Market Overview

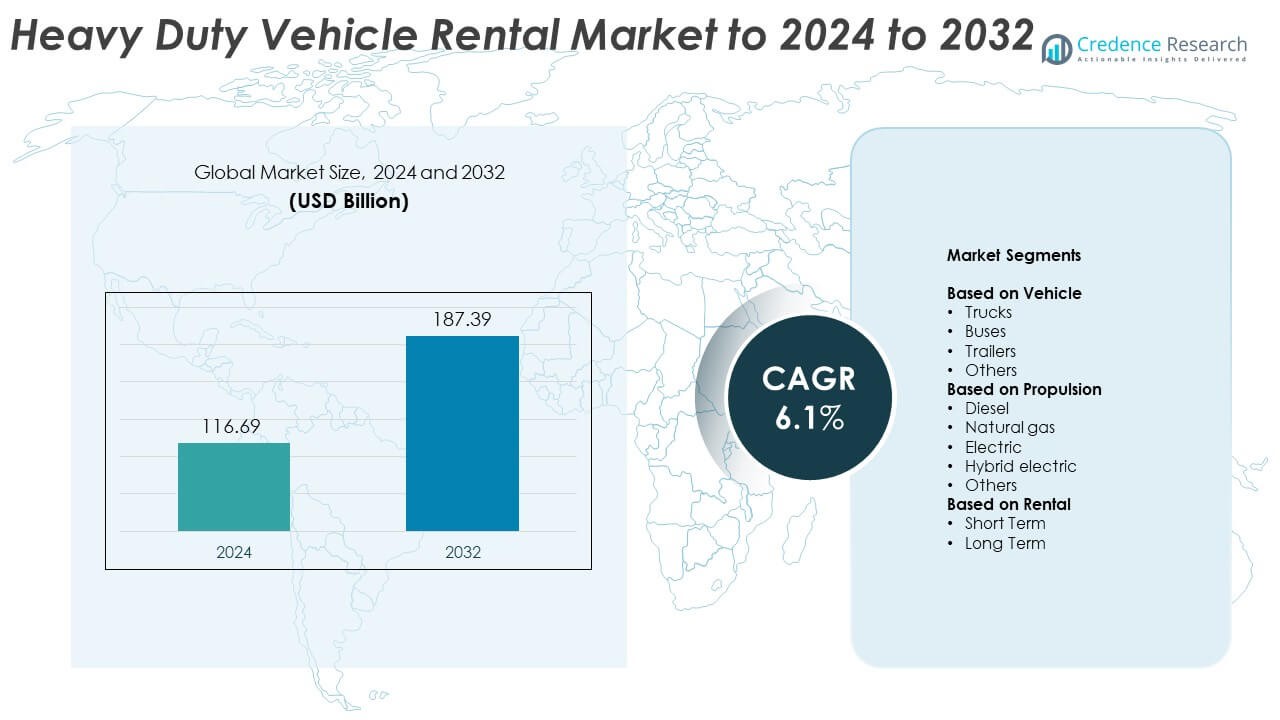

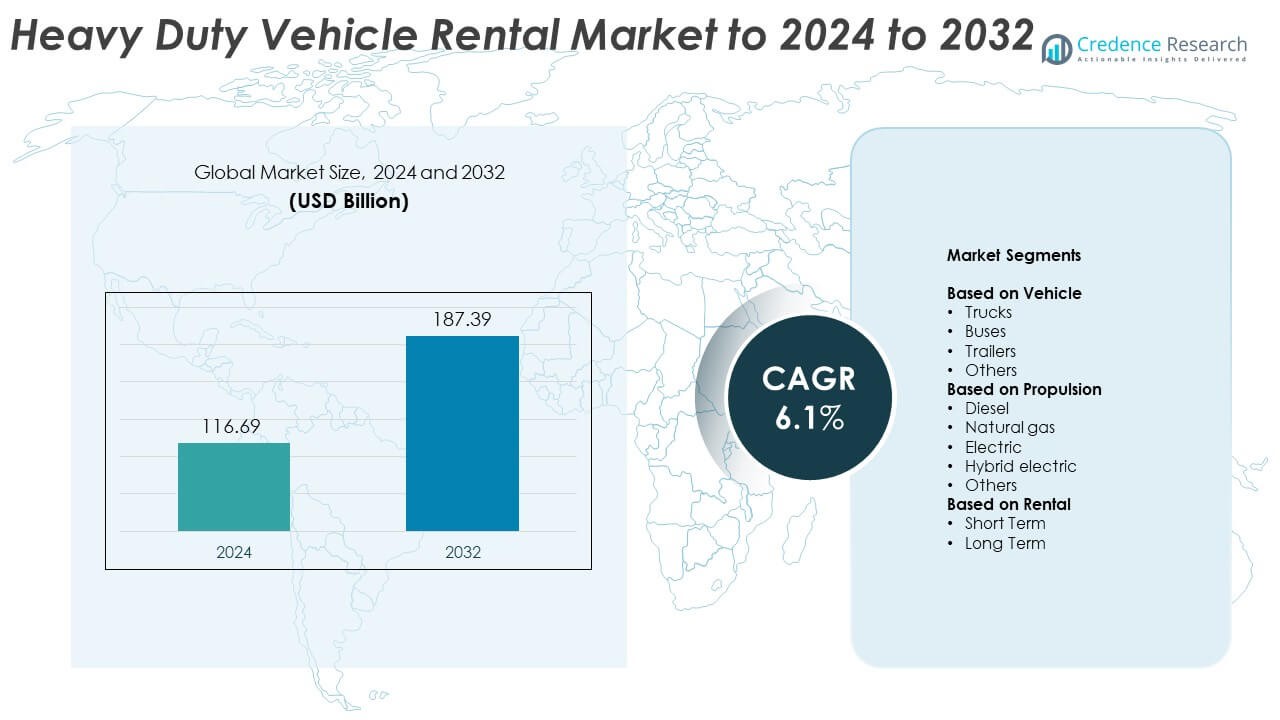

The Heavy Duty Vehicle Rental Market size was valued at USD 116.69 billion in 2024 and is anticipated to reach USD 187.39 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Duty Vehicle Rental Market Size 2024 |

USD 116.69 Billion |

| Heavy Duty Vehicle Rental Market, CAGR |

6.1% |

| Heavy Duty Vehicle Rental Market Size 2032 |

USD 187.39 Billion |

The heavy-duty vehicle rental market is characterized by strong competition among global and regional players such as Ryder System, Tata Motors, Scania Rents, Penske Truck Rental, LALAMOVE Automotive, U-Haul International, Toyota, Enterprise Truck Rental, Avis Budget, Hino Motors, Herc Rental, Flexter.com, PACCAR, Force Motors, and Sixt SE. These companies focus on expanding fleet diversity, improving digital rental platforms, and offering flexible leasing terms. Strategic partnerships and investments in telematics, predictive maintenance, and low-emission vehicles enhance service quality and operational efficiency. North America leads the global market with a 36% share, supported by high logistics activity, e-commerce expansion, and advanced infrastructure, followed by Europe and Asia Pacific with notable growth potential driven by sustainability initiatives and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The heavy-duty vehicle rental market was valued at USD 116.69 billion in 2024 and is projected to reach USD 187.39 billion by 2032, growing at a CAGR of 6.1%.

- Rising demand from logistics, construction, and industrial sectors drives market expansion as companies seek cost-effective fleet solutions without ownership burdens.

- Key trends include the adoption of electric and hybrid trucks, telematics integration, and subscription-based rental models that improve fleet efficiency and flexibility.

