Market Overview:

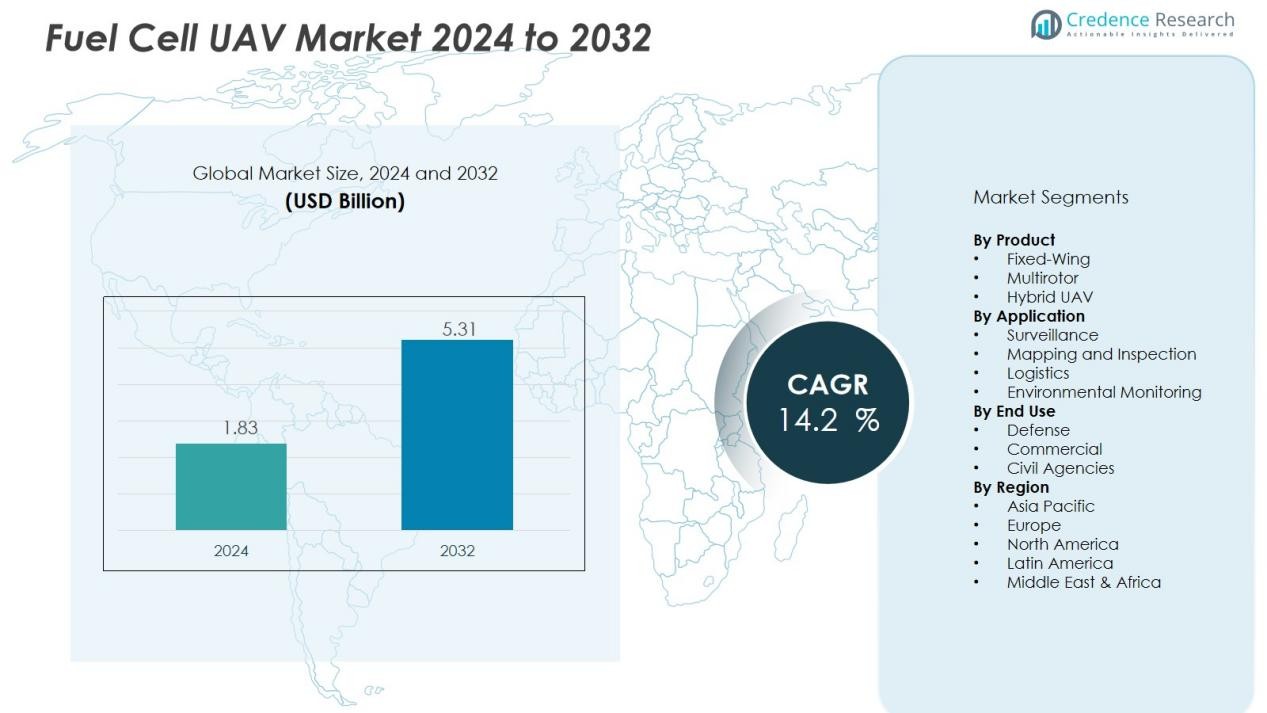

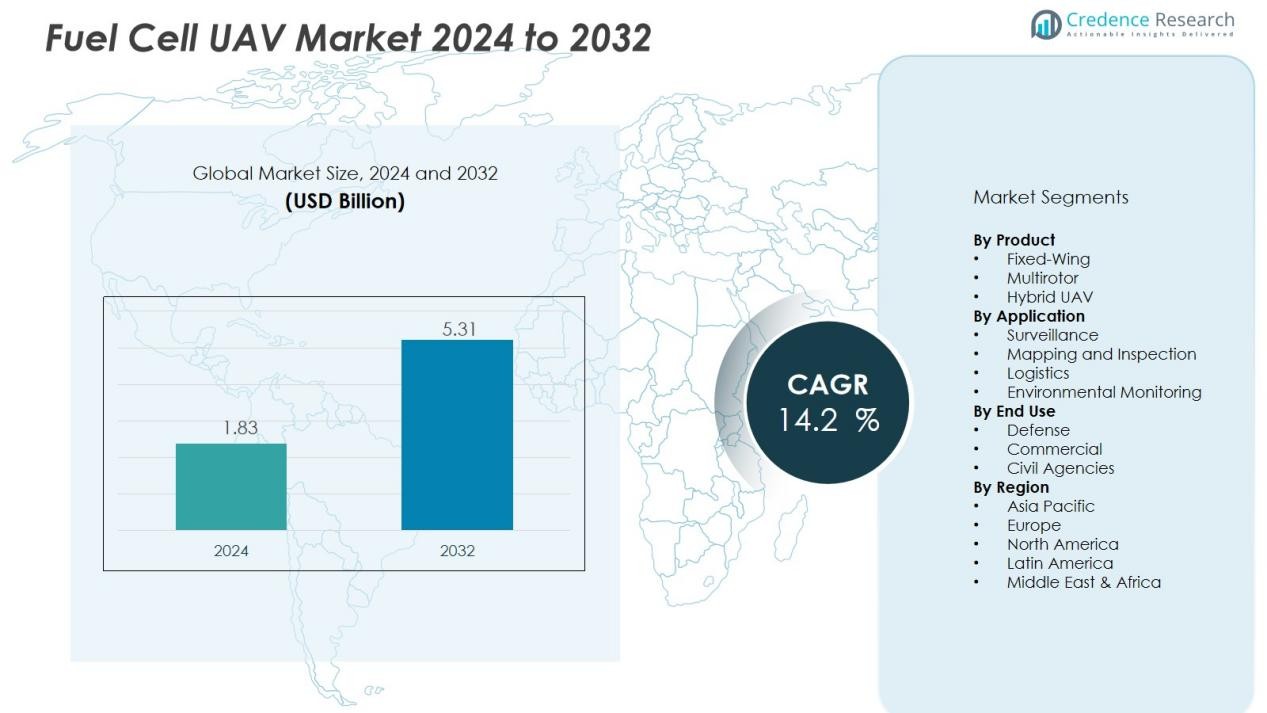

The Fuel Cell UAV Market size was valued at USD 1.83 billion in 2024 and is anticipated to reach USD 5.31 billion by 2032, at a CAGR of 14.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fuel Cell UAV Market Size 2024 |

USD 1.83 Billion |

| Fuel Cell UAV Market, CAGR |

14.2% |

| Fuel Cell UAV Market Size 2032 |

USD 5.31 Billion |

Key drivers include rising interest in clean propulsion and longer operational range. Fuel-cell platforms offer quieter operation and reduced emissions, which attract defense, logistics, and environmental agencies. Demand grows as operators seek reliable power for mapping, surveillance, and delivery tasks. Advancements in hydrogen storage, refill stations, and compact stacks also boost sector momentum. Corporate partnerships further strengthen system performance and commercial rollout.

Regional adoption varies across major markets. North America leads due to strong defense funding and faster integration in commercial fleets. Europe expands rapidly because of strict emission targets and strong interest in green aviation systems. Asia-Pacific gains traction through drone delivery pilots, industrial inspection needs, and supportive policies. Emerging regions show rising interest as infrastructure projects and environmental monitoring programs grow. This global spread ensures broad deployment and sustained market development.

Market Insights:

- The Fuel Cell UAV Market reached USD 1.83 billion in 2024 and is set to hit USD 5.31 billion by 2032, supported by a 14.2% CAGR driven by clean propulsion demand and longer endurance requirements.

- North America holds 38% share due to strong defense funding and mature hydrogen programs, while Europe holds 29% share backed by strict emission policies, and Asia-Pacific holds 25% share supported by large-scale trials.

- Asia-Pacific stands as the fastest-growing region with 25% share supported by drone delivery pilots, industrial inspection needs and national hydrogen incentives.

- Fixed-wing platforms account for the leading product share due to long-endurance missions required in surveillance and infrastructure inspection.

