Market Overview

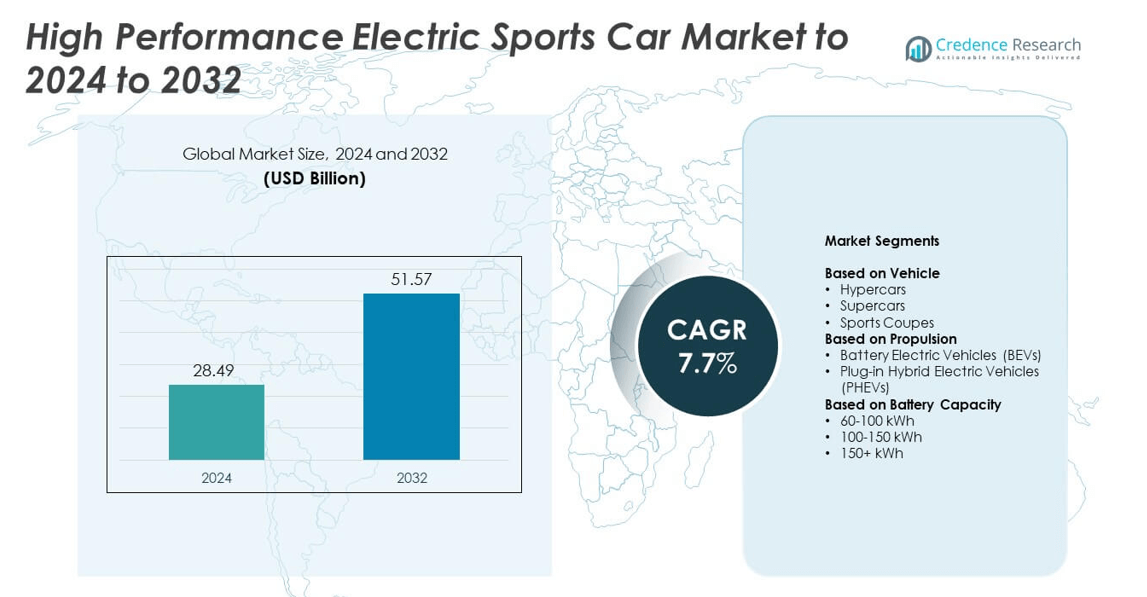

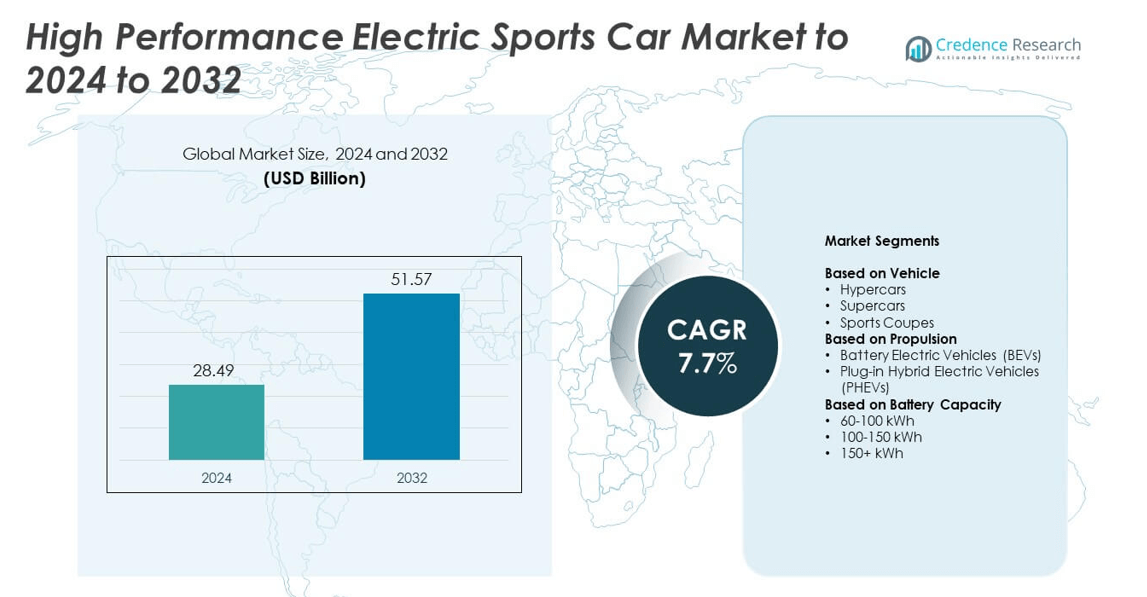

High Performance Electric Sports Car Market size was valued USD 28.49 Billion in 2024 and is anticipated to reach USD 51.57 Billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Performance Electric Sports Car Market Size 2024 |