- Market competition intensifies as providers invest in digital platforms, predictive maintenance, and eco-friendly fleets to enhance customer retention and sustainability.

- North America dominates with a 36% share, followed by Europe at 28% and Asia Pacific at 24%, while the trucks segment leads globally with a 49% share due to its extensive use in freight and infrastructure operations.

Market Segmentation Analysis:

By Vehicle

The trucks segment dominated the heavy-duty vehicle rental market in 2024, accounting for around 49 % of the total share. Strong demand from logistics, construction, and mining sectors drives this dominance. Companies prefer renting heavy-duty trucks to manage fluctuating transport needs without long-term capital investment. The growing e-commerce industry and large-scale infrastructure projects also support fleet expansion. Increasing focus on efficient freight movement and flexible rental options further boosts truck rental adoption across developed and emerging markets.

- For instance, Penske Truck Leasing, a subsidiary of Penske Transportation Solutions, operates and maintains a fleet of approximately 433,000 vehicles, supporting large truck availability for rent and lease.

By Propulsion

The diesel segment held the largest share of approximately 57 % in 2024, owing to its proven reliability and high torque output for long-haul operations. Diesel engines continue to dominate due to better fuel economy and wide refueling infrastructure. However, stricter emission norms are pushing rental providers to introduce cleaner alternatives. The transition toward Euro VI-compliant engines and renewable diesel fuels strengthens fleet sustainability while maintaining performance efficiency, driving continued use across industrial and commercial applications.

- For instance, Mercedes-Benz Trucks lists the eActros 600 with ~621 kWh LFP batteries and 500 km range per charge.