- Surveillance applications hold the highest share in the application mix, supported by demand from defense, utilities and environmental agencies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Extended Flight Endurance Driven by High Energy Density

Fuel Cell UAV Market growth benefits from strong demand for longer missions. Operators rely on hydrogen fuel cells for higher energy density than lithium-ion systems. This capability allows aircraft to cover larger areas during surveillance or inspection tasks. It supports fixed-wing and multirotor platforms that require stable output over long periods. The technology delivers extended uptime that enhances operational efficiency.

- For instance, Aurora Flight Sciences’ SKIRON-XLE achieved 7.0 hours of continuous flight time on hydrogen fuel, compared to the battery-operated SKIRON-X variant’s 3.5-hour endurance.

Increasing Adoption Across Defense and Security Agencies

Defense forces expand trials of fuel-cell drones to improve mission flexibility. Fuel Cell UAV Market demand grows as agencies seek quieter aircraft with low thermal signatures. These features support border patrol, tactical surveillance, and critical reconnaissance. It provides reliable performance in remote environments where rapid refueling is essential. Government funding strengthens R&D programs targeting safer and lighter stacks.

- For Instance, Certain hydrogen fuel cell VTOL drones, such as the Heven H2D250, have achieved flight durations exceeding eight hours per mission, extending operational windows compared to battery-only models. The MMC UAV Griflion H VTOL model can reportedly achieve flights of up to 15 hours without a payload.

Rising Commercial Use in Logistics, Mapping and Industrial Inspection

Enterprises deploy fuel-cell platforms to gain longer flight cycles for high-value tasks. Fuel Cell UAV Market adoption rises in logistics networks that require consistent delivery operations. Survey and inspection companies rely on long endurance to reduce downtime between missions. It supports wind turbine checks, pipeline routes, and large-scale land mapping. Growth continues with rising demand for reliable clean-power systems.

Strong Investment in Hydrogen Infrastructure and System Innovation

Hydrogen production and refueling networks expand, improving viability for drone fleets. Fuel Cell UAV Market advancement accelerates with compact stacks, safer tanks, and lighter components. Partnerships between energy firms and UAV manufacturers create faster development cycles. It benefits from improved storage systems that support quick turnaround between flights. Industry suppliers focus on durability to enhance long-term deployment.

Market Trends:

Shift Toward Long-Endurance and High-Payload UAV Platforms

Fuel Cell UAV Market operators emphasize platforms that handle heavier payloads without reduced range. Many users upgrade fleets to support sensors for surveillance, mapping and inspection tasks. It enables missions that require advanced optics, LiDAR or communication systems. Long-endurance demand grows in defense, energy, and transportation sectors. Manufacturers invest in lighter stacks to increase thrust efficiency. Hydrogen storage designs improve reliability for long-distance routes. These developments support consistent expansion of high-performance UAV fleets.

- For instance, cite a company that announced a payload uplift or range maintenance enabled by a fuel-cell architecture, with one precise figure.

Integration of Hydrogen Ecosystems and Autonomous Flight Technologies

Fuel Cell UAV Market growth aligns with broader hydrogen ecosystem development. Companies work with fuel suppliers to build compact refueling units for field operations. It benefits operators that require fast turnaround times. Autonomous navigation systems gain higher adoption to improve mission accuracy and reduce pilot load. AI-based diagnostics support predictive maintenance and enhance flight safety. Software platforms streamline route planning for complex industrial tasks. This convergence of hydrogen and automation strengthens commercial and defense use cases.

- For Instance, autonomous navigation and AI-based diagnostics are being integrated to improve mission accuracy, as demonstrated by ZeroAvia’s ZA2000 platform integrating onboard AI processors to monitor stack health in real time.

Market Challenges Analysis:

High Infrastructure Cost and Limited Hydrogen Availability

Fuel Cell UAV Market faces constraints linked to hydrogen supply and storage gaps. Many regions lack compact refueling units that support field deployment. It forces operators to depend on customized stations that raise project cost. Fuel transport rules restrict movement of high-pressure cylinders and slow adoption. Storage cylinders also require strict handling protocols that increase operational burden. Technical teams need specialized training to maintain pressure systems safely. These factors limit rapid expansion across commercial fleets.

