is supported by industrial automation and expansion of mid-scale production lines. Units above 75 kW serve heavy equipment and energy sectors, while those below 7.5 kW cater to light machinery and robotics, but mid-range systems maintain dominance due to balanced performance and cost efficiency.

Key Growth Drivers

Rising Industrial Automation Demand

The increasing adoption of automation across manufacturing, mining, and logistics sectors drives demand for gearboxes and gear motors. Automated systems rely on high-torque, precision gear solutions for conveyors, packaging, and robotic arms. The trend toward smart factories and Industry 4.0 integration fuels investments in motion control systems, improving operational efficiency. Manufacturers are modernizing production facilities with energy-efficient and durable gear systems, further supporting market expansion in both developed and emerging economies.

- For instance, WEG produces over 16 million electric motors annually, as reported in the company’s 2024 corporate profile.

Expansion of Renewable Energy and Power Generation

The growing renewable energy sector, particularly wind and solar, boosts gear motor deployment. Gearboxes are essential for adjusting turbine speeds, ensuring optimal power output. Wind turbines and hydroelectric plants rely heavily on high-torque gear systems for efficient operation. Government initiatives promoting clean energy and rising global capacity additions are expanding equipment demand. The increasing focus on sustainable power solutions creates long-term growth potential for gearbox and gear motor manufacturers worldwide.

- For instance, ZF Wind Power’s Coimbatore plant reached 50 GW gearbox output.

Growth in Construction and Material Handling Equipment

The surge in infrastructure development and logistics expansion supports demand for gear motors in cranes, elevators, and conveyor systems. Gearboxes enable precise torque control, ensuring safety and durability in heavy-duty applications. The rise in urbanization and smart city projects across Asia-Pacific and the Middle East further drives installations. Manufacturers are offering compact and high-performance gear units to meet the requirements of construction automation and bulk material handling operations.

Key Trends & Opportunities

Integration of Smart and IoT-Enabled Gear Systems

The adoption of smart gearboxes with IoT sensors is transforming predictive maintenance and performance monitoring. Real-time data collection improves reliability, reduces downtime, and extends equipment life. Industrial automation players are integrating connected gear systems to optimize energy usage and reduce operational costs. The trend supports digital transformation in industrial processes, helping companies achieve better asset management and efficiency across manufacturing and energy applications.

- For instance, ABB’s first-generation Smart Sensor for motors measures vibration from 0.04 to 700 mm/s across a 10 Hz–1 kHz frequency range and monitors temperatures between –40 °C and +85 °C. The sensor has a battery design life of 5 years under standard operating conditions, the actual battery life is estimated at 3–5 years and is highly dependent on factors such as ambient temperature and the frequency of measurements

Rising Adoption of Energy-Efficient Gear Solutions

Manufacturers are focusing on developing lightweight, low-friction gear systems to meet global energy efficiency standards. Enhanced materials, surface coatings, and advanced lubrication reduce energy loss during transmission. The shift toward eco-friendly and high-efficiency systems is driven by sustainability goals and stricter emission regulations. This trend creates opportunities for innovation in compact, high-torque solutions suitable for electric vehicles, robotics, and industrial automation systems.

- For instance, Harmonic Drive reports shaft-to-shaft efficiencies up to 90%.

Key Challenges

High Maintenance and Replacement Costs

Gearboxes and gear motors require regular maintenance to ensure precision and performance. High wear and tear under continuous operation lead to frequent replacements, increasing operational costs for end-users. Complex installations in heavy machinery also make servicing challenging. These costs often discourage small and medium industries from adopting advanced gear solutions, restraining overall market penetration in cost-sensitive regions.

Volatility in Raw Material Prices

Fluctuating prices of steel, aluminum, and copper impact production costs for gear components. Manufacturers face margin pressure due to unstable material supply and higher energy costs. The dependence on imports for specialty alloys and precision parts further exposes the industry to market disruptions. Companies are focusing on supply chain optimization and material recycling to mitigate these risks, but price volatility remains a key challenge for stable profitability.

Regional Analysis

North America

North America held a 34% share of the gearbox and gear motors market in 2024. Growth is driven by the strong presence of industrial automation, robotics, and renewable energy sectors. The U.S. leads the region, supported by high adoption in automotive manufacturing, mining, and oil and gas industries. Ongoing modernization of production facilities and investments in wind power infrastructure further support market expansion. Canada contributes through demand in construction and material handling applications, while advanced gear solutions from domestic manufacturers enhance efficiency and product reliability across key industries.

