Market Overview

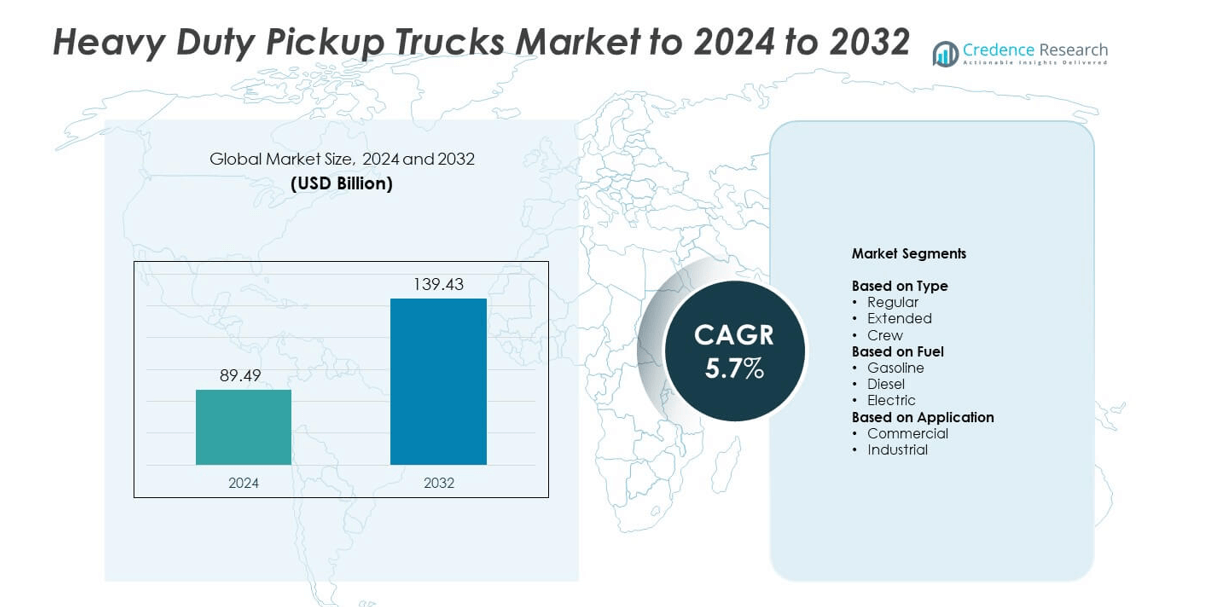

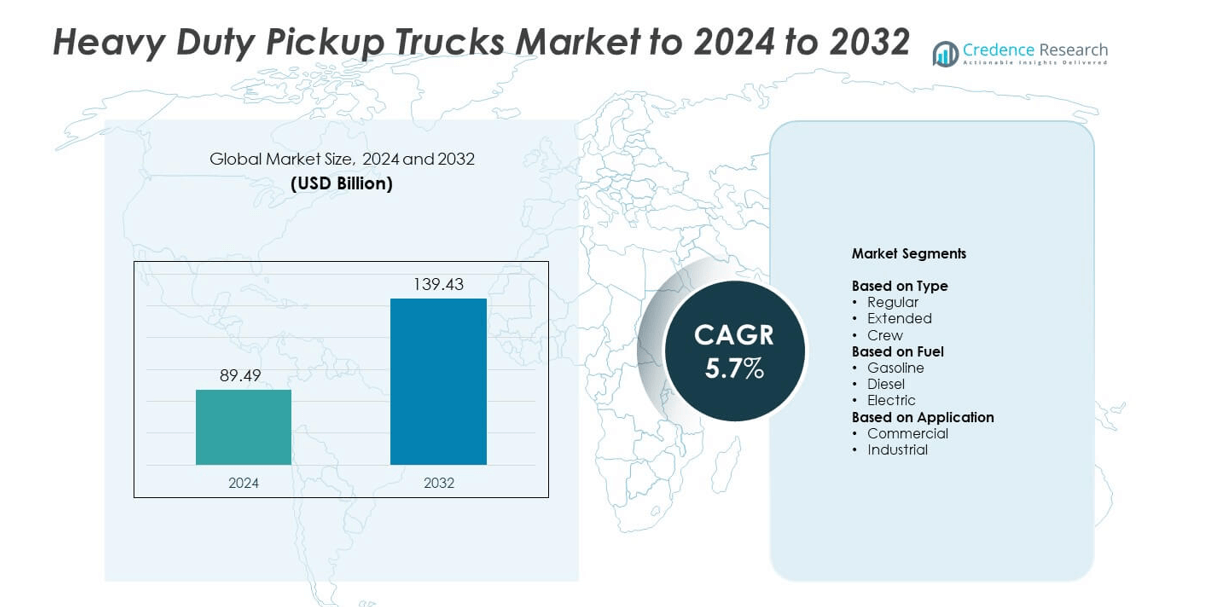

Heavy Duty Pickup Trucks Market size was valued at USD 89.49 billion in 2024 and is anticipated to reach USD 139.43 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Duty Pickup Trucks Market Size 2024 |

USD 89.49 billion |

| Heavy Duty Pickup Trucks Market, CAGR |

5.7% |

| Heavy Duty Pickup Trucks Market Size 2032 |

USD 139.43 billion |

The heavy-duty pickup trucks market is led by major companies including Toyota Motor Corporation, Ford Motor Company, General Motors, Nissan, Ram Trucks, Volkswagen, Honda, Mitsubishi Motors, Isuzu, Great Wall Motors, Kia Corporation, and NYE Toyota. These manufacturers compete through innovation in electrification, safety features, and connectivity to strengthen market presence. North America dominates the global market with a 48% share, driven by high adoption across construction, logistics, and personal utility segments. Europe and Asia-Pacific follow, supported by infrastructure growth and fleet modernization initiatives that continue to expand the global demand for heavy-duty pickup trucks.

Market Insights

- The heavy-duty pickup trucks market was valued at USD 89.49 billion in 2024 and is projected to reach USD 139.43 billion by 2032, growing at a CAGR of 5.7%.

- Rising demand from construction, logistics, and agricultural sectors drives market expansion, supported by fleet modernization and advanced performance technologies.

- Electric and hybrid heavy-duty pickups are emerging as key trends, with manufacturers focusing on battery efficiency, telematics integration, and sustainability.

- The market is highly competitive, with global and regional players emphasizing product innovation, lightweight materials, and improved fuel efficiency to gain market share.

