Market Overview

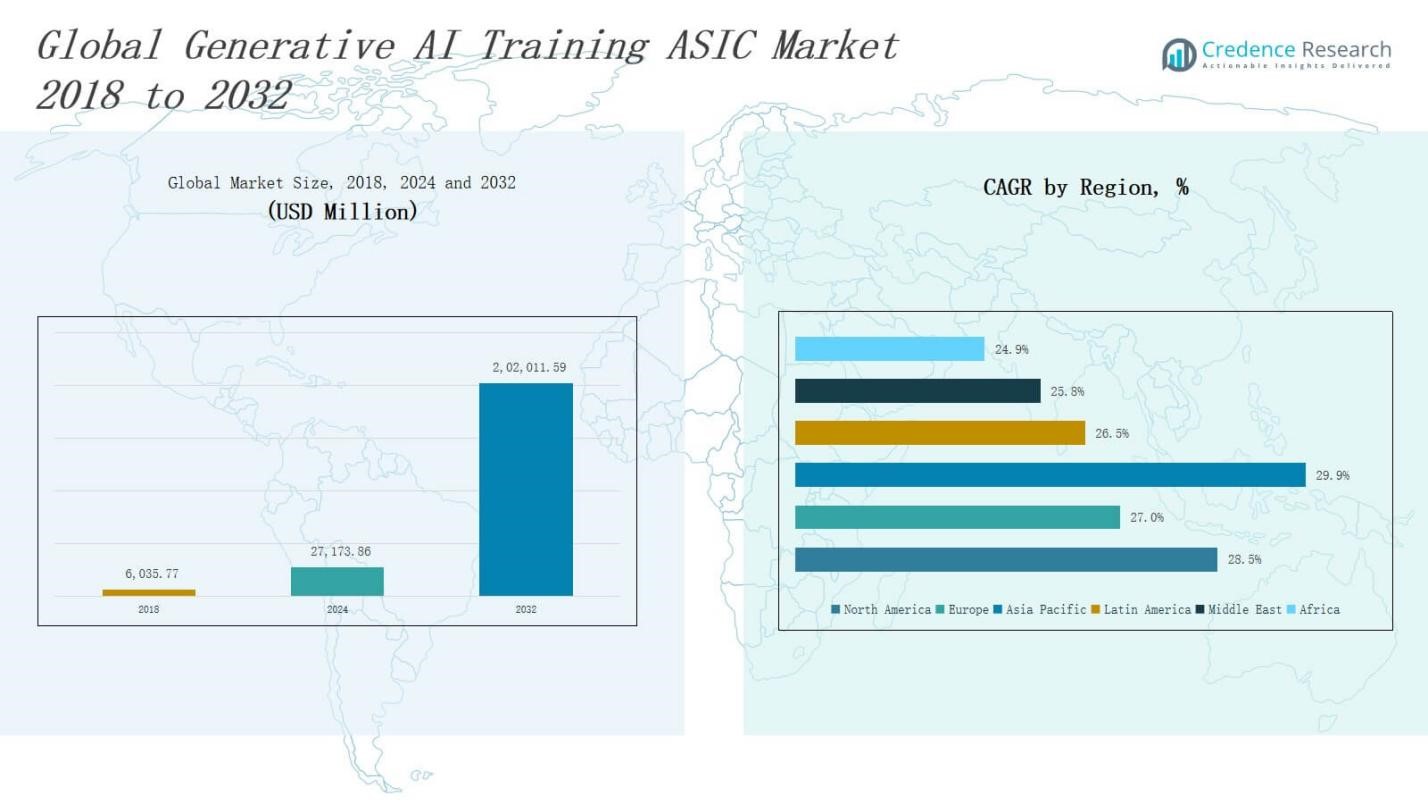

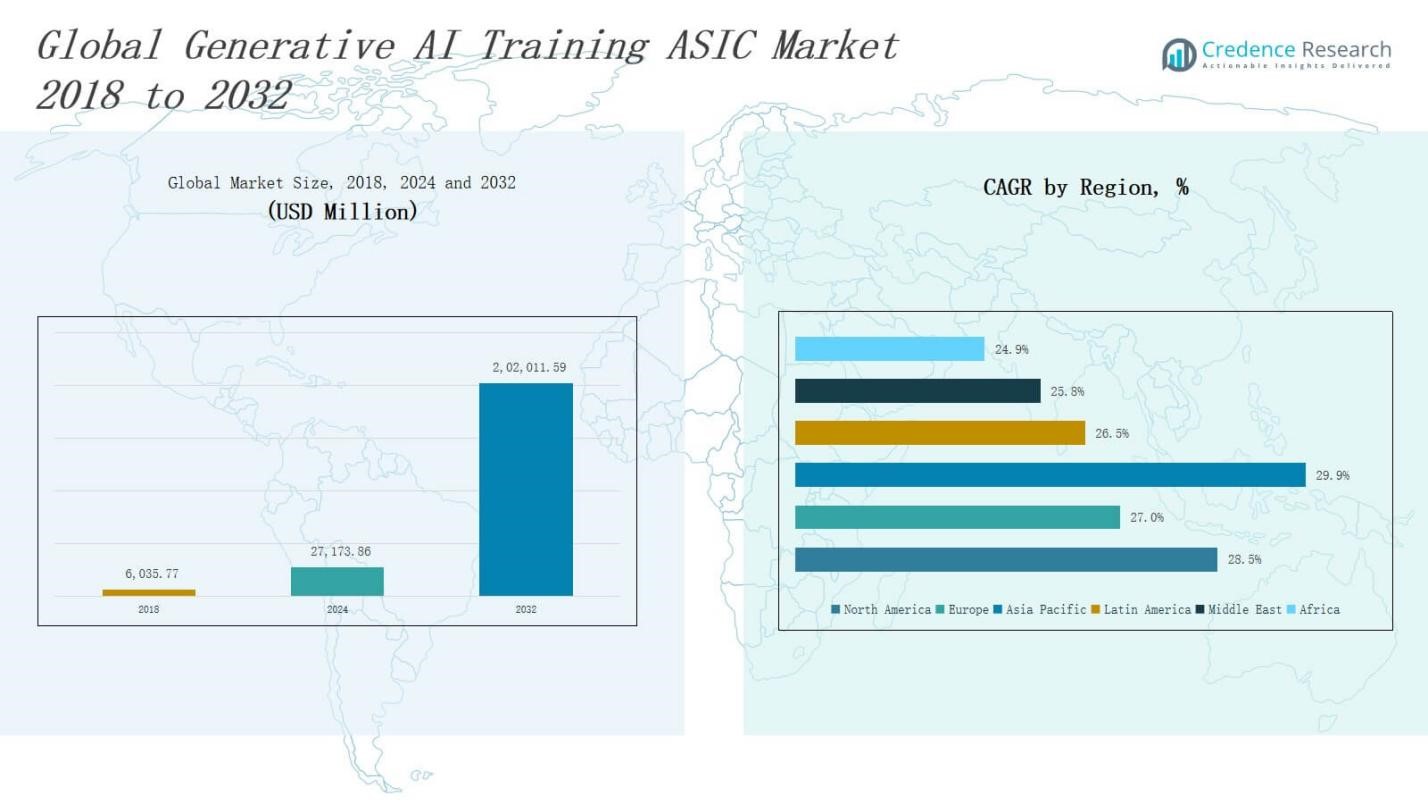

The Generative AI Training ASIC Market size was valued at USD 6,035.77 million in 2018 to USD 27,173.86 million in 2024 and is anticipated to reach USD 2,02,011.59 million by 2032, at a CAGR of 28.50 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Generative AI Training ASIC Market Size 2024 |

USD 27,173.86 Million |

| Generative AI Training ASIC Market, CAGR |

28.50 % |

| Generative AI Training ASIC Market Size 2032 |

USD 2,02,011.59 Million |

The Generative AI Training ASIC Market is driven by the exponential growth in generative AI applications across industries such as healthcare, automotive, finance, and entertainment, necessitating high-performance, energy-efficient training hardware. The increasing complexity of AI models like GPT, DALL·E, and diffusion networks requires customized ASICs that offer faster compute throughput, lower latency, and optimized power consumption compared to general-purpose GPUs. Rising demand for real-time data processing and scalable cloud AI training infrastructure is also accelerating adoption. Government-backed AI initiatives and growing investment from hyperscalers and chipmakers are further propelling development. Key market trends include the shift toward domain-specific architectures, integration of photonic and 3D-stacked chip technologies, and adoption of chiplet-based modular designs for scalability. Companies are also focusing on low-precision compute formats and sparsity-aware designs to improve training efficiency. The emergence of open-source hardware ecosystems and collaborations between AI labs and semiconductor firms is reshaping innovation, fostering rapid commercialization of generative AI accelerators.

