Market Overview:

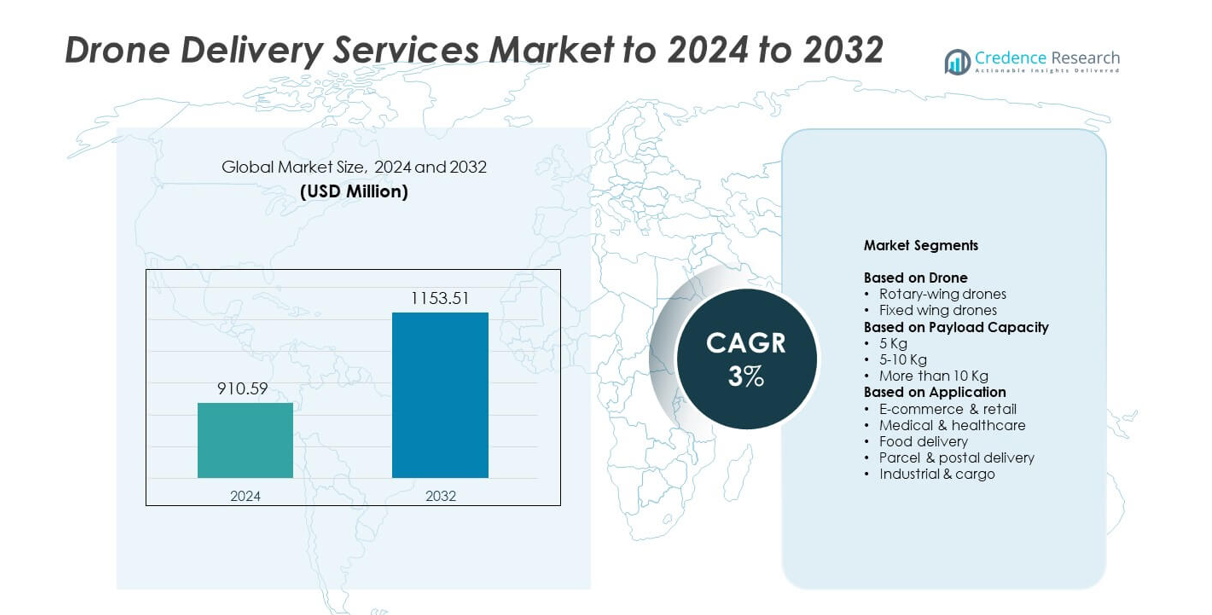

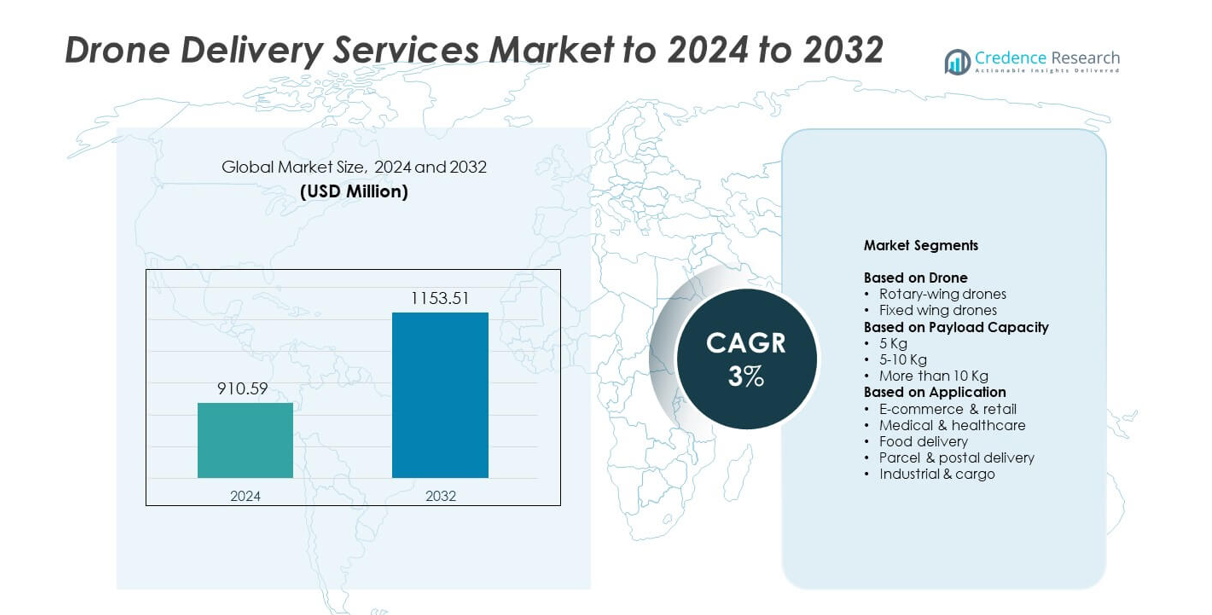

Drone Delivery Services Market size was valued at USD 910.59 Million in 2024 and is anticipated to reach USD 1153.51 Million by 2032, at a CAGR of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Delivery Services Market Size 2024 |

USD 910.59 Million |

| Drone Delivery Services Market, CAGR |

3% |

| Drone Delivery Services Market Size 2032 |

USD 1153.51 Million |

The Drone Delivery Services Market features major players including Wingcopter, UPS Flight Forward, Joby Aviation, Flytrex, Amazon Prime Air, Manna, Zipline, Wisk Aero, DroneUp, Matternet, Elroy Air, and Wing, each advancing autonomous delivery capabilities across commercial and medical sectors. These companies expand operational networks with stronger flight systems and improved payload efficiency. North America leads the market with a 33.11% share in 2024, supported by mature e-commerce infrastructure and favourable regulatory progress. Europe follows with about 30%, while Asia Pacific holds nearly 20%, driven by rapid digital adoption and government-backed drone programs.

Market Insights

- Drone Delivery Services Market reached USD 910.59 Million in 2024 and will hit USD 1153.51 Million by 2032 at a 3% CAGR.

- Demand rises due to fast last-mile needs, and rotary-wing drones lead the segment with about 68% share because they support precise landings and dense-route operations.

- Key trends include expansion of hybrid long-range models, growing medical logistics adoption, and wider testing of autonomous systems across busy urban corridors.

- Competitive intensity increases as major players scale fleets, focus on high-endurance platforms, and secure regulatory approvals that improve operational reach.