- North America leads the market with 48% share, followed by Europe at 23% and Asia-Pacific at 21%, while the crew cab segment dominates globally with about 46% share due to its comfort and utility advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The crew cab segment dominated the heavy-duty pickup trucks market in 2024, holding around 46% of the total share. Crew cab trucks offer spacious interiors and four-door designs, making them ideal for both personal and commercial use. Their comfort, towing capacity, and versatility attract construction firms, logistics companies, and individual users. Manufacturers are focusing on advanced driver-assistance systems and improved cabin ergonomics to enhance usability. The demand for multipurpose vehicles with enhanced passenger comfort continues to drive crew cab adoption globally.

- For instance, Ford’s Super Duty crew cab lists 43.6 in rear legroom and 131.9 cu ft passenger volume.

By Fuel

The diesel segment held the largest share of about 58% in 2024, driven by its superior torque, towing power, and fuel efficiency. Diesel-powered heavy-duty pickups are preferred in construction, mining, and long-haul transport applications requiring high load capacity. Major manufacturers are improving diesel engines with lower emissions and higher mileage to meet stricter environmental norms. The segment benefits from continued fleet modernization and government incentives for cleaner diesel technologies. Diesel remains the primary fuel choice due to performance reliability and cost efficiency.

- For instance, Ram’s 6.7L Cummins High-Output is rated at 1,075 lb-ft of torque and offers up to 37,090 lb of maximum diesel towing capacity when equipped in a Ram 3500 model from model years 2022 to 2024, though this capacity figure changed slightly for 2025.

By Application

The commercial segment accounted for approximately 62% of the heavy-duty pickup trucks market in 2024. These vehicles are widely used in logistics, construction, agriculture, and utility services for material transport and operations. Businesses prefer heavy-duty pickups for their durability, payload capacity, and adaptability to rugged terrains. Growing e-commerce activity and infrastructure expansion projects further boost demand. Fleet operators increasingly favor vehicles offering advanced telematics, reduced downtime, and fuel optimization features, strengthening the commercial segment’s dominance across global markets.

