| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Vendor Neutral Archives (VNA) And PACS Market Size 2024 |

USD 292.25 Million |

| Germany Vendor Neutral Archives (VNA) And PACS Market, CAGR |

8.39% |

| Germany Vendor Neutral Archives (VNA) And PACS Market Size 2032 |

USD 556.80 Million |

Market Overview

Germany Vendor Neutral Archives (VNA) And Picture Archiving And Communication Systems (PACS) Market size was valued at USD 292.25 million in 2024 and is anticipated to reach USD 556.80 million by 2032, at a CAGR of 8.39% during the forecast period (2024-2032).

The Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is driven by the increasing adoption of digital healthcare solutions and the need for seamless integration across various medical imaging systems. The growing demand for efficient and scalable storage solutions, along with advancements in cloud technologies, is propelling the market forward. Healthcare institutions are increasingly prioritizing interoperability and data accessibility, which VNA and PACS offer by enabling centralized data storage and easy retrieval across different platforms. Additionally, the rising prevalence of chronic diseases and the aging population are boosting the demand for advanced imaging systems. Trends such as the integration of artificial intelligence (AI) for enhanced image analysis and the migration to cloud-based systems are further shaping the market. These factors collectively contribute to the robust growth of the VNA and PACS market in Germany, with increasing investments in healthcare infrastructure and technology.

The geographical analysis of the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market reveals strong adoption across major cities such as Berlin, Munich, Hamburg, and Bremen, driven by advanced healthcare infrastructure and increasing investments in digital health technologies. These regions are leading the transformation toward interoperable and cloud-enabled medical imaging solutions, supported by a growing focus on healthcare digitization and patient data management. Key players operating in the German market include Siemens Healthineers, Philips Healthcare, Fujifilm Holdings Corporation, Agfa-Gevaert Group, and Sectra AB, among others. These companies are leveraging innovation, robust product portfolios, and strategic partnerships to expand their footprint. The presence of domestic and international vendors fosters a competitive landscape, with ongoing developments in AI integration, cloud solutions, and vendor-neutral platforms driving the evolution of imaging technologies in Germany’s healthcare system. This dynamic environment supports continued growth and modernization across the VNA and PACS market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany VNA and PACS market was valued at USD 292.25 million in 2024 and is projected to reach USD 556.80 million by 2032, growing at a CAGR of 8.39%.

- The Global VNA and PACS market was valued at USD 4,411.05 million in 2024 and is expected to reach USD 8,046.15 million by 2032, growing at a CAGR of 7.80% from 2024 to 2032.

- Increasing demand for digital healthcare solutions and interoperability is driving the adoption of VNA and PACS systems.

- Cloud migration and AI integration are major trends transforming imaging data storage, access, and analysis.

- Key players such as Siemens Healthineers, Philips Healthcare, and Fujifilm Holdings dominate the competitive landscape through innovation and partnerships.

- High initial implementation costs and integration challenges with legacy systems are restraining market growth, especially for smaller institutions.

- Major cities like Berlin, Munich, Hamburg, and Bremen are at the forefront of adoption due to advanced healthcare infrastructure.

- The market is shifting toward scalable, hybrid delivery models that combine on-premise control with cloud-based flexibility.

