Market Overview:

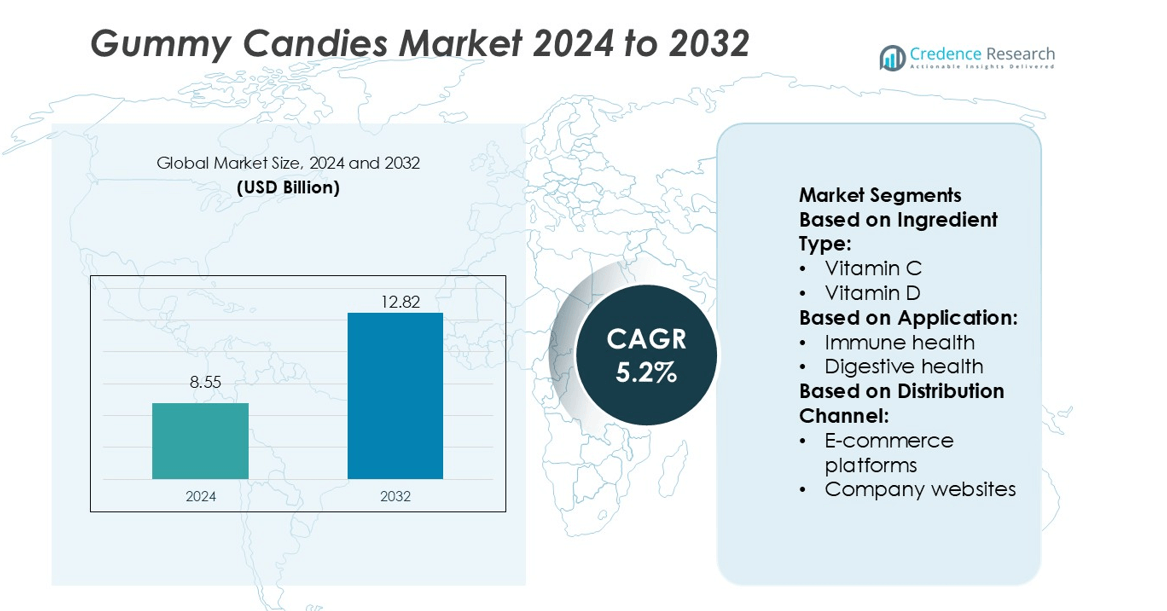

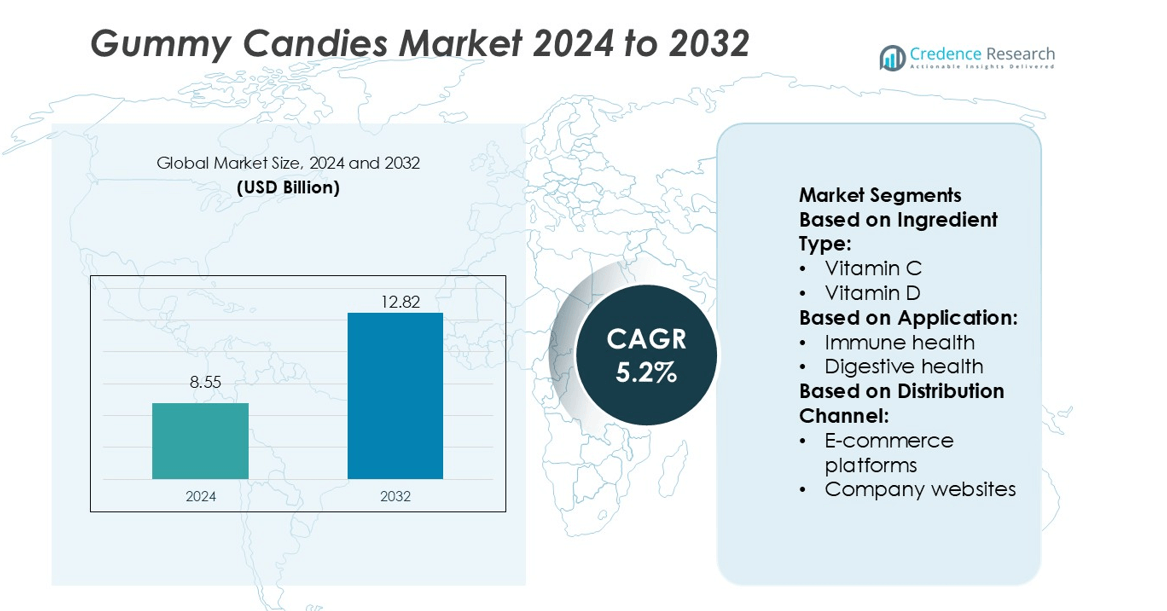

Gummy Candies Market size was valued USD 8.55 billion in 2024 and is anticipated to reach USD 12.82 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gummy Candies Market Size 2024 |