The Generative AI Training ASIC Market spans key regions including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America holds the largest share due to strong R&D activity and the presence of tech giants. Asia Pacific shows rapid growth led by China, Japan, and South Korea with strong manufacturing capabilities. Europe emphasizes ethical AI and chip sovereignty, while Latin America and the Middle East show steady progress through public-private AI initiatives. Africa represents an emerging market with increasing digital adoption. Key players operating globally include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Google (Alphabet), Graphcore, Cerebras Systems, Alibaba Group, Bitmain Technologies, Groq, and Tenstorrent. These companies compete through advanced chip designs, energy-efficient architectures, and strategic collaborations to address the growing demand for high-performance training hardware across diverse regional applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Generative AI Training ASIC Market was valued at USD 27,173.86 million in 2024 and is projected to reach USD 2,02,011.59 million by 2032, growing at a CAGR of 28.50%.

- High-throughput and low-latency training hardware is in demand to support complex models like GPT and DALL·E across industries including healthcare, finance, and entertainment.

- Leading players such as NVIDIA, Intel, AMD, Google, and Alibaba are heavily investing in proprietary ASICs to support internal AI training workloads.

- Trends include the adoption of chiplet-based modular designs, 3D-stacked chips, low-precision compute formats, and sparsity-aware logic for greater energy efficiency.

- North America leads the market, reaching USD 86,461.97 million by 2032, driven by hyperscaler infrastructure, R&D intensity, and tech ecosystem maturity.

- Asia Pacific shows the highest growth potential, projected to reach USD 66,462.82 million by 2032, with strong semiconductor manufacturing and national AI policies.

- Key challenges include high development costs, long design cycles, and lack of software standardization, limiting adoption across hybrid and multi-vendor AI environments.

Market Drivers

Rising Demand for High-Performance AI Hardware

The Generative AI Training ASIC Market is gaining traction due to the growing need for high-throughput, low-latency compute solutions to train large-scale models. Generative AI applications, including text, image, and video synthesis, require hardware that can handle billions of parameters with speed and efficiency. ASICs specifically designed for AI workloads offer significant performance advantages over GPUs. It reduces training time and optimizes power consumption. Enterprises increasingly prefer ASICs for cost-effective scalability in AI data centers.

- For instance, Insilico Medicine leveraged generative AI platforms with high-performance compute architecture to design a novel fibrosis drug candidate in under 46 days—a fraction of the typical 12–18 months required for traditional discovery cycles.

Expansion of Generative AI Across Industries

Widespread adoption of generative AI in sectors such as healthcare, finance, media, and retail is boosting demand for specialized training infrastructure. The Generative AI Training ASIC Market is responding to industry-specific requirements by developing tailored solutions that address model size, accuracy, and latency constraints. It supports innovations in drug discovery, autonomous systems, and personalized content generation. ASIC vendors are aligning product design with end-use application demands. This cross-industry expansion drives steady market growth.

- For instance, Angoor AI designed a generative AI-native CRM specifically for the finance sector, optimizing client engagement with automated, tailor-made communication tools.

Investment Surge from Hyperscalers and Chipmakers

Major technology companies and hyperscalers are investing heavily in proprietary ASIC development to reduce dependency on general-purpose processors. The Generative AI Training ASIC Market is benefitting from this trend, as players like Google, Amazon, and Meta continue to scale their in-house AI chip capabilities. It creates competitive momentum among semiconductor firms to build domain-specific training accelerators. Strategic partnerships and startup acquisitions further intensify activity in the market. These investments are pushing innovation cycles forward.

Optimization for Energy Efficiency and Scalability

Energy efficiency and scalability are becoming critical performance benchmarks for generative AI hardware. The Generative AI Training ASIC Market addresses this by integrating low-precision compute, sparsity support, and advanced cooling solutions into chip architecture. It helps meet the rising demand for sustainable AI infrastructure. Companies are also exploring chiplet and 3D-stacked designs to enhance modularity and reduce system-level bottlenecks. Such design choices improve performance per watt. This focus aligns with data center optimization goals.