Report Scope

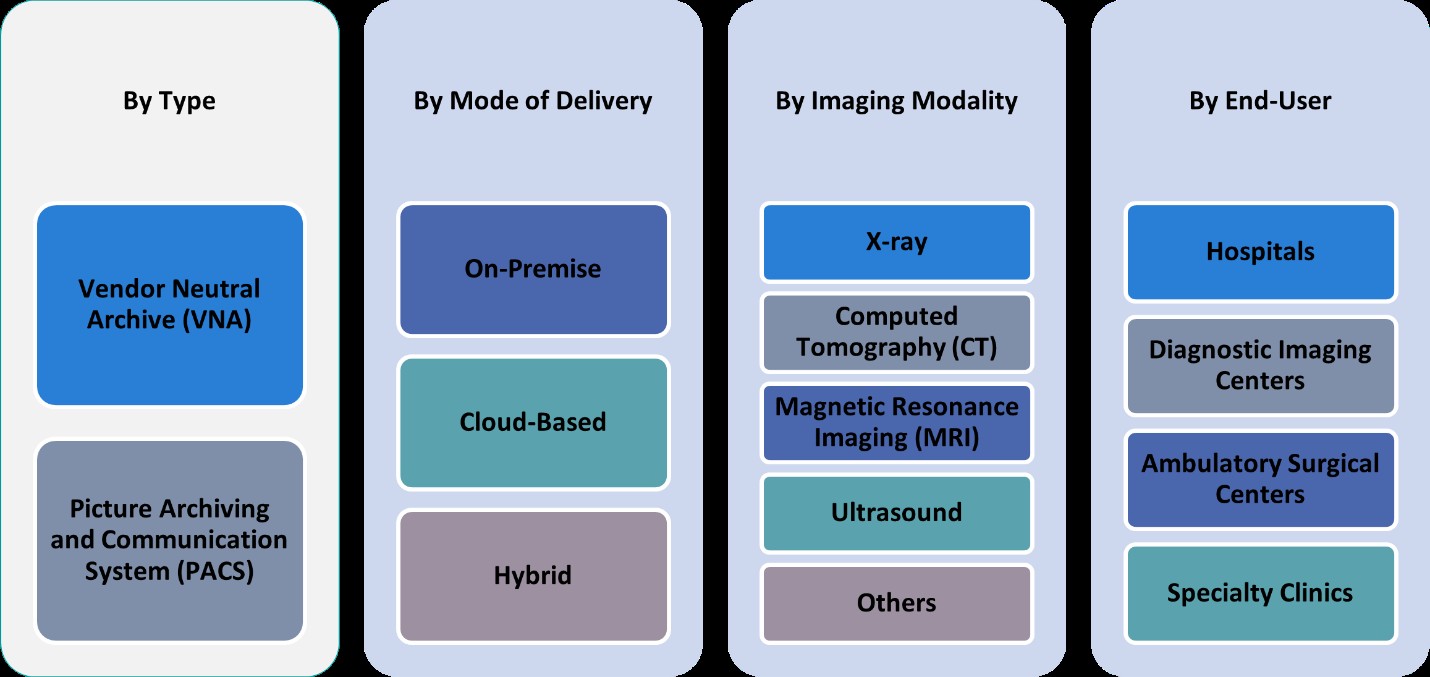

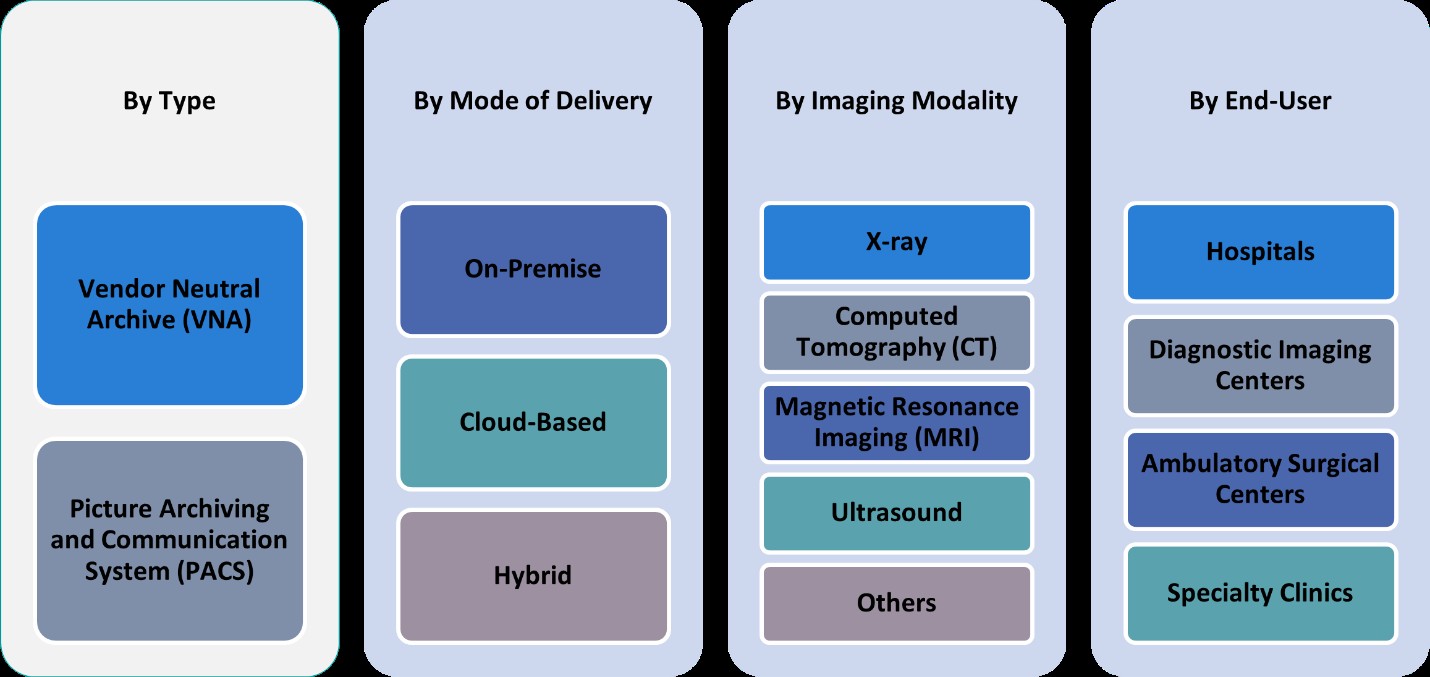

This report segments the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market as follows:

Market Drivers

Increasing Demand for Digital Healthcare Solutions

The growing adoption of digital healthcare solutions is a major driver of the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market. As healthcare providers seek to streamline patient care and enhance operational efficiency, the demand for digital imaging solutions has escalated. The shift from traditional film-based imaging to digital formats allows for faster and more accurate diagnoses. PACS enables the storage, retrieval, and sharing of medical images digitally, while VNAs further enhance this by providing a vendor-agnostic platform for image storage and management. This trend is not only improving the efficiency of healthcare providers but is also contributing to enhanced patient outcomes by facilitating better image access and collaboration among medical professionals.

Growing Prevalence of Chronic Diseases and Aging Population

The rising prevalence of chronic diseases and the aging population are major demographic drivers for the VNA and PACS market in Germany. As the elderly population grows and the incidence of conditions such as cardiovascular diseases, cancer, and diabetes rises, the demand for medical imaging systems increases. For instance, the Robert Koch Institute (RKI) reports that over 60% of older adults in Germany suffer from chronic diseases, increasing the need for efficient medical imaging solutions. Chronic disease management often requires frequent imaging, which calls for efficient and reliable storage and retrieval systems like PACS and VNA. Moreover, elderly patients typically require long-term care, further necessitating the need for accessible and interoperable medical data. The combination of a growing patient base and the need for ongoing imaging has made VNA and PACS indispensable for healthcare providers in Germany, as these systems ensure the accurate and timely access to patient images and data needed for continuous care.

Need for Interoperability and Centralized Data Storage

Interoperability between various healthcare systems is becoming a critical factor in the effectiveness of patient care. Germany’s healthcare institutions are increasingly recognizing the importance of seamless integration across various imaging devices and information systems. For instance, the German Digitalisation Strategy for Health and Care emphasizes the need for improved interoperability and centralized data storage to enhance healthcare efficiency. The adoption of VNA and PACS facilitates interoperability by providing a unified, standardized system for storing and managing medical images from different vendors and departments. This is particularly important in a country like Germany, where numerous healthcare providers, including hospitals, clinics, and imaging centers, use different imaging technologies. By leveraging VNA, organizations can centralize image data and make it accessible across platforms, reducing fragmentation and improving the coordination of care.