USD 28.49 Billion |

| High Performance Electric Sports Car Market, CAGR |

7.7% |

| High Performance Electric Sports Car Market Size 2032 |

USD 51.57 Billion |

The High Performance Electric Sports Car Market is led by key players such as Porsche AG, Tesla, Ferrari, BMW, Rimac, Lotus, Audi, and Automobili Pininfarina. These manufacturers focus on advanced electric powertrains, aerodynamic design, and lightweight construction to enhance performance and efficiency. Continuous innovation in solid-state batteries and AI-based drive systems supports higher speed, range, and reliability. Strategic partnerships with technology firms and battery suppliers further strengthen their product portfolios. Regionally, North America held the largest market share at 38% in 2024, driven by strong consumer demand and well-developed charging infrastructure.

Market Insights

- The High Performance Electric Sports Car Market was valued at USD 28.49 billion in 2024 and is projected to reach USD 51.57 billion by 2032, growing at a CAGR of 7.7%.

- Growth is driven by advancements in battery efficiency, expansion of charging infrastructure, and rising consumer demand for sustainable luxury vehicles.

- Trends include integration of AI-based drive systems, lightweight carbon fiber structures, and customizable digital performance features.

- The market is highly competitive, with leading players focusing on R&D investments, strategic alliances, and performance-based innovations to gain an edge.

- North America led the market with 38% share in 2024, followed by Europe at 33% and Asia Pacific at 21%; sports coupes dominated by vehicle type with a 47% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Sports coupes dominated the High Performance Electric Sports Car Market in 2024 with a 47% share. Their popularity stems from balanced performance, sleek design, and affordability compared to hypercars. Automakers are integrating lightweight carbon-fiber bodies and dual-motor systems to improve handling and acceleration. Demand is strong among urban and mid-range luxury buyers seeking efficiency and speed. Hypercars and supercars continue to grow as luxury buyers favor limited-edition models with advanced torque vectoring and ultra-fast charging capabilities, driving premium market expansion across Europe and North America.

- For instance, Automobili Pininfarina’s Battista hit 0–60 mph in 1.79 s, verified during UAE tests.

By Propulsion

Battery Electric Vehicles (BEVs) held the leading position with a 69% market share in 2024. The segment benefits from rapid advancements in solid-state batteries and fast-charging networks. Automakers such as Porsche and Tesla are enhancing performance by integrating 800-volt systems for superior acceleration and extended range. Increasing government incentives and stricter emission targets are fueling BEV adoption globally. Plug-in Hybrid Electric Vehicles (PHEVs) maintain niche appeal for users seeking dual-mode efficiency, but rising investments in BEV infrastructure continue to shift preference toward fully electric models.

- For instance, Audi’s 2025 RS e-tron GT uses a 105 kWh pack (97 kWh usable) and supports 320 kW DC charging, enabling 10–80% in 18 minutes.

By Battery Capacity

The 100-150 kWh segment led the market with a 52% share in 2024. This capacity range offers the optimal balance between driving range, power delivery, and vehicle weight. Models like the Porsche Taycan Turbo S and Tesla Model S Plaid deliver over 600 km per charge, appealing to high-performance enthusiasts. Continuous improvements in lithium-ion energy density are supporting greater endurance without compromising speed. Meanwhile, the 150+ kWh category is gaining traction as manufacturers aim for ultra-long ranges exceeding 800 km, catering to top-tier hypercars and endurance-focused designs.

Key Growth Drivers

Advancement in Battery Technology

Continuous advancements in battery chemistry and design are driving market expansion. High-performance lithium-ion and solid-state batteries enable longer driving ranges and faster charging times. Automakers are prioritizing high-density energy cells to achieve superior acceleration and thermal stability. These innovations reduce charging anxiety while improving power-to-weight ratios, making electric sports cars more appealing to performance-focused consumers. The push for sustainable, efficient energy systems remains a core driver for premium EV adoption across developed and emerging markets.

- For instance, CATL’s Shenxing Plus LFP enables 4C fast charging and targets 1,000 km range, with claims of 600 km added in 10 minutes.

