Market Overview:

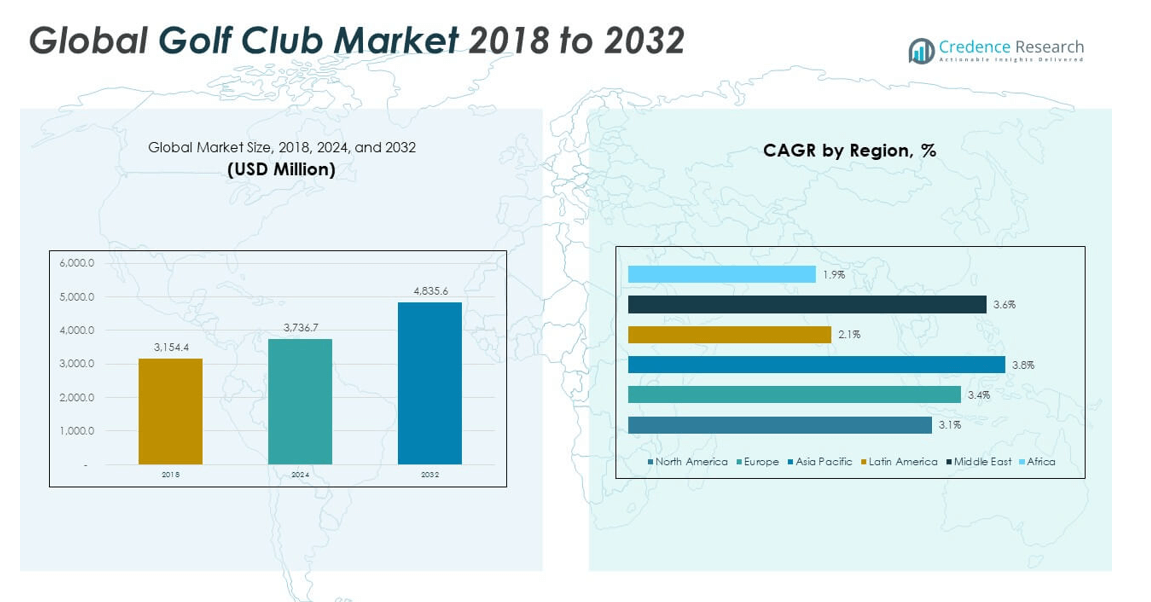

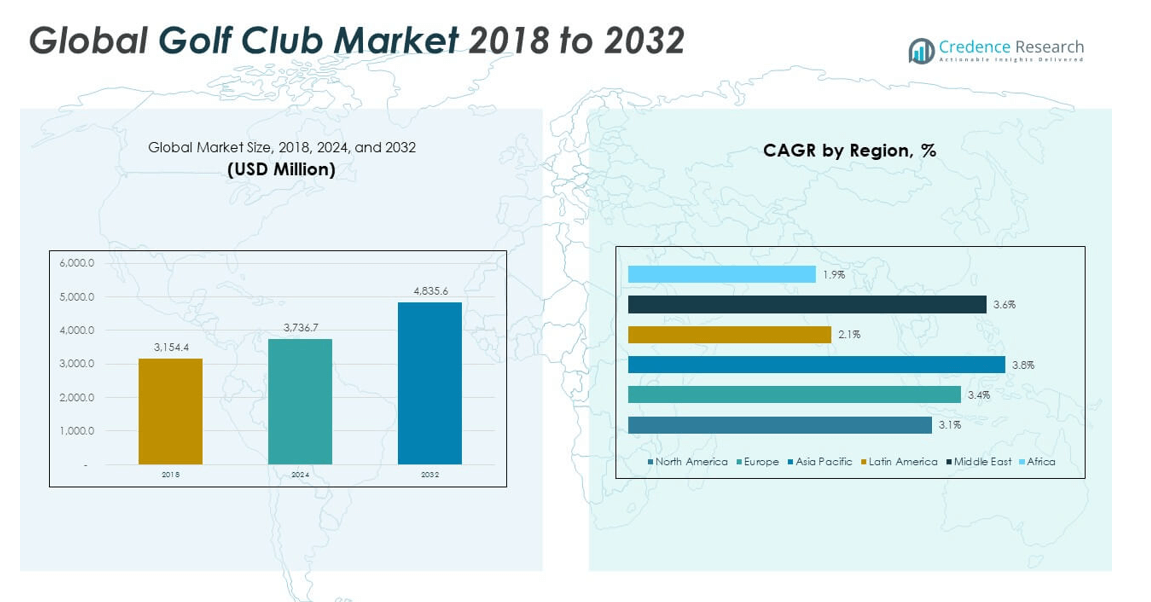

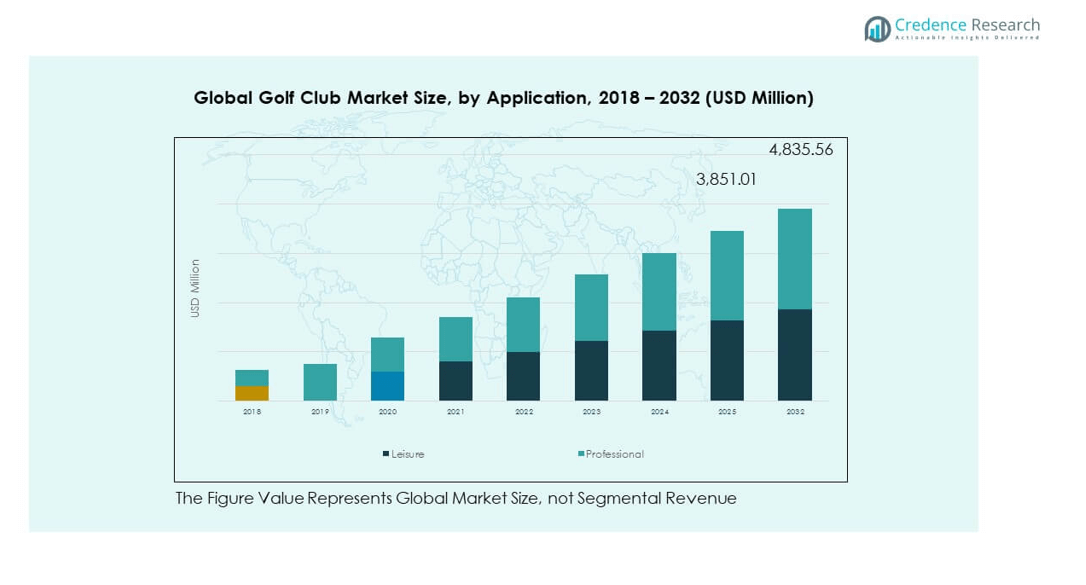

The Global Golf Club Market size was valued at USD 3,154.4 million in 2018 to USD 3,736.7 million in 2024 and is anticipated to reach USD 4,835.6 million by 2032, at a CAGR of 3.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Club Market Size 2024 |

USD 3,736.7 million |

| Golf Club Market, CAGR |

3.31% |

| Golf Club Market Size 2032 |

USD 4,835.6 million |

The market is witnessing steady growth driven by the rising popularity of golf as both a professional sport and a leisure activity. Increasing participation rates, fueled by younger demographics and women golfers, are boosting demand for modern, high-performance clubs. Technological innovations in club design, such as enhanced aerodynamics, adjustable features, and advanced materials, are improving performance and attracting both amateurs and professionals. Moreover, the surge in golf tourism and the development of new courses are further stimulating market expansion.

Regionally, North America holds the largest share due to its established golfing culture, a high number of courses, and strong spending power among consumers. Europe follows closely, driven by golf’s traditional presence and international tournaments. The Asia-Pacific region is emerging as the fastest-growing market, supported by expanding middle-class populations, rising disposable incomes, and increased interest in premium sports. Countries like China, Japan, and South Korea are investing in golf infrastructure, while emerging markets in Southeast Asia present new opportunities for industry growth.

Market Insights:

- The Global Golf Club Market was valued at USD 3,154.4 million in 2018, reached USD 3,736.7 million in 2024, and is projected to attain USD 4,835.6 million by 2032, growing at a CAGR of 3.31% during the forecast period.

- Rising participation in golf among younger demographics, women, and amateur players is driving consistent demand for modern, high-performance clubs.

- Technological advancements in materials, aerodynamics, and adjustable features are enhancing player performance and boosting brand loyalty.

- High equipment costs and limited accessibility in emerging markets are restraining market expansion, particularly among first-time players.

- Competition from alternative leisure activities and seasonal constraints in certain regions continues to challenge consistent player engagement.

- North America dominates the market due to its established golfing culture, extensive infrastructure, and strong consumer spending capacity.

