Market Overview

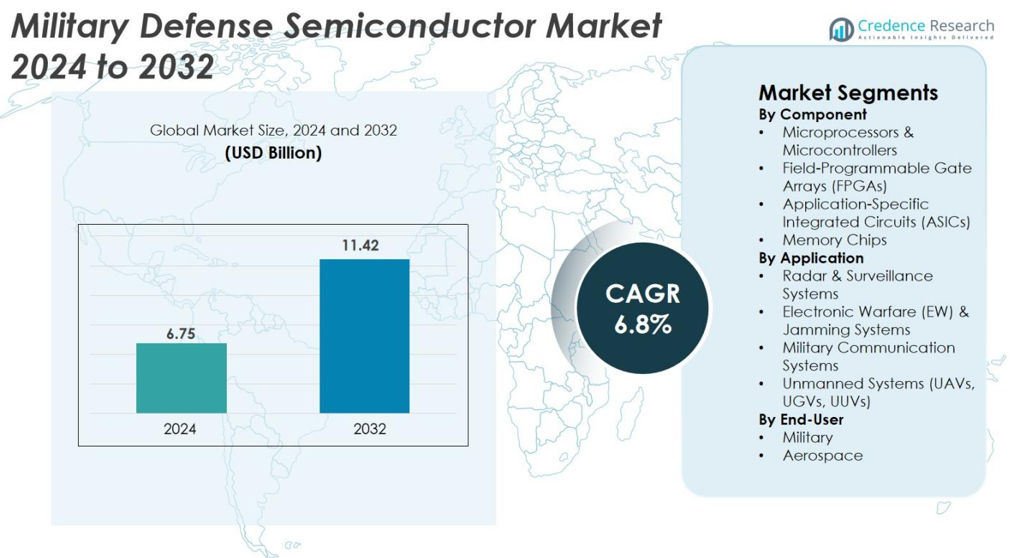

Military Defense Semiconductor market size was valued USD 6.75 Billion in 2024 and is anticipated to reach USD 11.42 Billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Military Defense Semiconductor market Size 2024 |

USD 6.75 Billion |

| Military Defense Semiconductor market, CAGR |

6.8% |

| Military Defense Semiconductor market Size 2032 |

USD 11.42 Billion |

The Military Defense Semiconductor market is driven by strong participation from global defense primes and advanced semiconductor producers. Leading companies such as Raytheon Technologies, Lockheed Martin, BAE Systems, Intel, AMD (Xilinx), NXP Semiconductors, Infineon Technologies, Texas Instruments, and Microchip Technology supply processors, FPGAs, ASICs, and ruggedized memory for radars, electronic warfare platforms, secure communication systems, and unmanned vehicles. North America remains the dominant regional market with 41% share in 2024, supported by high defense spending, domestic chip manufacturing capabilities, and continuous modernization of air, naval, and missile defense systems.

Market Insights

- The Military Defense Semiconductor market was valued at USD 6.75 Billion in 2024 and is projected to reach USD 11.42 Billion by 2032, growing at a 6.8% CAGR.

- Microprocessors and microcontrollers held the highest component share with 31%, driven by rising deployment of smart radars, electronic warfare equipment, and encrypted communication modules across modern defense systems.

- Radar and surveillance applications led the market with 34% share, supported by long-range detection programs, border monitoring, and anti-drone defense upgrades across developed and emerging nations.

- The competitive landscape features Raytheon Technologies, Lockheed Martin, BAE Systems, Intel, AMD (Xilinx), Infineon, Texas Instruments, and NXP Semiconductors focusing on AI-enabled processors, radiation-hardened chips, and secure data-processing modules.

- North America dominated with 41% share in 2024 due to strong defense spending and domestic semiconductor production, while Asia-Pacific accelerated procurement for indigenous missile defense, satellite programs, and unmanned military platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

Microprocessors and microcontrollers held the dominant share with 31% of total revenue in 2024. Defense contractors rely on these chips for mission-critical computing across radars, missiles, and secure communication units. Demand grows as armed forces shift to connected, autonomous, and software-defined platforms. FPGAs also gain traction due to real-time signal processing needs in surveillance and guidance operations. ASICs support high-speed encryption and secure data routing for next-generation command networks. Memory chips expand with rising battlefield data storage and edge analytics. The shift toward compact, high-performance defense electronics strengthens procurement across all chip categories.