Expansion of Charging Infrastructure

The rapid growth of global fast-charging networks is accelerating the adoption of high-performance electric vehicles. Governments and private players are investing heavily in high-voltage charging stations along major routes and urban centers. These networks enhance long-distance travel convenience and minimize downtime for users. Manufacturers are collaborating with infrastructure providers to integrate vehicle-to-grid and ultra-fast charging technologies. This ecosystem development is key to increasing customer confidence and driving the transition from combustion engines to high-end electric performance cars.

- For instance, IONITY (with Spark alliance) aggregates 11,000+ charge points across 1,700 stations in 25 countries, offering up to 400 kW.

Growing Consumer Demand for Sustainable Luxury

Rising consumer awareness toward eco-friendly mobility is reshaping the premium automotive segment. Buyers increasingly prefer luxury vehicles that combine speed, aesthetics, and sustainability. Leading brands are introducing zero-emission supercars that rival conventional performance models in both acceleration and design. Regulatory incentives and emission restrictions are further boosting demand for electric alternatives. The alignment of sustainability with performance appeal is a major growth catalyst for the high-performance electric sports car industry.

Key Trends and Opportunities

Integration of Advanced Drive Technologies

The adoption of AI-driven drive systems, adaptive torque control, and predictive power management is redefining performance standards. These technologies enhance traction, cornering stability, and overall driving dynamics. Automakers are leveraging machine learning for energy optimization and predictive maintenance. Integration of over-the-air updates and connected systems is also creating new aftersales opportunities. Such innovations position electric sports cars as benchmarks of digital and mechanical precision in the global luxury vehicle market.

- For instance, Lotus’ Evija carbon-fiber monocoque weighs 129 kg, aiding extreme performance targets.

Emrgence of Lightweight Composite Materials

]

The shift toward lightweight materials such as carbon fiber, graphene composites, and aluminum alloys is boosting speed and range. Weight reduction improves battery efficiency and handling, enabling higher performance without compromising durability. Manufacturers are investing in structural optimization techniques to lower production costs while maintaining strength. This trend supports sustainability goals and aligns with ongoing efforts to improve vehicle aerodynamics and energy utilization, providing long-term growth opportunities for the segment.

- For instance, Tesla’s Acceleration Boost lifted peak power by ~50 hp and cut Model 3 LR 0–60 to ~3.8 s in testing.

Expansion of Customization and Performance Tuning

Luxury buyers are demanding greater personalization in electric sports cars, including powertrain tuning, digital interface customization, and aesthetic modifications. OEMs are offering modular battery setups, dynamic control systems, and software-based performance upgrades. This approach enhances user engagement while creating recurring revenue through post-sale software and hardware enhancements. As digital configurators and cloud-based vehicle management evolve, personalized performance will become a key differentiator in the electric sports car industry.

Key Challenges

High Production and Battery Costs

Manufacturing high-performance electric vehicles involves costly materials, precision engineering, and advanced battery systems. Lithium, nickel, and cobalt price fluctuations increase production expenses. The need for cutting-edge thermal management, power electronics, and safety systems further raises costs. Limited economies of scale in hypercar and supercar production restrict price competitiveness. Despite declining battery prices, affordability remains a challenge for broader market penetration beyond ultra-luxury buyers.

Thermal Management and Performance Degradation

Maintaining battery efficiency under extreme performance conditions remains a key engineering hurdle. Continuous high-speed driving and rapid acceleration can lead to heat buildup, affecting range and cell longevity. Manufacturers are developing advanced cooling architectures and predictive energy management systems to address these issues. However, ensuring consistent thermal stability without compromising vehicle weight and design continues to challenge engineers. This constraint limits sustained peak performance in high-speed electric sports cars.

Regional Analysis

North America

North America led the High Performance Electric Sports Car Market in 2024 with a 38% share. Strong consumer preference for premium electric vehicles and extensive charging infrastructure support market dominance. The United States drives demand with brands such as Tesla, Lucid Motors, and Rivian investing in high-performance models. Government tax credits and emission reduction policies continue to promote EV adoption. Canada and Mexico also show rising demand as regional assembly facilities expand, improving affordability and supply. The growing luxury EV segment and advancements in battery efficiency further strengthen North America’s leadership position.

