| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gift Packaging Market Size 2024 |

USD29,965.98 million |

| Gift Packaging Market, CAGR |

3.61% |

| Gift Packaging Market Size 2032 |

USD40,635.38 million |

Market Overview

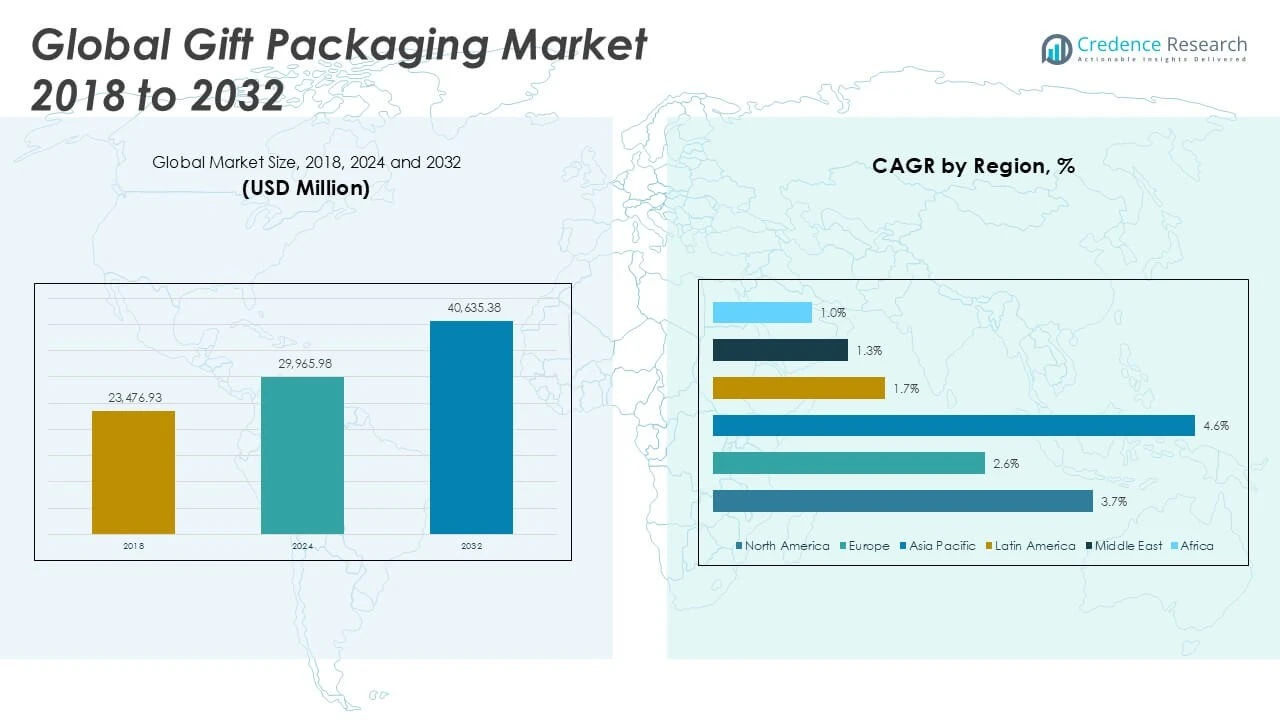

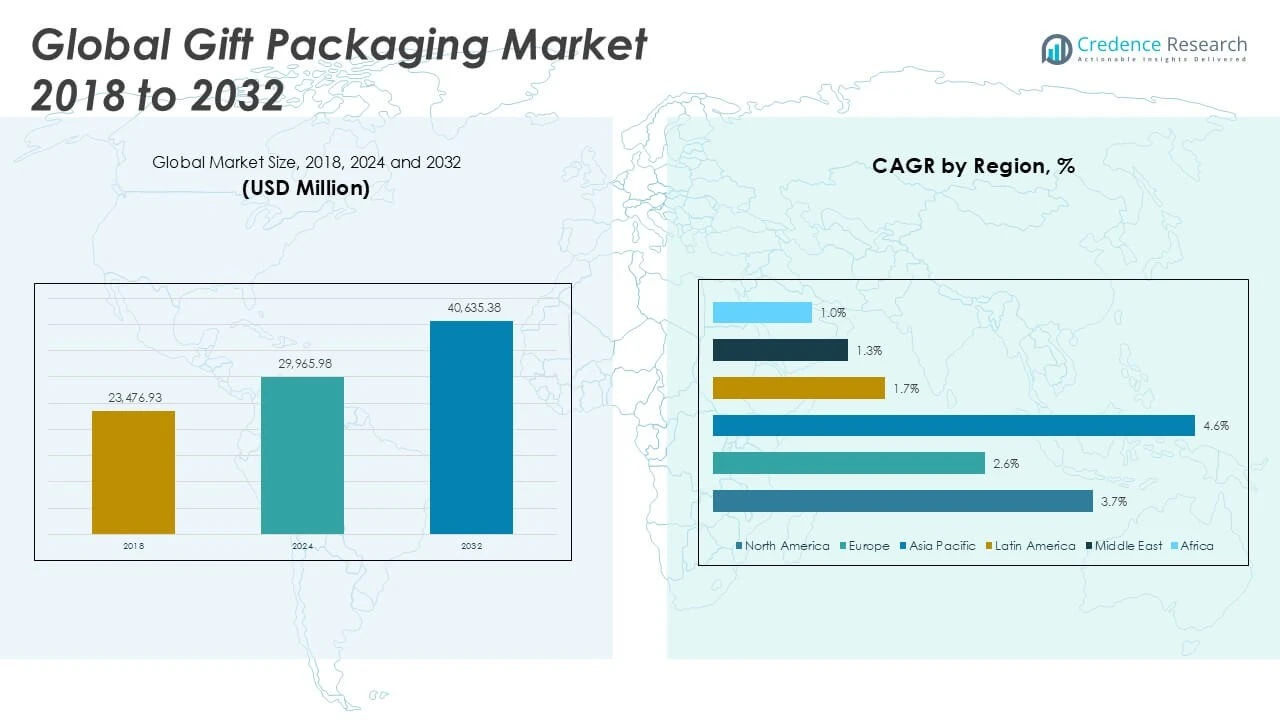

The Global Gift Packaging Market is projected to grow from USD29,965.98 million in 2024 to an estimated USD40,635.38 million based on 2032, with a compound annual growth rate (CAGR) 3.61% from 2025 to 2032.

Key market drivers include seasonal demand surges during festivals, weddings, and special occasions, alongside the growing trend of sustainable packaging. Eco-friendly materials such as recycled paper, reusable fabric, and biodegradable components are gaining traction as brands align with environmental regulations and consumer expectations. Additionally, the personalization trend has spurred innovations in design, printing technology, and material variety. Brands are leveraging creative packaging not only as a protective layer but also as a branding tool to enhance unboxing experiences and customer loyalty.

Geographically, Asia Pacific dominates the global gift packaging market, driven by its large population base, cultural gifting traditions, and growing retail sector. North America and Europe also hold significant shares due to high consumer spending and mature e-commerce ecosystems. Key players operating in the market include Mondi Group, Smurfit Kappa Group, Interpak, IG Design Group, Hallmark Cards Inc., and DS Smith Plc, all of whom are actively investing in product innovation and sustainable packaging solutions.

Market Insights