- North America leads with a 33.11% share, followed by Europe at 30% and Asia Pacific at 20%, while the up to 5 kg payload class dominates capacity distribution with nearly 54% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drone

Rotary-wing drones lead this segment with about 68% share in 2024. Rotary-wing models dominate due to strong hovering ability, vertical takeoff, and precise landing in tight areas. These features support last-mile delivery for e-commerce, food, and urgent medical supplies. Fixed-wing drones grow at a steady pace because they offer longer flight range and higher energy efficiency, but adoption remains lower for dense urban routes. Demand for flexible delivery fleets and rising use of automated flight systems drive the continued preference for rotary-wing platforms.

- For instance, the rotary-wing (multirotor) type led the small drone market, securing a revenue share of 60.6% in 2023, driven by superior maneuverability and Vertical Takeoff and Landing (VTOL) operations.

By Payload Capacity

The up to 5 kg category holds the largest share at nearly 54% in 2024. This range dominates because most e-commerce parcels, medical kits, and food orders fall within this weight class. Lightweight drones offer lower operating cost, shorter charging time, and stronger regulatory acceptance, which strengthens their use in large-scale delivery networks. The 5–10 kg and above 10 kg classes gain attention for industrial and cargo tasks, yet adoption stays slower due to higher battery demand and route restrictions for heavy loads.

- For instance, the less than 2 kg payload class accounted for 44.6% of the drone package delivery market revenue in 2022.

