Market Overview:

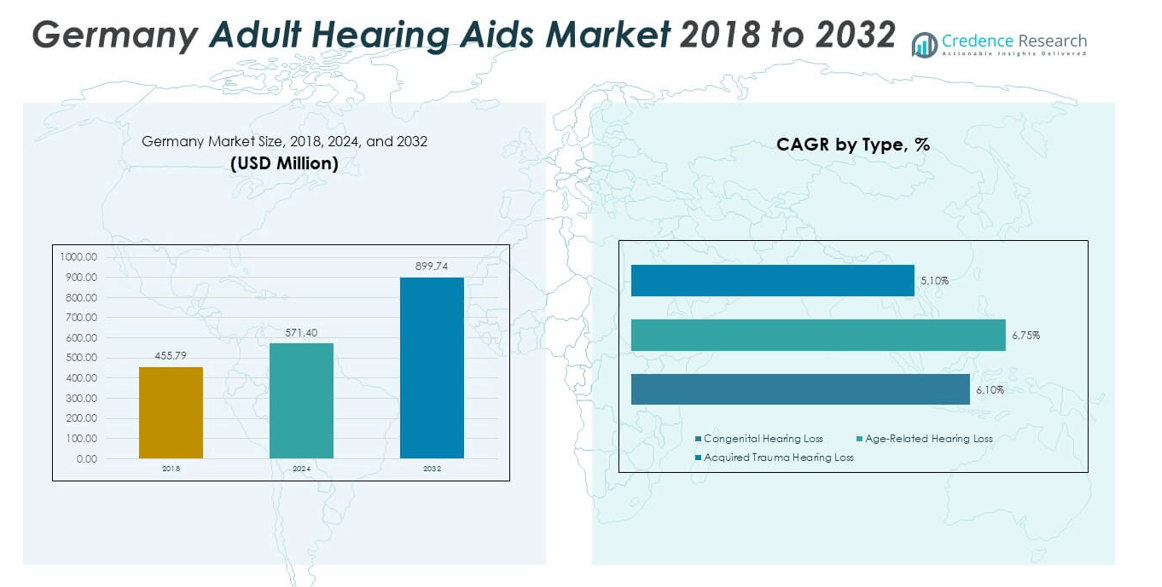

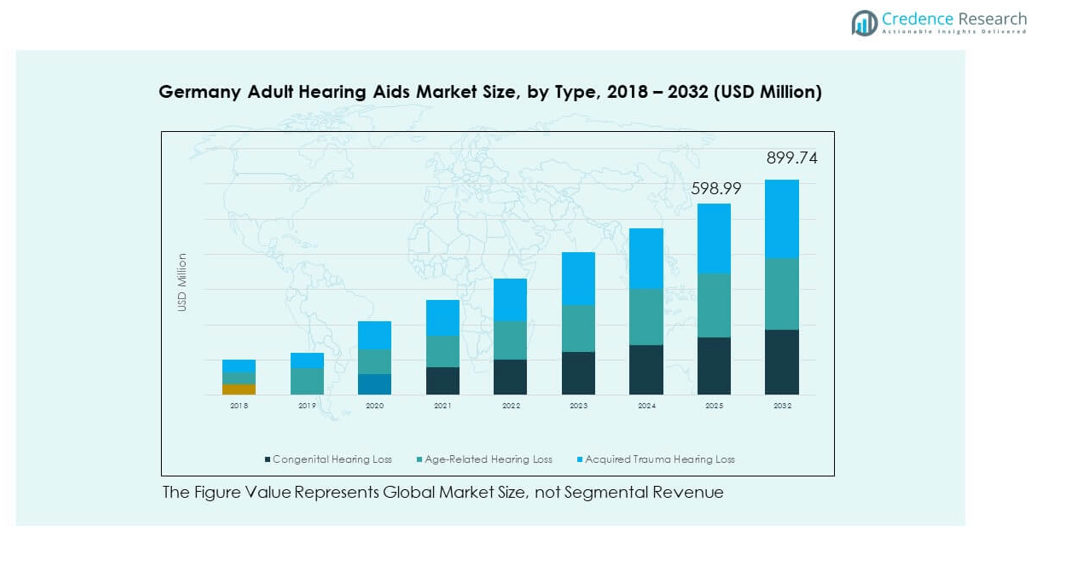

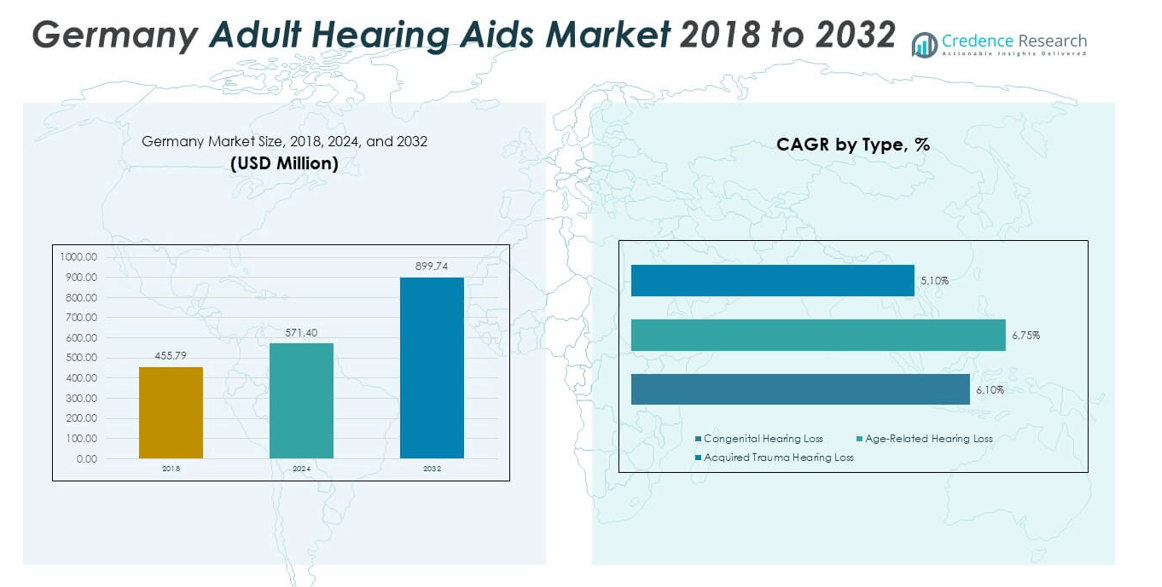

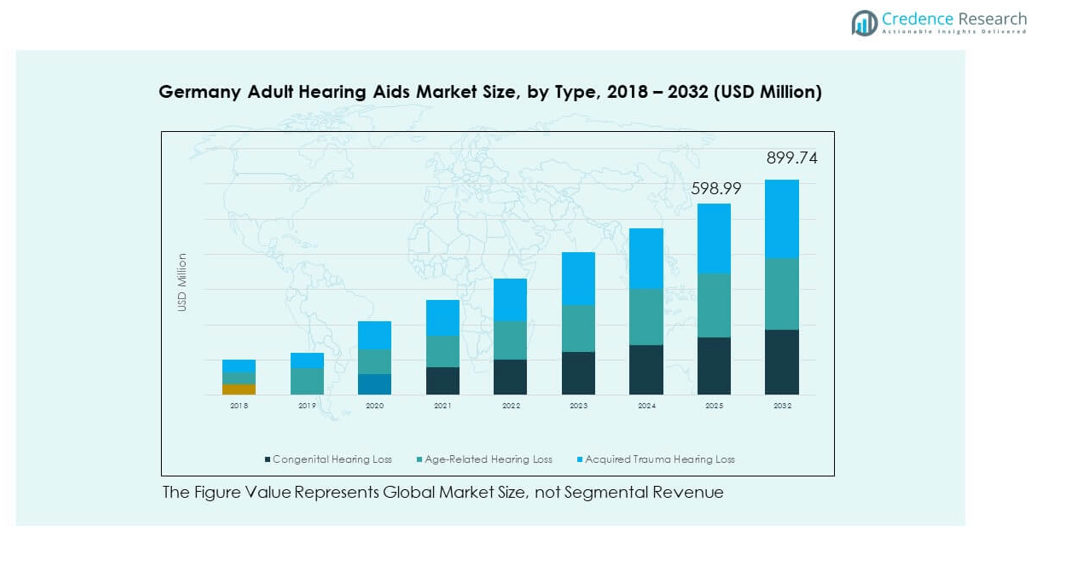

The Germany Adult Hearing Aids Market size was valued at USD 455.79 million in 2018 to USD 571.4 million in 2024 and is anticipated to reach USD 899.74 million by 2032, at a CAGR of 5.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Adult Hearing Aids Market Size 2024 |

USD 571.4 million |

| Germany Adult Hearing Aids Market, CAGR |

5.90% |

| Germany Adult Hearing Aids Market Size 2032 |

USD 899.74 million |

Growing awareness of age-related hearing loss, advancements in digital hearing technology, and wider insurance coverage are driving strong demand in Germany. The market benefits from increasing adoption of behind-the-ear and in-the-ear devices, which provide improved sound quality and comfort. Rising healthcare spending and government support for accessible hearing care further strengthen adoption. Additionally, innovations such as Bluetooth connectivity and rechargeable batteries are attracting younger users and boosting overall acceptance of hearing solutions.

Regionally, Germany plays a leading role in Europe’s hearing aids market due to its advanced healthcare infrastructure and strong audiology networks. Neighboring countries such as France and the UK also remain important markets with expanding adoption, while Eastern European nations are emerging through rising healthcare investments. The presence of global and local manufacturers in Germany provides a competitive edge, positioning the country as both a high-demand market and a hub for product development in the region.

