Market overview

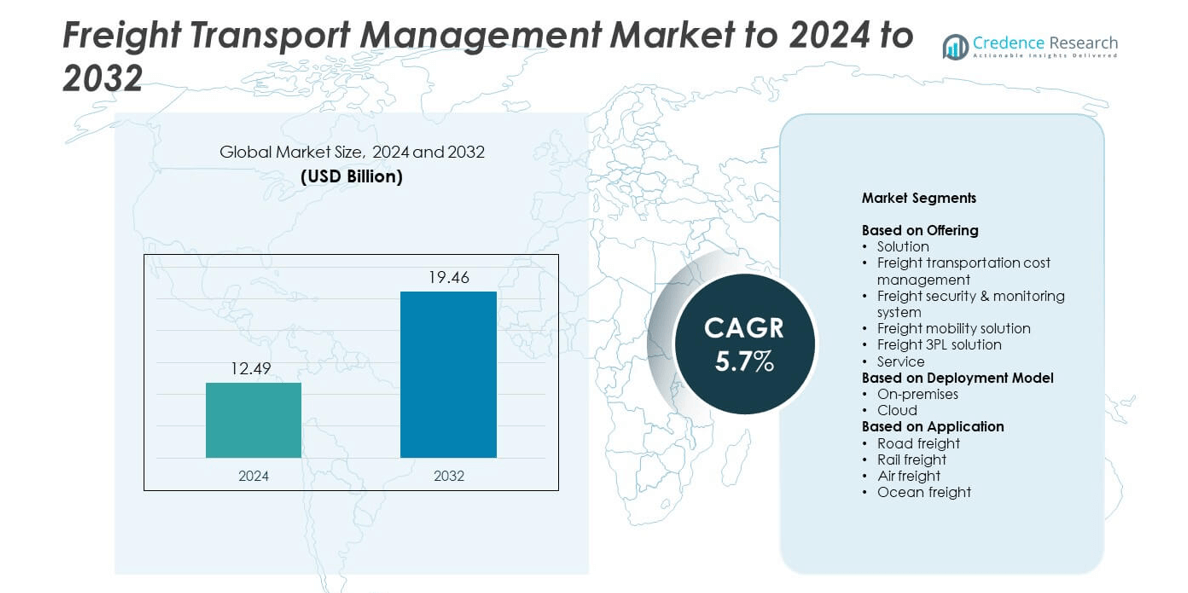

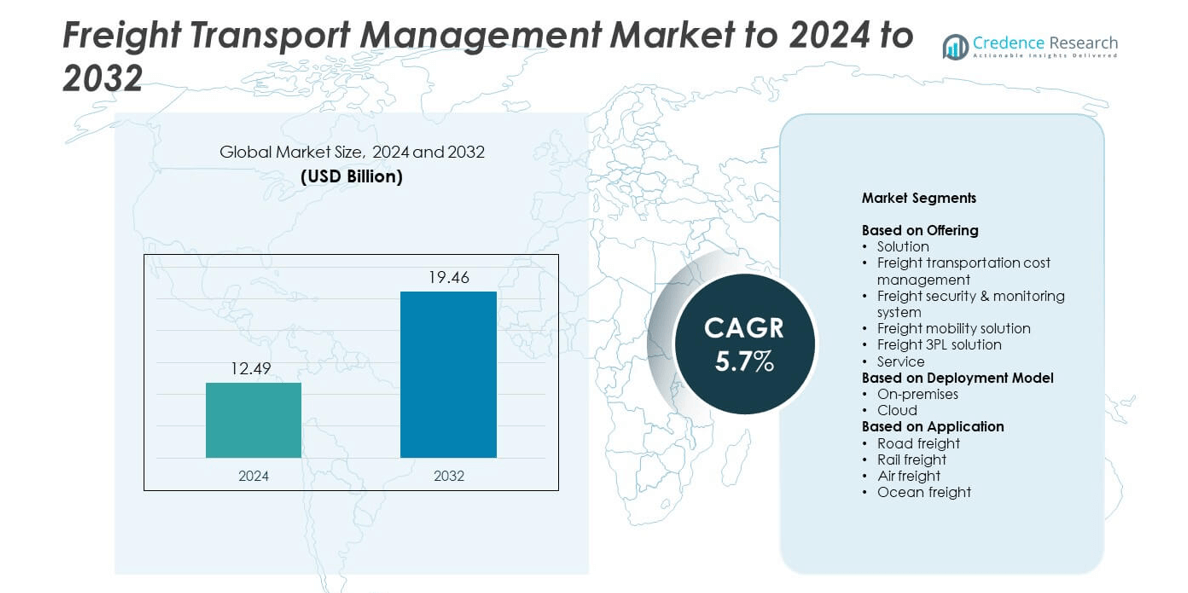

The Freight Transport Management Market size was valued at USD 12.49 billion in 2024 and is anticipated to reach USD 19.46 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freight Transport Management Market Size 2024 |

USD 12.49 billion |

| Freight Transport Management Market, CAGR |

5.7% |

| Freight Transport Management Market Size 2032 |

USD 19.46 billion |

The Freight Transport Management Market is dominated by leading players such as SAP SE, IBM Corporation, Oracle Corporation, Infor, Trimble, Körber AG, DB Schenker, CEVA Logistics, and ShipStation. These companies strengthen their positions through advanced freight management platforms, automation, and AI-driven logistics solutions that improve operational efficiency and cost control. Strategic partnerships, cloud adoption, and integration of IoT-based visibility tools further enhance competitiveness. North America led the market with a 37% share in 2024, supported by strong technological infrastructure and large-scale adoption of digital freight management systems across logistics and transportation networks.

Market Insights

- The Freight Transport Management Market was valued at USD 12.49 billion in 2024 and is projected to reach USD 19.46 billion by 2032, growing at a CAGR of 5.7%.

- Market growth is driven by the rising need for digital freight solutions, automation, and cost optimization in logistics operations.

- Trends such as AI-based analytics, IoT-enabled visibility, and sustainable logistics practices are reshaping global freight management strategies.

- The competitive landscape includes major players offering cloud-based and integrated transport management systems to enhance transparency and reduce delivery delays.

- North America led the market with a 37% share in 2024, followed by Europe at 29% and Asia Pacific at 26%, while the solution segment dominated with a 68% share due to increasing adoption of advanced freight management platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

The solution segment dominated the freight transport management market in 2024 with a 68% share. This dominance stems from the growing need for real-time visibility, route optimization, and automated freight cost tracking across logistics networks. Freight transportation cost management solutions lead within this category as logistics firms focus on reducing operational expenses through predictive analytics and AI-driven optimization. The adoption of integrated transport management platforms also supports regulatory compliance and enhances fleet efficiency, driving continued investment in digital freight solutions among third-party logistics (3PL) and supply chain operators.

- For instance, Descartes’ Global Logistics Network connects 200,000+ parties worldwide.

By Deployment Model

The cloud segment held the largest share of 61% in 2024, driven by its scalability and cost-effectiveness. Cloud-based freight management systems enable logistics providers to manage multi-modal transport operations remotely with enhanced data sharing and coordination. Real-time updates, flexible integration with warehouse systems, and lower infrastructure costs have encouraged rapid adoption among mid-sized and large enterprises. Growing use of SaaS-based platforms and IoT integration for shipment tracking and performance analytics is further propelling the demand for cloud deployment in freight management applications worldwide.

- For instance, FourKites tracks over 3.2 million shipments daily across more than 200 countries and territories, and includes over 1.1 million carriers.

By Application

Road freight accounted for the largest market share of 54% in 2024 due to the extensive highway infrastructure and rising e-commerce shipments. The segment benefits from improved fleet telematics, route optimization tools, and automated freight billing systems. Increasing demand for just-in-time delivery, combined with efficient last-mile logistics, continues to support road freight adoption. Additionally, investments in intelligent transport systems (ITS) and electric truck fleets enhance cost efficiency and environmental sustainability, strengthening the dominance of road freight in overall transport management applications.

Key Growth Drivers

Rising Demand for Digital Freight Solutions

The surge in digital transformation across logistics is a major growth driver for the freight transport management market. Companies are adopting advanced transport management systems (TMS), predictive analytics, and IoT-enabled tracking tools to enhance visibility and efficiency. The shift toward automation in shipment scheduling, fleet maintenance, and route planning reduces costs and minimizes human errors. This digital evolution supports faster, more transparent freight operations and strengthens partnerships between shippers and carriers across global trade routes.