USD 8.55 billion |

| Gummy Candies Market, CAGR |

5.2% |

| Gummy Candies Market Size 2032 |

USD 12.82 billion |

The gummy candies market is driven by key players such as Vitux AS, Prime Health Ltd., Lactonova, AJES Pharmaceuticals LLC, SMPNutra.com, Bettera Brands, LLC, Better Nutritionals, NutraStar Manufacturing Ltd., Allseps Pty. Ltd., and Boscogen, Inc. These companies emphasize product innovation, clean-label ingredients, and expansion into functional gummy categories. Strategic collaborations, advanced formulation technologies, and sustainable packaging initiatives strengthen their market presence globally. North America leads the global gummy candies market with a 36% share, supported by strong consumer demand for fortified, sugar-free, and plant-based gummies. The region’s well-established retail infrastructure and growing e-commerce penetration further sustain its dominance.

Market Insights

- The Gummy Candies Market was valued at USD 8.55 billion in 2024 and is projected to reach USD 12.82 billion by 2032, growing at a CAGR of 5.2%.

- Market growth is driven by rising demand for functional and fortified gummies featuring vitamins, minerals, and natural ingredients across both adult and children demographics.

- Clean-label, vegan, and sugar-free trends continue to influence product development, as brands focus on transparency, ingredient purity, and sustainable packaging.

- Competitive intensity remains high, with leading companies emphasizing innovation, strategic partnerships, and advanced formulation technologies to strengthen global presence.

- North America leads with a 36% share due to strong retail networks and e-commerce growth, while the ≥99% purity and vitamin-enriched segments dominate the market due to rising consumer preference for healthier confectionery choices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ingredient Type

The vitamins segment dominates the Gummy Candies Market, holding the largest share due to its wide consumer acceptance in functional confectionery. Among these, the Vitamin C sub-segment leads with a market share exceeding 35%, driven by its immunity-boosting benefits and use in daily nutrition. Growing health awareness, coupled with rising demand for sugar-free and vegan options, supports the segment’s expansion. Companies increasingly fortify gummies with multiple vitamins and natural sweeteners to meet clean-label expectations and appeal to both adults and children.

- For instance, Vitux AS employs its patented ConCordix® Smart Chew technology which allows a single chewable to deliver up to 600 mg of omega-3 and 800 mg of fish oil in one dose, and has shown a 44.9 % increase in nutrient uptake compared to standard softgels.

By Application

Immune health represents the dominant application segment in the Gummy Candies Market, accounting for more than 30% share. Demand surged as consumers prioritized preventive health and daily wellness support. Vitamin C and zinc-enriched gummies are popular choices for maintaining immunity, especially among adults and children. The digestive health and sleep management segments are also gaining traction, fueled by probiotic formulations and melatonin-based innovations. Rising awareness of stress relief and beauty nutrition further broadens the appeal of functional gummies in the wellness market.

- For instance, Prime Health Ltd. reports that its contract-manufactured gummy programme achieved a 24 000-piece hourly output on its twin-belt gummy line and implemented a ±0.3 mm die-cut tolerance for chew shapes, enabling consistent production of kids-friendly immune-support units with over 150 mg of vitamin C per piece and zinc at 5 mg per piece.

By Distribution Channel

The offline segment leads the Gummy Candies Market, contributing over 60% of total revenue. Supermarkets and hypermarkets hold the largest share within this channel, driven by high visibility and impulse buying behavior. Pharmacies also play a growing role in selling functional and vitamin-enriched gummies, reinforcing consumer trust. However, online sales through e-commerce platforms and company websites are rapidly expanding, supported by convenience, digital promotions, and product variety. Brands increasingly integrate subscription models and direct-to-consumer sales strategies to strengthen online reach.

Key Growth Drivers

Rising Demand for Functional Gummies

Consumers are increasingly seeking confectionery that combines taste with health benefits. Functional gummies enriched with vitamins, minerals, and botanical extracts are gaining wide acceptance among adults and children. The trend aligns with preventive healthcare and convenience-based consumption patterns. For instance, brands like Olly and SmartyPants Vitamins have expanded their nutraceutical gummy lines across global retail chains, offering targeted formulations for sleep, immunity, and skin health, thereby boosting sales and category penetration.

- For instance, Lactonova uses an Eco-Forming process to deposit gummies into steel moulds rather than conventional pans, reducing manufacturing downtime by 40 minutes per batch.