Market Insights:

- The Germany Adult Hearing Aids Market was valued at USD 455.79 million in 2018, reached USD 571.4 million in 2024, and is projected to hit USD 899.74 million by 2032, growing at a CAGR of 5.90%.

- The Global Adult Hearing Aids Market size was valued at USD 5,874.3 million in 2018 to USD 7,569.5 million in 2024 and is anticipated to reach USD 12,365.0 million by 2032, at a CAGR of 6.47% during the forecast period.

- Southern Germany accounted for 35% share, driven by advanced healthcare infrastructure; Northern Germany held 28%, supported by awareness campaigns; Western Germany captured 20% with strong adoption in urban centers.

- Eastern Germany, with 17% share, is the fastest-growing region due to rising healthcare investments and improved access in underserved areas.

- In 2024, age-related hearing loss dominated with 62% share, reflecting the aging population and rising demand for elderly care solutions.

- Congenital hearing loss held 21%, while acquired trauma hearing loss contributed 17%, reflecting steady demand from occupational and accident-related cases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Prevalence of Age-Related Hearing Loss and Expanding Awareness Campaigns

The Germany Adult Hearing Aids Market is driven by a rising prevalence of age-related hearing loss across the elderly population. Increased life expectancy in the country has created a larger base of individuals requiring hearing support. Awareness campaigns from healthcare organizations have improved recognition of early treatment, encouraging people to adopt hearing aids. The market also benefits from social programs that reduce stigma around hearing devices. Technological improvements in hearing screening tools make diagnosis easier at earlier stages. Family physicians and audiologists are promoting regular ear health check-ups. These factors create consistent demand across urban and semi-urban regions. It establishes hearing care as a vital part of public health management.

Expanding Insurance Coverage and Supportive Healthcare Infrastructure

Germany’s strong healthcare infrastructure has played a pivotal role in supporting the hearing aids market. Insurance providers increasingly include coverage for adult hearing aids, reducing financial barriers for patients. Subsidies and reimbursement policies encourage individuals to seek proper solutions rather than delaying treatment. The growing number of certified audiologists ensures that patients have access to qualified specialists. Hospitals and clinics integrate hearing services as part of overall geriatric care. Awareness of mental health risks linked to untreated hearing loss is also boosting treatment demand. It strengthens the adoption of advanced hearing aids across regions. The supportive framework improves accessibility and ensures consistent growth in this sector.