Market Trends

Shift Toward Domain-Specific Architectures for AI Acceleration

Companies are increasingly designing domain-specific architectures to improve performance and efficiency in generative AI workloads. The Generative AI Training ASIC Market is witnessing a growing emphasis on customization that enables chips to execute specific model operations with minimal overhead. It allows developers to optimize tensor operations, memory access, and data flow based on model requirements. Vendors are moving away from general-purpose designs toward task-optimized silicon. This trend is driving a wave of proprietary ASICs focused on generative applications.

- For instance, Bloomberg developed BloombergGPT, a language model with 50 billion parameters, trained on decades of proprietary financial data—enabling it to outperform general models in financial analysis tasks.

Emergence of Chiplet and 3D Packaging Designs

Chipmakers are adopting chiplet-based architectures and 3D packaging to overcome limitations in traditional monolithic designs. The Generative AI Training ASIC Market is seeing integration of multiple dies for compute, memory, and I/O within a compact footprint. It enables better scalability, thermal performance, and manufacturing yield. These modular architectures support rapid prototyping and allow for targeted upgrades. Leading players are using this trend to build highly parallelized systems for large-scale model training in data centers.

- For instance, Intel’s Foveros technology leverages 3D stacking to combine compute and I/O dies vertically, allowing enhanced scalability and energy efficiency in server and AI accelerator products.

Adoption of Low-Precision and Sparsity-Aware Computation

To improve compute efficiency and throughput, developers are implementing low-precision data formats such as FP8 and INT4, along with sparsity-aware logic. The Generative AI Training ASIC Market is moving toward designs that exploit structured sparsity in weights and activations. It significantly reduces power usage while maintaining accuracy in training. This trend helps ASICs meet the demands of large foundation models without ballooning energy costs. Precision tuning capabilities are becoming core to next-generation chip development.

Growing Collaboration Between AI Labs and Semiconductor Firms

Partnerships between AI research labs and chip manufacturers are accelerating the pace of innovation in hardware design. The Generative AI Training ASIC Market benefits from this collaboration, which bridges theoretical advancements and practical silicon implementation. It allows for rapid iteration and feedback-driven design improvements. Joint efforts are producing specialized chips aligned with cutting-edge model architectures. These collaborations also support open-source hardware initiatives and broader ecosystem growth for generative AI acceleration.

Market Challenges Analysis

High Development Costs and Long Design Cycles

Designing application-specific integrated circuits for generative AI requires substantial capital investment and extended development timelines. The Generative AI Training ASIC Market faces challenges from complex chip architectures that demand advanced fabrication processes and specialized engineering expertise. It limits entry for smaller players and delays time-to-market for new products. High non-recurring engineering costs and low flexibility in post-deployment updates further compound the risk. Companies must balance performance optimization with cost efficiency. These constraints hinder rapid scalability across diverse AI models.

Compatibility and Ecosystem Fragmentation Issues

Lack of standardized software stacks and toolchains across ASIC platforms creates barriers to adoption and integration. The Generative AI Training ASIC Market struggles with ecosystem fragmentation, where each vendor promotes proprietary compilers, libraries, and frameworks. It forces developers to invest in platform-specific optimization, reducing portability and increasing development overhead. Ensuring compatibility with evolving AI model architectures remains a technical hurdle. These issues slow deployment in hybrid or multi-vendor environments. The market must address interoperability to support broader adoption.

Market Opportunities

Rising Demand for Scalable AI Infrastructure

The growing deployment of large language models and multimodal AI systems presents a strong opportunity for specialized training hardware. The Generative AI Training ASIC Market can capitalize on the need for scalable, energy-efficient infrastructure across cloud data centers and enterprise AI platforms. It offers solutions that outperform traditional GPUs in throughput and cost per training cycle. Companies developing edge AI capabilities also seek compact, high-performance ASICs. This shift opens new application segments for tailored silicon. Demand spans public sector research, autonomous systems, and real-time analytics.

Integration of AI Accelerators in Emerging Devices

The adoption of generative AI in consumer electronics, robotics, and industrial automation creates a pathway for embedding training capabilities in non-traditional environments. The Generative AI Training ASIC Market can explore integration into hybrid devices where localized training or adaptation is essential. It drives innovation in lightweight, thermally efficient chips suited for space- and power-constrained systems. Collaborations with device OEMs and robotics firms offer growth channels. This trend extends ASIC deployment beyond centralized servers to edge-enabled smart ecosystems.