Key Growth Drivers

Rising Demand from Construction and Logistics Sectors

The expansion of construction and logistics industries significantly drives the heavy-duty pickup trucks market. These sectors require powerful vehicles capable of handling large payloads and challenging terrains. Increasing infrastructure investments across North America and Asia-Pacific amplify fleet purchases. Logistics operators favor heavy-duty pickups for their durability and towing efficiency, especially in last-mile and cross-country delivery operations. The rising need for fleet modernization and off-road adaptability continues to strengthen this segment’s growth momentum globally.

- For instance, GMC’s 2500 Crew Cab is rated to tow 22,070 lb, addressing worksite and logistics needs.

Technological Advancements and Vehicle Electrification

Manufacturers are integrating advanced technologies such as telematics, ADAS, and hybrid powertrains to enhance performance. Electrification efforts, including the development of battery-powered heavy-duty pickups, are gaining traction to meet emission standards. Improved battery density and fast-charging capabilities increase adoption across commercial fleets. Companies are also introducing AI-driven diagnostics for predictive maintenance. These innovations enhance fuel efficiency, safety, and reliability, positioning technologically advanced trucks as a preferred choice in both industrial and logistics operations.

- For instance, Chevrolet’s Silverado EV offers up to 492 miles EPA-estimated range and 12,500 lb towing on specified trims.

Growing Demand for Multi-Utility and Comfort Features

Customers increasingly seek heavy-duty pickups that combine power with passenger comfort and utility. Enhanced interiors, infotainment systems, and ergonomic designs make these trucks suitable for both work and personal use. Dual-purpose usage is rising among contractors and small business owners who value comfort and functionality. Manufacturers are responding by offering customizable cabin options and luxury-grade features without compromising load performance, strengthening overall market appeal across varied user segments.

Key Trends & Opportunities

Emergence of Electric and Hybrid Heavy-Duty Pickups

Electric and hybrid heavy-duty pickups are emerging as a major market opportunity due to sustainability goals. Automakers are investing heavily in electric models with extended range and higher towing capacities. Growing adoption of clean energy fleets in government and corporate sectors supports this shift. Charging infrastructure expansion and declining battery costs further encourage adoption. This trend presents strong long-term potential for reducing carbon emissions and enhancing operational efficiency.

- For instance, Tesla’s Cybertruck lists 11,000 lb towing and 120.7 cu ft cargo volume.

Integration of Advanced Connectivity and Fleet Management Solutions

The rise of IoT-based connectivity enables real-time vehicle tracking, predictive maintenance, and performance monitoring. Fleet managers leverage telematics systems to improve fuel usage, optimize routes, and reduce downtime. These connected systems enhance driver safety and operational control, leading to greater efficiency in commercial operations. As 5G technology expands, connected heavy-duty pickups will become integral to modern fleet ecosystems.

- For instance, Ford Pro reported having 610,000 global paid software subscriptions as of the end of Q2 2024, representing a 35% increase year-over-year.

Key Challenges

High Production and Ownership Costs

The heavy-duty pickup truck market faces challenges due to rising production costs linked to advanced materials and technology integration. High fuel consumption and maintenance expenses increase total ownership costs, especially for small enterprises. Despite strong demand, affordability remains a barrier for large-scale adoption in developing regions. Manufacturers are working to balance innovation with cost efficiency to retain competitiveness across price-sensitive markets.

Stringent Emission Regulations and Environmental Concerns

Tightening emission norms across major economies pose compliance challenges for traditional diesel-powered trucks. Manufacturers must invest heavily in cleaner technologies and exhaust treatment systems to meet regulatory standards. This increases R&D expenses and production complexity. Shifting toward electric and hybrid models demands significant infrastructure and supply chain adaptation, making it difficult for conventional manufacturers to maintain profitability during this transition phase.

Regional Analysis

North America

North America dominated the heavy-duty pickup trucks market in 2024 with a 48% share. The region benefits from high consumer preference for large vehicles and strong adoption across construction, logistics, and agriculture sectors. The U.S. leads due to advanced manufacturing facilities and the presence of key players such as Ford, General Motors, and RAM. Favorable financing options, fleet renewals, and demand for luxury-grade trucks drive steady growth. Ongoing infrastructure investment and electrification initiatives further strengthen regional market expansion, especially for hybrid and electric pickup models.

