| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Industrial Fasteners Market Size 2024 |

USD 6547.56 Million |

| Germany Industrial Fasteners Market, CAGR |

6.7% |

| Germany Industrial Fasteners Market Size 2032 |

USD 11002.06 Million |

Market Overview:

The Germany Industrial Fasteners Market is projected to grow from USD 6547.56 million in 2024 to an estimated USD 11002.06 million by 2032, with a compound annual growth rate (CAGR) of 6.7% from 2024 to 2032.

Key drivers propelling the growth of the Germany Industrial Fasteners Market include the increasing demand from the automotive and construction industries, which rely heavily on fasteners for assembly and structural applications. The automotive sector’s emphasis on lightweight materials and stringent safety standards has spurred innovation in fastener design and materials. Additionally, advancements in manufacturing technologies, such as automation and robotics, have heightened the need for precision fasteners. There is also a growing trend towards the use of corrosion-resistant and eco-friendly materials, aligning with sustainability initiatives in various industries. The rising demand for fasteners in renewable energy sectors, such as wind and solar power installations, also contributes to the market’s expansion. Moreover, the focus on improving operational efficiency and reducing material waste in manufacturing processes further accelerates the adoption of advanced fastening solutions.

Germany holds a significant share of the European industrial fasteners market, driven by its strong industrial base and advanced manufacturing capabilities. The country’s position as a key player in the automotive, aerospace, and machinery industries further boosts the demand for high-quality fasteners. Germany’s export activities also play a vital role; in 2023, German fastener exports were valued at around €8.1 billion, with the United States, China, and France being major destinations. This export strength reflects Germany’s competitive edge in producing high-quality fasteners tailored to international standards. Additionally, Germany’s commitment to Industry 4.0 and its strong manufacturing infrastructure provide an ideal environment for the continued growth of the fasteners market. The robust supply chain and the presence of numerous key manufacturers further contribute to the country’s dominance in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Industrial Fasteners Market is expected to grow from USD 6547.56 million in 2024 to USD 11002.06 million by 2032, with a CAGR of 6.7% during the forecast period.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- The automotive and construction industries are significant drivers of the market, with increasing demand for high-performance fasteners for vehicle assembly, lightweight materials, and infrastructure projects.

- Technological advancements in manufacturing, such as automation and robotics, are improving precision and efficiency in fastener production, driving the need for advanced fastening solutions.

- Sustainability is a growing trend, with manufacturers focusing on eco-friendly fasteners made from recyclable materials and meeting environmental standards, particularly in the renewable energy sector.

- Germany’s position as a global leader in manufacturing, particularly in automotive, aerospace, and machinery industries, contributes to its strong export market and continued demand for high-quality fasteners.

- Rising raw material costs, such as steel and aluminum, create challenges in maintaining competitive pricing and profitability for fastener manufacturers in Germany.

- Intense price competition from low-cost manufacturers, especially from countries like China and India, pressures German companies to balance quality and cost efficiency.

Market Drivers:

Rising Demand from Automotive and Construction Sectors

The Germany Industrial Fasteners Market is significantly driven by the growing demand from the automotive and construction industries. As a global leader in automotive manufacturing, Germany has a high demand for precision fasteners used in vehicle assembly and component manufacturing. With the increasing adoption of electric vehicles (EVs) and the shift towards lightweight automotive materials, fasteners designed for these applications are becoming increasingly sophisticated. For example, Bossard supplies bolts made from advanced materials like titanium and high-strength steel to meet automakers’ requirements for reduced weight, high tensile strength, and corrosion resistance. In parallel, the construction sector in Germany is witnessing a surge in infrastructure projects, such as commercial buildings, transportation networks, and residential complexes. These projects require durable, high-performance fasteners to ensure structural integrity and safety, further fueling the demand for industrial fasteners.

Technological Advancements and Automation

Technological innovation in manufacturing processes is another key driver for the growth of the fasteners market in Germany. The integration of automation and robotics in production lines has elevated the precision and efficiency of fastener manufacturing. Fasteners from the FLEXITOL® product family, for example, are engineered to compensate for manufacturing tolerances or decouple vibrations in automotive body parts. As industries demand higher quality, precision-engineered products, the need for advanced fastening solutions is becoming more critical. Moreover, the ongoing advancements in material science, such as the development of corrosion-resistant, high-strength, and lightweight fasteners, are enabling manufacturers to meet the stringent requirements of various sectors. These innovations are facilitating the growth of the industrial fasteners market by offering improved performance and longer lifespans for fasteners used in harsh environments.

