Market Overview

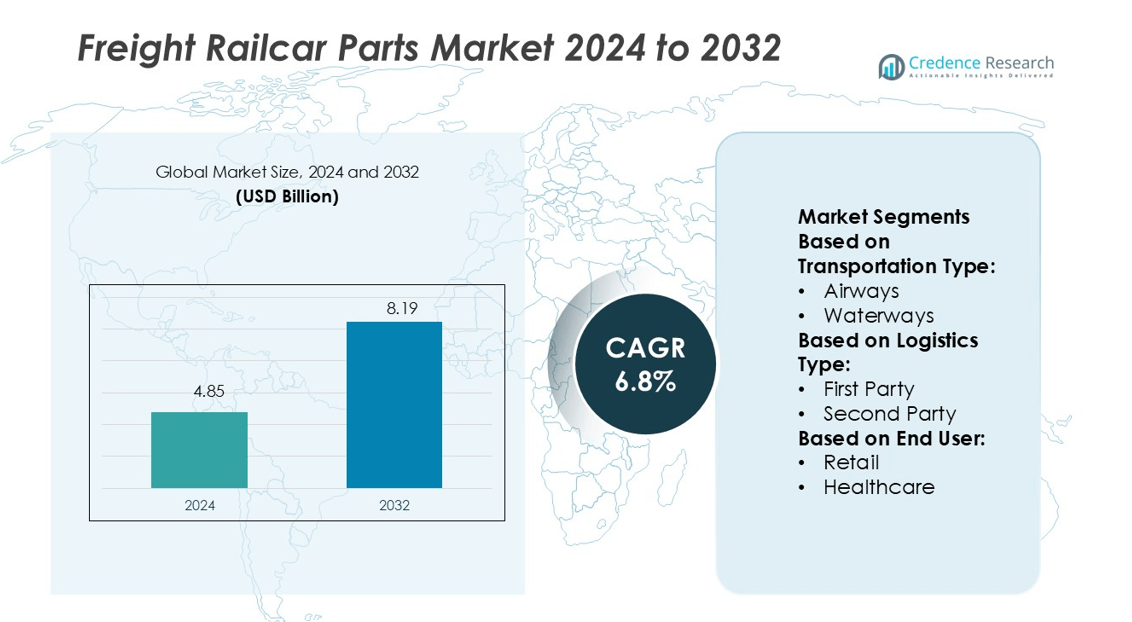

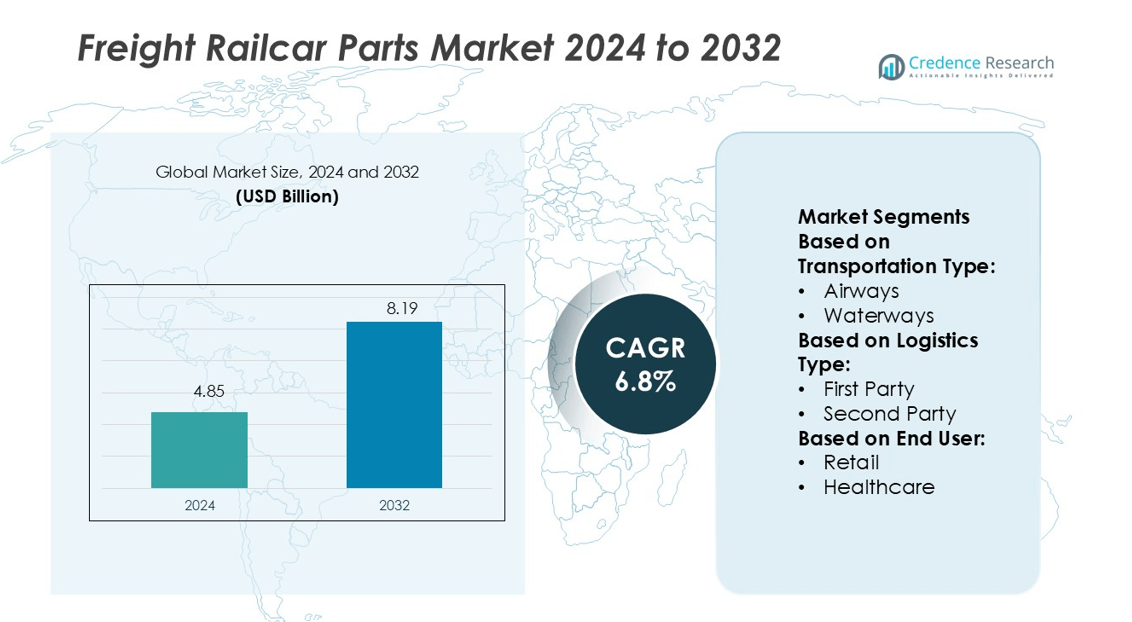

Freight Railcar Parts Market size was valued USD 4.85 billion in 2024 and is anticipated to reach USD 8.19 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freight Railcar Parts Market Size 2024 |