- The Global Gift Packaging Market is projected to grow from USD 29,965.98 million in 2024 to USD 40,635.38 million by 2032, at a CAGR of 3.61% from 2025 to 2032.

- Growth is fueled by increasing demand for visually appealing, customized, and premium packaging solutions across personal, retail, and corporate gifting sectors.

- Rising disposable incomes and festive gifting trends support steady year-round demand across multiple end-user categories.

- The market faces restraints from fluctuating raw material costs and increasing pressure to balance aesthetics with sustainability compliance.

- Stringent environmental regulations and the cost of adopting eco-friendly materials challenge smaller players in maintaining competitive pricing.

- Asia Pacific leads the market, supported by a large population base, cultural gifting norms, and a rapidly growing retail infrastructure.

- North America and Europe also hold significant market shares, driven by high consumer spending and advanced e-commerce ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Aesthetic Appeal and Premiumization in Consumer Products

The Global Gift Packaging Market continues to grow due to consumers’ increasing focus on presentation and visual appeal. Shoppers value packaging that enhances the overall gifting experience and conveys personal or brand sentiment effectively. This trend has prompted retailers and brands to invest in luxurious, textured, and creatively designed packaging. It has also elevated the importance of color schemes, finishes, and customizations in influencing purchase decisions. Gifting is no longer restricted to special occasions, which further widens demand throughout the year. This shift has positioned gift packaging as an essential element in consumer marketing strategies.