Complex System Design and High Upfront Integration Cost

Fuel Cell UAV Market contends with engineering challenges tied to stack durability and weight. Many platforms struggle to balance payload capacity with fuel-cell cooling needs. It pushes manufacturers to invest in costly materials and thermal systems. Certification adds long approval cycles for defense and commercial missions. Repair work demands skilled teams that understand stack behavior under different loads. Limited vendor ecosystems slow innovation for small operators. These issues raise lifecycle cost and reduce broad market penetration.

Market Opportunities:

Expansion in Long-Range Industrial and Environmental Applications

Fuel Cell UAV Market gains strong opportunity in sectors that require long-range operations. Energy firms need reliable aerial platforms for pipeline routes and wind farm inspections. It supports missions in remote areas where battery drones fall short. Environmental agencies plan wider use for wildlife tracking and coastal monitoring. Longer endurance opens new roles in disaster support and emergency response. Refueling speed also creates value for agencies that run multiple flights per day. These conditions strengthen long-term commercial demand.

Growth Potential Through Hydrogen Ecosystem Development and Defense Programs

Fuel Cell UAV Market benefits from global investment in hydrogen production and storage networks. Many governments expand hydrogen roadmaps that include mobile refueling solutions for UAV fleets. It creates a clear path for scalable deployments across large industries. Defense programs present another strong opportunity through adoption of quiet, low-emission platforms. Military units seek aircraft with longer mission time and strong reliability. Vendors that offer integrated stacks and onboard diagnostics gain competitive advantage. Rising demand for clean propulsion supports future platform innovation.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Fuel Cell UAV Market growth reflects rising demand for fixed-wing, multirotor and hybrid platforms. Fixed-wing aircraft gain strong interest due to long-endurance missions in defense and industrial inspection. Multirotor models remain preferred for short takeoff needs and precise maneuver tasks. Hybrid platforms combine stability and range, which helps operators cover wider routes. It supports diverse mission profiles that require high energy density, quick refueling and stable performance in remote areas.

- For instance, ZeroAvia’s documented achievement in early 2025 demonstrated a 1.0 kW/kg specific net power in its LTPEM fuel cell architecture within a 150 kW net power configuration, enabling longer-endurance UAV applications.

By Application

Fuel Cell UAV Market adoption increases across surveillance, mapping, logistics and environmental assessment. Surveillance remains a leading use case due to long flight duration and low acoustic signatures. Mapping and inspection teams rely on fuel-cell systems to cover large industrial sites without frequent downtime. Logistics operators adopt these platforms to support time-critical delivery tasks in rural locations. It strengthens commercial interest among companies that value reliable propulsion and longer mission capability.

- For Instance, Intelligent Energy develops hydrogen fuel cells for Unmanned Aerial Vehicles (UAVs), which are known to offer significantly longer flight times compared to traditional battery power. Fuel cells can extend multirotor drone endurance to hours, rather than minutes, with some large fixed-wing hydrogen fuel cell drones capable of flying for over 24 hours.

By End Use

Fuel Cell UAV Market expansion spans defense, commercial and civil agencies. Defense units deploy fuel-cell aircraft for tactical reconnaissance and border monitoring due to quiet operation and strong endurance. Commercial users in energy, construction, and mining invest in these systems to optimize inspection workflows. Civil agencies adopt the technology for disaster assessment, environmental monitoring and public safety missions. It improves operational continuity and supports broader integration into national drone programs.

Segmentations:

By Product

- Fixed-Wing

- Multirotor

- Hybrid UAV

By Application

- Surveillance

- Mapping and Inspection

- Logistics

- Environmental Monitoring

By End Use

- Defense

- Commercial

- Civil Agencies

By Regions

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leadership Driven by Defense and Hydrogen Programs

North America holds 38% share and reflects steady expansion in defense and commercial use. The region benefits from strong federal funding that accelerates adoption of long-endurance platforms. Fuel Cell UAV Market growth aligns with large-scale trials in surveillance and border monitoring. It gains further strength from active hydrogen roadmaps supported by energy departments and private investors. Commercial users in utilities and oil and gas sectors deploy systems for long-range inspection. Manufacturers in the United States lead innovation in compact stacks and lightweight tanks. Strong regulatory support encourages wider deployment across sensitive airspace.