- For instance, Germany’s statutory health insurance system (GKV) covers nearly 90% of the population. A 2020 study confirmed that adults with binaural hearing aids incur an average lifetime cost of €4,518 paid by insurance, with patients covering an average of €4,610.

Rising Adoption of Advanced Digital Hearing Technologies and Connectivity Features

The market has shifted toward advanced digital hearing aids that provide superior sound clarity and user control. Features such as Bluetooth connectivity, noise reduction, and rechargeability enhance consumer appeal. Younger demographics increasingly embrace hearing aids with smart functions that sync with smartphones and wearables. Manufacturers invest heavily in research and development to introduce new designs with improved comfort. Retailers and online platforms create visibility by promoting product comparisons and demonstrations. This trend aligns with consumer preference for customization and user-friendly options. It positions digital devices as a dominant product category. The integration of connectivity features contributes to broader acceptance among tech-savvy users in Germany.

Strong Role of Geriatric Population and Government-Led Health Initiatives

The expanding geriatric population in Germany directly drives demand for adult hearing aids. Older adults require tailored solutions that address varying degrees of hearing impairment. Government-led health initiatives support screenings and treatment programs for seniors. Regular awareness programs highlight the link between untreated hearing loss and cognitive decline. Hospitals and senior care facilities emphasize hearing solutions as part of wellness management. Local government units and healthcare associations conduct outreach programs in underserved areas. These initiatives ensure that adoption is not restricted to metropolitan regions. It strengthens the role of public health policy in accelerating market expansion.

- For instance, a peer-reviewed study conducted in 2021 in rural Brandenburg found that among 186 elderly participants (average age 74), 97% had hearing loss, yet 77% of those who reported their usage did not own hearing aids. This survey confirmed that the proportion of underserved patients significantly increased in towns lacking an ENT specialist or hearing aid provide.

Market Trends

Increasing Miniaturization and Demand for Invisible Hearing Devices

Consumers in Germany increasingly prefer compact and discreet hearing aid designs. The trend toward miniaturization allows users to benefit from advanced functions without visible devices. Modern in-the-ear and completely-in-the-canal devices reflect this preference. Audiology clinics promote invisible hearing aids as lifestyle-friendly solutions. Younger consumers also view discreet designs as socially acceptable compared to traditional bulky aids. Continuous advancements in materials and microelectronics make smaller devices powerful and efficient. It drives product innovation cycles among manufacturers. The trend highlights a shift toward blending medical solutions with fashion-conscious designs.

- · For instance, Phonak’s Virto Titanium hearing aids use a 15 times stronger medical-grade titanium shell than standard acrylic, enabling a 50% wall thickness reduction via 3D printing. This allows for significantly smaller, more discreet, and deeper-fitting devices.

Growing Role of Teleaudiology and Remote Care Platforms

Teleaudiology is transforming how hearing aid users access care in Germany. Remote platforms allow patients to consult audiologists without frequent in-person visits. Adjustments and fine-tuning of devices can be conducted virtually. This convenience appeals to both elderly patients and younger tech-oriented users. Healthcare providers integrate telehealth into their standard care offerings. It reduces waiting times and improves continuity of care in rural and urban areas. Remote services align with Germany’s broader digital health strategy. This trend ensures better accessibility and long-term satisfaction for hearing aid users.

Expanding Use of Artificial Intelligence for Personalized Hearing Experiences

Artificial intelligence plays a growing role in personalizing hearing aid experiences. Devices equipped with AI adapt to user environments, filtering background noise effectively. Adaptive algorithms enable real-time adjustments for conversations in noisy areas. German manufacturers and global players are developing models with intelligent learning capabilities. Consumers value hearing aids that adapt without manual changes. This shift reflects broader adoption of AI across healthcare devices. It positions Germany as a strong market for innovation-led adoption. The use of AI improves patient comfort, which drives consistent demand growth.

- For instance, Signia Augmented Xperience (AX) hearing aids utilize a dual-processor AI architecture to improve speech understanding in noise by processing focus sounds and background sounds separately.