Europe

Europe accounted for 29% share in 2024, supported by advanced manufacturing and stringent efficiency regulations. Germany, Italy, and France lead production in automotive, energy, and industrial machinery sectors. The region’s focus on Industry 4.0 and green manufacturing promotes demand for precision gear systems and energy-efficient motors. Wind energy deployment in Northern Europe and modernization in Eastern markets strengthen overall growth. European manufacturers are emphasizing high-performance and low-noise gear solutions to meet strict emission and operational standards across various industrial applications.

Asia-Pacific

Asia-Pacific dominated the market with a 31% share in 2024, led by China, Japan, and India. Rapid industrialization, expanding manufacturing capacity, and growth in construction equipment drive demand for gear systems. China remains the largest contributor, supported by heavy machinery, electric vehicle, and renewable energy applications. Japan focuses on automation and robotics, while India experiences rising demand from construction and infrastructure projects. The region’s cost-efficient manufacturing base and growing export capacity make it a global hub for gearbox and gear motor production.

Latin America

Latin America held a 4% share of the gearbox and gear motors market in 2024. The region benefits from ongoing development in mining, agriculture, and construction sectors. Brazil and Mexico lead demand, driven by machinery modernization and renewable energy initiatives. Industrial automation adoption is gradually increasing, improving productivity in mid-scale industries. However, limited domestic manufacturing and dependency on imports constrain market expansion. Investments in industrial infrastructure and government efforts toward renewable projects are expected to support moderate growth over the forecast period.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, driven by infrastructure projects and energy developments. Demand is concentrated in the oil and gas, mining, and construction sectors across Saudi Arabia, the UAE, and South Africa. Industrial diversification programs and renewable energy expansion stimulate equipment demand. The adoption of high-torque gear systems in heavy-duty machinery is growing, supported by foreign investments in industrial manufacturing. However, slow industrial automation and supply chain limitations continue to restrain faster market penetration in the region.

Market Segmentations:

By Type

- Helical Gear

- Planetary Gear

- Bevel Gear

- Worm Gear

- Others

By Product Type

By Rated Power

- Up to 7.5 kW

- 7.5 kW to 75 kW

- Above 75 kW

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The gearbox and gear motors market features key players such as Siemens AG, SEW-EURODRIVE GmbH & Co. KG, Bonfiglioli S.p.A., NORD Drivesystems Group, Regal Rexnord Corporation, Nidec Corporation, Sumitomo Heavy Industries Ltd., ABB, Flender International GmbH, Elecon Engineering Co. Ltd., Shanthi Gears Limited, Dunkermotoren, Portescap, Top Gear Transmissions, and NGL. The competitive environment is marked by continuous technological innovation, strong product customization, and expansion into high-growth industrial segments. Leading companies are investing in automation, IoT integration, and energy-efficient designs to enhance torque performance and durability. Strategic partnerships, mergers, and acquisitions strengthen their global supply networks and regional manufacturing bases. Players focus on delivering modular, low-maintenance systems for industries such as automotive, construction, and renewable energy. The shift toward digitalized production and predictive maintenance technologies continues to drive differentiation, while competition remains intense among established and emerging manufacturers striving to improve cost efficiency and operational reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- SEW-EURODRIVE GmbH & Co. KG

- Bonfiglioli S.p.A.

- NORD Drivesystems Group

- Regal Rexnord Corporation

- Nidec Corporation

- Sumitomo Heavy Industries Ltd.

- ABB

- Flender International GmbH

- Elecon Engineering Co. Ltd.

- Shanthi Gears Limited

- Dunkermotoren

- Portescap

- Top Gear Transmissions

- NGL

Recent Developments

- In 2025, SEW-EURODRIVE launched external oil cooling and supply systems for heavy-industry gearing. These systems are designed to support high-torque gearboxes by addressing thermal limitations, thus determining the gearbox size and performance.

- In 2025, ABB India officially launched its IE5 ultra-premium efficiency motors, which are manufactured locally and are free from rare-earth metals.

- In 2023, Siemens completed the carve-out of its low-voltage motors and geared motors business into a legally separate company, Innomotics.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Rated Power and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-noise gear systems will grow across industrial sectors.

- Integration of IoT-enabled and smart gear motors will improve predictive maintenance capabilities.

- Expansion of renewable energy, particularly wind and hydro, will increase gear unit installations.

- Automation in logistics, mining, and construction will enhance adoption of compact gear solutions.

- Rising electric vehicle production will create new opportunities for precision gear systems.

- Technological advances in lightweight materials will enhance durability and reduce power loss.

- Asia-Pacific will remain the primary growth hub due to industrialization and infrastructure projects.

- Manufacturers will focus on modular and customized designs for flexible industrial integration.

- Growing retrofitting demand in aging industrial facilities will support aftermarket sales.

- Strategic partnerships and mergers will strengthen global supply chains and regional manufacturing bases.