- For instance, a leading packaging firm introduced 150+ textured and embossed wrapping paper styles to cater to evolving consumer preferences.

Increasing Influence of E-Commerce and Social Media on Packaging Expectations

The rise in online shopping has placed packaging under greater scrutiny, making it a critical touchpoint for customer satisfaction and brand recall. Consumers now expect gift packaging to provide both functionality and visual impact. The Global Gift Packaging Market benefits from this shift, as more businesses aim to create memorable unboxing experiences. Social media platforms amplify this trend, with users sharing attractive packaging across digital channels. It strengthens the brand’s reach while raising the bar for packaging innovation. E-commerce platforms often include gift options, reinforcing the demand for efficient yet appealing packaging designs.

- For instance, brands leveraging Instagram and TikTok for packaging promotions reported a 35% increase in consumer engagement, highlighting the impact of digital marketing.

Growth in Personal and Corporate Gifting Across Demographics

Expanding income levels and changing consumer behavior are fueling a surge in personal and corporate gifting activities. The Global Gift Packaging Market sees increased traction across business sectors, including hospitality, banking, and luxury retail. It supports the need for high-quality, branded, and often bespoke packaging that aligns with corporate identity. Consumers also prefer curated and personalized gift sets, which require packaging that reflects exclusivity. It promotes creative solutions that balance aesthetic and cost efficiency. Seasonal gifting spikes continue to sustain the demand curve year-round.

Sustainability Trends Driving Material Innovation and Adoption

Environmental concerns and stricter regulations are pushing manufacturers to transition toward eco-friendly materials and practices. The Global Gift Packaging Market is witnessing higher adoption of recyclable, biodegradable, and reusable packaging formats. It encourages innovation in both material sourcing and production processes to meet sustainability goals. Consumers increasingly value ethical choices, making sustainability a brand differentiator. Businesses now incorporate minimalist and reusable designs to align with green initiatives. These shifts elevate the importance of responsible packaging in market competitiveness.

Market Trends

Adoption of Customization and Personalization Enhancing Consumer Appeal

Personalized packaging has emerged as a prominent trend, driven by demand for tailored gifting experiences. The Global Gift Packaging Market is adapting to this shift by offering design flexibility, name printing, personalized messages, and theme-based packaging. It helps brands build deeper emotional connections with consumers and enhance brand loyalty. Businesses are also leveraging variable data printing and digital print technology to offer unique packaging for small batches. This trend reflects a broader shift in consumer behavior toward individuality and exclusivity. It encourages packaging suppliers to invest in agile production systems.

- For instance, leading personalized gift companies such as Archies Limited and Hallmark Cards Inc. have expanded their product lines to include over 2,500 customizable packaging options, catering to the growing demand for unique gifting experiences

Preference for Sustainable and Minimalist Packaging Designs

Minimalist designs with eco-conscious materials are gaining ground across all customer segments. The Global Gift Packaging Market is moving toward natural textures, muted colors, and recyclable formats to meet these preferences. It supports clean, clutter-free designs that reflect modern values and reduce waste. Consumers view sustainable packaging as a mark of responsible consumption and are more likely to support brands aligned with these values. Retailers are reducing excess packaging layers to optimize material use and streamline logistics. These practices also help businesses lower environmental footprints and production costs.

- For instance, the global sustainable packaging industry has seen an increase in production, with over 8 million metric tons of plastic waste being redirected toward recycling initiatives annually

Integration of Smart Features and Digital Interactivity in Packaging

Smart packaging technologies are finding a foothold in gift packaging to offer interactive and engaging consumer experiences. The Global Gift Packaging Market is witnessing the integration of QR codes, NFC tags, and augmented reality elements into packaging solutions. It allows consumers to access digital content, personalized messages, or brand stories through their smartphones. This interactive dimension enhances consumer engagement and differentiates products in a crowded market. Brands are using these tools to track usage, measure impact, and collect feedback. It also helps improve transparency and authenticity in customer communication.