- For instance, Raytheon’s AN/TPY-2 radar system uses Xilinx FPGAs to accelerate threat detection and tracking during missile defense operations.

By Application

Radar and surveillance systems accounted for the largest share at 34%. Nations invest in long-range threat detection, border monitoring, and air-defense upgrades. Semiconductors enhance target tracking, signal clarity, and low-latency imaging in hostile environments. Electronic warfare and jamming systems rise with increasing cyber-electronic threats to aircraft, satellites, and naval fleets. Military communication systems adopt secure, encrypted chipsets to support real-time command links. Unmanned platforms such as UAVs, UGVs, and UUVs accelerate semiconductor demand for navigation, obstacle sensing, and autonomous mission control. Modern digitized warfare keeps semiconductor integration essential.

- For instance, GaN-based high electron mobility transistors (HEMTs) in monolithic microwave integrated circuits used by key defense contractors power long-range radar and jamming systems with efficient RF amplification and improved signal integrity.

By End-User

The military sector led the market with 68% share due to high deployment of advanced radars, communication suites, guided weapons, and EW tools. Procurement focuses on faster processors, energy-efficient memory, and rugged FPGAs for extreme battlefield conditions. Defense modernization programs in the U.S., China, India, and Europe drive semiconductor-based system upgrades. The aerospace segment expands with avionics, satellite electronics, and flight-control systems requiring reliable radiation-hardened chips. Growth in next-generation fighter jets, drones, and space-based defense assets increases semiconductor consumption across global aerospace OEMs.

Key Growth Drivers

Rising Investment in Radar and Electronic Warfare Programs

Global defense budgets continue shifting toward radar modernization, missile defense, and digital battlefield surveillance. Nations require faster detection, better target classification, and real-time countermeasure deployment. This demand accelerates semiconductor procurement for signal processing, beam steering, and interference mitigation. Governments in the United States, Europe, China, India, and the Middle East are issuing long-term contracts for air-defense radar, coastal surveillance, and anti-drone systems. Defense OEMs integrate radiation-hardened processors, FPGAs, and high-density memory to handle large data loads. Growth of hypersonic missile detection networks also increases semiconductor use. Radar, EW, and anti-jamming initiatives will remain a core spending priority, supporting continuous chip upgrades.

- For instance, the U.S. Missile Defense Agency recently received an upgraded AN/TPY-2 radar equipped with a Gallium Nitride (GaN) semiconductor, significantly enhancing detection sensitivity and range crucial for hypersonic missile defense.

Expansion of Unmanned and Autonomous Defense Platforms

Defense agencies are scaling autonomous fleets that include UAVs, UGVs, surface vessels, and underwater drones. These platforms rely on advanced chips to support navigation, communication, obstacle recognition, and weapons integration. Semiconductor demand rises as armed forces adopt swarming drones, loitering munitions, and unmanned surveillance networks for strategic and tactical missions. Low-power microcontrollers and FPGAs support long endurance missions and real-time processing at the edge. Satellite-linked guidance, encrypted telemetry, and onboard AI accelerate chip innovation. Technology transfer from commercial robotics also speeds adoption. As future warfare becomes autonomous, defense semiconductor orders will expand across land, air, naval, and space systems.

- For instance, NVIDIA’s Jetson Orin SoM powers the A230 Vortex military AI supercomputer, delivering up to 2,048 CUDA cores and 64 Tensor cores for high-performance, low-power data processing in unmanned systems, enhancing real-time object recognition and terrain analysis.