Sustainability and Eco-Friendly Solutions

The growing emphasis on sustainability and environmental responsibility is playing an important role in shaping the demand for fasteners in Germany. Companies are increasingly opting for eco-friendly fastening solutions that align with their sustainability goals. The rise of renewable energy sectors, including wind and solar energy projects, is further promoting the use of specialized fasteners for installations in challenging environments. Manufacturers are increasingly focusing on creating fasteners made from recyclable materials and those that meet stringent environmental standards. This shift towards sustainability is not only helping to reduce the ecological footprint of manufacturing processes but also opening new market opportunities for fastener suppliers that offer environmentally friendly products.

Global Market Expansion and Export Demand

Germany’s strategic position in the global manufacturing ecosystem and its focus on export-driven growth contribute significantly to the demand for industrial fasteners. As one of the largest exporters of industrial fasteners globally, Germany benefits from robust international trade relationships. The automotive, aerospace, and construction sectors, which are the primary consumers of fasteners, are increasingly relying on German manufacturers for high-quality products. Germany’s commitment to meeting international quality standards and its competitive pricing structure have enabled it to maintain a strong presence in global markets. Furthermore, Germany’s focus on innovation and continuous product development positions its fastener manufacturers as leaders in both European and international markets, contributing to the market’s continued growth.

Market Trends:

Shift Towards Lightweight and High-Strength Materials

A notable trend in the Germany Industrial Fasteners Market is the growing demand for lightweight and high-strength materials in manufacturing processes, particularly in the automotive and aerospace sectors. For instance, Bossard manufactures bolts using advanced materials such as titanium and high-strength steel, specifically designed to reduce weight while maintaining high tensile strength and corrosion resistance for automotive applications. As industries strive to meet energy efficiency and performance standards, fasteners are being designed to accommodate new materials like aluminum, composites, and high-strength alloys. This shift is particularly significant in the automotive industry, where the trend towards electric vehicles (EVs) is increasing the need for lighter vehicle parts. These advanced materials require specialized fasteners that can maintain strength and durability while reducing weight, thus driving innovation and product development within the fasteners market in Germany.

Increased Integration of Smart Technologies

The integration of smart technologies in industrial fasteners is another emerging trend in the German market. With the rise of Industry 4.0 and the Industrial Internet of Things (IIoT), there is a growing emphasis on creating fasteners that can communicate data and monitor performance in real-time. These “smart” fasteners are equipped with sensors to track load, stress, and environmental conditions, providing valuable insights for predictive maintenance and operational efficiency. This technological advancement is helping industries optimize their manufacturing processes and reduce downtime by enabling proactive maintenance of machinery and infrastructure. The adoption of smart fasteners is gradually expanding, particularly in industries such as aerospace and manufacturing, where reliability and precision are critical.

Focus on Sustainability and Green Manufacturing

Sustainability continues to be a key trend influencing the Germany Industrial Fasteners Market. As manufacturers increasingly focus on reducing their environmental impact, there is a growing demand for eco-friendly fasteners made from recyclable materials or produced using sustainable manufacturing processes. For instance, companies such as ARNOLD UMFORMTECHNIK have implemented initiatives like the “ACO2 Save” program, which helps users reduce CO2 emissions by developing sustainable fastening solutions and cold-formed parts. Additionally, the adoption of greener coatings, such as eco-friendly zinc coatings, is on the rise as companies look to reduce the environmental footprint of their products. This trend is in line with the broader European Union goals of reducing carbon emissions and promoting circular economy practices. Companies in Germany are aligning their product development strategies to ensure that their fasteners are not only durable and high-performing but also environmentally sustainable.

E-commerce and Online Retail Channels

The rise of e-commerce and online retail channels is also transforming the Germany Industrial Fasteners Market. While traditional distribution methods remain dominant, the increasing availability of industrial fasteners through online platforms is providing manufacturers and consumers with greater convenience and accessibility. This trend is particularly beneficial for small to medium-sized enterprises (SMEs) that can now access a broader range of fastener products without the need for large-scale procurement processes. Online platforms are also offering more customization options, allowing customers to select specific fasteners based on their unique requirements. As digital transformation continues to impact industrial sectors, the adoption of online sales channels is expected to increase, enhancing product accessibility and customer service.

Market Challenges Analysis:

High Raw Material Costs

One of the primary restraints impacting the Germany Industrial Fasteners Market is the volatility in raw material costs. The prices of essential raw materials such as steel, aluminum, and other alloys can fluctuate significantly due to global supply chain disruptions, geopolitical tensions, and changes in demand. For instance, German fastener manufacturers have faced a sharp increase in material costs over the past 1.5 years, particularly for steel and aluminum, which has significantly squeezed profit margins and complicated pricing strategies. These cost fluctuations pose a challenge for fastener manufacturers, as they can affect profit margins and increase the overall cost of production. The rising costs of raw materials also impact the pricing strategy of fasteners, making it difficult for manufacturers to remain competitive while maintaining product quality. This volatility creates uncertainty in the market and can delay investments in new production capacities or product innovations.