By Application

E-commerce and retail remain the dominant application with about 46% share in 2024. Strong parcel volumes, rapid-delivery expectations, and expansion of urban fulfillment hubs support this leadership. Retailers use drones to cut delivery time, reduce labor cost, and reach remote areas faster. Medical and healthcare delivery grows quickly due to rising demand for urgent transport of blood units, samples, and medicines. Food, parcel, and industrial delivery segments continue to expand, but they trail e-commerce due to limited route approvals and controlled airspace rules

Key Growth Drivers

Rising Demand for Faster Last-Mile Delivery

Consumers expect quicker deliveries, and drone fleets help meet that expectation. Retailers use drones to cut road delays and reduce human-based logistics. Faster routes support e-commerce growth and make short-distance delivery more predictable. More companies adopt automated paths that handle small parcels with high speed. This shift boosts market expansion as businesses aim for faster service. Strong focus on tight delivery windows strengthens drone uptake.

- For instance, Wing (Alphabet’s drone unit) reports completing more than 500,000 residential deliveries across three continents, with a fastest recorded delivery time of 2 minutes 47 seconds.

Expansion of Medical and Emergency Logistics

Healthcare networks use drones to move blood units, samples, and medicines quickly. This rapid movement reduces transport delays and supports critical care needs. Drone access to remote areas improves emergency response times and supports rural clinics. Governments approve wider use for urgent medical transfers, which increases deployment. Hospitals adopt drones to improve reliability and lower delivery risks. These benefits drive strong demand across healthcare networks.

- For instance, Zipline states that as of March 2025, its drones had completed over 1.4 million commercial deliveries and flown over 100 million autonomous miles across four continents for medical and other essential supplies

Advancements in Navigation and Autonomous Systems

New sensors and automated flight tools improve safety and route accuracy. Better obstacle detection reduces collision risks and supports dense urban usage. AI-based systems enable stable tracking and reduce pilot involvement. Enhanced battery tools extend flight time and support longer routes. These improvements attract large operators and make fleets more efficient. Strong investment in autonomous systems strengthens market growth.

Key Trends & Opportunities

Growing Integration of Hybrid and Long-Range Drones

Companies test hybrid platforms that mix rotary agility with fixed-wing range. These designs help cover longer distances and reduce charging gaps. Wider use of long-range flights supports medical, postal, and rural supply networks. Better endurance creates new delivery corridors across suburban regions. Operators explore new service models built on extended-reach routes. This shift opens opportunities for large-scale logistics networks.

- For instance, Wingcopter’s 178 Heavy Lift set a Guinness world speed record of 240.6 km/h for a remote-controlled tilt-rotor aircraft, while the newer Wingcopter 198 can deliver up to three packages in one flight with a combined payload of 5 kg and ranges up to 75 km with full payload.

Development of Dedicated Drone Delivery Corridors

Airspace regulators plan controlled lanes for commercial drone flights. These lanes reduce conflict with manned aircraft and improve route reliability. Structured corridors support frequent deliveries in crowded cities. More approved paths allow operators to scale their fleets faster. Local governments adopt drone-friendly policies for planned transport zones. These steps unlock major growth in organized delivery networks.

- For instance, Wing and Walmart launched drone delivery from two stores in the Dallas–Fort Worth metroplex, giving the network the ability to reach about 60,000 homes within the approved operating area under FAA rules.

Key Challenges

Strict Regulatory Approvals and Operational Limits

Drone operators face long approval processes across many regions. Flight rules change often, creating planning issues for service providers. Night flights or beyond-line-of-sight routes remain limited in several countries. These rules slow expansion and raise compliance costs. Companies must adapt to evolving standards and reporting duties. Such restrictions reduce speed of large-scale deployment.

Short Flight Duration and Payload Restrictions

Battery limits reduce range and cut useful delivery time. Heavy loads drain power faster and restrict coverage areas. This reduces suitability for long routes or bulky parcels. Operators need more charging hubs to support current fleets. Flight limits increase operating cost and make scaling harder. These constraints slow adoption in high-volume delivery environments.

Regional Analysis

North America

In 2024, North America held approximately 33.11% of the global drone delivery services market. The region benefits from mature e-commerce networks and established regulatory frameworks that support commercial drone flights. Strong presence of key players and investment into infrastructure accelerate adoption of drone logistics. This leadership position is reinforced by the region’s technological readiness and favourable airspace management, which enable scaling of delivery operations faster than many other markets.