Advancements in Cloud Technology and Artificial Intelligence

Advancements in cloud technology and the integration of artificial intelligence (AI) are further driving the growth of the VNA and PACS market in Germany. Cloud-based solutions offer scalability, cost-efficiency, and enhanced data accessibility, which are appealing to healthcare providers looking to manage ever-growing volumes of medical imaging data. With cloud storage, healthcare institutions can avoid the costs and complexities associated with maintaining on-premise infrastructure while ensuring that images are securely stored and easily accessible. Additionally, AI is revolutionizing the PACS market by enabling automated image analysis, improving diagnostic accuracy, and reducing the workload of healthcare professionals. These technologies are becoming essential in modern healthcare settings and contribute significantly to the adoption of VNA and PACS solutions.

Market Trends

Cloud Migration and Storage Solutions

One of the most significant trends in the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is the growing migration toward cloud-based storage solutions. As healthcare providers look to reduce costs associated with on-premise infrastructure, cloud adoption has become an attractive option. Cloud solutions offer scalability, flexibility, and enhanced accessibility to medical imaging data, making it easier for healthcare institutions to store and manage vast amounts of images. For instance, Microsoft Azure’s Qumulo Scalable File Service provides vendor-neutral PACS storage solutions, enabling healthcare providers to store and archive medical images efficiently. The ability to securely access images from any location, coupled with the reduced need for physical storage and maintenance, is driving this shift. Additionally, cloud-based PACS and VNA platforms improve data sharing across various healthcare systems, which is critical for patient care continuity and collaboration between different medical professionals.

Focus on Data Security and Compliance

As the volume of medical imaging data grows, so does the need for robust data security and compliance with healthcare regulations. In Germany, healthcare institutions are placing a greater emphasis on ensuring that their VNA and PACS solutions comply with strict data protection laws, such as the General Data Protection Regulation (GDPR). For instance, Germany’s new government plans to centralize data protection supervision, aiming to streamline compliance and reduce regulatory burdens for healthcare providers. These regulations require healthcare providers to safeguard patient data and ensure that it is stored, accessed, and shared securely. As a result, there is an increasing trend towards adopting PACS and VNA systems with enhanced security features, such as encryption, access controls, and audit trails. Healthcare organizations are also focusing on compliance with industry standards to avoid legal and financial penalties, making data security a crucial consideration in the selection and implementation of imaging systems.

Artificial Intelligence and Automation Integration

The integration of artificial intelligence (AI) and machine learning technologies into PACS and VNA systems is a prominent trend shaping the market. AI is being used to automate and enhance the analysis of medical images, enabling more accurate and faster diagnoses. These technologies help in detecting patterns in images that might be missed by human eyes, improving diagnostic precision and reducing the potential for errors. Additionally, AI-driven algorithms are streamlining workflow processes by automating tasks such as image sorting, tagging, and archiving. As healthcare professionals increasingly rely on AI to assist in image interpretation and workflow management, PACS and VNA systems that support AI capabilities are becoming essential components of modern healthcare infrastructure.

Vendor-Neutral Platforms for Enhanced Flexibility

The shift toward vendor-neutral platforms is another key trend in the German VNA and PACS market. Vendor-neutral archives (VNAs) allow healthcare organizations to store medical images in a format that is independent of any particular vendor’s system, thus offering greater flexibility and interoperability. This capability is particularly important in a market where healthcare providers often work with a variety of imaging technologies and equipment from different manufacturers. VNAs enable seamless integration of diverse imaging systems, facilitating the consolidation of image data into a single, easily accessible repository. This trend aligns with the broader push for standardized healthcare data formats and the need for healthcare systems to work together efficiently across different platforms.