USD 4.85 billion |

| Freight Railcar Parts Market, CAGR |

6.8% |

| Freight Railcar Parts Market Size 2032 |

USD 8.19 billion |

The Freight Railcar Parts Market is shaped by key players including GATX Corporation, Bombardier Transportation, Faiveley Transport, Progress Rail Services Corporation, Knorr-Bremse AG, Alstom SA, General Electric Company, Greenbrier Companies, CIMC Group Limited, and ABB Ltd. These companies focus on advanced component technologies, energy-efficient solutions, and digital monitoring systems to enhance freight performance and reduce lifecycle costs. Strategic mergers, capacity expansions, and R&D investments strengthen their competitive positions. Asia Pacific leads the market with a 36.1% share, driven by rapid industrialization, extensive rail infrastructure expansion, and strong government support for freight network modernization. This regional dominance supports sustained demand growth for high-quality railcar components.

Market Insights

- The Freight Railcar Parts Market was valued at USD 4.85 billion in 2024 and is projected to reach USD 8.19 billion by 2032, growing at a CAGR of 6.8%.

- Rising investment in freight infrastructure, modernization of rolling stock, and demand for energy-efficient components are driving market growth.

- Smart railcar technologies, predictive maintenance, and digital monitoring systems are emerging as key trends, improving operational efficiency and safety.

- The competitive landscape is shaped by leading players focusing on R&D, mergers, and capacity expansion to strengthen their global positions.

- Asia Pacific leads the market with a 36.1% regional share, followed by North America and Europe, while railways hold the dominant transportation segment share at 41.3%, supported by high freight volumes and infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Transportation Type

Railways dominate the Freight Railcar Parts Market with a 41.3% market share. The strong position is driven by high freight capacity, cost-effectiveness, and lower emissions compared to other modes. Railways offer better safety, lower maintenance costs per ton-kilometer, and long-distance hauling efficiency. Demand rises from expanding industrial freight volumes and improved rail infrastructure. Modernization of wagons and adoption of automated braking and coupling systems enhance reliability and speed. While roadways and waterways are growing, their market shares remain smaller due to capacity limits and slower transit times. Railways remain the preferred choice for bulk freight transport.

- For instance, GATX Rail Europe participates in digital automatic coupling (DAC) initiatives under the European DAC Delivery Programme. As part of this, it has provided some of its fleet of more than 30,000 railcars for testing standardized DAC prototypes from manufacturers to prepare for the industry-wide migration.

By Logistics Type

Third Party Logistics (3PL) leads the market with a 36.8% share. Its dominance comes from cost efficiency, better route optimization, and advanced supply chain visibility. 3PL providers leverage digital platforms and analytics to improve delivery timelines and reduce operational risks. Industries rely on them for flexibility, scalability, and expertise in cross-border trade. Growth is supported by rising e-commerce shipments and just-in-time delivery models. Contract logistics and freight forwarders follow, driven by specialized handling and customized solutions. Asset-based logistics remains significant for large manufacturers, but 3PL continues to expand its footprint through network strength and advanced services.

- For instance, Faiveley designed its CX pantograph used on TGV high-speed trains which sustained over 574.8 km/h during record trials, supplying current pickup reliably at that speed.

By End User

Industrial and Manufacturing holds the largest share at 39.5% of the Freight Railcar Parts Market. This dominance is driven by high freight volumes of raw materials and finished goods. Rail transport supports the movement of steel, cement, machinery, and chemicals at lower costs. Manufacturers prefer rail for bulk shipments due to reliability and infrastructure connectivity. Growing investment in industrial corridors and rail-based logistics hubs strengthens this segment. Retail and oil & gas sectors also contribute significantly as demand for efficient inland freight movement increases. Healthcare shows steady growth, supported by temperature-controlled and time-sensitive logistics solutions.

Key Growth Drivers

Expansion of Freight Rail Networks

The ongoing expansion of freight rail infrastructure is a major growth driver. Governments and private operators are investing in modernizing rail lines and building dedicated freight corridors. This expansion boosts demand for advanced railcar components, including braking systems, axles, bearings, and couplers. Improved connectivity lowers transit times and enhances cost efficiency, making rail transport more attractive for bulk shipments. The integration of smart rail systems and increased freight capacity further strengthens the role of rail transport, encouraging significant investments in high-performance and durable railcar parts.