Europe

Europe captured around 30% of the drone delivery services market in 2024. The region’s growth is supported by solid urban fulfilment networks and proactive regulatory efforts across countries like the UK and Germany. A growing number of pilot projects with logistics providers are driving commercial drone usage. While growth is robust, deployment varies significantly between Western and Eastern Europe due to infrastructure and regulatory maturity differences.

Asia Pacific

The Asia Pacific region accounted for roughly 20% of the global market in 2024. Rapid urbanisation, expanding e-commerce sectors and government initiatives in countries such as China and Australia propel growth in this region. Nevertheless, regulatory fragmentation and varying infrastructure quality across nations present execution challenges. Asia Pacific emerges as a high-potential market for long-term growth in drone delivery services.

Middle East & Africa

In 2024, the Middle East & Africa region held approximately 5% of the global drone delivery services market. The region’s growth is driven by the need for innovative logistics solutions in remote areas and rising investment in drone applications such as healthcare and industrial supply chains. Infrastructure and regulatory ecosystems are less developed compared with major markets, which limits scale for now but offers future opportunity.

Latin America

Latin America contributed an estimated 12% of the global drone delivery services market in 2024. The region’s expanding online retail sector, combined with logistics challenges in urban and rural areas, supports demand for drone-based solutions. However, inconsistent regulatory frameworks and infrastructure gaps restrict rapid roll-out of services. Over time, greater investment and regulatory clarity could unlock significant growth for the region.

Market Segmentations:

By Drone

- Rotary-wing drones

- Fixed wing drones

By Payload Capacity

- 5 Kg

- 5-10 Kg

- More than 10 Kg

By Application

- E-commerce & retail

- Medical & healthcare

- Food delivery

- Parcel & postal delivery

- Industrial & cargo

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Drone Delivery Services Market features key players such as Wingcopter, UPS Flight Forward, Joby Aviation, Flytrex, Amazon Prime Air, Manna, Zipline, Wisk Aero, DroneUp, Matternet, Elroy Air, and Wing. Competition intensifies as companies expand delivery routes, enhance autonomous flight systems, and invest in high-endurance drones to support long-distance operations. Firms focus on lowering operational costs through improved battery efficiency and optimized fleet management software. Partnerships with retailers, healthcare providers, and logistics networks strengthen market penetration, while regulatory approvals remain central to competitive advantage. Companies also accelerate testing of heavy-payload platforms and hybrid designs to unlock new commercial use cases. Emerging players concentrate on niche applications such as rural healthcare logistics or industrial supply routes, creating a diverse and evolving market environment. The industry continues to shift toward scalable delivery ecosystems, where reliability, safety, and route approvals drive long-term leadership

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wingcopter

- UPS Flight Forward

- Joby Aviation

- Flytrex

- Amazon Prime Air

- Manna

- Zipline

- Wisk Aero

- DroneUp

- Matternet

- Elroy Air

- Wing

Recent Developments

- In 2025, Flytrex partnered with DoorDash to initiate drone delivery services in the Dallas-Fort Worth metropolitan area, offering deliveries from multiple local and national restaurant chains.

- In 2022, Wing, a subsidiary of Google’s parent company Alphabet, initiated public demonstration services in Lusk, a suburb of Dublin, Ireland, as its first step into the Irish market and an expansion of its operational reach in Europe

- In 2022, Amazon announced the new, quieter, and smaller MK30 drone, which is designed to replace older models and has a planned deployment in the US, Italy, and the UK by the end of 2024

Report Coverage

The research report offers an in-depth analysis based on Drone, Payload Capacity, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Drone delivery networks will expand across more urban and suburban routes as approvals increase.

- Autonomous flight systems will reduce human involvement and improve delivery accuracy.

- Heavy-payload drones will gain wider use as battery density and endurance improve.

- Retailers will integrate drone fleets with warehouses to speed up last-mile logistics.

- Medical transport demand will rise as hospitals adopt faster emergency supply delivery.

- Regional drone corridors will support safer and more frequent commercial operations.

- Hybrid drone designs will enable longer routes and lower operational downtime.

- Charging hubs and rooftop landing stations will grow across dense cities.

- Cross-border drone logistics will emerge as airspace rules harmonize.

- Competition will intensify as more tech and logistics firms launch dedicated drone programs.