Rising Popularity of DIY and Handmade Packaging Concepts

Consumer interest in handmade and DIY-style packaging is influencing both independent artisans and large retailers. The Global Gift Packaging Market is responding by incorporating hand-drawn designs, craft textures, and limited-edition packages. It highlights the value of authenticity and effort in gifting practices. Retailers are offering packaging kits and modular components that allow consumers to create personalized wrapping. It taps into the creative preferences of consumers who value effort and craftsmanship. This trend supports a more engaged and meaningful gifting culture.

Market Challenges

Fluctuating Raw Material Costs and Supply Chain Disruptions Impact Profitability

The Global Gift Packaging Market faces pressure from volatile raw material prices, especially paper, cardboard, and specialty inks. It complicates pricing strategies and narrows profit margins for manufacturers and suppliers. Disruptions in the global supply chain due to geopolitical tensions, transport delays, or labor shortages further strain production timelines. It creates challenges in meeting seasonal demand peaks, especially during major festivals and retail events. Businesses must invest in supply chain resilience and alternative sourcing strategies to maintain operational efficiency. Delays in material availability can also hinder product innovation and timely market delivery.

- For instance, the global gift packaging industry saw over 93% of holiday shoppers in 2022 actively seeking discounts to offset rising inflation.

Balancing Aesthetic Appeal with Environmental Compliance Remains Complex

Meeting evolving environmental regulations while delivering visually appealing packaging is a complex challenge. The Global Gift Packaging Market must address growing consumer demand for sustainability without compromising on quality or design standards. It requires innovation in material composition and packaging engineering to create eco-friendly yet durable solutions. Biodegradable or recyclable materials often involve higher production costs, making it harder for smaller brands to compete. Limited infrastructure for recycling and composting in several regions also affects product adoption. Achieving both regulatory compliance and consumer satisfaction demands significant investment in research and product development.

Market Opportunities

Expansion into Emerging Markets with Rising Middle-Class Consumption

Emerging economies present strong growth potential for the Global Gift Packaging Market due to increasing disposable incomes and evolving consumer lifestyles. It benefits from a growing preference for premium and branded products in countries such as India, Brazil, and Indonesia. Cultural emphasis on gifting during festivals and celebrations further boosts demand. Local brands are seeking differentiated packaging to enhance product value and customer appeal. Market players can gain by offering cost-effective yet visually attractive solutions tailored to regional tastes. Investments in localized production and distribution can improve market penetration.

Innovation in Eco-Friendly and Smart Packaging Solutions Creates Competitive Advantage

The shift toward sustainable consumption opens new avenues for product development and differentiation. The Global Gift Packaging Market can capitalize on demand for biodegradable, compostable, and reusable materials that align with consumer values. It allows businesses to meet environmental regulations while attracting a conscientious customer base. There is also rising interest in smart packaging with embedded features such as QR codes or AR elements that enhance user interaction. These innovations strengthen brand engagement and improve customer experience. Companies that combine sustainability with technology can lead market transformation and unlock premium segments.

Market Segmentation Analysis

By Product Type

The Global Gift Packaging Market segments by product type into gift boxes, containers, ribbon and bows, wrapping paper, tissue paper and shreds, gift bags and sacks, gift cards and money holders, cellophane overwrap and bags, and others. Gift boxes hold a dominant share due to their versatility, structure, and appeal in both personal and corporate gifting. Wrapping paper and ribbon & bows continue to see steady demand, driven by festive occasions and retail gifting. Gift bags and sacks are gaining traction for their ease of use and reusability. Cellophane wraps and money holders cater to niche segments that value presentation and functionality. The growing diversity in product offerings allows brands to meet a wide range of consumer preferences and gifting needs.

By Material

Material segmentation includes plastic, paper and paperboard, metal, glass, and others. The Global Gift Packaging Market is witnessing a strong shift toward paper and paperboard due to environmental concerns and regulatory mandates. It remains the most preferred material for wrapping paper, gift boxes, and bags. Plastic, while widely used for ribbons and transparent wraps, faces increasing scrutiny and declining use. Glass and metal serve premium segments where aesthetic value and durability are prioritized. Brands are exploring material innovations to balance design, cost, and sustainability across segments.