Europe Growth Supported by Emission Policies and Industrial Demand

Europe secures 29% share and shows strong alignment with environmental and efficiency goals. Strict emission rules push industry users to shift toward clean propulsion solutions. The region invests in hydrogen corridors that improve refueling access for drone fleets. It benefits from collaborations between aerospace firms and energy providers that enhance reliability. Industrial operators across utilities, infrastructure and renewables adopt long-endurance models for high-frequency inspection needs. Cross-border initiatives support integration of fuel-cell aircraft into regional drone corridors. Stable funding programs strengthen long-term development.

Asia-Pacific Expansion Enabled by Large-Scale Trials and Policy Support

Asia-Pacific holds 25% share and marks rapid adoption in logistics, mapping and public safety tasks. Several countries run national-level drone programs that include hydrogen propulsion. It gains strong traction through high demand for long-range missions in energy, mining and agriculture. Local manufacturers scale stack production to support competitive pricing and faster deployment. Government incentives encourage investment in hydrogen storage and mobile refueling units. National agencies deploy fuel-cell aircraft for environmental monitoring and emergency response. This momentum positions the region as a major growth engine for future deployment.

Key Player Analysis:

- AeroVironment

- Aurora Flight Sciences

- Doosan Mobility Innovation

- Elbit Systems

- FlightWave Aerospace

- Hylium Industries

- ISS Group

- MMCUAV

Competitive Analysis:

The Fuel Cell UAV Market shows strong competition led by established aerospace and hydrogen-technology players. Key companies include AeroVironment, Aurora Flight Sciences, Doosan Mobility Innovation, Elbit Systems, and FlightWave Aerospace, each driving innovation in endurance, safety and stack performance. It benefits from firms that focus on compact hydrogen storage, lightweight materials and advanced propulsion designs.

AeroVironment and Aurora Flight Sciences expand portfolios with long-range platforms targeting defense and industrial users. Doosan Mobility Innovation builds momentum through proven hydrogen systems that support rapid field refueling. Elbit Systems strengthens its position through tactical UAV programs with strong global demand. FlightWave Aerospace focuses on durable multirotor platforms engineered for inspection and mapping operations. Manufacturers invest in partnerships with hydrogen suppliers to secure scalable refueling solutions.Continuous R&D supports higher flight efficiency and stronger system reliability across commercial and defense applications.

Recent Developments:

- In June 2025, AeroVironment signed a memorandum of understanding with UAS Denmark Test Center for collaboration on uncrewed aircraft system demonstrations and mission training.

- In November 2024, Aurora Flight Sciences was awarded a major NASA contract for research on aviation technologies to reduce environmental emissions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End Use and Regions. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Hydrogen infrastructure expansion will support wider deployment of long-endurance UAV fleets.

- Defense agencies will increase procurement of quiet, low-signature platforms for tactical missions.

- Commercial users will adopt fuel-cell drones for inspection of pipelines, grids and large industrial assets.

- Refueling systems will become lighter and safer, enabling faster turnaround for field operations.

- AI-based flight control and diagnostics will improve reliability and reduce maintenance delays.

- Environmental agencies will expand use for wildlife surveys, coastal monitoring and disaster assessment.

- Logistics networks will test long-range delivery routes in remote and hard-to-access regions.

- Manufacturers will develop hybrid designs that combine fuel cells with high-efficiency batteries.

- Global hydrogen roadmaps will encourage integration of UAVs into broader clean-energy strategies.

- Partnerships among aviation firms, hydrogen suppliers and public agencies will accelerate commercial scaling.

Market Segmentation Analysis:

Market Segmentation Analysis: