Market Overview

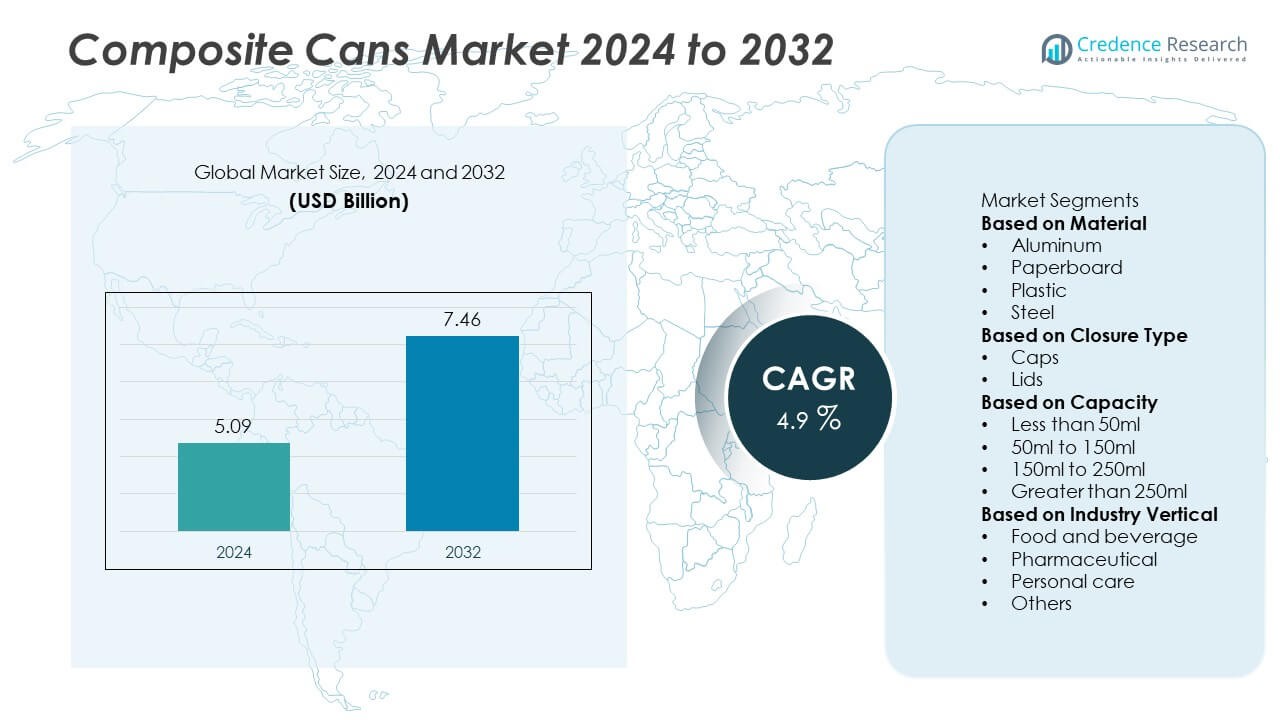

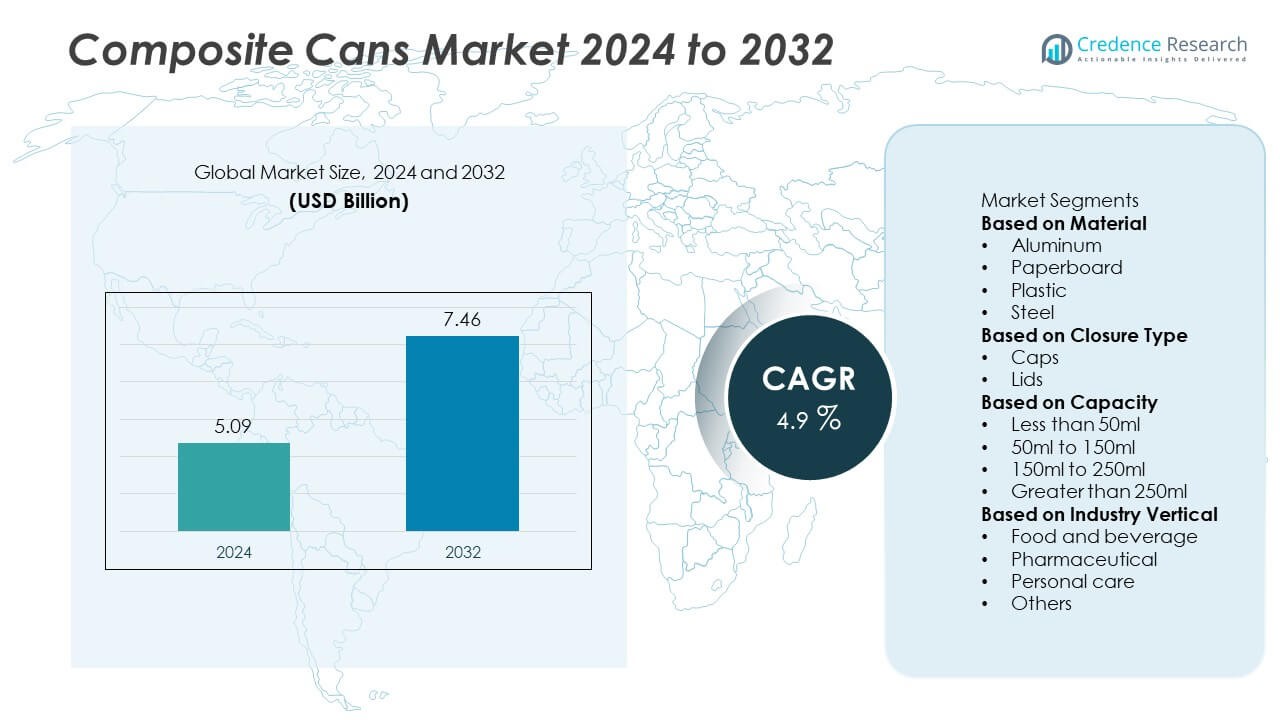

The Composite Cans Market was valued at USD 5.09 billion in 2024 and is projected to reach USD 7.46 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Cans Market Size 2024 |

USD 5.09 Billion |

| Composite Cans Market, CAGR |

4.9% |

| Composite Cans Market Size 2032 |

USD 7.46 Billion |

The composite cans market is led by key players such as Smurfit Kappa Group, Sonoco Products, Mondi Group, Corex Group, Irwin Packaging, Caraustar Industries, DS Smith Plc, Canfab Packaging Inc., Amcor Plc, and Visican Ltd. These companies emphasize sustainable, lightweight, and customizable packaging solutions tailored for food, beverage, and personal care applications. Asia-Pacific dominated the market with a 34% share in 2024, driven by expanding packaged food consumption and rapid industrial growth. Europe followed with a 28% share, supported by stringent sustainability policies and advanced packaging technologies. North America, holding 26%, benefitted from strong demand for recyclable and consumer-friendly packaging designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The composite cans market was valued at USD 5.09 billion in 2024 and is projected to reach USD 7.46 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

- Market growth is driven by rising demand for eco-friendly, lightweight, and recyclable packaging solutions across food, beverage, and personal care industries.

- Key trends include increased adoption of paperboard-based cans, development of biodegradable coatings, and expanding applications in e-commerce packaging due to durability and custom design flexibility.

- The market is competitive, with leading companies such as Smurfit Kappa Group, Sonoco Products, Mondi Group, and Amcor Plc focusing on sustainable innovation and regional expansion.

- Asia-Pacific led with a 34% share in 2024, followed by Europe at 28% and North America at 26%, while the paperboard segment dominated with a 52% share due to its cost-effectiveness and recyclability in consumer goods packaging.

Market Segmentation Analysis:

By Material

The paperboard segment dominated the composite cans market in 2024, holding a 52% share due to its sustainability, cost-effectiveness, and recyclability. Paperboard’s lightweight nature and high printability make it ideal for food, snacks, and household packaging. Growing environmental awareness and the shift toward eco-friendly materials are driving manufacturers to replace metal and plastic with paper-based alternatives. Advancements in multi-layer barrier coatings and biodegradable adhesives further enhance product durability and shelf life, supporting strong adoption across consumer goods and retail packaging industries globally.

- For instance, Smurfit Kappa Group introduced its Thermo Bag-in-Box solution featuring a multi-layer EVOH barrier film that extends the shelf life of hot-filled products like apple juice, which can then be stored under ambient conditions.

By Closure Type

The lids segment accounted for a 58% share of the composite cans market in 2024, driven by its superior sealing ability and convenience in resealable packaging. Lids are widely preferred in food and beverage applications where freshness and product integrity are critical. The growing use of metal and plastic lids in powdered foods, snacks, and coffee packaging supports market dominance. Manufacturers are focusing on easy-open and recyclable lid designs to improve user experience and sustainability, boosting adoption in premium and eco-conscious product lines.

- For instance, Sonoco Products Company launched its EnviroCan™ with PaperEnd™ recyclable composite can featuring a 100% paper-based lid, validated for curbside recycling in the U.S. by the Western Michigan University pilot plant.

By Capacity

The greater than 250ml segment led the market with a 47% share in 2024, attributed to its widespread use in food, beverage, and pet food packaging. Larger-capacity composite cans offer durability, protection from moisture, and improved stacking efficiency for bulk products. This segment benefits from strong demand in snacks, powdered beverages, and nutritional supplements. Increasing consumer preference for convenient, lightweight, and resealable packaging solutions continues to fuel growth. Rising use in e-commerce-ready packaging formats further strengthens demand for large-capacity composite cans across key global markets.