- Asia-Pacific is emerging as the fastest-growing region, supported by rising disposable incomes, golf tourism development, and increasing infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Participation Across Diverse Demographics Driving Demand Growth:

The Global Golf Club Market is expanding due to the growing participation of younger demographics, women, and amateur players. It benefits from the sport’s evolving image, which now appeals to a broader audience beyond traditional players. National and regional golf associations are actively promoting inclusivity through beginner-friendly events and affordable memberships. The development of training academies and urban golf ranges is increasing accessibility for first-time players. Golf tourism is contributing to higher demand, with players seeking high-quality equipment for travel and tournaments. The popularity of mini-golf and indoor simulators is encouraging initial exposure to the sport. Partnerships between clubs and schools are introducing golf at an early age. These factors are creating a steady pipeline of new golfers entering the market.

- For instance, TaylorMade Golf reported significant player engagement increases tied to the proliferation of their advanced driver models such as the Stealth™ series, which utilize 60 layers of carbon fiber to optimize performance, underscoring the impact of innovation and visibility through high-profile endorsements and televised events.

Technological Advancements Elevating Equipment Performance and Player Experience:

The market benefits from innovations in materials, design, and manufacturing techniques. The Global Golf Club Market now offers clubs with enhanced aerodynamics, adjustable loft settings, and improved weight distribution. Carbon fiber and titanium components are increasing durability while reducing weight. Precision manufacturing ensures consistent performance across product lines. Custom fitting technologies are making clubs more personalized to individual swing profiles. These improvements enhance shot accuracy, distance, and overall playability. Golf brands are leveraging advanced simulation and testing to refine designs before mass production. The use of AI-driven data analysis is optimizing design parameters for diverse player needs. This focus on performance innovation is reinforcing brand loyalty and repeat purchases.

- For instance, Arccos, a connected sensor brand, has logged over 1billion golf shots and reports members improving their scores by five shots on average within their first year of use, quantifying real-world outcomes of data-driven training.

Infrastructure Expansion and Golf Tourism Fueling Equipment Sales:

Investment in golf courses, resorts, and related infrastructure is directly influencing club sales. The Global Golf Club Market benefits from new facilities in both established and emerging golfing nations. Resorts are integrating premium golf courses to attract high-spending travellers. Countries aiming to boost tourism are hosting international golf tournaments, creating global exposure. Seasonal golf tourism in destinations with favorable climates sustains equipment demand year-round. Golf course renovation projects are modernizing facilities to meet contemporary player expectations. Local markets near major resorts often see increased retail activity for premium clubs. These developments are solidifying golf’s position as a lifestyle-driven leisure activity.

Strategic Marketing Campaigns and Sponsorships Strengthening Brand Visibility:

Leading golf brands are investing heavily in marketing partnerships with professional players and tournaments. The Global Golf Club Market gains visibility through televised events and digital campaigns targeting specific consumer segments. Sponsorship deals with tour professionals influence equipment preferences among enthusiasts. Brands are utilizing social media influencers to reach younger audiences. Interactive promotional events, such as demo days, allow potential customers to test products before purchase. Seasonal sales campaigns during major tournaments stimulate short-term spikes in demand. Collaborations with golf academies help brands establish trust with beginners. These strategies are enhancing consumer engagement and driving consistent sales growth.

Market Trends:

Rising Popularity of Indoor Golf and Simulation Technologies:

The Global Golf Club Market is witnessing increased integration of indoor golf simulators in retail stores, entertainment centers, and private homes. These systems allow year-round play regardless of weather conditions. Brands are adapting club designs to cater to simulator enthusiasts seeking specific performance attributes indoors. Growth in urban living has made indoor golf an attractive option for those without access to full courses. Simulator-based tournaments are gaining traction as competitive platforms. Rental and subscription-based access to high-quality simulators is expanding the customer base. Manufacturers are collaborating with simulator companies for product testing and promotional tie-ins. This trend is creating new channels for club sales outside traditional golf environments.

- For instance, Callaway’s AI-designed Ai 10X face in their 2025 Elyte driver dynamically adjusts thickness across the clubface, resulting in a 10% increase in off-center ball speed versus prior models. Players can review shot metrics on mobile apps in real time—empowering data-driven improvement with tangible performance gains, such as measurable reductions in scoring error percentages on professional tours.