Europe

Europe held around 23% of the heavy-duty pickup trucks market in 2024, supported by demand from industrial and commercial sectors. Germany, the U.K., and France are major contributors, driven by growing adoption in utility, construction, and transport applications. Increasing focus on low-emission vehicles and sustainable manufacturing practices is reshaping fleet procurement patterns. Manufacturers are launching cleaner diesel and hybrid models to meet Euro 7 emission norms. The region’s growing interest in electric variants aligns with decarbonization goals, promoting gradual yet consistent market expansion.

Asia-Pacific

Asia-Pacific accounted for approximately 21% of the global heavy-duty pickup trucks market in 2024. Strong demand from China, India, and Australia supports growth across logistics, mining, and construction industries. Urbanization and government investments in infrastructure fuel vehicle purchases for commercial use. Local manufacturers expand production capacity and offer cost-competitive models tailored to regional needs. The increasing shift toward electrification, particularly in China, further boosts the regional outlook. Expanding export activities and the rise of e-commerce logistics enhance long-term market potential.

Latin America

Latin America captured around 5% of the heavy-duty pickup trucks market in 2024, driven by rising construction and agricultural activities. Brazil and Mexico are the largest markets, supported by local assembly operations and favorable trade policies. Economic recovery and industrial expansion increase fleet purchases across commercial sectors. Diesel-powered models dominate due to fuel efficiency and durability in rugged terrains. However, limited infrastructure and high import duties slightly restrain growth. Ongoing fleet modernization and regional partnerships with global automakers are expected to improve market penetration.

Middle East & Africa

The Middle East and Africa region accounted for nearly 3% of the global heavy-duty pickup trucks market in 2024. Demand is led by oil and gas, mining, and construction industries requiring durable vehicles for tough environments. Countries like Saudi Arabia, South Africa, and the UAE show strong adoption due to infrastructure development and logistics expansion. Diesel variants remain popular, though interest in electric trucks is gradually emerging. Ongoing government investments in transport and industrial sectors are expected to strengthen market presence over the coming years.

Market Segmentations:

By Type

By Fuel

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The heavy-duty pickup trucks market is highly competitive, with key players such as Toyota Motor Corporation, Ford Motor Company, General Motors, Nissan, Ram Trucks, Volkswagen, Honda, Mitsubishi Motors, Isuzu, Great Wall Motors, Kia Corporation, and NYE Toyota leading global production and innovation. Competition centers on powertrain efficiency, electrification, and durability, driving companies to enhance performance, safety, and comfort features. Manufacturers are investing heavily in hybrid and electric pickup development to meet evolving emission standards and consumer preferences. Advanced telematics, autonomous driving systems, and digital connectivity are being integrated to improve fleet management and driver experience. Strategic collaborations with battery suppliers, software developers, and logistics operators are shaping next-generation vehicle designs. Firms are also optimizing manufacturing operations through modular platforms and lightweight materials to reduce production costs. Growing focus on sustainability, aftermarket services, and regional customization continues to define competition and strengthen brand presence across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Ram (Stellantis) announced the launch of the Ram 1500 Ramcharger hybrid ahead of schedule, showcasing Stellantis’ move to integrate hybrid technology.

- In 2024, Toyota introduced a 48V mild-hybrid system to the Toyota Hilux in several markets, enhancing performance and efficiency with a small electric motor and battery that can provide additional torque at start-off.

- In 2022, Ford introduced its all-new 2023 F-Series Super Duty, saying it is “unrivaled” among heavy-duty pickup trucks with the best towing capacity

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will focus on developing electric and hybrid heavy-duty pickups to reduce emissions.

- Advancements in battery technology will extend vehicle range and improve charging efficiency.

- Integration of autonomous and driver-assist technologies will enhance safety and fleet productivity.

- Demand for connected trucks with telematics and IoT features will continue to rise.

- Lightweight materials such as aluminum and composites will be adopted to improve fuel efficiency.

- Customization options for commercial and personal use will drive product diversification.

- Expansion of charging infrastructure will accelerate electric pickup adoption in major markets.

- Fleet operators will prioritize vehicles offering lower maintenance and operating costs.

- Government incentives for clean mobility will encourage investment in sustainable truck models.

- Strategic partnerships between automakers and tech firms will shape innovation in next-generation heavy-duty pickups.