By Packaging Type

By packaging type, the market includes primary, secondary, and tertiary packaging. The Global Gift Packaging Market sees primary packaging as the most critical, as it directly interacts with the product and consumer. It defines the first impression and influences buyer behavior. Secondary packaging, such as outer boxes and sleeves, enhances protection and branding. Tertiary packaging focuses on logistics and bulk handling, ensuring safe transportation. It supports efficient supply chain operations without compromising product integrity.

Segments

Based on Product Type

- Gift boxes

- Containers

- Ribbon & bows

- Wrapping Paper

- Tissue paper & Shreds

- Gift Bags and Sacks

- Gift cards & Money Holders

- Cellophane Overwrap & Bags

- Others

Based on Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

Based on Packaging Type

- Primary

- Secondary

- Tertiary

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Gift Packaging Market

The North America Gift Packaging Market is projected to grow from USD 10,975.97 million in 2024 to USD 14,932.73 million by 2032, reflecting a CAGR of 3.7%. It holds the largest regional market share at 36.63%, driven by strong consumer spending, well-established retail infrastructure, and a culture of year-round gifting. The U.S. leads in both demand and innovation, supported by e-commerce growth and increasing focus on sustainable packaging. Canada also contributes steadily with rising premium product consumption and festive traditions. Businesses across the region are integrating digital features into packaging to cater to tech-savvy consumers. Seasonal trends and holidays significantly influence sales volume and packaging preferences.

Europe Gift Packaging Market

Europe’s Gift Packaging Market is forecast to increase from USD 6,484.67 million in 2024 to USD 8,143.38 million by 2032, with a CAGR of 2.6%. It accounts for 21.63% of the global share. Countries like Germany, the UK, and France are key contributors due to a mature retail ecosystem and a strong focus on packaging aesthetics. Environmental regulations across the EU are pushing the shift toward recyclable and biodegradable materials. It encourages innovation in eco-friendly formats, particularly in wrapping paper and paperboard gift boxes. Demand for personalization remains strong in both corporate and personal gifting segments. European consumers favor high-quality packaging that aligns with brand values.

Asia Pacific Gift Packaging Market

The Asia Pacific Gift Packaging Market is anticipated to rise from USD 10,068.00 million in 2024 to USD 14,775.87 million by 2032, achieving the fastest CAGR of 4.6%. With a regional market share of 33.59%, it stands as the second-largest market globally. Growth is fueled by rapid urbanization, expanding middle-class income, and cultural emphasis on ceremonial gifting in countries like China, India, and Japan. E-commerce is reshaping packaging demands, favoring lightweight and durable materials. It supports mass production while still allowing customization for local preferences. The region is also investing in sustainable packaging to align with global environmental trends.

Latin America Gift Packaging Market

Latin America’s Gift Packaging Market is expected to grow from USD 1,144.27 million in 2024 to USD 1,333.88 million by 2032, registering a CAGR of 1.7%. It holds a 3.82% share of the global market. Brazil and Mexico drive regional growth through increased consumerism and rising interest in premium and themed packaging solutions. Retailers are focusing on attractive and low-cost packaging to address the price-sensitive nature of the market. It also creates opportunities for innovation in reusable and recyclable packaging formats. Local festivals and gifting customs influence seasonal demand spikes. Investments in domestic packaging capabilities are expected to reduce import reliance.

Middle East Gift Packaging Market

The Middle East Gift Packaging Market is set to grow from USD 731.00 million in 2024 to USD 828.73 million by 2032, at a CAGR of 1.3%. It represents 2.44% of the global market share. The market is supported by cultural events such as Eid and weddings, which drive demand for high-end and ornate packaging. Countries like the UAE and Saudi Arabia lead in luxury gifting and retail expansion. It promotes demand for premium packaging with decorative elements and personalized features. Growth is moderate due to limited adoption of sustainable materials. However, increasing tourism and hospitality segments are expected to boost demand.