Sustainability Initiatives Influencing Manufacturing and Consumer Choices:

The shift toward environmentally conscious products is shaping demand patterns. The Global Golf Club Market is responding with sustainable materials, recyclable components, and eco-friendly manufacturing processes. Brands are reducing packaging waste and implementing energy-efficient production methods. Consumers are increasingly prioritizing environmentally responsible purchases, influencing brand selection. Golf courses adopting sustainable practices are also promoting equipment choices aligned with these values. Transparency in sourcing and ethical labor practices is becoming a selling point for premium clubs. Companies that integrate sustainability into their branding are attracting loyal, eco-conscious customers. This alignment with broader sustainability goals is enhancing brand reputation in competitive markets.

- For instance, Arccos Smart Sensors automatically track 98% of all tee shots and pair with mobile apps to deliver real-time, AI-powered analytics—facilitating performance improvement and data-driven club recommendations. Their system has proven impact, with average members lowering their handicap by five shots in the first year, and with over 1billion shots already tracked globally.

Growth of Women-Centric Golf Products and Marketing Strategies:

An expanding female golfer base is prompting brands to create tailored product lines. The Global Golf Club Market now features women-specific club designs with optimized shaft lengths, lighter weights, and distinct aesthetics. Female-focused marketing campaigns are emphasizing empowerment and community engagement. Retail environments are incorporating dedicated sections for women’s golf equipment. Sponsorship of women’s tournaments is elevating visibility for these product categories. Brands are collaborating with female golf influencers to create relatable content. Training programs targeting women are generating consistent equipment demand. These efforts are fostering stronger female participation and expanding market potential.

Integration of Smart Technology in Club Design and Player Analytics:

The market is embracing smart sensors and connected technologies to improve player performance analysis. The Global Golf Club Market offers clubs embedded with tracking devices that measure swing speed, impact angle, and ball trajectory. Data integration with mobile apps allows players to review and improve techniques. Brands are partnering with tech firms to develop proprietary analytics platforms. This technology is being adopted by both professional and amateur players seeking performance insights. Customization options based on player data are enhancing the appeal of premium clubs. Retailers are offering live demos with real-time analytics to encourage purchases. The trend is bridging traditional sports equipment with digital performance monitoring.

Market Challenges Analysis:

High Price Sensitivity and Accessibility Barriers in New Markets:

The Global Golf Club Market faces significant challenges due to the high cost of premium equipment. Many potential players in emerging markets are deterred by the investment required for a full set of clubs. Limited access to financing or installment payment options compounds the problem. Entry-level clubs exist, but quality differences can impact player experience and retention. The scarcity of retail outlets in rural or less-developed regions restricts availability. Import duties and taxes further elevate pricing in certain countries. Lack of widespread rental services reduces opportunities for trial use. Addressing affordability remains critical to broadening the customer base globally.

Competition from Alternative Recreational Activities and Sports:

The sport competes with a wide range of recreational options that require lower financial and time commitments. The Global Golf Club Market is impacted when potential players opt for activities such as tennis, cycling, or fitness training. Younger generations often favor fast-paced sports with shorter play times. Urban lifestyles and work demands limit the availability for extended golf sessions. The need for specialized courses and equipment can be a barrier for casual interest. Seasonal constraints in certain regions reduce consistent participation. Marketing efforts must counter these diversions by emphasizing golf’s unique appeal and evolving formats. Maintaining relevance in a crowded leisure market is a continuous challenge.

Market Opportunities:

Expansion of Golf Academies and Youth Training Programs:

The growing investment in golf academies and youth development programs is creating new sales channels. The Global Golf Club Market benefits from partnerships with schools and sports institutions introducing golf at an early age. Junior-specific clubs and affordable starter sets are gaining popularity among parents. Training facilities in urban areas are increasing exposure to the sport. Local and national tournaments for juniors are fostering early loyalty to specific brands. This emphasis on grassroots participation is likely to produce long-term players and customers. Strategic alliances between brands and training programs can reinforce equipment sales growth.

Rising Demand for Custom-Fit and Premium Lifestyle-Oriented Clubs:

A shift toward personalized experiences is opening opportunities for high-margin product lines. The Global Golf Club Market is witnessing increased interest in custom-fit clubs that match player-specific swing profiles. Luxury and lifestyle-oriented designs are appealing to affluent customers seeking exclusivity. Integration of advanced fitting technology in retail outlets enhances purchase satisfaction. Limited-edition releases and collaboration with fashion brands are creating niche demand. Golf clubs positioned as status symbols attract both active players and collectors. This premiumization trend is contributing to higher average revenue per customer.