- For instance, J.B. Hunt utilizes its digital platforms, such as J.B. Hunt 360, as a key part of its Integrated Capacity Solutions (ICS) segment to match customers’ freight with available carriers. In the third quarter of 2025, the ICS segment saw its load volume decrease by 8% compared to the third quarter of 2024.

Expanding Global E-commerce and Cross-border Trade

Rapid growth in e-commerce and international trade is driving higher freight volumes, fueling the demand for efficient transport management systems. Businesses require solutions to handle dynamic pricing, route optimization, and real-time tracking across multiple transport modes. The surge in same-day and express deliveries compels logistics firms to modernize infrastructure and adopt integrated freight management software. This trend enhances operational flexibility, allowing companies to meet delivery commitments while maintaining profitability in highly competitive markets.

- For instance, DHL Supply Chain runs ~1,300 warehouses with ~39 million square meters of space.

Rising Focus on Cost Optimization and Sustainability

Cost management and sustainability initiatives are key drivers boosting market growth. Increasing fuel expenses, emission regulations, and pressure for eco-efficient logistics are pushing companies toward optimized route planning and alternative transport solutions. Advanced freight management platforms enable carbon tracking and dynamic freight allocation to reduce waste. The integration of green logistics practices, including electric vehicle deployment and load optimization, helps businesses achieve environmental goals while improving cost efficiency across transport networks.

Key Trends and Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are transforming freight management by enabling proactive decision-making. Companies use AI to predict delays, optimize loads, and forecast fuel consumption. Predictive models enhance operational visibility and ensure cost-effective routing across regions. The integration of machine learning also improves customer experience through accurate delivery estimates and dynamic pricing. This trend creates opportunities for logistics providers to differentiate services and gain competitive advantages through data-driven insights.

- For instance, Oracle was named a TMS Leader for the 17th time in 2024 and for the 18th time in 2025.

Emergence of IoT and Telematics in Freight Monitoring

IoT-enabled telematics systems are reshaping fleet management by providing real-time shipment visibility and safety monitoring. Connected sensors track temperature, fuel levels, and driver behavior, helping companies maintain regulatory compliance and reduce operational risks. The use of IoT improves efficiency across road, air, and ocean freight modes. Expanding deployment of telematics in smart logistics hubs offers new growth opportunities for freight operators seeking enhanced transparency and accountability throughout the supply chain.

- For instance, FedEx’s total average daily package volume, as cited by CEO Raj Subramaniam during the Q1 fiscal year 2026 earnings call, is around 17 million.

Key Challenges

High Implementation and Maintenance Costs

The significant cost of deploying advanced freight management systems remains a major challenge, especially for small and medium-sized logistics firms. Expenses related to hardware integration, cloud migration, and staff training can hinder adoption. Continuous upgrades and cybersecurity requirements further increase operational costs. Despite the benefits of automation and real-time tracking, limited financial resources and uncertain return on investment slow technology adoption among smaller enterprises in developing markets.

Regulatory Complexity and Data Security Concerns

Freight transport operations are subject to diverse regulations across countries, creating compliance challenges for global logistics providers. Managing customs documentation, emission standards, and safety requirements increases administrative burdens. Additionally, the growing dependence on digital systems exposes companies to cyber threats and data breaches. Weak security protocols can disrupt operations and damage client trust. Addressing these challenges requires strong cybersecurity frameworks and alignment with international freight and data protection standards.

Regional Analysis

North America

North America held the largest share of 37% in the freight transport management market in 2024. The region’s growth is driven by advanced logistics infrastructure, strong e-commerce activity, and early adoption of digital freight systems. The United States leads due to major investments in cloud-based transportation management and real-time tracking technologies. Increasing demand for cross-border trade with Canada and Mexico further supports market expansion. Key logistics companies and 3PL providers continue integrating AI and automation to enhance route optimization and reduce operational costs, reinforcing North America’s market dominance.