Market Challenges Analysis

Integration Complexities and Interoperability Issues

One of the key challenges in the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is the complexity involved in integrating these systems with existing healthcare infrastructure. Many healthcare institutions in Germany use a variety of imaging equipment and electronic health record (EHR) systems from different vendors, which can create significant interoperability issues. For instance, the National Interoperability Framework (NIF) in Germany promotes standardized ICT systems to ensure seamless data exchange and collaboration between healthcare providers. Ensuring seamless integration between PACS, VNA, and various other medical systems is often a complex and time-consuming process. Healthcare organizations need to invest substantial resources in customizing and configuring these solutions to work together effectively, which can lead to increased costs and delays. Additionally, data migration from legacy systems to modern PACS and VNA solutions poses another challenge, as older systems may not be fully compatible with new technologies, requiring significant effort to transfer and standardize data.

High Initial Costs and Maintenance Requirements

The high initial cost of implementing VNA and PACS solutions is another challenge faced by healthcare providers in Germany. While these systems offer long-term benefits such as improved efficiency and reduced operational costs, the upfront investment in hardware, software, and implementation services can be substantial. Smaller and mid-sized healthcare organizations, in particular, may find it difficult to allocate the necessary funds to deploy these advanced systems. Furthermore, the ongoing maintenance and updates required for PACS and VNA systems can add to the financial burden. Regular system upgrades, cybersecurity measures, and troubleshooting often require additional financial and human resources. As the systems grow in scale and usage, the complexity of maintaining them also increases, creating challenges in ensuring consistent performance and system reliability.

Market Opportunities

The Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market presents several growth opportunities driven by evolving healthcare needs and technological advancements. As the demand for digital healthcare solutions continues to rise, there is a significant opportunity for VNA and PACS providers to capitalize on the increasing adoption of cloud-based systems. Cloud technology offers scalability, cost-efficiency, and enhanced data accessibility, making it a highly attractive option for healthcare organizations looking to streamline image storage and management. The shift toward cloud-based platforms enables healthcare institutions to reduce the costs associated with on-premise infrastructure and offers a flexible, centralized solution for accessing medical images across different departments and locations. This trend opens up vast opportunities for VNA and PACS providers to offer innovative solutions tailored to the specific needs of the German healthcare market.

Additionally, the integration of artificial intelligence (AI) and machine learning in PACS systems creates significant market potential. AI-driven technologies have the ability to automate image analysis, enhance diagnostic accuracy, and improve workflow efficiency, making them an essential tool for healthcare professionals. As healthcare organizations in Germany look to improve patient outcomes while managing increasing volumes of imaging data, the demand for AI-enabled PACS solutions is likely to rise. Moreover, the growing focus on data security and compliance with regulations such as the General Data Protection Regulation (GDPR) presents an opportunity for vendors to offer highly secure and compliant systems. As healthcare providers prioritize patient data protection, there is a growing market for PACS and VNA solutions that integrate robust security features, such as encryption and access controls, while ensuring compliance with local and international standards.

Market Segmentation Analysis:

By Type:

The Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market can be segmented based on the type of system offered. VNA systems are gaining traction due to their ability to store imaging data from different vendors in a standardized, neutral format, providing healthcare institutions with increased flexibility and interoperability. As healthcare providers strive for seamless integration across various imaging platforms and vendors, VNAs enable centralized, easily accessible data repositories without being tied to a specific technology provider. On the other hand, PACS is a more established technology widely used for managing medical imaging data, including storage, retrieval, and distribution. While PACS is vital for handling medical images, VNAs offer additional advantages in terms of data accessibility and long-term storage, making them increasingly popular as healthcare organizations look for more versatile and scalable solutions to manage their imaging data effectively.

By Mode of Delivery:

The mode of delivery further segments the market into on-premise, cloud-based, and hybrid solutions. On-premise solutions, although traditionally popular, are witnessing a decline due to the high costs associated with maintaining physical infrastructure. Many healthcare providers are shifting toward cloud-based solutions, which offer greater flexibility, cost-efficiency, and scalability. Cloud-based PACS and VNA solutions allow healthcare organizations to store and access medical imaging data remotely, making it easier for multiple departments or facilities to collaborate. Additionally, cloud solutions reduce the need for costly on-site storage and enable healthcare organizations to scale their systems quickly to accommodate growing volumes of data. The hybrid model, which combines both on-premise and cloud-based systems, is gaining traction as it offers a balanced approach, allowing organizations to retain sensitive data on-site while leveraging the cloud for scalability and remote access. This delivery model is increasingly popular among healthcare institutions looking for flexibility, cost savings, and improved data security.