- For instance, Alstom deployed smart manufacturing across its plants: over 130 robots now operate in ~30 sites, supporting about 15 different applications (70% in welding).

Rising Industrial Freight Volumes

Industrial growth and expanding manufacturing activities drive strong demand for freight railcar parts. Industries such as mining, steel, construction, and chemicals depend on rail transport for bulk movement of materials. High-capacity wagons and durable components help reduce operational costs and ensure reliable long-distance hauling. As production volumes rise, companies invest in larger and more efficient fleets, leading to higher replacement cycles and component upgrades. This trend directly increases demand for brake systems, bogies, and digital monitoring components, supporting steady market expansion.

- For instance, Greenbrier’s Advanced High-Strength Steel Gondola™ cars reduce unloaded weight by up to 15,000 pounds per car through a new custom steel grade developed with U.S. Steel.

Shift Toward Sustainable Transportation

Growing environmental concerns and decarbonization initiatives are accelerating the shift toward rail freight. Rail transport emits significantly less CO₂ than road or air freight, making it a preferred choice for sustainable logistics. Governments are incentivizing green rail investments and operators are modernizing fleets with energy-efficient systems. Lightweight materials, regenerative braking, and aerodynamic railcar designs reduce energy consumption and enhance performance. This shift creates strong demand for advanced railcar parts designed for energy efficiency and longer service life, driving growth across global markets.

Key Trends & Opportunities

Adoption of Smart Railcar Components

Digitalization is reshaping the freight railcar parts market. Operators are adopting IoT sensors, GPS tracking, and predictive maintenance technologies to enhance efficiency. Smart components monitor axle temperature, wheel wear, and brake performance in real time. This allows for proactive maintenance and reduces unplanned downtime. As digital freight corridors grow, the need for intelligent railcar components will surge. This trend creates opportunities for manufacturers to offer integrated, data-driven solutions that extend asset life and optimize operational costs.

- For instance, ABB’s Enviline ERS (Energy Recuperation System) for DC rail lets surplus braking energy feed back into the AC grid. The converter modules run at 97.5 % efficiency, and support voltages of 600/750 V and 1500 V, with overload capability up to 225 %.

Growth in Aftermarket Services

Rising freight traffic and aging fleets are fueling aftermarket demand for railcar parts. Maintenance, repair, and overhaul (MRO) activities are becoming more critical to ensure reliability and compliance with safety standards. Rail operators increasingly partner with third-party service providers for component upgrades and lifecycle management. Manufacturers offering extended service packages, modular parts, and quick delivery gain a competitive edge. This creates opportunities for long-term contracts, value-added services, and digital maintenance solutions across developed and emerging rail markets.

- For instance, Siemens Mobility’s Railigent X digital platform supports predictive maintenance across fleets and contributes to achieving up to 100 % system availability in their service contracts.

Key Challenges

High Initial Capital Investment

The freight railcar parts market faces the challenge of high upfront costs for fleet modernization and component upgrades. Advanced systems, such as digital monitoring and energy-efficient braking, require significant investment. Many small and mid-sized operators struggle to allocate sufficient budgets for large-scale adoption. Limited funding slows down modernization and delays replacement cycles. This cost barrier affects the pace of technological integration, particularly in developing regions, where freight networks are expanding but capital resources remain limited.

Supply Chain Disruptions

Global supply chain disruptions remain a major obstacle for the freight railcar parts market. Fluctuations in raw material availability, shipping delays, and geopolitical uncertainties increase lead times and costs. Manufacturers face difficulties in maintaining consistent component supply, affecting project timelines. Dependence on global suppliers for critical parts such as axles, braking systems, and bearings adds further risk. Companies are forced to adapt with local sourcing and inventory strategies, but prolonged disruptions can still hamper market stability and growth.

Regional Analysis

North America

North America holds a 34.6% share of the Freight Railcar Parts Market. The region benefits from a well-established rail freight network and strong industrial activity. High volumes of commodities such as coal, chemicals, and automotive products drive demand for durable railcar components. Modernization of freight corridors and adoption of predictive maintenance solutions further support growth. The U.S. and Canada are investing in energy-efficient wagons and digital monitoring systems to improve operational efficiency. Increased public and private investments in rail infrastructure ensure steady demand for wheels, axles, couplers, and braking systems across the region.