Intense Price Competition

The Germany Industrial Fasteners Market is also hindered by intense price competition, particularly from low-cost manufacturers in emerging markets. Many fastener producers in countries such as China and India can offer lower prices due to cheaper labor and raw material costs. As a result, German manufacturers are under constant pressure to keep their prices competitive, which can impact profitability. This price sensitivity is particularly evident in the construction and automotive industries, where cost efficiency is paramount. Manufacturers must find ways to balance competitive pricing with the need for high-quality, durable fasteners, which can often lead to challenges in sustaining long-term profitability.

Regulatory and Compliance Challenges

Strict regulations and compliance requirements in Germany and the broader European Union also pose challenges to the fastener industry. Manufacturers must adhere to a range of environmental, safety, and quality standards to ensure that their products meet the necessary legal requirements. Compliance with these regulations can be costly and time-consuming, particularly for small and medium-sized enterprises (SMEs) that lack the resources to invest in continuous compliance management. Additionally, any changes in industry standards or environmental laws could require significant adjustments in manufacturing processes, further increasing operational costs and complexity.

Market Opportunities:

The Germany Industrial Fasteners Market presents significant opportunities for growth in emerging industries such as renewable energy, electric vehicles (EVs), and advanced manufacturing. As Germany continues to strengthen its commitment to sustainability and the green economy, the demand for fasteners in renewable energy sectors like wind and solar power is expected to rise. These industries require high-performance, corrosion-resistant fasteners for installations in harsh environmental conditions, providing a strong market opportunity for fastener manufacturers. Additionally, the automotive industry’s shift towards EVs presents opportunities for fasteners designed for lightweight materials and specialized components, enabling manufacturers to diversify their product offerings and capture a larger share of the growing electric vehicle market.

Another key market opportunity lies in the integration of smart technologies and advanced manufacturing solutions. The rise of Industry 4.0 and the adoption of the Industrial Internet of Things (IIoT) open new avenues for fastener manufacturers to innovate by incorporating sensors and digital connectivity into their products. These smart fasteners, which can monitor stress, load, and environmental conditions, are becoming increasingly valuable in industries that demand high precision and reliability, such as aerospace and heavy machinery. Manufacturers who invest in the development of smart, IoT-enabled fasteners will be able to offer solutions that improve operational efficiency and reduce maintenance costs, positioning themselves as leaders in this evolving market segment.