Segments:

Based on Type:

- Vendor Neutral Archive (VNA)

- Picture Archiving and Communication System (PACS)

Based on Mode of Delivery:

- On-Premise

- Cloud-Based

- Hybrid

Based on End- User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Specialty Clinics

Based on Imaging Modality:

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Others

Based on the Geography:

- Berlin

- Munich

- Hamburg

- Bremen

Regional Analysis

Berlin

Berlin holds the largest share in the Germany VNA and PACS market, accounting for approximately 32% of the overall market. As the capital and one of the leading healthcare hubs in Germany, Berlin boasts a high concentration of advanced hospitals, research institutions, and diagnostic centers. These facilities are early adopters of digital healthcare technologies, including VNA and PACS systems, to improve patient care and streamline operations. The city’s strong public and private healthcare infrastructure, combined with significant government investment in digital health initiatives, fuels the demand for interoperable and scalable imaging solutions. Additionally, Berlin is home to several health tech startups and academic collaborations that drive innovation in medical imaging and data management, further boosting the adoption of VNA and PACS technologies.

Munich

Munich represents the second-largest regional market, contributing approximately 26% to the national VNA and PACS market. Known for its advanced medical research and high-quality healthcare institutions, Munich’s healthcare providers are prioritizing the integration of cutting-edge imaging systems to enhance diagnostic capabilities and data interoperability. Many large hospitals and university-affiliated medical centers in Munich have been at the forefront of adopting hybrid and cloud-based PACS and VNA solutions to handle increasing imaging volumes efficiently. The region’s robust IT infrastructure and skilled healthcare workforce support the implementation of complex digital systems, while growing collaborations between medical technology companies and healthcare institutions further strengthen Munich’s position in the VNA and PACS market.

Hamburg

Hamburg accounts for around 22% of the Germany VNA and PACS market. As a major metropolitan area with a dense healthcare network, Hamburg has seen consistent growth in the deployment of medical imaging technologies. The presence of several private and public healthcare providers, including specialty clinics and diagnostic centers, drives the regional demand for efficient data storage and retrieval systems. Furthermore, Hamburg’s focus on smart healthcare infrastructure and digital transformation initiatives has encouraged the adoption of interoperable and vendor-neutral systems. The ongoing modernization of hospital systems and the integration of AI capabilities in imaging further support the region’s expanding role in the national market.

Bremen

Bremen, while smaller in comparison, contributes approximately 20% to the national VNA and PACS market. The region has shown growing interest in digital health solutions, particularly among its network of regional hospitals and specialized clinics. Investments in healthcare IT and gradual digitization of medical records have led to increased demand for both PACS and VNA systems that support secure, long-term storage and efficient data sharing. Bremen’s healthcare institutions are increasingly opting for scalable and cost-effective solutions, particularly cloud-based and hybrid models, to optimize resource utilization. As the region continues to modernize its healthcare infrastructure, Bremen is expected to play a more significant role in driving future growth within the national VNA and PACS market.