Expanding Retail and E-Commerce Channels

The growing accessibility of gummy candies through online and offline platforms is accelerating market expansion. Supermarkets, convenience stores, and e-commerce websites offer a diverse range of products with customized flavors and packaging. Strategic partnerships between confectionery manufacturers and e-commerce platforms enhance visibility and consumer reach. Ferrara Candy Company leveraged Amazon and Walmart’s online stores to distribute Trolli and Black Forest gummies, expanding its footprint across emerging markets.

- For instance, SMP Nutra manufactures supplements in a combined total of 277,000 sq ft of facilities that are both GMP Registered and FDA-registered. The minimum order quantity for stock/private label products, including gummy formulas, is specified as 1,000 bottles.

Product Innovation and Clean-Label Formulations

Manufacturers are innovating with natural ingredients, sugar-free formulations, and plant-based gelatin alternatives to meet consumer preferences. Clean-label claims such as “non-GMO,” “vegan,” and “organic” have become key differentiators in product marketing. For instance, Haribo and Albanese have introduced gelatin-free and reduced-sugar variants using fruit-based pectin, catering to vegan and diabetic consumers while broadening their customer base globally.

Key Trends & Opportunities

Growing Popularity of Nutraceutical Gummies

Nutraceutical gummies are bridging the gap between dietary supplements and confectionery. Consumers prefer these chewable formats for ease of use and pleasant taste. This segment is witnessing expansion in immune health, stress management, and beauty-from-within categories. Nature’s Truth launched collagen and biotin gummies targeting beauty-conscious consumers, signaling strong growth potential within wellness-oriented markets.

- For instance, Better Nutritionals and DouxMatok collaborated to launch gummies that deliver 40% less sugar and 33% fewer calories compared to leading pectin-based gummies, using the Incredo® sugar-reduction system.

Customization and Flavor Innovation

Brands are increasingly focusing on personalization, offering gummies in diverse flavors, shapes, and nutritional profiles. Advanced flavor technologies and regional taste adaptations are helping companies strengthen brand loyalty. Mars Wrigley introduced limited-edition fruity gummy variants under its Starburst brand, enhancing consumer engagement through innovative seasonal offerings.

- For instance, Asher’s constructed a new 125,000 sq ft facility in Pennsylvania that supports the production of more than 8 million pounds of chocolate-covered candy per year.

Sustainable Packaging and Eco-Friendly Practices

Sustainability initiatives are shaping brand strategies across the confectionery sector. Companies are investing in biodegradable packaging and renewable sourcing to align with eco-conscious consumers. For instance, Perfetti Van Melle implemented recyclable pouches for its Fruittella range, reducing plastic waste and supporting its global sustainability goals.

Key Challenges

Rising Raw Material and Ingredient Costs

Fluctuations in sugar, gelatin, and natural flavor prices impact manufacturing expenses. Producers face pressure to balance affordability and quality while maintaining profit margins. For instance, post-pandemic supply chain disruptions led companies like Mondelez to adjust pricing strategies for their candy portfolio to offset input cost inflation.

Health Concerns Linked to Sugar Content

Excess sugar consumption and rising obesity rates are influencing consumer choices. Governments are enforcing sugar taxes and stricter labeling regulations, challenging traditional candy producers. For instance, in the UK, the Soft Drinks Industry Levy prompted confectionery brands to reduce sugar levels or develop alternative sweetener-based gummy formulations to remain compliant and competitive.

Regional Analysis

North America

North America holds the largest share of 36% in the gummy candies market, driven by strong consumer demand for functional and fortified confectionery. The U.S. dominates the regional landscape with widespread adoption of vitamin-infused gummies and sugar-free variants. Major players like Mars Wrigley, Ferrara Candy Company, and Albanese lead through continuous product innovation and premium packaging. Expanding retail distribution and e-commerce penetration further strengthen market performance. Canada also contributes through rising consumption of vegan and organic gummies, reflecting growing health awareness among millennials and younger consumers seeking healthier snacking alternatives.

Europe

Europe accounts for 29% of the gummy candies market, supported by increasing preference for natural ingredients and reduced-sugar formulations. Germany, the U.K., and France are key contributors, driven by established brands such as Haribo and Cloetta. Consumer interest in clean-label and gelatin-free gummies continues to expand across the region. The shift toward plant-based confectionery aligns with evolving dietary patterns and sustainability goals. Retailers are also emphasizing private-label gummies with premium flavors, enhancing competition. Regulatory support for transparency in ingredient labeling and nutritional content strengthens consumer trust and sustains steady market growth.