Integration of Hearing Aids with Broader Wellness and Smart Ecosystems

Hearing aids are no longer seen as standalone medical devices. They increasingly integrate with wellness and smart ecosystems. Devices now connect with fitness trackers, smartphones, and digital assistants. German consumers show interest in multi-functional devices that support health monitoring. Manufacturers highlight integrated ecosystems to attract technology-conscious buyers. This trend broadens the perception of hearing aids as lifestyle tools. It creates cross-industry collaboration opportunities between audiology and consumer electronics firms. The Germany Adult Hearing Aids Market benefits from this convergence, fueling innovation and consumer adoption.

Market Challenges Analysis

High Cost of Advanced Devices and Limited Accessibility for Low-Income Groups

One of the major challenges in the Germany Adult Hearing Aids Market is the high cost of advanced devices. Digital and AI-enabled models come with premium pricing, making them less accessible to lower-income populations. Insurance coverage reduces some financial barriers but does not always fully reimburse the latest models. Elderly patients from rural and economically weaker regions often delay treatment due to affordability issues. This creates a gap in healthcare equality across demographics. Manufacturers face pressure to balance advanced features with cost-efficient solutions. The market must address these disparities to ensure widespread adoption. It highlights the ongoing tension between innovation and affordability.

Social Stigma and Lack of Awareness Among Certain Demographics

Despite increasing awareness, social stigma around wearing hearing aids still persists in Germany. Many adults associate hearing aids with aging or disability, leading to delayed adoption. Younger individuals facing hearing loss often avoid devices due to concerns about appearance. Lack of awareness about modern, discreet designs continues to hinder wider use. Cultural perceptions play a strong role in shaping consumer attitudes. Rural populations also show limited understanding of the long-term health benefits of hearing aids. These factors restrict market growth even in regions with healthcare accessibility. It underscores the importance of targeted awareness programs to shift public perception.

Market Opportunities

Expansion of Innovative Retail Channels and Growing E-Commerce Presence

Opportunities in the Germany Adult Hearing Aids Market are expanding through innovative retail models and e-commerce platforms. Consumers now compare and purchase devices through online channels supported by detailed specifications and reviews. Retailers also create awareness through virtual try-ons and guided consultations. The hybrid model of physical clinics combined with digital platforms increases consumer reach. It enhances accessibility, especially for younger and middle-aged buyers who value convenience. Manufacturers gain direct engagement opportunities with end-users, strengthening brand loyalty. This expansion creates space for new entrants and technology-driven startups to establish presence.

Rising Focus on Preventive Healthcare and Hearing Wellness Programs

The increasing focus on preventive healthcare provides significant opportunities for hearing aid adoption. Wellness programs highlight the benefits of early diagnosis and intervention, encouraging proactive hearing health management. Employers and healthcare organizations integrate hearing wellness into broader employee health programs. Educational initiatives emphasize the link between hearing and cognitive well-being. This fosters greater acceptance among both older and younger demographics. It creates opportunities for manufacturers to design solutions tailored for preventive care. The integration of hearing wellness with preventive healthcare aligns with Germany’s health policy goals. It ensures long-term market growth and improved patient outcomes.