Rapid Shift Toward Secure, High-Performance Military Communication

Modern defense communication needs ultra-secure, low-latency data links between aircraft, ground stations, satellites, and naval fleets. Semiconductor companies deliver encryption-enabled processors, secure memory, and custom ASICs to protect battlefield intelligence. Growth of network-centric warfare increases demand for high-bandwidth chips that support data fusion from sensors, radars, and command hubs. Electronic countermeasure threats push militaries to adopt anti-jamming radios and adaptive communication modules. Semiconductor suppliers design rugged, low-power chipsets for harsh military environments. As real-time connectivity becomes essential for mission decisions, semiconductor demand will intensify across command-and-control systems.

Key Trends & Opportunities

Rising Adoption of Radiation-Hardened and AI-Enabled Chips

Defense agencies need chips that resist radiation, heat, shock, and electromagnetic interference. This requirement creates opportunities for rad-hard processors, FPGAs, and memory used in missiles, satellites, and nuclear command assets. AI-enabled semiconductors are emerging for autonomous navigation, target classification, and predictive threat detection. Strong focus on edge AI means more chips performing analytics onboard drones and mobile radars instead of remote servers. As space-based defense expands, radiation-tolerant semiconductors represent a long-term revenue channel for chip manufacturers.

- For instance, BAE Systems has developed the RAD510 radiation-hardened system-on-chip using 45nm silicon-on-insulator technology, designed for reliable operation in space and missile defense applications.

Domestic Semiconductor Manufacturing and Supply Independence

Geopolitical tension and export restrictions are pushing nations to localize semiconductor production. The U.S., China, India, South Korea, and Japan are investing in fabs dedicated to defense-grade chips. Governments prefer domestic suppliers for secure communication and classified weapons platforms. This shift opens opportunities for partnerships between defense primes and semiconductor producers. Secure supply chains, lower import reliance, and national semiconductor missions will support long-term manufacturing investments.

- For instance, in India, the India Semiconductor Mission’s Cabinet approved four new semiconductor manufacturing units in Odisha, Punjab and Andhra Pradesh, supporting both advanced chip design and domestic production.

Key Challenges

Complexity of Radiation Hardening and Ruggedization

Defense electronics must survive extreme temperature, vibration, and electromagnetic exposure. Hardening these chips increases manufacturing time, production costs, and design complexity. Few global fabs can produce military-grade semiconductors at scale. Long qualification cycles delay deployment in high-speed weapons and avionics. Suppliers must balance performance, durability, and power consumption. This challenge limits new entrants and keeps supply concentrated among established vendors.

Supply Chain Disruptions and Export Controls

Semiconductor supply chains remain sensitive to geopolitical tension, trade restrictions, and raw material shortages. Export controls limit access to advanced nodes needed for defense computing and encryption. OEMs face longer lead times for high-performance chips. Dependence on a small number of global foundries increases risk. Defense agencies must stockpile or source alternatives to ensure mission readiness. These supply issues can slow modernization programs and raise overall procurement costs.

Regional Analysis

North America

North America led the Military Defense Semiconductor market with 41% share in 2024. The United States drives most demand due to strong procurement programs in radar, missile systems, and network-centric warfare. Major defense primes integrate advanced processors, AI-enabled FPGAs, and radiation-hardened chips into fighter jets, naval vessels, space assets, and battlefield communication platforms. Long-term investment under programs focused on hypersonic interceptors, electronic warfare, and unmanned systems boosts semiconductor consumption. Canada contributes through aerospace and surveillance modernization. Strong domestic chip manufacturing, research capabilities, and defense budgets keep North America a primary revenue hub.

Europe

Europe accounted for 27% of global revenue in 2024, supported by ongoing military digitalization, NATO defense upgrades, and expansion of missile defense networks. Countries such as the United Kingdom, France, Germany, and Italy procure advanced semiconductors for radar, secure communications, and EW platforms. Rising unmanned aerial fleet deployment and border surveillance demands strengthen electronics sourcing from European OEMs. The region develops rad-hard components for satellites and space missions under ESA programs. Partnerships between defense integrators and regional semiconductor manufacturers improve supply security. Modernization of air fleets and naval assets continues to sustain semiconductor purchases across Europe.