Key Player Analysis

- Siemens Healthineers

- Philips Healthcare

- Fujifilm Holdings Corporation

- Agfa-Gevaert Group

- Sectra AB

- Canon Medical Systems

- Dedalus Healthcare

- Esaote SpA

- PaxeraHealth

- Medavis GmbH

Competitive Analysis

The competitive landscape of the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is shaped by the presence of several leading global and regional players, including Siemens Healthineers, Philips Healthcare, Fujifilm Holdings Corporation, Agfa-Gevaert Group, Sectra AB, Canon Medical Systems, Dedalus Healthcare, Esaote SpA, PaxeraHealth, and Medavis GmbH. These companies are actively focusing on innovation, product diversification, and strategic collaborations to strengthen their market positions. The competitive landscape of the Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is characterized by strong technological innovation, a focus on interoperability, and increasing demand for cloud-based imaging solutions. Companies in the market are continuously enhancing their offerings through integration of artificial intelligence, automation tools, and data security features to meet the evolving needs of healthcare providers. Innovation in diagnostic imaging, improved user interfaces, and scalable platforms has become central to gaining a competitive edge. Vendors are also forming strategic partnerships with hospitals and research institutions to expand their regional footprint and align solutions with Germany’s healthcare digitalization goals. The market is highly dynamic, with both multinational corporations and specialized regional firms competing on pricing, service quality, and regulatory compliance. As cloud and hybrid delivery models gain momentum, competitors are investing heavily in cloud infrastructure and cybersecurity, aiming to offer flexible, secure, and future-ready imaging solutions tailored to clinical workflows.

Recent Developments

- In March 2024, at the European Congress of Radiology in Vienna, Philips unveiled new hardware innovations, focusing on integrating artificial intelligence into their imaging solutions to enhance diagnostic accuracy and workflow efficiency.

- In February 2024, FUJIFILM Healthcare Americas Corporation announced that it’s Synapse VNA and Synapse Radiology PACS solutions (in Asia/Oceania) were ranked #1 in the 2024 Best in KLAS Awards: Software and Services. The recognition, based on insights from KLAS Research, highlights companies excelling in improving patient care through their software and services.

- In January 2024, RamSoft (Canada) launched imaging EMR solution, named OmegaAI. The solution is a cloud-native, serverless imaging EMR software platform that consolidates VNA, Enterprise Imaging, PACS, RIS, simplified image exchange/sharing, routing & storage, a zero-footprint (ZFP) viewer, unified worklist, radiology reporting, document management, peer, patient portal, and a real-time business intelligence and analytics solution.

- In November 2023, InsiteOne (US) announced to acquire BRIT Systems cloud native RIS/PACS/VNA solution to advance imaging workflows. This acquisition will continue to focus on developing cost-effective solutions that improve operational productivity while enhancing patient care.

- In July 2023, Fujifilm Sonosite joined the newly formed Medical Imaging Division under the Advanced Medical Technology Association (AdvaMed), collaborating with industry leaders to advance medical imaging technologies.

Market Concentration & Characteristics

The Germany Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market exhibits moderate to high market concentration, with a mix of established global providers and a growing number of regional players. The market is characterized by a strong focus on interoperability, data security, and compliance with stringent healthcare regulations such as GDPR. Vendors are increasingly prioritizing scalable solutions that support cloud-based and hybrid deployment models, reflecting a shift in demand from traditional on-premise systems. The market also demonstrates a high degree of technological advancement, with integration of artificial intelligence, automation, and analytics becoming key differentiators. Hospitals and diagnostic centers are seeking flexible, vendor-neutral systems that can seamlessly interface with diverse imaging modalities and electronic health records. While competition is steady, customer loyalty tends to be strong due to the complexity and critical nature of these systems. This creates opportunities for innovation-driven differentiation and long-term service partnerships within the healthcare ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Mode of Delivery, End-User, Imaging Modality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of cloud-based VNA and PACS solutions will continue to accelerate across German healthcare institutions.

- Interoperability and system integration will remain top priorities for hospitals and diagnostic centers.

- Artificial intelligence will play a larger role in enhancing image analysis and clinical workflows.

- Hybrid deployment models will gain popularity due to their balance of flexibility and data control.

- Demand for scalable and modular imaging solutions will increase among mid-sized healthcare facilities.

- Vendors will focus on improving cybersecurity and data protection in response to regulatory demands.

- Real-time data sharing and remote access capabilities will become essential system features.

- Regional hospitals will increasingly adopt vendor-neutral platforms to modernize legacy systems.

- Strategic collaborations between technology providers and healthcare institutions will drive innovation.

- The market will see continued growth as digital transformation initiatives expand nationwide.