Market Segmentation Analysis:

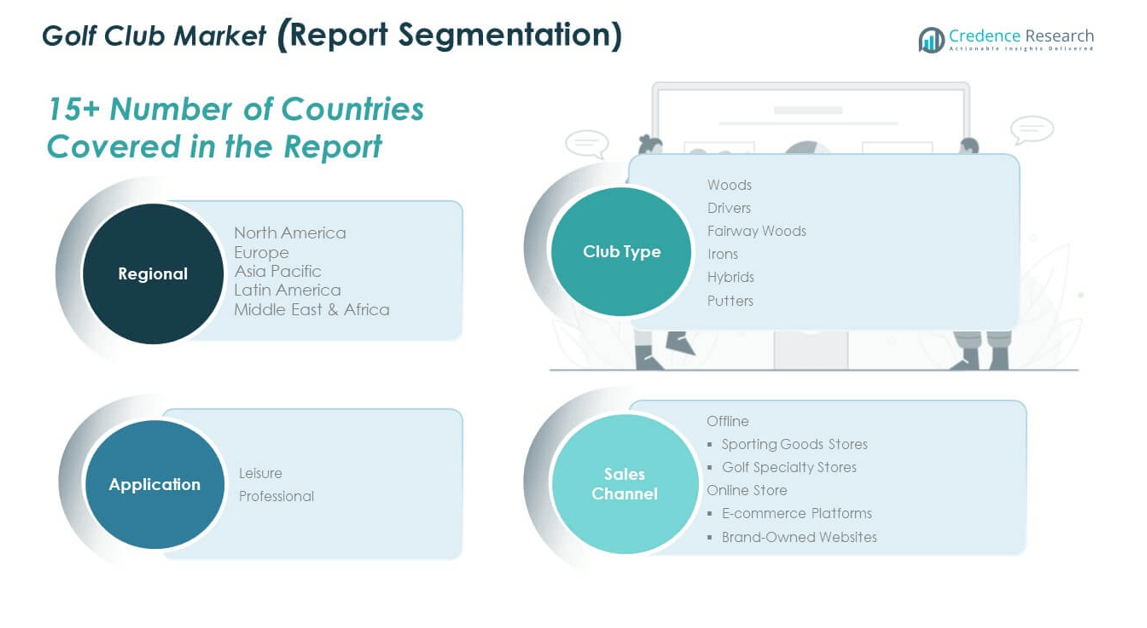

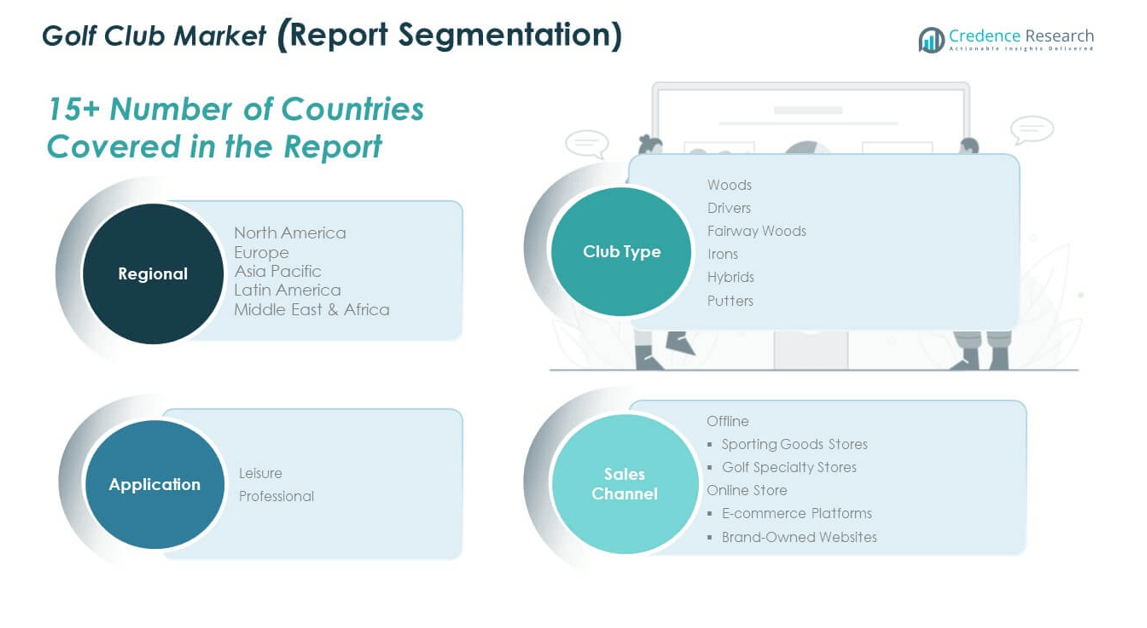

By Club Type

The Global Golf Club Market is segmented into woods, drivers, fairway woods, irons, hybrids, and putters. Woods and drivers dominate demand among professionals and serious amateurs due to their role in achieving long-distance shots, while fairway woods cater to precision play from various lies. Irons remain the most versatile category, serving both practice and competitive needs. Hybrids are gaining traction for their ease of use and forgiveness, appealing to new and intermediate players. Putters, essential for short-game accuracy, sustain consistent demand across all skill levels.

- For instance, modern drivers now use carbon fiber composites to create ultra-light shafts and titanium-alloy heads, expanding the sweet spot for enhanced forgiveness. Leading club makers utilize maraging steel in irons and wedges, delivering superior energy transfer and improved distance and control, while the adoption of 3D-printed components in putters enhances customization and accuracy for both amateurs and pros.

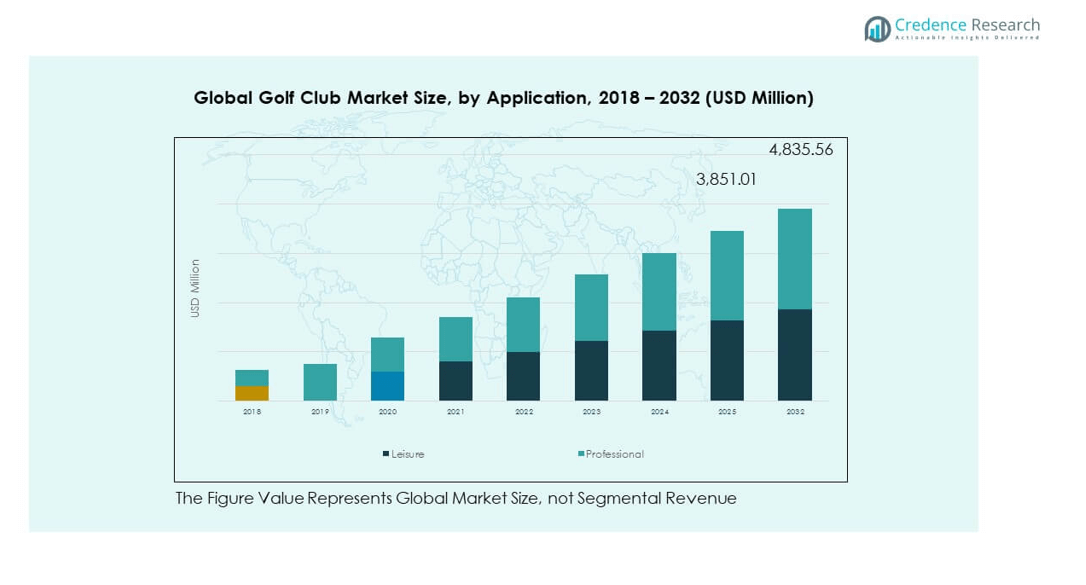

By Application

The market is divided into leisure and professional segments. Leisure golfers represent a significant share of sales volume, driven by recreational participation, golf tourism, and casual play. The professional segment generates higher value sales, with demand centered on advanced technology, custom fitting, and premium materials to enhance competitive performance. Each segment maintains distinct purchasing priorities, influencing brand positioning and product development strategies.

- For instance, the professional market pushes performance, as seen in the adoption of Bridgestone’s e9 Long Drive ball by World Long Drive competitors, yielding documented increases in launch and carry distances for elite players. Meanwhile, the proliferation of accessible custom fitting and data-powered club selection ensures that even leisure golfers now achieve measurable improvements in swing speed and ball flight, narrowing the gap between amateur and professional outcomes.

By Sales Channel

The market includes offline, online stores, and others. Offline channels, comprising sporting goods stores and golf specialty stores, hold a major share due to the preference for physical trials and expert consultation before purchase. Online channels, including e-commerce platforms and brand-owned websites, are expanding rapidly, supported by convenience, broad product availability, and increasing digital engagement among consumers. The “others” category covers secondary distribution avenues such as rental services and resale markets, catering to cost-sensitive or occasional players. This diverse sales channel mix enables the market to effectively meet varying customer needs across regions.