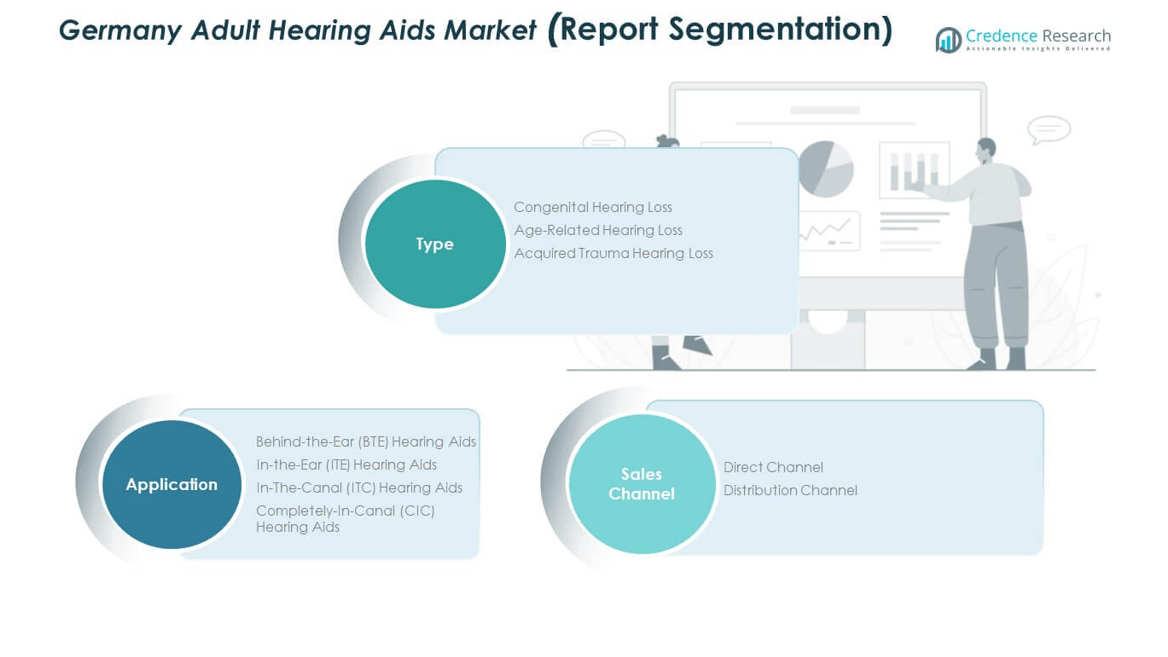

Market Segmentation Analysis:

The Germany Adult Hearing Aids Market

By type shows clear dominance of age-related hearing loss devices, reflecting the country’s aging population. Congenital hearing loss solutions remain a smaller but important segment, supported by advancements in pediatric diagnostics transitioning into adult care. Acquired trauma hearing loss contributes steadily, driven by rising incidences linked to occupational hazards and accidents. It reflects the importance of diverse solutions tailored to specific medical conditions across patient groups.

- For instance, Germany’s universal newborn hearing screening program, mandated by the Federal Joint Committee (G-BA), sets goals for hearing loss diagnosis by three months of age and treatment by six months.

By application, behind-the-ear (BTE) hearing aids hold a strong position due to comfort, durability, and advanced sound processing features. In-the-ear (ITE) hearing aids attract consumers seeking discreet yet effective solutions. In-the-canal (ITC) and completely-in-canal (CIC) devices are gaining traction among younger demographics due to their cosmetic appeal and compact designs. The Germany Adult Hearing Aids Market benefits from continuous innovations that enhance sound clarity, connectivity, and usability across these application categories.

By sales channel, distribution networks dominate as they ensure broad accessibility across clinics, hospitals, and specialty retailers. Direct channels, including online platforms and company-owned outlets, are growing rapidly with digital adoption and consumer preference for convenience. It creates multiple touchpoints for buyers, increasing awareness and boosting sales conversions. Strong presence of both traditional distribution and digital platforms ensures comprehensive reach across urban and rural regions.

- For instance, provider networks such as Audika, the retail division of Demant, operate a significant number of specialized hearing care clinics in Germany, consistent with industry trends towards vertical integration.

Segmentation:

By Type

- Congenital Hearing Loss

- Age-Related Hearing Loss

- Acquired Trauma Hearing Loss

By Application

- Behind-the-Ear (BTE) Hearing Aids

- In-the-Ear (ITE) Hearing Aids

- In-the-Canal (ITC) Hearing Aids

- Completely-In-Canal (CIC) Hearing Aids

By Sales Channel

- Direct Channel

- Distribution Channel

Regional Analysis:

The Germany Adult Hearing Aids Market demonstrates a strong presence across major regions, with Southern Germany accounting for 35% of the overall market share. This dominance stems from advanced healthcare systems in Bavaria and Baden-Württemberg, where audiology clinics and research institutions are well established. The concentration of high-income populations further supports demand for advanced digital devices. Southern Germany also benefits from a robust distribution network that ensures accessibility in both metropolitan and smaller cities. It creates favorable conditions for global and local manufacturers to expand their presence. The region is expected to maintain steady momentum with ongoing healthcare investments.