Africa Gift Packaging Market

Africa’s Gift Packaging Market is projected to expand from USD 562.08 million in 2024 to USD 620.79 million by 2032, growing at a CAGR of 1.0%. With a 1.87% global share, the region shows modest potential. South Africa and Nigeria are the key markets, driven by retail modernization and evolving gifting culture. It sees growing demand for paper-based and cost-effective packaging. Limited manufacturing infrastructure remains a barrier, creating dependency on imports. Retailers are introducing locally inspired designs to appeal to diverse consumer segments. The market is likely to benefit from gradual economic development and rising disposable incomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Qwikcilver Solutions

- DS Smith plc

- Ebro Colour GmbH

- IG Design Group plc

- Packlane

- Diageo

- Interpack

- Smurfit Kappa Group

- Karl Knauer KG

- Mondi plc

- Hallmark Cards

Competitive Analysis

The Gift Packaging Market features a competitive landscape driven by innovation, sustainability, and customization. Established players such as DS Smith plc, Mondi plc, and Smurfit Kappa Group lead with robust production capacities and global distribution networks. It also includes specialized firms like IG Design Group plc and Hallmark Cards, which focus on creative and seasonal packaging designs. Emerging players such as Packlane and Qwikcilver Solutions offer digital customization and tech-driven packaging solutions. Companies are investing in eco-friendly materials and smart packaging technologies to strengthen brand differentiation. The market rewards agility, regional adaptability, and the ability to meet evolving consumer preferences across both mass-market and premium segments.

Recent Developments

- In May 2025, DS Smith plc and Carlsberg received the “Best of Show” and Gold Award at the 2025 Flexography Awards for their sustainable packaging design.

- In April 2025, IG Design Group plc announced plans to exit the US market due to rising tariff burdens impacting its DG Americas operations.

- In May 2025, Diageo announced a \$500 million cost-cutting initiative and asset divestiture plan extending to 2028, aiming to reduce corporate debt.

- In December 2024, Smurfit Kappa Group introduced Bag-in-Box innovations to help clients comply with new sustainability regulations.

- In February 2025, Hallmark Cards partnered with actress Lacey Chabert to launch a branded collection of greeting cards and gift wrap for the 2025 holiday season.

Market Concentration and Characteristics

The Gift Packaging Market shows moderate concentration, with a mix of global giants and niche players competing across various segments. It includes established manufacturers with wide product portfolios and smaller firms offering specialized or region-specific solutions. The market is characterized by high product differentiation, seasonal demand patterns, and strong influence from consumer trends and retail dynamics. It demands continuous innovation in design, materials, and functionality to remain competitive. Sustainability and customization drive product development strategies. It also reflects price sensitivity in emerging regions and a premiumization trend in developed markets. Brand loyalty, distribution strength, and creative flexibility define long-term success.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Packaging Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The gift packaging market will witness increased demand for sustainable materials such as recycled paper, compostable plastics, and biodegradable fabrics. Brands will prioritize eco-conscious packaging to align with evolving consumer preferences and environmental regulations.

- Personalization and customization will become standard features, with digital printing and modular packaging formats gaining popularity. Consumers will expect packaging to reflect personal tastes, event themes, or recipient preferences.

- E-commerce growth will continue to influence packaging innovation, leading to lightweight, durable, and tamper-proof designs. Packaging will need to protect products during transit while enhancing the unboxing experience.

- Smart packaging integration, including QR codes, augmented reality, and NFC tags, will become more prevalent. These features will allow consumers to engage with brands, access digital content, or verify product authenticity.

- Demand for premium and luxury packaging will rise in both personal and corporate gifting segments. Brands will use high-end finishes, magnetic closures, and bespoke designs to differentiate their offerings.

- Asia Pacific will emerge as the fastest-growing regional market, driven by rising disposable income, urbanization, and cultural emphasis on gift-giving. Regional manufacturers will scale up production to meet domestic and export demands.

- Innovations in packaging design will focus on reducing waste through minimalism and multifunctionality. Reusable gift boxes and foldable packaging solutions will help optimize storage and cost-efficiency.

- Retailers will collaborate more closely with packaging suppliers to co-create exclusive packaging lines. These partnerships will aim to improve shelf appeal, brand identity, and customer retention.

- Regulatory compliance will shape product development, especially in terms of material safety, recyclability, and labeling standards. Companies that invest in compliance will gain long-term market credibility.

- The gifting culture will expand beyond traditional events, with year-round demand driven by lifestyle gifting, influencer trends, and online gifting platforms. The gift packaging market will adapt by diversifying its product range and distribution strategies.