Key Growth Drivers

Rising Demand for Sustainable Packaging

Growing environmental awareness and strict regulations on plastic waste are driving demand for composite cans made from recyclable materials. Paperboard-based cans are emerging as preferred alternatives to metal and plastic packaging due to their biodegradability and lower carbon footprint. Consumers and brands are increasingly adopting eco-friendly packaging for food, beverages, and personal care products. This transition toward circular packaging solutions supports long-term market growth, particularly in regions emphasizing sustainability such as Europe and North America.

- For instance, Mondi Group developed its Hug&Hold paper-based carrier to replace plastic shrink wrap for beverage multipacks. This recyclable solution is suitable for existing European paper waste streams. In partnership with Krones, the system was validated for automated packing processes with 1.5-liter bottles for Coca-Cola HBC in Austria.

Expanding Processed Food and Beverage Industry

The expanding global processed food and beverage industry is a major growth driver for the composite cans market. These cans provide effective protection against moisture, light, and odor, maintaining product freshness and flavor. Their lightweight, stackable design enhances transport efficiency and shelf appeal. Rising consumption of snacks, powdered drinks, coffee, and infant formula in developing markets is fueling demand. Food producers prefer composite cans for their customizable shapes and printability, aligning with brand visibility and convenience trends.

- For instance, Sonoco Products Company supplies composite cans for leading brands like Pringles and Nestlé, using multi-layer materials and inner liners for moisture control. In collaboration with Kellanova Europe (Pringles’ parent company) and Nestlé, Sonoco has introduced more sustainable paper-based cans, with the Pringles tube now featuring a fiber bottom and the Nestlé coffee can being 95% paper-based.

Technological Advancements in Packaging Design

Continuous advancements in barrier coatings, laminates, and closure systems are improving the performance and versatility of composite cans. Innovations such as moisture-resistant liners, aluminum-free designs, and biodegradable adhesives enhance product protection while maintaining sustainability. Manufacturers are integrating automation and digital printing technologies to streamline production and customization. These developments not only reduce material usage but also expand composite can applications across non-food sectors, including cosmetics, nutraceuticals, and pet food packaging, boosting market penetration.

Key Trends & Opportunities

Shift Toward Lightweight and Recyclable Packaging

A growing trend toward lightweight and recyclable materials is reshaping the composite cans market. Consumers and brands favor packaging that reduces environmental impact without compromising performance. Lightweight cans help minimize shipping costs and carbon emissions while maintaining durability. Manufacturers are increasingly using water-based adhesives and recyclable metal ends to enhance sustainability. This trend aligns with global efforts to reduce single-use plastics, presenting opportunities for eco-friendly packaging innovations in both food and non-food applications.

- For instance, Amcor Plc developed its AmLite Ultra Recyclable high-barrier laminate to provide high-barrier protection and be recyclable where appropriate infrastructure exists. This innovation, which replaces aluminum or metallized barrier layers with a recyclable transparent coating, can reduce a pack’s carbon footprint by up to 64% compared to an equivalent non-recyclable pack.

Growing Popularity in E-Commerce Packaging

The rapid rise of e-commerce is creating new opportunities for composite cans due to their strength and product protection capabilities. These cans resist deformation during handling and transport, making them ideal for online retail shipments. Their compact design, tamper resistance, and customizable branding appeal to digital-first consumer goods companies. As online sales of snacks, nutritional powders, and personal care items grow, composite can manufacturers are focusing on e-commerce-ready designs that balance durability, cost-efficiency, and sustainability.

- For instance, DS Smith Plc introduced its ePack solution, a line of general e-commerce packaging, which includes options with high compression strength suitable for long-distance courier networks.

Key Challenges

High Production and Material Costs

The manufacturing process of composite cans involves multiple layers and materials, leading to higher production costs compared to single-material alternatives. Prices of raw materials like aluminum, adhesives, and barrier films add further pressure. Smaller manufacturers often face difficulties achieving economies of scale. Despite their sustainability benefits, cost-sensitive industries may prefer cheaper plastic packaging options. To overcome this challenge, producers are investing in process automation and localized material sourcing to lower costs and improve production efficiency.

Limited Recycling Infrastructure in Developing Regions

While composite cans are recyclable, the lack of adequate recycling infrastructure in many developing countries poses a challenge to market expansion. The multi-material composition requires specialized separation and recycling systems, which are not widely available. This limits the recovery and reuse of materials, undermining the sustainability advantage. Governments and industry players are focusing on awareness programs and investment in recycling technologies to enhance circular economy adoption. However, progress remains uneven across emerging markets, restraining full-scale market penetration.