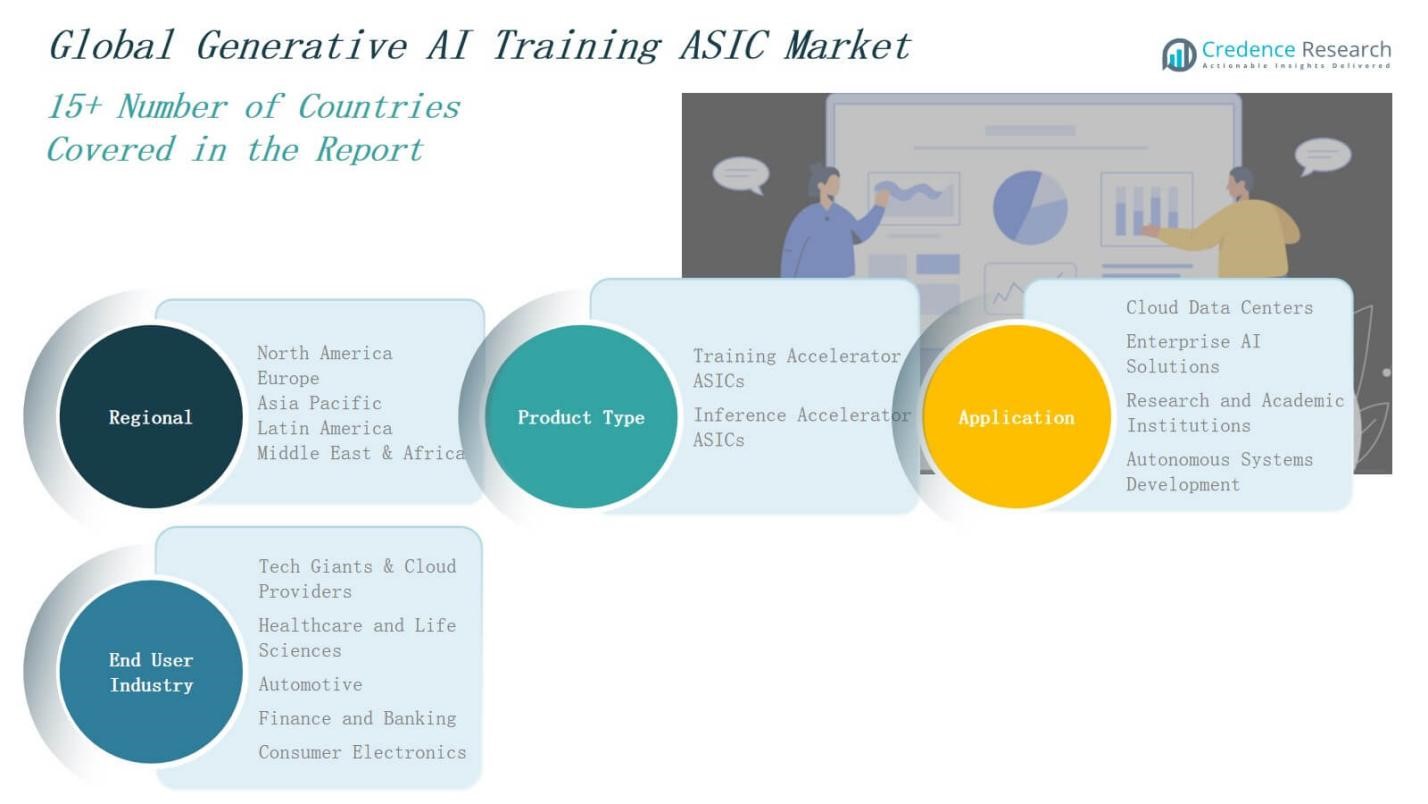

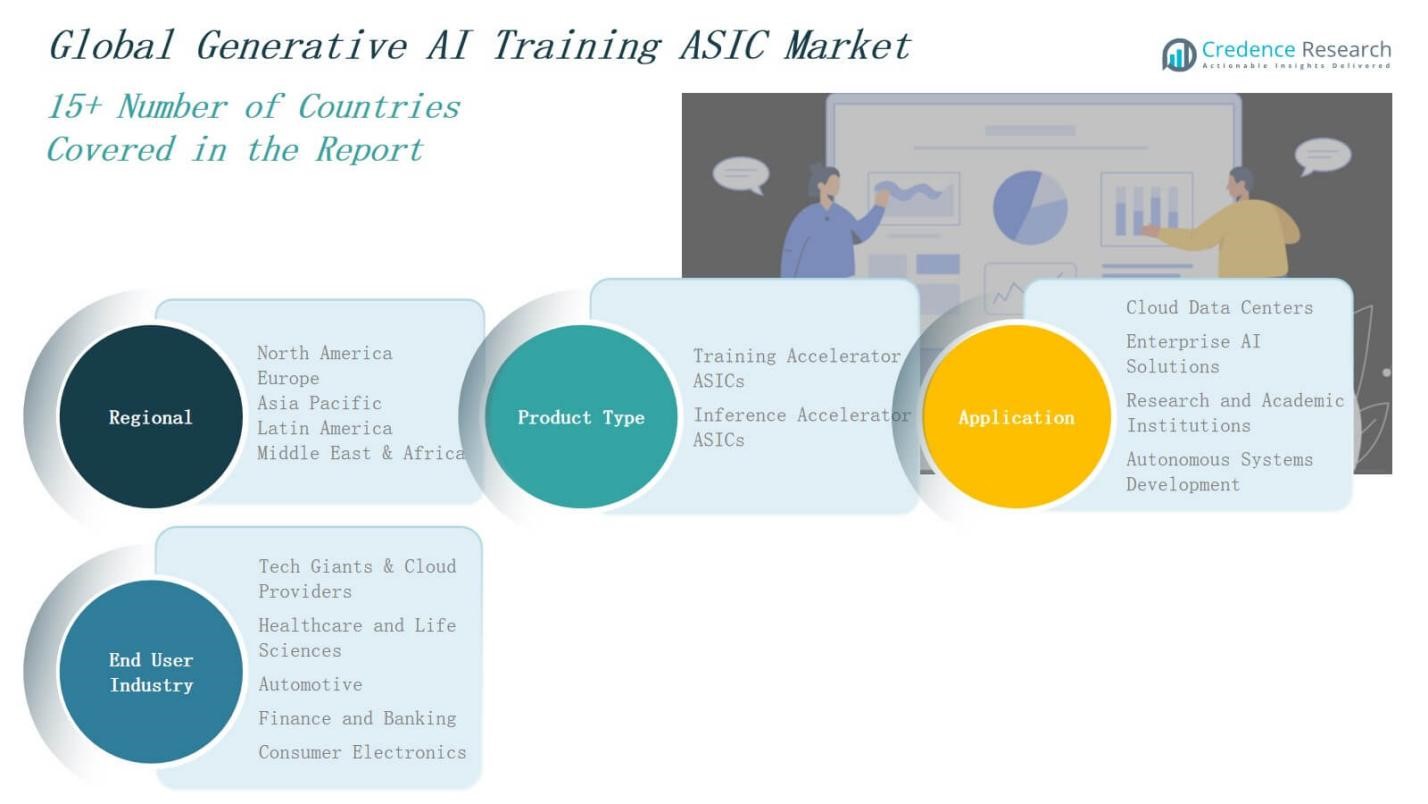

Market Segmentation Analysis:

By Product Type

The Generative AI Training ASIC Market is segmented into Training Accelerator ASICs and Inference Accelerator ASICs. Training Accelerator ASICs dominate the segment due to their critical role in handling compute-intensive model training tasks for large generative models. These chips enable faster training cycles, reduced energy consumption, and increased scalability in AI workloads. Inference Accelerator ASICs are gaining traction in latency-sensitive deployments, where real-time model execution is prioritized, particularly at the edge and in embedded systems.

- For instance, Google developed its Tensor Processing Unit (TPU) ASICs specifically to accelerate the training of deep learning models for AI applications; TPUs are widely adopted in Google’s data centers to support tools like TensorFlow and power advancements in generative AI.

By Application

The market serves diverse applications including Cloud Data Centers, Enterprise AI Solutions, Research and Academic Institutions, and Autonomous Systems Development. Cloud Data Centers contribute the largest share due to high demand for scalable training infrastructure among hyperscalers. Enterprise AI Solutions segment shows strong growth driven by the integration of generative AI in business operations. Research institutions leverage ASICs to accelerate experimentation with novel model architectures. Autonomous systems use them for real-time data processing and self-learning capabilities.