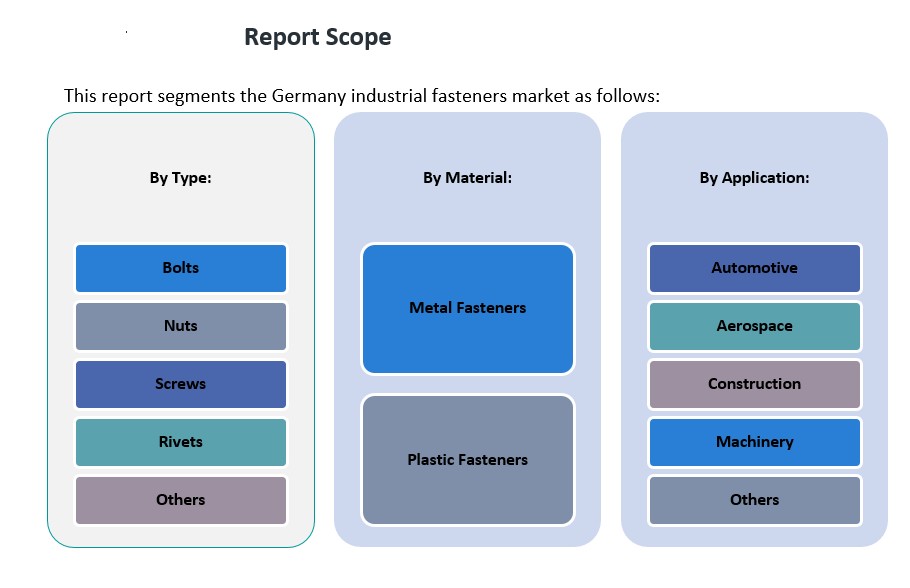

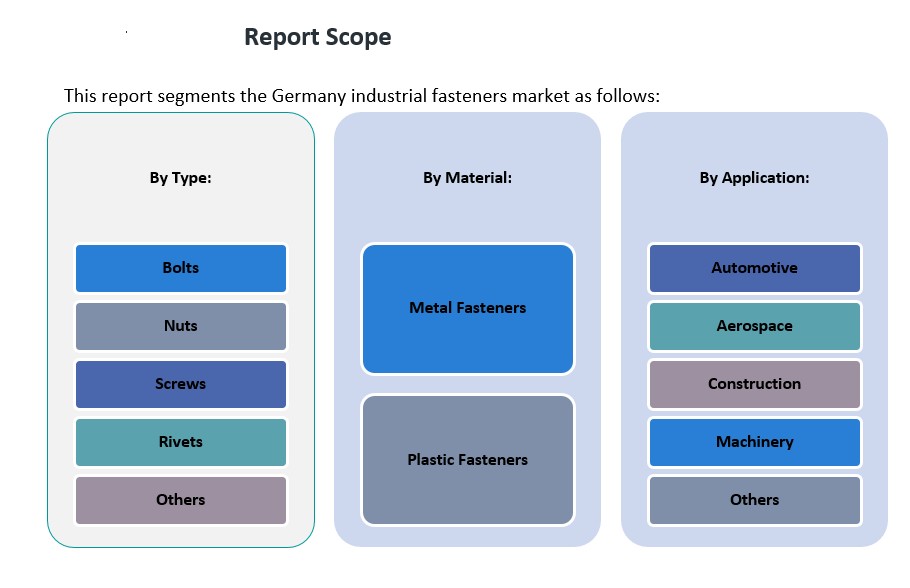

Market Segmentation Analysis:

By Type Segment

The Germany Industrial Fasteners Market is segmented into bolts, nuts, screws, rivets, and others. Among these, bolts and screws hold the largest share, driven by their widespread application in automotive, construction, and machinery industries. Bolts are particularly favored for their strength and ability to secure heavy-duty applications, while screws are commonly used in precision assemblies. Nuts complement these fasteners, providing the necessary fastening mechanism for various industrial applications. Rivets, although a smaller segment, continue to find usage in aerospace and automotive industries due to their reliability and strong bond formation. The “others” segment includes various specialized fasteners designed for niche applications, including fasteners used in renewable energy sectors such as wind turbines.

By Application Segment

The application segment of the Germany Industrial Fasteners Market includes automotive, aerospace, construction, machinery, and others. The automotive industry is the largest consumer of industrial fasteners, driven by the growing demand for vehicle production, particularly electric vehicles (EVs). The aerospace sector follows closely, requiring high-performance fasteners for lightweight, durable, and corrosion-resistant components. The construction sector also presents a substantial demand for fasteners, particularly in the construction of infrastructure projects and residential buildings. The machinery segment, which includes industrial equipment and manufacturing plants, further bolsters the market for fasteners, with high demand for precision-engineered products.

By Material Segment

In terms of materials, metal fasteners dominate the market due to their strength, durability, and versatility. These fasteners are commonly used across automotive, aerospace, and construction industries. Plastic fasteners, while a smaller segment, are growing in demand due to their lightweight properties and resistance to corrosion. They are often used in industries where weight reduction is critical, such as in electronics and automotive applications. The increasing demand for specialized fasteners that offer both strength and lightweight properties is contributing to the growth of plastic fasteners in specific sectors.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Germany Industrial Fasteners Market is influenced by the country’s strategic location, strong industrial base, and the demand across various sectors. Germany, as a major manufacturing hub in Europe, plays a critical role in the European market and is well-positioned to meet the demands of both domestic and international industries. The regional market is primarily driven by the automotive, aerospace, construction, and machinery sectors, which are the largest consumers of industrial fasteners.

Germany (Domestic Market)

Germany’s domestic market accounts for the largest share of the regional industrial fasteners market, contributing significantly to the overall demand for fasteners. The country’s automotive sector, which is one of the largest in the world, remains a key driver of the market. Germany is home to major automotive manufacturers such as Volkswagen, BMW, and Daimler, all of which rely heavily on fasteners for vehicle assembly. The growing focus on electric vehicles (EVs) has further amplified the demand for lightweight, high-performance fasteners designed for new materials such as aluminum and composites. The machinery and construction industries also contribute to Germany’s strong position in the fasteners market, with infrastructure projects and manufacturing expansions driving demand.