Segmentation:

By Club Type

- Woods

- Drivers

- Fairway Woods

- Irons

- Hybrids

- Putters

By Application

By Sales Channel

- Offline

- Sporting Goods Stores

- Golf Specialty Stores

- Online Store

- E-commerce Platforms

- Brand-Owned Websites

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Golf Club Market size was valued at USD 869.34 million in 2018 to USD 1,016.55 million in 2024 and is anticipated to reach USD 1,292.55 million by 2032, at a CAGR of 3.1% during the forecast period. North America accounts for approximately 27.2% of the global market in 2024. It remains the leading region due to its well-established golfing culture, large number of courses, and strong spending capacity among players. The U.S. dominates regional demand, supported by high participation rates in both professional and recreational golf. The presence of major golf tournaments such as the PGA Tour drives brand visibility and equipment upgrades. Canada and Mexico are contributing through growing golf tourism and expanding infrastructure. Retail networks, both specialty stores and e-commerce, are well-developed, ensuring easy access to premium products. Strategic partnerships between brands and professional golfers further reinforce demand. Seasonal weather patterns influence play schedules but do not diminish long-term equipment sales.

Europe

The Europe Global Golf Club Market size was valued at USD 746.64 million in 2018 to USD 888.17 million in 2024 and is anticipated to reach USD 1,155.70 million by 2032, at a CAGR of 3.4% during the forecast period. Europe holds around 24% of the global market in 2024. The region benefits from a rich golfing heritage, with countries like the UK, Germany, France, and Spain hosting numerous championship courses. High interest in international golf events drives equipment demand across professional and leisure segments. The UK remains a major contributor due to its mature market and presence of leading golf retailers. Southern Europe benefits from year-round tourism, attracting golfers from across the continent. Demand is increasingly shaped by technological innovation, custom fitting services, and sustainability initiatives. Northern European countries focus on indoor golfing facilities to offset seasonal limitations. E-commerce adoption is rising, with brands targeting younger demographics through digital marketing.

Asia Pacific

The Asia Pacific Global Golf Club Market size was valued at USD 992.05 million in 2018 to USD 1,212.19 million in 2024 and is anticipated to reach USD 1,632.49 million by 2032, at a CAGR of 3.8% during the forecast period. Asia Pacific commands approximately 32.4% of the global market in 2024, making it the fastest-growing region. Expanding middle-class populations, rising disposable incomes, and infrastructure investments are fueling market growth. Japan, South Korea, and Australia have matured golfing markets, while China and Southeast Asia are emerging strongly. Golf tourism is expanding in countries like Thailand and Vietnam, increasing demand for both leisure and professional equipment. Urban centers are seeing a rise in indoor simulators and training facilities. Regional players are competing with global brands by offering cost-effective alternatives. Sponsorship of local tournaments is building stronger consumer-brand connections. The market is supported by both offline specialty stores and rapidly expanding online channels.

Latin America

The Latin America Global Golf Club Market size was valued at USD 322.06 million in 2018 to USD 356.86 million in 2024 and is anticipated to reach USD 419.24 million by 2032, at a CAGR of 2.1% during the forecast period. Latin America represents about 9.5% of the global market in 2024. The region’s growth is supported by increasing golf tourism, particularly in Brazil, Mexico, and Argentina. International tournaments and resort-based golfing facilities are boosting visibility for the sport. Economic conditions influence discretionary spending on premium golf equipment. Local clubs and training facilities are limited in some countries, constraining participation rates. However, partnerships with international brands are enhancing product availability. Online retail penetration is growing, though offline specialty stores remain the primary sales channel. The focus on high-net-worth individuals and expatriate communities sustains demand in premium segments.

Middle East

The Middle East Global Golf Club Market size was valued at USD 150.78 million in 2018 to USD 182.14 million in 2024 and is anticipated to reach USD 241.78 million by 2032, at a CAGR of 3.6% during the forecast period. The Middle East holds around 4.9% of the global market in 2024. The region’s growth is driven by luxury golf resorts, international events, and an affluent customer base. The UAE leads in terms of infrastructure, hosting world-class golf courses and tournaments. Saudi Arabia is making strategic investments to position itself as a golfing destination. Premium product demand is high, with players favoring custom-fit clubs and exclusive designs. The region relies heavily on imports, with international brands dominating the market. Golf tourism from Europe and Asia contributes significantly to seasonal demand. Indoor golfing facilities are gaining attention, particularly in urban centers.