- For instance, in Autonomous Systems, Tesla employs custom AI chips (“Full Self-Driving Computer”) for real-time sensory data processing and decision-making in its vehicles, directly supporting autonomous driving capabilities through high-speed, on-board inference.

By End User Industry

The Generative AI Training ASIC Market spans key end-user industries such as Tech Giants & Cloud Providers, Healthcare and Life Sciences, Automotive, Finance and Banking, and Consumer Electronics. Tech Giants and Cloud Providers lead in adoption due to their in-house model development needs and cloud service offerings. The healthcare sector uses these ASICs for training medical imaging and drug discovery models. The automotive industry integrates them into ADAS and autonomous driving platforms. Financial institutions adopt them to enhance fraud detection and risk modeling, while consumer electronics firms explore on-device training for personalized AI features.

Segments:

Based on Product Type

- Training Accelerator ASICs

- Inference Accelerator ASICs

Based on Application

- Cloud Data Centers

- Enterprise AI Solutions

- Research and Academic Institutions

- Autonomous Systems Development

Based on End User Industry

- Tech Giants & Cloud Providers

- Healthcare and Life Sciences

- Automotive

- Finance and Banking

- Consumer Electronics

Based on Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

The North America Generative AI Training ASIC Market size was valued at USD 2,603.47 million in 2018 to USD 11,597.94 million in 2024 and is anticipated to reach USD 86,461.97 million by 2032, at a CAGR of 28.5% during the forecast period. North America holds the largest market share, driven by early adoption of generative AI technologies and the presence of leading tech firms such as NVIDIA, Google, and AMD. It benefits from a robust cloud infrastructure and high R&D investment. Demand from U.S.-based hyperscalers and AI labs continues to expand ASIC deployment in data centers. Government initiatives supporting semiconductor innovation further enhance regional growth. The region’s established semiconductor ecosystem supports rapid commercialization of AI-specific hardware.

Europe

The Europe Generative AI Training ASIC Market size was valued at USD 1,166.29 million in 2018 to USD 4,972.89 million in 2024 and is anticipated to reach USD 33,736.47 million by 2032, at a CAGR of 27.0% during the forecast period. Europe contributes a significant share, supported by AI policy frameworks, strong academic collaborations, and government-backed chip initiatives. It focuses on sovereignty in chip manufacturing and ethical AI. Countries like Germany, France, and the UK are investing in specialized AI infrastructure. The market sees growing interest in generative AI for automotive, fintech, and healthcare use cases. ASIC deployment is also expanding in regional cloud services and research centers.

Asia Pacific

The Asia Pacific Generative AI Training ASIC Market size was valued at USD 1,721.58 million in 2018 to USD 8,189.25 million in 2024 and is anticipated to reach USD 66,462.82 million by 2032, at a CAGR of 29.9% during the forecast period. Asia Pacific ranks second by market share, fueled by massive investments from China, South Korea, and Japan. It benefits from the presence of global semiconductor manufacturers and regional AI startups. Governments are actively promoting AI chip innovation through national AI strategies. Demand for generative AI in smart manufacturing, robotics, and consumer electronics drives ASIC adoption. Cloud providers and academic institutions in the region continue to scale AI training infrastructure.

Latin America

The Latin America Generative AI Training ASIC Market size was valued at USD 278.37 million in 2018 to USD 1,237.30 million in 2024 and is anticipated to reach USD 8,115.37 million by 2032, at a CAGR of 26.5% during the forecast period. Latin America shows emerging potential as countries adopt digital transformation strategies across healthcare, finance, and government sectors. Brazil and Mexico lead ASIC deployments through public-private AI partnerships. It sees growing cloud infrastructure investments to support enterprise AI. Regional startups are testing generative models in language processing and customer service automation. Infrastructure limitations and import dependencies remain challenges to growth. However, policy support and foreign investments are enabling steady expansion.

Middle East

The Middle East Generative AI Training ASIC Market size was valued at USD 170.39 million in 2018 to USD 701.72 million in 2024 and is anticipated to reach USD 4,408.60 million by 2032, at a CAGR of 25.8% during the forecast period. The Middle East market is gaining traction due to smart city initiatives and AI-driven government transformation projects. Countries like the UAE and Saudi Arabia are deploying AI chips in national cloud platforms and surveillance systems. It benefits from rising interest in generative AI for Arabic language processing and public services. Strategic collaborations with U.S. and Asian tech firms are helping bridge technological gaps. ASIC adoption is rising in the region’s defense and oil & gas sectors.