By Rental

The long-term rental segment led the market in 2024 with nearly 63 % share, driven by corporate clients and logistics firms seeking cost stability and maintenance benefits. Long-term contracts enable fleet standardization, lower downtime, and predictable operational costs. Businesses in construction, energy, and mining favor extended rentals to support project-based activities. This trend aligns with the rising adoption of contract-based logistics services and increased outsourcing of fleet management, fostering consistent demand for long-term heavy-duty vehicle rentals globally.

Key Growth Drivers

Rising Demand from Logistics and Construction Sectors

Growing logistics operations and large-scale infrastructure projects are major drivers of the heavy-duty vehicle rental market. Rental fleets help logistics firms manage seasonal demand surges without heavy capital investment. The construction sector’s reliance on specialized trucks and trailers for material transport further supports market growth. Expanding e-commerce distribution and increasing cross-border trade are also creating consistent demand for flexible, high-capacity transport solutions across regions.

- For instance, Scania delivered 102,069 vehicles in 2024, which included trucks, buses, and power systems, reflecting strong customer procurements for transport needs.

Shift Toward Cost-Effective Fleet Management

Businesses are increasingly renting heavy-duty vehicles to reduce ownership costs and maintenance burdens. Rental options provide access to modern, fuel-efficient fleets without upfront investment. This approach enhances operational flexibility, particularly for firms with fluctuating project timelines. Rental companies offering value-added services such as telematics and predictive maintenance further attract corporate clients seeking performance assurance and cost transparency in logistics operations.

- For instance, Navistar’s OnCommand Connection ingests 70+ data feeds from over 375,000 connected vehicles to cut downtime

Expansion of Green and Hybrid Fleets

Rising environmental concerns and stricter emission regulations are driving rental firms to introduce electric and hybrid heavy-duty vehicles. These fleets help businesses reduce carbon footprints while complying with sustainability goals. Advancements in battery technology and improved charging infrastructure make cleaner alternatives more practical. Rental providers benefit from incentives for adopting low-emission fleets, attracting eco-conscious clients and supporting the transition toward sustainable transport solutions.

Key Trends & Opportunities

Adoption of Telematics and Smart Fleet Management

Telematics integration is transforming heavy-duty vehicle rental operations through real-time tracking and performance monitoring. Rental companies use data analytics to optimize routes, reduce fuel consumption, and ensure vehicle safety. These technologies also enhance transparency for clients by providing detailed usage reports and predictive maintenance alerts. The adoption of AI-based fleet management platforms creates opportunities for improved efficiency and customer satisfaction.

- For instance, Penske’s Catalyst AI analyzes about 300 million data points daily across its fleet to spot issues early.

Growing Popularity of Subscription-Based Rental Models

Flexible subscription models are emerging as an alternative to traditional leasing. These arrangements allow businesses to scale fleets quickly based on demand without long-term commitments. The trend aligns with the shift toward operational efficiency and financial agility in logistics and construction industries. Subscription-based models also include comprehensive maintenance and insurance packages, providing customers with predictable costs and enhanced convenience.

- For instance, DHL will operate 30 eActros 600 via hylane’s pay-per-use model, billed by kilometers driven, with trucks due by Q2 2026.

Key Challenges

High Maintenance and Depreciation Costs

Despite rental advantages, maintaining large heavy-duty fleets remains costly. Continuous wear, long-distance usage, and varying load conditions accelerate depreciation. Rental providers must balance competitive pricing with the high expense of upkeep, replacement parts, and insurance coverage. Managing asset life cycles while ensuring vehicle reliability poses a financial challenge, especially in markets with volatile fuel and repair costs.

Limited Availability of Electric and Hybrid Options

While demand for sustainable fleets is rising, the limited availability of electric and hybrid heavy-duty vehicles restricts market expansion. High purchase costs and insufficient charging infrastructure slow adoption among rental companies. The limited range of heavy-duty electric models further impacts operational flexibility. Overcoming these barriers requires greater investment in technology, supply partnerships, and government-backed infrastructure initiatives.

Regional Analysis

North America

North America held the largest share of 36% in the heavy-duty vehicle rental market in 2024. The dominance comes from strong logistics networks, widespread construction activities, and increasing demand for short-term fleet solutions. The United States leads regional adoption, supported by e-commerce expansion and infrastructure renewal programs. Rental companies are focusing on long-term leasing models and telematics-enabled trucks to improve cost efficiency. Additionally, government initiatives promoting cross-border trade between the U.S., Canada, and Mexico further enhance market opportunities in the region.