Asia-Pacific

Asia-Pacific captures 24% of the global gummy candies market, reflecting rapid urbanization, rising disposable income, and Westernized consumption trends. Countries like China, Japan, and India show increasing demand for nutraceutical gummies targeting immunity, beauty, and digestion. Local manufacturers are innovating with tropical flavors and culturally preferred ingredients to enhance market appeal. International brands are expanding through regional collaborations and e-commerce platforms. For instance, Haribo and Ferrero have scaled production capacities across Southeast Asia. The region’s younger demographics and growing health-conscious population continue to drive significant volume growth across both traditional and functional gummy segments.

Latin America

Latin America represents 7% of the gummy candies market, with Brazil and Mexico leading consumption growth. Rising demand for affordable confectionery and growing awareness of fortified gummies support regional expansion. Local producers are introducing new flavors and portion-controlled packs to attract health-minded consumers. International players are investing in localized production to reduce costs and cater to regional taste preferences. Regulatory shifts promoting lower sugar content have encouraged innovation in formulation. Despite economic fluctuations, increasing youth population and urban retail development contribute to the market’s moderate but consistent growth trajectory.

Middle East & Africa

The Middle East & Africa region holds an 4% share in the gummy candies market, with increasing consumption in the UAE, Saudi Arabia, and South Africa. The market benefits from rising disposable income and growing availability of imported confectionery brands. Halal-certified and gelatin-free gummies are gaining strong traction among Muslim consumers. Local manufacturers are expanding production capacities to meet the surging demand for natural and vitamin-enriched candies. E-commerce and modern trade channels are improving accessibility across key cities. Although the market remains in a nascent phase, it offers strong long-term growth potential.

Market Segmentations:

By Ingredient Type:

By Application:

- Immune health

- Digestive health

By Distribution Channel:

- E-commerce platforms

- Company websites

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The gummy candies market features strong competition among key players such as Vitux AS, Prime Health Ltd., Lactonova, AJES Pharmaceuticals LLC, SMPNutra.com, Bettera Brands, LLC, Better Nutritionals, NutraStar Manufacturing Ltd., Allseps Pty. Ltd., and Boscogen, Inc. The gummy candies market is marked by rapid innovation, brand differentiation, and expanding global reach. Companies are investing in advanced formulations, such as sugar-free, vegan, and functional gummies, to meet the rising demand for healthier confectionery options. Manufacturers emphasize clean-label ingredients, natural flavors, and eco-friendly packaging to align with evolving consumer preferences. Strategic mergers, partnerships, and product launches are driving market consolidation and innovation across regions. Additionally, the increasing role of contract manufacturing and private-label production enables smaller brands to enter the market efficiently, intensifying competition among established and emerging players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vitux AS

- Prime Health Ltd.

- Lactonova

- AJES Pharmaceuticals LLC

- com

- Bettera Brands, LLC

- Better Nutritionals

- NutraStar Manufacturing Ltd.

- Allseps Pty. Ltd.

- Boscogen, Inc.

Recent Developments

- In May 2025, Ferrera’s SweeTarts has unveiled its latest creation. SweeTarts Gummy Halos. These Gummy Halos boast a light, fluffy gummy base, crowned with a chewy pink and blue layer, and are enveloped in a delightful mix of sweet and tart flavors.

- In April 2025, Trolli Gummi Pops offer the brand’s signature soft and chewy gummi texture that fans know and love in a one-of-a-kind frozen treat, available in two unique. The launch targeted younger audiences seeking adventure in both taste and format.

- In April 2025, Pfizer announced the discontinuation of the development of danuglipron, an oral GLP-1 receptor agonist, which was being investigated for chronic weight management.

- In April 2024, Nestlé Health Science announced it would expand its presence in India through a joint venture with Dr. Reddy’s Laboratories, which will make its nutraceutical products more accessible to consumers and patients across the country. This partnership is aimed at leveraging the strengths of both companies to increase the availability of health science products in the Indian market

Report Coverage

The research report offers an in-depth analysis based on Ingredient Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The gummy candies market will expand as demand for functional and fortified confectionery rises.

- Manufacturers will focus on sugar-free, vegan, and plant-based formulations to attract health-conscious consumers.

- E-commerce and direct-to-consumer channels will continue driving higher product accessibility and brand visibility.

- Innovation in flavor combinations and texture enhancement will boost consumer engagement across age groups.

- Companies will increase investments in sustainable and biodegradable packaging to meet environmental goals.

- Asia-Pacific will emerge as a key growth region, driven by urbanization and youth-focused marketing.

- Collaborations between nutraceutical and confectionery brands will strengthen functional gummy offerings.

- Digital marketing and influencer collaborations will shape brand awareness and customer loyalty.

- Regulatory support for clean-label and natural ingredients will promote product diversification.

- Continuous advancements in ingredient technology will improve product stability and nutritional efficiency.