Africa

The Africa Generative AI Training ASIC Market size was valued at USD 95.67 million in 2018 to USD 474.76 million in 2024 and is anticipated to reach USD 2,826.35 million by 2032, at a CAGR of 24.9% during the forecast period. Africa represents a nascent but growing market, driven by increased focus on digital inclusion and AI for development. South Africa, Egypt, and Nigeria are early adopters, exploring generative AI in education, agriculture, and fintech. It faces infrastructure and talent limitations, slowing deployment pace. International partnerships and cloud-based solutions are helping bridge the gap. Growing interest in regional language modeling and AI research creates long-term demand for training accelerators. The market is expected to grow steadily as digital infrastructure improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bitmain Technologies

- Cerebras System

- Google (Alphabet)

- Graphcore

- NVIDIA Corporation

- Groq

- Tenstorrent

- Intel Corporation

- Advanced Micro Devices (AMD)

- Alibaba Group

Competitive Analysis

The Generative AI Training ASIC Market features intense competition among established semiconductor giants and specialized AI hardware startups. Companies such as NVIDIA, Intel, and AMD dominate with advanced chip designs and broad software ecosystems. It sees growing pressure from innovators like Cerebras Systems, Groq, and Tenstorrent, which offer disruptive architectures optimized for large-scale model training. Google and Alibaba leverage in-house ASICs to power proprietary AI platforms, strengthening vertical integration. Graphcore focuses on intelligence processing units tailored for generative workloads. Bitmain Technologies brings ASIC design expertise from crypto to AI. The market rewards firms that deliver performance, energy efficiency, and scalability. Strategic partnerships, custom silicon development, and AI model alignment drive differentiation and market share. Companies are also expanding global manufacturing and forging alliances with cloud providers, OEMs, and research labs to strengthen their supply chain and support ecosystem. Accelerated product cycles and first-mover advantage remain critical for sustaining competitive leadership.

Recent Developments

- In February 2025, OpenAI finalized its first custom AI training chip design to reduce dependency on NVIDIA for large-scale generative model training.

- In May 2025, NVIDIA launched “NVLink Fusion,” allowing companies like MediaTek and Marvell to develop semi-custom AI silicon within its partner ecosystem.

- In April 2025, Cerebras Systems partnered with Meta to deliver significantly faster inference performance for Meta’s new Llama API, achieving up to 18× GPU speed.

- In December 2024, NVIDIA completed the $700 million acquisition of Run:ai to enhance orchestration of AI workloads using Kubernetes-based management tools.

Market Concentration & Characteristics

The Generative AI Training ASIC Market exhibits a moderately high level of market concentration, dominated by a few large players with proprietary architectures and deep integration across hardware and software stacks. It is characterized by rapid innovation cycles, high entry barriers, and strong vertical integration among tech giants like NVIDIA, Google, and Intel. These firms invest heavily in R&D and control both chip design and training software ecosystems. Specialized startups such as Cerebras Systems, Graphcore, and Groq are challenging incumbents with novel architectures and performance-focused designs. The market prioritizes compute efficiency, energy optimization, and scalability, which drives demand for custom ASICs over general-purpose GPUs. Strategic alliances, acquisitions, and exclusive supply agreements are common among players seeking to gain technological and market edge. It continues to evolve through advancements in packaging, precision formats, and co-design with generative AI model developers, reinforcing the need for specialized and adaptable silicon solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for custom AI training chips will increase with the scaling of large language and multimodal models.

- Companies will invest in energy-efficient designs to meet sustainability goals in data center operations.

- Adoption of chiplet-based architectures will grow to support modular, scalable AI hardware solutions.

- Edge deployment of generative AI will drive demand for compact, high-performance ASICs.

- More hyperscalers will develop in-house ASICs to optimize cost and performance across AI infrastructure.

- Collaborations between semiconductor firms and AI research labs will accelerate innovation cycles.

- Integration of photonic and 3D packaging technologies will enhance performance and thermal efficiency.

- Open-source hardware ecosystems will expand to reduce development barriers and foster innovation.

- Regulatory focus on AI transparency and safety will influence ASIC design for compliance.

- Emerging markets will adopt AI training ASICs as digital infrastructure and AI capabilities mature.