Europe

The broader European market holds a significant share in the industrial fasteners market, with Germany being the largest contributor within the region. Europe as a whole benefits from well-established manufacturing industries in countries such as France, the United Kingdom, and Italy. Germany’s advanced technological capabilities and innovation in fastener design, particularly in the automotive and aerospace industries, make it a key supplier within Europe. The rise of Industry 4.0 and the digitalization of manufacturing processes in Germany have further reinforced its position as a market leader in the European fasteners sector. The market share of the European region is estimated to account for over 35% of the global industrial fasteners market, with Germany representing a substantial portion of this figure.

Rest of the World (ROW)

The rest of the world, including regions such as North America and Asia-Pacific, also plays an important role in the demand for Germany-manufactured fasteners. German fasteners are recognized globally for their high-quality standards and advanced materials, making them highly sought after for international projects. Germany’s export activities have increased in recent years, particularly to regions such as the United States, China, and other parts of Asia, where manufacturing and industrial growth continue to rise. The export market for German fasteners is expected to grow at a steady rate, supported by the country’s strong international trade relationships and the increasing demand for durable, high-performance fasteners in emerging economies.

Key Player Analysis:

- LISI Group

- The Würth Group

- Bulten AB

- Bossard Group

- EJOT Holding GmbH & Co. KG

- Fabory Group

- Bolt & Nut Industry Ltd

- Precision Castparts Corp.

- Bufab Group

- Fischer Holding GmbH & Co.

Competitive Analysis:

The Germany Industrial Fasteners Market is highly competitive, with several key players dominating the landscape. Leading manufacturers such as Würth Group, Bossard Group, and Arnold Umformtechnik GmbH are well-established in the market, offering a wide range of fasteners for industries like automotive, aerospace, and construction. These companies leverage advanced manufacturing technologies and stringent quality controls to maintain their competitive edge. Additionally, many players are focusing on innovation, developing high-performance fasteners made from advanced materials such as corrosion-resistant alloys and lightweight composites, to meet the growing demands of electric vehicles and renewable energy projects. The market is also witnessing increased consolidation, as companies seek to expand their product portfolios and geographic reach through mergers and acquisitions. Furthermore, the increasing demand for eco-friendly and sustainable fasteners is prompting companies to invest in green manufacturing practices and materials. The competitive landscape is expected to remain dynamic, driven by technological advancements and shifting industry demands.

Recent Developments:

- In January 2023, Sherex Fastening Solutions, a company specializing in engineered fasteners, tooling, and automation, introduced a new product called Optisert. This round body rivet nut is positioned as the best-performing in its category, offering enhanced strength and resistance to spin-out compared to standard round-body rivet nuts. The launch of Optisert follows over five years of engineering design and research, aiming to deliver superior resistance to spin-out and pull-out failures, thus elevating the quality of applications it serves.

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing

Market Concentration & Characteristics:

The Germany Industrial Fasteners Market is characterized by a moderately concentrated competitive landscape, dominated by several key players with substantial market shares. Leading companies such as Würth Group, Bossard Group, and Arnold Umformtechnik GmbH leverage their extensive product portfolios, advanced manufacturing capabilities, and robust distribution networks to maintain a competitive edge. These firms focus on product innovation, quality assurance, and strategic partnerships to meet the diverse demands of industries like automotive, aerospace, construction, and machinery. Despite the dominance of these major players, the market also accommodates smaller, specialized manufacturers that cater to niche applications. These companies often focus on specific product types, such as aerospace-grade fasteners or eco-friendly solutions, allowing them to compete effectively by offering customized products and services. The presence of both large and small enterprises fosters a dynamic and competitive environment, driving continuous innovation and responsiveness to industry trends. Overall, the Germany Industrial Fasteners Market exhibits a balanced mix of concentration and diversity, supporting its growth and adaptability in a rapidly evolving industrial landscape

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Industrial Fasteners Market is expected to experience steady growth, driven by advancements in manufacturing technologies.

- Demand for fasteners will rise in the automotive sector, particularly with the growing adoption of electric vehicles.

- Aerospace and renewable energy industries will continue to be key contributors to market expansion, requiring specialized fasteners.

- The trend towards lightweight materials in manufacturing will boost the demand for high-performance fasteners.

- Smart fasteners with IoT integration are anticipated to gain traction, particularly in industries like aerospace and machinery.

- The focus on sustainability will increase demand for eco-friendly fasteners, aligning with Germany’s green initiatives.

- Germany’s strong export market will continue to drive growth, with increasing demand from international markets.

- Automation and robotics in production lines will enhance fastener precision, improving quality and operational efficiency.

- The rise of e-commerce will provide new distribution channels, increasing accessibility for small and medium-sized businesses.

- Increased focus on product customization and innovation will help manufacturers capture niche markets and diversify product offerings.