Africa

The Africa Global Golf Club Market size was valued at USD 73.50 million in 2018 to USD 80.82 million in 2024 and is anticipated to reach USD 93.81 million by 2032, at a CAGR of 1.9% during the forecast period. Africa accounts for about 2.2% of the global market in 2024. South Africa dominates regional demand, supported by a strong golfing tradition and established courses. Golf tourism plays a vital role in sustaining equipment sales, especially in resort destinations. Economic constraints and limited infrastructure in several countries hinder market expansion. Imports dominate supply, with few local manufacturing capabilities. Growth opportunities exist in high-income urban areas where demand for premium equipment is rising. Golf clubs are increasingly marketed through specialty stores located in affluent neighborhoods. Online sales are emerging but remain secondary to offline channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mizuno Corporation

- Acushnet Holdings Corp

- TaylorMade Golf Company

- Roger Cleveland Golf Company, Inc.

- Bridgestone Sports Ltd

- Amer Sports Corporation

- Callaway

- Takomo Golf Company

- Golfsmith International Holdings, Inc.

- Ben Hogan Golf Equipment Company

- Other Key Players

Competitive Analysis:

The Global Golf Club Market features a highly competitive landscape marked by several established brands and emerging challengers each pushing performance and innovation. It includes global manufacturers like Callaway, Titleist, TaylorMade, and Mizuno, each leveraging advanced technologies and product differentiation to command market share. It faces pressure from niche players and new entrants offering high-value propositions at affordable price points. Distribution networks span traditional specialty stores and digital platforms, increasing consumer access and driving retail rivalry. It relies on continuous innovation in materials, fit, and customization to maintain relevance. Strategic partnerships with golf courses, academies, and professional athletes reinforce brand prestige and customer loyalty. Consumers benefit overall through improved product options and competitive pricing, which continues to shape the market dynamics across regions.

Recent Developments:

- In 2025, Mizuno Corporation launched its new Mizuno Pro 243 irons as part of a refreshed lineup. The Pro 243 irons, which replace the Pro 223, feature a new Microslot design in the longer irons for higher launch and faster ball speeds, along with a wraparound sole for improved turf interaction. Mizuno also introduced Pro S-3 and JPX 925 forged custom irons, expanding options for both pros and enthusiasts. New putter models and color options for signature wedges and irons were also released in mid-2025, emphasizing performance and craftsmanship.

- In April 2025, Roger Cleveland rejoined Cleveland Golf, the company he founded, as Founder & Advisor. This move marks a significant shift, promising renewed innovation in wedges and short-game clubs as Cleveland Golf seeks to combine legacy craftsmanship with new technologies. His role is expected to have a considerable impact on product development and brand direction going forward.

- In May 2025, Amer Sports Corporation reported record first-quarter financial results, with 23% revenue growth and raised projections for 2025. The company’s Ball & Racquet segment—which houses Wilson, a major golf club brand—delivered healthy sales and profitability, benefitting from inflows across technical apparel and performance segments. These results underscore Amer’s expanding market presence in sports equipment, including global golf.

Market Concentration & Characteristics:

The Global Golf Club Market exhibits moderate concentration, with several dominant brands maintaining substantial influence through distribution networks and innovation. It features a mix of global incumbents and niche manufacturers, fostering both brand loyalty and product diversity. Premium equipment commands a notable share, but mid-tier and value offerings attract price-sensitive customers. It depends on performance, customization, and brand reputation to differentiate products. While barriers to entry include high R&D costs and established retail partnerships, digital platforms and simulation technologies create opportunities for newer players. The market balances between exclusive offerings for enthusiasts and accessible products for casual users, driving continuous evolution and segmentation.

Report Coverage:

The research report offers an in-depth analysis based on club type, application, sales channel, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of golf tourism and resort-based facilities will sustain demand for both leisure and professional equipment.

- Increasing adoption of advanced materials and aerodynamic designs will enhance club performance and player satisfaction.

- Growth in women’s participation and youth engagement programs will diversify the customer base.

- E-commerce platforms will strengthen distribution, offering broader product access and customization options.

- Rising investment in indoor golf simulators will create year-round playing opportunities in urban markets.

- Emerging economies will experience higher market penetration through infrastructure development and affordable entry-level clubs.

- Partnerships between brands and professional golfers will continue to influence consumer purchasing decisions.

- Sustainability initiatives in manufacturing and product design will attract eco-conscious customers.

- Custom fitting technologies will gain traction, improving player performance and equipment value perception.

- Regional market leaders will focus on premiumization strategies to differentiate in competitive landscapes.