Europe

Europe accounts for 27.8% of the Freight Railcar Parts Market. The region’s focus on decarbonization and rail electrification drives fleet upgrades and component replacement. EU countries are modernizing freight wagons to align with environmental regulations and interoperability standards. Growth is supported by cross-border freight corridors connecting major industrial hubs. Demand is high for lightweight materials, advanced braking technologies, and telematics systems. Germany, France, and the U.K. lead the market, supported by well-developed logistics networks. Investments in sustainable freight solutions strengthen Europe’s position as a key contributor to global market growth.

Asia Pacific

Asia Pacific dominates the global Freight Railcar Parts Market with a 36.1% share. Rapid industrialization, expanding manufacturing activity, and growing export volumes drive strong demand. China and India are investing heavily in new freight corridors and high-capacity wagons. Modernization of rolling stock and rapid expansion of logistics hubs increase the need for advanced axles, wheels, and couplers. The adoption of smart rail technologies enhances operational efficiency and reduces downtime. Rising demand for bulk transportation of raw materials and finished goods positions the region as a critical growth engine for railcar component manufacturers.

Latin America

Latin America represents a 6.4% share of the Freight Railcar Parts Market. The region’s growth is fueled by increasing exports of minerals, agricultural products, and energy commodities. Brazil and Mexico are key contributors, focusing on improving freight infrastructure and modernizing fleets. Investments in efficient wagon designs and braking systems are rising. Although infrastructure development is slower compared to other regions, growing private investments and logistics partnerships support market expansion. The region’s untapped freight potential offers long-term opportunities for component manufacturers targeting cost-effective and durable solutions.

Middle East & Africa

The Middle East & Africa region accounts for 5.1% of the Freight Railcar Parts Market. Growth is supported by government-led investments in freight corridors and mineral transport projects. Countries such as Saudi Arabia, South Africa, and the UAE are focusing on expanding freight capacity to boost trade connectivity. Demand is increasing for axle assemblies, wheels, and braking systems in bulk freight operations. Though the market is relatively nascent, infrastructure development and regional trade agreements are creating strong opportunities. Expanding industrial projects and port connectivity will further drive adoption of modern freight railcar components.

Market Segmentations:

By Transportation Type:

By Logistics Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Freight Railcar Parts Market is driven by leading players such as GATX Corporation, Bombardier Transportation, Faiveley Transport, Progress Rail Services Corporation, Knorr-Bremse AG, Alstom SA, General Electric Company, Greenbrier Companies, CIMC Group Limited, and ABB Ltd. The Freight Railcar Parts Market is defined by strong innovation, technological advancement, and infrastructure modernization. Companies are focusing on developing lightweight, durable, and energy-efficient components to enhance performance and reduce lifecycle costs. Investments in smart rail technologies, such as predictive maintenance systems and IoT-enabled monitoring, are rising rapidly. Strategic collaborations, mergers, and acquisitions are helping expand global footprints and strengthen product portfolios. The increasing adoption of automated braking, axle monitoring, and digital safety systems reflects a clear shift toward efficiency and reliability. This competitive environment encourages continuous R&D and accelerates market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Firnal announced the launch of an international manufacturing and logistics division in partnership with DVR International. This new division focuses on international manufacturing, shipping, and risk mitigation to meet global supply chain challenges and offer stability.

- In April 2025, Swan Defence and Heavy Industries launched a commercial logistics ecosystem at Pipavav Yard. The model is designed to help companies shorten project execution timelines, minimise handoffs, and reduce overall project risk.

- In April 2025, Gulf Warehousing Company (GWC) Q.P.S.C. will launch one of the largest private solar energy projects in the Gulf Cooperation Council (GCC), marking a significant step in its sustainability journey and reinforcing its position as a leader in green logistics.

- In January 2025, Sustainable Shared Transport Inc. (SST), a subsidiary of Yamato Holdings Co., Ltd. and Fujitsu Limited, today announced the launch of a joint transportation and delivery system for shippers and logistics providers in Japan

Report Coverage

The research report offers an in-depth analysis based on Transportation Type, Logistics Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increasing adoption of digital monitoring and predictive maintenance systems.

- Railcar component manufacturers will focus on lightweight materials to improve energy efficiency.

- Expanding freight corridors will drive higher demand for durable axles and braking systems.

- Governments will support modernization through infrastructure investments and incentives.

- The shift toward green logistics will accelerate fleet upgrades and part replacements.

- Aftermarket services will grow as operators extend the life of existing fleets.

- IoT and automation will enhance safety, tracking, and operational reliability.

- Regional trade agreements will increase cross-border freight volumes.

- Rising industrial output will boost demand for high-capacity railcar components.

- Strategic collaborations will strengthen global supply chains and technology integration.