Europe

Europe accounted for a 29% market share in 2024, supported by robust intermodal transport systems and sustainability-driven logistics policies. Countries like Germany, France, and the Netherlands are investing heavily in smart freight corridors and green logistics solutions. The EU’s focus on emission reduction and supply chain digitalization encourages adoption of freight management software. The growing use of rail and sea freight modes complements demand for integrated transport management platforms, promoting cost efficiency and regulatory compliance across European trade networks.

Asia Pacific

Asia Pacific held a 26% share in 2024 and is the fastest-growing regional market. Rapid industrialization, expanding manufacturing bases, and rising e-commerce volumes in China, India, and Japan drive strong freight activity. Governments are investing in logistics modernization and smart port initiatives, enhancing supply chain visibility. Increasing use of cloud-based freight platforms and real-time tracking supports efficient cross-border operations. Regional logistics players are adopting automation and IoT technologies to streamline fleet operations, improving delivery speed and network efficiency across diverse transport modes.

Latin America

Latin America captured a 5% market share in 2024, driven by growing trade integration and expanding infrastructure networks. Brazil and Mexico are key contributors, supported by rising demand for freight cost management and transport visibility solutions. Regional logistics providers are investing in digital tools to handle fluctuating fuel costs and complex customs regulations. The adoption of cloud-based freight management systems remains in an early growth stage, but government-backed infrastructure projects and increased foreign trade activity are improving market opportunities across the region.

Middle East & Africa

The Middle East & Africa region held a 3% market share in 2024, supported by expanding trade routes and logistics development initiatives. Countries such as the UAE and Saudi Arabia are investing in freight hubs and digital transport infrastructure to strengthen regional connectivity. The focus on port modernization and smart logistics systems enhances freight efficiency across air and sea modes. Although adoption is still developing, the shift toward cloud logistics and sustainability-driven freight management creates new opportunities for growth in regional transport systems.

Market Segmentations:

By Offering

- Solution

- Freight transportation cost management

- Freight security & monitoring system

- Freight mobility solution

- Freight 3PL solution

- Service

By Deployment Model

By Application

- Road freight

- Rail freight

- Air freight

- Ocean freight

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Freight Transport Management Market features key players such as SAP SE, IBM Corporation, Oracle Corporation, Infor, Trimble, Körber AG, DB Schenker, CEVA Logistics, and ShipStation. These companies compete through advanced digital platforms, AI-based analytics, and integrated logistics solutions that enhance operational visibility and cost efficiency. The market is characterized by strong investment in automation, cloud-based freight management, and real-time monitoring systems. Vendors are expanding global footprints through strategic alliances and technology-driven logistics optimization. Increasing focus on multimodal integration, sustainability compliance, and data-driven decision-making defines the competitive intensity. Players are prioritizing scalable transport management systems and predictive analytics to meet the growing demand for efficient, secure, and transparent freight operations across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Trimble launched a new Freight Marketplace in North America, with Procter & Gamble as its first shipper customer.

- In 2025, SAP announced new innovations for S/4HANA TM 2025, including Lean Service Procurement, new Key Performance Indicators (KPIs) in the Transportation Cockpit, and integrated scheduling for Stock Transport Orders using Business Process Scheduling.

- In 2023, Oracle introduced generative AI-based features across its Fusion Cloud Applications, including enhancements for its Transportation Management (TM) and Global Trade Management applications,At the CloudWorld 2023 event.

Report Coverage

The research report offers an in-depth analysis based on Offering, Deployment Model, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as digital freight platforms enhance global supply chain visibility.

- AI-driven analytics will optimize route planning, improve fuel efficiency, and reduce delivery delays.

- The adoption of IoT and telematics will rise, enabling real-time tracking and predictive maintenance.

- Cloud-based transport management systems will dominate due to scalability and cost benefits.

- Green logistics and carbon tracking features will gain importance with stricter emission rules.

- Blockchain integration will increase transparency and security in cross-border freight transactions.

- E-commerce growth will fuel high demand for multimodal and last-mile delivery solutions.

- Partnerships between 3PL providers and software developers will drive innovation in freight automation.

- Emerging economies will invest heavily in smart logistics hubs and digital freight corridors.

- Cybersecurity and data governance will become strategic priorities in transport management operations.