Regional Analysis

North America

North America held a 26% share of the composite cans market in 2024, driven by strong demand for sustainable and lightweight packaging solutions in the food, beverage, and personal care sectors. The U.S. leads regional growth with rising adoption of paper-based cans as an eco-friendly alternative to plastics. Stringent packaging waste regulations and high consumer preference for recyclable products support expansion. Major packaging manufacturers are investing in product innovation, advanced barrier coatings, and digital printing technologies. Growing use in snack foods, coffee, and nutraceuticals continues to strengthen market growth across the region.

Europe

Europe accounted for 28% of the global composite cans market in 2024, supported by strict sustainability standards and the European Union’s circular economy policies. Countries such as Germany, France, and the U.K. lead the transition toward recyclable and paper-based packaging solutions. Strong adoption across food, beverage, and cosmetics sectors drives regional demand. Innovation in biodegradable coatings and metal-free can designs enhances product appeal. Consumer preference for premium, eco-friendly packaging continues to encourage manufacturers to expand local production capacity, reinforcing Europe’s position as a hub for sustainable packaging development.

Asia-Pacific

Asia-Pacific dominated the composite cans market with a 34% share in 2024, fueled by rapid urbanization, industrialization, and rising packaged food consumption in China, India, and Southeast Asia. Expanding middle-class populations and growing awareness of sustainable packaging solutions are key growth factors. Local manufacturers are investing in paperboard-based composite cans to meet demand from snacks, tea, and powdered beverage industries. Government initiatives promoting sustainable materials and foreign investment in packaging infrastructure further support growth. The region’s expanding e-commerce and retail networks continue to drive large-scale adoption of eco-friendly packaging formats.

Middle East & Africa

The Middle East & Africa region captured a 6% market share in 2024, supported by increasing diversification of packaging industries in Saudi Arabia, the UAE, and South Africa. Rapid expansion in food processing, dairy, and personal care sectors is generating demand for lightweight and moisture-resistant packaging solutions. The adoption of composite cans is rising due to their durability, design flexibility, and recyclability. Governments promoting waste reduction and sustainable packaging are creating new business opportunities. Growing retail modernization and import substitution efforts further enhance the regional market outlook.

South America

South America held a 6% share of the composite cans market in 2024, driven by rising consumer preference for recyclable and cost-effective packaging. Brazil, Argentina, and Chile lead regional growth due to expanding food and beverage industries. Increasing use of composite cans in snacks, powdered drinks, and pet foods supports market expansion. Local manufacturers are partnering with global companies to enhance material quality and improve production efficiency. Economic recovery and growing focus on sustainability in packaging design continue to drive steady adoption of paper-based composite cans across the region.

Market Segmentations:

By Material

- Aluminum

- Paperboard

- Plastic

- Steel

By Closure Type

By Capacity

- Less than 50ml

- 50ml to 150ml

- 150ml to 250ml

- Greater than 250ml

By Industry Vertical

- Food and beverage

- Pharmaceutical

- Personal care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the composite cans market features major players such as Smurfit Kappa Group, Sonoco Products, Mondi Group, Corex Group, Irwin Packaging, Caraustar Industries, DS Smith Plc, Canfab Packaging Inc., Amcor Plc, and Visican Ltd. These companies focus on developing lightweight, recyclable, and customizable packaging solutions for food, beverage, and personal care applications. Leading manufacturers are investing in advanced materials, digital printing, and high-barrier coatings to enhance product protection and sustainability. Strategic collaborations with food and FMCG brands are expanding their market reach, while regional players focus on cost-efficient production and eco-friendly innovations. Growing consumer demand for biodegradable and paper-based packaging is intensifying competition, prompting key companies to diversify product portfolios and strengthen global supply chains. Continuous innovation in design flexibility, recyclability, and performance optimization remains central to maintaining a competitive edge in this evolving packaging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Amcor Plc won the RECOUP Award for its reusable cup and lid range.

- In September 2025, Amcor Plc announced it would introduce its Modena Flip Top tamper-evident closure for sauces and dressings.

- In November 2023, Sonoco Products acquired Amcor’s composite cans operations in Asia Pacific to expand its footprint.

Report Coverage

The research report offers an in-depth analysis based on Material, Closure Type, Capacity, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as demand for sustainable packaging increases.

- Paperboard-based composite cans will dominate due to their recyclability and cost efficiency.

- Asia-Pacific will remain the leading regional market supported by rapid industrialization.

- Europe and North America will see strong adoption driven by eco-friendly packaging mandates.

- Food and beverage applications will sustain major demand for composite cans globally.

- Manufacturers will focus on advanced coatings and biodegradable materials for better performance.

- Automation and digital printing technologies will enhance production efficiency and design flexibility.

- Partnerships between packaging companies and FMCG brands will strengthen market presence.

- E-commerce growth will boost demand for durable, lightweight, and transport-safe can packaging.

- Long-term market growth will rely on innovation in recyclable and premium packaging solutions.