Europe

Europe accounted for 28% of the heavy-duty vehicle rental market in 2024, driven by strict emission norms and growing sustainability commitments. The region’s demand is led by Germany, France, and the United Kingdom, where fleet rental supports compliance with Euro VI standards. Rental providers are investing in low-emission diesel and hybrid models to meet customer and regulatory expectations. Infrastructure upgrades and urban logistics expansion also encourage higher vehicle utilization rates. The shift toward electric fleets and subscription-based rental options continues to strengthen the European market.

Asia Pacific

Asia Pacific captured 24% of the market share in 2024, primarily due to rapid industrialization and logistics expansion across China, India, and Japan. The growing manufacturing base and e-commerce activities increase the need for heavy-duty trucks and trailers. Businesses in emerging economies are turning to rentals to reduce ownership costs and enhance flexibility. Government-led infrastructure projects, such as smart city initiatives and freight corridor expansions, are key growth enablers. Rising adoption of telematics and connected vehicle solutions further boosts operational efficiency across regional fleets.

Latin America

Latin America held around 7% of the heavy-duty vehicle rental market in 2024, driven by infrastructure development and mining sector investments. Brazil and Mexico remain the major contributors due to their expanding manufacturing and construction industries. Companies in the region increasingly rent heavy-duty trucks to manage fluctuating demand while minimizing capital expenditure. Logistics service providers benefit from improved fleet availability and flexible contract terms. Growing awareness of cost-efficient transport and sustainable vehicle use continues to support regional market expansion.

Middle East and Africa

The Middle East and Africa accounted for 5% of the heavy-duty vehicle rental market in 2024. Growth is primarily fueled by ongoing construction and energy infrastructure projects in Saudi Arabia, the UAE, and South Africa. Rental demand is increasing as firms seek reliable fleets for large-scale industrial and oilfield operations. The presence of global rental companies and adoption of smart fleet management technologies enhance efficiency. Expanding government investments in transport and logistics infrastructure will further strengthen market development in this region.

Market Segmentations:

By Vehicle

- Trucks

- Buses

- Trailers

- Others

By Propulsion

- Diesel

- Natural gas

- Electric

- Hybrid electric

- Others

By Rental

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the heavy-duty vehicle rental market includes Ryder System, Tata Motors, Scania Rents, Penske Truck Rental, LALAMOVE Automotive, U-Haul International, Toyota, Enterprise Truck Rental, Avis Budget, Hino Motors, Herc Rental, Flexter.com, PACCAR, Force Motors, and Sixt SE. Market competition is defined by innovation in fleet management, rental flexibility, and integration of digital technologies. Companies are expanding service networks and investing in telematics, electric mobility, and maintenance support to enhance customer retention. Rental providers increasingly focus on value-added services, including predictive maintenance, digital booking, and on-demand fleet scaling. Strategic alliances with OEMs, logistics firms, and technology providers are strengthening service reliability and sustainability goals. Furthermore, the growing preference for subscription-based and long-term rental models is reshaping market dynamics, encouraging providers to modernize fleets with hybrid and low-emission vehicles while maintaining competitive pricing and operational efficiency across global logistics and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ryder System

- Tata Motors

- Scania Rents

- Penske Truck Rental

- LALAMOVE Automotive

- U-Haul International

- Toyota

- Enterprise Truck Rental

- Avis Budget

- Hino Motors

- Herc Rental

- com

- PACCAR

- Force Motors

- Sixt SE

Recent Developments

- In 2025, Hino Motors Showcased an updated 500 Series Ranger at the Japan Mobility Show, featuring Euro 6 compliance. Also finalized the integration with Mitsubishi Fuso.

- In 2024, Tata Motors Launched new heavy-duty trucks, the Ultra T.9 and Ultra T.14. It also connected 5 lakh commercial vehicles with its Fleet Edge platform for efficient fleet management.

- In 2024, Force Motors Displayed its e-Traveller electric bus and CNG Smart CitiBus at the Bharat Mobility Global Expo.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Rental and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of electric and hybrid heavy-duty vehicles for sustainable transport.

- Telematics and AI-driven fleet management will enhance operational efficiency and predictive maintenance.

- Subscription-based rental models will grow, offering flexibility for short and long-term needs.

- Expansion in e-commerce and last-mile delivery will continue to drive truck rental demand.

- Rental companies will focus on digital platforms for real-time booking and fleet tracking.

- Governments’ infrastructure development programs will boost demand for construction-related vehicle rentals.

- Strategic partnerships between OEMs and rental providers will expand fleet availability and customization.

- Demand for low-emission and fuel-efficient vehicles will rise due to stricter environmental regulations.

- Integration of renewable fuels in rental fleets will gain momentum to reduce carbon footprints.

- Emerging economies will present strong growth opportunities through expanding logistics and industrial sectors.