Europe

Europe accounted for a 33% market share in 2024, supported by the region’s commitment to carbon neutrality and luxury vehicle innovation. Germany, Italy, and the United Kingdom are major contributors, housing leading automakers such as Porsche, Ferrari, and Aston Martin. Strong emission regulations and incentives for zero-emission vehicles are fueling electric supercar adoption. The presence of advanced R&D facilities and partnerships in battery innovation enhance competitiveness. Demand for sustainable performance cars continues to rise across Western Europe, with growing attention to design, aerodynamics, and eco-efficiency.

Asia Pacific

Asia Pacific captured a 21% share in 2024, driven by rising investment in electric mobility and rapid infrastructure development. China leads regional sales with growing consumer interest in luxury EVs and strong domestic production by brands like BYD and NIO. Japan and South Korea contribute through technological advancements and performance-oriented electric models from Nissan and Hyundai. The regional market benefits from government support for clean transport and battery manufacturing. Increasing disposable income and demand for premium electric performance cars continue to position Asia Pacific as a fast-growing region.

Middle East and Africa

The Middle East and Africa held a 5% market share in 2024, showing gradual adoption of high-performance electric sports cars. Wealthy consumer bases in the UAE and Saudi Arabia are driving early demand, supported by luxury-focused infrastructure projects. Governments are promoting electric mobility through sustainability programs and renewable energy investments. However, limited charging infrastructure and high import costs constrain broader market growth. Premium automakers are expanding dealership networks to capture the growing interest among high-net-worth buyers seeking electric alternatives to traditional supercars.

Latin America

Latin America accounted for a 3% share in 2024, reflecting emerging interest in electric luxury vehicles. Brazil, Mexico, and Chile are leading markets due to favorable trade policies and increasing environmental awareness. Government incentives for EV imports and partnerships with European automakers are fostering growth. Infrastructure development remains limited, but private investments in charging networks are rising. As regional economies stabilize, demand for luxury electric vehicles is expected to strengthen, particularly in metropolitan areas with rising sustainability consciousness and growing high-income consumer segments.

Market Segmentations:

By Vehicle

- Hypercars

- Supercars

- Sports Coupes

By Propulsion

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

By Battery Capacity

- 60-100 kWh

- 100-150 kWh

- 150+ kWh

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The High Performance Electric Sports Car Market features leading manufacturers such as Porsche AG, Tesla, Ferrari, BMW, Rimac, Lotus, Audi, and Automobili Pininfarina. Competition is defined by innovation, design excellence, and technological integration aimed at achieving peak performance and sustainability. Companies are investing heavily in electric powertrains, lightweight chassis materials, and advanced battery management systems to deliver superior acceleration and range. Continuous R&D efforts focus on solid-state batteries, AI-driven drive assistance, and thermal efficiency improvements. Strategic alliances with tech firms and battery suppliers are strengthening product pipelines. Brands are also expanding production capacity and introducing software-based performance upgrades to enhance customer engagement. Marketing strategies emphasize eco-luxury, connected driving, and zero-emission credentials to capture growing interest among premium buyers. The race toward high-performance electrification continues to intensify as manufacturers balance sustainability goals with engineering precision and brand exclusivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Automobili Pininfarina officially unveiled the unique, open-top Battista Targamerica at The Quail during Monterey Car Week.

- In 2024, Porsche Launched a facelifted Taycan with a bigger battery pack and increased range. Unveiled the new all-electric Macan EV, a high-performance SUV, highlighting its shift toward electrification across its model range.

- In 2023, Lotus introduced the Emeya, an all-electric ‘hyper-GT.’ The top-tier ‘R’ version features a 905 bhp dual-motor setup, while other variants come with a 603 bhp dual-motor setup

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Battery Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for luxury electric sports cars will grow with expanding charging infrastructure worldwide.

- Advancements in solid-state batteries will boost range, performance, and safety.

- Automakers will focus on lightweight materials to enhance acceleration and efficiency.

- Integration of AI-based drive control systems will redefine handling precision and driving dynamics.

- Partnerships between automakers and tech firms will accelerate digital cockpit innovation.

- Subscription-based ownership and performance upgrades will create new revenue opportunities.

- Regulatory incentives for zero-emission vehicles will continue to drive premium EV adoption.

- Emerging markets in Asia and the Middle East will witness rising luxury EV sales.

- Customization and software-defined performance tuning will strengthen customer engagement.

- Continuous R&D investments will position high-performance EVs as the future standard for sustainable luxury mobility.