Asia-Pacific

Asia-Pacific held 22% share, driven by China, India, Japan, and South Korea investing heavily in indigenous defense manufacturing. National security programs focus on missile defense, electronic surveillance, and next-generation fighter jets, which increases semiconductor use. China accelerates domestic chip production to reduce import dependence, while Japan and South Korea supply advanced processors and sensors for naval and air platforms. India expands radar and drone procurement under “Make in India” initiatives, boosting local semiconductor assembly. Territorial conflicts and rising cybersecurity concerns push governments to adopt secure, high-performance electronic systems for land, air, and naval defense.

Middle East & Africa

The Middle East & Africa captured 6% share in 2024, influenced by military modernization across Saudi Arabia, the UAE, Israel, and Turkey. Procurement focuses on missile defense, border surveillance, anti-drone systems, and secure communication infrastructure. Demand rises for FPGAs, microcontrollers, and encrypted memory modules in air defense and command control programs. Israel leads semiconductor design and autonomous defense technology, while Gulf nations rely on international OEM partnerships. Growing drone adoption and radar upgrades strengthen chip purchases. Africa shows smaller but rising demand through surveillance and border security programs, supported by technology transfer and foreign defense collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Component

- Microprocessors & Microcontrollers

- Field-Programmable Gate Arrays (FPGAs)

- Application-Specific Integrated Circuits (ASICs)

- Memory Chips

By Application

- Radar & Surveillance Systems

- Electronic Warfare (EW) & Jamming Systems

- Military Communication Systems

- Unmanned Systems (UAVs, UGVs, UUVs)

By End-User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Military Defense Semiconductor market remains highly concentrated, with established defense contractors and leading global chip manufacturers controlling most revenue. Companies such as Raytheon Technologies, Lockheed Martin, Northrop Grumman, and BAE Systems source secure, radiation-hardened processors and FPGAs for radar, missiles, avionics, and command-and-control platforms. Semiconductor leaders including Intel, AMD, NXP Semiconductors, Texas Instruments, and Infineon supply high-performance chipsets with enhanced encryption, low-latency processing, and ruggedized designs. Continuous innovation in AI-enabled processors and edge computing strengthens competition. Long-term defense contracts, classified technology requirements, and export restrictions create high entry barriers. Firms invest in domestic manufacturing, advanced packaging, and military-grade integrated circuits to reduce supply chain risks. Growing demand for autonomous systems, satellite electronics, and electronic warfare modules encourages strategic partnerships between defense primes and chipmakers, ensuring secure production and reliable component sourcing.

Key Player Analysis

Recent Developments

- In May 2025, Infineon Technologies AG launched a new family of radiation-hardened GaN transistors (HEMT) for space and defense applications, certified to the DLA JANS standard.

- In January 2025, Teledyne HiRel Semiconductors introduced a high-power RF GaN switch (model TDSW84230EP), designed for aerospace and defense communications, with a frequency range of 30 MHz to 5 GHz.

- In October 2024, Raytheon, an RTX business, won a three-year, two-phase contract from DARPA to develop ultra-wide bandgap semiconductors (UWBGS). These semiconductors, using diamond and aluminum nitride materials, aim to enhance power delivery and thermal management in sensors and electronic applications.

- In June 2023, Lockheed Martin partnered with GlobalFoundries to strengthen the U.S. semiconductor supply chain. This collaboration aims to enhance domestic production capabilities for defense applications.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as nations expand radar, missile defense, and surveillance programs.

- Defense agencies will invest more in AI-enabled processors for autonomous platforms.

- Radiation-hardened chips will see higher adoption in space and hypersonic weapon programs.

- Secure, encrypted communication chips will become mandatory for battlefield networks.

- FPGAs and ASICs will gain traction for real-time signal processing in electronic warfare.

- Unmanned air, land, and naval fleets will push continuous semiconductor procurement.

- Domestic manufacturing programs will reduce reliance on foreign chip suppliers.

- Next-generation fighter jet and drone development will increase procurement of rugged processors.

- Edge computing will shift analytics from command centers to onboard mission systems.

- Strategic partnerships between defense contractors and chipmakers will accelerate long-term innovation.