Northern Germany holds 28% of the market share, driven by cities such as Hamburg and Bremen that have well-structured healthcare services and strong awareness campaigns. The region has a significant elderly population, creating consistent demand for age-related hearing loss solutions. Distribution channels remain highly effective in covering both urban and rural areas, ensuring better accessibility. Local partnerships between audiologists and retail providers strengthen the supply network. The Germany Adult Hearing Aids Market in this region benefits from government-backed awareness initiatives, increasing early adoption rates. It remains a vital contributor to overall national growth.

Eastern and Western Germany collectively capture 37% of the market share, reflecting a balanced mix of urban development and emerging healthcare facilities. Western Germany, with hubs such as Cologne and Düsseldorf, shows strong adoption due to modern hospitals and established private practices. Eastern Germany is gradually expanding, supported by rising investments in healthcare infrastructure and awareness programs. The combination of developed and emerging markets in these regions creates unique growth dynamics. It ensures steady expansion while reducing regional disparities in hearing care accessibility. These areas highlight the importance of tailored strategies to meet diverse consumer needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Singnia

- Sonova

- William Demant

- WS Audiology

- GN ReSound

- Rion

- Sebotek Hearing Systems

- Audina Hearing Instruments

- Microson

- Audicus

- Horentek

- Others

Competitive Analysis:

The Germany Adult Hearing Aids Market is shaped by global leaders and specialized local firms. Major players such as Sonova, William Demant, WS Audiology, and GN ReSound hold strong positions with advanced product portfolios and extensive networks. Their focus on digital, AI-enabled, and rechargeable devices drives innovation and secures brand loyalty. It enables them to maintain dominance and capture demand across diverse consumer groups. Smaller firms like Audina Hearing Instruments, Microson, and Horentek strengthen competition with affordable solutions for price-sensitive buyers. Direct-to-consumer brands such as Audicus use online channels and transparent pricing to expand accessibility. Local companies and startups diversify the market by offering targeted products for specific demographics. The competitive environment is defined by mergers, partnerships, and product launches that improve reach and service quality. Firms also build collaborations with hospitals, clinics, and insurers while using digital platforms for remote support. Competition is set to intensify as companies pursue larger shares in Germany’s expanding hearing aid sector.

Recent Developments:

- In February 2025, Signia, a leading brand in the German adult hearing aids market, launched the Pure Charge&Go BCT IX hearing aids, which stand out for incorporating the longest battery runtime of any Bluetooth® Classic compatible device up to 36 hours on a single charge, including five hours of streaming.

- In June 2025, Demant, headquartered in Denmark, announced its largest acquisition to date: a €700 million deal to acquire KIND Group, one of Germany’s leading hearing aid retailers. The acquisition expands Demant’s distribution network by around 650 clinics, predominantly in Germany and with additional locations in Switzerland, Austria, Luxembourg, and Singapore.

- In May 2025, Sonova announced strong market share gains for its Europe adult hearing aids business, supported by successful new product launches and commercial execution improvements during the financial year.

- In August 2024, Sonova Holding AG introduced two new hearing aid platforms under its main brand, Phonak: Audéo Infinio and Audéo Sphere Infinio. Audéo Sphere Infinio features proprietary dual-chip technology, including a chip that uses real-time artificial intelligence for enhanced sound processing.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Adult Hearing Aids Market will expand with rising adoption of digital and AI-enabled solutions.

- Demand for discreet and miniaturized designs will grow, driven by lifestyle preferences among younger users.

- Insurance coverage and government reimbursement programs will strengthen accessibility across income groups.

- Integration of teleaudiology platforms will support remote consultations and device adjustments, improving patient care.

- Growing geriatric population will remain the strongest driver for consistent long-term demand.

- Connectivity features linking hearing aids with smartphones and wearable devices will increase user engagement.

- Direct-to-consumer sales models and e-commerce will reshape distribution, offering greater choice and transparency.

- Rising focus on preventive healthcare will boost early adoption through awareness campaigns and wellness programs.

- Competition between global leaders and local innovators will intensify, spurring continuous product advancements.

- Expanding healthcare infrastructure in semi-urban and rural areas will create new growth opportunities for providers.